Differences in the value of assets (currency pairs, stocks or precious metals) are considered an effective source of stable profits on exchanges. In such transactions, a term such as "spread" will often be involved.

Only thanks to price surges can you make money by using all kinds of tools for the most reliable investment forecast: you can benefit from the growth and reduction of the cost of the transaction object.

Spread - what it is and classification of spreads

Spread is the difference between the profitable (paid) purchase price and the situation during the sale (during speculation) of an asset. Otherwise called profit that goes to brokers, or income.

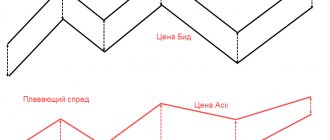

In the standard currency market, transactions are concluded constantly, but the broker's earnings on each position are not constant. To understand why this happens and what a spread is, it is worth understanding the difference between the price of purchasing and selling a currency when assessing trades, which also determines the liquidity of the market. Spread on Forex is often presented in the following versions:

- Fixed fee. A constant parameter that does not change due to the state of the international exchange rate. Sometimes an expandable option may be used, which can be increased manually based on forecasts for investments, the state of the economy and the financial base.

- Floating fee. The spread on Forex is fixed by the broker within the established limits of the lower value and can be adjusted under the influence of changes in currency prices within a larger growth range. The indicator does not have an exact value, since it depends on the market reaction.

The floating analogue is more often used: in unpredictable situations it can reach 50 points or higher, and its typical range in a moderate market ranges from 2 to 5.

The current state of the stock exchange should be monitored not only by traders, but also by investors (and their assistants). When investing in an asset with an indicator of future problems with delays, you should definitely take its volume into account, otherwise there is a risk of being left completely without a profitable result (profit).

Liquidity comes first

What is liquidity? This is the ability of a product to sell and buy well.

Let's take an example from life:

Which car do you think will be more liquid on the secondary market, Hyundai Solaris or Porsche Cayenne? Answer: Solaris. Let's look at the process of selling both cars through the eyes of the seller. There are more Korean cars on the market than German ones. The price of a Hyundai is much lower, which means there will be an order of magnitude more buyers for this brand. In other words, if you had both brands and decided to sell them, then it would be easier for you to find a buyer for Solaris at the right price. Cayenne will be sold for a long time at the price you need. And to sell it faster, you will have to greatly reduce the price, which will be unprofitable.

Now let's look at the same example, but through the eyes of the buyer. Let's say you have 500,000 rubles. for a used Solaris for his wife and 2 million rubles. for a used Caen for your loved one. There will be 100 Solaris at this price, of which it will be easier for you to choose a car that is not damaged and technically sound. But there will be about 20 Caen at this price, but upon closer examination, many of them will disappear, since they will either be broken, or repairs will require considerable investment, in other words, it will be much more difficult to find an unkilled Caen.

In the Forex market, the equivalent of Solaris is the euro/dollar pair. Every 3rd trader in the world (37%) trades this asset. This means that it has high liquidity and brings regular income to the broker. Therefore, the spread here is minimal.

Unlike the USD/ZAR pair, which in Forex is the equivalent of Caen (dollar/South African rand). Have you heard of the rand before? Now imagine how often they buy it, even if the name of the currency doesn’t tell you anything. It is clear why the spread here is 80–250 points (taking into account the low exchange rate, this is $60–190 with a volume of 1 lot). However, liquidity depends not only on the type of asset!

Influential factors include time of day, holidays and news releases. Let's remember the Swiss franc, which collapsed during the New Year holidays.

What is bid, ask and its connection with spread

There are 2 types of prices on the market:

- Bid - the amount that the buyer of a monetary asset plans to spend;

- Ask - the price at which the owner is willing to give the position to an interested party.

And the spread is the difference between the previously mentioned bid and ask that occurs during the transaction. A good example of transparent market relations is trading at the bazaar, when a low price is put forward, and the second participant adheres to the requirements for a high bid.

