What is stop out on Forex

A Forex Stop Out level is where open positions in Metatrader are forced to close due to a decrease in free margin, meaning that open positions can no longer be maintained.

Forex trading is typically done using leverage, which means that for each dollar trader, for each trade, the broker can provide them with a certain amount of money that exceeds the trader's actual capital so that they can make more profits.

In this article we will answer the following question: what is a Stop Out level in Forex and how to calculate a stop out and also look at various examples and terms that help explain what a stop out level is.

What is stop out

You may remember from previous articles that if you do not take any action after a margin call (the broker's warning about a critical margin level), the position will be closed with a stop out. These two concepts – margin call and stop out – are closely related. If the first means only a warning, then the second means the final cessation of trading due to a loss.

The stop ut level is one of the broker's risk management tools. As you know, most brokerage companies provide traders with borrowed funds in the form of leverage, and it is not advisable to risk this money. Therefore, all risks are “shifted” onto the shoulders of those who directly carry out trading operations.

So, what is stop out? This is the moment when the free margin becomes so small that there are not enough funds to maintain open positions.

For example, you have 750,000 rubles on deposit. ($10,000 or 290,000 UAH) or 0.1 lot (1 lot is equal to 7,500,000 rubles (100,000 $ or 2,900,000 UAH)). Leverage – 1:100. The selected EUR/USD pair is trading at a price of 1.2. We open a deal with a volume of 11,250,000 rubles. ($150,000 or 4,350,000 UAH). To determine the size of the deposit, recall the formula for calculating margin on Forex:

\[ M=\frac{V}{L*R},where \]

\( V \) – transaction volume;

\( L \) – leverage size;

\( R \) – current exchange rate.

So the margin will be equal to:

150,000/100*1.2=135,000 rub. ($1,800 or 52,200 UAH).

Thus, $1,800 will be frozen in the account, and available funds will amount to RUB 615,000. ($8,200 or 237,800 UAH) (10000-1800).

The broker has set a stop out level of 20% of the deposit amount. In our example, this level will be 27,000 rubles. ($360 or 10,440 UAH) (1800*20%).

The position will be closed by stop out if a loss of RUB 723,000 is received. ($9,640 or 279,560 UAH) (10000-360).

Recommendations for reducing risk

To reduce losses, it is important to remember the following nuances:

- Limitation of losses. Only a position without limiting losses can reach forced closure. In trading, Stop Loss are used for restrictions. These are auxiliary orders that will automatically close the transaction with a small loss if the forecast does not come true. The Stop Loss size is set by the trader.

Force majeure happens in Forex. Quotes are influenced by hundreds of factors, including unpredictable ones. Politics, military actions, terrorist attacks, natural disasters, the behavior of major players and much more can cause severe volatility in traded assets.

Important fundamental factors can move prices by hundreds and thousands of points. If at this moment a position is opened in the opposite direction without a Stop Loss, even a conservative account can knock out a Margin Call in a few minutes and then close with a loss.

- Refusal of Martingale and other averaging grids. Negative transactions with this approach are not closed, but additional ones are concluded with an increased lot. In the hope that a small correction in the right direction will bring both positions into total profit.

Averaging forces not only to enter into new transactions (each of which requires collateral), but also to do so with an increased volume, which increases the price of a point passed against the forecast. If the chart continues to move in the opposite direction, available funds will shrink much more.

- Risk management and money management strategy. Profitability is proportional to the level of risk. By increasing the lot and working with a large leverage, the trader creates an additional load on his account. It is important to set an acceptable level of risk for opened transactions.

Experts recommend setting it at 5-7%. In the worst case, if the position is closed by Stop Loss, the amount of losses should not exceed 5% of the account.

- Number of completed deals. This mistake is often made by traders who work using robots or analyze several charts at the same time. The indicated level of risk (5-7%) applies to all open positions, and not to each one separately.

If there is a possibility of simultaneous execution of several transactions, this must be taken into account when selecting a lot to limit trading risk.

Principle of operation

When the stop out level is reached in forex, the position is automatically closed upon receipt of the maximum allowable loss amount. Of course, this is preceded by a margin call, after which the trader can fund the account. If this does not happen, the stop out mechanism is triggered.

If we return to the example above, we see that the broker does not risk anything: the loss of 9,640 US dollars lies entirely on the shoulders of the trader, whose deposit was 0 rubles. (0 $ or 0 UAH) when opening a transaction. In simple words, if the automatic stop out did not work, then in the event of further unfavorable developments, borrowed funds would also suffer. Stop out prevents this situation.

Margin call calculation

On the Forex trading platform, quotation indicators tend to change quickly. In this regard, brokerage firms work for the purpose of reinsurance, determining the level of Margin Call. Margin call calculation is possible through account level. This value is calculated automatically by the terminal, and it is shown in a special window containing account information.

