Scalping is one of the most popular trading techniques that has long proven its effectiveness. Previously, it was actively used to make a profit on the foreign exchange market, although with the growth of the cryptocurrency sector it began to be used for the digital coin market.

Scalping is great for both novice traders who are just learning to understand the market, and professionals who have built complex trading systems around this technique. Despite some disadvantages and the fact that this is a rather risky way of trading, the effectiveness of scalping has been proven over more than 15 years of use by hundreds of thousands of traders.

That is why the technique has found widespread use in cryptocurrency, allowing you to receive a stable income and, most importantly, practical experience.

What is Scalping on Forex

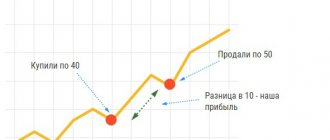

Translated from English, scalping means cutting off the top of something. Scalping on the stock exchange involves a quick reaction from the trader and concluding/closing a transaction in a short time.

Scalping is an intraday exchange operation that allows you to make money on fast trades concluded within a few seconds.

Such manipulations can be carried out on the foreign exchange and stock markets. Experienced traders note that for scalping it is not important what is traded, but the reaction of the participants in the transaction is important.

Among those trading on the stock exchange, scalping is also called pipsing. The basics of scalping allow you to understand the operation of the exchange and make money. It is believed that scalping strategies work most profitably when trading currency pairs. The exchange rate of world monetary units changes every second.

For example, after a slow and steady rise, a sharp decline may occur, and if a trader bet that the currency would fall, he would make a profit. Those who make money on such short-term transactions are called scalpers.

To engage in scalping on the stock exchange (SE), you need to observe the chart and analyze the available data. In this strategy, you can use a system without indicators. The frequency of such transactions is not limited, and a stockbroker can create 150-200 transactions per day.

Advantages and disadvantages

The scalping strategy, like a number of other systems for making money on the FB or simply on the stock exchange (including Forex), has a number of positive and negative characteristics.

The benefits include:

- simplicity of the system;

- high transaction speed;

- quick profit generation;

- convenience of trading.

In addition, the advantages of playing for quick profit is that it is suitable for beginners and does not require large starting capital.

The scalping trading strategy allows a beginner who does not have sufficient analytical knowledge to get involved and make the first profit. In addition, the system provides basic concepts about the operation of FB.

To become a scalper, you do not need to have a large starting capital and play big. It’s enough to see what a line chart looks like and how the system works (this is done for free on a demo account), and in a few minutes you can start working.

Having understood what scalping is, you need to remember that the process consists of many quick transactions that are concluded within 1-2 seconds, so you can monitor the movement of currency pairs on the way to work or during your lunch break. Profit is credited to the trader’s account quickly, and when the set amount is reached, it can be withdrawn to a card or e-wallet.

In addition to its positive qualities, scalping in the stock market (MS) has disadvantages:

amount of time spent;- high risk of losing funds;

- speed of decision making;

- greater concentration of attention.

The method requires the player to take a long time to earn a profit that can be withdrawn, although the trades are completed quickly. In addition, by incorrectly calculating his strength, the scalper risks losing all the funds on the deposit.

Forex manipulation requires increased concentration, it is tiring, and a new exchange player may lose concentration due to overwork.

Those who understand what scalping is recommend not risking more than 5% of the account amount on each trade. In addition, you need to limit your own income and, having 150 dollars on deposit, play for 25, and when the amount of earnings reaches 25 dollars, leave the exchange and do not trade anymore that day.

Signs of scalping

Since the volatility of currency pairs allows traders to earn 100 to 200 pips per move, you need to know how to determine when scalping is occurring.

The trader will be informed about it:

- use of timeframes M1-M30;

- working with market orders;

- short Stop Loss;

- short Take Profit;

- attention to pipsing.

An example of a strategy is “Jumping”:

Psychological attitudes

Strategy requires constant attention and quick reactions. Success in this type of trading depends entirely on the mood and psychotype of the trader. A trading session cannot be successful if you find it difficult to maintain maximum concentration.

Beginners often choose quick strategies to compensate for their lack of experience by feeling constantly busy. Dozens of trades until you sweat or exhausting worries about the work of an adviser in the eyes of those around you look more attractive than an outwardly idle medium- and long-term trader.

As we wrote above, when switching from M1-M5 to M15, the strategy may become unprofitable. This is a common psychological “block” associated with increasing the duration of the transaction. Yes, they still last 3-5 candles, but now it’s almost an hour and for “seasoned” scalpers the waiting becomes unbearable. Transactions are closed ahead of schedule, trading begins to work out non-existent entry points to maintain a high pace of trading. Naturally, the result worsens.

