Hello, dear friends. One of the disadvantages of active trading is being tied to your workplace . When trading intraday, it is impossible to predict in advance the time of formation of the entry point. The developers of trading software took this into account and implemented the ability to set pending orders that are executed without the participation of the trader. A pending order in MetaTrader 4 will work even if the terminal is turned off on the trader’s side. This reduces the chance that a signal will be missed.

What is the advantage of a pending order?

There are 2 fundamentally different ways to open a position:

- By market. The deal is concluded at the current price. The application is processed in a split second, after which a position is opened. The disadvantage of this method is that the trader needs to wait for the entry point to form. It is impossible to predict when this will happen. Increases the risk that the signal will be missed.

- Pending order . An order to enter the market is placed at a certain distance from the current price. If the chart reaches this level, the order will be executed and a deal will be concluded. There are different types of orders, we will talk about this a little later.

The use of depositors provides a number of advantages . I will include:

- Saving time . You are not tied to a workplace. If, for example, a retest of the level after a breakout is expected, you can not wait for this to happen, but simply place a pending order. If the scenario comes true, the deal guaranteed to be concluded.

- Psychological comfort. When tracking the market in real time, it is tempting to enter a trade before a clear signal is formed. Using pending orders solves this problem.

- The entrance is exactly at the designated level. When trading manually, there is a risk that the price will go in the unfavorable direction while the trader sets the parameters of the transaction.

I would also like to note guaranteed entry into the market. After placing a limit or stop order, information about this is transmitted to the broker's server. You can turn off your PC, and when the specified point is reached, the deal will still be concluded.

Demo database

Below is a selection from the "Customers" table in the Northwind sample database:

| CustomerID | CustomerName | ContactName | Address | City | PostalCode | Country |

| 1 | Alfreds Futterkiste | Maria Anders | Obere Str. 57 | Berlin | 12209 | Germany |

| 2 | Ana Trujillo Emparedados y helados | Ana Trujillo | Avda. de la Constitución 2222 | Mexico DF | 05021 | Mexico |

| 3 | Antonio Moreno Taqueria | Antonio Moreno | Mataderos 2312 | Mexico DF | 05023 | Mexico |

| 4 | Around the Horn | Thomas Hardy | 120 Hanover Sq. | London | WA1 1DP | UK |

| 5 | Berglunds snabbköp | Christina Berglund | Berguvsvagen 8 | Luleå | S-958 22 | Sweden |

Types and features of pending orders

MetaTrader 4 has 2 types of postponers - Stop/Limit . Stop orders are placed in the hope that the price will continue to move in the same direction, while limit orders are placed in the hope of a rollback before the price continues to rise/fall.

For clarity, we will analyze all types of pending orders on Forex:

- Buy Stop. This is an order to buy at a price higher than the market price. For example, quote EURUSD equals 1.20622, the trader expects the currency pair to grow, but is not going to buy from current levels. At around 1.2100, for example, a buy order is placed. This is a Buy Stop order.

- Sell Stop. This is a pending sell order, set below the market price of the asset. Same as Buy Stop, but the trader expects the downward movement to continue and places a sell order below the current price.

- Buy Limit. It is used in situations where an asset’s growth is predicted, but a correction is expected before that. For example, a resistance level is broken, but the trader is not going to enter immediately after the breakout. Instead of waiting for the chart to retest, you can set a Buy Limit at this price level and go about your business. If a correction of the required depth takes place, the transaction will be opened.

- Sell Limit. The logic is the same as that of Buy Limit, but the bet is made on an upward correction, on which a sell transaction is concluded. One of the scenarios for using an order is a retest of support after a breakdown by an impulse movement. It is not profitable to enter immediately after the level is broken. In order not to wait for a correction to support, you can set a Sell Limit delay in this zone.

Stop loss and Take profit

In MetaTrader 4, only 4 types of pending orders . As for Take Profit and Stop Loss orders, they fall under the types of postponements described above:

- Take Profit is used to fix profit. The current transaction is closed by an opposing position of the same volume. For long TP positions, Sell Limit can be considered.

- Sell transactions are closed according to the same scheme; TP works in the same way as Buy Limit.

- Stop Loss acts as a loss limiter. For long positions, the stop loss is below the price, so it can be considered as a Sell Stop.

