The concept of swap is often used in various fields of activity, including trading. The term comes from the English meaning of the word "transfer". Most often this concept is found in financial markets. Let's figure out what it means. Initially, swap transactions were used only at the interbank level. This transaction involved trade and adequate exchange of currencies between the trading parties.

The usual conversion through buying and selling is not very convenient, since not everyone needs the currency at that particular moment. In addition, not everyone has enough cash to spend on transactions.

A currency swap transaction is an operation that represents the exchange of the currency of any country. It is carried out in 2 stages: the 1st is called the value date, the 2nd is the end of the swap.

What is swap?

Swap (from the English swap) - this, as mentioned above, means transfer.

In stock trading, it means conducting two conversion transactions for a specific amount with different delivery dates. The main subject of interest of the buyer and seller is money, so over time, a new category emerged from currency swaps - interest rate swap. It can be divided into two subcategories relating to the deferred delivery of financial assets at interest (most often determined by LIBOR - London Interbank Offered Rate), or to the delivery of purchased money in equal installments during the term of the contract.

Conversion transaction

represents transactions of traders in the foreign exchange market aimed at exchanging currencies. The operation takes place according to a pre-agreed course and date.

Features of swap transactions

- Stretched over time for up to several years.

- They place the buyer and seller at equal risk.

- They allow you to refinance or get rid of an unnecessary asset for a while.

- Allows you to conduct simultaneous transactions with dozens of counterparties.

- Can be measured both in financial and in kind form.

If you move away from complex terms and analyze a swap using a specific example, its simple operating principle will become clear.

There are three main swaps in stock trading: short

swaps,

short one-day swaps

and

forwards

. The first should not cause difficulties - here both stages of the transaction took place within one day. The second ones are executed within two working days - today and tomorrow, while the third ones have a value date earlier than the conclusion of the contract.

There are three types of contracts on the Moscow Exchange foreign exchange market:

- TOD (T+0)

– today, today - TOM (T+1)

– today plus one day – tomorrow - SPT (T+2)

– from English spot – plus two days – the day after tomorrow

If a trader wants to take delivery, he simply purchases the contract he needs and waits for its execution today, tomorrow and the day after tomorrow. However, if we are talking about transferring funds without delivery, then the broker is obliged to conduct a swap transaction by selling the client’s current contract and buying another one in return, but with a different lifespan.

In more detail it looks like this. The client purchased 1 lot USDTOM ($1000). But he has only 40,000 rubles in his account. At an exchange rate of 80 rubles per dollar, the remaining 40,000 are the broker’s credit funds, the position is opened with leverage. Since delivery occurs only at his own expense (the client cannot pay the counterparty half the cost of $1000 with borrowed money), the next day the client will not see 1 lot of the USDTOD contract in his account. He had USDTOM as he had it and will remain so. The broker will automatically sell today's TOM and buy tomorrow's TOM at the end of the trading session.

Long and short currency positions

A swap of short and long positions in the forex market is accompanied by some changes in price. In fact, the trader loses a little in value each time the position is rolled over to the next day or weekend. In general, the foreign exchange market is significantly different from the stock market. There are no dividend cut-offs for currency pairs and, in general, the potential value of a particular monetary unit can only be assessed in relation to another monetary unit. A trader must analyze the economy of an entire state, and not the financial condition of an individual enterprise.

Shorts and longs in Forex can be used in the concept of any short-term and medium-term strategy. A trader must clearly understand what positions are open in his portfolio and what operations he must perform so as not to accidentally form unwanted positions on the account.

An investor can separately create short and long lists of a securities account in order to evaluate the structure of his own portfolio. In addition, the broker himself creates short and long lists They contain those assets that can be used in margin trading. For example, a broker cannot afford to provide the opportunity to short low-liquidity stocks.

Financial arithmetic of SWAP

The cost of the swap is the difference between the quotes of the so-called “legs” of the swap ( swap legs

) — quotes of conversion transactions that create a spread.

Simply put, a swap is represented by 2 opposing trades exchanged between traders in a transaction at specific interest rates. Since these rates on deposits and loans are not always equal, then - if the proportions of the amounts on the first leg of the swap are equal and the terms on conditional securities transactions are equal - interest payments will not be equivalent. It is this difference between these parties that determines the price of the swap itself.

