Hello, fellow Forex traders!

Many of us disdain the classic indicators available by default in the trading terminal. But in vain. Do you know how they got there, why they actually became classics? Because they work. They worked great many years ago, which is why they became famous, and they still work now.

And today we will talk about perhaps the most famous oscillator, the Stochastic Oscillator. We will talk about how this indicator was created, what it means, as well as application strategies, many of which you are unlikely to have heard of)

Stochastic - all about the Stochastic forex indicator

Meet Stochastic!

About thirty years ago, the prevailing belief among market analysts was that stock prices depended on so many factors that it was impossible to predict them. However, the systematization of the experience of exchange trading and the development of computer technology have clearly shown the possibility of predicting the behavior of prices on the market. The tempting prospect of “earning” a lot of money prompted many mathematicians to develop various methods for predicting prices. These methods were later called “indicators”.

The number of known indicators has long numbered thousands. Despite the fact that some of them are known only to a narrow circle of specialists, many indicators are well known to most traders, including beginners. One of the most popular indicators (including forex) widely used in trading systems is the stochastic oscillator , which George Lane began to develop in the early 1950s. This oscillator, popularized by George Lane, is very similar to the RSI line. The Welles Wilder Relative Strength Index (RSI) and the Stochastic, two of the most popular and well-known improvements to Larry Williams's basic %R oscillator, are essentially the same as the Stochastic, just not as smooth and with the scale turned upside down.

So, stochastic is one of the most popular indicators. It can be found on all available services that offer various charts, in all trading software packages and MetaTrader 4 is no exception. And yet, many traders, especially newbies, use it incorrectly.

History of creation

The stochastic oscillator was developed in the late 1950s by George Lane, president of the Investment Educators Corporation. All calculations had to be done manually, and a group of traders developed formulas for the oscillators, sequentially giving them the names %A, %B, %C, etc. Only three turned out to be functional: %K, %D and %R. According to legend, one of the Poles who helped Lane in some way had a friend, an old immigrant from Czechoslovakia. He told him in his broken English about the formula they used in Czechoslovakia to figure out how much limestone needed to be added when smelting iron ore to make steel. They took this formula, adapted it to their own purposes, and began to play with it. And so the stochastic was born.

The first two curves (%K and %D) are known as Lane stochastics, and the last one (%R) is named after Larry Williams. Another variant of the origin of the names of the lines of the stochastic indicator: %D - from the word deviation, %K - from the name Kelly (the middle name of George Lane).

George Lane intended to become a doctor, like his father. One day he accidentally visited the stock exchange and what he saw interested him very much. In the late 1950s, Lane bought himself a $25 membership on the Chicago Open Board of Trade, now known as the MidAmerica Commodity Exchange, and began trading grains. Later, George Lane becomes president of Investment Educators Inc and invents stochastic, an indicator widely used throughout the world. George Lane died on July 7, 2004.

What does stochastic measure?

The stochastic oscillator is an indicator of the rate of change or momentum of price. Stochastic measures the speed of the market by determining the relative position of closing prices in the range between the high and low over a certain number of days. The simplest oscillator takes the current price and subtracts from it the price that was several days ago. Let's assume that trading on the EURUSD pair closed today at 1.2050, and 10 days ago at 1.2000. In this case, the oscillator value would be 0.0050. The process is repeated every day and the data is plotted on a graph.

For example, the 14-day stochastic indicator measures the position of closing prices within the entire range between the high and low of the previous 14 days. The stochastic expresses the relationship between the closing price and the high-low range as a percentage between zero and 100. A stochastic oscillator reading of 70 or higher indicates that the closing price is near the top of the range; A stochastic reading of 30 or below means the closing price is near the lower end of the range. That's all. Simply put, if you see a figure of 50%, it means that the closing price lies exactly halfway between the maximum and minimum. If the indicator is 75%, then the closing price is between the maximum and minimum at the level of 75%. In other words, it would be at 75% of the day's range, or closer to the high than the low. Thus, if the market closes at its maximum every day, then you can only see an indicator equal to 100% on the stochastics. The main idea is that if the market tends to close at the top of the daily range, then it is bullish, if at the bottom, then it is bearish.

Oscillators will report a market reversal before the price actually changes, as changes in momentum lead to changes in the actual price. The same thing happens in physics: the rate of change of an object's speed will show a decrease in momentum until the object changes direction.

