The first cryptocurrency brought thousands of percent income to investors who bought it 5 years ago. But this is far from the best result. Users who believed in popular altcoins earned many times more

The cryptocurrency industry began just over 10 years ago with the advent of Bitcoin. Since then, digital assets have gained worldwide fame, and billionaires and large institutional investors have begun investing in BTC.

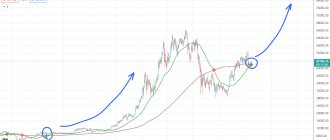

As cryptocurrency spread throughout the world and was accepted by society, its price increased. At the same time, investors who purchased digital assets several years ago, when the new technology was known to a narrow circle of people, became richer. The editors of RBC-Crypto calculated how much you could earn on the most famous digital coins by buying them in 2015 and selling them today.

What was the rate in 2008

August

Three guys, Neil King, Vladimir Oksman and Charles Bry apply for a patent on encryption technology. All three deny any connection to Satoshi Nakamoto, the supposed creator of the Bitcoin concept. That same month, the trio registered the domain Bitcoin.org using an anonymous domain name registration service.

October

Despite all of the above, Satoshi Nakamoto publishes his report on the concept of electronic mutual settlements entirely based on P2P technology. In his opinion, this will solve the problem of counterfeiting, and will also give Bitcoin the opportunity to gain a foothold at the legal level.

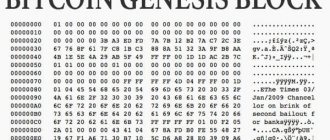

The launch of the first block, codenamed Genesis, initiates the start of “mining.” Later that month, the first transaction is recorded between Satoshi and Hal Finley, a developer and activist in cryptography.

Mining development

In the field of Bitcoin mining, in comparison with the revolutionary year 2013, there have not been any stunning changes. Over the entire year, the difficulty increased by only 2.5 times, while in 2014 it increased almost 10 times, and in 2013 it increased by more than 60 times!

In the middle of the year, the rate of increase in complexity decreased noticeably, and in the first half of the year there was even a decrease in several recalculations. It was insignificant, remaining within 5%, but it gave rise to talk about both the achievement of a technological peak and the uncertainty of future prospects for the mining industry.

But, as autumn showed, all this was just an accumulation of strength before the next breakthrough. Chip developers still have reserves, and in November a new stage of growth began, again showing double-digit figures for several consecutive recounts. More than half of the annual growth occurred in the last 2 months.

At the last recalculation, which occurred on December 31, the difficulty rose by 11.5% and for the first time in the history of Bitcoin exceeded the mark of 100,000,000,000 (one hundred billion) units! The estimated computing power of the network exceeded 800 Ph/s (petahashes per second) in peaks, and averaged about 720 Ph/s. This means that in the first, maximum in the second quarter of 2016, we can talk about reaching the milestone of 1 Eh/s (exahash per second)! The Bitcoin network confidently holds the lead in power among all existing computer networks in the world.

Opponents of cryptocurrency often point out, from their point of view, the waste of hundreds of megawatts of electrical power. However, the financial industry, which supports the functioning of fiat currencies and the global payment system, spends disproportionately more electricity and other resources, while remaining not the most convenient, and often technically outdated. And almost a quarter of the world's population still remains unbanked and uses only cash. Therefore, the efficiency of resource use can still be debated.

What caused the new breakthrough in mining difficulty? The three largest equipment manufacturers - AntMiner, KnC Miner and Bitfury in the second half of 2015 announced the release of new generations of their chips, which once again reduce specific energy consumption and increase productivity per watt of power, which will lead to obsolescence of previous generations of miners. These chips (except Antminer) already use the 16 nm process technology, thus approaching the 14 nm limit achieved by the world leader, Intel. Obviously, in the last two months, equipment based on these chips has begun to be launched en masse, and the growth will continue until the market is saturated again.

Course in 2009

On October 5, 2009, Bitcoin received its first rate against traditional currencies. New Liberty Standard set the rate of 1 dollar for 1,309.03 BTC, that is, for more than a thousand bitcoins they gave only a dollar, accordingly, no one calculated the cost of one bitcoin because it was a negligible number. This already included the cost of consumed electricity, since to mine bitcoins you need to keep your computer always on.

Bitcoin Acceptance

The first State of Bitcoin of its kind, released by Coindesk in 2014, states, “The adoption of Bitcoin by larger consumer-facing companies (eg Overstock and Zynga) will introduce Bitcoin to a larger audience.”

Whether the adoption of Bitcoin by more merchants has led to more use of it is still in question, as decreased purchasing power has led to many Bitcoin owners choosing to hold onto their coins rather than spend them. Although there is no doubt that the adoption of Bitcoin by big name corporations has kept the cryptocurrency in the media headlines in 2014.

Following the rapid adoption of Bitcoin payments in early 2014, Overstock CEO Patrick Byrne said in an interview with CNN that Amazon would be "forced" to begin accepting Bitcoin soon.

