- Symmetrical triangles

- The Psychology Behind Triangles

- Determining the price target for the triangle breakout

- Transforming a symmetrical triangle into a head and shoulders

- Right Triangles

- Converting a right triangle into a rectangle

- Triangle: market examples

- When the Right Triangle Doesn't Work

- The Psychology Behind Failed Right Triangles

- Triangles: let's summarize

- Symmetrical triangles, briefly

- Right Triangles, Briefly

(The correct title, of course, would be “how to trade with triangles.” However, when translating, I constantly imagined how someone timidly stood on the corner of a quiet street and sold triangles from under the tail of a shabby coat and I was bursting with laughter, that’s why name, approx. Binguru).

The triangle is one of the most common patterns, but at the same time one of... the least reliable. It is formed both in sideways and during reversals and represents a narrowing of the trading range within two merging trend lines. For such a line to form, you need at least two touches.

As a result, any triangle consists of at least four tangents, two for each trend line. However, in practice, triangles are more reliable if there were three or more touches on the line. In other words, the more touches, the better.

In Chapter 4, “Trend Lines: The Forgotten Fundamentals,” we already discussed that any trend line is nothing more than a dynamic zone of support and resistance. So the more often the price touches such a line or approaches it, the more likely it is that the line will act as a support and resistance zone. Accordingly, the stronger the breakdown will be.

There are two types of triangles, symmetrical and rectangular, so let's look at both.

What is a triangle technical analysis figure?

The triangle figure in technical analysis is a classic trading pattern that allows you to trade with a good mathematical expectation . The figure is determined visually, and a trend line is used for construction .

The big advantage of the model is the frequency of formation and good performance.

Its uncertainty lies in the fact that the entry point can form in any direction.

The popularity and effectiveness are confirmed by a large number of traders who successfully use the formation in various markets :

- Stock exchange (shares).

- Forex.

- Options.

- Futures.

The article contains a detailed description, the main types of patterns, basic trading strategies and methods for setting stop loss, as well as take profit.

Masterforex-V about the alternative to “ascending” and “descending” triangles

In my opinion, the problems and differences of these triangles are absolutely far-fetched by A. Elder, E. Nyman, D. Murphy, because Each of them

- draws these triangles... in different ways;

- interpret the signals upon breaking through these triangles... each in their own way (the same signal for one of them is “strong”, for the other “medium strength”);

- all classic trading triangles were drawn on history, and not at the end of the chart, in order to give specific recommendations for trading. And why do we need triangles that can give trading tips only based on history?;

- I do not know a single experienced successful trader who would use THEIR triangles and at the same time receive a stable profit from trading on Forex.

What is artificial and far-fetched does not work in the market.

Rising model

An ascending triangle is a figure formed when the price often hits a resistance level, but does not update its lows . a breakdown of the triangular consolidation occurs . A buy signal appears when it consolidates at the resistance level. Then further hike up. The diagram with the breaking rules is shown in the figure below:

The diagram shows the following features :

- There may be more or less price rebounds from resistance and support than the figure shows.

- Take profit is equal to the height of the figure. It is equal to the length between the maximum and minimum of the technical analysis construct.

- Stop loss is placed after the last break from support.

- A bullish trend precedes formation.

An ascending triangle in trading is a figure of market growth and continuation of movement in an uptrend.

Working out the bullish formation

On the GBPUSD currency pair, a bullish candlestick structure was formed for four days, then it left the boundaries and within a day the price reached take profit. The trade would have earned twice the potential risk.

However , there are exceptions when this pattern forms at the bottom of the market . If we see a picture like the one below, then a reversal is formed . However, you should not count on big profits when trading a breakout in the opposite direction.

Recommendations for testing

Any Forex triangle belongs to the group of technical patterns of double interpretation.

Strength of triangle pattern signals.

- The classical technique stipulates that a full Forex triangle includes at least 5 waves and necessarily an odd number. Price max/min should be near strong support/resistance, the boundaries are drawn along reverse price pullbacks. They are considered correct only after at least two retests.