Definition of swap

A swap in trading is the execution of 2 conversion transactions for a certain amount, while the delivery dates for these transactions are different. The main thing that interests the selling and buying parties is money. In this regard, a separate type of swap was gradually formed from currency swaps - interest rate. It can be divided into 2 subgroups. The first is associated with the deferred delivery of funds at interest. The second is associated with the delivery of purchased funds in equal parts over the duration of the contract. A conversion swap transaction is a player's operation on the foreign exchange market. Its goal is to exchange currencies at a pre-fixed date and rate.

Swap on the currency exchange

Before moving on to consideration of swaps, it is necessary to dwell on such terms as “exchange”, “trader”, “broker”. An exchange is understood as a legal entity that contributes to the smooth operation of the organized market for exchange goods, currencies, securities, etc. It is regulated by the state.

Among the world's exchanges, the following are of greater importance:

- London International Financial Futures Exchange;

- European Options Exchange in Amsterdam;

- German derivatives exchange in Frankfurt (Deutsche Terminboerse);

- Singapore International Monetary Exchange;

- Sydney Futures Exchange;

- Austrian forward options exchange in Vienna (Oesterreichische Termin Option-sboerse).

Among domestic exchanges, they focus on the following:

- Moscow;

- St. Petersburg.

Separately, it is necessary to mention Forex, because when they talk about swaps, they mean the procedure for making money on this particular global market.

On Forex, currency is also exchanged at free prices (as on any currency exchange), but there is practically no government regulation. However, Forex gives participants access to a larger number of instruments. The same cannot be said about Russian stock exchanges.

Table: difference between a trader and a broker

| Exchange participant name | Characteristic |

| Trader | This is the name of someone participating in trading on an exchange or over-the-counter exchange platform. His professionalism doesn't matter. If desired, anyone can become a trader, the main thing is that he has time and patience. Typically, a trader invests his money to carry out trading operations and invest in stocks, but sometimes he can do without it (in the case of using loans). |

| Broker | It means an intermediary who carries out currency transactions according to the instructions of his client and receives a certain, pre-agreed payment for this. |

Let's move directly to swaps on the stock exchange. Swap in English means exchange. In a broad sense, this concept implies an agreement between parties through which they temporarily exchange something of value. In a narrow sense, the definition of a swap can vary.

For brokers, a swap is a commission in the form of money for the action of moving a transaction to a day later. For traders, it means the difference between the interest rates of the currencies that he has chosen for his trading operation.

What determines the size of a swap on the Forex exchange?

A single formula for calculating a currency swap is presented below.

Calculation for the example in the previous section:

- — We buy 1 lot (i.e. 100,000 units) GBPUSD, the price of the pair upon transfer is 1.28000, the broker’s commission is 0.25%.

— SWAP = (100000 * (1.25 + 0.25) / 100) * 1.28 / 365 = 5.26 USD.

As a result, when transferring a position, a swap of 5.26 USD will be written off.

Important: most Forex brokers even have individual swap conditions for currency pairs, taking into account commissions; all of them are listed in the instrument specifications on the official website, so in practice it is worth focusing on these documents. The formula is presented more for informational purposes. What 'small' commissions actually lead to was discussed here

Additionally, swap can be checked immediately in the MetaTrader terminal in the “Specification” section. Just right-click on the instrument of interest and select the desired item.

Next, we look for fields with swaps.

The formula for CFD calculation also depends on the contract specification from the terms of the contract. An example for index CFDs.

Calculations for CFD on STOXX50 (percentage per annum or swap rate from the broker to buy = 3):

- — Buy 1 lot STOXX50 (10 contracts) at 3427;

— SWAP = 3 / 100 / 360 * 3427 * 1 * 10 = 2.7 USD.

As a result, when transferring we pay a swap of 2.7 USD.

Example for CFD on futures.

Calculations for the BRN (oil) transaction:

- — We buy 1 lot of BRN (100 barrels) at 75, the broker’s swap is 3, which in points = 3 * 0.01 = 0.03;

— SWAP = 0.03 * 1 * 100 = 3 USD.

As you can see, there is a significant difference in swap calculations for different types of instruments. It doesn’t make much sense to take current rates for calculations; it would be more correct to look at the specifications of the instruments on the broker’s website and insert the finished figure into the formula.

