Hello, dear readers of the KtoNaNovenkogo.ru blog. Let us continue to examine concepts, the essence of which is not clear to many readers.

Many people have probably watched the movie “Divergent” and intuitively understood why it is called that, but are not sure of the accuracy of their guess.

Therefore, today we will talk about what divergence is and in what areas this term is used.

Examples

Most often, animals that have a similar need for food supply and its quality try to occupy one site or a certain area. So what is divergence in biology? The definition of this phenomenon allows for the acquisition of similar characteristics by unrelated, different groups.

After a certain period of time, the supply of food is depleted, animals have to change their habitat and look for new territories to settle. In the case where animals with different needs for environmental conditions are located on the same site, there is minimal competition between them.

Darwin determined that on an area of one square meter, up to twenty species of plants that belong to 8 families and 18 genera can be found in nature. What's good about divergence? In biology, this is the process of population branching.

For example, as a result of a similar process, seven different species of deer appeared. These are roe deer, musk deer, maral, sika deer, elk, fallow deer, and reindeer.

Sympatric speciation

Spatial separation of populations is not necessary for sympatric speciation.

In animals and plants, there are a number of mechanisms that can ensure intraspecific divergence. Already the hereditarily determined phenotypic polymorphism of populations and the diversity of living conditions contain the prerequisites for the sympatric formation of new forms.

This is proven by the existence in the same geographical areas of similar species of butterflies, aphids, etc., each of which is a strict monophagus, that is, it feeds on its own specific host plant. Among parasitic protozoa, closely related forms are also known that infect different hosts.

In plants, significant genetic factors of sympatric speciation can be polyploidy, mutations that determine the incompatibility of genomes and cytoplasm.

Consequences of the process

Divergence in biology is a process that is closely related to natural selection. There is a gradual extinction of some species, the survival of others. Forms that diverge as much as possible in terms of characteristics have the maximum ability to survive natural selection and leave high-quality offspring. This example can confirm that divergence in biology is an important phenomenon. Competition between intermediate individuals is significantly higher, so they decrease over time and then die out completely.

Let's remember the basics

Let's summarize.

Regular divergence

Bullish

- Price: low minimums.

- Oscillator: upper lows.

- Description: indications of the exhaustion of the downtrend and its reversal.

Bearish

- Price: upper highs.

- Oscillator: lower highs.

- Description: the bulls are exhausted. An indication of a possible trend reversal from upward to downward.

Hidden divergence

Bullish

- Price: upper minimums.

- Oscillator: lower lows.

- Description: occurs on pullbacks, confirms further stable movement along the trend. It often works on a retest of previous lows.

Divergence value

So what is divergence? Biology considers it as an opportunity to subdivide one species into several subspecies. For example, dolphins, which are a class of mammals, ichthyosaurs, which belong to the class of reptiles, and sharks, which are a class of fish, have a similar body shape. The reason is that they all exist in the same environment and have similar conditions of existence.

External similarities have been identified in the climbing agama and chameleon. Scientists explain the reasons for the similarity of different systematic groups by similar habitats. For example, organisms that live in the air have wings. In a butterfly they are presented in the form of outgrowths of the body. For a bat and a bird, the wings are modified forelimbs, that is, divergence is observed; this is discussed in detail in biology (examples, features) in the school course.

Divergents in psychology

In psychology there is a term " divergent thinking ". This means the ability of an individual to find many options for solving one problem. Moreover, the vector of solutions can be diametrically opposite.

To determine the level of divergence in human brain activity, psychologists have developed various tests. One of these tests: you need to determine the maximum number of ways to use, for example, a brick. Have you tried it?

And if the only thought that came into your head was that you can build something out of brick, then, alas, you do not have divergent thinking.

An individual with divergent thinking would find several more ways to use a brick: as a hammer, a press, a projectile, a target, a decorative object, a door stop, etc.

Japan is famous for its level of development of technology and technology. Large companies even have the position of “fresh head” . This is an employee with divergent thinking; he generates fresh, non-standard ideas, which are then implemented by the company.