Strength of triangle pattern signals (continued).

Click the button to go through a step-by-step guide to the “Triangle Shape” and master the strategy in a few simple steps Explore »

- The basic rule of technical analysis is observed - the older the timeframe, the more reliable the signal, especially when the pattern is expanding. Also, special attention to market volumes (even teak!). The longer the internal price movement, the more volumes fall. Immediately before the breakdown, they increase sharply, which can be considered a leading signal.

Expanding volume upon reaching the breakdown point.

- If the price begins to quickly exit before the triangle is completely completed, this may mean that the trend reversal began before the last wave and it is already possible to enter the market.

- A quick exit of the price from the pattern zone indicates that the market has begun a reversal before the last wave occurs and a deal can already be opened.

- A breakout at the end of a reaction to fundamental news is most likely to be false, since the market is unpredictable during this period. The Forex triangle can either continue to form or move into other graphic patterns such as “Diamond”.

- Always look for additional signal confirmation from at least one oscillator. As practice shows, the triangle fits well into Fibonacci levels, especially on timeframes from H1 and higher. At a minimum, wait until the breakout Japanese candlestick closes outside the borders.

Click the button to go through a step-by-step guide to the “Triangle Shape” and master the strategy in a few simple steps Explore »

Triangle "Wedge" type.

- An expanding pattern can be traded inside only if the increase is within the limits of average daily volatility. If the amplitude continues to grow, this means that the market has reached the point of a possible trend change and you need to prepare to open a trade or fix profits/losses. A flat may also begin, especially at the end of the week or on holidays, when market makers do not trade.

Descending model

This type of triangle is an inverted mirror analogue of the ascending triangle . A descending triangle is a figure formed when the price often hits a support level, but does not update its highs. Next comes a breakdown, consolidation at the support level and a move further down . A diagram of how to properly build a formation is shown in the figure below:

The rules and nuances of the formation are mirrored from the ascending formation. A bearish trend precedes, and there are also different numbers of rebounds from the levels.

A descending triangle in trading is a figure of a market decline and continued movement in a bearish trend.

On a real chart, there is a case when a protracted downward trend is accompanied by the appearance of two structures in a row.

Alexander Elder on Ascending and Descending Triangles

A. Elder calls a “triangle” with a growing lower border ascending. Elder also writes:

“It tells you to expect a breakout to the upside. A descending triangle has a falling upper boundary. It suggests that prices are likely to go down. A symmetrical triangle indicates that the forces of bulls and bears are balancing and the trend is likely to continue.”

According to Elder, true breakthroughs usually occur within the first two-thirds of these patterns. When, after a breakout, prices return to the figure again, more favorable conditions arise for concluding a trade in the direction of the breakout.

A descending “triangle ,” according to A. Elder’s definition, has a relatively flat lower border, and the upper one is inclined downward. The horizontal bottom level of the pattern suggests that bearish sentiment in the market is growing, which is why prices can no longer rise as high as before.

Alexander Elder states:

“A descending triangle is more likely to end in a downward breakout. Volume tends to fall as the triangle ages. If it increases as prices move up, then an upside breakout is more likely. If volume increases as prices approach lows, a breakout to the downside is more likely. A true breakout is confirmed by a volume surge of at least 50 percent of the average over the past five days.”

Since true breakouts, as Elder says, predominantly occur within the first two-thirds of a pattern, he does not advise “playing” for a breakout in the last third:

“If prices stagnate all the way to the crossover point, they will probably remain constant. The triangle resembles a fight between two tired boxers starting to lean on each other. An early breakthrough shows that one of the fighters is stronger. If prices remain within the triangle until the end, then both fighters are exhausted and the formation of a new trend is unlikely.”

We do not find anything new in calculation of the goals of breaking through Just like Murphy, you need to measure the height of the figure and set aside this distance from the point of breakthrough through one of the levels. As a result, we will get the value to which the price will definitely reach, i.e. the minimum, which, most likely, will be exceeded in practice. This is especially true for small patterns that appear within a strong trend, as we already mentioned in the previous chapter.

Rice. 11. The power reserve after breaking through the level is always not less than the height of the “triangle”

Symmetrical model

Other names for this pattern are equilateral, isosceles or converging triangle . A symmetrical figure is formed with a large number of touches at the cost of inclined lines, which are built at approximately the same angle relative to the horizontal . Standard entry point:

- The price is squeezed into a narrowing price channel , alternately bouncing off the edges of the formation.

- Next we see the breakout of one of the lines and a retest. The entry point is a return to the trend line or a stop order (mark 1) at a distance of several points from the border. The difficulty of placing a hold is that you need to constantly move the order as the price moves.

- Stop loss is placed beyond the nearest extremum of the opposite border

Setting take profit for a symmetrical formation

If we look at the two standard ways to set take profit , the following stand out:

- Take equal to the height of the structure.

- Setting a take on a parallel support line (bullish candlestick combination) built from the high.

These two options can be at the same point, as shown:

Working on the chart

Formation of a reversal figure at the top of the market on the GBPUSD currency pair. The reverse upward movement of the price gave an entry point on the lower edge , and the take profit was greater in the second method .

Right Triangles

Right triangles are a type of symmetrical triangle where one line is formed at an angle of 90 to the vertical axis and thus will be horizontal

You can admire this in Fig. 9-10.

Rice. 9-10. Bearish Right Triangle

The symmetrical triangle itself does not indicate in which direction the breakdown may occur. But the rectangular one indicates, thanks to the inclined lines of support and resistance.

Like most patterns, a triangle breakout is usually followed by a pullback. An example is shown in Fig. 9-11 for a right angled ascending triangle.

Rice. 9-11. Bullish Right Triangle with Retracement

If you missed the breakout, then a rollback usually gives a second chance, and in calmer conditions. If you can add a retracement trend line, as in Fig. 9-11 above, the breakout line becomes an excellent entry area as it consolidates an existing breakout.

The probability increases even more if the pullback occurs on a decrease in volumes, and the breakdown above the retracement trend line, on the contrary, occurs on a slight or significant increase in volumes.

Converting a right triangle into a rectangle

One of the problems with these patterns is that many rectangles start out looking like right triangles. Therefore, you need to be especially careful when working with such patterns.

An example is shown in Fig. 9-12, where a likely downward right triangle eventually becomes a rectangle.

Rice. 9-12. Failed Bearish Right Triangle

Expanding model

The pattern is the opposite of a tapering triangle. The recommended number of touches at the price of one trend line is at least three. If you see fewer touches, then it is better to refrain from entering the market. The diagram of the entrance and how to correctly draw the model is shown in the figure.

The profit taking level does not differ from the standard pattern.

An example of a divergent real market formation

A good example of a divergent triangle has formed on the GBUSD asset. The trend has changed globally and it was possible to take much more profit than following the example.

How can you improve your results in triangle trading?

The first and most important thing is the time frames you will use. Stay away from low time frames and intraday noise that can result from minor news events and random price fluctuations. Also, on higher timeframes, false breakouts are much more rare.

You will have much more time to make trading decisions. You will worry less and will be able to calmly find the optimal entry point and decide on your profit goals.

Make fewer deals. If you trade on daily time frames and make more than ten trades per month, there is a 90% chance that you are trading too often. In other words, you choose quantity over quality. When it comes to the best entry points, there will never be many of them. In my experience, this number ranges from three to four to perhaps ten during an active month.

Before adding the triangle to your trading arsenal, you will have to be patient. Don't expect this figure to appear every week or even every month. However, with the right risk-to-reward ratio, the potential return can meet all your expectations.

Constantly track your results, both good and bad. Tracking your mistakes is much more important than your successes. Although it can be tedious and even boring at times, keeping a trading journal is a crucial step in becoming a profitable trader.

The main differences between a triangle and a wedge and a pennant

a triangle and a pennant on a chart. Visually, they look exactly the same, but they are trend continuation figures . The main differences between technical analysis:

- Time of figure formation . For a pennant, the banner forms faster.

- The entry point is different , the Pennant is trading on a breakdown of the upper consolidation point, and the triangle is on a retest to the trend line.

In trading, a wedge represents an inclined reversal pattern ; it occurs at the peaks of the chart, changing the trend. They have the same entry point with the triangle on the return . The wedge shape always angles upward to one side in a bullish pattern.

Triangle: market examples

An example of a right triangle is shown in Chart 9-5 for Intel.

Schedule 9-5. Intel shares, 1986-1987, daily timeframe

If the June 1986 decline looks like a shoulder, then we have a reverse head and shoulders situation, where the horizontal trend line acts as a neck.

Someone will start to grumble that it is not so horizontal, and the triangle is more like symmetrical. In fact, there is no need to rack your brains and crumble the loaf. In the end, it doesn’t matter at all what exactly you call the pattern. What is really important is a clear struggle between buyers and sellers, which ended in favor of the buyers. This is the only thing that matters to us and this is the only thing that matters.

Also notice how much volume increased on the breakout to the upside and that the price touched the lower trend line 6 times. If the standard for triangles is just a double tap, then in this case we have an impressive line of support. Once again, we used a two-pronged method to determine where the price would go.

The parallel line method allowed us to find temporary resistance in January. When the price broke the line, a strong trend began. The proportional method gave an even better result, and, curiously, the price reference line eventually became the support and neck line for the unsuccessful head and shoulders.

Chart 9-6 shows Analog Devices stock and another ascending triangle.

Rice. 9-6. Analog Devices shares, 1991-1994, weekly timeframe

This time it was formed after the market bottom and represents a consolidation pattern. Let us note how the volume decreased as the triangle formed. Then it expanded at the breakdown, but not straight to the ceiling.

Chart 9-7 shows Northrop Grumman stock and a fairly large descending triangle.

Schedule 9-7. Northrop Grumman shares, 1984-1990, weekly TF

The original (dashed) descending line had to be redrawn twice due to two trends in 1987. But when the price fell below this line a second time, a huge gap formed and the pattern was eventually completed.

When the Right Triangle Doesn't Work

Any experienced trader or investor just loves it when a pattern doesn't work - it opens up a ton of cool opportunities! Moreover, this is most relevant specifically for right triangles.

We have already seen how such triangles can turn into rectangles. However, the breakdown of right triangles is often accompanied by very funny stories. In general, there are two options for failure.

The first is when the price breaks the horizontal trend line and then returns through it.

At 9-13, a false breakout to the upside forms a false top close enough that a tight stop can be placed just below the rising trend line.

Rice. 9-13. Failed Bullish Right Triangle

Moreover, it makes sense to close the deal altogether if the price goes below the horizontal line again. At the same time, the probability of an unsuccessful entry increases greatly if the price breaks the ascending line in a bullish pattern, because it is this line that usually acts as strong support.

False breakouts are generally often accompanied by a strong movement in the opposite direction from the expected one, so there is an excellent opportunity to go down after the breakdown of the ascending trend line. The stop will need to be placed above the trend line (X) and moved until a better zone is found below.

In Fig. 9-14 is another false breakout, this time in a downward pattern.

Rice. 9-14. Failed Bullish Right Triangle

The distance between the breakout point and the downward trend line is very significant, so any downward entry from the downward breakout point must be closed as soon as possible if the price goes above the horizontal line at point X.

An example of a false breakout to the upside is shown in Chart 9-7 for Northrop Grumman.

Schedule 9-7. Norhrop Grumman shares, 1984-1990, weekly TF

This failure of 1988 is generally classic, since the breakout formed against the movement of the main trend. It all started much earlier, with the breakout of the nearly three-year rectangle. As the failed pattern formed, the volumes decreased, which is a common occurrence.