If you cannot control your impulsiveness, or are not naturally inclined to make quick, high-risk decisions, choose calmer Forex strategies. This way you will save your nerves and your deposit.

Choosing a broker for scalping

Having understood what scalping is in trading, you need to choose the right broker to play by the rules.

The specialist must:

- take into account all short-term transactions;

- correctly understand spreads of currency pairs;

- choose a loyal spread;

- quickly open trades when signals appear;

- do not use requotes in scalping;

- have a good long-term reputation.

Not all trading participants who allow customers to play on their platform are conscientious about short-term transactions lasting no more than 4-5 minutes. There are DCs that do not take into account such contracts.

Here are the brokerage companies that allow scalping:

In addition, to reduce the risk of financial losses, the broker must choose a loyal spread and evaluate the difference in exchange rates of currency pairs. Opening a trade without requotes allows you to make a profit at the right time.

Defining the terms and concepts of scalping on Forex

To begin with, I propose to decide what can be considered scalping, what can be classified as pipsing, and what style of trading fits the definition of quiet intraday trading.

Scalping is understood as a type of intraday trading in which transactions are concluded on small time frames, usually no higher than m15, maximum m30. At the same time, transactions do not last long - the lifespan of one is in the range from several minutes to several hours, here a lot depends on the trader’s trader.

As for pipsing, at first glance it is very similar to scalping:

• trading is also carried out on small timeframes, m1-m5;

• the lifespan of one transaction is short, usually does not exceed several minutes, or even seconds.

But still, these are different trading styles. Scalping does not stoop to minute-to-minute trading, and scalping strategies can indeed be profitable, although they are very difficult to work with. There can be about a dozen or even more transactions per day.

Pipsovka differs precisely in the intensity of trading and the fact that it is supposed to work on the smallest time frames. As a result, the profit on a transaction can be measured in literally several points, while scalping strategies can give a profit on a transaction of several tens of points.

Management of risks

Having understood what scalping is, an exchange player needs to minimize the risk of financial losses.

To do this, the FR participant must:

- control yourself;

- stop trading when the High mark appears on the calendar;

- avoid American sessions;

- stick to trends.

Patience and knowing when to stop are good skills for a FB player. Beginners are not recommended to quickly increase their deposit. In addition, there is no need to trade when information is published in the news that may affect the course of the game and the prices of currency pairs. Such news is marked with a High beacon.

American sessions are considered the most unpredictable. To avoid losing money, it is not recommended to trade at these times.

Scalping in trading requires concentration and attention from the trading participant. By following the chart and price changes, you can quickly conclude a deal and make money.

Scalping Stop Loss and Take Profit

Protective Take Profit and Stop Loss orders help close a trade at the right time and minimize losses by locking in profits. Take Profit is responsible for fixing earnings when it reaches the desired level, and Stop Loss limits the player’s possible losses. These functions are useful when the trader is away from the monitor.

The best way to trade

On the global stock market, you can trade securities or make money on futures contracts. Such complex manipulations can be done by experienced stockbrokers who understand market trends.

While learning scalping, beginners think about what is the best way to trade on FB. For those who have recently become interested in the financial program, experts recommend starting with stocks or exchange rate differences.

Psychology

Experienced stock traders note that scalping consists of a mixture of the player’s fortitude and the strategy he chooses. Those who do not know how to control themselves and control their emotions will not be able to master Forex scalping strategies.

The scalper must be ready to trade throughout the FB business day. Playing in the stock market is a stressful experience every minute, which a trader must prepare for in order to keep the situation under control.

Automated advisors

The lag of technical indicators and the impossibility of high-quality technical analysis on M1 and M5 leads to the logical conclusion that the advisor’s trading session can be profitable only if there is a function to compensate for losses by changing the volume of the next transaction and setting pending orders at probable price rebound/breakout levels. These algorithms are well known to traders - these are Martingale and a grid of orders.

Scalper robot algorithms.

The classic Martingale strategy of doubling the next trade only leads to quick losses, but there are “softer” options when a more complex strategy is used that involves a smaller increase in positions. This approach only postpones the moment of inevitable loss of the deposit, but if you want to take a risk, take two mandatory steps:

- Open a separate account (preferably a cent one) on which you will trade an amount that you don’t mind losing. This way you will avoid complete ruin. The strategy will simply stop working when the Margin Call is reached.

- After reaching the break-even level (profit exceeded the deposit), constantly withdraw your profit .

As for scalping order grids, they only make sense on M15, where price impulses and trends are already sufficient to capture several pending orders.

Click the button to go through the step-by-step guide to “Scalping Trading” and master trading strategies in a few simple steps Explore »

Guide: 5 Steps to Scalping

When learning what scalping is, you need to look at 5 steps to confidently play on the FR.

It is recommended to determine:

- market conditions;

- which instrument to choose for trading;

- trend;

- key support and resistance levels over a period of time;

- own position in the exchange space.

Once you understand what this is for, you can become an experienced scalper and earn money.

Tools for scalpers

Scalping trading can be carried out using tools such as:

stock;- currency pairs;

- indexes;

- metals;

- raw materials.

Experienced stock traders recommend studying all the instruments and choosing the right one. There is no need to take on all the options offered, as this will not bring profit.

- Example strategy - “Infinity”:

Basic scalping strategies

Over the years of operation of the global exchange market, traders have developed dozens of strategies, many of which are presented on our website.

Basic methods that are suitable for both a beginner undergoing scalping training and an experienced player are:

- scalping according to the trend;

- scalping along a trend channel;

- Puria method;

- 3 moving averages;

- "Victory";

- popular Forex strategy.

Scalping with the trend

The first scalping strategy is trend skimming. When choosing a game at an ascending price, they wait for a rollback, calculating the entry point, mentally dividing the traversed path of the line by 3. After the rollback, the trend will begin to move again, and you need to open a deal at the moment when the price path on the chart is equal to the calculated third.

The Stop Loss beacon is placed below the trend level after the rollback, and the Take Profit is placed at the same level where the price was before the rollback. At the moment when the trend reaches the end level of the previous movement, the Stop Loss is moved to the break-even level.

Scalping in a trend channel

You can choose both ascending and descending price channels to work with. Both scalping strategies work according to the same plan. Using ascending lines, they buy, and descending lines, they sell.

The trade is entered when the price goes up by setting a Stop Loss at the width of the channel. Take Profit is placed at half its width.

- For more information about the principle of trading, see this link ⇒

Puria's exact method

The Puria strategy is based on working with the MASD indicator and is considered one of the simple strategies.

Using it as scalping on futures, as well as for the Forex market, you need to know the types of selection of the moving MA indicator. Having chosen Puria, MASD in relation to Close is set to 5/26/1. Before the start of the session, the MA is fixed in relation to Low with a shift of 0 for periods of 85 and 75. In relation to Close, a period of 5 and a shift of 0 Simple are set. The timeframe is set to H30. Stop Loss does not need to be set.

The work begins when all MAs intersect in the direction indicated earlier. Buying occurs when moving up, selling when moving down. Wait until the MASD indicator touches the zero line. The trade is closed when the MA returns.

3 moving averages

Scalping on stocks or currencies occurs using a technique with three moving averages. In this case, 3 MAs are used with steps of 3.5 and 8. When the moving averages intersect at the top, a purchase is made, and a sale is made at the bottom. The transaction is closed at the moment when the indicators reverse.

TS "Pobeda"

Forex scalping strategies include the “Win” method. To work with this strategy, you will need TMA, SSRC and Currency Power Meter indicators. Before starting work, timeframes are set to M1 or M5.

A trade is entered when:

- the price touches the lower TMA level and reverses;

- the SSRC channel is wider than 10 points and points upward;

- the strength of the base currency is indicated by the Currency Power Meter;

- for M5 the price is above average.

Having figured out what scalping is and how to work with the Moscow group of traders using the “Victory” strategy, the Stop Loss value is set to 15, and Take Profit to 5. They exit when Profit is triggered.

Experts do not recommend using the strategy when breaking news appears. There is no need to trade within 30 minutes.

Simply a popular Forex strategy

The last method is called by stock traders “The Forex scalping strategy that breaks everything.” It is indicator-free and requires opening 4 charts of a currency pair, indicated by Japanese candlesticks.

The first chart has a time frame of 1 hour, the second one has a time frame of 30 minutes. The third should record the short-term market trend in 15 minute increments, and the fourth - 5 minutes.

When the candles on the charts turn white (and turn green on our chart), set a Stop Loss 15 points below the entry point and open a deal. When the profit reaches 15 pips, Stop Loss moves to “Break-even”.

Take Profit is set 30 pips above the entry point. You can use the same technique to work with black candles.