Often we watch or read news that talks about the World Bank or centralized finance. Even if it is possible to grasp the main essence, a person cannot understand how the world economy works and how this relates to him personally. He barely manages his finances and rarely cares about the financial system itself. However, a financially literate person should know such things - for himself personally or for serious discussion.

If you learn to understand the financial system, you will be able to defend your point of view and understand many economic issues. We will not only look at each subsystem separately, but also touch on such a sensitive topic as corruption.

Every person probably often thinks about what happens to his money after he has spent it or why taxes are needed. Unfortunately, things don’t go beyond interest and he continues to live as before. We will try to partially cover these issues and consider what the financial system of the state and the entire planet consists of.

Structure of the financial system

The financial system is a form of organizing monetary relations between all subjects of the reproduction process for the distribution and redistribution of the total social product.

To put it simply, the financial system is the accumulation of monetary income and its subsequent distribution. This can be done by the bank, the state, and even you, because you are also part of the financial system.

You must understand that some things in economics are very easy to explain. Any financial system deals with income and expenses. Always remember these two simple words - it will help you understand many complex things. Just as the financial system deals with income and expenses, in the same way finance itself can be spent or acquired (or temporarily acquired).

The financial system is divided into two types: centralized and decentralized finance.

Next we will look at these two types in more detail, but for now we invite you to solve this case so that you can see how the financial system directly affects you and your decisions.

Statistics Full screen

Basic Operation

Within the framework of a market economy, certain basic provisions are taken as the basis for monetary relations, compliance with which allows the system of decentralized finance to function as efficiently as possible. In this situation, they are able to guarantee the stable operation of the economy and the social sector, making income the basis for the development of the entire system.

The approach to financial management plays an important role in job stability. The constructed algorithm ensures the development of programs and determines the most promising areas for financing.

In turn, resources can be used:

- To fulfill obligations to the creditor and provided for by law.

- Financing expenses associated with business expansion, increasing authorized capital, modernizing equipment and others.

Centralized finance

Centralized finances are funds of funds intended to support the activities of state and municipal authorities. Accordingly, they are divided into municipal and state finances.

Municipal finances form the basis of the economic viability of municipalities. Moreover, each such municipality has its own budget, which is called local.

The local budget is funds intended to financially support the functions and tasks of local government.

Let's take any town. It is governed by local governments (mayor's office and city council), which need municipal finances to form the local budget. Any city requires a large number of expenses, which becomes possible only when there is the same amount of income.

Let's see what ways to generate local budget income exist:

- Revenues from local taxes and fees . The mayor's office makes local laws in the same way as the state and collects taxes.

- Deductions from certain federal taxes and fees . This means that the state can additionally help the local budget if it cannot cope on its own.

- Deductions from some regional taxes and fees . As we see, not only the state, but also the regions can help the city budget.

- Subsidies . We are talking about transferring money from the state budget free of charge.

- Income from municipal property . This could be, for example, renting out some city property.

- Fines . For example, for illegal parking.

- Other income.

From available revenues, municipal authorities form local budget expenditures.

Local budget expenses can be as follows:

- Maintenance of local government bodies.

- Landscaping and landscaping.

- Maintenance of educational, cultural, physical culture and sports institutions.

- Organization of public transport. Buses, trolleybuses and trams require a lot of money for repairs and maintenance.

- Organization and maintenance of housing and communal services.

- Waste disposal and recycling.

- Maintenance of local roads, as well as their construction.

- Conducting local elections and referendums.

- Other expenses.

The column “Other expenses” includes dozens of other types of local budget expenses. Sometimes they can differ significantly depending on the requirements of voters and budgetary capabilities. There may also be large differences between countries.

The second type of centralized finance is public finance.

Public finance is a form of organizing financial relations in which the state is a participant in one form or another. Any state requires the necessary amount of money to function and fulfill its obligations to the society that founded it.

Public finance has three main functions:

- Test.

- Distribution.

- Regulatory.

Public finances form the state budget. A state budget is a document that shows the revenues and expenses of a particular state for a certain period of time. As a rule, for one year - from January 1 to December 31. Significant cash flows pass through the budget and it directly affects such economic indicators as the unemployment rate, money supply, exchange rate, inflation, public debt, investment, production volumes, etc.

Let's look at what government revenues and expenses might be.

