Bitcoin ATMs allow you to buy and sell Bitcoin with cash and relative anonymity.

In this post, we'll cover the different ATMs, their pros and cons, and show you how to find a Bitcoin ATM near your home if there is one.

Brief information about Bitcoin ATMs

Bitcoin ATMs, also known as BTMs

, are machines that accept cash and pay with Bitcoin in exchange. Some ATMs will also buy Bitcoin from you and give you cash in exchange.

Due to their anonymous nature, most ATMs have strict purchase limits, and some even require a verification process (KYC).

Beautiful girl buys Bitcoin through an ATM

subscribe

Keep reading and you will learn everything about ATMs.

What is a Bitcoin ATM?

A Bitcoin ATM acts as a physical Bitcoin exchange where you can buy and sell BTC with cash.

The world's first BTC ATM

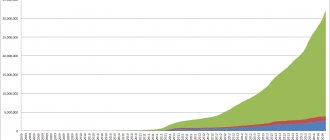

The world's first crypto ATM was opened on October 29, 2013 at Waves Coffee Shop in Vancouver, Canada.

The device often consists of a scanner, a cash dispenser, and a computer to manage transactions.

subscribe

Pros and cons of crypto ATMs

There are positive and negative qualities when using Bitcoin machines. Let's look at them in more detail.

Advantages:

- more familiar format;

- the ability to buy virtual coins for cash;

- high speed of operations;

- no risk of falling for scammers.

Flaws:

- removal of commission for each transaction;

- limited number of such devices;

- uncertainty in legal matters;

- a small selection of transaction methods (for example, only purchase);

- difficulties with identification (for some cases).

The process of installing crypto ATMs in the Russian Federation is being slowed down for several reasons - the tough position of the Central Bank of the Russian Federation, the lack of clear regulation by law, the criminal factor and, of course, the high price of the equipment - from 5 to 15 thousand dollars.

How do ATMs work?

Bitcoins are issued either to the buyer's Bitcoin wallet (via a scanned QR code on a mobile device or paper wallet) or to the paper wallet itself, generated and printed by the ATM at the time of purchase.

Scanning a Qr code at an ATM

The purchase price depends on the current exchange rate, which the ATM receives from the Internet in real time. In addition, the ATM charges an additional fee for the service and takes into account its cost.

Commission and rate

Difficulties with the implementation of Bitcoin terminals in Russia arose due to the desire of law enforcement agencies to know more information about cryptomats. They are interested in the principles of exchange rate formation, tax issues, the ability to verify users’ personal data, the size of the commission, etc.

Most often, the installation of Bitcoin terminals is carried out by private companies that resolve legal issues on an individual basis. In this case, the exchange rate price is tied to the current value of the virtual currency on the exchange platform. Many devices simultaneously work with several exchanges and take into account the average rate.

In the future, it is planned to add exchange rates for private buyers, when the crypto machine will be used to conduct transactions between two users. To do this, it is enough to connect payment terminals to the Local Bitcoins platform. But when this will be implemented is still difficult to say.

The size of the transaction fee tends to decrease. If earlier this parameter was about 15%, today it has almost halved to 5-7%. As the number of Bitcoin machines increases, the commission will have to fall.

Commission and rate in Bitcoin terminals

How to use a Bitcoin ATM?

Although each BTM is different, the purchasing process is essentially the same:

- Select "Buy Bitcoin"

- Scan the QR code of your Bitcoin address using a BTM scanner.

- Depending on the ATM and jurisdiction, you may be required to provide identification (KYC).

- Enter the amount you want to purchase.

- Insert money into BTM.

- Wait while the machine processes the transaction.

- Check your Bitcoin wallet to confirm the transaction.

The process for selling Bitcoin is much more varied and depends on the specific BTM, however, these machines are quite intuitive to use, so simply follow the on-screen instructions.

How to distinguish scammers when selling cryptocurrency

Lately, investors have become increasingly interested in cryptocurrency.

