Good day, ladies and gentlemen, forex traders. Today’s video tutorial will talk about the secrets of working with the classic “Double Top/Double Bottom” graphic pattern. This pattern occurs frequently and is mentioned in many books about Forex, but few know how to trade it correctly.

Double top / double bottom - secrets of the Forex pattern Double bottom / double top

Hello ladies and gentlemen traders. In this video lesson we will talk about such a graphic formation as a double bottom or double top. This pattern occurs very often. It is reversible. And in this lesson we will talk about how to enter the market when this pattern occurs. How to set stop losses and goals. How to Avoid Falling for the False Double Bottom/Double Top Pattern, What to Look For. And also the characteristics of the most adequate assessment of this pattern.

How can this pattern be interpreted?

The first peak, after which the market makes a pullback. At the moment, you cannot say for sure whether it will be a reversal, since trending markets go into correction from time to time. Second peak - the market again makes a pullback in the same area. This is the first sign that the market may go even lower. Breakout of the neckline - sellers are increasingly taking the initiative, and the market may continue to decline.

Thus, the formation of a double top signals a possible trend reversal.

Not all double top formations are quality. If you find this pattern in a strong uptrend, the market is likely to continue moving higher.

It is also very important that enough time passes between the first and second peaks and, accordingly, there is enough free space.

Try to look for setups such that the peaks of the peaks are located at a sufficiently large distance from each other. As in the example below.

Why is it important for the vertices to be far apart? When enough time passes between the formation of the first and second peaks, the level from which they start becomes more significant, and an increasing number of traders begin to enter sales from this level.

Size of reversal patterns

First, you need to measure the size of the pattern. To do this, connect the two tops/bottoms with one line. Then add a perpendicular to the line between the two tops/bottoms, starting from the neck line. This distance is the size of your Double Top or Double Bottom.

The size of the Double Top pattern is illustrated by the purple colored arrow in the image above. This works the same way as the double base, but in reverse.

Trap setup double top

Consider the following graph.

At the moment, many traders will wait for the breakout of the neckline and begin to open long trades. The breakdown occurs on a large candle. But then the following happens:

Traders who were hoping for a long-term bullish trend are now trapped in a false breakout because the market has made a sharp reversal.

Now that this has happened, we have the opportunity to take advantage of this situation. How? We will open a sell position after a false breakout. If the market continues to decline, it will trigger the stop losses of traders who were long, causing the price to move even lower.

When you trade this strategy, you will likely be trading against the long-term trend. Therefore, do not be too aggressive with setting take profits. Instead, you may want to consider taking profits at a nearby level.

Setting stop loss and take profit

Stop loss is calculated in this way - the most extreme value of the quote + spread + 2 points for the instrument . Since spreads on different currency pairs, futures, options, and indices are different, choose assets with minimal spreads for lower costs.

Most often, when setting a take profit, the height of the figure is measured, and then this distance is laid down from the breakout zone.

However, you can use other ways to maintain a position to maximize your profits.

Fixing a position in two parts or entering with two orders , where the take profit is divided into several price levels. The first is 100% of the formation size. Here we can take profit partially or completely. The next zone is the nearest support, which the price has not yet touched. We can also place the second trade on an automatic trailing stop or a manual trailing stop and enjoy the profit.

For more professional trading, you can also use the Fibonacci lines tool to set take profit . Read more in the article Fibonacci levels in trading.

How to enter a trade with the best combination of risk and profit?

In classic technical analysis, it is recommended to enter a trade after the price breaks the neckline and place a stop above the top level (or below the bottom level in case of a double bottom).

However, this approach has two problems. Often, after a sharp movement and breakdown of the neckline, a false breakout is formed. And also the risk-to-reward ratio with the classic stop setting is not the best.

Therefore, sometimes it is better to wait for a slight consolidation near the neckline, which is nothing more than a set of positions due to traders opening buy trades at this level. And place a stop outside the border of this consolidation.

If you enter using this strategy, use a trailing stop and try to take as many points as possible in the upcoming movement.

How to determine market reversals with the greatest accuracy?

To determine the highest probability of a market reversal using the double top pattern, you can use the multiple time frame strategy. Here's how it works.

Determine that the market is in a downtrend. Let the price approach the nearest resistance area. Look for a double top formation on the lower time frame.

Here's an example. The price is approaching the resistance level on the 4-hour timeframe.

A double top is formed on the hourly timeframe.

What is a double bottom?

The double bottom pattern is used to determine the market reversal after a downtrend. However, trading this figure has its own nuances and features.

A double bottom is a reversal pattern in a bearish trend (its opposite is called a double top).

It consists of three parts:

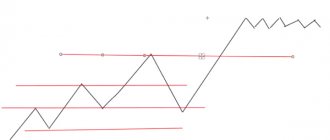

- The first low is the first price rebound.

- The second low is the second price rebound.

- The neck line is a resistance zone.

What does this pattern mean?

First low - the market makes the first pullback in a downtrend.

The second minimum - at approximately the same place the market turns around again. We now understand that there is strong buying pressure in the market, but it is too early to say whether the downward trend will finally change direction.

Breakout of the neck line - the price breaks through the neck level, and this signals that buyers are now in complete control of the situation. The market will most likely continue its upward movement.

In short, a double bottom pattern signals that a downtrend has likely bottomed out and the price will soon begin to rise.

This is what it looks like:

Let's sum it up

Double top

- Price: two tops after a good trend are formed at approximately the same level. Separated by a price drop and a sufficient period of time

- Pattern Completion: When the price falls below the low

- Volumes: large volumes at the first peak, much less at the second

- The goal is to set the distance between the highest peak and its minimum from the breakout point

- False breakout - a rollback of 50% or more from the distance between the second top and the breakout point

- Where to exit if the market has a false breakout - a rollback of 50% or more from the distance between the second top and the breakout point

Double bottom

- Price: two lows after a strong price fall are formed at approximately the same level. Separated by sufficient distance.

- Completion of the pattern: when the price from the first low moves above the high formed by it.

- Volumes: strong volume on the first day, weak on the second. An upward breakout is desirable on very large volumes.

- Target: The distance from the lowest low is projected from the breakout zone.

- False breakout: a rollback of 50% or more from a distance from the second low to the breakout zone. Breakout on a small volume.

- Where to exit in case of a false breakout: on a decline that rolls back 50% or more from the distance from the minimum to the breakout zone.

Triple Top

- Price: after a good trend, three peaks form at approximately the same level, the second peak should not be higher than the other two (otherwise it is HyP).

- Completion of the pattern: when the price falls below a more or less horizontal trend line that combines three lows.

- Volumes: strong volume on the first two tops, less on the second than on the first. At a triple top, volumes are less significant.

- Target: The distance from the highest of the three peaks is projected from the breakout zone.

- False breakout: a rollback of 50% or more from the distance between the third peak and the breakout zone. Breakout of a strong trend line connecting the third top with any minor trend high

- Where to exit in case of a false breakout: on a rollback of 50% or more from the distance between the third top and the breakout zone. Breakout of a strong trend line that connects the third top and the subsequent high

Triple bottom

- Price: after the fall, three bottoms are formed, approximately at the same level, where the second is not lower than the other two.

- Completion of the pattern: price movement above an approximately horizontal line that connects the highs coming from the two initial lows.

- Volumes: strong volume on the first day, very strong on the upward breakout.

- Target: distance from the lowest low to the breakout zone.

- False breakout: a rollback of 50% or more from a distance from the third low to the breakout zone.

- Where to exit in case of a false breakout: on a rollback of 50% or more of the distance from the third low to the breakout zone. When the breakdown is on low volume. Breakout of any trend line that connects the last low and any new one.

We have brutally dealt with the tops and bottoms, and next we have the favorite of any trader, be he drunk or sober, harsh or soft.

These are, of course, their Majesties triangles, which are so loved...and hated so much. And the same people. Oh, something will happen.

- Back: 7. Head and shoulders

- Next: 9. How to trade triangles

Don't Make This Mistake When Trading the Double Bottom Pattern

Many traders open positions on the breakdown of the neckline after the formation of a double bottom. However, they do not pay attention to the market context. So be careful.

If the market is in a strong downtrend and forms a small double bottom, the market is likely to continue its decline.

You can use an additional filter to avoid this situation:

- Add a 20-period moving average (MA) to the chart.

- If the price is below the 20 MA, do not enter the market.

How to trade double bottom and make a profit?

If you are trading a double bottom pattern, you should pay attention to the space between the two lows - the larger this distance, the better.

Why is that?

When the lows are far enough apart, it attracts the attention of a large number of traders who open short positions and thereby become trapped.

We can take advantage of this situation:

- There must be sufficient space between the first and second minimum.

- The price must make a false breakout.

- We expect a strong price rebound and open a long trade.

As the price falls below the first low, many traders begin to short the market and place their stops just above the broken level. But if the price turns upward, the stops of these traders begin to be triggered. You can take advantage of this by going long on the double bottom pattern.

Triple top and triple bottom in Forex

This is a type of double top and double bottom reversal pattern. They are formed when the price makes not one rollback from the level of the first extremum, but two consecutive ones. At the same time, it is important that the reversal levels themselves are preserved; the retracement levels can be at different price values. Triple tops and triple bottoms are not very common in trading, but you can often see how traders incorrectly interpret what is happening on the chart, trying to find these particular figures in a simple consolidation with the implied continuation of the trend.

Triple bottom

Trading with a triple top and a triple bottom is completely the same as the methods outlined for a double top and a double bottom. The entry points remain the same, and a situation is possible when the entry was made according to a pattern with two extremes, but the market turned around and drew a triple top. It is for such situations that you should make a small deviation from the price levels, which was discussed in the paragraph about setting stops.

Reliable entry technique

The price often pulls back after breaking the neckline. However, you can see the strength of buyers in advance before entering a long position. To do this you need:

- Find a potential double bottom.

- Wait until the price starts moving up.

- See the formation of a pullback in the form of a tight consolidation.

- Open a trade when the price breaks out of the range.

This is a reliable entry technique that will give you the opportunity to enter the market with an optimal risk to reward ratio.

When there is a weak pullback that turns into a tight consolidation, it suggests there is no selling pressure. You can set a stop loss below the low of the range boundaries.

However, sometimes the price will move up without any pullbacks. What to do in this case?

Don't chase the market

When the price makes a sharp breakout of the neckline, it is not worth pursuing the market in this case. You won't have a logical place to place a stop loss, and you'll likely take a loss on the first pullback or reversal.

Instead, it is better to wait for the breakout level to be retested.

- After the breakout, we are waiting for the neck level to be retested.

- We are looking for a price action pattern on the neck line.

- Open a long position by setting a stop loss at a distance below 1 ATR from the entry point.

Sometimes the market may not test the neck level. However, a bullish flag may form instead. Another figure based on which you can enter the market.

Neck Line Breakthrough

The pattern is confirmed when the price breaks the neckline. A candle closing outside the neckline means there is a valid range breakout that occurs after the initial trend. Since the breakout is opposite to the trend, we confirm the emergence of a new trend.

If you have a double top pattern, you will be waiting for a bearish breakout. If you have a double day pattern, you will wait for a bullish breakout to confirm. And after that, you will trade the pattern in the direction of the breakout.