Profit is the main goal of every participant in trading relations in the financial market. With the development of the stock exchange, the number and complexity of trading strategies with which you can increase it are constantly increasing.

They differ in the period and actions with tools that are performed to achieve the desired result. What is long and short, how these technologies are used by exchange participants, shorting on the stock market - what it is, you need to understand in order to conduct successful trading transactions.

What is a short and long position in trading?

If translated from English, long is long, short is short. But in financial markets, these terms have a slightly different meaning. It is more correct to call them “up” (long) and “down” (short) trading. Although there is no difference. Whoever wants, calls it what he wants. But the short position does not have to be sold anytime soon. Or, on the contrary, keep it for several years.

The bullish strategy is called long because the market usually rises over a long period of time.

Traders are also called differently. Those who play for a raise are called bulls. On the downside - bears. This is an association with animal kicks. Bulls strike with their horns from bottom to top, while bears, on the contrary, strike from top to bottom.

In general, financial markets have a lot of their own slang. For example, they may say “go long” or “put on shorts.”

Even the famous phrase from the Soviet cartoon “execute cannot be pardoned” was remade on the stock exchanges into “short cannot be long.”

Looking for a good broker? Check out these:

Long: buy low, sell high

Let's start with the most popular type of orders. Long or, as it is also called, a long position, involves the purchase of an asset with the aim of further selling at a higher price. As a rule, beginners start with such transactions.

The procedure for opening long positions is as follows:

- We are looking for and buying an asset that should soon increase in price. To do this, you need to carefully analyze the market.

- We are waiting for prices to go up. The waiting time depends on the ability to analyze the market and the accuracy of the forecast. In some cases the wait may be long.

- If the calculation turns out to be correct, we sell the asset at a higher price. The difference between the purchase price and the sale price is our profit.

Example:

End of 2022. The market is actively growing. Some experts say that the price of Bitcoin is not supported by anything and it will soon collapse. Others, on the contrary, say that Bitcoin will soon conquer the whole world and its price will very soon reach $1 million.

We are optimistic and on November 17, 2017 we buy 1 bitcoin for $7850.

A month passes, and we decide that the price has reached its maximum value and may fall further.

We are selling our Bitcoin on December 17, 2017 at a price of $19,267. Our earnings were $11,417 ($19,267-$7,850).

Unfortunately, such rapid growth cannot continue forever. In mid-December, Bitcoin reached its price highs. Those who decided to go long at these levels had two options:

- Record the loss (sell the purchased bitcoins at a lower price so as not to lose even more).

- Keep waiting. It is quite possible that the price will break through this level again and rise even more. But when this will happen is anyone's guess.

What does short and long mean?

You already partially understood from the previous chapter what this means. To make it more clear, it is better to explain with an example. Beginners need to be explained in more detail.

To go long is to trade in the hope that will rise . Let some trader buy shares worth 100 thousand rubles. After some time, their rate rose by 10%. If he sells them, he will receive 110 thousand rubles. The trader will benefit only if the exchange rate increases.

A long position is a bullish game

Shorting is trading in the hope that will fall . A trader borrows shares from a broker and sells them for 100 thousand rubles. This amount is already in his account. If the shares fall by 10%, he can buy them for 90 thousand rubles and return them back to the broker.

A short position is a bearish game

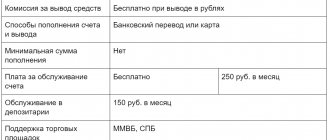

And the remaining 10 thousand rubles will become his profit. It is worth considering that in this case the broker takes a commission, which is debited daily. The amount may vary depending on the broker.

You can short and long on any market: stock, derivatives or foreign exchange.

How to determine which direction to trade

Indeed, how do you know whether to go long or short? Up or down?

Actually, not at all. Not at all. We don’t know what will happen on the market, how it will behave, how prices will change. All normal and thinking people realize this.

All other people think that the future can be predicted. And they are trying to do it.

They do this by analyzing the market. It can be analyzed in two ways.