A major criticism is that oscillators sometimes give a trade signal when the market is in a strong trend and the signal turns out to be false. It is known that oscillators perform well in non-trending markets and poorly in trending ones. The simpler the oscillator, the more sensitive it is to changes in the current market price. For example, a simple oscillator based on a 10-day rate of change is more sensitive to changes in the current price than an oscillator based on a 30-day rate of change.

Many analysts have suffered greatly from using simple oscillators and have tried to improve them. Stochastic shows the position of each closing price in the previous interval of maximum and minimum prices. Stochastic is more complex than Williams' %R. It has several steps to remove market noise and suppress bad signals. Stochastic consists of two lines: a fast one, called %K, and a slow one, called %D.

The most common and classic formula for calculating Stochastic is the following:

where max(Hn) – maximum high for N – periods

min(Ln) – minimum Low for N – periods

C0 is the closing price of the current period.

those. moving average with period M from %K

This version of the Stochastic indicator calculation is used in most technical analysis programs.

However, several other variations are known, for example:

Where

– moving average with period N from the minimum price for the last 3 periods

– moving average with period N from the maximum price for the last 3 periods

Divergence

We mentioned above that the Stochastic oscillator is capable of showing the phenomenon of divergence in the market. It is observed quite often in the market, so every trader must recognize this phenomenon.

When the price diverges from the movement of the Stochastic, you know that you are dealing with divergence. It signals an imminent price change.

Stochastic is up and the price is down

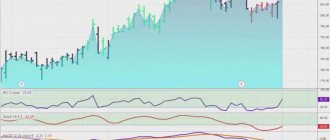

From the screenshot below you can see how the price is gradually decreasing. At the same time, the Stochastic indicator shows a signal to buy a Buy option. This is divergence. In this case, you should look for a signal not at the price, but look at what our oscillator-type indicator shows. After some time, the price changes direction and confidently moves up.

Stochastic is down and the price is up

The price moves up, and our assistant, called Stochastic, deviates from it in the opposite direction. Here, as in the first case, you should trust the indicator signal.

Similarity to the RSI line

As I already said, stochastic is very similar to the RSI indicator, which we discussed not so long ago.

The time frame for both indicators is usually 9 or 14. The stochastic is also placed on a scale from 0 to 100. However, its overbought and oversold boundaries are slightly wider than the RSI, in the sense that stochastic readings above 80 are a signal for overbought, and below 20 - oversold. This is because the stochastic oscillator is more volatile than the RSI. The other main difference is that the stochastic oscillator uses two lines instead of one. The slower %D line is the moving average of the faster %K line. It is the presence of two lines instead of one that distinguishes the stochastic from the RSI line and gives the former greater significance. The fact is that accurate trading signals on the stochastic oscillator are given when two lines intersect and when their value is above 80 or below 20.

Indicator parameters and calculation

The period of the %K line is the period of the oscillator itself.

The period of the %D line is the period of the oscillator signal line, which is simply a moving average of the %K line.

Slowdown – additional smoothing of the %K and %D lines.

Prices – select prices for calculating the oscillator – based on highs/lows of candles or closing prices.

The MA method is a method for calculating the %D line, everything is the same as for a regular moving average.

One of the stochastic lines is indicated by a solid line, and the other by a dotted line:

The solid line is called the main line, this is the same %K line. The dotted line is called the signal line, it is the %D line, which is a moving average of the main %K line.

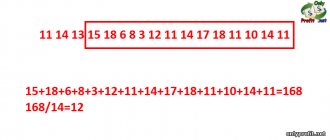

I will give an example of calculating an indicator with parameters 1433.

Fast Line (%K) = 100 [(close - 14 day low) / (14 day high - 14 day low)]. Slow line (%D) = 3-period moving average based on the %K line

Then both resulting lines are smoothed by a 3-period moving average. We see the result on the graph. Such a stochastic is called slow because of this additional smoothing. To get a fast stochastic, it is enough to replace our parameters from the example with 1431. The slow stochastic is most often used.

