Hello! In this article we will talk about what the Forex market is.

Today you will learn:

- How the Forex currency market functions;

- Who can be its participants;

- What you need to do to make money on Forex.

Nowadays there are few people who have not heard about the existence of the Forex market. A lot of advertising says that with the help of Forex you can gain absolute financial independence. But before you plunge headlong into the world of Forex, you should understand that this is not a game of chance, but serious work that needs to be done well.

Content

- What is the Forex market

- Differences from other markets

- Circle of participants

- Principle of operation

- What is Forex market analysis?

- Technical analysis

- Fundamental Analysis

- Intuitive Analysis

- Forex trading and its rules

- Demo account

- How much can you earn

- Forex Brokers

- Positive and negative aspects of making money on Forex

- How to pay taxes on Forex

- Conclusion

Stock exchange - if you want assets to have physical form

The stock exchange (in Russia we are most often talking about the Moscow Exchange) is a huge trading platform on which all available funds are traded - from stocks and currencies to kerosene, raw sugar and unprocessed cotton. This exchange employs thousands of brokers and dealing centers seeking to either invest in the most profitable assets or make a profit from active speculation in instruments.

The main features of the stock exchange include:

- Strict government regulation of all aspects of the operation of the exchange and its players;

- The ability to transfer most of the purchased funds into “physical” form - for example, order purchased shares in paper form;

- Complex and branched work structure;

- Specific work schedule – trading can only be done when the exchange is open;

- Both independent purchase of shares and acquisition of a share in a mutual fund are possible - that is, transfer of money to trust management;

- Income is subject to personal income tax, the basis for calculation is the difference between the “sale” price of the asset and its value at the time of purchase, transaction costs (broker commissions) are also deducted;

- Intermediaries on the stock exchange undergo mandatory licensing and inspections; they are subject to strict requirements that virtually eliminate the risk of fraud;

- Many instruments for long-term investment (precious metals, securities).

Thus, the stock exchange seems to be a more reliable structure than Forex, but requires a completely different approach and deep knowledge (or transfer of funds to trust management).

What is the Forex market

To put it simply, Forex is an “exchange” in which people transfer one currency to another. If we use a more official interpretation, then:

Forex is a market based on the interbank volume of currency at a free price.

Briefly, the market can be characterized as follows: the trading process in this market occurs in the same way as in ordinary ones: based on supply and demand. But in this case, the commodity is currency.

Control and regulation of this market in the Russian Federation is carried out by the Central Bank, although no clear regulations have been developed.

Differences from other markets

Most often, the Forex currency market is compared to the stock market. Note that the stock market is considered more stable than the foreign exchange market. Stocks, bonds, and other securities are traded on this market.

For a more accurate comparison, let’s consider the features of stock markets too:

- Certain places (stock exchanges) are used for trading;

- Securities quotes differ on different exchanges;

- The number of bidders is limited;

- Before purchasing securities, you need to find both a buyer and a seller;

- You cannot sell shares that actually do not exist; for this you borrow from a broker;

- Only certain groups of investors will receive profits;

- Stock exchanges operate for a certain period of time.

On Forex the situation is diametrically opposite:

- There is no connection to a specific place;

- The market is unified, which means the currency quotes are the same;

- Any number of people can participate in the auction;

- You can carry out operations that exceed the deposit;

- Any participant can receive a profit of any size;

- The market is open 24 hours a day, except Saturday and Sunday.

The most important difference is that all transactions are carried out remotely, via the Internet. Traders can be located in different countries, moreover, on different continents.

Five key priorities of the Forex exchange

- Concluding transactions using more than 50 major world currencies.

- 24/7 operation 5 days a week.

- Wide range of trading instruments.

- An impressive range of free and paid training programs.

- Intuitive multilingual interfaces of software platforms.

There are also demo accounts on Forex, with the help of which beginners can learn all the basic nuances of concluding contracts remotely.

This project works within the framework of international legislation, collaborating with the world's largest banks and exchanges. This system constantly introduces new options and opportunities that make it easier to conclude profitable contracts. Using leverage up to allows you to work with large lots without having a large starting capital. AvaTrade provides the opportunity to trade stocks, indices, cryptocurrencies and other financial instruments, including:

| Apple shares | #APPLE |

| Tesla shares | #TESLA |

| Amazon shares | #AMAZON |

| Google shares | #GOOGL/GOOG |

| Facebook shares | |

| Bitcoin | #BTC |

| Litecoin | #LTC |

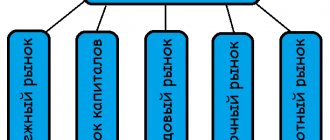

Circle of participants

The foreign exchange market involves the presence of different participants. Each of them has the same goal - to sell more expensive, buy cheaper. The goal is the same, but each of them has its own status and performs its own functions.

So, the largest players are the central banking organizations of different countries. They not only influence exchange rates, but also buy and sell currency on the domestic market.

In addition, they are responsible for the refinancing rate. Because of this, exchange rates experience certain fluctuations.

Commercial banking organizations are in second place. The largest number of exchange transactions take place through them.

Importers and exporters are the next category of participants. They sell foreign currency for national currency, and also purchase the currency in the country in which they have partners.

IFs (investment funds) – have a large turnover of funds, which affects the rates of different currencies. Their task is to obtain the maximum possible profit.

Another participant is brokerage companies. Thanks to them, transactions are carried out all over the globe. Their clients trade through special programs.

The next level is occupied by investors - individuals. Their profit is formed due to the difference that has developed between the buying and selling rates of the currency. It does not matter at all in what order these operations are performed.

Principle of operation

It's actually not complicated.

Example. To purchase the EUR/USD currency pair, a trader needs to pay $1.2326. After the price increases, he will be able to sell for a higher price. And the difference from the transaction will remain to him. This is the whole principle of work.

What is a currency pair? – the reader will ask and he will be right.

A currency pair is 2 currencies, the first of which is base, and the second is quoted. They are objects for buying and selling transactions.

The EUR/USD currency combination shows how many dollars a euro is worth.

There are a few more typical currency pairs: USD/JPY (Japanese Yen), GBP (Great Pound/USD). These are the most popular and liquid instruments on the market.

You can also mention “exotic” currency pairs, for example: USD/RUB (liquidity is low, popularity is therefore low).

There are also cross-currency pairs without the dollar in them. For example: EUR/GBP (Euro/Great Pound).

Catching gaps - “price gaps”

The strategy of multidirectional trading on two accounts opened with different Forex Brokers makes it possible to use a leverage of 1 to 1000 to catch gaps - price gaps that arise in the first minutes of market opening.

This is a rare phenomenon for major currency pairs, which can only be seen on Monday if significant events occurred during the weekend. But for many national currencies with weak economies or short working hours, gaps are a constant attribute.

The trader uses the tactics already described in the volatility trading strategy, with the only difference being that a multidirectional position is opened in the last seconds, before the end of the session.

The price gap that appears at the opening of the next day “kills” one of the transactions, generously covering the loss with profit on another account.

Reasons why “gap fishing” does not work for Forex brokers

It is quite difficult to find a broker that allows you to trade “peripheral” currency pairs with high leverage. If the company agrees to such conditions, then it limits the possibility of a transaction to 100% of the deposit. If this obstacle is absent, the trader may fall into a trap - the position will disappear from the terminal if a gap is planned in a positive direction. It is not difficult to calculate its direction a few hours before the start of the session, so the broker purposefully cleans the premarket.

What is Forex market analysis?

Before you start making transactions, you should conduct a market analysis. Each trader has his own strategy here; we will consider the main indicators for such analysis.

Three types of analysis are known:

- Intuitive;

- Technical;

- Fundamental.

If a trader wants to become successful and receive a stable income, it is simply necessary to analyze the state of the market. In addition, all three types of analysis are equally important and should not be neglected. Let's look at them in more detail and start with the technical ones.

Technical analysis

Divided into manual and automated.

During manual trading, technical indicators are analyzed and a decision is made to buy or sell a currency pair.

With automated analysis, the factor of psychology, which has harmed a considerable number of traders, is completely eliminated.

When using automated analysis, the system examines previous price fluctuations to determine subsequent price fluctuations.

Fundamental Analysis

With this type, several different factors are analyzed: from the unemployment rate to the economic situation in the country that is associated with the currency pair.

Therefore, those who prefer this type of analysis should always be aware of current economic news.

Intuitive Analysis

As practice shows, most often this type of analysis is used by beginners. It turns out that they plan to become rich only through luck. But this path is a dead end.

Some traders never come to this conclusion and simply become disillusioned with Forex. Opening trades at random is not the best strategy.

Carrie arbitrage

Trading positions carried over to the next day have swap losses/charges, which depend on the ratio of the interest rates of national Central Banks. If a trader bought a currency with a larger swap size than the other half of the pair, then every day he will receive a slight plus in his account.

For example, in the case of EURUSD, the ECB's zero rate and the Fed's 2.75% rate will provide a short daily positive swap for the pair. To make money on it, simultaneously with selling, you should open a long position on EURUSD with a broker with an “Islamic account” or connect.

Swap charges are not that high, but the annual profit can reach 30% without any serious risk, so many beginners like this idea of earning money.

Reasons why the carry-arbitrage strategy will not work

- If “Islamic Forex” is chosen, then proof or justification for this choice will be required;

- A swap-free account may include a commission for transferring or holding a position;

- The broker can “recalculate” the earnings on the swap, reducing or zeroing it for a number of far-fetched reasons;

- If the Security Service “detects” two active accounts in different directions, the trader may be accused of violating the user agreement.

Forex trading and its rules

Let's talk about the rules, following which you can become a successful trader. Many people who have already achieved a certain level of success recommend adhering to them, since these recommendations can be called universal.

- Learn the basics. For many, this may seem trivial, but most often beginners simply ignore this rule. They immediately trade using real money and end up losing everything.

- If you want to get rich quickly by investing a minimum of funds, Forex is not for you. Even professionals can fail and lose money due to a few incorrect bets. And a beginner, “guessing the tea leaves,” will very quickly be disappointed. Novice traders are attracted by beautiful advertising videos; they are sure that without knowledge they can become a rich person.

- Gambling with your last money is a bad idea. Don't borrow money to test your next brilliant strategy. If you lose, you will lose not only your funds, but also those of others. But the debt will still have to be repaid.

- Monitor the economic situation. This doesn't mean you need to watch the news 24/7. If the broker is experienced, he simply picks up the slightest changes.

- Leave the game on time. First of all, this recommendation applies to beginners. You always need to know when to stop and not give in to temptation if you don’t want to lose every penny.

- First, practice on a demo account. But do not forget that a virtual and a real account are different things.

- Be on the lookout for fake experts. Of course, the experience of colleagues with extensive experience is invaluable. But there are also “experts” who, after making 2-3 transactions (maybe successful ones), begin to think that they are a guru. In fact, they just want various guides and training materials to be purchased from them. You shouldn't pay attention to such people.

- Learn to conduct your own market analysis. You can listen to the advice of others, but you need to learn to make your own decisions. Learn to analyze the market, it's important!

- Choose your path. Beginners often fail for two reasons: lack of experience and blindly following the advice of others. You need to work out your own path, gradually ceasing to follow the crowd.

- Develop and hone your strategy. This does not mean that you need to start inventing something unusual. If there is a strategy that has proven itself, you can simply refine it.

These rules can to some extent be called elementary. But they really help novice traders find their way. Of course, everyone has their own approach to business, but it’s still worth paying attention to these recommendations.

Now let’s focus on the concept of a demo account. Let's find out what it is and what it is needed for.

Demo account

This is a “sample” of a real account. It is given so that a novice trader does not risk his money, but at the same time becomes a full-fledged market participant.

By opening a demo account, you can decide on a strategy and analyze all the instruments available for trading.

The disadvantages of working with demo accounts are that sooner or later the trader’s sense of risk will begin to dull. And earnings received from virtual money have very little practical significance.

There are also many myths associated with a demo account. For example, using it you can easily learn how to earn money. This is far from reality. This account is designed to allow a beginner to see and understand the technical side of trading.

You can trade on a demo account until you achieve real and constant profits (over a period of 1 to 3 months).

Trading volatility using maximum leverage

The volatility trading strategy is one of the options for traders’ tactical response to Forex brokers’ bans on trading on news.

To receive a guaranteed profit regardless of the movement of the currency pair, choose a volatile instrument, for example, USDJPY. The trader opens two accounts, selecting the conditions for providing a maximum leverage of 1 to 1000. Next, two differently directed positions are placed on the same currency pair until the news comes out or the publication of a significant political event, the opening of the European session (the “London Explosion” strategy), etc. d.

Having previously calculated the take profit, which covers losses from the drain of one of the deposits that are equal to each other, the trader earns (usually +100%) on the impulse rise in quotes on one account, while the second one is reset to zero. This is made possible by the large size of the shoulder.

