From the article you will learn:

Trader rules come from several areas. For example, from psychology. You must know yourself, know your weaknesses, then your strengths will become more useful, and you will learn to control yourself.

On the other hand, the rules of a successful trader are recommendations that relate to the trading system. After all, no trader, even the most seasoned one, can become successful if he does not have successful trading rules in his arsenal.

Another type of rule concerns trading philosophy. It is the right philosophy that helps create a profitable trading system and withstand the psychological stress that falls on the trader.

Always use stop losses

Stop loss fixes losses, which is, of course, an extremely unpleasant situation for every trader. To make it easier to cope with losses, treat them as insurance. You pay this insurance against major losses. In life, we also often take insurance, but for some reason we take it calmly. In trading, you also need to be calm about such fees.

A triggered stop loss is a payment for insurance against large losses.

Sometimes stop losses are triggered too often. In this case, you need to adjust your trading system. Perhaps the position is opened in the wrong place or the stop loss is too small.

This is one of the most important rules that allows you to always stay “in the game”. Sitting out unprofitable trades is fraught with risk.

I also advise you to use the “2% rule”, which states:

Never risk more than 2% of your deposit in one trade.

This is the optimal figure that allows you to preserve both the nerves and sanity of the trader.

I recommend checking out:

- How to look for the best stop loss levels;

Where to start trading

The best place to start is by learning the basics of trading. If a beginner does not understand investments and does not know the peculiarities of a broker’s work, then it is too early to move on to real trading. At best, you will earn a little money, and at worst, you will be left with debts.

Important topics to master:

- overview of opportunities - existing instruments, brokers and exchanges;

- principles of price changes when selling and buying;

- types of trading positions;

- methods of placing orders;

- trading session schedule;

- capital and risk management;

- trading systems and strategies.

At the same time, you should not blindly rely on other people’s advice, forecasts and automatic assistants. Analyze the information and form your own opinion. It is advisable to test each of the methods found on a demo account. This will allow you to find the most optimal trading strategy, saving your nerves and real money.

Choosing a broker

When selecting a broker, consider the following points:

- Reliability. The organization does not deceive, provides clients with stable work and timely payments.

- Safety. The office must monitor the safety of data and accounts. Ideally, you need an officially registered organization without a bad reputation. A big plus is the availability of permission for financial activities in the trader’s country. This ensures that the company operates legally.

- Minimum deposit and commissions. Somewhere there is a subscription fee for servicing the account. Others ask to start with $10,000. Additional costs include commissions for opening and transferring positions, as well as a percentage deduction on withdrawals.

- Trade. This includes the choice of financial instruments and working platform. The wider the range, the more comfortable it is for the trader. Although, with a narrow specialization, a wide range of services will become an unnecessary addition.

Choosing a broker

The broker's honesty can be verified using popular ratings and review articles. True, among real opinions there may be custom reviews. So overly negative or positive comments should be treated with caution.

Opening a trading account

First of all, the user needs to register on the broker’s website, indicating:

- last name, first name and patronymic;

- telephone;

- e-mail;

- address of the actual residence.

Next you will be asked to undergo verification. As a rule, you need to provide a scan of your passport or any other identification document.

This provides:

- account personalization;

- increased profile security;

- removal of restrictions on the services offered;

- unhindered deposit and withdrawal of funds.

To open an account, go to “Personal Account” and select the appropriate option:

- account type and currency;

- working terminal;

- leverage size;

- additional settings (if available).

The final stage will be replenishing your balance.

Gaining access to trading

Trading terminals are used to enter the market.

Internet trading

To make deals you need:

- register on the broker's official website;

- confirm email and phone number;

- go through the verification procedure;

- open and top up an account;

- install a trading terminal and log in.

The most popular are the freely distributed MetaTrader systems. The Russian analogue is QUIK, which is focused on online stock trading. In addition, individual brokers provide proprietary platforms to clients.

Software installation

The installation process of the trading terminal is similar to installing any other program:

- download the program distribution;

- run as administrator;

- specify the directory - the place to install the program;

- follow instructions.

To avoid problems, it is advisable to download files either from official sites or from a trusted source. When working with several accounts simultaneously, you will need copies of the software installed in different directories.

Analysis of information about exchange rate dynamics

There are 2 types of analysis:

- Technical - uses statistical patterns to make predictions. Evaluates historical data, suitable for short- and medium-term trading. The main tool of the methodology are indicators developed using mathematical models, formulas and algorithms.

- Fundamental - tracks the impact of economic events on market dynamics. The trader also looks for patterns, but makes forecasts taking into account external factors. This approach is used for long-term investing.

Analysis of exchange rate dynamics

Analytics is included in the basics of trading for beginners for a reason. Lack of market understanding leads to chaotic transactions that equate trading to gambling.

Generating a request to open a deal

To generate a request, you must select a financial instrument in the context menu and click on the “New Order” button. When opening positions, they set a purchase (Buy) or sale (Sell) of the selected asset.

There are 2 types of order:

- market - the operation is carried out immediately after confirmation, at the current rate;

- deferred—when created, conditions are set for opening and closing a position.

All requests are generated through the trading terminal, which redirects them to the broker. Variability and customization depends on the platform used. It is mandatory to indicate the volume of the transaction - the amount of the asset being sold or purchased. This indicator affects the size of profit and loss, as well as the value of the margin.

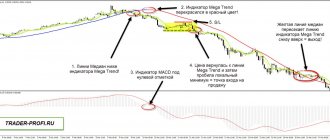

Recording financial results

To fix the result of the transaction, the trader needs to close a previously open position.

For this purpose, the terminal provides additional orders:

- Take-profit - maximum profit. The trader specifies the threshold at which the system will close the position.

- Stop-loss - minimum price. It is used to indicate the level at which the transaction will automatically complete. Which limits the possible loss.

You can do a similar action yourself by selecting the appropriate item in the menu. But experts recommend not to neglect the stop loss. In the absence of conditions for premature exit from the market, losses will grow uncontrollably. And in the absence of a take-profit, the trader can “wait it out” and lose income due to a price reversal.

Following the rules of money management

The second important rule: follow the rules of money management or money management in other words. The main idea of these basics is not to use a lot of leverage, and for beginners it is better not to take it at all. Open transactions with lots of adequate size.

- Everything about margin trading;

There is a rule on the market that it is better to always have some amount in fiat, because the market always provides an excellent opportunity to buy more at those moments when we no longer have free money.

I would also like to highlight one more rule from this section: do not increase the size of unprofitable positions. Averaging such transactions can bring profit, but someday there will come a time when the market fails greatly without a rollback, then the trader will find himself in a deep drawdown, from which he may not be able to get out at all in the coming years.

It is better to “add” money to profitable transactions as profits grow.

Read in a separate article:

- A complete list of money management rules;

- Pyramiding strategy;

Rules for a successful trader from the field of psychology

Article on the topic: Basic rules of Forex trading.

- Be disciplined.

- Profitable trades should not become unprofitable because of your greed, learn about Take profit.

- Work only according to your strategy, for example, according to the ABC Flag strategy, do not change approaches like gloves.

- Don't hold a losing trade for too long, especially without a stop loss. Such trades can make your trading truly futile.

- Be consistent in your actions, this will give confidence and strengthen control.

- Make only identical transactions. This will help you make profits only in proven situations that are less exposed to risks.

- Choose the right time to trade from Forex trading sessions. The market is not uniform throughout the day. He can be very calm at night and unrestrained during the day, changing the trend in the evening. Keep this in mind and try to follow the market that suits your temperament.

Keeping a trade diary

Record all your transactions in a diary. What should such a diary look like? It should contain:

- Transaction dates;

- Purchase amounts;

- Purchase/sale prices;

- Reasons why the transaction was made;

The latter is very important.

After some time, it will be possible to analyze the records, trading results and understand what the mistakes were. It really helps you learn from your mistakes on your own. All professionals use records in their trading.

The diary also disciplines the trader, which is also important.

Advantages and disadvantages of trading

Advantages:

- without restrictions on age, gender and profession;

- lack of geographical reference;

- unlimited income;

- no boss or employees;

- There are many educational articles in the public domain;

- opportunity to learn on a demo account.

Trading has both advantages and disadvantages

Trading has a low entry barrier. A person only needs a computer, the Internet and initial capital. And thanks to the large number of brokers, finding favorable trading conditions will not be difficult.

However, the area is not without its drawbacks:

- you need to understand the specifics of the chosen activity;

- there is a risk of losing the invested money;

- no really stable income;

- trading involves constant stress;

- requires self-discipline and patience;

- a lot of scams - pseudo-brokers, useless courses, etc.

To trade successfully, you must undergo at least basic training. You need to constantly learn and also master a large amount of information. Some people do it on their own. Others attend paid courses or online webinars. But you need to keep in mind that none of this guarantees earnings.

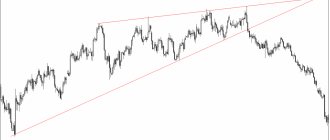

Trade only with the trend

Only those traders who follow the trend make money. This fact is no secret to anyone. If you look for constant turning points, then little will come of it. It is easier and more profitable to follow the direction of the main movement.

There is even a saying among traders: “The trend is our friend.”

Determining the direction of the trend is not difficult. For this, a simple moving average with a period of 50..200 is sufficient.

Unfortunately, trends are not always present in the markets, so sometimes you have to wait for them to appear and remain in the cache for a long time (months).

I also advise you to read:

- How to determine a trend reversal;

- How investors lose money on the stock market;

What is social trading

Social trading is included in the “package” of options that make life easier for a novice trader. In essence, we are talking about one of the forms of trading - passive trading, where clients are offered the opportunity to use the experience of professionals to make one or another trading decision by copying transactions.

Unlike ATS, the role of advisor is performed by real traders who not only recommend, but also participate in the trading process. Naturally, this format of cooperation has a high degree of trust among users of “tips.”

Social trading scheme

The social trading service operates according to a simple scheme: a trader selects a “leader” (it is possible to analyze his activities over a long-term period) and subscribes to copying his transactions (a paid service).

Then everything happens automatically - the system connects your account to the trading platform, transactions will be opened in compliance with all parameters - asset, lot size (scaled to the trader’s deposit), stop order levels.

Social trading services can be used to trade on any financial markets.

Top best platforms for social trading

The social trading service is not available from all brokers, so the service has been developed on specialized platforms (you must register to receive the service).

In the ranking of the best:

- Zulu Trade is one of the world's largest platforms. Works simultaneously with several brokers, offers interactive communication between traders through social networks.

- eToro is a broker with a developed social trading network. In demand among beginners, because... offers a number of training programs, a fully functional demo account and a user-friendly terminal interface.

- Tradeo is a specialized social network for traders. Has the function of simulating transaction copying.

- Who Traders - the platform from FINAM offers social trading using a variety of assets, incl. leading US exchanges. Registration cost is $10, subscription to connect to the accounts of 10 traders is $50. Unites more than 1 million clients.

- ATON Space is a platform for “moneybag” traders (access with a minimum deposit of $100 thousand).

Advantages and disadvantages

Social trading will be an excellent assistant for new traders, because... does not require immersion in analytical market research, provides invaluable practical experience, and minimizes risks. The price of the service is comparable to the broker's commission.

There is also a flip side to the trading “coin” - the effect of getting used to ready-made trading solutions slows down the formation of an independent trader.

About discipline and control of emotions

Discipline in trading is a very important point and clearly shows a sign of mastery. Only disciplined traders will never lose their deposit.

What is meant by discipline? This is a banal adherence to your own trading rules. Surely you have them? You know that you shouldn’t risk more than 2% in one trade, but for some reason in some trade you take and risk 5%. This will already serve as a sign of a lack of discipline. The rules must be followed in all transactions without exception.

The same applies to the size of opening positions. If there is a clause in the rules not to take leverage, then you don’t have to take it, no matter how much you want to.

I also included emotions in this list, since discipline is most often violated due to emotional turmoil. Did you make or lose too much on one trade? Is the market rising or falling too much? All this causes a desire to commit emotional actions without common sense. When there is a rush in the markets, it is better not to trade or to throw off what is available at high prices.

Read more about discipline and psychology in the article:

- Psychology of trading in trading;

Discipline training for a trader...

1. Right now, pick up a notebook and write down the rules of your strategy point by point. It is important that these rules are always before your eyes.

2. Start exercising regularly. For example, you can start doing exercises every morning. This is beneficial both for your health and mental efficiency, and for training your discipline.

3. Find yourself a mentor who could monitor your development. This is the person you could trust with your discipline training plans. They could be a work colleague, a wife, or even a child.

4. Write down a daily routine for yourself . At the end of the day, take stock of yourself and see if you were able to stick to this routine. By exercising such control, you will gradually be able to improve your personal discipline.

5. Set a task for yourself that you have long wanted to do, but never got around to. This could be a daily run in the evenings, cleaning the garage, etc. Complete this task for a week and be sure to sum it up at the end.

6. Sometimes it's good to just not trade. Try taking a break from trading, for example for a week. At this time, strictly observe the chart, analyze the statistics and draw certain conclusions for yourself.

If you can avoid trading, you will significantly strengthen your discipline. Make this a regular practice.

7. Set aside small amounts of time to learn something new. Many people spend entire hours of the day on various nonsense, for example, scrolling through social networks, watching TV or smoking. Instead, start learning foreign words, poems, or memorizing other useful information. You will train your memory and develop discipline!

Don't read news and analyst forecasts

News distracts a trader from his plan of action, and it is better to never listen to forecasts. Try to avoid this information from outside. For example, if the news constantly predicts that a certain stock will rise, then over time you can begin to believe in it.

As real statistics show: more than half of the forecasts do not come true. If you open a position in the opposite direction, the chances of making money are higher.

The only news that is useful to know about is the meeting of the Federal Reserve, ECB or other central bank whose currency you are trading with. Decisions on key interest rates can set a new trend in the market. The market reacts extremely emotionally to this news. Stop losses should be set adequately at these moments, since the market can fluctuate 1000-3000 points in one minute. Naturally, all stop losses will be carried away with a big “bang” and slippage.

It’s good that such news comes out rarely and the market does not always react to it so violently.

1. Plan your trading and trade according to plan.

2. Hope and fear are the two worst enemies of a speculator.

3. Record your trading results.

4. Maintain a positive attitude no matter the size of the loss.

5. Don't think about the market at home or on vacation.

6. Excessive privacy can be your biggest enemy. Beware of her.

7. Constantly set higher trading goals for yourself.

8. Stops are the key to the success of many traders. Limit your losses.

9. A successful trader is one who trades for a long time.

10. Successful traders buy when there is bad news and sell when there is good news.

11. A successful trader is not afraid to buy at high prices and sell at low prices.

12. A successful trader always takes the time to study the market.

13. A successful trader sets the profit margin for each trade.

14. Do not collect other people’s opinions before entering the market - facts are priceless, opinions are worth nothing. A successful trader isolates himself from outside influences.

15. Constantly strive for patience, restraint, certainty and rational behavior.

16. Never exit the market just because you are impatient, and never enter simply because you are tired of waiting.

17. Do not remove your stop loss while trading.

18. Don't enter or exit the market too often.

19. The most powerful trading tool is simply following the trend.

20. Do not change your position in the market without good reason. There must be a serious reason or plan in place to make a trade, so do not exit the market unless there is a clear signal of a trend change.

21. A speculator is taught by losses, not profits. Use every loss to learn how to work in the market.

22. Keys to investing success: determination, persistence, rigor and hard work.

23. The most difficult thing in a speculator’s work is not prediction, but self-control. Successful trading is difficult and often leads to disappointment. You are the most important element in the formula for success.

24. The main factor in price fluctuations is human emotions. Panic, fear, greed, insecurity, desire, stress and uncertainty are factors in short-term price changes.

25. The bullish consensus peaks as the market makes a top. There are also always several strong bulls around the important bottom.

26. Discipline yourself by following predetermined trading rules.

27. Watch the spread. For example, don't go long if the spread narrows.

28. Remember that a bear market in one month will completely eat up three months of bull market gains.

29. Calculate the determining factor for each instrument. Be prepared for a change in the main factor.

30. Make a list of bearish and bullish factors for each instrument every day. If you can only list bullish factors, watch for bearish ones as they are bound to be there and they can turn the market around. And also vice versa.

31. Increase objective information about the market and limit the flow of personal opinions.

32. Never let a big successful trade turn into a loss. Stop if the market drops 20% from your maximum profit point.

33. You must have a trading program, you must know your trading program, you must follow your trading program.

34. It is impossible to know everything about everything, so the speculator is constantly in danger.

35. A profitable trade requires four things: knowledge, disciplined courage, money and energy to properly combine the first three.

36. Expect and accept losses with gratitude. Those who obsess over losses tend to miss the next chance to win.

37. The application of organized effort is the only truly necessary ingredient for making money with money and keeping it.

38. If you don't progress, you fall back. Once you have achieved your trading goal, it is important that you immediately set a new trading goal.

39. If you find yourself distracted by many trading opportunities, consider specializing. Intensity elevates and transforms the heroic into the great.

40. The art of concentration will help you become a great trader. In other words, divide your time into thinking, planning, figuring out, researching, analyzing, evaluating, and carefully executing your trades.

41. Divide your profits in half. Never risk more than 50% of your profit on the market.

42. The key to successful trading is knowing yourself and your personal stress tolerance level.

43. The true difference between winners and losers is not so much a natural gift as the ability to train yourself not to make mistakes.

44. The greatest risk of trading is relying solely on intuition. Never replace facts with hopes. The biggest thing you can lose is your self-confidence.

45. No one can perform well for a long time wearing shoes nailed to the floor. In trading, just like in fencing, be fast or die.

46. Remember Mark Twain: “Only 10% of people think. 10% think what they think. The remaining 80% would rather die than start thinking.”

47. Avoid confidential news like the plague. Consider the distributor to be obviously incompetent or malicious.

48. A person who has reached the top of trading does not do as he pleases. He taught himself to choose between two freedoms: the freedom to do as he wants, and the freedom to do what needs to be done.

49. Because there is always the possibility of unpleasant surprises in thin, dead markets, less capital should be invested in them than in broad, moving markets.

50. The risk of one trading position should not exceed 10%, the total risk of all open positions should not exceed 25% of the trading capital. Track your risk every day, adding profits and subtracting losses from open positions, and relate the result to your trading capital.

51. It does not require a lot of capital to trade in the market if you have the knowledge and understanding. St. Paul said, “When I am weak, I am strong.”

52. The word is silver, but silence is gold. True market alchemists do not talk.

53. Typical mistakes of traders are divided into: a) trading without good reason; b) trading that relies more on intuition than on facts; c) not related to trade and capital.

54. “I prefer going short because there is usually less competition.” This is incorrect - the position, as a rule, should be long.

55. A fatal mistake that a trader can make is fixing a small profit. This is the result of limited vision. Extremes always seem stupid to “reasonable” people.

56. Trade only when fundamental analysis suggests it. Use graphs to confirm your guesses. Track entry and exit times.

57. Believe that a “big movement” is possible - be prepared for it to begin. Have the courage to participate, relax mentally and physically, and allow your gains to increase and your losses to decrease.

58. Dream big, think high. Very few people set truly high goals for themselves. A person becomes what he thinks about during the day.

59. Trading is the art of treating fear as the greatest of sins and getting rid of it as the greatest mistake. It is the art of accepting failure as a step towards victory.

60. Are you lost? Forget about it quickly. If you are in profit, forget about it even sooner. Don't let your self and greed take over your thinking and hard work.

61. The characteristics to understand a bull market are: a) a fundamental bullish situation; b) desire of speculators to buy; c) market sentiment is either on guard or rising.

62. Always remember that the weather market is volatile, highly volatile and very difficult to manage. Weather forecasts several days in advance are unreliable.

63. Nothing can be changed about the past day. When one door closes, another opens. The best opportunity is almost always waiting at the door that opens.

64. Trader's best-kept secret: separate your wishes from the market's behavior. The market reflects reality because it takes into account all forces. As long as the trader understands this, he is safe. When a trader ignores this truth, he loses.

65. Sometimes changes happen that can make you rich.

66. Beware of the “fool’s disease” (for example, don’t wait for trades that you are sure will be 100% profitable). Never allow yourself to believe that you can be 100% sure of something.

67. Well-known fundamental data is unnecessary data.

68. Major trends rarely break unless the market goes against the trend for more than three days.

69. Collect the following information on a daily basis. Defensive: a) available capital; b) margin losses; c) main forces; d) net purchasing power; e) calculated risk of an open position; f) percentage of capital in trade. Offensive information: a) potential profit; b) potential losses; c) required margin; d) profit/loss indicator; e) profit/margin indicator; e) degree of confidence.

70. It is much faster to start trading than to get out of it.

71. If the market does not do what you expect from it, and you are tired of waiting, it is better to leave.

72. Stay calm and maintain a cool mindset when trading large amounts.

73. The weather market is the most volatile. Therefore, set your stops wider and give the market more space so that you do not get caught without waiting for the direction you need.

74. Reassess your position in the market if the charts deteriorate and fundamental data does not meet your expectations.

75. Among other things, be mentally prepared for unforeseen situations of every trading day - from morning to evening.

76. Do whatever it takes to stay on top of the market in which you trade.

77. Be confident that the market is stronger than you. Don't try to fight the market.

78. Beware of large transactions that can throw your feelings and emotions out of balance. In other words, don't be too aggressive with the market. Treat it with respect, allowing your assets to grow smoothly, without sudden jumps.

79. Remember: preserving capital is almost more important than increasing it.

80. If the market has left you and you are a moment late, you should still try to jump into the last car, despite the fact that it may be difficult and dangerous.

81. Work hard to understand the major factors that determine the behavior of the market in which you operate. In other words, the harder you work, the better your trading will be.

82. Remember that it is better to have several profitable trades a year on large market movements and timely exit with a profit than to constantly trade.

83. Don't let minute-to-minute or daily market swings influence your approach to market direction.

84. Determine the goal of each trade at the time you enter the market and exit the market as soon as you achieve it. Don't be greedy!

85. Remember that for many commodities, politics is more important than economics.

86. Never add to a losing position.

87. Be careful when trading at market extremes.

88. Closing on top on Friday is a buy signal! Important information often comes at the end of the week. If the trend does not continue on Monday, change direction.

89. Day trading is a solo journey.

90. Think about how much you can lose. Calculate your profit/loss ratio before entering into a trade. Aim for potential gains to be at least three times greater than potential losses.

91. If suddenly the majority of the bulls opened long positions, be on alert.

92. If you are in a good position and all the news seems too good to be true, it is better to take profit.

93. A clerk who reminds you of margin is your best friend.

94. News always follows the market.

95. You will always make money if, when starting, you are confident of success. Stay in the market when events favor you. Play by your own rules. If you accept someone else's rules of the game, you will lose. There are complete fools who make mistakes all the time, the commodities fool thinks he needs to trade non-stop.

96. There is only one side to the market, it is not bullish or bearish, it is the right side.

97. You need to believe in yourself and your attitudes if you want to survive in this game.

98. Before you want to solve a problem, you must pose it to yourself.

99. Never give advice without asking, and never boast of victories.

100. Big money is made from big movement. “I have never made money through desire, only through perseverance.” It is very rare to find people who are both right and patient. The market is not able to win against them; they win against themselves. You need to have the courage to stand up for your beliefs and the patience to consciously wait.

101. Buying in a rising market is the easiest way to buy. Buy on the up move, sell on the down move.

102. Commodities are never too expensive to buy and never too cheap to sell. However, after the first trade, do not make a second one unless the first one made a profit.

103. Use the motto: “Big money comes from big movement.” Regardless of the initiating impulse that created the movement, it must continue as quickly and as long as the determining forces influence.

104. In the long term, prices for commodities are regulated by only one law - supply and demand.

105. In a tight market, there is no point in waiting to see whether the next market move will be up or down.

106. Losses never annoy me after I have recorded them. I forget about them by the next morning. But by making mistakes and not recording losses, I do something that destroys my wallet and soul.

107. It is very profitable to study your mistakes.

108. Of all the mistakes in speculation, the worst are: selling assets that show profits and holding losing positions.

109. To trade well, it is important to know yourself thoroughly. For a speculator, no amount of money can measure the value of this knowledge. Knowing himself will protect him from arrogance.

110. There is nothing new in commodities. The rules of the game do not change - just like human nature.

111. In a bear market, it is wise to have coverage for unexpected developments.

112. The principles of successful commodities speculation are based on the assumption that people in the future will make the same mistakes that they made in the past.

113. In a bull market, especially during a boom, the public makes money only to lose it a little later by staying in the market.

114. A bull market needs food every day, a bear market needs food once a week.

115. Staying on the sidelines is also a position.

116. Never forget about the Federal Reserve.

117. If you don’t know where you are, it’s impossible to understand where you should go.

118. It is dangerous to underestimate how long it will take the market to go in the opposite direction when it is rising.

119. Never buy on the first rise and never sell on the first fall.

120. Know that it is better to be interested in the market reaction to news than in the information itself.

121. Don't get carried away with diversification - focus on a few contracts. A large number of tools reduces the amount of money you can handle on each one, and also requires significantly more attention.

122. Do not count on help from above when trading in the market.

123. Take your time in determining market lows and highs. Let the market tell you that.

124. Keep perspective. Trees do not grow to the skies, and values do not depreciate to zero. What are the rumors? What are the latest high-lows? Loan rates? Interest on a loan does not necessarily determine the price bottom. CCC (Commodity Credit Corporation) price rates do not always determine the price ceiling.

125. If you enter the market based on rumors from Uncle Vasya, then exit the market based on rumors from Uncle Vasya. If you use another person's idea, use it from start to finish.

126. Do not confuse activity and result.

127. Start running from the beginning or don't run at all. Don't be a bull at 11 o'clock and a bear at 17 o'clock.

128. Avoid unexpected market turns. If you decide to close a long or short position, wait until the market turns in the opposite direction.

129. US President Woodrow Wilson said: “The fundamental purpose of government is to unite general interests against private interests.” A successful trader looks for opportunities in the market, speculating that the government's main priority is unlikely to be achieved.

130. Inertia is the main enemy of account management, that is, the tendency to remain at rest if you are already resting, or to continue moving if you are already moving.

131. W. D. Gann: “If the market moves in one direction for seven days, watch for the necessary correction on the seventh day.”

132. People who buy newspaper headlines usually end up selling newspapers.

133. If you don't know who you really are, the market is an expensive place to find out.

134. As the oat market moves, so does the entire grain market.

135. Tuesday redoes what Monday did, and if this does not happen, then Wednesday does it.

136. Never give advice - a smart person doesn’t need it, but a stupid person still won’t understand.

137. Developing a long-term trading strategy helps avoid the herd instinct, a disease of many investors. “The majority knows best” – this rarely happens. Have you ever seen a monument to a crowd?

138. Protect yourself from any forecasts. In the world of money, which is based on human behavior, no one has the most humane idea of what will happen in the future. Note this word – “nobody”. Therefore, a successful trader does not do anything based on assumptions, but reacts to what happens.

139. Anxiety is not a disease, it is just an indicator that you are healthy. If you're not worried, it means you're not taking enough risks.

140. Except for unforeseen circumstances, get into the habit of taking your profits as soon as possible. Don't torture yourself if successful trading continues without you. There's always a chance it won't last long. This will give you comfort every time you exit the market with a small gain. Otherwise, you may have losses.

141. When the ship starts to sink, you don’t need to pray, you need to jump overboard.

142. Life never goes on a straight path. Every adult knows this. But under the hypnosis of charts, we too easily forget about this. Be carefull!

143. Never trade the market just because the market “owes” you something—or worse, you “owe” yourself to show what you can do to make it clear what it can do. If this road leads nowhere and you see a better way, jump onto another train.

144. If astrology worked, all astrologers would be rich people.

145. Optimism means hoping for the best, and confidence means that you know how to get out of the most difficult situation. Don't start if you're just an optimist.

146. A premonition can be trusted when it is explainable. In other words, only implement your hunch into trading if you can recognize the information that caused the hunch. If you do not have such awareness, drop the premonition.

147. Whatever you do - whether you go with the crowd or against it, or stay outside the market - first analyze everything impartially.

148. Constantly re-evaluate open positions. Ask yourself the same question: would I invest the money if I had to decide today? Is this position moving in the direction I have outlined for it?

149. The money lost on short-term speculation is much less than the huge amounts lost on investments. Long-term investors are the biggest gamblers: after making a bet, they often wait until they lose everything. A smart trader will do everything to keep his losses to a minimum.

150. What was once a support level becomes a resistance level. The reverse is also true: what was once a resistance level becomes a support level.

151. The rule of thumb is that a good trend line should usually go through three highs or lows. The more points the line touches, the better the trend.

152. In a bull market, sell signals may not work, just as buy signals may not work in a bear market.

153. Volume and open interest are as important to the analyst as price.

154. The easiest way to determine the direction of a trend is to analyze previous highs and lows. Increasing highs and lows indicate an increasing trend, falling lows and highs indicate a decreasing trend.

155. Gaps indicate continuation of movement.

156. Although gaps are not always filled, often the gap is filled before the movement begins.

157. A state that has a lot of grain has many problems; a state that does not have bread has only one problem (Byzantine proverb of the 5th century).

158. Do not buy in a calm market after a rally, since small volumes of trades during a rally actually indicate a bear market.

159. Don't sell in a calm market after a decline because a low volume selloff is actually a super bullish situation.

160. Lose your opinion, but not your money.

161. “Wealth is exhausted by vanity, but he who gathers with labor multiplies it” (Book of Solomon’s Proverbs).

162. Prices are made in people's minds, not in bean fields: fear and greed can inflate prices far above the actual value of a product.

163. A commodity trader must clearly understand and consider the risk of crash. Traders, trying to solve all problems at once through one large position, are playing Russian roulette with their capital. Always be on the lookout for deals that could ruin your career. You can go from being a participant to being an observer.

164. If it is obvious, it is false.

165. If the market closes lower one day and opens higher the next, do not go short.

166. Trade divergences between similar instruments. For example, if all grains except legumes are growing, be prepared to sell the legumes when the grains weaken.

167. If the market breaks out of the trading range to the upside, go long. If it breaks out on a downward move, go short.

168. When the market breaks above a weekly or monthly high, it is a buy signal. When it breaks below the weekly or monthly low, it is a sell signal.

169. Try to trade contrary to generally accepted standards. For example, if traders are confident that the market will rise, but the rise does not occur, this is often a good signal to sell, especially if it is supported by government announcements.

170. If the market moves down little by little day after day, this may be a specific signal of an imminent upward trend. The reverse is also true.

171. Each sunken ship had a map. Every losing trade had a chart.

172. Do not change plans during bidding. Decide on the main course and do not let intraday ups and downs disrupt your plans.

173. Take a break. It will allow you to look at the market with new eyes and understand how you will trade over the next few weeks.

174. Absorb to the core the rules that work for your trading.

175. “The difference between success and failure in the commodities market is the difference between someone who knows the rules and follows them, and someone who guesses. If you want to succeed and make money, your goal should be to learn as much as possible; learn all the time and don’t think that you already know everything” (W.D. Gann).

176. “The final stage of a bull market is acceleration at the very top. In this phase, the market makes you believe that you have underestimated its potential. The temptation to continue pyramiding increases as you become more convinced that your profits can withstand any setback. In this case, you should definitely take your profit and reduce your main position to the initial level. Then, when it becomes obvious that the movement is over, the main position is liquidated” (W.D. Gann).

177. “The same experience manifests itself again and again - both in economics and in social history, since human nature is unchanged. In other words, man never controls his nature” (W.D. Gann).

178. Breakthrough means: 1) an increase in volume; 2) from two to three days of movement; 3) clearly visible movement up or down from the congestion area; 4) absence of a rollback to the congestion zone. If these four requirements are not met, the market is likely to remain in a trading range and reverse direction.

179. There is a difference between cause and explanation. A cause is what gives an event meaning before it happens. The explanation comes from the analyst's data and sheds light on why the market went up or down. The Wall Street Journal is filled with explanations.

Source: Magazine “Currency Speculator” https://www.spekulant.ru/

There is no concept of expensive/cheap in the market

Beginners and those who are far from trading often use the words “expensive” and “cheap”. Forget these words. Perhaps in real life these words might actually make sense. There are no such concepts in trading. Any asset is worth as much as the market valued it at the moment.

If a stock has never cost 100, and then it breaks through this level and goes further up, then the price can easily reach 150 or 200. If we reason with the concept that 100 is expensive, and 110 is, in general, space, and 120 is simply an impossible price, then the trader will definitely remain outside the trend and miss the rally.

The same can be said about “cheap”. Remember the stock market crash in 2007-2008. In six months, assets fell 10 times in price. Every day the price fell lower and lower, and each time it seemed that you could take it, because it was so cheap. Buying on such crashes is risky. The price can fall by 20 or 50 times, because there is no concept of expensive/cheap for the value of an asset.

Always act according to the situation.

How to make money from trading: expert advice

The primary task of a novice trader is not to “lose your deposit.” If this stage is completed successfully, then you can think about making money.

Pros recommend focusing on the following “pillars” of trading:

- Don't trade without a strategy.

- Do not rush to increase the volume of transactions and always adhere to the rules of money management.

- Avoid stress and keep your emotions under control.

- Don't stop practicing and learning new trading strategies (use a demo account).

- Increase your knowledge in technical and fundamental analysis.

- Follow your trading plan.

- Analyze your actions.

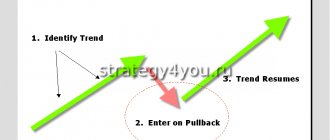

Let your profits grow

Novice traders, seeing a small profit, immediately cling to it and fix it. This approach will not make money.

Don't stop your profits from growing.

To make big money you need to catch a big trend and wait patiently. I understand how difficult it is to see +3%, +10%, +30% profit, but you need to wait further until there are some clear signs of a reversal and end of the trend. Each trader must have his own rules for exiting and taking profits.

Don't look for picks in the market. It is impossible to predict them, so just wait until the market itself begins to give signals that the trend is over.

Forecasting and market attitude

1. Don’t hold on to a “sinking” market. If he does not do what the trader expects from him, then it is better to temporarily stop trading and exit the market. 2. The losing position is not the same for everyone. Some traders manage to make profits where 99% of other investors fail. Therefore, it turns out that all the blame for the losses lies on your shoulders. 3. Don't count your profits in advance. The stupidest and most common mistake, because if you are busy counting unearned money, then someone else will definitely analyze the market and receive this money, and you will again think about possible profits. 4. Start simple. Each method or strategy must be clear. There is no need to grasp at complex things in which you cannot think anything. 5. It is impossible to know all the reasons for changes in the market. Therefore, do not overdo it with curiosity in this matter. 6. Large positions only with a stable emotional background. Don't be too aggressive towards the market. He will respond in kind. 7. Peaks and summits, although important, do not need to be constantly identified. 8. Be reasonable about your capabilities. 9. A thin market is not suitable for forecasting changes in direction. 10. You can make predictions, but don’t forget to take into account those moments that have already happened.

A trend never ends instantly

In continuation of the previous point, we can safely say that a trend never ends instantly. There is always a period of flat when the market is marking time. At this moment, a redistribution of assets occurs. Those who are aware that the market will not grow leave, and ordinary traders enter.

Therefore, there is a whole period of time when you can safely exit the market with a profit.

Trade like a woman

The New York Times compared the trading methods of men and women. 3 main conclusions:

- Men think they know everything about the market. Women accept facts, ignorance - they open less intuitive and unlikely transactions.

- Men are more obsessed with news. In transactions on the foreign exchange market, the fundamentals do not play a key role. It is enough to track important indicators and rely on the graph readings.

- Men need to be “right” - this leads to frequent mistakes in their work.

Being in the cache is not bad at all

Located in the cache (in money) is as useful as positions. Therefore, you don’t have to worry about whether you have money or specifically look for entry points in the market when they don’t exist. Being out of a position can often be much more profitable than being in one.

Having money in your account, you can enter into a trade profitably.

While you are in cash on the stock market, you can buy bonds. For example, you can take short-term government bonds (OFZ). There are practically no risks with them, and profits will flow while you wait for entry signals.

Read more about this in the articles:

- Bonds - what are they in simple words;

- Coupon income on bonds;

- Duration of the bond;

- All about investing in bonds;

- Corporate bonds;

- Eurobonds - what they are and how to buy;

How to complete trading training for beginners: step-by-step instructions

Beginning traders should not try to immediately “take the bull by the horns” - this applies to both trading and the learning process. The best option is a “step by step” tactic.

Choosing a learning method

Of the training options listed above, you can choose any one or even combine several if you have the desire and opportunity. The only “hard” connection is the mandatory study of the basic trading school.

Mastering the market and the main concepts of stock trading

A trader needs to start with the basics:

- Master the trader’s “primer book” - terminology, without which further training is impossible (for a beginner, such concepts as swap, margin call, take profit, gap, trailing stop, ECN account, etc. are a secret “closed seal”) .

- Understand the types and mechanisms of functioning of the main financial platforms - who, where, when and what trades.

Studying the trading terminal

The trading terminal is the main tool for conducting operational activities, so a trader must thoroughly master all its functionality and be able to quickly carry out the necessary manipulations (sometimes the issue of making a profit/loss is resolved in a few seconds). Practical skills are acquired on a training account.

Brokers’ trading conditions must contain information about the type of platform offered, which will allow you to first familiarize yourself with its capabilities and determine whether it is suitable for you (beginners are not recommended to use “overloaded” terminals and opt for the universal options of MetaTrader - version 4 or 5).

Learning the basics of risk management

Issues related to risk minimization are united by the concept of “money management trading” and are included in the group of knowledge on which the outcome of not only a specific transaction, but also the entire deposit depends.

Common truths, ignoring which leads to fatal losses:

- excessively high lot size;

- opening many orders simultaneously for different types of assets;

- trades without setting a stop loss;

- attempts to hold unprofitable positions in anticipation of a price reversal.

The basic rule of trading is that the total size of open transactions should not exceed 2–5% of the total deposit amount.

Introduction to the basics of fundamental analysis

Common types of analytical studies of market fluctuations are fundamental and technical analysis. Despite the ongoing debate about their priority, a trader should master both.

Fundamental analysis is based on data from economic indicators (published in the economic calendar on brokers’ websites). Relevant for traders working on stock exchanges (in Forex it is more often used for forecasting long-term strategies).

Study of technical analysis

Technical analysis is based on the study of graphical trading models, which include market research methods using various indicators and patterns (figures). The tools used are the set that is equipped with the trading terminal.

Opening a demo account and applying the acquired knowledge in practice

A training account (demo) allows new traders to acquire practical trading skills and test individual trading strategies. Work on a “demo” can be carried out in parallel with trading on a real account, without which it is impossible to learn how to manage emotions and risks (responsibility for the loss of a virtual and real deposit are two big differences).

Stop Day Trading

Short-term speculation will not bring profit. All professional traders claim that in their entire lives they have not encountered a single day trading (in other words, intraday). Therefore, do not chase mini movements, take only large ones.

The market drives you crazy if you constantly trade on it without leaving the monitor for 8-12 hours a day (maybe someone can trade around the clock).

You can read more about short-term trading in the article:

- Scalping - basics and principles;

Who can become a trader

In theory, anyone can become a trader. This profession does not require specialized education, nor does it require knowledge of mathematics.

Minimum required:

- stable psyche - self-control and discipline, analytical abilities;

- computer, laptop or smartphone with Internet access;

- free time;

- desire to learn;

- initial capital.

A professional trader must know the terminology and also be able to:

- manage capital;

- determine the level of risk;

- calculate lot size, positions for stop-loss and take-profit;

- analyze market behavior.

Anyone can become a trader

Mathematical and economic knowledge, although not required, will be a unique advantage.

Avoid high volatility and opening trades

Market openings are often extremely emotional. This is because there are traders and investors who are eager to buy or sell. As a rule, after the morning “boom” there is an adequate market reaction and the price rolls back.

Why participate in a “crazy” discovery? Take care of yourself, don’t get involved in the emotional market.

Also avoid high volatility market situations. At such moments, many false signals may arise, which provoke you to open a losing trade.

Related posts:

- What qualities do you need to have to be successful...

- How to trade stock indices on Forex

- The truth about trading from a trader - what is real...

- How much can you earn by trading - detailed information

- Trend in trading - what it is and how to build trend lines

- Popular mistakes of traders - what prevents...

- Carry trade strategy on Forex and the stock market - description

- Pyramiding strategy - what it is and how to trade

Features of online trading

Online trading allows you to use almost all exchange trading tools - select any financial assets, analyze the market situation based on historical and current quotes, use margin trading, replenish your deposit and withdraw profits, use manual and automated trading methods, and use the advice of professional traders.

A prerequisite is the presence of a stable Internet connection and an agreement with a broker.

Advantages and disadvantages

According to statistics, 95% of traders work remotely from the main exchange platforms, which proves the global trend in favor of online trading via the Internet. Comfortable conditions (the trader himself chooses the place and time to work), the ability to choose a financial platform and broker (you can work with several at the same time), minimal costs for technical equipment - these are the factors that determine the positive attitude of Internet traders.

In contrast to the obvious advantages, we should not forget about the potential threats of online trading:

- high risks of trading with leverage;

- poor quality internet broker service;

- imperfect legislation in the field of protecting the rights of traders.

Risky situations and knowledge

1. There is no need to press until “the ship completely sinks.” 2. You should not sell or buy at highs and lows, this train has already left. 3. It’s better to lose opportunities, but not your money. 4. Constantly study market sentiment and the factors influencing it. 5. Always read only useful materials. There may be few of them, but it is better than studying useless literature in large quantities. 6. Create your personal strategy from personal experience. 7. Take risks as a last resort. 8. Trade only at the right moment, so there may be days that are completely inappropriate. 9. Daily transactions have a dual nature. 10. Be guided by composure and do not give in to euphoria.

Strategy

Strategy is a method of trading. This is trading what is clear to the trader on the chart. This is trading in those patterns that he has learned to identify and filter.

Most traders, having suffered another failure, begin to change their trading strategy or look for another. They sincerely believe that this is the problem, that it is the strategy that prevents them from making a profit.

But there are no profitable or unprofitable strategies. Traders make them this way themselves.

In general, the strategy should not provide the trader with profit. It has one single function. It should provide the trader with an understanding of WHAT, WHERE and WHEN to trade. And the sooner a trader stops shifting responsibility from himself and his actions to his strategy, the faster he will learn.

It will take time for you to feel confident in your strategy. Time to adapt the method to suit yourself, to suit your understanding of the market. You can take any strategy you like as a basis and, taking into account your strengths and weaknesses, determine how and what you will trade.

For example, I am emotional, impatient, I don’t like boundaries and restrictions, but I can make decisions quickly. Therefore, I trade intraday, my trading is short-term, because... I can only follow the rules and concentrate for a short time.

If a trader is a calm and balanced person, capable of weighing and making decisions for a long time, long-term analysis, medium-term or long-term trading is more suitable for him. Don't be lazy to study yourself.

Take a strategy and trade it for a month without expecting any profit. Your task is to find something that doesn’t work after a month. Maybe it's inputs at the wrong time or generated signals in the wrong place or something else. Take it away and trade for another month.

Then compare the results. It will take a long time before you develop your trading method completely for yourself. I won't go into detail about this, it is work that you will need to do on your own to gain confidence in what you will be trading.

What is a trading style?

Trading style is a set of preferences that determine how often you place trades and how long you keep them open. This will depend on your account size, how much time you can devote to trading, your personality and your risk tolerance.

While your trading style and your trading plan should be unique to you, there are four popular styles that you can choose from.

- Positional trading.

- Swing trading.

- Day trading.

- Scalping.

Deciding what and when to buy

Day traders attempt to make money by exploiting the instantaneous price movements of individual assets (stocks, currencies, futures and options), usually using large amounts of capital to do so. When deciding what to focus on—say, a stock—the typical day trader looks at three things:

- Liquidity allows you to get in and out of the market at a good price - for example, with tight spreads, or the difference between the bid and ask price of a stock and low slippage, or the difference between the expected price of a trade and the actual price.

- Volatility is simply a measure of the expected daily price range, the range within which a day trader operates. Higher volatility means greater profit or loss.

- Trading volume is a measure of how many times a stock is bought and sold in a given period of time. This is commonly referred to as average daily trading volume. High volume indicates strong interest in the stock. An increase in stock volume is often a precursor to a price jump up or down.

Once you know what stocks (or other assets) you're looking for, you need to learn how to determine your entry points, that is, at what point you're going to invest. The following tools will help you with this:

- Real-time news services : News moves stock prices, so it's important to sign up for services that tell you when potentially market-moving news breaks.

- ECN/Level II : ECNs, or electronic communications networks, are computer systems that display the best available bid and offer quotes from multiple market participants and then automatically match and execute orders. Level II is a subscription-based service that provides real-time access to the NASDAQ order book, consisting of price quotations from market makers of all NASDAQ-listed securities and over-the-counter market electronic bulletin boards. Together they can give you real-time insight into order execution.

- Intraday Candlestick Charts : Candlesticks provide a rough analysis of price movement. More on this later.

Determine and write down the conditions under which you will enter a position. “Buy in an uptrend” is not enough. Something like this is much more specific and also verifiable: "Buy when price breaks above the upper trend line of the triangle, when the triangle was preceded by an uptrend (at least one higher high and higher swing low before the triangle formed) by two-minute chart in the first two hours of the trading day."

Once you have a specific set of entry rules, look at more charts to see if these conditions are created every day (assuming you want to trade every day) and more often than not result in price moving in the expected direction. If so, then you have a potential starting point for a strategy. You will then need to evaluate how to exit or sell these trades.

Position trading

Position trading involves holding a trade for an extended period of time, be it weeks, months or even years. Position traders don't worry about short-term market fluctuations—instead, they focus on the overarching market trend.

Investing is perhaps the most popular form of positional trading. However, an investor will most often use a buy and hold strategy, while position trading can also apply to shorter positions.

Positional trading involves taking fewer trades than other trading styles, but the positions will tend to have higher value. While this increases the potential for profit, it also increases the trader's exposure to risk. Position traders must have a lot of patience to adhere to the rules laid out in their trading plan. They need to know exactly when to close a position and when to let profits run.

Typically, position traders will rely on technical analysis and global support and resistance levels.