In order to avoid contact with Margin Call and Stop Out, a trader needs to know the maximum potential drawdown of his account. The degree of drawdown is calculated using the following formula: the maximum drawdown to the margin call degree is equal to multiplying the total collateral amount by the stop out level, followed by subtracting the result from the account balance.

Let's consider ways to minimize financial risks within these critical market values (Margin Call, Stop Out):

1) It is not recommended to open a large number of orders at once. The most acceptable method is if the gross loan does not exceed ten or fifteen percent of the total amount.

2) Always control open trades by setting Stop Loss.

3) The need to develop the ability to regulate balance within various levels of Margin Call and Stop Out.

The influence of leverage on the stop-out level

To analyze how the size of the leverage affects the stop out level, let’s again turn to the example discussed above, but we will increase the size of the leverage (leverage) to 1/300.

This would mean that for every dollar of its own, the broker provides $300 for transactions. In other words, if I open a deal for 22,500 rubles. ($300 or 8,700 UAH), then only one of my own dollars is involved in the trade, the remaining 299 are the broker’s money.

And now let’s calculate the amount of the deposit with other parameters remaining unchanged:

M=150000/300*1.2=45,000 rub. ($600 or 17,400 UAH).

We see that leverage has increased and margin has decreased by 3 times. Hence the conclusion: the higher the leverage, the lower the margin. We leave the stop out level unchanged - 20% and get 9,000 rubles. ($120 or 3,480 UAH) (600*20%).

So, with increased leverage, we could trade up to a $120 account balance rather than $360 as in the example above. What conclusions can be drawn?

Among the recommendations given in the event of a margin call is advice on increasing leverage. With higher leverage, it would seem that the stop out will come later. But is this really so?

Yes, indeed, take our example: we “win” as much as $240 when we increase our leverage. With this money you can buy 200 euros. And on the scale of large transactions, an increase in leverage will allow you to hold out for more than one trading day.

However, you should pay attention to what factors lead to losses up to the stop out level. It could be:

- high volatility;

- trader inaction;

- improper money management.

Agree, all these factors increase the risk.

Thus, as leverage increases, risk increases. And, despite the fact that the stop out will come a little later, if the market moves negatively, the losses will increase.

Conclusions about margin calls

You can gain profit by trading only with your own funds. You can remain at a loss for a long time without the risk of using leverage. The only thing that is impossible in the market is to constantly be on margin.

A personal investment strategy should include a reversal of positions, taking into account the changed trend, and even a stop loss . If you do not promptly respond to the alarm bell ringing ( margin call ), the problems will only get worse.

Any trader should carefully monitor price dynamics. You cannot rely solely on the stop losses you set. They may not work. If the president had signed a law on a tax on bank deposits and bonds on the eve of the weekend, no stop loss would have saved us from a gap and losses.

Invest in stocks with a trusted broker. Visit the page with new online courses. Thank you for your attention, always your “Maximum Income”

Formula for calculating stop out on Forex

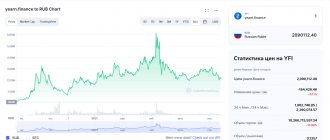

How does a broker calculate the stop out percentage? This depends on individual parameters: account status, currency pairs, number of transactions, etc. Most often, this percentage ranges from 10 to 30, in rare cases – 50% or more. To calculate the stop out level, average data on trading operations for the current period is used.

Let’s assume that the average transaction price is 1 lot (RUB 750,000 (USD 10,000 or UAH 290,000)). The trader uses the EUR/USD pair with RUB 3,750,000 in his account. ($50,000 or 1,450,000 UAH). That is, theoretically, if five transactions on 1 lot turn out to be unprofitable, then all funds will be spent, including the deposit (375,000 rubles (5,000 $ or 145,000 UAH)), and then the broker’s money will be used.

To prevent this, the broker assumes that a maximum of 4 trading operations per lot, plus 9 transactions of 0.1 lot, can end with a loss, and the maximum loss, which determines the stop out level, is at around 3,675,000 rubles. ($49,000 or 1,421,000 UAH).

Thus, the stop out percentage is calculated something like this: (50000-49000)/5000=20%.

Tips for choosing an account

The types of accounts used in Forex are:

- Standard. This is the most common type and is suitable for beginners. The minimum transaction amount is 0.01 lot.

- The ECN account is used in trading with frequent entries. The trader works with several brokers united in the ECN (Electronic Communication Network) system. There is a commission per trade, which is usually covered by the lower spread.

Spread is the difference between the maximum selling price and the minimum purchasing price.

- Swap-free account, where there is no commission (swap) for transferring an order to the next day;

- Cent account – the balance is displayed not in dollars, but in cents;

- A demo account is a virtual account designed for beginners to familiarize themselves with the features of Forex trading.