Since 2 parties should carry out an exchange, each of them, in theory, can give up a certain part of the amount, but in moderation, otherwise the benefit is then lost.

In simple words, the outcome of the agreement on the market is closely intertwined with the spread value. If it suddenly starts to rise, it will be difficult to benefit. Often the spread is characterized by individual parameters for each brokerage firm: each organization dictates its own tariff.

Market spread

During ongoing trading, the owner of the assets can gradually lower the initial cost, and the future client can increase it. This way, each party can offer attractive conditions to its partner.

These conditions have yet to be fully agreed upon, but prices are gradually moving toward the point of contact. Then the concept of “calendar” arises - futures for an asset with different execution periods.

The factors influencing the spread (in the form of dumping securities) in the stock market are similar to the same reasons in Forex, which include:

- crisis in the country's economy;

- sudden news about the company;

- bullish or bearish trend alerts;

- stopping trading on the stock exchange.

In the above situations, the difference between fixed prices narrows.

Only in a situation where the owner of the bids and the buyer come to mutual agreement regarding the final price that will have to be paid at the end and the cost of sale, the intended agreement is automatically concluded.

Spread on the stock exchange

During the trading period, the spread on the exchange constantly depends on the capabilities of the trader who wants to sell shares (or other important documents) not on the basis of the latest market price. All trading on the exchange is carried out through mutual agreements and reducing the spread volume.

If the final market value of a valuable document continues to increase, then the buyer, focusing on the situation that has arisen among the participants, also automatically increases the bid, while simultaneously understanding that the seller has the right to demand more initially.

And if you act in the reverse order, then the current value of the stock decreases. The owner himself, under persistent market pressure, will also reduce the ask price, realizing that the client will not buy at the old, inflated price. The standard difference between spread prices is extremely small and comes down to a minimum amount of a few kopecks (or a similar amount, but in a different currency). This situation can be avoided through a transaction based on the current market pricing policy.

Example

On the PFTS portal or any other exchange you can find many examples that simultaneously reflect 3 prices on the chart in different colors:

- market price (red);

- ask (green);

- bid (blue).

You can notice that the price on the market almost always stands between the average cost of the ask and bid. Rainbow arrows indicate the points where participants alternately give up their positions. A blue tint marks the moment when users agreed to purchase at the sellers’ standard price. And green shows cases when sellers agree to reduce the price down to the bid level.

Conclusion

The bid and ask values are easy to study in practice, and the difference between these values is the Forex spread.

If a person has traded at least once, then theoretically he knows how to set his own bid as a buyer, and how to offer his own ask as a seller. If the differences narrow or disappear altogether, then agreement is reached, after which an agreement can be officially concluded. Exchange trading follows a similar pattern: when traders don't like the market price, they offer their ask and bid, and then narrow the spread until the trade ends in a trade.

How to protect your deposit from spread jumps - 2 “golden rules”

Spread (even fixed) tends to expand. Your agreement with the broker always states that in cases of force majeure it may increase. This is exactly what happened to the Swiss franc in January 2015 due to the National Bank’s decision to stop cash injections to support the currency. Then the spread widened from 3 to 300 points in 1 hour and traders suffered enormous losses due to the execution of Stop Out.

And with a floating spread, jumps occur 90% more often than with a fixed spread. The gap between bid and ask widens:

- at night up to +50 points (especially from 21:00 to 00:00, until the Tokyo Stock Exchange is open);

- on holidays (liquidity drops due to the small number of players on the exchange);

- when important news is released (the ask price rises sharply, but the bid remains in place, or vice versa).

What follows from this?

Rule #1: If you want to win using a lower floating spread, close trades before important news comes out. Here are some examples of such important news:

- Nonfarm every last Friday of the month,

- speeches by heads of central banks;

- presidential election results,

- decisions on joining/leaving the EU, etc.

Rule #2: always check the current spread. This can be done on the broker’s website or by installing a program that displays this parameter in the MetaTrader window.

The following video will help you consolidate your knowledge.

Spread in trading

In the analyzed operations, the spread in trading takes the place of one of the central concepts. In a traditional market, the quotation for a product is formed based on the results of a bargain between the owner and the buyer. If the client is ready to buy the product at a fixed price, then the transaction occurs. But their prices do not always coincide. It is clear that the client wants to buy the product as cheaply as possible if the seller is only interested in resale at a high rate.

For the sake of maximum comfort for the trader, the spread measurement is always in points and is automatically removed (displayed) in any MetaTrader terminal.

But in practice, each currency pair corresponds to different sizes: when the duo is exotic (rare), then its level is higher. The volume is directly affected by the state of the market: in the case of high volatility, they are larger than with a calm forecast.

Simple example

If we consider the popular EUR/USD pair with the current quote 1.2668/1.2672, then from the differences between the currencies it is clear that the fixed spread for the 1st lot is approximately 2 points (about $20).

Therefore, at the time of opening an order for 4 lots, the initial “minus” will be $80. This flaw must be compensated when closing the transaction so that the quotes of the currency pair differ in favor of the buyer by at least 5 points. Only then will such trading bring a net income of $20.

Therefore, the spread on Forex is sometimes compared to a mandatory commission, which is considered the main income of large-scale brokerage firms and individuals associated with them.

Often its size also reflects the price of an exchange transaction: in life, shares are purchased from one trader and given to another partner, on whose platform they trade. Therefore, the final volume is the volume of predicted profit.

When its value changes

From the example discussed earlier, it is clear that if a larger number of orders appear on the market, the cost between bid and ask will be closer and, accordingly, the spreads themselves will be smaller (narrower).

A wide spread is present in those markets where the price favorable to the client and the seller is very different and neither of them wants to give in to each other. Narrow - more characteristic of securities with inflated capitalization and volume (many offers for purchase and sale).

How to play on the spread size

One way to understand what a spread is in trading is that many traders trade exclusively with it on a short-term basis.

In situations where there are plenty of other players on the market who launch market (non-limit) positions, new offers can quickly take off and immediately complete the process, bringing only a small profit to the owner. And the meaning itself, for example, for binary options, is not duplicated, so many Forex traders switch to this type of operation.

Description

An exchange spread is the difference between the best selling price and the best buying price for a particular asset on an exchange.

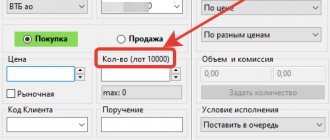

Spread in the trading terminal. Transactions on the stock exchange take place in the trading book. It shows the sale and purchase prices of a particular asset. In addition, at each price level, the investor sees the amount of the asset that they want to buy or sell at that price.

As a rule, sales prices are shown in red at the top. At the bottom in green are purchase prices.

Trading order book for Gazprom shares in the Quik web terminal. At the top are limit sell orders in red. Below are limit buy orders in green.

In the order book, orders are placed by investors who want to sell or buy at a certain price. Such orders are called limit orders. Investors who want to buy immediately at any price submit a market bid, or market order. Market orders are not visible in the trading order book.

A trade occurs when a market order meets a limit order. If the exchange only had limit orders or only market orders, investors would have to wait for the bid and ask prices to match.

The difference between the closest bid and bid prices is called the spread. The spread exists because the buyer and seller are not ready to give in to each other and are in no hurry to sell or buy.

On the stock market, spreads can be as large as several kopecks, as in shares of Gazprom or Sberbank. But there are spreads of several tens of rubles, as in shares of the Saratov Oil Refinery. The spread can be calculated not only in absolute values, but also as a percentage.

For example, the best price at which you can buy shares of the Saratov Oil Refinery is 13,950 RUR, and the best price at which you can sell them is 13,800 RUR. The spread is equal to:

(13,950 R - 13,800 R) / 13,950 R = 1.075%.

The best purchase price for shares of PJSC Gazprom is 232.41 RUR, and the best sale price is 232.38 RUR. The spread is:

(2232.41 R − 232.38 R) / 232.41 R = 0.013%.

The smaller the spread, the higher the liquidity of the asset.

To ensure transactions are completed quickly, there are market makers on the exchange. These are professional participants in the securities market. They enter into an agreement with the exchange and are obliged to maintain a certain spread in the trading order book. For this they receive preferences and rewards from the exchange. For example, their orders are executed first, and commissions are minimal. Market makers make money on the spread because they place limit orders to both buy and sell.

Spread trading - benefits

The market situation often changes dramatically. Algorithms sometimes work poorly, and movements occur in a chaotic manner, sometimes greatly increasing: volatility and risks. Therefore, the previous trading algorithms (strategies), which previously provided benefits, no longer all work in the current conditions.

But the spread has many advantages to replace them:

- Predictability. The behavior of indicators is much easier to predict compared to changes in private financial instruments. The average price of such leverage cannot be predicted, so it automatically represents a profitable exception.

- Small risks. The values for the starting set of a group of instruments always have insurance for the main positions, which are opposite in the adjacent set of instruments, and the overall position will be familiar in comparison with the usual strategies.

- Simple tactics. When manipulating, the tools advise searching so that the spread during the main time changes within clear boundaries relative to typical values. Then you will have to either buy or sell, as soon as it approaches the moment of hesitation, in anticipation of a return.

- Potential. Investors have access to an expanded list of financial elements from any platform in the world. This option includes generous opportunities to search for profitable versions of instruments that allow you to make a profit with the least risk.

Therefore, trade trading is an effective strategy that has a lot of advantages. Previously, it was the prerogative of only large representatives and hedge funds, but now it has become available to everyone.

Where are the spreads large and where are they small?

The smallest spread is for currency pairs in which the currencies of developed countries are located. The smallest is the Eurodollar, because the European Union and the United States are symbols of developed countries, economic colossi. Here is a list of other currency pairs that are similarly classified as “developed”:

They are located in the terminals in the group of “major” financial instruments. Most of them, according to professional traders, are better amenable to technical analysis and are much easier to trade due to the low spread.

Currencies of developing countries paired with the dollar, euro, and also paired with each other form two other groups of instruments: minor and exotic. There are always very large spreads, which can make trading very difficult.

Spread on the Forex exchange, Forts: definition, meaning, essence

The value is set by the exchange, which has the right to adjust it at any time (with possible expansion or contraction). And the liquidity of the trading instrument also affects the size of the spread.

If it is necessary that the market situation does not exceed the agreed threshold of the daily parameter (which risks leading to the end of trading), restrictions are specifically created in the form of costs.

Forex costs

The spread on Forex is very different not only when you try to trade different currency pairs, but also when you change broker.

If you want to reduce costs, you need to choose more liquid pairs and pay attention to the volume of instruments offered.

When a broker promises the very minimum sreads, and previously it was even zero, it is worth checking whether you have chosen a scam. Also, do not forget about swap (additional payment for transfer), which can be very unprofitable for the trader. But you also need to check if there are any bonuses from the brokerage company, since some Forex companies offer a service of returning part of what they earned (rebates), for example, the Alpari Cashback Program:

Types of spreads for those who trade them

The division of an instrument by type of arbitrage trading can be done using the following method:

- spatial (1 instrument is traded on other markets);

- calendar (futures with delivery periods);

- equivalent (act with adjacent dependent instruments).

The correct choice will directly affect the trading results, unless the participant scalps (makes a large number of trades).

Summary

The main thing you should take away from my article is:

- The broker will receive his profit on any transaction.

- The spread can be minimized by wisely choosing a company, account type, and currency pair. But reducing it to zero will not work . If it nevertheless decreases to near-zero values, then the broker will still receive his due from the commission.

Messages periodically appear on the network that there was a negative spread , but in most cases this is explained by a software malfunction. This can happen on a demo account with a very large amount of virtual deposit. In theory, this can also happen on a real account, when large-volume limit orders remain on one ECN platform, but on another they have already been sorted and the price has changed. But they are sorted out in a few ticks, and it is almost impossible to catch such a moment.