- For short positions, the essence of the stop loss is the same as that of the Buy Stop.

For beginners, pending orders on Forex seem like a complex tool, but this is just an illusion. I guarantee that after a few minutes of practice, you will no longer confuse limit and stop orders, understanding the nature of both instruments.

Profitable trading in AMarkets

Take profit and stop limit

Another combined application in Kwik. It consists of two orders, which are discussed above: stop limit and take profit. This order is intended to close a trading position. Either with a profit according to the take profit, or with a loss according to the stop limit. When one order is executed, the second one is automatically canceled. Please note that cash limits are blocked for each of the named applications.

These tools are discussed in detail at the beginning of the article. The joint use of such orders guarantees the sale of an asset without opening a new position.

Learning to exhibit

We follow this algorithm.

1. Press F6. and call the order entry window.

2. In the input window, select the type of stop order - take profit and stop limit.

3. Set the expiration date for the order.

4. Select a specific trading asset.

5. Set a Buy and Sell position.

6. Set the price to activate take profit.

7. Set the price to activate the stop limit.

8. To protect against slippage, fill out the Price window. The number here should be slightly less than in point 7.

9. In the Indent from min window, set the rebound value for triggering the order. This value is set as a percentage or price currency.

10. Set a Protective Spread.

11. Determine the number of lots.

12. Select Client Code.

13. Activate the application by clicking on Enter.

Methodology for placing orders in MetaTrader 4

For reliability, I will describe in more detail the solution to the question of how to set a pending order on MT4 for all types of orders. The beginning is the same - right-click on the working window , select “ Trade ” - “ New Order ”, a menu with settings will open. You can also access it using the F9 .

Next, in the “ Type ” field, you need the “ Pending Order ” option. After this, additional items will appear.

Further for different types of orders:

- Buy Limit - in field "by price» indicates the level at which the purchase reserve will be located. This mark should be lower than the current quote. Stop loss is set below the Buy Limit level, and take profit is set above this level. If everything is done correctly, then after clicking on “ Place order"You will see that a pending buy order has appeared on the chart.

- Buy Stop. Placed above the current quote, the stop should be below it, and the TP above the Buy Stop. Volume, commentary and " best before dateThe stop order is set using the same logic as the Buy Limit order.

- Sell Limit. Since the price must correct upward, the order is placed above the market quote. This is a sell order, so the stop loss is placed above the Sell Limit and the TP below it.

- Sell Stop. A pending sell order is placed under the current price. Stop and TP are located above and below the Sell Stop, respectively.

Regardless of the type of postponement, the trader sets:

- The instrument by which the order is placed. The list of available assets is in the " Symbol " drop-down menu. By default, the instrument whose chart is open in the terminal is displayed here, but you can select another one.

- Volume – measured in lots.

- Comment is an optional item. It is displayed in the report, it will be more convenient to analyze the results.

- Validity. Here you can set the date and time during which the deferr will remain active. If the price does not reach the specified level before this moment, the order is automatically deleted.

Distance to market price

As for the deposit in general and how to display it correctly, you need to take into account the minimum distance to the market price. The relevant information is indicated in the description of trading conditions on the broker's website and in the window when setting order parameters.

In the example in the figure above, the minimum distance is 40 pips , this limitation is valid for a demo account . The broker uses 5-digit quotes; postponements can be set at a distance of 4 points from the current price. On ECN accounts there may be no such restrictions; pending orders can be placed even within the spread (the so-called difference between the Bid and Ask). If you are hearing these concepts for the first time, I recommend taking the educational course “What is a spread in trading” and familiarizing yourself with the rest of the terminology.

It is impossible to make a mistake when placing a limit order or a stop order . If you specify an incorrect price, for example, for a Buy Stop lower than the market quote, then the terminal simply will not allow you to place an order, reporting an error.

Start trading with AMarkets

Varieties

The ITS QUIK trading terminal works with the following conditional orders:

- with a related application;

- stop limit;

- stop price for another security;

- take profit;

- take profit and stop limit.

The trader independently sets the validity period of such an order. This parameter is specified when creating an order. There are three options available in Kwik. A stop order can be valid:

- during the current trading session;

- before the specified calendar date;

- until canceled, when the trader cancels the placed order.