But such a stir around bitcoins has contributed to the emergence of a huge number of scammers. Therefore, before you look for how you can cash out bitcoins from your wallet, make sure that you do not contact thieves. Otherwise, you may not only not withdraw money, but also lose the money withdrawn. If you are not well versed in the security rules for working with cryptocurrency, it would be useful to mention how to recognize fraud. This can be done using the following criteria:

- The offered rate is too attractive and does not correspond to the market situation. As a rule, on reliable services the rate is always lower than the market rate. Nobody wants to work at a loss;

- The exchange service was recently registered. Practice shows that more than half of young exchangers are simply dummies who do not pay out money and disappear in a day or two;

- If a purchase occurs hand-to-hand, scammers often come up with sob stories to gain empathy and trust from their opponent. It is also undesirable to trust such sob stories;

- And, of course, you cannot use suspicious websites for exchange, much less install various mobile applications from them. Due to virus programs, the pages of even reliable exchangers can be replaced.

The number of methods of deception is unpleasantly amazing. Every month more and more fraud schemes appear. It’s impossible to talk about everything, but before you cash out money from a Bitcoin wallet, be extremely careful and use trusted resources. Of course, this is not always profitable based on the exchange rate, but at least you won’t be left broke. The money will come in any case. And extra risk rarely pays off.

Best Bitcoin ATMs

General Bytes

General Bytes is a Czech company that is the world's largest manufacturer of ATMs for Bitcoin and other altcoins. The company has sold more than 2,500 machines in more than 60 countries.

Their ATMs can support over 120 different currencies and over 60 different cryptocurrencies. The company produces two main BTM models:

BATMTWO

This ATM model is designed to be securely mounted on a wall or an additional stand. It only supports the purchase of cryptocurrencies and has a built-in fingerprint scanner to comply with AML/KYC (know your customer) procedures.

BATMTWO costs about $3,249.

BATMTHREE

The 23-inch FullHD display is completely mounted in the BTM. This Bitcoin ATM offers both buying and selling of Bitcoin and other cryptocurrencies.

BATAMTHREE costs about $7,499.

Genesis Coin

Genesis Coin Inc. is a company located in San Diego, USA, and is the second most popular ATM manufacturer. The company supplies three different BTM models:

Genesis1

Genesis1 is a Two-way ATM (buy and sell) with additional features such as an account checker, barcode scanner, EMV card reader, fingerprint reader (optional) and thermal printer.

Gensis1 costs $14,500.

Satoshi1

Satoshi1 is available in both 1 and 2 models. This machine is much smaller than the Genesis1 and has a 21-inch screen, a high-definition camera and an optional fingerprint scanner.

Satoshi1 costs $6800.

Finney3

Finney3 is the newest and smallest BTM from Genesis Coin. This single-sided BTM has a 21-inch screen and has the same specs as the Satoshi1, only it is smaller and must be hung due to its size.

Finney3 costs $4,500.

Lamassu

Lamassu is a Swiss company that is the oldest BTM manufacturer (since 2013).

Lamassu slot machines are open source and support Bitcoin, Zcash, Ethereum, Bitcoin Cash, Litecoin and Dash.

You can add additional coins manually if necessary.

Lamassu has four different Bitcoin ATM models:

Gaia

Designed for wall or desktop mounting and weighing just 25kg, Gaia can fit in an airplane case.

Gaia is a purchase-only ATM and costs €3,600.

Sintra

Constructed from 2.5mm thick steel sheets and an all-glass user interface, the Sintra has a dedicated computer board with battery backup, 3G connectivity, intrusion sensors and front door control.

This is a beautifully designed ATM with both receiving and dispensing. The model with reception only costs 6,200 euros, and the model with reception and delivery costs 7,500 euros.

Sintra Forte

The Sintra Forte is 20% larger than the Sintra and includes storage controlled by an electronic lock.

The vault is made of 6mm hardened steel and contains the banknote validator, bill dispenser and computer board.

This BTM also comes only for buying BTC (for 7,700 euros) or for buying and selling (for 8,900 euros).

Douro II

The Douro II is the latest model from Lamassu. Like the larger Sintra, the new Douro II uses a special computer board with battery backup, 3G connectivity and tamper sensors.

This single-sided BTM costs €5,200.

Day to Day Management

Day-to-day management of an ATM business involves servicing customers who are having problems with the machine, performing cash transactions to either replenish the machine's inventory or deposit cash into the bank, ensuring smooth operations with interchange integration. Channel prices remain in working order and that the machine works without glitches.

