- home

- Investments

Evgeny Smirnov

Updated: February 3, 2021

0

Article navigation

- What is real investment

- Types of real investments, classification, example

- Forms of real investments and features of their management

- Risk management in real investing

- Objects of real investment

- Investments in the real sector of the economy, assets and businesses

- Investment projects for a portfolio of real investments

- Leasing as a method of financing real investments

- Methods for assessing the effectiveness of real investments

A person who is far from the world of finance and business has a very vague idea of what investment is. Usually by this concept people understand financial investments in the purchase of various securities, the Forex market or the purchase of real estate. But in addition to financial investments, there are also investments in the real sector or, as they are also called, real investments.

What is real investment

Financial investments are usually understood as investments of monetary capital in various financial instruments - stocks, bonds, commodity futures, etc. In essence, this is the purchase of speculative assets with the aim of their further resale at a more favorable price. What investments are called real?

Real investments are investments in the real sector of the economy, that is, in production and the service sector, in the creation of tangible and intangible assets. If we look at investments from the point of view of macroeconomics, then these are investments in the general improvement of the material well-being of society.

Thus, real investments are investments in maintaining the economic complex, as well as in its modernization and expansion. In this case, investments can be aimed at acquiring or creating both tangible and intangible assets (intellectual property objects - production licenses, artistic works, software, etc.).

Real investment is, in most cases, financing large, expensive projects. If, when making financial investments, you can buy securities in small quantities for literally a few thousand or even a few hundred dollars, in the real sector any investments almost always represent fairly large amounts.

For this reason, real investors are either wealthy individuals or legal entities with large capital. Only they are wealthy enough to provide financing for projects for the construction, modernization and expansion of production complexes of various sizes.

Types of real investments, classification, example

Real investments are more diverse than financial investments, since they are applicable to all types of economic commercial activities. And these are dozens of sectors of the economy and thousands of different types of activities, in each of which there may be several areas for investment.

In general, all types of real investments can be divided into two main groups:

- Material investments. They represent investments in the creation or acquisition of material objects. The classification of this type of investment covers such types of costs as the purchase or creation of real estate, production and auxiliary equipment, utilities, transport infrastructure, etc.

- Intangible investments. These are investments in the intangible sphere, which is important for conducting business activities. An example of this is investment in advertising that promotes better sales of a product, purchasing a license to use foreign technologies in production, costs of personnel training, etc.

It is noteworthy that some categories of investments are formalized, as a rule, in the form of current production costs of the enterprise, rather than capital investments. This is due to the peculiarities of their financing through regular contributions rather than one-time expenses. This happens with advertising, the use of other people's technologies (renting licenses) and software.

Real investments include the following investments:

- purchase of equipment;

- purchase of land, including mineral deposits;

- purchase or construction of buildings and structures;

- investments in production modernization;

- expenses for structural reorganization of the enterprise;

- purchase or creation of trademarks, brands;

- purchase of patents and licenses;

- research funding;

- training and retraining of personnel.

The concept of real investment, with some stretch, also includes investments in the purchase of bonds or shares of an enterprise, if their resale to third parties is not provided, and the proceeds are used to expand or modernize production.

Real investments are in many ways more profitable than financial investments. Although they do not always provide a higher level of profitability compared to financial ones, they are less risky. Firstly, they are little exposed to short-term market fluctuations. Secondly, real investment objects have their own value, which allows them to be sold if necessary and thereby return most of the investment.

While financial investments allow the investor to make money solely on fluctuations in market conditions, real investments are focused on making a profit by producing additional tangible and intangible benefits.

Real investments are always closely related to specific production. If, when purchasing shares, an investor is only interested in the prospect of their rise in price, then when investing in the expansion or modernization of production, many additional factors become of great importance. All the problems of the production process become important to the investor, which ultimately affect the increase in production volumes and profit from the sale of products.

For these reasons, a person who wants to invest in investments and actually make money must be closely connected with the management of the enterprise. An investor needs to not only understand where exactly his money will go, but also be able to influence this process. Thus, a real investor almost always takes part in the management of the enterprise to one degree or another. He either initially owns or receives a block of voting shares in exchange for his investment.