The first is fundamental analysis. This is when an analyst studies the financial situation in the country, the state of affairs in the company and assumes how prices will change. For example, when the coronavirus pandemic began, it was clear to everyone that airline stocks would fall. This assumption was confirmed when border closures began.

The second is technical. Techies believe that information about the future lies in the past. You need to look at the history of price fluctuations, that is, at the chart, and find clues about the future in it.

Technicians try to find such clues in the following ways:

- Classic analytics. They draw channels, look for support and resistance levels, look for patterns.

- Indicators. There are special programs - indicators. They automatically analyze the chart and provide trading signals.

- In waves. There is a separate analytical direction - the wave theory of Ralph Elliott. Wave traders try to identify impulse and corrective waves and make trading decisions based on them.

- Analysis of Japanese candles. I have a separate article about candles - read it.

And there are a bunch of other methods like Gann tools, Fibonacci lines and so on.

But. Neither techies nor fundamentalists can predict the future. Yes, the pandemic has begun. What if a cure were found immediately? What if a vaccine appeared immediately? What if this pandemic ended in a couple of months, like in China? No one knows.

And the charts couldn’t predict the pandemic at all. There, everything could point to impending growth, and then suddenly - bam, and the collapse began.

However, traders continue to do their job. They continue to look for “keys” to the market, make forecasts and, based on them, open either long or short.

How to play short on the stock exchange?

As we explained above, with a short position, a trader sells shares that he does not own. This kind of trading is often called short selling .

Some investors believe that making money from this is wrong. After all, it turns out that the trader supports the fall of the market. In fact, the opposite situation occurs. He buys shares from those who want to sell them. And this has a positive effect on the price. Otherwise it could quickly collapse.

It is worth noting that playing short carries more risk . After all, the course can suddenly change direction and go up. Shares fall in price only to zero, but they can theoretically rise indefinitely. It turns out that profits here are also limited. Therefore, here you need to analyze the market even more carefully.

Rules of the game for shorting

Greater risk when playing short is not typical for all markets. For example, in the foreign exchange market such risk is minimal.

Today, shorting is quite easy. There is no need to enter into any additional contracts. Everything happens automatically. But you will definitely need to draw up a service agreement with the broker. And after that, in most cases, it is enough to select the “sell” command, enter the number of shares and the transaction amount will appear on the account. It turns out that another trader has already bought the shares.

It’s even easier to give an example from the foreign exchange market (Forex). A trader has 100 dollars and wants to buy euros, as he assumes that the dollar will become cheaper. Let their rates at the time of the transaction be the same. A trader buys 100 euros, and the dollar becomes cheaper by 10%. This means that now 100 euros can buy 110 dollars.

You can only short certain assets. Each broker has their own. But this limitation can be easily circumvented if you use futures instead of stocks.

Current trading strategies

We can say that all short strategies relate to speculation. After all, the broker lends shares at interest. And the sooner the trader returns them, the less interest he will pay on the loan. Accordingly, he will earn more from the transaction itself. It’s unlikely that anyone will short for a long period of time.

Stocks are usually chosen to be the most liquid so that they can be bought and sold quickly. Therefore, we can distinguish 3 most popular strategies:

- Scalping. The trader sells assets and immediately sets the purchase price. Everything happens in a matter of seconds. This strategy seems to be the simplest, but in fact it is only suitable for professionals. You need to be able to find profitable deals, spend a lot of time in front of the monitor and make dozens, or even hundreds of transactions a day.

Scalping strategy diagram - Swing. The trader hopes for a further decline in the price, so he holds the shares for several days. Perhaps this is the most accessible strategy for beginners. Here you can use fundamental and technical analyzes to help predict future prices. Traders make only a few transactions per week or month, and minimal time is allocated for this.

From a swing trading perspective, the price movement looks like this: - Intraday. Similar to scalping, only the trader takes into account fundamental analysis. This is a less stressful strategy. Usually no more than 10 transactions are carried out during the day. Also suitable for beginners, but experienced traders often use it.

