Lazy Investor Blog > Stock Exchange

Recently, conservative instruments with predictable returns have become increasingly popular among investors. Since the topic rose to the top of my most requested by subscribers, I decided to make another review. We continue to dive into the topic of debt securities, this time into amortizing bonds.

What are amortizing bonds and who issues them?

Bond amortization is the annual payment of the face value in installments over the maturity period. The advantage for the issuer is that he does not have to redeem the entire face value at the end of the term, accumulating and spending large sums on this. In addition, the company reduces coupon payments, which are accrued only on the principal balance. In this case, the income from coupons is not fixed, but variable. Every year the total amount of payments (part of the face value + coupon) decreases.

Bonds are usually considered not by current or simple yield, but by effective yield, that is, with the condition of reinvesting the received coupon income. For depreciation securities, unlike simple ones, the effective rate is usually lower than the current one.

The issue of bonds with amortization is relevant for issuers whose business depends on periodic income. Examples are leasing companies, banks, utilities and energy sales structures. Such a company is not interested in accumulating capital in order to pay off investors at once. Amortization of the principal debt can be compared to regular payments on a loan, the debt on which is also repaid in small portions. In the corporate sector, at the time of writing, there are 197 issues in circulation with debt amortization at par.

Federal loan bonds with amortization, issued since 2002 by the Ministry of Finance, are designated OFZ-AD. The maturity period for them can be up to 30 years. Unlike the popular OFZ with constant income (FD), this is not the most popular type of bond among investors due to the floating coupon income and low liquidity. In the early 2000s, they accounted for up to 60% of the OFZ market, but today the choice of government securities of this type is small, and the last placement took place in 2011. These debt securities are gradually being withdrawn from circulation, so there is no point in considering them in detail here. The official list of traded OFZ-AD government debt bonds is on the Ministry of Finance website here. But it’s more convenient to search and filter these issues in the rusbonds service:

I also recommend reading:

General Invest: analysis of reviews and independent review

Honest review of the General Invest broker

Subjects of the federation and municipalities are more willing to issue depreciation bonds than other issuers. For more information about them, see the article on municipal bonds. There are 119 issues in circulation, with 2–3 new issues registered every month. In this segment, unlike OFZs, there really is plenty to choose from. Cash flows of the constituent entities of the Russian Federation are tied to the budget process. It is easier for them to pay investors the funds allocated annually for these purposes within the budget than to accumulate large debts and pay interest income on it. It is important that depreciation reduces the region’s debt burden, and this is a priority indicator when assessing the performance of officials.

Useful life

The calculation of depreciation of fixed assets is regulated by the Tax Code if a company, using depreciation deductions, reduces the income tax base. To correctly determine the useful life of an object (SPI), a classifier is needed. The directory states that machines for processing concrete belong to the fifth group, the service life is 7-10 years. Within this framework, you can select the accrual period.

If depreciation is needed for management accounting, the company can set this period itself. The shorter it is, the larger the amount of depreciation will be redistributed to costs, this can lead to an increase in product costs. Conversely, if the period is chosen to be very long, the equipment may fail before it is completely depreciated. Calculating depreciation of fixed assets involves different methods, but a company can choose only one of them. You can change the method once every five years.

Deductions begin from the next month after purchase. If Betoniya bought the machine in July, then the first accrual will be made in August.

How to analyze the yield on amortizing bonds

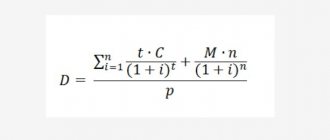

On the secondary market, bonds with amortization, just like regular ones, are sold taking into account the accumulated coupon income (ACI). But calculating the yield to maturity on amortizing bonds is more difficult. In this case, trading terminals come to the rescue. It is important that the correct brokerage settings are filled in in the terminal for this type of security, otherwise the profitability will be displayed incorrectly. Also, ready-made calculations are available on specialized services. The main resource where you should view bonds of this and any other type is rusbonds.ru (registration is free). Another advantage is that the investor knows in advance the schedule of amortization payments from the prospectus, so he can calculate his profitability manually.

Principal repayments do not necessarily start from the first year, sometimes they are deferred for 3-4 periods. You can find out the date of the first or next payment, as well as the percentage of the face value and the amount in the description of the issue.

Unlike classic bonds, in lists of issues with amortization we cannot immediately see the coupon income, which is floating. It depends on the period and number of remaining depreciation payments. To calculate the potential profitability, you need to go to the issue description and correlate the initial coupon with the number of days after placement and until maturity. In the “Bond Analysis” section, we enter the issuer and look at all the parameters in the “Amortization” tab.

I also recommend reading:

Clearing on the stock exchange: how it works and why it is needed

What is exchange clearing and why should an investor know about it?

The coupon yield can be calculated using a simple formula. Example: issue for a period of 5 years, coupon 11%, par value 1000 rubles. Depreciation from the first year in equal shares, that is, 1/5 of the nominal value. Thus, the coupon income for 5 years, taking into account depreciation, will be:

This is an uninteresting return if you do not reinvest the payments received (part of the face value + coupon). Does this mean that buying bonds with amortization means exposing yourself to the risk of losing out to inflation? The answer is negative. It is not profitable to invest in securities with depreciation during a reduction in the Central Bank rate. The holder must reinvest the received part of the nominal value to avoid idle capital. And he can invest only in those securities whose yield has already decreased compared to the time of purchase. On the contrary, during an increase in rates, an investor can direct money from depreciation payments into new securities with an increased coupon income.