However, during the breakout, the volumes expanded and gave false confidence that this was a real breakout. After the price fell below the growing trend line, volumes literally shot up and gave a clear indication that the breakout was false - sellers were now in charge and the market had turned completely bearish.

The second time a rising triangle can fail is when a rising or falling trend line breaks before the horizontal line breaks. An example is shown in Fig. 9-15, where buyers are more confident with each fall, because it will inevitably come back.

Rice. 9-15. Failed Bullish Right Triangle

Techies will immediately notice this price behavior and start buying, expecting the successful completion of the pattern. However, everything will be different if the price breaks down the ascending triangle, hinting at a significant drop.

An example of an unsuccessful ascending triangle is shown in Fig. 9-16.

Rice. 9-16. Failed Bearish Right Triangle

If such a breakout in the other direction is accompanied by an increase in volumes, someone has made a significant mistake. The increase in volumes shows that a lot of people are trying to close their positions, while others are rushing to catch the new trend train before it leaves the station.

The Psychology Behind Failed Right Triangles

What happens there in unsuccessful ascending triangles (see Fig. 9-16)? As the price returns to the horizontal line, the confidence of market participants increases. However, each drop is smaller than the previous one. Everyone begins to wait for the price to pass above the horizontal resistance line and open corresponding positions.

At the same time, sellers are quite comfortable closing positions every time the price rises to the line. Since this happens multiple times, there is no need to accept the low price until the rising trend line is broken.

When this happens, everything changes. The original sellers understand that selling at a higher price from the horizontal line will no longer work. Those who bought in the hope of a breakout upward will be very disappointed. Actually, this is why such breakouts - based on disappointment - are so strong.

Chart 9-8 for Linear Technologies stock shows a good example.

Schedule 9-8. Linear Technology shares, 1981-1983, daily timeframe

At first, it looks like it's forming a nice downward, right-angled triangle. The period from June to August even created the basis for a symmetrical triangle. However, the descending triangle was never completed, and the price broke through it upward.

Chart 9-9 for WorldCom shows examples of three unsuccessful triangles at once, two ascending and one descending.

Schedule 9-9. WorldCom shares, 1993, daily TF

Notice how volumes decreased during the formation of all three triangles and expanded during false breakouts. Finally, at the beginning of 1994, a large rectangle formed.

Finally, Chart 9-10 for Analog Devices also shows the unsuccessful upward pattern that formed towards the end of 2001 and beginning of 2002.

Schedule 9-10. Analog Devices shares, 1998-2003, weekly timeframe

How to determine take profit and stop loss

Stop loss for each type of figure is placed behind the nearest extreme point before the breakout.

Take profit can be set according to the classic version, or you can use the following methods:

- Take profit at the nearest technical analysis level.

- Use the Fibonacci grid to determine the price target. The extreme height points of the pattern should be at levels 0 and 100 of the indicator. The level of 261.8 is the expected profit.

- Use a computer analysis indicator.

- Do not use take profit, but wait for a return signal . Exit from the transaction is carried out at Price Action, another technical analysis figure, or at the indicator's turning point.

- At the intersection of the take profit line for purchases (sales) parallel to the support (resistance) line.

How to trade

It is best to look for a point to enter the market when the support or resistance line is broken.

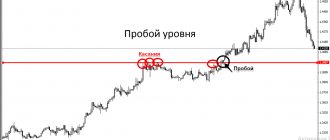

Triangle Breakout

According to classical technical analysis, a breakdown should occur in the range of 50-75% of the length of the triangle. If the strength level is not broken during this time period, volatility gradually fades. In this case, it is recommended to refrain from transactions.

You can find more lessons from this young trader video course HERE ⇒

To buy a currency pair or financial asset, it is best to look for ascending formations. The downward pattern is most often considered for short selling without covering. It is recommended to trade symmetrical figures in the direction of the main trend. An expanding triangle can be used to open a medium-term position against the trend if the signal is confirmed by other indicators.