If you are just starting to trade, limit yourself to the majors and do not chase the number of transactions . In this case, the influence of the spread on the result will be reduced to a statistical error, and the profit will depend solely on your trading skills.

Surely you still have some questions after reading the material. They can and should be asked in the comments - I will be happy to answer them. And don’t forget to subscribe to my blog, you are guaranteed not to miss the release of new materials. With this, I bid you farewell for a moment. See you soon and good luck in your trading!

If you find an error in the text, please select a piece of text and press Ctrl+Enter. Thanks for helping my blog get better!

What is swap

Swap (“swap”) is a daily interest accrued to or withdrawn from the trader’s account for the use of borrowed funds (credit - trading with leverage), which is conditionally placed on a deposit or withdrawn from it in favor of the broker if the trading position remains open at postponed past midnight. When trading Forex, the broker usually provides a table on the website with the amount of swaps, here is an example from Alpari:

Relationship between pip and spread

Pips is an abbreviation for “percentage in point,” which means percentage point. In Forex, it is also simply called a point and is described as the minimum price change available on the market, since rates are quoted with refinements to 4 decimal places (for example, for the euro 1.1236 - 1.2502 - 4 decimal places).

But recently, 5-digit quotes are even available (for example, for the euro 1.12367 - 1.25024 - 5 decimal places). Its final price depends on the entire contract amount, and the spread always affects the indicator in direct proportion.

What is the difference between 4-digit quotes and 5-digit quotes, see this link >>

Spread or commission - 3 assets on which you can get rich or lose everything

Have you heard of zero spread accounts? Tempting stuff! Up close, everything turns out to be not so rosy, because the 0 spread points are compensated by the commission. And you pay the same amount, only it is called differently. But there are assets for which the commission and spread levels are strikingly different (you can save up to 50%):

- USD/CAD (Canadian dollar): on accounts with zero spread the commission is 2 points, and on traditional ones the spread is 4.

- XAG/USD (silver). This is the opposite option, when on accounts with zero spread the commission is 2 times higher than the traditional spread. Accordingly, the commission is 10 points versus 5 points of the spread.

- BTC/RUB (bitcoin/ruble): commission – 0.1%, spread – 0.8%.

In what cases is commission also more profitable than spread?

- If a trader trades pending orders. That is, it sets a condition to automatically open a deal when the price reaches a certain level. In this case, spread may cause the order to fail. For example, news is expected on the UK's exit from the EU. The trader assumes that the pound will fall against this background. But he knows that at such moments the servers are overloaded, and it is almost impossible to open an order. Or is at work, away from the computer. The way out of the situation is to trade on GBP/USD. According to it, if the price falls below 1.3398, a Sell order is opened. But there is still a spread of 8 points! And in fact, the trade will not open until GBP/USD reaches 1.3390. But the quote may not reach this level.

- Pips traders (scalpers) also prefer commissions. After all, if a trader makes a profit of 3–5 points, paying 4 for a spread is simply not profitable for him! Whereas the commission will be equal to 1 point.

- When trading intraday (when orders are not left overnight). Due to the spread, the price often does not reach the Take Profit or knocks down the Stop Loss. After all, this is a kind of “trailer” that the deal pulls behind it. But with the commission there is no such problem.

The meaning of spread in trading

Spread trading through a foreign exchange fund is always carried out through experienced intermediaries or special dealing centers, where a considerable commission is requested for the services provided. Often the broker’s earnings become the spread, which is calculated using a simple formula:

Spread = initial purchase price - final sale price.

It is easy to assume that the value being studied is dynamic and is constantly transformed for each element of the market system. And its essence is best demonstrated by the work of a simple currency exchange office.

Currency liquidity and spread size

Spread and liquidity are closely intertwined: the more often a given currency is in demand, the lower the final commission for approving a transaction. Sometimes the difference can be several dozen points (as EUR/USD varies from 0.5 to 3, based on the rules of the dealing center). When searching for an exotic pair, such as USD/ZAR, you need to pay almost 50 pips per agreement, and the likelihood of making money is greatly reduced. But many traders use currencies that do not have the euro or dollar among their elements, and usually for these pairs the difference between the purchase and sale prices is always greater.

Floating or fixed

A spread is characterized by a constant volume or a tendency to change based on market liquidity. With a fixed value, the size is always oriented towards the specified parameter in the specification and is often used when trading through the Dealing Desk.

Compared to the floating scheme, it changes in a wider range (for EUR/USD it changes from 0.3 to 5.2, and even higher for news) and allows you to launch transactions with almost no extra expenses.

Importance in trading

The spread amount is withdrawn upon opening each transaction from the trader’s deposit, regardless of its size. If your deposit is 100 thousand dollars, then when opening a deal of 1 lot, the spread will be approximately 10 dollars and it will not particularly affect the size of the deposit. But when the deposit is $200 and with a leverage of 1:500 you continue trading 1 lot, paying $10 for each new step, then there is a big risk of getting huge losses even on the size of the spread.

You also need to remember about the number of transactions, since the spread on them adds up and grows - the more transactions, the more the broker earns from you.

Defining the terminology - what is spread

The word spread (from the English spread ) means the difference between the purchase/sale price of an asset. It is also called the difference between Bid and Ask :

- Bid refers to the buyer's price from you. That is, you open sell transactions (short positions) using it.

- Ask – seller price , at which the counterparty will sell you the asset. That is, long positions or buy transactions are opened using Ask.

For a better understanding, let's look at a detailed example:

- Suppose trader No. 1 wants to buy Gazprom shares at a price of 154 rubles. per piece, and this is the maximum among all applications. In the glass, it will take first place among buyers' prices.

- Trader No. 2 wants to sell Gazprom shares at a price of 154.5 rubles. a piece. This is the minimum offer among all, which means his order in the order book will be the leader among sellers or the Ask price.

In our example, the spread would be 154.50 - 154.00 = 0.5 rubles or 50 kopecks . Although the example is described in extremely simple language, an idea of the essence of this phenomenon should already be formed.

Options for working with spreads

At the trading stage of the exchange, the trader is surrounded by charts and quotes, which are placed in a table (“order book”):

orders from buyers and sellers for execution are accumulated there. Assets have their own step (minimum difference in value according to the selected currency). For liquid versions, the spread is almost similar to the price step (which jumps during high volatility), while for illiquid versions it immediately becomes overestimated.

It cannot be fixed for a long time: it only reflects the temporary consensus of the transaction participants regarding the price.

There are a lot of assets among bonds where you can enter prices for sale, but cannot find prices for purchase. Then, if the bond meets the reliability criteria, it is recommended to set your own purchase target in the “glass” and wait for it to be fulfilled.

Rebate services - how to return up to 90% of the spread

The spread on Forex is one of those pitfalls that have caused more than one thousand deposits to crash. But it turns out you can also make money on it! How? By registering in Rebate services.

These are Internet companies that are ready to return to the trader part of the funds he spent on spread. Brokers themselves offer a similar service, but the percentage there is much lower (about 15%).

Why charge the spread first and then give it away? This is a multi-move game, like in chess. The broker takes a commission from the trader. Then he enters into a partnership agreement with a rebate service to attract new clients for money. Next, the Rebate service advertises its services, attracting people to the broker’s company, and receives its reward. He pays part of it as interest on the spread. Everyone is happy!

Spread trading in the Forex market

Forex spread trading is a departure from typical Forex trading methods. This method of work makes it possible to have a constant income regardless of the market situation. Here it is important to correctly select several instruments that form the spread itself and ensure that the difference between their prices changes within a clearly established boundary over a longer period.

Therefore, you should look for instruments with high correlation and related characteristics (securities of a single organization from different exchanges or futures with different completion dates).

Trading algorithm

An emphasis on long-established and stable options will help you understand what a spread is in Forex:

- crush spreads (between soybeans and products made from them);

- crack spreads (between petroleum and similar substances);

- currency and metal spreads (platinum and silver, gold and silver, platinum and palladium, palladium and silver).