The most important stochastic setting is the first parameter of the three - this is the stochastic window, which determines the number of bars included in the calculation. The other two parameters determine only the degree of smoothness of the fast and slow lines. The creator of stochastics, George Lane, recommended a period from 9 to 21, and the authors of the book “Computer Analysis of Futures Markets” recommend parameters of 9-15. However, by default the MetaTrader 4 platform uses parameters 533.

To determine the most optimal stochastic period, it is worth conducting your own research, taking into account the fact that for each currency pair and each time frame the optimal period will be different. In this case, in general, I can recommend some ranges for searching for optimal values: up to M30 - period 9-13, H1 - 14-21, H4 and above - 5-9. At the same time, do not forget that to search for divergences and determine overbought/oversold conditions, it is best to use different parameters. Well, of course, as always, the higher the period of the indicator, the less sensitive it becomes to minor market fluctuations and the later it will react to price changes, the more it will lag.

The overbought/oversold levels for this indicator are considered to be 20 and 80, but you, of course, are not limited to independently selecting these levels. In a calm market, during scalping during the Asian session, for example, a fast stochastic with settings of 7/3/1 and levels of 30 and 70 is perfect.

The author of the indicator recommends using stochastic on daily and weekly charts, since it is on them that it generates the most reliable signals. It is known that the same George Lane (the creator of stochastic) used to use it with 3-minute bars when trading futures on the S&P 500 index.

Advantages of indicators when trading the Forex market

The indicators discussed in this article are basically standard, and it cannot be said that they are somehow different from others, but with their help you can:

- Filter out bad deals;

- Enter the market very accurately.

When working with indicator signals, it is important to adhere to one “golden” rule: we work only in the direction of the prevailing trend.

As they say: “where the trend goes, so do we.”

In addition, these two indicators complement each other. Their use, taking into account the recommendations presented here, represents a classic trend trading strategy.

In high-frequency trading on minute timeframes, indicators are used as hard filters. They allow you to identify bottlenecks that are suitable for closing deals.

Adviсe

And in the end, some tips that will help you improve your trading and increase your profit:

- Pay attention to the MACD indicator more often, especially the histogram columns. If they are at or above previous highs and then decline and the moving indicator breaks the signal line, a change in the underlying price movement is possible;

- Stay out of the market when the bars fluctuate in a narrow range. Usually this is a situation in which there is no dynamics in the market and it stands still;

- Look for divergences. Disagreements in price dynamics and MACD histogram. If there is inconsistency between the price and the indicator on a higher time period, there is a high probability of a change in the price trend for the long term.

- Don't forget about the heavy moving average. In our case, this is an EMA with a value of 200.

On the chart, this indicator can be compared to a powerful river flow and you need to trade only in the direction in which it points.

But don't look at the EMA just as the only signal.

- Read the chart taking into account the location of the price relative to the moving average. If prices are higher than it, there are only purchases, and if prices are lower, only sales.

- Build a heavy moving average on a higher timeframe and use it only for visual and quick analysis of price direction.

By following these simple rules, you can take profit from almost any market, spending a minimum of time. But don't forget about money management.

We recommend that you familiarize yourself with the profitable Macd strategy for binary options.

Fast vs slow stochastic

I mentioned the existence of two variants of stochastics: fast and slow. The fast stochastic has a large number of notches and sharp jumps, so most traders use the slow stochastic. Slow stochastic lines are considered more reliable, but they lag more.

Basic signals of the stochastic oscillator

The interpretation of stochastic signals is similar to the interpretation of the RSI line. These are overbought and oversold situations (in this case, however, the values of the levels are: 80 and 20), and the search for potential divergences. Unfortunately, when studying the movements of stochastic lines, such powerful tools in the case of RSI as the search for graphical figures (triangles, flags, heads and shoulders, etc.), levels and trend lines are usually not used.

But what distinguishes the stochastic from the RSI is the additional line that adds a truly valuable ingredient to this oscillator. However, some traders do use levels, trendlines and patterns for stochastics, so experiment: after all, stochastics and RSI are similar.

- Divergence.

The best signal from a stochastic oscillator is considered to be divergence or discrepancy between the %D line or %K line and the price. When the price makes a new lower low and the oscillator makes a higher low, there is a divergence and a good buy signal. Each trader must determine for himself which line to take to determine divergences. At the same time, as can be seen in the illustration, it is worth taking only divergences formed inside the overbought/oversold zones - they are more reliable.