Where to find swap in the MetaTrader terminal

The swap size can be found in the terminal:

For example, in Metatrader 4 you need to open the “Market Watch” window, right-click on the currency pair of interest and select “Contract Specification” in the tab that appears.

Screenshot 1. EURUSD specification

Screenshot 2. Where to find swap in the MetaTrader terminal

A window will open with information about the currency pair, where, among other parameters, there will be “Swap of long positions” and “Swap of short positions”.

When is the swap calculated and who is interested?

Trade transactions on the foreign exchange exchange are accompanied by the conclusion of agreements, which stipulate payment dates and payment methods.

Payments are directly dependent on the following important indicators:

- exchange rate;

- interest rate;

- product rate;

- security rate. The price of a security is one of the indicators that affects the settlement system in a trading operation

Every day on the currency exchange all open positions are recalculated. Traders who trade intraday are not dependent on the swap, unlike those participants who carry the transaction to the next day.

Those trading participants who maintain a position beyond a week should be interested in the swap value. Under favorable conditions, this makes it possible to earn income.

It is worth keeping in mind that making money on swaps is practiced to a greater extent on Forex. This market is predominantly speculative, that is, it is traded by people who make money on speculation and are not actually interested in the supply of currency.

Forex does not function on weekends, which explains why the triple rate is charged on the night from Wednesday to Thursday.

Swap calculation mechanism:

- At the time of the transaction, the purchased currency from the currency pair is conditionally moved to the deposit. In turn, the sold currency is issued on credit.

- All deposit and loan accruals occur when an open position is transferred to tomorrow. This is due to the fact that the timing of holding a trading position is unknown in advance.

- Further, the difference in interest rates between the deposit and the loan becomes of great importance. If the deposit rate is higher than the loan rate, then the swap is charged to the trader’s account. In the opposite situation, the swap is written off.

Swaps are used for the following purposes:

- to reduce risk when exchanging currency;

- to confirm that payments will be permanent;

- in order to make money on the difference in exchange rates;

- to generate income based on forecasts of rates and rates.

Swap transactions have their own characteristics, namely:

- are long-term;

- allow you to liquidate for some time those assets that are not yet needed;

- make it possible to conduct simultaneous transactions with several counterparties;

- can be expressed both in cash and in kind.

Mechanism of formation and calculation method of Swap

Swap is a parameter present in many markets. In the case of Forex, it is the currency swap ; the rest have nothing to do with it. This value depends on:

- selected trading instrument (two currencies);

- directions of the transaction;

- day of the week.

The swap is proportional to the transaction amount; the larger the order volume, the larger the final swap value will be. It should be noted that the swap is a standard value, it is not an invention of brokers, but a completely economically justified amount that is paid by both speculators and investors on the stock exchange, as well as the most ordinary companies conducting trading activities abroad and forced to take into account the currency swap.

Maybe

What types of swaps are provided?

There are different types of swaps on exchanges.

Depending on the result, they are divided into positive and negative types:

- in case of a positive outcome, a kind of commission accrual is visible;

- in the negative version, the above accrual tends to be written off.

Table: types of swaps depending on the nature of the transactions performed

| Type name | Peculiarities |

| Interest rate swap | Are agreements that result in the exchange of a series of interest payments between parties before the expiration of a specified period. |

| Currency swap | Almost identical to an interest rate swap. Its distinctive feature is that it is produced in different currencies. |

| Swap on shares | When exchanging payments, the stock index and interest rate are taken into account. Thus, features of both shares and interest payments are observed. |

| Precious metal swap | This is a transaction in which a precious metal is purchased or sold. At the same time, a counter-deal is made. |

| Swaption | The term is the result of the merger of two phenomena: an option and a swap. A swaption is a contract that allows the buyer to make a swap transaction in the future (with predetermined indicators). |

| Credit default swap | Has a connection with the provision of courts for exchange transactions in conditions of default. |

| Commodity swap | It is understood that the parties to the contract agree to fulfill the following conditions:

|

Hedging risks using swaps

Swap hedging involves insuring risks by participants in an exchange transaction and is used by major players in financial markets (two independent contracts are concluded). With the help of swap, Forex market makers insure:

- from interest rate fluctuations (interest rate swap);

- unfavorable dynamics of exchange rate quotes (currency swap);

- changes in prices for goods (commodity swap) and securities (stock swap).