- index spreads (mini options).

If you plan a spread without errors, then you can trade with it much more profitably than with separate independent instruments. Sometimes the presented classification is simplified to 3 areas: operations with futures and currency spreads, index/portfolio arbitrage and pair trading (crash and crack).

Here is another useful video on the topic:

Dangerous and safe transactions - how spread can “eat” your deposit

In early 2016, Chris Davison conducted a formal study on the profitability of Forex trading. According to its results, only 30% of traders regularly earn money. And what an interesting coincidence! Only 30% of respondents check the spread size before opening a trade. Maybe there is a connection between these numbers?

TOP 10 assets with low spread

There are about 10 assets with a low spread size (up to 5 points). This:

- AUD/USD – Australian dollar (“Audi”) against the US dollar;

- GBP/USD – British pound to dollar;

- EUR/CHF – euro/Swiss franc (“chief”);

- EUR/GBP – Euro/English pound sterling;

- EUR/JPY – euro/Japanese yen;

- EUR/USD – euro/US dollar;

- NZD/USD – New Zealand dollar (“kiwi”)/US dollar;

- USD/CAD – US dollar/Canadian dollar;

- USD/CHF – dollar/Swiss franc;

- USD/JPY – dollar/yen;

- XAG/USD – silver/dollar.

Usually, these tools are enough to conduct profitable trading. But there are times when there is a reason to trade other assets!

Where can you get a $200 spread?

High spread rates are usually set for exotic currency pairs. As well as gold, corporate shares and cross pairs (without US dollar).

Let's take gold as an example. Considering its growth by 8,500 points from August to September 2017, you can invest money in a purchase. But only if your deposit can withstand large drawdowns. After all, having opened a deal, you will immediately find yourself in the red from 18 to 80 points! This is exactly how much the spread is for different brokers. The slightest rollback, and Stop Loss or Stop Out (lack of funds in the account) takes away your savings. (Fig.5)

Enlarge image

Other assets with high spreads (10 points or more):

- AUD/NZD – “audi”/“kiwi” (Australian dollar/New Zealand dollar);

- GBP/AUD – British pound/Australian dollar;

- GBP/CAD – pound/Canadian dollar;

- GBP/CHF – pound/chief;

- GBP/NZD – pound/New Zealand dollar (“kiwi”);

- EUR/AUD – euro/Australian dollar (“audi”);

- EUR/NZD – euro/kiwi;

- EUR/PLN – euro/Polish zloty;

- NZD/CAD – “kiwi”/Canadian dollar;

- NZD/CHF – “kiwi”/Swiss franc (“chief”);

- USD/MXN – US dollar/Mexican peso;

- USD/PLN – US dollar/Polish zloty;

- USD/RUB – US dollar/Russian ruble;

- USD/ZAR – US dollar/South African rand.

Stop Loss and Take Profit - how to set the levels correctly

Spread affects the execution of Take Profit and Stop Loss. But before we figure out how, let's understand these concepts. (Figure 6)

Enlarge image

Take Profit – an order to close a transaction upon receipt of a certain profit. Why is it needed? The price movement on the chart resembles steps. She cannot go in one direction all the time and jumps up and down, forming a corridor. The boundaries of this corridor are called support and resistance lines. The quote for them goes out very rarely and immediately comes back.

Therefore, the trader always places Take Profit in front of these lines. This is necessary to take profits before the price pulls back. How does the spread affect order execution?

It prevents the order from being closed at the specified price, automatically delaying execution by several points. As a result, the chart jumps onto the resistance/support line and reverses. And the trader is left with nothing!

The situation is similar with Stop Loss - an order to close a transaction with minimal losses. Only here execution occurs before the price reaches the line you set. Again, by several points equal to the spread size.

How to deal with this? Set the spread value when calculating Take Profit and Stop Loss. That is, set Stop Loss a little further, and Take Profit closer.