By the way, short and long divergence are distinguished separately. The short one takes a period of 3-7 bars (as in the picture above), the long one is more extended in time.

2. Overbought and oversold levels.

By default, levels 80 and 20 are taken as overbought/oversold levels.

Stochastic oscillators work best on wide price ranges or soft trends with a slight upward or downward bias. The worst market for normal use of stochastic oscillators is a market that is in a strong trend and is subject to only minor corrections.

In the case of a stable strong trend, the stochastic oscillator may remain behind the overbought/oversold levels for a long time, so the indicator crossing these levels is a bad signal for entering a position:

The reverse intersection of these levels by the indicator can be a signal to enter during a correction to the main trend, while Fibonacci levels can serve as a good filter:

In the figure above, at point 1, the stochastic is already signaling an opportunity for sales. At the same time, the price has not yet reached the Fibonacci level of 38.2% of the previous movement (for different pairs these values must be determined empirically depending on the volatility of the pair, on average from 38.2% to 61.8%), saving us from premature entrance. At point 2 the price reached the level of 38.2%. At point 3, a divergence formed, after which the main and signal lines of the indicator crossed.

3. Zero line 50.

Based on the indicator formula, it is quite obvious that when the stochastic is in the range from 100 to 50 most of the time, there is an upward trend and vice versa for the range from 0 to 50. Moreover, you can even enter the market when the stochastic crosses the 50 line. A To make the inputs sufficiently accurate, you just need to take a sufficiently large period of the indicator:

As you can see, this option of using the indicator alone can become a completely profitable trading strategy in itself. In the picture above, the red circles are the places where the indicator crosses the 50 line - potential entries into the deal. Green circles are the recommended exit from the trade (exit from the overbought/oversold zone. Blue circles are an option for additional entry into a position upon a rebound from level 50 (entry after crossing the main and signal lines). The orange circle (the only one in the picture) is a false signal that could lead to some losses, which are nevertheless fully compensated by profits.Transactions in the example for the period from January 2009 to February 2012 on the daily chart of the eur/usd currency pair brought a total of 4350 old points, which is with a deposit of 1,000 dollars and trading a fixed lot of 0.1 over these three years will bring $4,350 in profit with a maximum drawdown of $180.

But the point is not in the numbers, but in the fact that any method of trading stochastics can actually bring profit with the right approach, patience and consistency. Pay attention to how simple this TS is, even if it does not pretend to be complete and was born in my head during 3 minutes of contemplating a chart with the stochastic indicator.

4. The intersection of the main and signal lines.

The main signals of the stochastic oscillator are the intersections of the %K and %D lines. Any intersections should be analyzed within overbought/oversold zones.

There are right-sided and left-sided intersections of lines:

In the picture above, there is a left-hand intersection on the left, and a right-hand intersection on the right. The right-hand crossing is considered more reliable.

There is another interesting feature of analyzing the intersection of the main and signal lines - failure when trying to exit the overbought/oversold zones. The figure below identifies two such cases, which usually lead to further prolonged growth or decline (to a fall for the examples given). The main line crosses the signal line in the overbought/oversold zone, and then turns around - the bulls/bears did not have enough strength. As a rule, the indicator continues to move within the zone for some time while the price continues its movement. To avoid such cases when using any of the stochastic signals, I always recommend waiting for the indicator to exit the zone.

Using this little secret of using stochastics, I once came across an entire trading system, using which a trader traded quite successfully (unfortunately, I didn’t remember the details). I am sure that few people would think of using an indicator like this. By the way, this option came to the mind of such a famous trader as Alexander Elder. In one of his books, he calls this technique a “stochastic jump,” explaining this phenomenon as the last price impulse before the trend changes.

It is also worth paying attention to the shape of the indicator’s minimums and maximums in overbought/oversold zones. If the low is sharp, the bulls are strong and the movement will be rapid; if it is rounded, then the upward movement will be sluggish.

In the picture above, wide spreads are highlighted in red, narrow ones in green.

5. Direction of stochastic lines

Typically, the stochastic fluctuates from the overbought zone to the oversold zone and back. Also, it often changes its direction when approaching level 50.

That is, it turns out that if the stochastic has left the oversold zone, then it will most likely reach the level of 50 and, possibly, the level of 80.