Who are OFZs suitable for?

Financial advisors like to suggest that beginning investors build a 60/40 portfolio—60% stocks and 40% bonds. In reality, the share and general availability of the latter depend on the goals, age, risk tolerance and time horizon of the investor.

There are situations in which it is worth taking a closer look at OFZs:

- Long-term savings. If an investor is going to buy an apartment or pay for children’s education in 5–10 years, then it is important for such a person not to lose money. Stocks fluctuate too much, so it is wise to sacrifice potential profitability, but preserve and increase your savings a little.

- “Parking” money for a short period of time. Sometimes an investor does not see good stocks to invest in or thinks that the time has not come yet. He may buy bonds to protect his capital from inflation while waiting for the right opportunity.

- Training with little blood. Government bonds are quite safe and are often not as complex as corporate bonds. A novice investor can figure them out pretty quickly, and without losing a lot of money in the learning process.

Taxation

Tax laws changed at the end of 2022. According to the new changes, investors are required to pay taxes on coupon income. In simple words - on the profit you receive, you must pay 13% for citizens of the Russian Federation and 30% for foreigners. The amendment came into force on January 1, 2022.

If the client has opened an IIS (individual investment account) through which bonds were purchased and type “A” deduction is selected, then the broker will automatically deduct contributions from the coupon. In this case, the client does not need to pay anything! Many Russian brokers act as tax agents.

If type “B” is selected according to the IIS, the investor is exempt from paying 13%. If a different type of agreement is drawn up, then it is best for the client to contact the broker in advance to clarify information regarding taxation. If the 13% is not paid by the broker, the client will need to submit a declaration himself.

Important! Personal income tax from coupons can be returned using a tax deduction. All available deductions are presented on the official website of the Federal Tax Service. You can submit a declaration remotely, if you have a personal account on the tax service website. If it is missing, you should contact the federal tax service.

Nonlinear method

Can be used in tax accounting, but not in accounting. Does not apply to objects of 8-10 groups from the classifier, for example, real estate. The cost of fixed assets of one group is summed up, and depreciation is charged immediately to the entire group:

Deductions = Cost of the fixed assets group x Depreciation rate

The brick making machine belongs to the fifth group; the company has only one machine, so the calculation is carried out only for it. The depreciation rate for a brick making machine is 2.7. Depreciation is calculated every month and reduces the cost of the asset every month. In the first year, deductions will amount to 139,982.11 rubles, which is almost twice as much as with the first method. In the month following the moment when the total cost of the fixed assets group becomes less than 20,000 rubles, the company can write it off one-time.

Write-off method based on the sum of years of use

An accelerated method that writes off most of the cost of the OS in the first years of use. Calculation of depreciation of fixed assets is carried out on the basis of the original cost and the sum of the remaining years of useful life.

Depreciation rate = Remaining SPI: Sum of SPI years x 100%

Sum of SPI years = 8 + 7 + 6 + 5 + 4 + 3 + 2 + 1 = 36

Depreciation rate (first year) = 8: 36 x 100% = 22.2%

Depreciation rate (second year) = 7: 36 x 100% = 19.4%

Deductions = Initial cost x Depreciation rate

500,000.00 x 22.2% = 111,111.11 (rub.) - the amount of depreciation for the first year;

111,000.00: 12 = 9,259.26 (rub.) - monthly deductions in the first year.

Where does the money go when repaid?

When making an offer, the broker and the buyer agree on the method of receiving income. In practice, several accounts are used:

- IIS (Individual Investment Account). Tinkoff Bank offers to open an account for the holder of the Central Bank for free and top it up afterwards with any amount. At Sberbank, to open an IIS, you must make a minimum contribution of 10,000 rubles. In practice, financial experts recommend opening investment accounts to receive a tax deduction, or to avoid paying tax on the profits received.

- Regular brokerage account. You can open it for free at a bank or through a broker who sold the securities. When choosing an account, you should pay attention to the withdrawal fee and the timing of depositing money. For example, Tinkoff offers to withdraw money for free only to your bank card. Then withdraw money from an ATM of another bank without commission. They do not provide transfers to cards of third-party banks.

- Bank account. It opens for free and does not require you to place money on it. You can withdraw the income received only through the cash desk of the office in which it is opened. As an alternative, you can arrange a transfer to a card of any bank, taking into account the commission.

In practice, income is paid to the account where it was deposited.

To summarize, it can be noted that the repayment procedure depends on factors such as: the type of securities, the date of issue, how long the issue (circulation) was valid. It should be understood that this can be a transfer in one installment at the end of the offer or in installments (in installments, in the case of depreciation). The security may be returned early. The initiator can be not only the client, but also the issuer. No matter when the bond is sold, there are tax considerations to keep in mind. In practice, 13% of the income received is paid by the broker, not the holder.

Linear method

Used in tax and accounting. Payments are made evenly throughout the entire period of use. Formula for calculation:

Deductions = Initial cost: SPI in months

For the brick making machine, the SPI of 8 years or 96 months was chosen.

500,000.00 : 96 = 5,208.33 (rub.)

And this is what the table of annual accruals will look like: