The bullish engulfing model (pattern) is a Japanese candlestick pattern, which is also called an External Bar or BUOVB (Bullish Outside Vertical Bar). Bullish Engulfing is one of the most reliable reversal patterns in the Forex market. It does not appear on the chart as often as we would like. Moreover, it is important to understand how to fully use it in practice in order to obtain the maximum potential profit. In this article, we will look at 3 important bullish engulfing characteristics that are important to pay attention to and will help you maximize potential profit and minimize risk.

What is an absorption pattern?

An engulfing pattern is a trading model of Price Action candlestick analysis in the foreign exchange market and indicates a change in price direction.

When using the formation, you can find the best entry points during the end of the correction or when the trend changes.

Absorption is characterized by a high level of signal processing and reliability . And the name of the candle structure is due to the fact that the first candle is absorbed by the second.

A trading pattern, also known as an outside bar , is often used to identify a trend reversal point. Less commonly, it indicates a continuation of global price movement. Externally, absorption consists of two candles (white and black, or red and green), directed in different directions - the first is smaller, the second is larger.

The article talks about how to trade, what it consists of, reasons for its formation and main indicators.

conclusions

When trading Price Action, you need to take into account several factors at once. Candlestick patterns provide guidance for action, but one should not lose sight of the main trend and price levels. The pattern itself must always have a fulcrum. Such a comprehensive assessment will help to avoid deliberately false entries, and the habit of a calculated approach will only be for the better.

Topic on Price Action on our forum

Best regards, Vlasov Pavel

Reasons for absorption in trading

An engulfing pattern appears after a long price movement in one direction . That is, the reason for the formation is the exhausted potential of the trend.

If we look at this pattern from the point of view of the crowd, then the fading price movement indicates the uncertainty of a large mass of small traders. Speculators do not know in which direction to open trades next. As a result, the value of the asset begins to stagnate.

At the same time, the positions of major players form a new direction of movement - a large engulfing candle. They are the first to realize that a new trend is starting and accumulate a position. Small players catch stop losses or follow the updated movement of the asset.

For example, if the price of an instrument stopped declining, then the bears encountered a strong support level. At the same time, downward orders were opened when the downward direction remained due to the inertia of the currency pair.

At this point, the bulls can open a large volume of trades in the opposite direction, collect the stops of the bears and knock them out of the market. Collected stops will push the price further up.

This is how a new upward trend is formed. This principle also applies during a downward reversal, when the bullish movement loses its strength.

Varieties of engulfing pattern in trading

There are two main types of absorption model :

- Bullish engulfing. In this formation, the larger candle is the one pointing upward . The trading structure is located at the end of a pronounced downtrend . It indicates that the bulls are taking power away from the bears and provides an upward reversal signal.

- Bearish engulfing. In the pattern, the second downward candle is the larger one . The pattern is formed at the end of a strong bullish trend . Indicates the victory of buyers over sellers with a selling entry point.

The significance of the pattern will be higher if the new candle absorbs not only the body of the previous one, but also the shadow. In intraday trading, the closing price of the first bar and the opening of the second may be the same.

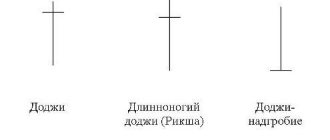

If, when an absorption is detected, you move to a higher time range, you can see a pin bar. The equality of the first and second candle on the next TF represents a doji candle.

Two important factors to consider

- Strong impulse in a significant area.

- Strong price rebound.

If you are buying from support, do you prefer the nearest price high to be close or far away? You'll likely prefer it to be far away so your trade has more profit potential (before selling pressure sets in).

However, if you see a stepwise price decline on the chart that hits support, the market will likely continue to experience selling pressure:

Not all bullish engulfing patterns are created equal. As shown earlier, a bullish engulfing pattern is usually a retracement against a downtrend (on a lower time frame). This is especially true if the size of the candles is small or similar to the size of previous candles.

But if the range of the bullish engulfing pattern is greater than the earlier candles, it signals strong buying pressure. Additionally, if you look at a lower time frame, you will likely see a breakout in the market structure as price makes higher highs and higher lows (another sign of strength from buyers).

Bullish engulfing and its features

In the pattern, the body of the bullish bar completely engulfs the bearish one. Let's consider the daily timeframe model and evaluate it according to the following criteria:

- A downward trend is easily recognized on the chart .

- On the first day, a small bearish candle with small shadows is formed.

- On the second day, the opening price of the new outside bar may be lower (higher) than the closing price of the bearish one . There may be a noticeable price gap.

- The formed bullish candle completely covers the body of the bearish one . The asset price closes significantly above the border of the bearish bar – 25% of the entire range.

With bullish engulfing, the volumes of the bearish trend should decrease noticeably . This pattern indicates that the bulls are warming up before moving the asset in the opposite direction.

Features of bearish engulfing in trading

The pattern is formed when the bullish trend fades . At the very top of the D1 time period, a small white candle appears . The next day a black one forms . The minimum of a black candle is lower than that of a white candle, and the maximum is higher. As an additional signal to enter the market, you should use a rebound from the trend line. The longer the pattern's candles, the higher the reversal potential.

When an upward candle is formed, trading volume should decrease, and when a bearish movement begins, it should increase.

Signal Boost

In the absence of amplifying elements, the signal may be false. Consider the following market factors:

- There is a big difference in the size of the candles in the model . The larger the second candle and the smaller the first, the stronger the reversal signal.

- Absorption of several previous candles. When a reversal outside bar turns out to be larger than several previous ones, it makes sense to expect a change in trend.

- Candles without shadows are the most suitable option.

- The emergence of a pattern during a prolonged trend. The longer the price moves in one direction, the fewer people want to open positions along the trend. That is, large players who are already in the market are beginning to take profits.

If there was a sideways movement before the appearance of two bars of the formation, the signal is not counted.

- Increase in volume when the second candle is formed . This means an increase in the activity of players opening transactions in a new direction. This behavior of traders strengthens the signal received from the structure.

Some lyrics

Remembering my history, when I just started studying candlestick patterns, engulfing immediately gave me pleasant emotions. Firstly, there are so many of them on charts of different time frames that the study and analysis of this figure is greatly simplified. Secondly, having only studied and immediately started testing the acquired skills in practice, either I was lucky or I understood everything so well, but my depot steadily began to replenish. Although, remembering my transactions and analyzing them using current knowledge, it becomes clear that they gave me more money into my account than the earnings were wise.

Books usually don’t write how to trade this or that model correctly. From the book, you can get more introductory knowledge than practical knowledge. Someone will say that the market is changing and therefore the methods proposed by the authors stop working, but I have a different idea. As you know, 95% of traders consistently lose their deposits, and these traders, just like you and me, were trained precisely from those books that are freely available on the Internet. The question arises: “Since such a huge percentage is lost, and the training is of the same type, is it not more logical to assume that the books either do not add the most important detail, or deliberately direct them along the wrong path?”

Well, okay, you and I understand that any information needs to be double-checked 100 times, and then only used in your trading, so with Japanese analysis you need to be more careful and it is better to receive less or miss a deal than to buy a moose.

How to trade the engulfing pattern - basic Forex strategies

The basis for using the engulfing pattern is the directional movement preceding it. The optimal time frames for working with absorption are H1, H4 and D1.

A prerequisite for opening a transaction is confirmation . This could be the formation of an additional graphic reversal figure, an indicator signal, or a breakout of a trend line. A good reason to enter the exchange is the formation of an outside bar at technical analysis support or resistance levels. On lower timeframes, when trading on Forex, the price may go beyond the level with a false breakout.

enter the market based on a signal in the following ways:

- Based on the closing price of the second bar of the model. This is a profitable entry point if the pattern has been identified correctly.

- Pending order to buy or sell. This trading system is used for ascending and descending formations. An order to open a position must be placed at a distance of 4-5 points from the Low or High of the second candle - depending on the direction of the reversal. In this case, you need to take into account the size of the spread and add it too. If the strategy signal turns out to be false, the order simply will not be opened.

- Opening a trade at the close of the next bar or a pending order in the presence of a confirmation candle. The second strategy is a classic one for entering the market. The previous principle of setting pending orders is used here. Only this time, the Low or High candle that is formed immediately after the pattern is taken into account.

- Tactics for entering with a limit order at a 50% retracement. After the second candle of the pattern engulfs the first, the price often retraces 50% of the body of the engulfing bar. Therefore, a limit order to buy or sell is initially placed at this point. There is a risk of missing the entry point in the absence of a correction, but the risk-to-reward ratio increases several times.

When working with absorption, it is not recommended to use a fixed profit order . It is best to choose take profits placed at global and local levels. After a strong price movement in a new direction, you need to move to breakeven as soon as possible.