An example of entering a buy and sell deal using the Intraday strategy

Typically, shorts are used in cases where the security is overvalued and should soon fall in price. Or when a trend ends (indicators show divergence, resistance breaks, etc.)

Risks

Despite the fact that you can make money quickly by shorting, this position is quite risky. Firstly, there is an almost endless possible loss. Secondly, the market historically tends to always go up. Therefore, the trader needs to have time to make transactions during short periods of decline. Thirdly, a trader who works with shorts always has additional expenses. For example, paying interest on a loan.

In addition, if the broker sees that the rate has gone up, he can take the shares back so as not to be in the red himself. In this case, the trader may suffer huge losses (margin call). To prevent this from happening, there must always be an insured amount in the account. It is called warranty coverage .

It's not uncommon for brokers to prohibit short trades altogether.

There is also such a thing as a “short squeeze.” This is when market players are afraid of losing money and begin to urgently sell shares. And this creates an even greater increase in prices.

Expert opinion

Dmitry Dunyashev

Blogger, private investor, project manager real-investment.net

In 2022, WTI oil futures dropped below zero to minus 37 , which happened for the first time in the history of the market. Traders who played short received losses many times greater than the size of their positions and the amount of capital. Accordingly, they owed the broker.

Features of a short trade

Short positions have some features that you should know about in advance:

- Not all stocks can be shorted . The list of assets for which short positions can be opened is compiled by the broker. Each intermediary may have its own list, so first you need to familiarize yourself with it. Typically, this list includes the most liquid securities.

- The broker can force a position to be closed if the security continues to rise in price and the trader does not have enough money to buy it back. The broker's requirement to close a trade or replenish the account to cover a loss on a trade is called a margin call.

- It is unprofitable or impossible to open shorts before the dividend cutoff . After dividend payments, the value of assets usually falls by approximately the amount of the dividend payments. This happens because shareholders made a profit and many begin to sell off their securities, which is why the quotes sag a little. This phenomenon is called the dividend gap. At such a moment, it would be logical to open a short position - the trader bets on a decline, and it naturally occurs after the gap. But you won’t be able to make money this way: firstly, some brokers prohibit placing short positions before the cutoff, and secondly, if this is still allowed, the trader will have to pay both dividends and taxes on them. The fact is that a broker, in order to loan shares to a trader, takes them from another investor (and the investor may not even be aware of this). Of course, the broker cannot leave the investor without dividends, and therefore the short-term trader will have to pay them.

Features of long positions

Going long on stocks and currencies is simple and does not cost you any extra costs. Here the trader hopes to make money if the rate goes up. To do this, just purchase shares (currencies) using the “buy” command of your program (terminal).

In this case, speculation is also used, but long-term investment strategies are more popular. Even if the exchange rate declines in the short term, it should rise in the long term (more than 100 years of history have proven this). Therefore, the most popular strategy is “buy and hold” , when the investor does not sell shares for several years.

But there are many other strategies.

For example, dividend , which justifies long-term holding of positions on the stock exchange. Here, an investor can make money not only from rising stock prices, but also from dividends. They are paid once a year (more often for foreign shares). This strategy allows you to avoid serious risks. But to get good dividends you will have to invest decent money. It's like a deposit in a bank.

Another approach is investing in new companies , they sometimes bring good profits. When companies go public (IPO), they may be undervalued. That's why shares are inexpensive. But in the future, if the company begins to develop rapidly, the stock price may increase several tens or even hundreds of times. On the other hand, the company may go bankrupt, then the investor will suffer a loss. This is a profitable but high-risk strategy.

Some traders use a reverse trend strategy (against the trend). No one is immune from mistakes. This also applies to companies. If they have performed poorly in the past, their shares may be worth cheap. But if future prospects are visible, the stock price may rise sharply.

Longs with futures

Longs with futures contracts are more difficult to understand. Although in fact the same principle works. You need to buy cheaper and wait for the price to rise. If it rises, the trader will make money. If he falls, he will be at a loss. Here the long is closely intertwined with the short. After all, a contract is concluded by two people - one with a long position, the other with a short position. And if the first one makes a profit, the second one will lose money.