Naturally, if the specified condition is met, the application is automatically executed by the trading terminal.

Setting the order lifetime allows you to automate the trading process. It is not at all necessary to be in front of a computer monitor and control the market situation. The trading participant sets the terms of the transaction once at a convenient time. For example, the levels of purchase and sale of an asset. Kwik will do the rest.

There are several ways to place a conditional order in the QUIK ITS. The easiest one is to press the F6 key. This action will display a window for entering a stop order on the monitor screen.

How to place a pending order in two clicks

MetaTrader 4 provides an option for quickly placing limit and stop orders. To do this, move the cursor to the level where the order should be located, click the right mouse button and in the “ Trade ” item you will see 2 postponements for the price at which the cursor was located.

At this level, only a delayer will appear without a stop and TP . But Stop Loss and Take Profit can be specified later, before the order is triggered. You can also activate trailing stop , in which SL will move behind the price in a certain step, but only if the chart goes in a profitable direction.

This method is suitable in situations where speed . For example, a trader tries to catch news impulses and manually sets delays 10-20 seconds before the publication of important statistics. Even a few seconds saved are important .

Features of execution of pending orders

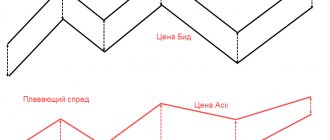

In the MT4 settings you can activate the display of the Ask price. You will see 2 prices:

- Upper – Ask or seller price. Purchase transactions are made using it.

- Lower – Bid, the buyer’s price, at which sell transactions are made.

This feature affects the execution of pending orders. If the Ask is not displayed in the terminal and only the Bid is visible, then:

- Buy Stop will be executed with a visual price shortfall before the postponement.

- Buy Limit executed when the chart moves beyond the level by the spread amount.

- Sell orders are executed at the Bid , that is, the price that is visible in the terminal.

Features of the execution of postponements have virtually no effect on trading when working with majors and popular crosses. The spread on these instruments is small, its influence can be neglected by changing the position of orders by a couple of points to guarantee.

If you work with low-liquid assets, the spread increases. The position of limit/stop buy orders must be adjusted taking into account the difference between the Bid and Ask.

Open a Forex account in AMarkets

Pending order management

Once the depositors are installed, they can be controlled . It is not necessary to wait for the order to be triggered; you can delete it at any time, remove the stop loss or take profit, or move the order to another price level.

There are several control methods:

- In the window "Trade" select the desired postponer and select the option in the context menu “Modify/delete order”. You can also get to this menu by double-clicking on the corresponding postponement.

- If move the cursor to the order, a double arrow will appear next to it. Click right mouse button, and in the context menu there will be buttons for deleting or adjusting the postponement. Here you can activate the trailing stop. Double clicking on an order will open a menu where you can adjust its parameters.

- Can delete only SL or TP. You need to move the cursor to it and select the corresponding item in the context menu.

- You can also directly adjust on the chart position of order, stop and take. If you move the cursor to a level, a small double arrow will appear next to it. While holding down the left button, drag the pending order to the desired location. Stop loss and take profit move with it. If you move the cursor to SL or TP, you can adjust the position of only the stop or take profit, respectively.

Once the order is triggered, the trade will be displayed in the Trade . You can close it manually, wait for the stop or take profit to be triggered, or alternatively, the trailing stop is activated.

Take Profit

This is a conditional order, which was invented to close a position on an asset with the maximum possible profit. The name of such an order speaks to this as well. Translated from English, take profit means to make a profit.

The set take profit is executed if the asset price deteriorates from the local maximum by the amount specified by the user of the trading terminal.

The application in question works in Kwik on the sliding stop principle. This approach helps to close a trading position without determining a specific price level in advance. When quotes move in the direction desired by the trader, the stop will automatically move to the same side. However, if prices reverse and reach the set rebound value, the order will be closed.

The trader sets the magnitude of the rebound from the reached extremum (from the maximum during long or minimum during short) in percentage or absolute values.

Let's look at a specific example.

On May 14, 2022, the trader bought shares of PJSC Gazprom at a price of 165 rubles. At the same time, the trading participant entered the market at the beginning of a powerful upward movement. By the time the trading session closed, the issuer’s quotes soared by tens of percent to the level of 190.9 rubles.