- A PAMM account allows you to attract funds from third-party investors. Recommended for “advanced” traders.

What to advise a beginner? First of all, you need to start by using a demo account to learn the basics. Then, depending on the size of your capital, goals and ambitions, you can choose:

- classic (standard) type – with a small deposit;

- swap-free – for long-term trading;

- ECN and PAMM accounts are for experienced traders with investment skills and knowledge of the peculiarities of the foreign exchange market. Owners of such accounts must be able to independently calculate call and stop out margin levels, commission amounts, spreads and other parameters.

What causes a stop out

This question can be answered in one sentence: a stop out in Forex is the result of improper money management, namely:

- you have opened too many trades;

- you have chosen the wrong lot volume when the deposit volume is limited.

In other words, they did not calculate the volume, did not manage to take control of the situation in time, or did not pay attention to the stop loss and stop out level.

To be fair, it should be noted that sometimes not everything depends on you. An unfavorable development of events is also facilitated by such a factor as the absence of a stop loss - the price level at which the transaction will be closed with minimal losses. In addition, collapses occur in the markets, to which not everyone has time to react quickly.

Next, let's talk about what you can do to avoid loss.

A few simple rules

For now, you need to remember a few simple rules:

• make sure that the margin on your positions does not exceed 10-15% of the amount of funds on your deposit.

• never leave your open positions unattended. If you do not have the opportunity to monitor developments in the market, set a protective order - this will guarantee the closure of the position if the market turns against you.

• learn to “estimate” the values of the deposit level in your head, based on the actual amount of funds in your account, as well as the amount of deposits for the currency pairs that you usually trade.

How to avoid a stop out

If you trade small volumes (up to 10% of the deposit) and do not hold unprofitable positions for a very long time, then you hardly need to worry about a stop out. But if you play big, then you need to know the following:

- The most important thing is to count. I won’t say that you need to recalculate the ratio of margin to free funds every day, but if there are significant currency fluctuations, this must be done. Namely, compare the amount of collateral for one lot taking into account leverage. For the EUR/USD pair it will look like this:

\[ R*100000/L, where: \]

\( R \) – current exchange rate;

\( L \) – leverage.

If several transactions are open, use the built-in trader calculator.

- For each major trade, compare the size of the margin and the stop-out level. For example, the ratio of these parameters is:

SDU/M=5 (stop out level is 20% of the deposit). Then you should calculate how many price change points remain until this level. For example, for the EUR/USD pair the cost of one point is 750 rubles. ($10 or 290 UAH) (1% of the lot). The same calculations need to be performed for other currency pairs.

- Learn the basics of risk management. A novice trader should place special emphasis on the theory of risk hedging.

- When receiving a margin call, you should not remain idle. It is better to “throw away” the position without waiting for forced closure.

How to calculate your account level

After one or more transactions have been closed, only that part of the deposit that was not affected by losses remains on the account. The concept of account level, which can be seen in the terminal, is very important here. Calculated using the following formula:

Floating deposit (plus profit minus losses): Margin on open transactions x 100%

If we take the above example with the purchase of a mini-lot of EUR/USD and zero loss/profit, we get:

(1500 : 138) x 100% = 1086%.

This is a high indicator, which indicates the safety of the deposit. Many dealing centers close positions if the account level reaches 10-20%. It is better if the indicator is kept at 300%.

Stop out: calculation example

Let's calculate the stop out for a Forex transaction based on the initial data:

- deposit amount – RUB 1,500,000. ($20,000 or 580,000 UAH);

- leverage – 1:100;

- currency pair – EUR/USD;

- exchange rate – 1.18;

- transaction volume – 0.5 lot (RUB 3,750,000 (USD 50,000 or UAH 1,450,000));

- stop-out level – 30%.

First, let's calculate the deposit, available funds and margin level:

M=50000/1.18*100=31,780 rub. ($423.73 or 12,288 UAH);

C=20000-423.73=1,468,220 rub. ($19,576.27 or 567,712 UAH);

Margin level=19576.27/423.73*100=4619.99% (a value of 300% and above is considered safe).

Stop out level=423.73*30%=9,534 rub. ($127.12 or 3,686 UAH).

The amount of allowable loss will be:

20000-127.12=1,490,466 rub. ($19,872.88 or 576,314 UAH).

Calculators

It is not necessary to calculate the level at which a margin call will occur manually. On the Internet you can find special calculators for calculating the indicator.

One of the best is the service from oanda.com. Although cryptocurrency is not currently on the list of supported assets, you can select any currency pair and enter the required values.

You can also download one of the xls calculators (Excel files):

- A simple calculator from BreakingDownFinance. Calculation example: where $20 (P0) is the asset price, 50% (0.5) is the initial margin, 25% (0.25) is the support margin.

- Calculator with 5 examples (formula and explanations inside the file).

- A more advanced calculator in Russian.