Concept of financial investments

The concept and classification of financial investments are disclosed in two main legislative acts: PBU 19/02 (clause 3 of section I) and “Regulations on accounting…”, approved.

by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n (hereinafter referred to as the regulation on BU) (clause 43). Clause 2 of PBU No. 19/02 establishes conditions, the simultaneous fulfillment of which allows assets to be classified as financial investments. These conditions are:

- Availability of ownership rights for financial investments.

- Expectation of future economic benefit. This benefit can be received in the form of interest, dividends, an increase in the value of the asset as a result of the difference between the purchase price and the subsequent sale price, or as a result of an increase in the current market price.

- Transfer to the investor (buyer) of the risks associated with the financial investment: the risk of decreased liquidity; the risk of loss of solvency of the issuing organization or debtor organization; risk of negative changes in asset values.

Forms of real investments and features of their management

Investments in the real sector of the economy can be made in various ways. These methods represent separate forms of investments.

The most understandable and obvious option is the acquisition of a manufacturing enterprise. Although in principle a wealthy individual can purchase a small workshop, store or other business complex, in practice it is more common for one enterprise (or its tangible assets) to be acquired by another, larger enterprise.

An important aspect of this form of investment is that it is not individual property that is purchased, but an entire economic complex that is fully or partially ready to produce products or provide commercial services. This type of investment is well suited for experienced entrepreneurs, who can save time and effort by restoring the operation of a purchased business rather than starting their own from scratch.

Next, we should mention such a form of investment as the purchase of individual tangible assets - buildings, land, machines, transport, etc. It is resorted to in cases where it is not practical to purchase a ready-made economic complex. For example, a factory needs 100 new machines. Obviously, buying another factory just for this equipment is stupid. You just need to contact the manufacturer of this type of machine and buy the required number of machines.

Another popular form of real investment is the construction of new buildings, engineering facilities and communications, transport and industrial infrastructure. This form is in demand in cases where an enterprise needs new buildings, facilities and communications, but does not have the opportunity to purchase them. For example, an agricultural enterprise needs its own granary. And if there is no such facility in the area, in principle, then it is impossible to buy it. Similarly, you cannot buy a road between two production workshops on your own territory, you can only build it.

The main forms of real investment also include reconstruction and modernization. This is a special form of real investment, which to some extent is an alternative to enterprise expansion. In this case, the goal is not to increase the number of fixed assets, but to improve them or replace them with more advanced ones that are suitable for modern technical realities. Although increased production volumes are often a consequence of this type of investment, the main goal is still to reduce production costs by optimizing production processes and reducing the costs of raw materials, personnel and energy resources.

Constant modernization is the only type of real investment that no enterprise can do without. Even if we are talking about a small family cafe in a provincial town, where, in principle, there are no prospects for expanding the business, constant technical re-equipment is still necessary both in the kitchen and in the sales area.

Finally, there is such a form of investment as the purchase or creation of intangible assets. As mentioned above, this includes technical patents, trademarks, manufacturing licenses, software, and more.

Process nuances

Investment in production is represented by the transfer of money to production, which involves the creation of new material goods. Their main purpose is to meet the needs of society.

Investments in new production facilities can be presented in different forms, since they depend on the chosen direction of the company’s work. Most often, large and experienced investors prefer to invest their own funds in the following areas:

- industry;

- construction of production facilities;

- forestry or fisheries;

- agricultural complex;

- information Technology.

The above areas are considered the most promising and interesting for many investors. For them, the risks of losses are minimal, since the demand for production results is considered high.

Risk management in real investing

Analysis and risk management when making real investments is one of the main tasks of the investor. Although investments in the real economy are considered more reliable compared to the financial sector, risks still exist. This is an objective phenomenon that exists both at the industry level and at the level of an individual enterprise. The specifics of managing them is a separate science.

When implementing any investment project, one must take into account the possible risks that investments will not be able to pay for themselves for reasons that arise at the macroeconomic and local level. For any investment project, an assessment of the degree of risk is made, taking into account its specifics, and possible methods and features of their management are also provided. The following types of risks are distinguished:

- Risk of insolvency. This implies the possibility that during the implementation of the project the investor will run out of money and the project will be disrupted, and the investments already made will be lost.

- Design risk. The danger of having significant errors in the business plan or technical design that could greatly affect the profitability or even the possibility of implementing the original project.

- Execution risk. Unskilled performers can ruin all the original plans by doing the job poorly, taking too long, or increasing costs excessively.

- Marketing risk. The possibility that consumer demand for the product for which the project is being created will be lower than expected.

- Inflation risk. As a result of inflation, the costs of implementing the project will greatly increase, or the final real profit will be less than the real costs.

- Tax risk. The possibility of new taxes appearing or existing ones being increased, which will cast doubt on the economic feasibility of the project.

- Structural operational risk. During the operation of an already implemented project, current operating costs may increase for various reasons and reduce its profitability.

And these are just some of the most common problems that have to be taken into account when conducting risk analysis and management.

Classification and evaluation of financial investments

Financial investments are classified into:

- short-term;

- long-term (with a period of more than a year).

- non-current;

- negotiable;

- assets purchased for the purpose of receiving interest income, dividends, or other forms of income as a result of their ownership;

- assets purchased for resale;

- participating in the formation of the authorized capital;

- participating in the formation of debt obligations.

The above classification is not complete, but reflects the most common modern approach to the classification of financial investments that exists in the Russian Federation today.

When accepted for accounting, financial investments are assessed at their original cost.

IMPORTANT! Organizations that have the right to use simplified accounting methods can carry out subsequent assessment of financial investments traded on the organized securities market at their original cost, regardless of changes in their current market value (paragraph 2, paragraph 19, paragraph 21 of PBU 19/02 , clause 10 of Information of the Ministry of Finance of Russia N PZ-3/2015).

Objects of real investment

Various classification methods can be applied to investment objects. They are distinguished by the following characteristics:

- scale;

- project focus;

- the nature and content of the investment cycle;

- the nature of state participation in the project;

- investment efficiency.

The most typical objects to which real funds can be directed as part of an investment project are land plots, buildings, production equipment, utilities, etc. More specific objects for this type of investment include scientific and technical research, development of new improved types products and services, advertising, expansion of the sales network, company reorganization, personnel training.

Investments in the real sector of the economy, assets and businesses

The key feature of investing in a real business compared to investing in financial assets is the direct connection with the real sector of the economy. While speculation in securities is only remotely related to the actual production process, every penny of real investment directly affects the production of goods and services.

It is noteworthy that a financial investor may have absolutely no understanding of how the company whose shares he bought works. For him, only the general financial results of the enterprise’s activities are important, as well as the state and prospects of the sector of the economy in which it operates. For a real investor, absolutely all aspects are important, right down to the territorial localization of production workshops and the average age of employees.

Thus, to make real investments you need to be a real professional and expert in the industry in which you are investing. Or you need to hire such experts as consultants.

The investor also has to take into account that investments in real assets have extremely low liquidity. They are difficult (and often completely impossible) to convert back into financial resources, which almost eliminates the possibility of speculative disposal of them. For this reason, real investments are always made for the long term.

From a macroeconomic point of view, real investment is the only source of real economic growth. Speculation in securities can enrich specific individuals, but only investments in the real sector of the economy - in the construction of buildings, production of goods and services - can ensure a general increase in production volumes in the country.

What benefits does the investor receive?

By investing in production, investors can expect some positive results. These include:

- an increase in equity capital due to constant growth in profits, and this can be expressed not only by an increase in the money supply, but also by the accumulation of securities;

- non-economic effects, which include opportunities to attract new clients or counterparties, work regularly on the market, and expand areas of activity;

- social return represented by recognition from the public and owners of large enterprises.

An investor can be not only an individual, but also a company seeking to expand its sphere of influence. Constant investment of funds makes it possible to gain a foothold in the market and develop existing success.

Investment projects for a portfolio of real investments

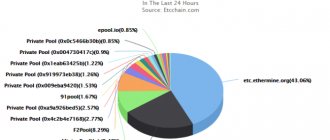

A portfolio of real investments is a collection of several investment projects in the real sector of the economy, subordinated to certain tasks and goals. Theoretically, such a portfolio could be owned by a private investor who invests his capital in various enterprises in order to minimize risks while maintaining high rates of return on investments.

However, in practice, a portfolio of real investments is, as a rule, a set of investment projects implemented at a specific enterprise with the aim of increasing production volumes, reducing production costs and expanding the distribution network.

Any portfolio of real investments is characterized by extremely low liquidity. It often has zero value as a speculative asset and can only generate profit for the investor in the medium to long term. This is due to the fact that the only way to make a profit from these investments is the production and sale of products (services) of the enterprise in which the funds were invested.