State budget revenues:

- Duties and non-tax charges.

- Taxes on income of legal entities and individuals.

- Regional and local taxes.

- Revenues from the real sector (income tax).

- Receipts of indirect taxes and excise taxes.

As you can see, the main source of income for the state budget is taxes. Therefore, it will be so tempting for a government leader to focus on this type of replenishment of the state treasury. In countries with a social bias, taxes are very high, there is a redistribution of resources from rich to poor. Which can lead to dire consequences: the emigration of rich people to countries with low tax rates.

For example, the city-state of Singapore has one of the most advanced and fair tax systems in the world. This doesn't make Singapore a great tourist destination because prices are quite high, but it is an investor's paradise. Perhaps in the very near future, in terms of the size of placed assets, Singapore will overtake Switzerland, the world leader in this area. This city-state is a dream for any investor, and many can become permanent residents if they invest enough money into the economy. While France, for example, is going in the opposite direction.

State budget expenditures:

- Industry.

- Agriculture.

- The science.

- Defense.

- Public administration.

- Healthcare.

- Social politics.

- International activity.

- Law enforcement.

If the ratio of income and expenses in the state budget is equal, then it is said to be balanced. When expenses exceed income it is called a budget deficit and the government often issues new money, which causes inflation. If revenues exceed expenses, we are talking about a budget surplus. We touched on this topic in the last lesson, but now we see how this happens in practice, since we understand what specific income and expenses can be.

However, there are other ways to replenish the state treasury in case of a serious deficit. The government may decide to issue and sell securities (bonds and bills). In this case, a wealthy entrepreneur can become a bank for such a state and it will owe him. Central bank funds can be used, but this should be the last resort. Some countries turn to other countries or banks for credit. This all helps to temporarily plug the hole in the budget and show the population that everything is under control.

Corruption

It is impossible not to ignore the theft of finances in the area of public finance management. This is where the level of corruption in any country is simply amazing. Why? Because in essence, state money has no owner, besides, very few people are interested in building a state facility and a lot of people want to make a big profit from it.

A very revealing story happened in the 19th century after the creation of the Pacific Railway in the United States. It was a state-owned company and it was declared bankrupt several times, despite the fact that the state invested enormous amounts of money in its development. The workers and managers were paid for each mile they built, so they were incentivized to build it in a curved rather than straight line. In addition, the structure was constantly being altered, because it seemed to be deliberately built incorrectly. The workers were interested in increasing the length of the railway and long-term construction, and the managers only supported the former in this. In addition, money constantly disappeared somewhere.

At the same time, James Hill built his own railway, the Great Northern Railway, with his own money. He found investors, invested his money, and very quickly built an incredibly efficient railroad. To make a profit, Hill knew a simple truth: the road must be straight and stable. When a physical facility is built with the private money of specific people, you can be sure that the level of corruption in it will be minimal.

If you heard in the news about the monstrous level of corruption, then you can also be sure that we are talking about public money and most likely there are many people in the government who are interested in this. Even if we assume that the person in charge of construction with state money will be a very decent person, this object will still be built for more money than if he had built it with his own money. This is how human psychology works.

Budgetary funds of the Russian Federation

Absolutely all actions of budgetary funds in our country are regulated by the Budget Code, and such structures themselves are created and function in strict accordance with current legislation. Typically, such funds are laid down by the government at the state level, as part of the Federal Budget Law for the next financial year. In this case, it is possible to create budget funds at the level of a subject and even a separate territorial entity. The sources of filling the budgetary funds of the Russian Federation are budgetary funds, treasury bills, special taxes, targeted government loans, etc.

Decentralized finance

Decentralized finance is a form of organization of monetary relations formed by enterprises, organizations, other economic entities, as well as individual households and citizens. They belong to commercial and legal entities. Part of the income from such a business goes to the state and local budgets; with their help, budgetary organizations are financed, and subsidies, pensions, and scholarships are paid.

Decentralized finance moves the economy of any country forward, because the vast majority of such organizations are commercial and tax revenues from their income help replenish the budget. If you imagine for a second that such organizations will leave the country en masse, very difficult times will await it, because there will be nothing to collect taxes from. In this case, the state will switch to its population, raise taxes and all this will end very badly, perhaps even in default.

Also, it is precisely such financial organizations that attract new investments into the country, which allows for more construction and production. In addition, they take out loans for their business from banks, which allows the country's banking system to function.

