Do you know exactly when to close your positions and take profits? I would say that entering and exiting the market are equally important. These two elements must work in harmony if you want to continually increase your deposit size. Oddly enough, exiting a position is more difficult. This is due to the fact that before you open a new trade, you are not yet emotionally involved in what is happening in the market. However, once your money starts to be at risk, things immediately become much more complicated and confusing.

Your trading plan may be completely changed or even forgotten. The key level that you determined in advance moves a little higher or lower. You may decide to push back your goal to earn even more profit. Every trader faces all these problems.

However, there are several simple and effective ways that will help you learn how to successfully take profits. These methods will give you the ability to control your emotions and calmly close your positions. We will analyze them in today's article.

Know your levels and don't change them when you're in a trade

Determine your profit goal

Use price action

Don't forget about the economic calendar

The highs and lows of price movement are important

Conclusion

Know your levels and don't change them when you're in a trade

The very first step to making a profit is identifying key support and resistance levels. You should always have a clear understanding of where exactly the market may experience an increase in demand or supply. This will allow you to open your positions from levels - this is what price action is all about.

It is not enough to simply draw a few lines on a graph. You should be confident enough in your ability to identify key levels to rely on them to manage your positions.

Remember that support and resistance levels are rarely uneven. That is, most often they should be located at approximately the same distance from each other.

Let's look at an example. Please note that the levels are spaced fairly evenly:

Knowing this principle will allow you to double-check your levels if you see an unusually large distance between them:

Notice the large space between the two levels. If you encounter something like this, chances are you've missed a key level in your analysis.

This is another reason why you should always draw levels before entering the market. Otherwise, you may find that your subconscious mind is skipping certain levels in an attempt to make the trade setup seem more attractive than it actually is.

As with everything in technical analysis, this idea of even spacing between levels should be viewed as a guideline rather than a hard and fast rule. This pattern will not work on every chart or under every circumstance, but most often it holds true.

Dividends

Investing in companies that pay dividends is another way to protect against possible losses.

Historically, dividends have been considered one of the most important elements of the overall return of a security investment. In some cases, this was the only income. There are studies showing that companies that pay dividends usually grow profits faster than competitors that do not pay investors. A higher growth rate also translates into a higher share price for the company, giving investors a double gain. The link provides a calendar of dividend payments by Russian companies.

Determine your profit goal

I like graphic patterns. Using them, you can easily measure potential profit targets. These targets allow me to determine how far the market can move once the pattern is confirmed.

Let's look at the head and shoulders figure as an example:

We first measure the distance from the head to the neckline and then project the same distance from the neckline to the bottom of the market.

The measured target gains greater strength if it corresponds to a predetermined support or resistance level:

Use of structured products

Investors who are seriously concerned about protecting their assets use so-called structured products.

Their essence lies in the possibility of choosing acceptable risk parameters. As a result, you can completely eliminate the risk of financial losses. This reduces the possible profit, but provides guaranteed protection - in the event of unfavorable dynamics of the underlying asset, the company will return absolutely the entire invested amount. The profitability of a structured product depends on the participation coefficient and changes in the value of the underlying asset (share, index, etc.). If an investor chooses a participation rate of 80%, and the price of the underlying asset changes in the direction he wants by 10%, then the income will be 8%. That is, by investing directly in the underlying asset, you could earn a little more, but with a much higher risk.

Use price action

As price action traders, we constantly analyze the price movement on the chart. This helps us determine whether a favorable entry point has arisen or whether it is best to stay on the sidelines for now.

We can use price action patterns not only to enter the market, but also to exit it.

For example, a bullish pin bar that occurs at a key support level means it's time to take profits:

The same applies to graphic formations. A double top pattern that occurs while holding a long position can signal a market reversal.

A price action trader must constantly analyze the price movement on the chart to determine the most appropriate places to enter and exit the market.

Diversification

The cornerstone of modern portfolio theory (Modern Portfolio Theory, MPT).

According to it, during market downturns, a well-diversified portfolio will perform better than those that include a small set of assets. Diversification involves creating portfolios that include a wide range of different financial instruments and asset classes. This allows you to reduce the unsystematic risk that arises when investing in a specific company - as opposed to the systematic risk that arises when investing in specific markets in general.

Don't forget about the economic calendar

As a technical analysis trader, I rely solely on price movement analysis in my trading. I never trade on news or base my market entry decisions on whether NFP is good or bad. I don't care whether the Fed's rhetoric was hawkish or dovish.

However, I am interested in how exactly the market reacts to news releases. In other words, I'm more interested in reading how prices react to news than I am in reading the news itself and looking at the economic calendar.

I have noticed that the market sometimes reverses after an extended move up or down on a significant news event.

What exactly do I mean? Here's an example. ECB interest rate statement after which the price soared by 400 points:

I have often noticed this pattern. The market moves for several weeks or even months without strong pullbacks before major news dramatically changes its direction. Therefore, this moment is the most suitable for taking profits or moving a stop loss.

However, note that there is no such thing as a guaranteed stop loss. This is especially true during periods when increased volatility leads to decreased liquidity. If this happens, your broker may have trouble getting you out of the position at the optimal price, and slippage may occur. Therefore, be prepared for this when important news is released.

The best option to exit the market remains the one that suits you best. As traders, we must remain as focused and attentive as possible from the moment we open a position until the moment we close it.

What are Stop loss and Take profit

The Binance exchange provides traders with the opportunity to use so-called pending orders. They have two important features:

- the position is opened (or closed) not manually, but automatically;

- the actual opening/closing of a transaction does not occur immediately, but after a certain period of time.

Thus, a transaction can be opened/closed without the participation of the trader, and at this moment he may be completely outside the market.

Stop Loss and Take Profit are the main types of pending orders.

How stop loss works

Stop Loss (SL) translated from English means “stop losses”. As a rule, such an order is placed as an addition to an already open position and is used to minimize risks.

For example, consider the following situation:

- you bought one Ethereum coin at a price of $2000;

- the maximum loss you are willing to incur from this transaction is 10%.

In this case, you need to place a stop order at $1800. And if the chart starts to move in a direction unfavorable for you, then at the moment when the rate reaches $1800, an order will automatically be placed to sell 1 ETH at the market price. Moreover, this will happen regardless of whether you are currently authorized in your exchange account or not. As a result, you will receive a loss of 10%, but this figure will not be exceeded under any circumstances.

How take profit works

Take Profit (TP) translated from English means “take profit”. This type of order is also placed in addition to an already open position. Its main task is to set a target profit level.

For example, consider a similar situation:

- you bought one Ethereum coin at a price of $2000;

- The profit you want to make from this trade is 20%.

In this case, you need to set your take profit at $2400. And if the exchange rate chart goes in a direction favorable to you, then when the quotes rise to $2400, 1 ETH will automatically be sold at the market price.

This order is used to quickly lock in profits. Indeed, in a volatile market, the price can reach the desired level only for a short period of time. And if at this moment you are outside the exchange, you will not be able to close the position. As a result, the price may turn in the opposite direction, and your profit will decrease or disappear altogether.

Similarities and differences

Stop loss and Take profit have only two common characteristics:

- they are always placed in the form of pending orders;

- work in conjunction with another open transaction and are used to close it.

Well, their main difference lies in the purposes of application: stop loss is needed to reduce losses, and take profit is needed to make a profit.

The highs and lows of price movement are important

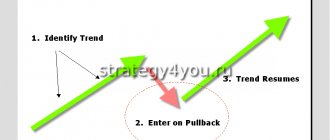

The highs and lows of price movements help us determine the strength of a trend, but they can also be used to take profits.

The market structure itself is based on highs and lows. They give us key levels to trade as well as favorable places to place stop losses.

We know that a downtrend is defined as a market that makes lower highs and lower lows. The opposite is an uptrend, where the market makes higher highs and higher lows. It goes without saying that breaking one of these highs or lows would be a sign that the market could turn around.

The chart below shows a strong uptrend that reversed after forming a lower low:

After a long upward movement, consolidation began. Further lower lows and highs emerged, which finally confirmed the reversal of the previous trend.

Stop loss to take profit ratio

Experienced traders use different ratios of stop loss and take profit, and it is calculated in a standard mathematical way:

- if when opening a trade you set the same size of stop loss and take profit (for example, 10%), then your ratio is 1 to 1;

- if you set the stop loss size at 10% and take profit at 20%, then your ratio is 1 to 2.

The most common stop loss and take profit ratios have the following values: 1:3, 1:2, 1:1, 2:1. Each trader decides for himself which option to use, and it depends on the specific strategy.

Stop Loss/Take Profit 1:3

This ratio is most often used in trend strategies and long time frames. Of course, in this case you have to “catch” the stop loss more often. But with the correct forecast of price movement, you can extract maximum profit - one successful take profit will cover the losses from three stop losses.

As a result, this strategy is capable of generating stable income if it is possible to carry out at least 30% of successful transactions.

Stop Loss/Take Profit 1:2

In this case, one take profit will cover the losses from two stop losses. At the same time, there will be slightly more successful transactions than in the previous version. And for stable profit making, it is necessary that at least 40% of positions are closed at take profit. Most often, this ratio is used in medium-term strategies.

Stop Loss/Take Profit 1:1

In this case, the profit from one take profit is destroyed by the loss from one stop loss. Therefore, in order to earn consistently, taking into account commissions, you need to carry out at least 55% of successful transactions. Such strategies are used in an uncertain market when the chart moves within one price corridor.

Stop Loss/Take Profit 2:1

With this ratio, the take profit will be triggered more often, but each stop loss will bring a double loss. Therefore, to make money, you need to carry out at least 70% of successful transactions. This ratio is most often used in scalping strategies; it allows you to make a profit regardless of the global market movement, and even when trading against the trend.

Reducing the tax base

The following are recognized as expenses that reduce the taxable base of profits received from the sale of securities:

- payment for the services of the registrar, registrar, depository, broker;

- costs reimbursed to intermediaries;

- exchange commissions and fees;

- tax paid by the holder of securities upon their inheritance or receipt as a gift;

- other costs associated with acquisition, sale, and maintenance.

When selling financial instruments traded on an organized exchange, interest paid on a loan taken for these purposes can also be used to reduce the tax base. Expenses in this case should not exceed the amounts calculated based on the refinancing rate of the Central Bank of the Russian Federation.