Thus, the Bitcoin ATM business is not a business that can be easily managed remotely. You or a trusted employee will need to be on site to check the machine, perform maintenance if necessary, and perform cash management.

All Bitcoin ATM Manufacturers

There are more than 40 Bitcoin ATM manufacturers. Here's a list of everyone:

- General Bytes

- Genesis Coin

- Lamassu

- BitAccess

- Coinsource

- Covault

- Order Bob ATM

- Digital Mint

- Shitcoins Club

- Coinme

- Sumo ATM

- Bytefederal

- zzBit

- wBTCb

- RusBit

- BTC Facilities

- BBFPro

- Bcash Greece Inc

- Intellogate

- BitTeller

- Bitstop

- ChainBytes

- Bitnovo

- Vault Logic

- Trovemat

- CoinLogiq

- BTCRiot

- Criptec

- Open Bitcoin ATM

- Criptomat

- DOBI ATM

- Coin Capital

- CryptoMat

- CryptoMatic ATM

- CryptoGo

- BitOcean

- Bitcoin Já

- BitVending

- Coinplug

- Fastcoin ATM

- Virtual Crypto

Overview of purchasing methods

There are five traditional ways to buy Bitcoin:

- Via Exchanger

- Through the exchange

- Via telegram bot

- Via P2P platform (LocalBitcoins)

- From the owner

Cash payment imposes restrictions: to replenish an exchange wallet or buy crypto through a bot in Telegram, you will need electronic payment systems. There are three options left: the exchanger, the LocalBitcoins platform and the owner. In each of these methods, restrictions appear due to cash payments, but the transaction is still possible.

When you need to buy Bitcoin in Moscow, another option is added - a terminal or ATM. These are devices that allow you to buy currency directly, without a seller. There are terminals in other cities, but in Moscow and St. Petersburg there is more choice and a larger number of points for exchange.

First, let's look at the more common methods.

Where can I find a Bitcoin ATM?

A complete list of Bitcoin ATMs around the world is provided on the CoinATMRadar resource.

Just find your location and see where the nearest ATM is.

The map also allows you to search for altcoin ATMs if you want to buy/sell other cryptocurrencies.

Each ATM takes a certain fee per transaction, which varies from one machine to another, so make sure you are aware of the terms and conditions that are usually printed on the machine.

What's the result?

Screenshot of the LocalBitcoins website

As you can see, crypto ATMs still have more disadvantages, but many of the current problems are easy to solve. In 2022, there is hope that such equipment will finally begin to officially operate in Russia, and the network of Bitcoin terminals will only grow. At this stage, if you want to invest in cryptocurrency, you have to use other methods, for example, the capabilities of the exchange platform, exchangers or the Local Bitcoin service. If you wish, you can earn Bitcoins and immediately transfer them to your wallet.

Rules for working with a BTC ATM in the USA

Below are four key elements that you can use to build your compliance strategy before launching an ATM:

1) Study of requirements for money transmitters in the operating state

It is important to understand that some states are more friendly to Bitcoin ATMs or cryptocurrency in general than others.

This can mean the difference between a comprehensive and costly state licensing process under state money transmitter laws.

The differences are only as great as they are constantly changing. States continue to evolve their enforcement of existing and outdated remittance law.

However, it is important to understand the requirements in your state. For beginners, the non-profit bitcoin research and advocacy group Coin Center offers a useful real-time status tracking system.

2) Register with FinCEN as a Money Services Business (MSB)

It may be hard to believe, but registering with FinCEN, the nation's leading anti-money laundering organization, may be the easiest thing to do.

This is literally a “tick the box” activity. Indeed, unlike the licensing process at the state level, at the federal level, organizations simply register with FinCEN through an online portal.

The process can usually be completed in less than an hour. While registering with FinCEN is a simple exercise, it comes with a lot of responsibility.

This includes, but is not limited to, state registration, if applicable; development and implementation of an anti-money laundering (AML) program; storing certain transaction information; and reporting suspicious activity and transactions over $10,000.

3) Implementation of an anti-money laundering (AML) program

FinCEN regulations require the implementation of a written AML program. An effective AML program is designed to prevent your Bitcoin ATM from being used for money laundering.

Every AML program must be written and, at a minimum, address the "four pillars" as follows:

- Implement policies, procedures and internal controls reasonably designed to ensure compliance with the Bank Secrecy Act (BSA)

- Assign a compliance officer responsible for day-to-day compliance with the BSA and AML programs.

- Provide ongoing targeted training to relevant personnel regarding their responsibilities under the AML program.

- Ensure that your AML program is independently reviewed or audited on an annual basis, at a minimum.

3) Check your AML program

Start by running some example transactions from your Bitcoin wallet through terminals.

Be sure to review your thresholds to ensure your customer's KYC requirements are being triggered as expected, as well as any red flag indicators of potentially suspicious or unusual activity.

Ensure that customer and transaction information is correctly received and recorded. When doing so, document your findings, especially any subsequent changes to your AML program as a result of this testing.

The future of Bitcoin terminals in Russia

If you look at the map of the website coinatmradar.com, you can see that there are many crypto ATMs in Russia, which are scattered throughout the territory.

Moreover, five of them are located in Moscow. You can also see on the map that you can buy cryptocurrency in Penza, Saratov, Smolensk and a number of other cities. But some information is outdated, and the devices themselves have long been seized due to trends in Russian legislation regarding virtual coins. Screenshot of a map from the site coinatmradar.com

The situation is aggravated by the fact that in Russia there is no clear position regarding the turnover of cryptocurrency. At the same time, in 2022, a large raid was carried out to seize Bitcoin terminals in different cities of the Russian Federation. During the raid, 22 BBFpro devices were seized. Other suppliers were also hit. According to law enforcement officers, such actions are aimed at identifying and controlling the illegal movement of funds. It is believed that cryptocurrencies can be used to finance terrorist activities and other illegal schemes.

In 2022, there is hope that Bitcoin terminals will appear in Russia again and will operate as usual. Recently there was news about the introduction of such equipment in collaboration with the “Koshelek.ru” service. This is a large-scale company that already has a Telegram bot for transactions, a number of mobile applications, etc. Plans for 2022 include the launch of a cryptocurrency exchange and crypto ATMs themselves.

The number of devices that will be installed in the Russian Federation has not yet been announced. Negotiations with partners are currently underway. At the same time, issues involving the use of cryptocurrency are being resolved. The company clarifies that the purchase and sale of virtual money does not constitute its use as a means of payment, but the final decision still remains with the authorized bodies.

Foreign partners may be involved in the implementation of some functions. In addition, clients have the opportunity to link a bank card to a crypto account. In this way, it will be possible to simultaneously solve two issues - simplify the process of transferring money and resolve the issue of user identification. During the payment process, there will be an instant conversion from virtual coins to fiat funds.

The main problem is that many consider cryptocurrency as a tool for investment and earnings. It is necessary to change this stereotype and use Bitcoins and other virtual money as a means of payment. Many countries have already come to this. The matter remains with Russia.

Buying from the owner: advantages and risks

Those who want to buy Bitcoin from the owner are those who save on commissions and are concerned about data protection - but that’s where the advantages end. Due to the high risk of fraud, the method is no longer simple. If you did not want to register and verify on exchanges and exchangers, finding a suitable seller will take even more time.

Fraudsters take advantage of the lack of official status of cryptocurrency in Russia: it is considered neither a product nor a means of payment. Let's say you've been scammed: a bank will refuse to reverse a transaction from an individual to an individual without a recognized precedent. The police will see neither theft nor provable fraud in such a situation.

Seller selection and transaction security

For the transaction to be successful, you need a responsible seller. Ideally, this should be one of your friends or relatives. Or someone they can recommend.

When it comes to finding a trader online, use cryptocurrency forums. On BiTalk and Bits.Media there are many advertisements “I will buy bitcoins for cash”, and no less - the same advertisements for sale. Check the status of the seller: when was the last sale, how many successful transactions were there. Read the reviews and ask him to show his account on the p2p exchange, if he has one. Talk to people who have worked with the seller.

Arrange to meet in person in a public place. A bank would be ideal. Draw up a receipt or other document documenting the terms of the transaction. It will become the basis for contacting the police if necessary.

If you are afraid to cooperate with a person personally, cooperate with a company, it is safer. There are organizations in Moscow that transparently, in their own office, exchange BTC for rubles for cash. They charge commissions, but their rate is close to the exchange rate.