Swap ruble dollar (USDRUB)

Let’s take a separate look at the Russian currency. In theory, the positive exchange swap for USDRUB should be quite large:

- — rate in the USA — 2%;

— the rate in the Russian Federation is 7.25%.

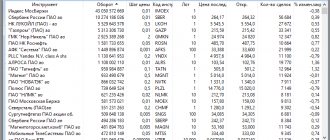

Let's calculate how it will work out for various brokers when selling 1 lot of USDRUB:

Alpari (swap from the terminal 1.19 p.). Price per item = 0.001 * 100,000 / 67 = 1.49 USD. Swap = 1.49 * 1.19 = 1.77 USD.

Forex4you (swap from the terminal 292.6 p.). Price per item = 0.00001 * 100,000 / 67 = 0.01 USD. Swap = 0.01 * 292.6 = 2.62 USD.

However, the above table shows that not all brokers provide such conditions. In the same Alpari, a swap for USDRUB is not very different from a swap for EURUSD. If we take ZAR as an example, then in South Africa the rate is 6.5%, and the swap is much higher than for the ruble. Everything is somehow connected with broker commissions and their interests, so swap strategies for USDRUB are not appropriate in most cases.

Carry trading: positive, negative swap

Having studied the previous formulas, you can see that the swap value on the exchange can be both negative and positive. In practice, this means that the transfer can be beneficial to the trader if it allows him to earn more.

The essence of carry trading is long-term holding of positions on currency pairs with a positive swap. This method allows you to simultaneously make money on rising or falling prices, as well as on differences in interest rates. However, this does not mean that you can buy whatever you want with a positive swap and forget about market analysis. Here are some current examples of pairs with a positive swap at the time of writing from the Alpari specification:

- — USDZAR Short — 9.328 p.;

— USDMXN Short — 10.534 p.

The only problem is that these instruments have quite large spreads, which will reduce the potential profit. There are also less profitable options, but with a low spread:

- — USDJPY Long — 0.512 p.;

— USDCHF Long — 0.599 p.

On the other hand, for all of these instruments it is very difficult to expect a trend towards a positive swap.

To survive such fluctuations, you need to either successfully “read” the market and enter from corrections, or sit with a very small position. The first will give a solid profit even without swap, but the second will simply give very little, which would be easier to invest in a bank deposit. As an example, let’s calculate the pip value, potential profit and risks of selling 1 USDZAR lot:

- — Approximate pip value = 1 pip * Lot size / Market price = 0.00001 * 100,000 / 14.2 = 0.07 USD.

— Swap in points from the terminal is 93.29, i.e. 93.29 * 0.07 = 6.5 USD per day. Over the course of a year, this will give 365*6.5 = 2372.5 USD.

— Alpari’s average spread for USDZAR is 127.2 points. Thus, we will immediately lose 127.2 * 0.07 = 8.9 USD.

— During one semi-annual wave, USDZAR passes on average 200,000 points (as was calculated for 5-digit quotes), 0.07 * 200,000 = 14,000 USD of potential profit or loss. And from this wave 2372.5/2 = 1186.2 USD will give a positive swap - this is about 8% of the profit.

Personally, my attitude towards carry trading is purely skeptical. Yes, this is a nice bonus to a transaction that lasts, for example, six months, but the main profit still needs to be expected from speculation on prices, because if you drop by 14,000 USD, then the swap will be only weak consolation.

“Fine-tuning” currency swap auctions

In June 2015, the system of monetary policy instruments was supplemented with “fine-tuned” currency swap auctions. The Bank of Russia may hold auctions for concluding currency swap transactions for periods of 1 or 2 days with US dollars or euros.

The Bank of Russia may decide to hold a “fine-tuning” currency swap auction if necessary to significantly and quickly increase the supply of bank liquidity. A “fine-tuning” currency swap auction for a period of 1-2 days can only be held simultaneously with a “fine-tuning” repo auction for a similar period (single auction). Such an auction is held only if credit institutions experience a shortage (deficit) of market collateral, which may negatively affect the Bank of Russia’s ability to manage money market rates.