Pure speculative long in futures

For example, an investor wants to buy Sberbank shares for 200 rubles. But he has no money, it will appear only in a month. He opens a long futures contract and waits. If the exchange rate becomes 250 rubles, the investor will be in the black. After all, he signed a contract to buy shares for 200 rubles and it makes no difference to him how much the asset actually increased in price.

If the rate drops, for example, to 180 rubles, a trader with a long position will receive a loss of 20 rubles. After all, he will buy the asset at a higher price. But the trader with a short position will be in the black.

Unlike stocks, futures have a limited expiration date. That is why they are classified as a derivatives market . But you can close your position earlier. If the futures expires, traders automatically receive money at the rate of the last day of holding. This day is usually called the expiration date (completion of circulation). In this case, the calculation is carried out only in monetary terms. No actual deliveries are expected. Although deliverable futures also exist, they are used extremely rarely and not at all for the purpose of making money on price differences.

In general, trading futures is much more profitable than trading stocks. After all, a trader needs less money to hold a position, but can earn the same amount as if he owned shares. In addition, futures allow you to work with instruments that are not available on the stock market. For example, an oil contract. Well, the commission also plays a role, because in the derivatives market it is much less.

Comparison of risks when shorting and long

Both surgeries are considered risky. But the risk on a short trade is higher. Let's figure out why.

First, let's look at the long strategy. An investor buys 1,000 shares at a price of RUB 1,000/piece. He goes long and waits for the quotes to rise. The biggest risk is the bankruptcy of the company and the loss of 1 million rubles, the smaller risk is an infinitely long wait for profit. The investor will not lose more than a million money, but the profit can be many times higher, especially in the long term.

The possible loss is limited to the amount invested in the purchase of securities and will not fall below zero. For example, you bought a share for 1,000 rubles. Then the price dropped to 500. The paper loss is 500 rubles (50%). If you are sure that the price will rise, then it is not necessary to record a loss; hold the paper until the quotes rise. The price will not fall below 0. You may lose the money invested, but you will not owe the broker.

In the case of shorts, the opposite is true. Profit is limited, but possible loss is not. For example, you shorted a stock at 500 rubles. But the price increased to 1,000 rubles. The paper loss is 500 ₽. The price may rise further, and with it a loss. For each day you short, the broker will charge you interest. When the loss reaches a critical level, a margin call will occur. If the requirement to close a transaction or replenish the account is not fulfilled, the broker may forcefully close the position.

Short and long at the same time

Some successful investors make money by being long and short at the same time. It's logical. After all, the market constantly falls and rises. Although this is usually only practiced by investment funds, using differently directed positions of the same instrument. This approach is very complex. Not to mention one position. After all, you cannot short shares that are available. The broker will sell them, and that’s it.

But you can try, for example, buy 10 shares, and then enter into a futures contract for the same number of these same shares. It turns out to work in two markets - stock and derivatives. This way the trader will protect himself from risks. But it is unlikely that you will be able to make good money on this, since the profit of the long trade will be equal to the loss of the short trade. And vice versa. This is called hedging and this method should only be used if you have a good understanding of how it works and the possible consequences.

The investor will not pay a commission to the broker if the short position is closed during the day.

Features of short and long trading

Trading strategies in the stock market are subject to their own laws and rules. To generate income, traders perform actions according to the same scheme.

It includes analyzing the direction of quotes, holding an order, entering and exiting the exchange. The trader gets acquainted with the company's financial statements, calculates the multipliers and evaluates the situation. This is how companies are identified whose shares have the potential to fall or grow.

Actions are taken thoughtfully, after analyzing and checking previous indicators and charts, taking into account the trading strategy, the risk of the deposit and the psychology of traders.

Sometimes exchange participants open both short and long positions at once. Such special variants of transactions are dealt with by arbitrage traders - traders whose goal is to buy cheaper on one exchange and sell at a higher price on the second place. In such cases, they receive income from the difference in quotes.