Reasons Why Volatility Trading Doesn't Work for Forex Brokers

- The broker may prohibit trading for the entire deposit amount at a high leverage level;

- At the time of news release, the movement of quotes on two accounts may change in different directions;

- The broker may write off profits due to an alleged technical failure;

- A trader may be caught opening an opposite position in another company and both accounts may be blocked.

How much can you earn

Several factors influence the amount of future earnings. The desire to make big profits is not a priority, and working in Forex has nothing in common with working for a manager. It is unlikely that anyone will be able to name specific figures for a trader’s earnings.

- The presence of a certain set of personal qualities, as well as a psychological state. If a person does not know how to control his emotions, he will not see big earnings. He will earn money for a short time, and then he will still incur losses. If he knows how to control himself and calculate every step, success will come, and with it good earnings.

- Deposit amount. Traders usually measure their income as a percentage of their deposit. A good figure is about 15% per month. Disappointed? But this is an objective figure. If trading is done carefully and deliberately, the percentage can increase.

- Following a specific strategy. The more thoughtful the strategy, the more clearly it is followed, the better the result.

- Following money management rules. If the trader is experienced, he understands that they must be followed. There are two sides to this: if you enter the market with the entire amount of your deposit, as many beginners do, you can earn a lot, or you can suffer a complete collapse. In this situation, it’s not work, but a game of roulette. And if you follow the rules, the profit will not be huge, but the risks will be less.

- State of the market. The market can be sleepy, almost dead. This usually happens before serious news or after it has come out. On such days it is better not to open trades; you won’t be able to earn much. Profit does not always depend only on the trader.

So, let's summarize. If a trader carefully analyzes the market, keeps his emotions under control, and also follows a number of the rules already mentioned, the profit will be up to 30%. Over time it will increase. A jump to 100 percent or more is more luck than a pattern.

conclusions

So, an individual trader in Russia is offered either trading funds on the stock exchange or playing on currency quotes. The final choice depends on the capabilities and knowledge of the novice trader. The general rule is this: if you need short-term investments and making big profits, then it is better to choose Forex; if you need to invest and receive a stable income, you should give preference to the stock exchange. Successful traders combine work on both platforms, accumulating all the positive effects.

Forex Brokers

Why do you need a Forex broker? They provide a large number of services useful to the trader: they can provide a cash loan, provide clients with information materials, and so on.

Many companies provide training to their clients, help withdraw funds, and provide consulting services.

Our table provides information about several such companies.

| No. | Name | Characteristic |

| 1 | Forex Club | He has been working with both beginners and professionals for a long time. Provides full customer support |

| 2 | Alfa-Forex | Mainly works with professional traders |

| 3 | InstaForex | A great start for beginners: you can get big bonuses |

| 4 | Alpari | A very large company, one might say, the largest. Conducts webinars and master classes |

Positive and negative aspects of making money on Forex

Pros:

- There is no limit to the amount you can earn;

- Before starting work, no one will be interested in whether you have a diploma or whether you speak three foreign languages;

- Ability to work from anywhere in the world where there is Internet;

- The schedule allows you to deal with personal matters, successfully combining them with work;

- The bosses are absent, and colleagues do not ask stupid questions.

Minuses:

- There is always the possibility of losing money;

- There is no opportunity to abandon everything and leave: there will be no income;

- It's difficult to explain to others what you do. Many people believe that Forex is just another scam.

In general, everyone formulates their own advantages and disadvantages, we only talked about the general ones.

How to pay taxes on Forex

To avoid becoming a victim of red tape, you can do the following:

- You can open a bank account for trading;

- Towards the end of the year, contact your broker and request a report on all transactions that were completed. This stamped report is sent by registered mail and then presented to the tax office;

- Calculate the amount and pay 13% of it;

- At the place of registration, fill out and submit a declaration.

Any income that a citizen receives in addition to his main place of work must be declared.

Who are liquidity aggregators?

Liquidity aggregators are small organizations compared to large banks. They act as intermediaries between liquidity providers and retail Forex brokers (Dealing Centers).

At their core, these are software products that collect orders from different sources into a single stream and distribute orders to liquidity providers on a best-of-price basis.

List of major liquidity aggregators

Thanks to the liquidity aggregator, offers from suppliers are processed so that the order is executed at the best price. Among the largest aggregators are:

- Lmax;

- Currenex;

- Prime XM;

- Quotix;

- Integral.