Also, when leaving the overbought zone, the indicator will most likely reach the level of 50 and, possibly, the level of 20. Accordingly, if the stochastic is directed upward on the daily timeframe and is located between 20 and, say, 30, it is logical to assume that the indicator will reach the level of 50. For of the D1 period, this indicator move from 20 to 50 may take only a couple of candles, but on the H1 timeframe this movement will look like a full-fledged trend. I hope you get my point: you can predict price movement in lower periods by analyzing the direction and location relative to stochastic levels in older periods.

This option is also often encountered: when the level 75 is reached on the daily charts, the trader on the hourly chart looks for an entry point into purchases. With a high degree of probability, the stochastic on the daily will reach the level of 80 and above, which on the hourly timeframe can bring significant profits. According to Jake Bernstein, half of the strong market moves occurred when the stochastic broke the 75 and 25 barriers.

How to use Stochastic in binary trading?

In most strategies for binary options, the stochastic oscillator plays the role of a filter; it is used to determine the state of the market (oversold or overbought). But the list of options for using the indicator is not limited to this. Let's start with standard techniques, and later we will look at several trading strategies.

Standard Stochastic signals

We include:

- exit of both lines from the oversold or overbought zone and the intersection of the lines in these areas. This is a classic, but this technique does not always work; do not rush to enter the market. In a trending market, Stochastic lines “stick” to one of the zones, and we do not trade in binary options or other markets at such moments. Entering one of the zones does not guarantee an immediate reversal, it only means that a confident movement took place before it;

- divergence and convergence are not the main signal, but if you receive such a design, take it to work;

- crossing level 50. This technique is used in Forex; when the level is fixed, there is a high probability of continuation to the next zone. For this purpose, a large Stochastic period (150 or 200), we don’t get entry points, it’s more of a method for assessing the current state of the market. In binary options, use the signal only if you work with long expiration dates.

When working intraday, we recommend not setting the period too long in the settings. The delay of the signal will increase, as a result, transactions will be delayed, and you will receive an entry point after the actual completion of the movement.

Next, we will analyze the most profitable strategies for binary options on the stochastic oscillator.

Using stochastics with other indicators

Stochastic is recommended to be used together with RSI. Since stochastic is more nimble, it gives signals earlier than RSI, but its signals are considered less reliable. By combining RSI and stochastic, weak signals can be filtered out. Stochastics are also recommended for use with trend indicators (as, in fact, all oscillators).

The figure below shows a simple trend system that involves entering the current trend on a pullback. Bollinger Bands (100) are used to determine the presence and direction of a trend. If the BB rises and the price fluctuates at the top of the BB, the trend is up. If the BB is sloping down and the price is at the bottom of the BB, the trend is down. In this case, entry into the market is carried out on a rollback to the middle line of the BB. If the price moves inside the BB from the lower border to the upper one, the trend is sideways and you can enter from the BB borders inwards.

Trades are filtered using the RSI (7) and Stochastic Oscillator (14,3,3) indicators. In the trend section during a rollback to the middle of the BB, it is important that both oscillators are in the overbought zone for a downward trend (oversold for an uptrend). When leaving the zone, a transaction is carried out.

Notice how the oscillators filter each price approach to the BB midline, preventing early entry into a position. In this case, the RSI indicator filters the stochastic readings.

Indicators used in the strategy

The stochastic indicator evaluates the position of the Close price in the High/Low price range for the period specified in the settings. Using two oscillators with different settings allows you to assess the situation on the market over a short- and medium-term period.

In the TS, work is not carried out with the chart at all, only with indicators. You will need to add two Stochastics to the chart with the following parameters:

- 9, 3, 3 – considered fast in this Forex strategy.

- 21, 9, 9 – slow oscillator indicator, used as a filter.

- The oversold/overbought levels are 80 and 20, respectively. For low-volatility assets, they can be transferred to 70 and 30.

For trading you only need 2 indicators.

The main disadvantage of oscillators of this type is that during the trend line they hang for a long time in the overbought/oversold area . The two-stochastic strategy is also not without this drawback.

The settings are given for timeframes M5-M15; for higher timeframes you will have to experiment and select the parameters yourself. As the period of the slow Stochastic increases, the delay in receiving the signal increases, but the chance of receiving a loss decreases. You will have to find a balance between signal speed and reliability.