The simultaneous holding of auctions, first of all, means the same time limit. In addition, the Bank of Russia sets the total supply volume (limit), draws up a unified register of applications and determines one cut-off rate, below which it will not enter into repo and currency swap transactions. The minimum interest rate on rubles, which can be specified by auction participants in applications, is equivalent to the key rate. Interest rates on funds in foreign currency are equal to market LIBOR rates on loans in the corresponding currency for a period of 1 day. “Fine-tuning” currency swap auctions are held at the Moscow Exchange.

How Swap is formed for transactions

To better understand the essence, let's imagine a simplified picture:

Let's take the EUR/USD currency pair if we want to buy euros by selling dollars. To do this, we must borrow dollars and then exchange them for euros.

For the loan you will need to pay interest equal to the key rate (the Key rate is set by the Central Bank).

Let's say for the dollar it is 2%.

So, by buying dollars and selling them for euros, our debt to creditors is an additional 2% per annum.

But the euros won’t just sit there either: we will loan them out at interest equal to the key rate for the euro - 1%.

Then our swap is calculated as: +1% - 2% = -1% per annum.

However, this is a very primitive description and does not take into account the differences in rates offered by specific Central Banks, as well as other conditions of your trading account.

In reality, the broker will calculate the swap somewhat more complicated.

Income Opportunities

Is it possible to make money on swaps, you ask? This, I tell you, is a very pressing question. Earning money is quite possible and methods appeared relatively long ago. This is a whole separate industry, and it’s called carry trading.

Of course, you won’t be able to make a fortune in a short period of time, since in Forex there is also a spread. We have already discussed this concept with you in the previous article.

The swap is always less than the spread, which is charged once, and swaps are charged every day. Therefore, if you hold a deal for a long time with a positive swap, the spread will close and the trader will be able to benefit.

But there is also a problem, because the market does not stand still at this time. This means that if you opened for an increase in order to accumulate swaps, and at this time the bullish trend was replaced by a bearish one, then you will not see the money like your own ears.

In order to earn money, you must adhere to the following steps:

- Determine the currency pairs for which the largest swaps are charged and determine the required type of transaction.

- Study graphs of price fluctuations from a week ago and identify the type of trend, make a forecast based on technical methods of analysis. It is recommended to take an integrated approach. With the help of technical analysis, you can determine the most appropriate point to open a trading bet in a certain direction.

- Study the initial data and determine where the market is looking. Even on the weekly chart there are movements that contradict fundamental analytics. In this case, you should not open long bets. The best option will be when technical and fundamental analysis coincide.

- Identify price values.

- Make a forecast for how long the market will move in the desired direction until it returns to its original level. In this case, it is necessary to take into account volatility.

Permanent currency swap

Currency swap as a permanent instrument was introduced in September 2002. As a result, credit institutions were able to attract liquidity from the Bank of Russia on a daily basis for a period of 1 day in exchange for US dollars (the “ruble-US dollar” instrument). Since October 2005, a similar “ruble-euro” instrument has appeared.

In accordance with the general purpose of instruments for providing permanent liquidity, the Bank of Russia currency swap serves two purposes. Firstly, it contributes to the formation of the upper limit of the interest rate corridor, since the interest rate paid by credit institutions for ruble liquidity for these operations is set at a level corresponding to the upper limit of the Bank of Russia interest rate corridor. Secondly, it allows credit institutions that for some reason were unable to find funds in the money market to attract liquidity from the Bank of Russia for a period of 1 day, secured in foreign currency.

For permanent currency swaps, the interest rate on rubles is set at the key rate plus one percentage point, and interest rates for funds in foreign currency are equal to market LIBOR rates for loans in the corresponding currency for a period of 1 day.

Currency swap transactions are concluded at organized trading on the Moscow Exchange with financial market participants who have access to exchange trading. The Bank of Russia participates in exchange trading only in a non-addressed mode, that is, when concluding transactions, participants in organized trading do not know their counterparty.

Transactions on the “ruble-US dollar” instrument are carried out daily from 10:00 to 18:00 Moscow time, and on the “ruble-euro” instrument - from 10:00 to 15:15 Moscow time.

Information on the conditions of permanent currency swap operations is published daily on the Bank of Russia website.

What are the features of swap transactions?

The main features of swap are as follows:

- their duration can even be several years;

- they involve risks equal for the buying and selling parties;

- provide the opportunity to lend or get rid of an unnecessary asset for a certain period;

- have the ability to conduct transactions with a large number of counterparties at once;

- They are characterized by measurements in financial and physical terms.