Description of indicator settings

- Size Ratio – if you specify the coefficient for ATR here, the signal filter is activated, in which the indicator shows only those external bars whose signal candle is greater than or equal to the received value in points. For example, if we specify 1, all signal candles smaller than the current ATR value will not be shown;

- ATR Period for Size Ratio Comparizon – ATR period when using a filter from the Size Ratio ;

- Wicks Ratio – coefficient for filtering out candles with too large tails (shadows). How many times the total length of the candle should be greater than the shadows;

- Buy Signal Arrow Color – color of the arrow for the buy signal;

- Sell Signal Arrow Color – color of the arrow for the sell signal;

- Arrow size – arrow size;

- Maximum history bars to search back – how many candles in history to analyze back;

- Entry break plus points – how many points to add to the entry point;

- StopLoss Calculation method – stop loss calculation method – in points (specified in the StopLoss plus points ), according to ATR, or through the High/Low of a signal candle;

- StopLoss plus points – how many points to add to the stop loss;

- StopLoss ATR Multiplier – multiplier for stop loss when calculated by ATR;

- StopLoss ATR Period – ATR period for calculating stop loss;

- TakeProfit Calculation method – take profit calculation method – in points (specified in the TakeProfit 1/2 plus points ), by ATR, or by multiplying the Stop Loss by the coefficient specified in the TP1 Reward and TP2 Reward ;

- TakeProfit 1 plus points – how many points to add to the first take profit;

- TakeProfit 2 plus points – how many points to add to the second take profit;

- TakeProfit ATR Period – ATR period for calculating take profit

- TakeProfit 1 ATR Multiplier – multiplier for the first take profit when calculated by ATR;

- TakeProfit 2 ATR Multiplier – multiplier for the second take profit when calculated by ATR;

- TP1 Reward – the ratio of the first take profit to the stop loss size;

- TP2 Reward – the ratio of the second take profit to the stop loss size;

- Settings for the colors of the indicator elements in the assortment);

- Alerts settings .

Absorption is trending

A trading formation can occur within a global price movement. Visually, candles can look perfect - the first is small, the second completely absorbs the first, along with the shadows.

If there is no trading volume on the exchange, then a reversal may not happen. The asset will continue to move in the same direction, and the trader will lose money. For this reason, there is no need to rush to open a trade when an engulfing pattern appears on the chart. Even the visual beginning of a reversal may turn out to be a microtrend or a correction of the main movement.

General requirements for absorption figures

The requirements for candles that form engulfing patterns are as follows:

- None of the candles should be "Rainy". These are candles that have almost no body and long shadows.

- The second candle should always be engulfing, and the first candle should always be engulfing. In no case is it the other way around.

- In an ideal formation, both candles should have no shadows (maribozu type), but this option is extremely rare. Therefore, the shorter the length of the shadows, the stronger the pattern.

We also recommend that you familiarize yourself with the information about the indicator for drawing on the Forex chart. It will help you manually mark important candlestick patterns directly on the chart workspace.

Support and resistance levels

Using levels of technical analysis will allow you to more accurately determine the correct candlestick structures . The price level indicates a limitation on the potential for growth or decline in the value of an asset. If a pattern is formed near the levels, then the probability of a valid signal increases significantly.

As an example, let's take a situation when the price is approaching a resistance area. If the pattern appears, the signal will indicate significant downward potential. This principle also works in the opposite direction.

When viewing the screenshot of EURUSD, we see how the price approached the resistance level and a bearish engulfing formation formed. In the end, the signal turned out to be correct. In a bullish engulfing pattern, price may also approach the support level several times before the pattern is finally formed.

Forex indicators from the MT4 terminal

If you analyze free programs to identify a pattern, then the best option is Vertical Bar Setup . The advantage of the indicator is to search for absorption patterns on the chart and indicate the optimal stop loss and take profit values.

Key Features:

- Identifies and places stops using ATR.

- Filters false breakout signals by candlestick extremum.

- Marks models that did not make a profit.

download Vertical Bar Setup here.

Less popular, but still effective indicators include RFX Pattern Recognition . In addition to absorptions, the program displays a large number of patterns on the chart . You can download it here.

The indicator settings boil down to setting the value true in the Display_Bearish_Engulfing and Display_Bullish_Engulfing g columns. Display the Show_Alert alert on the screen if desired.

Such indicators have a similar principle of operation. The main differences come down to the relationships between the elements of the candles established by the developers. All patterns must be checked manually, since indicators are an auxiliary tool and cannot be completely relied on.

You can use other indicators to conduct additional technical analysis . It is better to add them to the hourly chart.

popular among traders :

- Stochastic (Stochastic) and RSI . Oscillators indicate that an asset is oversold or overbought. Their confirmation is desirable for trading. Without the market overheating, it is better not to open in the market.

- Cluster volumes from the futures exchange . Confirms the signal for a trend change. These cluster indicators are not available in the MT4 (MT5) terminal.

After the indicators are installed, you need to wait for the full pattern to form.

If upward absorption is expected, then the second candle shows an increase in volume. At the same time, Stochastic should move up from the oversold zone. If there is a signal with such confirmations, a buy position is opened.

External Bar Indicator for MT4

At first, beginners may find it useful to use the auxiliary indicator for the MetaTrader 4 terminal, which determines the setup on the chart for you (without taking into account levels and other nuances), and also gives profit taking levels and stop loss settings.

The indicator is installed according to standard instructions.

Setting a stop loss

To properly manage risks when using different types of patterns, consider the rules for setting stop orders:

- Bearish engulfing . Stop Loss is set slightly above the maximum price level of the second day of pattern formation. It is necessary to fix a loss if this level is broken through by the price maximum within two days and when the market closes above the level.

- Bullish engulfing . Stop Loss is set a couple of points below the low of the second bar of the engulfing pattern. The loss is recorded when the market closes below this low or if there are two last lows that closed below the low of the second candle.

You cannot use the formation without stops. The price level may break out, which leads to a continuation of the current trend with heavy losses.

Mistakes in trading

The most common mistake is to enter a buy position immediately after an engulfing pattern appears on the chart . An upward formation is often a correction to a downward trend.

Therefore, you need to check signals that strengthen the pattern and receive confirmation of a reversal. If the price moves along the trend and trading volumes are large, it is better not to take risks. To obtain more accurate information, you need to look at lower timeframes . Here you can see whether the formed engulfing pattern is a pullback within the trend.

For example, you can take graph H4.

The chart shows that the daily bullish engulfing pattern was a pullback against the global price movement.

The Absorption Model: Three Techniques That Will Improve Your Trading

If you want to take your trading to a higher level, you must understand all the nuances of the market. Here are three questions you should ask yourself if you are considering trading the engulfing pattern:

- How exactly did the price approach the level?

- How strong or weak was the price rebound from the level?

- What is the market structure on the lower time frame?

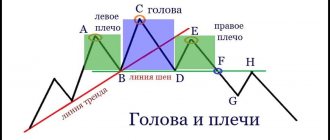

How exactly did the price approach the level?

When you trade a reversal, you want the price to rapidly approach the level on the large candles. Such a price movement necessarily attracts the attention of buyers or sellers, who begin to open their positions. However, as the price approaches the level, the momentum of the movement is exhausted and a so-called liquidity gap or lack of interest of big money appears. Therefore, the price can easily turn in the opposite direction.

If you are trying to trade a reversal, always look for strong price momentum towards the level.

How strong or weak was the rebound from the level?

When you trade an engulfing pattern, it is best to ignore the weak price rebound from a key level:

We need to see a strong price rebound. The range of the candle that engulfs the previous one should be much larger.

Do you see the difference? When the price bounces strongly from a key level, a price reversal is more likely.

What is the market structure on the lower time frame?

On the lower timeframe, we can see who really controls the situation in the market.

For example, a strong impulse price movement towards a level is a series of higher highs and lows on the 4-hour time frame. Now imagine that on the daily time frame the price is at a resistance level and an engulfing pattern appears. On the 4-hour timeframe we will see lower highs and lower lows.

What does it mean? This tells us that sellers are now in control of the situation, and the market is likely to turn down. Thanks to this understanding, we are able to enter shorts with the least risk.

Advantages of trading the engulfing pattern

A significant advantage of using the design is to obtain a clear signal of a trend change . But subject to the presence of supporting elements. If a trader sees that the trend has exhausted its potential, volumes are falling and there is reason to expect a reversal, then the absorption pattern allows you to accurately determine the desired point.

Another advantage of the model is that it is simple and easy to find on a chart . Even beginners can use the formation.

Markets on which the takeover is traded

The engulfing pattern can be successfully used in Forex.

With information on volumes, a trader will be able to determine the potential of a trend in Forex and accurately identify the moment of reversal.

A simple engulfing pattern can also be used successfully in the stock market. The markets for binary options, cryptocurrencies, futures and other securities are no exception.