The trader found himself in a difficult situation. On the one hand, he was already in good profit. On the other hand, the potential for growth in Gazprom shares has not been exhausted. The trader set a take profit. The rebound value was 5%.

As you can see, the trader who acted this way was right. Long closed on June 3, 2022. At that trading session, quotes showed a maximum of 251.65 rubles, and then sharply corrected downwards. The system closed the trader’s position at the level of 239 rubles. Everyone will assess the size of the profit independently.

Learning to exhibit

Follow this algorithm.

1. Press F6 and call the order entry window.

2. Select the type of stop order – take profit.

3. Set the expiration date for the order.

4. Choose between the Buy and Sell items.

5. Set the price, upon reaching which QUIK activates take profit. This is the same local extremum that we were talking about.

6. Determine the number of lots per order.

7. Set the Client Code.

8. In the Offset from max/min window, set the rebound value for triggering a stop order. Set this parameter as a percentage or price currency. It is important to correctly determine this value. A small indent will work with the first small correction. A large one will interfere with profit maximization.

9. Set a Protective Spread. This is a guarantee of the sale of the entire volume of shares upon request and protection against slippage.

10. Press the enter key and agree to activate the application in the window that appears.

Tips for using orders

The main disadvantage of postponements is that at the moment they are triggered, the trader does not control the market. The situation may change, but the trader will not be able to react to it.

For example, a rebound from the support level is expected. The trader hedges his bets and places a Buy Limit at this level. Instead of rebounding from support, the chart breaks through it with impulse and continues its downward movement. Buy Limit is triggered and brings a loss. If the postponer had not been used, the trader would not have entered into the trade manually, since there was no reversal signal when approaching support.

When working with a trend, use Fibo levels to determine the end points of the correction. Postponers are only an auxiliary tool; they do not solve the problem of finding a reversal level. Previously, I prepared a separate post “How to use Fibonacci levels”, I recommend reading it if you have not used them in trading before.

The work scheme is simple . In a growing market, Fibo levels extend to a trending upward wave; in the range of 38.2% - 61.8%, we can expect the completion of the correction. Postponers are often placed directly on Fibonacci levels.

You can also use graphical analysis (trend lines, horizontal support and resistance levels) to determine guidelines. The listed tools can be combined with each other. When working, you can use the correlation factor between 2 instruments. Linking the movements of 2 assets helps in trading. The article on the correlation of currency pairs talks about this in more detail.

When using pending orders, remember that at the moment it is triggered, you may not control the market. The level for setting the depositor must be confirmed several times. Do not try to catch unreliable signals using stop and limit orders - the risk will not pay off .

Stop price for another security

This is a conditional order of the stop limit type, the stop price condition of which is checked for one asset, and another asset is specified in the executed limited order.

Such orders are used by traders who work with arbitrage strategies or hedge risks. Simply put, when one position is defended with the help of another positioned in the opposite direction. In addition, such orders are used by traders who see a connection in the market movements of 2 different instruments. For example, ordinary and preferred shares of one company.

Let's give an example of using a stop price order for another security.

The trader identified a pattern in the movements of quotes for ordinary and preferred shares of Sberbank. First, the movement is made by the habit. Then the prefs join it. In other words, if ordinary shares of Sberbank are growing strongly, then the trader wants to buy preferred securities, predicting their imminent increase in price.

Please note that this is an example and not a description of a trading strategy.

Learning to exhibit

Let's take the example discussed above as a basis. Now let’s look at the algorithm for placing a stop price order for another security.

1. Press the F6 key on your keyboard.

2. Select the stop price order type for another security.

3. Set the expiration date.

4. In the Instrument window, select the asset with which the transaction is planned. In our case, these are preferred shares of Sberbank.

5. In the Take a stop price for an instrument window, select the asset for which we are interested in the change in quotes. In our case, these are ordinary shares of Sberbank.

6. Select Buy or Sell.

7. In the If price >= window, indicate the specific value of the quotes. Please note that this refers to the Instrument from point 4. That is, ordinary shares of Sberbank.

8. We set a price for purchasing preferred shares of Sberbank. This is a regular limit order, which is activated when the stop price for another asset is reached.