Look at the photo below to see what the solution to the problem of sleeping in a subway car looks like (on the sign - please wake up at the desired station):

Such an idea could only come to the mind of a person with divergent thinking, finding non-standard solutions to problems.

What is characteristic of a person with divergent brain activity:

- he quickly formulates several solutions to one problem;

- he can think about several decisions at the same time;

- he is able to generate non-standard ideas;

- he not only finds non-standard solutions, but also creates an algorithm for their implementation.

Such abilities are given to a person by nature. But they can be developed . There are special psychological practices and trainings. And the sooner a person begins to develop these abilities, the more he can achieve.

That is why even in school textbooks from the early grades there are tasks “for intelligence”. This helps eliminate the rigidity of consciousness and develops its flexibility. The habit of thinking in patterns does not allow a person to grow and develop intellectually.

Parallelism

Translated from Greek, it means “walking nearby.” This evolutionary development is assumed for close groups. It consists in their independent acquisition of similar features of external structure on the basis of features that were inherited from common ancestors. Parallelism is common among different groups of living organisms during their phylogenesis (historical development).

For example, there were three directions in the development of adaptation in the evolution of pinnipeds to an aquatic habitat. Pinnipeds and cetaceans (seals, walruses), as they adapted to life in the water element, independently acquired flippers. In some species of winged insects, the fore wings have transformed into elytra. Lobe-finned fish developed characteristics of amphibians, and similarities with mammals appeared in wild-toothed lizards. In parallelism, similarity is a confirmation of the unity of origin of organisms and the presence of similar conditions of existence.

Allopatric speciation

Let's look at some examples of allopatric speciation. Of the 1,200 species of fish living east and west of the Isthmus of Panama, which formed in geologically recent times, only 6% are common to the fauna of both oceans - the Pacific and Atlantic, while most species are geographically isolated, long-diverged forms. A similar picture is observed here in relation to animals of other classes - mollusks, sea urchins, worms, crustaceans, etc.

A good example of ecological specialization in connection with spatial separation is the so-called “ring” species. The ranges of the herring gull (Larus agentatus) and black-billed gull (L. fuscus) overlap in Western Europe.

Both of these species are clearly distinct from each other and do not interbreed. However, if you trace their geographical races to the west (Greenland, Labrador, Canada, Alaska) and to the east (Northern Europe, Northwestern and Northeastern Siberia), it will be revealed that the latter form a continuous ring around the Arctic Ocean.

In this case, crossing between individuals of neighboring geographical races occurs freely. N.V. Timofeev-Resovsky suggests that the initial settlement of gulls to the west and east began from some intermediate area, for example, from Eastern Siberia.

It was accompanied by increasing specialization of geographical races, so that when the ring closed in Western Europe, related forms (L. argentatus, L. fuscus) “did not recognize” each other and turned out to be different species.

Ecological specialization within a species can also occur in adjacent areas without significant geographic removal of diverging forms, while maintaining the possibility of exchange of genetic material between neighboring populations.

Indicative in this regard is the abundance of endemic forms in large closed reservoirs. Thus, Lake Baikal is home to more than 300 species of crustaceans belonging to the family Gammaridae, most of which are found nowhere else. The emergence of these endemics is most likely due to ecological isolation and differences in the direction of selection in locally isolated populations.

Ecological specialization obviously determines the formation of ecotypes in plants confined to certain ecological niches and characterized by a hereditarily fixed set of morpho-physiological characteristics.

The category of phenomena under consideration should also include seasonal isolation, which manifests itself in divergences in the timing of reproduction.

Thus, the same plant species have spring and winter forms, as well as ephemeral races that bloom in the spring, or late-ripening races that bloom only in the fall. In all cases, intraspecific divergence associated with ecological specialization contributes to the adaptation of populations to specific living conditions and ensures the most complete use of territorial, food and other resources of the habitat area.

The divergence in morpho-physiological characteristics of geographical or ecological races is based on the divergence of the genetic structure of their constituent populations.

If such divergence goes far enough, then this leads to the development of mechanisms of reproductive isolation that can, to one degree or another, limit the possibility of interbreeding of individuals belonging to different races.

The main forms of reproductive isolation are expressed in a change in the nature of mating and fertilization selectivity, in a decrease in the fertility of hybrid individuals and a decrease in the viability of hybrids.

A change in the nature of mating selectivity (behavioral isolation) usually precedes in its occurrence in animals the appearance of other forms of reproductive isolation.

This is due to the fact that the sexual behavior of individuals is a complex, highly species-specific, finely coordinated complex of hereditarily controlled (unconditioned) reactions. An example of this is the mating games of many species of fish, birds and mammals. This entire complex of reactions ensures, on the one hand, the synchronization of the sexual cycles of males and females, and on the other, the prevention of interspecific crossings, i.e. ensuring reproductive isolation.

As for other mechanisms of reproductive isolation—a decrease in the fertility and viability of hybrids—their occurrence, as a rule, reflects the result of far-reaching genetic differences, when divergent forms reach the rank of independent species.

Features of evolution

Divergence and convergence in biology are irreversible processes. As soon as the body adapts to the new environment and conditions of its existence, the organ that has undergone the change disappears.

Even when returning to the original living conditions, restoration of the lost organ is not observed. In his scientific works, Darwin repeatedly said that even with an ideal repetition of the habitat, a species does not have the opportunity to restore its original state; this is divergence and convergence in biology. Examples of such transitions can be given for dolphins and whales.

The internal structure of their fin retained the characteristics of a typical limb of a land mammal. Due to mutations, the gene pool of the entire population is constantly updated; there is no repetition of the gene pool of the previous generation.

What it is?

In general, when conducting technical analysis when considering price and oscillator charts together, 2 similar phenomena are observed:

- Divergence or divergence of graphs ( from the Latin divergo means I deviate).

- Convergence or convergence ( from convergo means bringing closer together).

Since the differences in the generated signals are determined only by the directions of the charts, and their interpretation is subject to general rules, the term “divergence” has mainly become entrenched in the everyday life of traders.

The formation of divergences is possible on all known oscillators/advisors - from MACD, Stochastic, on h4, RSI and CCI to the original developments of traders. The rules for their use are described in detail in books on technical analysis and manuals on indicators.

Any divergence (convergence) occurs when new extremes formed on the price chart during a directional movement do not find their confirmation on indicator charts. An example is the classic version of bearish divergence, when the formation of new highs on the price chart in an uptrend corresponds to the appearance of oscillator highs, but forming a downward sequence.

In other words, divergence/convergence is a situation of inconsistent (in different directions) movement of the price chart and the line of a technical indicator (oscillator), monitored during the formation of adjacent extremes of the same name (maximums/minimums).

The nature of divergences (convergences)

In order to accurately identify convergence/divergence on a chart and correctly interpret the market state corresponding to the model, it is necessary to understand the essence of the phenomena.

Since the price chart represents the real market situation, and oscillators express the interest (activity) of trading participants with a sufficient degree of accuracy, the discrepancy in the directions of movement can be considered from the following positions:

- As long as the expectations (moods) of traders coincide with the development of the trend, and actions are aimed at supporting it, a healthy trend is reflected in the charts. Extremes on the price chart and in the oscillator window are formed in concert, with simultaneous updating of highs or lows.

- As the trend develops, the number of players entering into transactions in the mainstream direction grows and eventually reaches a maximum. The inertia of thinking of the “crowd” (the bulk of traders) continues to support the trend (“latecomers” strive to realize at least part of the movement by opening trades along the trend). At the same time, the interest of market participants in the development of the situation begins to decline, which is reflected in both volumes and oscillators. As a result, the price updates its extremes (although the growth rate decreases), and the indicators clearly show a change or fading of the trend (new extremes are worse than the previous ones), which forms the model.

Model Definition

Divergence/convergence becomes a signal of a decrease in traders’ interest in maintaining the current trend. However, it is incorrect to interpret it unambiguously as a reversal.

- Divergences indicate the likelihood of a trend change or the beginning of a correction. But such a development of the situation is not necessary - the appearance of another powerful price impulse can hold up the movement, turning the signal into a false one. Accordingly, the formation of a new price wave needs confirmation - by patterns on the chart, other technical analysis tools (for example, trend indicators).

- The angle between the lines drawn on the charts is perceived by traders as the “strength” of the generated signal. In reality, the magnitude of the mismatch (angle) does not provide reliable information about the increase in the probability of a reversal, and even more so, about the scope of further movement.

- The assumption about the predominant use of a signal in countertrend trading is incorrect. Divergences/convergences indicating the development of a trend are no less effective than signaling a change in direction.

Read more: A trader’s workplace is the most important factor in successful trading!

The main advantage of using models is versatility:

- convergence/divergence of price charts and oscillators is observed in most of the latter and is effective in all markets, assets, timeframes;

- The models are suitable for building trading systems and strategies based on trend following, trading from the boundaries of price channels, including against trends, and swing trading.

At the same time, the accurate construction of divergences, when confirmed by other tools, guarantees high accuracy of decision making.

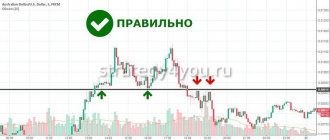

How to plot it correctly on a graph?

To search and identify divergences, you need to know 2 basic rules for graphically constructing models:

- The next extremum (peak or trough) is formed on the price chart, which is preceded by at least one more of the same name. A minimum of 2 consecutive extrema of the same name is a prerequisite for the model. It is possible to plot based on a larger number of highs/lows, which adds reliability and strength to the signals.

- At the moments corresponding to the extrema of the price chart, extrema of the same name are also formed on the oscillator line.

In the trading terminal, the sequence of actions is as follows:

- Determine the formed extremum closest to the current price level.

- Find the next one with the same name.

- Connect the resulting points with a line.

- Draw vertical lines along the extreme points of the price chart until they intersect with the oscillator chart.

- At the intersections with the indicator line, mark the corresponding extreme points.

- Connect them and visually determine the discrepancy with the segment on the price chart.

Traders need to avoid several common mistakes:

- The search for models is carried out in a trend area with pronounced extremes. When moving horizontally, it is wrong to count on the appearance of divergences and the correct interpretation of incoming signals.

- When the next extreme, opposite to the last formed, is formed, you should switch your attention to it when searching for divergence. Practice shows that the formation of a new signal cancels the previous one (significantly reduces the likelihood of its implementation in price).

- Convergence/divergence should only be considered synchronously - in the window of the price chart and oscillator, extreme points that form at the same points in time are analyzed.

If you follow the algorithm and rules, detecting divergence/convergence will not be difficult even for an inexperienced trading participant.

Forex divergence indicators

The question of divergence indicators on Forex, the stock exchange and other financial markets has two interpretations:

- oscillators for which model search is recommended;

- means for automating the construction and identification of divergences/convergences for technical analysis tools.

Oscillators and divergences

The theory of technical analysis states that convergence/divergence patterns work equally well on any oscillator.

At the same time, the experience of analysts and traders shows that practical application is preferable on charts that do not have a saturation effect.

Indeed, the algorithms of such indicators as Stochasic, RSI and similar ones involve assigning minimum and maximum values to the readings under certain conditions (for example, for stochastic - 0 and 100%). This leads to the exclusion of some real extrema from consideration, which complicates the search and analysis of divergences.

As a result, it is proposed to consider indicators without clear boundaries and overbought/oversold zones, for example MACD, ROC, TRIX and similar ones, as the optimal option for work.

However, all the necessary constructions are also effective for classical oscillators with restrictions. The only mandatory condition is compliance with the “5% rule”. In accordance with it, it is necessary to select the indicator calculation period and other important parameters in such a way that the indicators are in the active zone (between overbought/oversold zones) 95+% of the time. In addition, the strength of signals formed in oversold/oversold zones increases.

Divergence indicators

Automating the process of graphically constructing a model and identifying convergence/divergence will save the user's time and reduce the number of subjective errors. To solve this problem, traders have developed a significant number of original indicators.

The list of developments should include:

- MACD Divergence. One of the best indicators for determining convergence/divergence on the MACD. It reveals both classic and hidden divergences (types of models will be discussed later), visualizes lines on both charts (can be disabled), shows the expected direction of movement (with arrows) after the signals are implemented.

- Stochastic Divergence. Works with a standard stochastic oscillator. Draws lines for divergences in the price and indicator windows, highlighting bearish and bullish patterns in color.

- Divergence Panel. Information indicator based on the classic MACD. The panel displays the currency pair, time frame, type of divergence (bullish or bearish), and the distance from the moment the pattern was formed to the current bar. The main advantage is that it works simultaneously with all time frames and major currency pairs. When you click the Chart button in a panel line, the corresponding graph is visualized.

Read more: What is consolidation in trading?

- Divergence Viewer. An information indicator that determines divergences of various types (classic A, B, C and hidden) for several oscillators - MACD, RSI, RVI, Momentum, StDev, Stochastic, etc. When a model is detected, it gives a signal (Alert), displaying the signal type and type in the window convergence/divergence, timeframe.

- A set of indicators of the “TT” series – CCI Trix Divergence TT, CCI VWMA Divergence TT, S-ROC TT, Super Stochastic DA TT, etc. The author’s developments are built on various oscillators and determine divergence/convergence models with high accuracy.

It should be noted that due to the calculation of historical data with a large number of conditional statements in the code, the performance of almost all indicators leaves much to be desired. Their widespread use requires powerful hardware to install a trading terminal.

The best option is to build it yourself, since it does not require a special level of training, a significant investment of time and solves the specific problems of a particular vehicle. In addition, most tools do not detect all types of divergences.

The meaning of mutations

For example, whales and dolphins did not turn into fish. In the process of their transition from land animals to aquatic inhabitants, only convergence of the limbs occurred.

Considering that mutations cause updates to the gene pool of a certain population, we note that it does not repeat itself. If at a certain stage of evolution reptiles developed from primitive amphibians, they will no longer be able to give birth to amphibians.

The stem of the butcher's broom has thick and shiny leaves. They are modified branches. In the center of such modifications are true scale-like leaves. In spring, flowers appear from the axils of such scales, which, as they grow, turn into fruits.

Kinds

Convergence/divergence models are usually divided into several types:

- Depending on the type of signal - bullish (if the price is likely to increase) and bearish (if the price decreases).

- According to the configuration of the lines - classic (three additional types are distinguished - A, B, C or I, II, III), hidden and extended.

Classical

Classic or regular countertrend divergence is the most obvious and easily recognized version of the model. The search is carried out when there is an obvious directional movement of the asset (price chart). It is considered a reversal signal, the appearance of which indicates an increasing probability of a trend reversal (the start of a correction wave).

The probabilistic nature of the signal requires confirmation.

Depending on the market situation (read, the relative position of the completed lines on the charts), it is divided into several classes (types).

Divergence "Class A" (Type I)

A Class A (Type I) bearish countertrend divergence occurs in an uptrend.

The model manifests itself as follows:

- As the price of an asset rises, successively increasing highs are formed on the chart (each peak is higher than the previous one).

- In the oscillator window, moments of extreme points in the price chart correspond to decreasing peaks - the next extreme point is located below the previous one.

It is obvious that the lines connecting the maximums of the graphs diverge. The presence of such a divergence indicates the exhaustion of the bullish trend and the possible beginning of a bearish one (or a bearish correction).

The signal is considered strong (and therefore belongs to the highest class or first type). However, even in this case, we can only talk about the probability of a reversal and opening a position requires confirmation. As a confirmation signal, it is enough to consider the oscillator leaving the overbought zone or the location of the MACD histogram columns below the signal line.

According to traders, the angle between diverging segments on the charts determines the strength of the signal (primarily the duration or scope of the new trend or correction). However, no mathematical or statistical justification for this point of view has yet been provided.

Classic bullish divergence (more precisely, convergence) of type I (class A) is considered in a similar way, but on a falling trend. On the price chart, the main element of the pattern is the lows with successive decreases. They correspond to increasing (each subsequent one is higher than the previous one) lows of the oscillator.

The formation of divergence (convergence) indicates a bullish reversal (a change from a downward price wave to an upward one). Assessing the signal strength and its reliability is similar to bearish divergence.

Divergence "Class B" (Type II).

Similar to the previous option, type II (class B) divergence is divided into bearish and bullish. The first is formed during a period of rising asset prices, the second – during a period of falling. The model will also be based on the highs (bearish) and lows (bullish) of the price chart and indicator.

It differs from strong (A or I) by the minimum difference between the prices of the last two extremes of the price chart - in fact, a double top or double bottom is formed with highs or lows at the same level (close levels with a difference of several points). The oscillator line forms decreasing highs during bearish divergence and increasing lows during bullish divergence.

The generated signal refers to reversals of medium strength. It becomes reliable if there is a strong confirmation, for example, when the main MACD line crosses the zero level or the center line of the oscillator chart (50% for RSI and Stochastic, 0 for CCI).

Divergence "Class C" (type III)

When constructing the model, the classical conditions of divergence (convergence) are used:

- bearish is formed during an upward trend, bullish - during a downward trend;

- The formation involves rising highs for a bearish divergence, and falling lows for a bullish one.

Read more: What is swing trading?

A feature of the model is the minimal difference between neighboring extreme points on the oscillator chart (double top or double bottom) and a consistent increase or decrease in extreme points on the price chart.

The resulting signal is interpreted as weak, in which the probability of a trend continuation is higher than its reversal. Traders are advised to ignore its appearance, and the condition for trading type III (class C) divergence is the appearance of a strong reversal signal on other indicators or the price chart.

Hidden

This type of chart convergence/divergence is also considered a pattern that generates strong trading signals. But, unfortunately, when building strategies and trading systems, most traders ignore it (to some it is simply unknown).

The principle of its formation is the opposite of the classical version, and the result changes accordingly.

Hidden bearish divergence.

The bearish pattern is considered in a downward (bearish) trend. To draw a line on a quote chart, a search for maximums is carried out, and each next one must be lower than the previous one.

Divergence (more precisely, convergence) is formed when the decreasing peaks of the price chart correspond to updating highs of the oscillator.

This configuration clearly shows an increase in traders' interest in trading during a fall in asset prices and serves as a strong signal of the development of the dominant trend. Experienced traders and analysts advise considering opportunities for selling or increasing short positions.

Any confirmation is required for the signal to be implemented.

Hidden bullish divergence.

By analogy with hidden bearish convergence, rules for identifying hidden bullish divergence are formulated:

- the model works on an upward (bullish) trend;

- when the price rises, local minima (depressions) of the price chart are considered with each subsequent level increasing relative to the previous one;

- On the oscillator, at the moments of key price extremes, a sequence of decreasing lows is formed.

The signal indicates a continuation of the upward trend. Upon confirmation, long positions are opened or increased.

Extended

The extended divergence model is similar in some respects to the classic class B (type II) divergence. However, the specificity of its formation leads to its rather rare appearance on the graphs.

Extended bearish divergence.

In the extended bearish divergence model, not neighboring extremes are considered, but price chart peaks, between which there may be several local maximums/minimums. In fact, there is an expansion of the time range, which gives the discrepancy its name. The construction condition is the approximate equality of the levels of the maximums (a “double top” figure).

At the same time, on the oscillator chart, the maximums corresponding to the selected price extremes decrease, and the distance between them turns out to be significant.

The signal indicates a continuation of the downward trend and is considered strong (or medium strength). As with other options, confirmation is required.

Extended bullish divergence.

For an extended bullish divergence, there must be two price lows at the same level (or with a minimal difference) - a “double bottom” and a significant increase in the oscillator lows.

When confirmed, the signal is considered bullish, a continuation pattern of an upward trend.