The principle of swap is absolutely simple. To understand it, let's look at an illustrative example. In stock trading you can find 3 types of swaps:

- short – they usually do not cause difficulties, both stages are carried out within one trading day;

- short one-day – these transactions are executed within 2 business days: for today and the next day;

- forward – provide for a value date that is earlier than the moment the transaction is concluded.

The Moscow Exchange provides the following types of swap transactions:

- TOD (T+0), which means today.

- TOM (T+1), which means tomorrow (today + 1 day).

- SPT (T+2), the day after tomorrow (from English Spot + 2 days).

If a trading participant wants to make a delivery, his actions consist of purchasing the desired contract and waiting for its execution. It is worth considering that if a transfer of money without delivery is provided, the brokerage company must carry out the transaction by selling the trader’s current contract and buying another one instead, however, with a different validity period.

Let's consider an example of a currency swap transaction. The trader purchased one lot of USD TOM for 1000 dollars, however, he only has 40 thousand Russian rubles in his account. Considering the exchange rate of 80 rubles/$, the remaining 40 thousand rubles is the leverage of the brokerage company. Since the delivery is carried out exclusively with his own funds (the trader cannot pay the counterparty 50% of the cost of 1000 dollars with borrowed funds), the next day the trader will not find one lot of the USD TOD contract in the account. He will still have USD TOM. The brokerage company will automatically sell today's TOM contract and buy tomorrow's TOM at the end of the trading day. A trader may have the following question: at what rate will the brokerage company perform currency swap transactions?

When one trade is carried over to another, a spread will inevitably form, which will lead to losses for the trader. But the formation of the spread occurs on the basis of supply and demand, however, at a separate, narrower market level.

After the bidding is over, the auction opens. On it, large traders and brokerage companies create a book of swap operations, striving for the most profitable transfer. The brokerage company is entirely responsible for transferring the transaction. The variance in the swap is at least the base rate divided by 365 days, however the rate may be higher at the time of the rollover spread.

A good broker allows a large trader to trade ETS Swaps contracts, which are the same trades that carry over.

This indicates that the trader has the right to independently choose the deviation between the contracts that are transferred. However, private investors with small capital cannot take advantage of this opportunity, since trading the USD TOD TOM swap involves a lot equal to 100 thousand dollars. Therefore, to carry out a transaction and transfer 100 lots of USD TOD swap, you need to purchase one lot of USD TOD TOM.

There is a special system between the US Federal Reserve System and the Central Bank of Europe - a swap line. It is intended for tranche conversion between the dollar and the euro. The exchange takes place at a predetermined rate. This allows the European Central Bank regulator to issue Eurodollars, providing European banks with loans in US currency.

Trading using swap transactions can be classified as over-the-counter trading methods. This is due to the fact that there are no special rules of the exchange platform and the process itself depends on the wishes of counterparties and their capabilities.

Given this, there are many opportunities for selling contracts, there are many conditions, prices, and the number of persons participating in the constructed swap. There is no general scheme as such. Instead, an application is generated on the trading platform: the issuing company demonstrates its readiness to purchase a swap from some other issuing company for a period of one year on its terms.

Applications are submitted electronically and are processed programmatically by stock exchange robots. Only one thing is required from the trade participant: consent or refusal. When the deadline expires, the reverse step occurs. If you look at it superficially, it may mistakenly seem that the principle of operation is consent or refusal. However, swap transactions require increased attention, market understanding and the availability of a huge amount of information.

The Russian swap market replaces loans and credits for its participants. There is also the concept of repo, applications for which are constantly placed by the Bank of Russia to increase the stability of the ruble exchange rate.

Currency swap as a tool to maintain financial stability

Currency swap as a tool to support Russian credit institutions with dollar liquidity was introduced in September 2014, as a result of which credit institutions were able to daily attract US dollars from the Bank of Russia for a period of 1 day in exchange for rubles. Such transactions are offered by the Bank of Russia with “today/tomorrow” and “tomorrow/the day after tomorrow” settlements.

Currency swaps for the provision of US dollars by the Bank of Russia are aimed at helping banks with dollar liquidity when access to it is difficult for reasons beyond their control, as well as at preventing sudden changes in quotes on the currency swap market in the event of a short-term increase in demand from market participants for foreign currency.