A portfolio of real investments is very difficult to manage and is directly related to the management of the enterprise itself. For this reason, the real investor is often either the owner of the company (individual or other legal entity) or the company itself.

Within one enterprise, a portfolio of real investments is formed from investment projects based on the general development strategy of a given business entity. Accordingly, profiting from these investments is directly tied to increasing production volumes, reducing costs and expanding the customer base.

As an example of such an investment portfolio, let’s take a small agricultural enterprise that is on the verge of large-scale expansion. The owners and management decide to implement several projects at once:

- purchase new tractors;

- acquire additional land plots for new agricultural crops;

- build a livestock complex;

- hire and train additional staff.

Each item on this list is a real investment project that can be financed both from the operating profit of the enterprise, and from funds raised from outside through the mechanism of issuing shares and bonds, or from credit funds. Well, all these projects together are combined into a single portfolio, which at the same time is the overall development strategy of this company.

Importance of the manufacturing sector

A developed manufacturing sector is one of the stages of evolution; economic growth directly depends on it. A country cannot move to an economy dominated by the service sector without developing real production.

This is a win-win investment. The investor receives benefits in the form of investment growth, the business receives capital for development, and a number of goals important for all humanity are achieved:

- Poverty is decreasing. A 1% increase in employment in the manufacturing sector reduces poverty by 5-7%.

- The quality of life of humanity as a whole is improving.

- Over time, production becomes more economical - this has a positive effect on the environment.

- Due to the development of new technologies, the resource utilization rate increases, the volume of waste decreases, which also benefits the environment.

- The chance of new technologies emerging increases.

A number of more local goals are also being achieved. For example, the quality of products improves, the trade balance of a particular country improves, and logistics chains that are more resistant to crisis events are formed.

Leasing as a method of financing real investments

Leasing as a method of financing long-term investment projects is an excellent alternative tool for raising funds. In a stagnant economy with high inflation and high rates on bank loans, leasing allows you to successfully implement expensive investment projects with a long payback period. How it works?

Inflation can eat up all the profits from long-term investments, so an outside investor is not interested in a real investment project designed for a long term. If the enterprise does not have enough of its own working capital for such a project, it only has a bank loan. But due to high interest rates, investments in real assets may turn out to be unprofitable.

The solution to this situation is leasing. A third-party investor purchases the relevant property (for example, industrial machines) and leases them to the industrial enterprise. As a result, the investor receives a rental profit that covers the level of inflation, and at the same time remains the owner of the property, which can be sold after the lease agreement expires.

In turn, the enterprise receives for use the property it needs, the rent of which is covered from the profit generated by this property. Moreover, the cost of rent is lower than payments on a bank loan.

One more fundamental point should also be noted regarding this source of investment financing. A bank loan can only be taken out from a bank in the country in which the enterprise is located. The law prohibits direct lending from foreign banks with lower interest rates. But a leasing agreement can be concluded with non-residents, that is, you can rent property from companies and individuals registered in another country.

By the way, the decisive prerequisite for the influx of real foreign investment is precisely the high cost of bank loans in our country. Foreign investors are willing to participate in leasing schemes, which are quite safe and at the same time provide all parties with excellent conditions for making a profit.

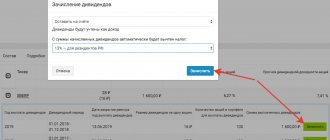

How are balance lines 1170 and 1240 formed?

Line 1170 “Financial investments” is formed by adding the debit balance of the accounts:

- 58 (only for long-term financial investments, the period of which exceeds 12 months);

- 55 (only investments and deposits for a period of more than 12 months);

- 73 (only interest-bearing long-term loans to company employees).

The amount of debit balances on the above accounts is reduced by the balance on the credit account. 59 in terms of creating reserves for long-term investments.

The formation of the value of short-term financial investments occurs in a similar way. So, line 1240 is formed as the sum of the debit balance of the account. 58 (for short-term financial investments), reduced by the credit balance on the account. 59 (for reserves for short-term financial investments), debit balance of the account. 73 (regarding short-term loans to personnel) and account. 55 (in terms of short-term deposits).

Check whether you correctly reflect financial investments in your financial statements using the guide from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

More information about the rules for creating an enterprise balance sheet can be found in the article “Deciphering the lines of the balance sheet (1230, etc.).”