9. Set the number of lots for purchase.

10. Select or set the Client Code.

11. Press enter and confirm the application.

Profitable broker for Forex trading

Based on personal experience, I can recommend AMarkets. A review of the AMarkets broker was done earlier, I recommend that you familiarize yourself with it. I will present the main terms of trade in tabular form.

| Company | AMarkets | ||

| Rates | Standard | Fixed | ECN |

| Minimum deposit | 100$/100€ or 5000₽ | 200$/200€ or 14,000₽ | |

| Recommended capital | 1000$ | 50 000$ | |

| Leverage | 1 in 1000 | 1 to 200 | |

| Spread, points | Floating, from 1.3 | Fixed, from 3 | Floating, from 0 |

| Commission | No | 2.5$, 2.5€ or 175₽ for 1 lot one way | |

| Minimum Margin | 1$ | 5$ | |

| Stop Out | 20% | 40% | |

| Exiting client transactions to the interbank market | No | Yes | |

| Ability to place pending orders inside the spread | No | Yes | |

| Requotes | Eat | Their absence is guaranteed | |

| Open an account | |||

| Criterion | AMarkets |

| Regulation | The Financial Commission |

| Minimum capital | From $100, €100, 5000 RUB for standard accounts |

| Number of assets | 100+ |

| Recommended capital | $1000 |

| Account currency | USD, EUR, RUB |

| Maximum leverage | 1 to 1000, on ECN – 1 to 200 |

| Spread in points | Floating, from 0 for ECN, fixed from 3 |

| Commission | $2.5, €2.5 or ₽175 for 1 lot one way for ECN |

| Execution speed, ms | 53,3 – 70,0 |

| Stop Out | 20-40% |

| Exiting client transactions to the interbank market | + |

| Number of positions | No limits |

| Pending orders inside the spread | + |

| Requotes | — |

| Limiting the number of transactions | Absent |

| Limit orders inside the spread | + |

| Availability quote | — |

| Own indicators | Cayman (market sentiment) and COT (provides information from the Commodity Futures Trading Commission) |

| Peculiarities | Welcome bonus up to $10,000. Cashback, there are tournaments and other incentives for traders |

The importance of following a strategy

Whatever Stop Loss/Take Profit ratio you choose, always remember that the most important thing is to strictly adhere to your strategy. Many traders make mistakes when, due to psychological stress, they begin to rearrange their pending orders, thereby violating their own strategy.

Artificial reduction in profits

Typically this error occurs in the following way:

- The trader initially chose a ratio of 1:3.

- After opening the trade, he set the stop loss at -5% and the take profit at +15%.

- At that moment, the price of the asset rose by 5%, and the trader closed the position manually, without waiting for take profit.

As a result, the estimated profit from the transaction was reduced by three times. Accordingly, one take profit did not cover the losses from three stop losses. Thus, the strategy became unprofitable, and the trader lost money.

Artificially inflating losses

This error is also quite common, and can be seen with a similar example:

- The trader initially chose a ratio of 1:3.

- After opening the trade, he did not set a stop loss with the expectation that if something happened, he would close the trade manually.

- At some point, the price of the asset decreased by 5%, but the trader decided not to close the position, but to wait for the reverse movement.

If the price continues to decline, the loss from one transaction may reach 10%, 20% or more. Accordingly, the loss from 1-3 stop losses will exceed the profit from take profit. As a result, the strategy will become unprofitable, and the trader will again lose money.

To avoid such mistakes, you must always follow the intended strategy, regardless of what is happening in the market. You should not close a trade ahead of time if it has not yet reached the planned profit. And there is no need to be afraid to record a loss if it is included in your strategy. Deviation from your own trading system or completely uncontrolled transactions leads to losses in almost 100% of cases.

FAQ

Below are answers to the most common questions related to pending orders.

Why was the order activated, although the price did not reach it several points?

This happens due to the fact that the Bid price is displayed in the terminal, and buy orders are executed at Ask. One gets the feeling that the schedule did not reach the specified level, but it worked.

Which orders are executed at the Bid price, and which at the Ask price?

According to Ask, pending orders to buy (Buy Stop and Limit) are executed, and according to Bid – to sell (Sell Stop and Limit).

Is money reserved for a pending order?