Let's consider the types of entities that contain decentralized finance. Let's highlight three main ones: household finance, organizational finance and international finance.

Household finances

This is a set of relationships regarding the creation and use of funds of funds and financial assets necessary for the life of members of the household. This refers to a group of people, most often related by family relationships, who jointly make financial decisions and form a household budget. Although a household may consist of one person who independently and independently forms its own budget. So whether you like it or not, you are members of households.

In the system of market relations, a household acts as:

- The taxpayer who forms the budget.

- Buyer and consumer of goods and services.

- Lender or borrower.

- Accumulator of cash funds by saving part of the income received (we will talk about this in the next lesson).

- Supplier of factors of production: labor, capital, and so on.

Household members have internal and external financial relationships. Internal ones arise among members of the household. External relations are:

- with the state;

- with enterprises and organizations;

- with employers;

- with commercial banks regarding loans and deposits;

- with insurance companies;

- with other households.

Household budget

This is the balance of income and expenses of a farm for a certain period of time (month, quarter, year).

Household incomes are:

- Wage.

- Pensions, scholarships, benefits and other social benefits.

- Income from real estate and cash transactions on the stock exchange and financial market.

- Income from business activities.

We will talk about ways to generate income in the next lesson. Now it’s worth adding that a financially literate person always keeps his income above his expenses. Although there are a large number of them.

Household expenses are:

Taxes and fees:

- Income tax.

- Land tax.

- Property tax.

- Government duty.

- Tax on vehicle owners.

- Resort fee.

- Collection for cleaning of populated areas.

- And so on.

Utilities and other monthly payments:

- Payment of utility services.

- Payment for cold water.

- Payment for hot water.

- Payment for electricity.

- Payment for garbage removal.

- Payment for heating.

- Payment for the radio point.

- And so on.

Current consumption expenses:

- Expenses on clothes and shoes.

- Expenses on food and drinks.

- Expenses for periodic needs: hairdresser, laundry, dentist, other medical services, types of personal insurance, and so on.

- Expenses for tourism, recreation, travel.

- And so on.

Capital expenditures on consumption of non-food products:

- Purchasing housing.

- Purchasing a car.

- Purchasing furniture.

- And so on.

Capital expenditures to generate profits in the future:

- Education expenses.

- Business expenses.

- And so on.

Expenses can also include the accumulation of cash capital or an insurance reserve for a rainy day.

Varieties of DeFi

Decentralized finance is a monetary system that is built on the basis of smart contracts and decentralized applications in the Ethereum ecosystem. It does not have central authorities and levers for its application. All participants in the system are equal to each other.

Decentralized finance includes the following promising areas of development:

- Decentralized exchanges .

- Stablecoins like Dai or USDC;

- Baskets of tokens , that is, the decentralized equivalent of ETFs;

- Asset management funds based on smart contracts like MelonPort;

- Tokenized lending platforms like Fulcrum or Compound;

- Decentralized prediction markets like Augur and Gnosis.

Financial organizations

These are monetary relations that are associated with the formation and distribution of monetary income and their use for various purposes. A financial organization uses money from the sale of products - the sale of goods, services and works. If such an organization does not have funds, then loans are usually used to obtain them for a short-term period. If for the long term, then shares and bonds can be issued. And the ratio of loans to equity issues forms the capital structure.

These organizations can decide to invest, that is, generate additional income. They assess risks by analyzing economic factors.

There are three types of financial organizations:

1

Commercial Bank

They are further divided into three types:

- Commercial Bank . This is a credit institution that carries out banking operations for individuals and legal entities.

- Investment bank . This type of bank organizes the raising of capital on global financial markets for large companies and governments. He is also an intermediary in the trading of stocks and bonds, and can provide advisory services in the purchase and sale of businesses.

- Mortgage bank . Provides mortgage loans and resells mortgage-backed securities.

This division is very arbitrary, because some banks work in all three directions.

2

Non-bank credit organization

Its types:

- Pawnshop . This organization provides short-term loans secured by property.

- Insurance Company . It concludes insurance contracts and their maintenance.

- Non-state pension fund . It accumulates pension savings and can even invest them with the person’s consent.

- Credit cooperative . Specializes in providing financial assistance to members of this organization.

3

Investment institutions

Its types:

- Investment company . Members of such an organization give it the right to manage their investments. So-called investment portfolios are created, where shares of different companies are collected. This allows you to minimize the risk in the event that a company goes bankrupt - then a member of the organization will lose only a minimal amount of money, and in the best case, will receive less income.

- Investment fund . Similar to an investment company. There are several types of such funds, including hedge funds and mutual funds.

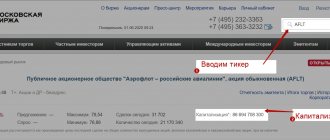

- Stock Exchange . Ensures the regular functioning of the securities market. We will talk about it separately in lesson five, when we study financial analysis.

- Investment dealers and brokers . A broker performs intermediary functions on the stock exchange - only he has a license to carry out such transactions. The dealer conducts business on his own behalf and can be an investment or commercial bank.

Using the budget fund

The use of financial reserves of budget funds is regulated by relevant regulatory documents. Central Bank Funds are formed at the expense of designated purpose income and can only be used to finance the relevant target areas. All operations with such funds are carried out exclusively through branches of the Central Bank, as well as the main department of the Treasury of the Ministry of Finance. Funds are accounted for in budget accounts opened with the Treasury/Central Bank.

“Money from budget funds cannot be withdrawn and in no case can be used for profit”

International finance

This is a concept that characterizes the totality of international financial resources in their movement. Globalization has led to the development and growth of international finance and the emergence of global financial markets.

The main participants in the global system are banks, portfolio investors, transnational corporations and many others.

The very existence of international finance has led to the fact that a major financial crisis in one particular country eventually spreads to the whole world. This is, for example, the global crisis of 2008. Today, international financial flows are intertwined in the world so much that financially literate people pay attention to the global economy and try to predict the future situation in their home country.

Thus, an international financial organization . This is a financial institution whose participants are states and non-state institutions, therefore they are all subjects of international law. International financial organizations emerged after the global crisis of 1929-1933.

The IFO is created to bring together participating countries to solve problems in the development of the world economy. The goals may be to develop cooperation, smooth out contradictions and ensure the integrity of the global economy. Such organizations also analyze economic trends, conduct stock market transactions, finance scientific research and engage in charitable activities.

Examples of international financial organizations:

- The World Bank . Created with the aim of organizing financial and technical assistance to developing countries. The headquarters is in Washington.

- International Monetary Fund . A specialized UN agency that provides short- and medium-term loans when there is a government balance of payments deficit. Currently, the IMF unites 188 countries, each of which can apply for a loan subject to certain conditions. The headquarters is in Washington.

- International Bank for Reconstruction and Development . Member of the World Bank Group. Goals: assisting in the reconstruction and development of the economies of member countries and promoting private foreign investment. The headquarters is also located in Washington.

- European Investment Bank . Created to finance the development of backward European countries in the form of long-term loans. The headquarters is located in Luxembourg.

- European Central Bank . This organization issues the euro and also manages the official reserves of the Eurosystem. She is completely independent. The headquarters is located in the German city of Frankfurt am Main.

In this lesson we covered the world's financial system, moving from household finance to the World Bank. Of course, in reality everything is much more complicated, but in order to understand financial news or analyze some important points, you have a weapon. In order to understand any structure, you need to look at it from two points of view - close-up and general plan, which is what we did.

In the next lesson, we will deal with one of the most important aspects of financial well-being - studying sources of passive income. We will also understand the importance of saving, which will allow us to invest in the future.

Funds of budgetary institutions

It is also worth mentioning the special funds of various budgetary institutions. Their composition is formed from revenues for specific purposes, after which the funds are appropriately distributed and spent in accordance with legal norms. The fund's budget funds are spent primarily on the implementation of measures to ensure the uninterrupted functioning of such an institution. The income portion of the special fund is formed on the basis of calculations calculated for each individual source of income (as in the cases described above, opening a budget account with the Federal Treasury is required).

Centralization

In a centralized financial environment, exchanges or trading platforms are owned by a single individual or corporation. They provide various services to make cryptocurrency more accessible to their customers. However, centralized exchanges are responsible for everything from user registration and setting the ground rules, among other things. On the other hand, DeFi applications aim to decentralize ownership and become community owned. Each user can influence how the application should work, as long as its code is managed and maintained by the community.