Cryptocurrency mining continues to gain popularity both among professional brokers in the financial market and among ordinary Internet users. There are quite a few ways to earn a decentralized currency such as, for example, bitcoin, from watching advertisements to trading on the Forex financial market. However, the most common and accessible mining tool is a mining farm, that is, earning digital currency using the computing power of a computer or video card. However, the cost of the equipment is high, and the payback period of a mining farm may not satisfy everyone, and may even confuse them.

Most people who have no idea about mining crypto coins, but want to try it, do not know all the aspects of this process. An ordinary cheap video card or processor is unlikely to be enough to recoup the electricity and time, because cryptocurrency earnings will be relatively insignificant. Therefore, there have been rumors on the Internet for a long time about certain crypto-farms that allow you to experience all the delights of the so-called crypto-mining.

Information about the project “Crypto Farmer”

The project itself has very interesting gameplay as a whole. You don’t just have to put up a farm that will bring you profit, but build it from different parts .

The essence of the game is this: You have a so-called field where you can build your mining farm. You need to go to the game store and purchase everything for this. The more and more expensive parts you buy, the faster you earn.

Just look at the white paper and you will understand what’s what.

- Build power plants

- Install system units and install cards

- Install cooling to strengthen the farm

- Receive blocks to the warehouse

- Exchange blocks for coins at Crypto Bank

- Buy new properties or withdraw money

- 10 blocks = 1 coin

- 1,000 coins (harvest/coins) = 1 dollar

This is what the playing field looks like

If you click on the “help” icon at the bottom of the field, it will indicate how many blocks your farm makes per hour, i.e. its performance.

Upon registration, you are given 5,000 coins , which can be spent on building a farm.

- Registration is simple and does not require email confirmation.

- Replenishment of cryptocurrency through Free-kassa, Payeer, Cryptonator

- Withdrawal is available on Ethereum, Payeer, Qiwi, Litecoin

- Referral program in 5 levels. 20% 10% 3% 2% 1% respectively. At the moment it is unknown whether the referral works.

- Bonus from replenishment of $5 - 10% from $10 - 20%

- Minimum withdrawal – $100

- There is surfing that has 5 advertisements

- Online mining in the browser, where the creators of the project will gladly take your money

What do you need to play games with Bitcoin withdrawal?

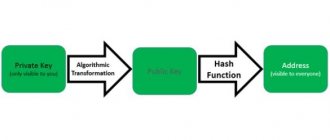

Below we will tell you in which games you can get bitcoins absolutely free, but first you will definitely need to create your own wallet. Firstly, you will receive your coins on it. Secondly, it may be needed to top up accounts in games that require investments.

In the article - how to find out the Bitcoin wallet address there is a list of services through which you can open a BTC account for free.

No matter what games you decide to play, you will need a wallet in any case. Through it, various operations are performed, replenishment, withdrawal, storage. You will also need instructions on how to withdraw cryptocurrency:

Some sites require you to provide an account number immediately upon registration. Therefore, do not delay creating a wallet, do it right now. And choose reliable services, otherwise you will lose all your coins.

Project contacts

- Naturally the address is Urb. Saladillo 224 29630 Estepona (Málaga), Spain is fake.

- The VK group has not been active since spring https://vk.com/cryptofarmer

The domain was registered on March 27, 2022 in the USA.

Over the last 3 months, visitor traffic has been falling. But it does it smoothly, which means the creators of the project are still investing money there thanks to the 5 levels. In the referral program, people themselves are interested in inviting others here.

45,000 people come here per day , which significantly exceeds the figures for other projects. But there are still fewer and fewer people.

Exposing the Crypto Farmer project

- The interest rate is unclear. Nowhere is it written how much you can earn, at least the minimum, you have to calculate it yourself.

- The information in the White paper is not true. After all, if the project were built on the Blockchain system using Smart-Contract on Ethereum, then transactions would be made directly from your Ethereum wallet or in exchangers, and not through a payment aggregator.

- The Smart-Contract address is not indicated anywhere because the balance would be visible on it and the project could really be considered more transparent

Naturally, we will not ignore a couple of excerpts from the rules:

4.2.2.6. The organizer is not responsible for the malfunction of the game software. The Participant uses the software on an “AS IS” basis. If the organizer determines that during the game there was a malfunction (error) in the operation of the site, then the results that occurred during the incorrect operation of the software may be canceled or adjusted at the discretion of the organizer. The participant agrees not to appeal to the organizer regarding the quality, quantity, order and timing of the gaming opportunities and services provided to him.

5.3. The Organizer is not responsible for losses incurred as a result of the participant’s use or non-use of information about the Game, game rules and the Game itself and is not responsible for losses or other harm incurred by the participant in connection with his unqualified actions and ignorance of the game rules or his mistakes in calculations;

5.4. The participant agrees that he is using the playground of his own free will and at his own risk . The Organizer does not provide any guarantee to the participant that he or she will benefit from participating in the game. The degree of participation in the Game is determined by the participant himself.

On top of that, there are reviews on the Internet that the conclusions simply “stuck.”

Cost and payback of a mining farm

A crypto farm is equipment specialized in cryptocurrency mining that runs on high computing power. As a rule, the main component of a farm is a set of advanced video cards.

The main advantages of such equipment are its power and task priority. Connected mining equipment completely frees the computer and its video card from heavy processes, thereby minimizing all possible loads and risks. The power of the crypto farm allows you to mine digital currency in relatively large quantities in a short time, which allows you to feel the payback of mining and profit.

The price of one crypto farm varies differently. However, if we consider an original mining system with a guarantee, the average price will be from $1,000 to $8,000. The determining factor in cost is power.

As for the payback of a mining farm, equipment suppliers promise it in about 1 - 1.5 years of operation, while providing the same warranty periods. That is, purchasing a system for $5,000, the average annual income will be $3,000 - $5,000, which is equivalent to $250 - $415 per month, or $8-13 daily.

Possible losses on the Crypto Farmer project

The project isn't really worth your time. After all, the minimum withdrawal is 100 dollars or 6,730 rubles. Just think about these numbers. Let's calculate the percentage profit from the 5 dollars donated by the system.

At 5 dollars we will get a farm with a yield of 10 blocks per hour or 1 coin. In total, we will make 240 blocks or 24 coins per day. It will take us 41 days to earn one dollar. Accordingly, we will earn 5 dollars in 208 days .

Naturally, with an investment of $100, the income will be greater. But there is no approximate calculation anywhere. You need to count everything yourself.

How to quickly make money on cryptocurrency. 4 ways

Over the course of several months, DeFi tokens have brought investors multiple profits, and DeFi platforms promise users thousands of interest per annum for opening a deposit. We tell you how to choose a project with good potential and reduce the risk of losing all your money

The cryptocurrency market provides opportunities to earn money every day. Some of them are conservative, for example, trading on fluctuations in the Bitcoin exchange rate, the value of which can be about 10% per day. Other options offer both much greater income and significant risks.

High leverage trading and options

One of the surest ways to earn hundreds of percent on one trade or lose everything on it is trading with leverage. Many exchanges and derivatives platforms, such as Bitmex, Binance Futures, OKEx and others, allow clients to borrow funds against their assets. The loan size and risks are determined by a coefficient, the value of which starts from 1 and reaches 100, in rare cases exceeding this value.

It works as follows. A trader temporarily gives the exchange, say, 1 ruble as collateral and, choosing leverage with a coefficient of 100, receives 100 rubles in return. They automatically buy cryptocurrency. If its price rises by 1%, the user receives 100% of the profit. If the asset falls in price by 1%, the platform closes the transaction and takes both the issued funds and the collateral.

Private trader Alexander Boyarintsev spoke about another way to make money. He suggested the option of purchasing call options on cryptocurrency. These are contracts that give the right to buy an asset under predetermined conditions. The price of such contracts may fall if the volatility of the asset price decreases, this will make the transaction more profitable.

“Example: the price of Bitcoin was $9,500. Volatility fell, and options with a strike price of $11,000 and an expiration date of two weeks were priced at $60. I bought 3 options. Then the price of BTC went above $11,000. Accordingly, everything that was above this price turned into profit. The risk was $180—$60 for each option. The total profit is $3,000,” Boyarintsev explained.

Investing in DeFi tokens

Another sure way to significantly increase your capital or reduce it to zero is investing in cryptocurrencies from the field of decentralized finance (DeFi). In 2022, this sector is experiencing a boom phase. Many DeFi tokens that did not exist in June-July saw growth of thousands of percent in August. The most striking example is the Yearn Finance (YFI) platform token. It was released on July 18th and cost $32 at the time. In September, the price of YFI rose by more than 130,000%, to $44,000, and has now dropped to $22,000.

There are many such examples. The Unitrade token (TRADE), which appeared on August 5, went from $0.11 to $2.6, but then fell in price to $1. The UMA coin (UMA), released at the end of April, showed an increase from $0.3 to $25, now costs $12.5. The price of the Ocean Protocol (OCEAN) cryptocurrency over the same period grew from $0.03 to $0.62, and has now dropped to $0.32.

There is a lot of hype around the DeFi industry, so even one successful purchase of a DeFi token can increase your investment many times over. But the chance of losing on this is much higher than the chance of luck. Firstly, there are now a lot of decentralized projects, especially when compared with the beginning of summer. Therefore, user capital, which was previously distributed over a limited number of assets, is now allocated to thousands of projects.

Secondly, along with the hype, scammers came into this area. And there are significantly more supposedly DeFi tokens issued by them than there are real projects. After the incredible rise in the price of YFI, many users decided that they should try to buy DeFi coins as early as possible, before the masses found out about it. In this regard, there is a demand for services that allow you to be the first to know about the release of a new DeFi token.

Most of these coins appear on the Uniswap exchange for the first time. Services such as Astrotools.io or Dextools.io allow you to monitor in real time how new projects are added to the site. On the one hand, this gives traders the opportunity to buy coins immediately after they appear, in the hope of multiple growth.

On the other hand, there is no strict listing procedure on Uniswap. Anyone can issue a token and add it to this exchange. In this regard, scammers take advantage of traders’ hunt for new projects and try to “slip” their coins, which have absolutely nothing behind them. This is probably why, according to data from Astrotools.io and Dextools.io, new cryptocurrencies appear on Uniswap literally every 5 minutes. Often, it's not even people who do it. Fraudsters create special programs that automatically issue tokens and add them to Uniswap and other decentralized exchanges.

The amount of risk and possible income from the hunt for new DeFi projects is demonstrated by the example of the HotDog token. It was released on September 2 and within 24 hours the price rose from $5 to $6,200, and then within a few minutes the price dropped to almost zero. Another example is the SAVE coin. On September 14, its rate soared by more than 500%, to $5,000, after the creator of YFI spoke about the project on his Twitter account. The very next day SAVE cost about $300.

There are several criteria that increase the likelihood of selecting a token with good potential. The first is limited edition. The lower this indicator is for an asset, the higher its price may be. For example, a key factor in the growth of the YFI rate was the fact that there are 30 thousand tokens in total. But the issue itself does not guarantee an increase in the price of cryptocurrency. On the contrary, many fraudulent projects issue coins with an emission of exactly 30 thousand in order to make inexperienced traders believe that this is the new YFI.

The second is product availability. If a project has released any application or platform, as its polarity grows, more and more users will become aware of this coin. This makes it likely that it will rise in price in the future.

Having a product also increases the chances that the token will be added to marketplaces. This is the third and probably the most important criterion for selecting DeFi projects. After listing on exchanges, DeFi coins show rapid growth. Reasons: more users get the opportunity to invest in cryptocurrency, and addition to the exchange gives more reason to assume that the project is not a dummy.

However, it is usually too late to buy DeFi tokens after they have been added to large platforms. As a rule, listing on Coinbase, Binance and other industry giants coincides with the peak price of such coins. Therefore, the chance to make money by investing in DeFi tokens is higher if you buy them after they appear on small trading platforms in the expectation that market leaders will pay attention to them.

"Profitable farming"

The DeFi sphere offers another way to make risky money - “yield farming”. It works as follows. The user makes a deposit on the platform in cryptocurrency, for example, Ethereum. Interest is paid on this deposit, but in another cryptocurrency - in the project’s native tokens. Thus “the farmer reaps the harvest.” The resulting coins can then be sold to lock in profits.

“Yield farming” is very popular now. The reason is sometimes insane deposit rates. In the first days of operation, DeFi platforms often offer returns in the thousands of percent per annum. For example, the Spaghetti Money project in the first day of operation allowed users to receive up to 35,000% per annum in Bitcoin. Sushiswap project - more than 2000%. And these are normal indicators for the sector.

Such bets are suspicious. And indeed there are a number of nuances. Firstly, the amount of profitability depends on the number of users - the more there are, the fewer tokens there will be per “farmer”.

Secondly, the price of the coin in which the harvest is “harvested” plays a key role. Typically, the price is high on the first day after the app is launched. But as soon as users start receiving payments, they sell tokens and their value drops. This has a corresponding impact on deposit rates.

Thirdly, most DeFi platforms are launched without undergoing a code audit. This means that the protocol may operate with a critical vulnerability, and there is a risk for users to lose funds. For example, on August 12, the Yam platform began operating; in the first 24 hours, users contributed more than $500 million in cryptocurrency to it. The next day, the project developer reported an error in the code. Within half an hour after this, the price of the Yam token dropped from $167 to $1.

Thirdly, scammers. They come up with various ways to deceive users and steal their funds. One example is that the platform code includes an extremely high commission for withdrawing funds. Let’s say that to deposit cryptocurrency for “harvesting” you need to pay $30-50, and to withdraw it – more than $1000. Another example is that attackers, luring users with high rates, may try to sell them their tokens, which have no intrinsic value.

Fourth, a lack of understanding of how “yield farming” works. On September 11, a user told how he lost $5,000. He introduced funds to the platform to receive 300% income per year when depositing in Ethereum. However, later I decided to change the plan to another, more profitable one.

The Kimbap project offered a 1000% return if the platform's native token was used for farming. The user bought it for $5000 and made a deposit. The next day, the price of the coin fell by more than 100 times. This outcome could be expected, since in this coin other traders “harvested” and sold it to realize profits.

Fourthly, not only the project token, but also Ethereum itself or any other cryptocurrency used as a deposit may fall in price. There are also fees to consider. Due to the rapid growth in popularity of the DeFi sphere, the cost of one transaction in the ETH network has increased tenfold since the beginning of summer - up to $6-10. Smart contracts, the use of which is necessary for farming, have become even more expensive - $30-50.

The increase in commissions has left “farmers” with a difficult choice. On the one hand, they need to allocate a fairly large amount for this strategy in order to reduce the share of the commission. You can lose about $100 on deposit/withdrawal alone. On the other hand, in order to receive a significant income, you need to deposit funds into the platform in the first days of its launch. And doing this with unverified projects that have not passed the audit is extremely risky.

On September 13, former product manager at analytics company Messari Qiao Wang called DeFi tokens “the investment opportunity of the decade.” He believes that not taking advantage of this chance is the same as not buying Bitcoin in 2013 or Ethereum in 2015. However, there is a lot of “junk” in this industry, so it is extremely important to choose projects that develop a real product and have a fundamental basis for growth.

- “The hype will not end soon.” How to increase your savings using cryptocurrencies

— The price of the Unicorn token soared by 500,000% in a day due to a traders’ error

— The Binance exchange offered a 1200% return on cryptocurrency deposits

You will find more news about cryptocurrencies in our telegram channel RBC-Crypto.