No. You can have open positions and pending ones. If by the time the chart reaches the deferred level, there is not enough money in the account, then the deal simply will not be concluded.

Is there a maximum allowed number of pending orders?

No. Their number is limited only by your deposit. If there is not enough money, then the part simply will not be fulfilled.

How are delays executed at gaps?

Usually at the first quote after the break. There are no prices in the gap, so orders are not executed in the gap.

Can slippage occur when a pending order is executed?

This is an extremely rare scenario. It requires a gap or impulse movement.

Is it possible to work with postponers on weekends?

No. The market is closed, you cannot trade or change the position of orders.

A message appears stating that SL or TP is set incorrectly, why does this happen?

You either have the prices mixed up or are trying to place an order too close to the market price.

How to use stop limit on Binance

To open the trading window, log in to your account, then select Trade , then Classic :

Next, select the desired cryptocurrency pair in the right column:

Scroll down a bit. Below the chart there will be two forms (Buy) Buy coin_name and ( Sell) Sell coin_name. Since the sale is more interesting, let's look at it first. There are three tabs above the forms, go to the Stop Limit :

The form now contains three fields:

- Stop — the price at which the order will be placed on the exchange;

- Limit — the price at which the coin will be sold;

- Amount — number of coins for sale;

- Total - how much you will receive as a result;

Let's take the same example that we looked at above. we bought NEO at 46 and are waiting for the cryptocurrency to grow, but we do not want to lose money if it falls below 35. Therefore, we set the price in the Stop to 35, and in the Limit field to 33:

Then click the Sell NEO and the order will appear at the bottom.

Let's look at another purchasing option. For example, you think that NEO will grow if the coin breaks the level of 100, then set the Stop field to 100, the Limit field to 105. As soon as the coin grows to 100, you will buy it at a price from 100 to 105 and the coin will continue to grow, if, of course, you were right in your assumptions.

Now you know how the stop limit works on binance.

Summary

Pending orders are definitely useful tool that expands the capabilities of traders. As for how to use them, I recommend using them as a backup option in case you don’t want to miss a possible signal, but there is no way to wait to enter the market. If you choose your layaway levels carefully It is also convenient that they do not create an additional burden on the deposit. If there is not enough money, then the delay will simply not be fulfilled.

Do not forget that orders of this type are an auxiliary tool. This is not a trading strategy or a technique for finding entry points . They will only be useful if you already know how to make money through trading.

I recommend subscribing to my blog on Telegram . This is convenient: you will receive notifications about the release of new materials and are guaranteed not to miss any of them. At this point I say goodbye to you for a moment and wish you success in trading. See you soon!

If you find an error in the text, please select a piece of text and press Ctrl+Enter. Thanks for helping my blog get better!

SQL SELECT TOP

The SELECT TOP statement is used to specify the number of records to return.

The SELECT TOP statement is useful for large tables with thousands of records. Returning a large number of records may impact performance.

Note:

Not all databases support SELECT TOP. MySQL supports the LIMIT clause to select a limited number of records, while Oracle uses ROWNUM.

SQL Server/MS Access syntax:

SELECT TOP number|percent column_name(s) FROM table_nameWHERE condition;

MySQL syntax:

SELECT column_name(s) FROM table_nameWHERE condition LIMIT number;

Oracle syntax:

SELECT column_name(s) FROM table_name WHERE ROWNUM <= number;

Add WHERE

The following SQL statement selects the first three records from the "Customers" table, where the country is "Germany":

Example

SELECT TOP 3 * FROM Customers WHERE Country='Germany';

Try it yourself"

The following SQL statement shows an equivalent example of using LIMIT:

Example

SELECT * FROM Customers WHERE Country='Germany' LIMIT 3;

Try it yourself"

The following SQL statement shows a corresponding example of using the ROWNUM parameter:

SQL TOP, LIMIT and ROWNUM Examples

The following SQL statement selects the first three records from the "Customers" table:

Example

SELECT TOP 3 * FROM Customers;

Try it yourself"

The following SQL statement shows an equivalent example of using the LIMIT clause:

Example

SELECT * FROM Customers LIMIT 3;

Try it yourself"

The following SQL statement shows a corresponding example of using the ROWNUM parameter:

Example

SELECT * FROM Customers WHERE ROWNUM <= 3;