One of the important conditions for successful trading is chart analysis, but many traders face a problem - sometimes small price fluctuations distract attention and can lead to errors in the analysis. It is in order to obtain clear information about significant changes and main trends that the ZigZag indicator is used.

If you were at least briefly interested in the method of trading using Elliott waves, then you simply could not help but hear about the auxiliary indicator ZigZag, which allows you to make fewer errors in constructing waves by filtering out minor market noise. For example, different traders can plot Elliott waves on the same chart in different ways. This is due to the fact that each person views this or that movement in his own way. It is to bring the analysis to a single denominator that this indicator is used. ZigZag is the hero of today's review.

All about the ZigZag indicator

Description and features of the ZigZag indicator

The ZigZag indicator connects the most significant extreme points on the chart with a straight line, filtering out small price fluctuations. Unlike most technical analysis indicators, Zigzag does not predict further price movements; it only helps analyze previous fluctuations.

ZigZag helps identify major trends. It is often used to determine Elliott waves, since each trader sees them on the chart differently, and often determining them “by eye” can be fraught with losses. Due to the fact that ZigZag is ineffective in predicting future price movements, it is almost always used in conjunction with other tools or analysis methods.

Introduction

As you know, the market moves in different directions and a zigzag curve of asset prices inevitably appears on the chart. Zigzag patterns are ubiquitous and are present on all charts at all possible quote update intervals. Within each price movement there are waves of price fluctuations, ups and downs, peaks and troughs. And all these price changes can be displayed on the chart with a simple zigzag.

The ZigZag indicator is suitable for effective trading using many methods and virtually all time frames. As a tool for confirming trends and calculating exit points, ZigZag can be used for most trading methods. When using the indicator, it will be important to calculate exactly where the price is heading and with what relative amplitude (angle) to the expected values. And the price direction itself is a factor that can be calculated even more easily with this technical analysis tool.

Installation and configuration of the indicator on the chart

Zigzag does not have a specific category, so in the Meta Trader 4 terminal it is located in the “Custom” tab. To install it on the chart, you need to open this category in the indicators menu, find “ZigZag” in it and click on it.

RegistrationDemo account

Having installed the tool on the chart, you can begin adjusting its parameters. ZigZag has three key parameters:

- Depth – the number of candles on which the top of the ZigZag will not be built, if the Deviation condition has not been met.

- Deviation – deviation (the difference between the extrema of the candles, which is considered sufficient to build a new top. Expressed as a percentage.

- Backstep – the minimum number of candles between two tops.

Increasing Depth and Backstep causes ZigZag to skip more small peaks, and build kinks only at the most basic extremes. Increase Deviation. On the contrary, it makes the indicator more sensitive, and new kinks appear on the line.

Trading using Zigzag signals

Although ZigZag does not make predictions and works better in conjunction with other tools, it can also be used alone. Trading using ZigZag signals alone is very simple and resembles classic trading on the breakout of an extreme point.

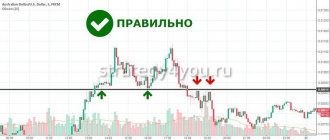

Orders are set up as follows:

- After the Zigzag forms a top and then a bottom, a Buy Stop order is placed several points above the top.

- After the Zigzag forms a bottom and then a top, a Sell Stop order is placed several points below the bottom.

The trading tactics are universal, and are suitable both for opening positions on Forex trading pairs and for trading CFDs on stock market shares and cryptocurrency.

To test the effectiveness of this trading method, several transactions were opened on the hourly timeframe of the GBPUSD currency pair. Despite the fact that the last movement was quite strong, and the Zigzag line turned out to be long, the last three transactions closed in the negative.

The first two transactions were closed almost immediately, the third was affected by a random price fluctuation, after which the chart turned in the desired direction. However, setting a stop loss is a mandatory requirement of money management, although this time it played against the trader.

Even if we write off the result of the last trade as an accident, the dynamics as a whole are not in favor of such primitive trading tactics. To increase efficiency, it is necessary to use other analysis methods in conjunction with the ZigZag indicator.

The key disadvantage of zigzag

If we limit ourselves to analyzing history, it seems that this indicator is ideal. Each reversal indicates a change in direction of movement, and the idea of trading is immediately born when a new High/Low zigzag is formed. When trying to implement this idea, an understanding emerges of the main drawback of the indicator - the last zigzag fragment is redrawn.

There is no deep redrawing; the indicator readings do not change in history, but the extreme point of the broken line can change its position. This effect is noticeable when checking zigzag in the tester; this nuance is not visible in history.

After an upward movement, the GBPUSD chart began a downward movement. When the pair passes a distance of 5+%, the formation of a new downward wave begins.

At the moment of the expected reversal, the illusion of a trend change appears. The zigzag builds a segment, growth has begun, if it exceeds the Deviation value, then the drawing of a new section of the broken line will begin.

But the growth turned out to be moderate. The decline resumes and the perceived reversal point moves to a new low. During a trend movement with shallow corrections, this can be repeated several times, giving a whole series of false signals.

It is because of this that the Zigzag indicator is prohibited from being used as the sole signal provider . There are too many complex signals, if you do not filter them, the deposit will be lost.

Trading strategy with Zigzag and technical analysis patterns

Zigzag makes it easier for a trader to find and plot technical analysis patterns on a chart. Using this feature of the indicator, you can build a simple trading system based on the method of trading using graphic patterns that has been proven for decades.

The most basic way to combine the ZigZag indicator and chart patterns is triangle trading. A triangle is a universal figure that can give signals both to open a purchase transaction and to enter a short position.

To construct a triangle, ZigZag must construct two tops and two bottoms so that the second top is lower than the first, and the second bottom is higher than the first. After constructing the figure, at the place where the price is expected to cross its boundaries, two breakout orders (buy and sell) are placed. After this, traders can only wait to see which one will work, periodically pulling them closer to each other as the lines of the triangle narrow.

Stop loss and take profit levels are set depending on the timeframe. For example, when trading on M15, the stop can be set at 10 points from the order, and the take at 30 points.

Additional indicators for scalping

You can supplement the ZigZag strategy described above with some other technical tools, for example:

SuperSignalsChannel. This indicator is an improved price channel. On the chart it looks like two colored lines between which the price moves. As soon as the latter touches the line, an arrow appears. You can download it for MT4 using the link - super-signals-channel (archived).- FT PVD - FT_PVD. This instrument is presented in the form of a strip of red and blue bars. The appearance of the former indicates a downward trend, the emergence of the latter indicates an upward trend.

You need to open a buy order with the following indicators:

- A green SuperSignalsChannel arrow appears on the chart.

- There was a top in the indicator with the previous extremum.

- Blue bars appear on the FT PVD strip.

You need to sell when:

- A red arrow appears on the SuperSignalsChannel.

- The broken ZigZag found the minimum.

- The bars on the FT PVD strip are colored red.

Stop Loss is set slightly below the nearest minimum or slightly above the maximum.

Strategy with ZigZag and Bollinger Bands indicators

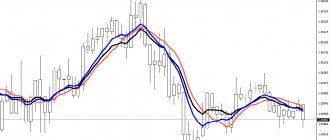

Finally, we will analyze a more complex strategy, which is built on signals from several technical instruments at once. To get started, you need to install the following indicators in the terminal:

- 2 ZigZag indicators with parameters (12,5,3) and (8,2,3).

- Bollinger Bands indicator with standard settings.

- CCI indicator with a period of 14 and levels -90 and 90.

- Stochastic oscillator with parameters (11,5,5).

Buy trades based on the strategy are opened according to the following algorithm:

- Both Zigzags converged at one point.

- The price crossed the Bollinger Bands from top to bottom, and then turned around and crossed in the opposite direction.

- The CCI indicator is below the -90 level.

- Stochastic lines are directed upwards.

Sell transactions are opened under mirror conditions.

Stop loss and take profit are set according to the general rules in a ratio of 1:3.

The strategy is multi-currency and works on all popular assets. It is recommended to choose M15-H4 as a working timeframe; H1 will be the best option.

More about construction methods

Option number 5. The next way to get this tool is Hierzhik’s , or rather, the method was taken from there and it is actually used in construction. Interestingly, the book contains some of Gann's theory.

Option number 6 (and the next 5) were created by one programmer - klot . The next mode is repeated. It is built in the usual way.

Option 7. Developed by a programmer under the nickname klot. I could not find information about this person. Well, it’s good that you developed a useful thing!

Option 8. I can say the same about the Candid programmer. It's good that he exists!

Option 9. This type was developed using fractals, an indicator that comes in the MetaTrader 4 package.

Option 10. Modified Zigzag indicator. Also based on Hjerzhik’s book, only it was developed by a different programmer.

Option 11. Next comes the point where 7 different indicator algorithms in one in scanning mode look for Gartley patterns.

Option 12. Made by Talex . Talex, in general, is the name of a world-famous Polish IT company. I think that the person who works under such a nickname is not a buffoon, but the person whose ideas are being promoted works quite decently in his field.

Option 13. Created according to the algorithm of a certain tovaroved Alexander Shchukin . It's hard to say who he is. I would say that he is quite an interesting conversationalist, he is often praised for his participation in discussions, various developments and the like.

Option 14. Created based on the work of the Wallex . Another look at tool construction.

Option 15. This setting is necessary so that the construction is based on the Elliott .

Advantages and disadvantages of the ZigZag indicator

Zigzag makes it easier for a trader to perceive a chart. By filtering out market noise, it identifies only the most significant tops and bottoms. Using the breaks of the ZigZag indicator, it is convenient to construct technical analysis figures and simple trend lines; you can place pending orders on them.

ZigZag helps in identifying Elliott Waves; it is convenient to stretch the grid of Fibonacci levels along its tops. Zigzag generally interacts well with other technical tools. But without them it is practically useless. This indicator is difficult to use to predict future price movements; it can change the position of the last point, which is sometimes confusing and harmful to trading. Therefore, the indicator is not recommended to be used without additional analytical tools.

Trading in financial markets involves a high level of capital risk. In order to reduce risks, it is recommended to strictly follow the rules of money management and always set Stop Loss. All decisions that a trader makes when working on Forex are his personal responsibility.

RegistrationDemo account

What does the zigzag indicator show, how does it work?

After being added to the chart, the zigzag indicator draws a broken line on top of the candles . We get a zigzag line; as new candles form, the indicator updates the marking, adding new segments from the right side of the chart. The zigzag is virtually endless; if you try to move into deep history, you will see that constructions are carried out from the first available candle.

The indicator does not carry out complex calculations; the work of zigzag is reduced to constructing a segment connecting High and Low prices. Construction rules are discussed in the section with an overview of settings.

The main purpose of the zigzag indicator is to filter out price noise, that is, eliminate insignificant chart movements. Due to this, the trader receives ready-made extreme points, which can be used to build support and resistance levels and trend lines. There are other ways to use a zigzag.