Experts do not advise opening a deal immediately after breaking through the price level: in this case, slippage costs will be high, and the breakout may turn out to be false. It is best to wait for the situation to stabilize and the price to roll back to the strength level. According to the classics of technical analysis, support should become resistance or vice versa. You can enter the market using a limit or market order.

Another option for executing a trade is using a pending stop order. The order is placed above resistance or below support outside the triangle. In this case, it is important to determine what distance from the level confirms the breakdown of the figure. If the trade was entered correctly, you can consider increasing the position volume.

Where to set Take Profit and Stop Loss

The easiest way to decide is to set a stop order to fix a loss. Such an order should be placed after the figure breaks through resistance or above support within the triangle. The stop loss should not be too tight that it will not be taken out when testing the level. At the same time, a large order size greatly worsens the ratio of potential profit and loss.

Alternatively, you can use the ATR (Average True Range) indicator to set a stop loss. It talks about the average size of candles for a selected period of time. The trader can determine the size of the stop order in the range of 0.5-1.5 ATR depending on the volatility.

Various techniques are used to place an order to take profit. Technical analysts believe that after breaking through the figure, the price must travel a distance equal to the height of the triangle. In practice, this happens often, but not always. Take Profit can also be set using moving averages, Fibonacci levels and other analytical tools.

Another approach involves using a trailing stop order. This option is especially effective when the price moves strongly in the direction of the taken position: then the trader will take most of this movement and lock in profit in the event of a rollback of quotes. Moving averages can be used as an auxiliary indicator when placing a moving order.

Useful tips for trading

When trading using triangles, it is recommended to adhere to the following general rules:

- The emphasis should be placed not on quantity, but on the quality of transactions. This means that a trader should be patient and use only reliable patterns for trading. There will not be many good entry points, but they provide the best ratio of potential profit to loss.

- Another important point is determining working timeframes. When day trading, there is a lot of noise in the market, and the number of false breakouts increases dramatically. On higher timeframes there are much fewer of them, and there is more time for making decisions.

- There is no need to open a trade immediately after the figure is broken. It is better to wait for quotes to consolidate above the price level or for it to be tested.

- Strict compliance with all risk management rules is necessary.

The triangle is a fairly simple pattern in terms of its identification on the chart, but to consistently make a profit you need to strictly follow your trading strategy.

Triangle in Elliott Wave Trading

Ralph Elliott wrote the wave theory, which remains relevant today. The underlying fact is that history always repeats itself.

Let's look at the features of Elliott theory applicable to a technical pattern on the chart:

- Each subsequent wave is shorter than the previous one (a is shorter than b, the length of b is greater than c, and so on).

- The waves may have an uneven, zigzag appearance . That is, within one movement there can be several waves. Usually there are at least three such zigzags.

- The triangle is often included in other technical analysis patterns on a higher time period.

- The last two waves d and e can turn into horizontal accumulation . It is important that a, b and c have a clear direction.

- Wave e can have its own structure of five waves on a smaller time frame.

In a divergent trend reversal model, the wavelengths increase to form a technical analysis graphical figure.

conclusions

In general, we can say that the Forex triangle indicates a short-term equilibrium between sellers and buyers, when neither party can move the market in its direction. In turn, “Klin” says that large players are preparing for speculative actions, squeezing out smaller ones and increasing volume to begin a reversal or resumption of the trend. Accordingly, volumes increase sharply.

The ability to find a triangle in time and work it out correctly should be in the arsenal of all traders, and no matter what asset he is trading on, the rules remain the same. Even if the profit is small, trading will become much more stable and with fewer losses.

Indicator for finding the triangle pattern on charts

The PricePatterns indicator is used by traders to find the main patterns of technical analysis . In addition to the triangle, the Japanese candlestick chart displays head and shoulders, double top, and wedge.

download the file with the indicator from the link pricepatterns

Using the PricePatterns indicator

Signals for opening an order

The main prerequisite for opening a new order in the terminal is a breakout. It is important to take into account not only the fact that the price overcomes the formed support or resistance line, but also the increase in the number of orders when such an event occurs. In this case, the signal is confirmed by market players, which strengthens it many times over. The volume cannot grow constantly, and the strongest signals are given by a trend in which volumes increase when forming in the direction of the general price movement and decrease during price pullbacks.

In the example above, it is recommended to place a protective order at the intersection of the lower border. This will allow you to avoid losses due to a false breakout and subsequent change of direction.

Trading goals are calculated as follows:

- distance at the widest part of the figure (in points)

- at new support levels, counted from at least two adjacent candles

Most likely, the continuation of a longer-term trend is more likely than its breakout. It makes sense to additionally confirm the received information in a window with a larger interval.

Basic mistakes when trading

Let's look at the mistakes and difficulties that traders face:

- Searching for a reversal pattern when you need to look for a trend continuation . Such technical analysis constructs are considered weak.

- Short time for the pattern to appear.

- Large stop loss - for the farthest extreme . Trading without stop loss

- Long decision-making time or late detection of the pattern. As a consequence, opening an order when the chart has already gone far beyond the boundaries of the formation.

- Aggressive trading when touching the sloping line. Touching does not mean a breakout of the pattern.

Read more:

Chapter 17. Expanding triangle - unresolved problems of the classics of Forex technical analysis>>

Chapter 18. A trader’s work on the news: mistakes and unsolved mysteries of classical analysis>>

Book 1. Secrets of mastery from a professional trader (or what Bill Williams, Alexander Elder, Erik Naiman and others did not tell traders about Forex) >>

Book 2. Points of opening and closing transactions on the Forex market / Forex (basic rate)

>>

Get professional training in Forex and stock trading >>

Triangle figure and its types

There are four types of tools:

Ascending triangle pattern

The Ascending Triangle pattern is stronger in a bull market compared to a bear market because the angle of the support line is directed upward, meaning buyers (bulls) are more interested. And the price usually breaks through the horizontal resistance line. Therefore, in a bear market, when an “ascending triangle” appears, you need to be very careful.

This figure can be identified by the following characteristics:

- the resistance line of the triangle has a horizontal direction (or almost horizontal)

— the support line of the triangle has a slope and rises up.

The Ascending Triangle pattern is usually found in an uptrend and is a trend continuation pattern, however, it can sometimes serve as a reversal pattern for a downtrend. Therefore, sometimes, even in a bear market, it is considered a bullish signal.

Another example from life:

Ascending triangle on a bullish trend

Trade:

Trading inside the triangle is not recommended, but as soon as the price breaks the figure at point “A”, you need to open a position. Since the “spring” effect is triggered, that is, the price breaks through the support/resistance line at high speed and moves over a long distance. That is why it is recommended to open positions only after the triangle has been broken out.

Comment:

In a typical situation, during the formation of an “Ascending triangle”, volume indicators fall. Moreover, in the direction where the price is most likely to break through, volume indicators increase and vice versa. Therefore, if a price increase inside the figure is accompanied by an increase in volume indicators, then it is most likely that the “Ascending Triangle” will be broken upward. And vice versa, if inside the Ascending Triangle the price fall is accompanied by an increase in volume indicators, then it is most likely that the figure will be broken down.

In general, it must be said that the likelihood of the price breaking through a particular level can be influenced by many factors: the type of the previous trend (bullish/bearish), support/resistance lines, the proximity of significant support/resistance levels, etc.

If the breakout occurs in the direction of the previous trend, then the effect will be maximum and the price will travel a long distance. Moreover, most likely, the distance of movement in the direction of the breakdown will be equal to the distance that served to form the figure.

The space inside the Ascending Triangle figure is conventionally divided into intervals. If the exit occurs in the interval from 1/2 to 2/3 of the length of the figure, then the effect of such an exit will be maximum. If the price enters the last third of the figure, then, as a rule, consolidation occurs and rapid price movement does not occur.

Here are additional examples of the strength of Ascending Triangle signals in various situations: