Users trading on the Binance or Bittrex cryptocurrency exchanges have probably noticed the USDT asset, which is called Tether. The platform is created on the basis of the Bitcoin blockchain using the Omni Layer protocol.

Buy or sell cryptocurrency

Tether allows you to use fiat money under cryptographic protection. The platform’s digital assets are pegged to the US dollar. The ratio of Tezer to USD is one to one. The project was initiated by the Bitfinex exchange. Tether Limited is responsible for the creation and development of the network.

What you need to know about the token

Many users still do not know what kind of currency USDT is. These are coins that can be stored and transferred like any other digital asset. The unique technology allows you to transfer virtual funds into real ones, avoiding government bans on the conversion of digital assets. Tether simplifies the exchange of funds. Many exchanges have added cryptocurrency to the listing.

The developers emphasize that USDT is not fiat assets in electronic form, but a cryptocurrency that facilitates the transfer of financial assets and acts as an alternative to Bitcoin. The platform is based on a Proof of Reserves mechanism. Dollars, yen, and EU currency are entered into the system. T is added to the designation of the crypt - the first letter of the platform name.

Tokens are backed by real currency - assets are not subject to high exchange rate volatility, as is the case with other digital tokens. Transfer and storage of Tezer coins is carried out using wallets that support Omni Layer.

USDT cryptocurrency and its features

Stability

. Tether tokens are backed to some extent by real currency, so users do not have to worry about the exchange rate volatility that is typical of other digital assets when conducting financial transactions.

Transparency

. The developers claim that they regularly check the amounts of funds in user accounts with the balance of the main storage.

Commission

. There are no or minimal fees for USDT transactions between two cryptocurrency wallets.

Popularity

. Tether is now listed on almost all trading platforms. It is more difficult to find an exchange that does not have USDT than one that does have these tokens.

Versatility

. The cryptocurrency network makes it possible to transfer fiat funds much faster and cheaper than traditional bank payments.

Reserve Fund

. Its presence allows you to maintain a stable USDT rate. The funds in the account are equivalent to the amount of tokens that are in circulation at a particular point in time.

Purpose of development of USDT

The main function of the project is to provide users with a stable digital coin that will facilitate the conversion of national currencies into electronic money. The Bitcoin exchange rate to the ruble, dollar, etc. depends on demand, and therefore is characterized by high volatility. The Tezer cryptocurrency is backed by the US dollar and does not come under criticism for the lack of a real basis. The proof of reserve mechanism allows foreign exchange reserves to be confirmed by periodic audits and bank accounts.

The platform was the first to use a mechanism for digitizing the dollar. Some users criticize the fact that the Tether cryptocurrency does not have high exchange rate volatility, which would allow them to make money from investing. However, the project includes other functions:

- no commission;

- fast transactions;

- stable value compared to other digital assets.

Buying and selling USDT cryptocurrency is carried out on various exchanges and through the Tether.to resource.

READ Mining the Zcash cryptocurrency: setting up, choosing a pool

Disadvantages of Tether (USDT)

These tokens have few disadvantages, but they exist, and they cannot be ignored:

- You can send or receive USDT coins without authentication (anonymously), and to receive or send fiat coins you will need to provide scanned copies of identification documents in English. Most exchanges provide just such a procedure, although there are also those where a simple registration is enough to exchange for fiat.

- Periodically, the USDT exchange rate fluctuates within 2-3%. For cryptocurrencies, such volatility (the tendency for price volatility) is considered very low, but still cannot be qualified as zero.

- On exchanges that support Tether, not all pairs with it have a liquidity reserve. This means that it is difficult to sell more than a few thousand Tether coins at a good price. Liquidity in exchange services can be higher, but the rate is much lower.

- The creators released the entire volume of the new currency into circulation at once, so it cannot be mined through mining.

Above we talked about the possibility of selling back Tether tokens. So far, in practice, such transactions are quite easy, but the creators of the platform reserve the possibility of complicating them. According to the conditions specified in the technical documentation, Tether Limited is not obliged to buy back tokens upon the first request of their owners.

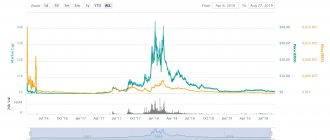

Online exchange rate of Tether to dollar and ruble. Schedule for a day, a week, a month, six months, a year.

- 0shares

- 0

- 0

- 0

Using coins on cryptocurrency exchanges

Exchange of dollars to Tezer is popular. Tokens are issued at the moment the national currency is deposited into the account. When funds are withdrawn from the system, the coins are " erased ".

Tether is used on crypto exchanges as a reliable alternative to Bitcoin. This is especially true for platforms that do not work with fiat funds, for example, Binance. USDT allows you to take profits in dollar terms without fear of a rate collapse.

To fund your Binance exchange account with USDT cryptocurrency, you need to go through several steps:

- Register on the site.

- Go to your profile and click “ Calculated cost ”, after which you will automatically go to the “ Deposits/Withdraw cash ” tab.

- After entering the name of the currency, click the “ Deposit ” button - funds will be credited to the specified address.

- To withdraw money, you need to do the same steps, but instead of “ Deposit ” click “ Withdraw ”. It is important to focus on the commission amount and input and output limits.

Go to Binance website

To trade, you need to go to the “ Shopping Center ”. Here you trade at market value or through pending orders. Today the USDT to dollar rate is 0.99 USDT.

Benefits of Tether (USDT)

When using this digital asset as a transit, traditional money reaches recipients faster and at lower costs than with bank payments. Payment transactions with Tether proceed at the same speed as with other virtual currencies. There are no fees for transferring assets between electronic wallets if these wallets are provided by Tether and not by any third-party platforms. True, enrollment in the fiat system is still subject to commissions, which most often amount to a fixed amount of $1. Don’t forget about another important advantage of blockchain – maximum transaction security.

Of course, for transit you can use not USDT, but, for example, the popular bitcoin. However, transfers to VTS can take up to 24 hours, and this is fraught with loss of money due to exchange rate changes that may occur during this time (the converted amount is credited at the time of receipt, and not at the time of transfer). At the same time, the USDT rate is quite stable, and transactions are carried out quickly.

Users can not only purchase tokens from their creators, but also, if desired, sell them back (exchange them for fiat). To do this, you need to go to the Tether Limited website and carry out a payment transaction, after which the specified monetary units will be transferred to the seller’s wallet minus the applicable commission. Tokens that are “redeemed” (that is, converted and withdrawn) in this way lose their value because they are no longer backed by sufficient fiat funds. The company withdraws them from circulation in accordance with a special procedure. It should be noted that selling USDT on cryptocurrency exchanges is often more profitable and technically simpler (without so many formalities).

Some exchanges do not have the ability to include USD in the list of trading currencies. This happens for various reasons: due to the peculiarities of the legal status, the inability to obtain a license, or difficulties with reporting. With the advent of Tether, trading on such platforms has become much easier.

Most of the traditional money received by the Tether team for the sale of tokens goes to the formation of a reserve fund, which ensures the market stability of UDST. The volume of the reserve is a significant amount, comparable to the total volume of Tether tokens in circulation.

The new currency is traded on many major cryptocurrency exchanges, where it can be sold for dollars or rubles, converted into bitcoin or ether, or stored in an electronic wallet. UDST allows you to avoid lengthy and expensive banking procedures when transferring USD from one exchange to another, as well as during other operations: withdrawal, sale, etc.

Another great quality of USDT is the ability to integrate with e-wallets of other digital currencies. In particular, there are already BTS wallets with Tether support.

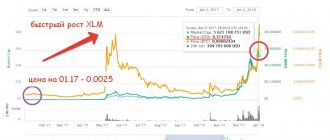

The price of USDT confirms one of the main purposes of this cryptocurrency – stability and the absence of significant fluctuations.

Buying cryptocurrency

The platform excludes mining, so the only way to become the owner of tokens is to buy coins on a specialized resource. , almost all major platforms work with

Cryptocurrency can be purchased on exchange resources. The site bestchange.ru allows you to choose a favorable rate.

Buying through exchangers is the easiest way, but exchanges have better quotes. Most cryptocurrency resources do not accept fiat, so you will first have to purchase Bitcoin or another cryptocurrency that is exchanged for Tether.

Cryptocurrency exchanges Binance, Kucoin, Exmo, Huobi, Yobit, etc. where USDT is traded:

Platform Features

Compared to other cryptocurrency projects, Tether stands out with the following characteristics:

- safe work with a coin that is not susceptible to high volatility and government restrictions;

- decentralized but public transactions;

- high platform security;

- pegged to the dollar, which eliminates exchange rate volatility;

- functional wallets with the necessary tools;

- facilitated conversion of cryptocurrencies and fiat money.

The wallet quickly converts funds without commission. Working with a wallet does not require special skills or extra time.

Future prospects

The qualitative development of the platform depends on how much the project can maintain the USDT to dollar ratio. Tether is a digital reflection of the dollar, not a means of payment.

Cryptocurrency allows commission-free trading in dollars, but the lack of volatility makes the token unattractive to investors. There is no point in investing in an asset to make a profit.

USDT is a convenient tool for trading. The 1:1 ratio allows you to speculate on deviations from a given course. Often the cost varies up or down. The last deviation was 0.9 USD, which made it possible to earn good money after the rate returned to its previous positions.

The future of the platform also depends on the Bitcoin blockchain. If BTC undergoes updates, this will have a positive impact on the further development of the Tether project.

Analysts are concerned that in the licensing agreement USDT is a non-financial instrument, which reduces the backing of real currency to conventions. The company indemnifies itself from liability for the use of Tether. Experts view a fixed cryptocurrency rate as a way for creators to get rid of unnecessary hassle. The risks of loss of financial resources fall entirely on the participants.