Also, opening short and long transactions on exchanges will help minimize the risks associated with price surges. In connection with the opening of a short, the trader can also receive additional funds into his account. But this is only a secondary factor related to the goal of making money from falling assets.

When using shorts, be sure to set a stop loss, i.e. the price at which shares are automatically sold, limiting monetary losses.

Useful materials on the topic

Subscribe to my newsletter. Soon I will have many more new articles on finance, investment, and trading. I think you will find it interesting. Subscribing will allow me to send you the best articles in this section by email. This way you won't miss anything.

If you know nothing at all about investing, I highly recommend this course: “Personal Finance and Investments” from Netology. I personally watched it, although in a more condensed version, now the course has been expanded and made more in-depth.

It is hosted by professional investor Sergey Spirin. He will first explain to you why it is pointless to simply save money, wait for a good pension or make money from speculation, and then he will introduce you to the idea of passive investments. He will tell you in clear language what they are and how they happen.

Then you will get acquainted with the main types of financial instruments, learn how to choose them correctly, and what are the features of their price movements. The course is conducted in video format, after each video you must take a test to better assimilate the material. You can ask the teacher questions even after teaching.

If you don’t have money for the course yet, look at free materials on investing. For example, AkBars Bank, which at the same time is engaged in brokerage activities, has several webinars on investments. More precisely, recordings of these webinars on YouTube. Here is the first entry, you will find the rest yourself:

I also advise you to glance at these three books from the City of Investors. They are free, download them in electronic format and read them.

- How to become financially independent in 1 year.

- 5 ways to effectively invest 1000+ rubles.

- 6 steps to financial security.

Vasily Blinov, who owns this site, regularly takes investment courses in the City of Investors. Among them there are both paid and free. Of the free ones, I recommend these two webinars:

- Investment portfolio for $100 per month - about what investment portfolios are, how to create them from scratch, how to choose a broker, how to rebalance. You will discover the fact that you can start investing with very small amounts. And quite effectively.

- Investments without a million in your pocket are especially important for “ordinary” people. Evgeniy Khodchenkov will teach you how to make investments with 500 or 1,000 rubles, and take the right financial start.

Each webinar lasts approximately 2.5 hours. Do not miss. Moreover, they are both completely free.

The best paid programs are:

- Passive income incubator - here teachers talk about buying stocks. But not to short them or go long with them, but to keep these shares in the portfolio for many, many years and receive good income in the form of dividends.

- Passive income on the machine is a “marathon” that lasts ten days. During this time, you will learn how to choose the right instruments for passive investing, understand the difference between them, and how to properly diversify them.

- Super profitable investments in IPO. You can start investing in an IPO only with large sums. When Vasily Blinov completed this course, he made an investment of 370,000 rubles. You can read about this in his Telegram channel (the link leads directly to the message about the IPO). Even if you don’t have the required amounts right now, you can still take the course to understand how an IPO works and how people make money there. To know what to strive for.

If you still want to try to make money on speculation, here is my selection of trading courses. Take a look there. I used to believe that such earnings were possible, but now I don’t think so. I put free courses first in the selection - study them all first, and then move on to paid ones. You will always have time to throw money away.

How to open a short position?

The technical algorithm that traders use to short looks like this:

- a person borrows an asset from a broker and sells it on the stock market (while its value is high). Placing an order to sell an asset means starting to “short”;

- as soon as the value of an asset falls, a person buys it at a new reduced price. Then returns the loan asset back to the broker. Placing an order to buy an asset is closing a short position;

- The remaining amount as a result is the profit from the transaction.

Shorts or investments?

Shorting stocks is subject to its own set of rules that are different from regular investing. This includes a common rule called a stop-loss, a rule designed to limit short selling from further reducing the price of a stock that has fallen more than 10% in one day from the previous day's closing price.

The risk of loss in a short sale is theoretically infinite since the stock price can continue to rise without limit. Short selling tactics are best used by experienced traders who know and understand the risks.