The interest rate on US dollars on these currency swaps corresponds to the market rate of LIBOR on loans in US dollars for a period of 1 day, increased by 1.5 percentage points. At the same time, the interest rate on rubles is set at the key rate minus one percentage point.

Every day, the Bank of Russia sets aggregate limits on the maximum volume of currency swap transactions separately for an instrument with settlements “today/tomorrow” and for an instrument with settlements “tomorrow/the day after tomorrow”.

Currency swap transactions for the provision of US dollars are concluded at organized trading on the Moscow Exchange in a non-addressed mode. Transactions are concluded daily from 10:00 to 18:00 Moscow time.

Basic characteristics of operations

The Bank of Russia establishes the following conditions for concluding currency swap transactions: the date of concluding transactions, the dates of exchange for the first and second parts, the base rate, the interest rate on rubles, the interest rate on funds in foreign currency, and also, in accordance with general market practice, announces the swap difference. The base rate is the central rate for the corresponding currency pair, calculated by the NPO National Clearing Center (JSC) on the date of trading of the Public Joint Stock Company Moscow Exchange MICEX-RTS (hereinafter referred to as the Moscow Exchange). Interest rates are set by a decision of the Board of Directors of the Bank of Russia. The swap difference is calculated as follows.

Where

- SR

- the value of the swap difference, expressed in rubles, rounded to 4 decimal places; - BKCUR

is the base rate, which is used as the central rate for the corresponding currency pair, calculated by the NPO National Clearing Center (JSC) on the date of trading on the Moscow Exchange; - PSRUB

is the interest rate on rubles established by the Board of Directors of the Bank of Russia, in percent per annum; - PSCUR

is the interest rate on funds in foreign currency, established by the Board of Directors of the Bank of Russia, in percent per annum; - D

- the number of calendar days from the day of settlement for the first part of the currency swap (excluding the day of settlement for the first part of the transaction) to the day of settlement for the second part of the currency swap (including the day of settlement for the second part of the transaction); - DГRUB

- the number of calendar days in a calendar year (365 or 366).

If parts of a currency swap fall on calendar years with different numbers of days, then the D/DGRUB

is calculated based on the actual number of days falling on each year.

Trading without swaps

Does it make sense to trade without swaps? There are several ways to do this:

- “intraday” trading: if you open a deal and close it within a day, no swap is charged. In medium-term trading, the coefficient is not large and your profit will not suffer because of it;

- opening a swap-free account: most advanced brokers have this feature. Such an account can be opened only for positional trading, when you want to hold a deal for several months.

Before deciding to open such an account, you need to think carefully about whether you can hold positions for a long time.

Don't forget to share materials with friends on social networks. I wish you more profit on trading platforms!

Recommendations for long-term trading

For those who work with holding a position for a month or more , I recommend trading on Islamic accounts. The exception is carry traders and those who plan to trade pairs with zero or small positive swap.

If you work in the majors and hold trades for a few days at most, then the swap can be neglected. Usually, with such a lifespan of a transaction, the goals exceed 100-150 points, the loss of 4-5 pips due to the rollover is insignificant compared to the profit.

If your trading is something in between, with an account containing both trades with a hold period of a couple of weeks and faster trades, take a look at offers with improved swaps. For example, at Amarkets for Platinum accounts negative rollovers are reduced by 30%, and positive rollovers are increased by a third.

Exotic swaps

Not long ago, combined Equity Default Swaps, or EDS for short, appeared on the market. They are derivative trading instruments. Because they are not standard, they are called exotic and represent a special asset that helps transfer risk from one trading participant to another. These risks are usually associated with an equity event, which means the entry into force of some events. First of all, it means a decrease in the value of securities for a specific price level. Consequently, an exotic swap serves as protection for the trader when the value of an asset or contract decreases by 20 percent of its price at the time the contract is concluded.

An EDS swap is a contract between two parties. In it, the buying party pays the selling party negligible interest during the life of the swap until the contingency event occurs. In this case, the selling party constantly and fully pays the cost of the contract, after which it is executed.

EDS swaps are similar to CDS contracts, with one difference - in the latter, the selling party pays cash if a particular issuing company goes bankrupt.

Exotic swaps are also similar to binary options, since one of the participants risks everything at the same time. However, the frequency of payments is a distinctive feature of this financial instrument, which makes it possible to create effective and non-standard trading strategies based on it