And while Byrne did not specify a time frame for this prediction, Amazon responded to the growing pressure from Bitcoiners, saying that they have no plans to “get involved in Bitcoin.”

This may have looked like bad news, but some predicted that other giants such as Dell, DISH, Time Inc and Microsoft would begin accepting Bitcoin by the end of 2014, giving it a vital boost of legitimacy.

History for 2022

- January

After the State Bank of China inspected the activities of the country’s main cryptocurrency exchanges (they are the largest in the world) and identified some violations, the BTC rate collapsed by a third.

Exchanges that were inspected by the main bank of the Middle Kingdom: OKCoin, Huobi and BTCC. At the end of the month, these same crypto exchanges began charging commissions from traders for the first time in their history. These were the only sites that were monetized through margins (differences in exchange rates). As a result, BTC trading volumes fell to a minimum. Chinese exchanges took such steps to reduce the volatility of the Bitcoin exchange rate and the speculative sentiments of traders.

- February

Once again, the intervention of the State Bank of China caused a sharp drop in the cryptocurrency. This time, the financial regulator forced exchanges to limit the withdrawal of funds outside the country. Thus, the Chinese government decided to combat the outflow of funds from the territory of the state.

Due to the introduction of restrictive measures by the Chinese government, most crypto traders “moved” to Japanese exchanges. As a result, the bulk of transactions for the purchase and sale of bitcoins began to be concluded in this country. The first bank specializing in exchanging cryptocurrencies for fiat has opened in Austria. This is the first financial institution of this type of activity in the world.

- March

BTC recorded a new record value against the dollar. On March 2, Bitcoin traded for the first time at $1,290. In the same month, Bitcoin for the first time became more expensive than 1 ounce of gold. But then, due to an update to the blockchain protocol, the cryptocurrency rate dropped to $900.

- April

On April 3, the recognition of BTC by the Japanese government as an official means of payment caused the crypto rate to increase by almost 10%.

- May

In the middle of the month, Bitcoin reached $2,000 for the first time. And by the end of May, the main tycoons of the BTC market agreed to update the crypto network algorithm. Segregated Witness was able to partially solve the problem of blockchain scaling.

- June

At the beginning of summer, the capitalization of the cryptocurrency market exceeded the $100 billion mark. By June 11, the cost of BTC reached $3 thousand. But then its rate fell to 2.5 thousand due to the fact that industry experts called Bitcoin an unreliable asset.

- July

As a result of rumors about the upcoming hard fork, the value of the coin fell by $1 thousand.

At the same time, the new Segregated Witness blockchain protocol was supported by almost 100% of Bitcoin miners.

- August

At the beginning of August, a Bitcoin hard fork occurred. After which a new altcoin appeared – Bitcoin Cash. Its creators were a group of blockchain participants who were not satisfied with the terms of the new protocol (Segregated Witness). Some miners spoke in favor of a sharp increase in the volume of the transaction block (up to 8 MB). At the same time, the version of the BIP 91 protocol proposed as part of the Segregated Witness update involves expanding the block only to 2 MB. But this did not prevent Bitcoin from reaching a capitalization of $50 billion. And then the cryptocurrency “broke” the 4 thousand green mark.

At the end of August, the Segregated Witness update was officially launched.

- September

At the beginning of September, BTC almost reached $5 thousand. But then, due to the Chinese authorities banning ICOs, the Bitcoin exchange rate fell.

In the same month, the world's first real estate purchase transaction for bitcoins was recorded. It took place on September 19 in Texas.

- October

BTC is already worth 6 thousand dollars.

Then, in the twentieth of November, another Bitcoin division occurred. As a result, a new coin appeared – Bitcoin Gold. But another hard fork did not affect the price of BTC.

- November

During November, the Bitcoin rate constantly increased. By the end of the month, its price increased to 11 thousand dollars.

And the volume of transactions made daily on the blockchain exceeded $3 billion.

- December

At the beginning of December, in terms of working capital volumes, Bitcoin almost caught up with the top five “fiat” leaders (dollar, yuan, euro, yen, rupiah). By the middle of the month, the coin rate reaches 20 thousand dollars.

Bitcoin's value fluctuated throughout December. At its minimum it fell to $12 thousand. At the end of the month, due to rumors about a ban on the circulation of cryptocurrencies in South Korea, the BTC rate dropped to $13,000. A positive factor that kept Bitcoin afloat in December was information leaked online about the imminent appearance of BTC-based futures. The information was confirmed: on the 18th, CME GROUP (options exchange from Chicago) launched this financial instrument for the first time in the world.

Ethereum

Ethereum was one of the first altcoins. In 2015, the coin was just born. To date, it has become the second in capitalization among digital assets and the first in the number of deployed decentralized applications.

Ethereum first began trading on exchanges in August 2015. Exactly five years ago it cost about $0.83, now it costs $585. By investing in the coin 5 years ago, you could earn more than 70,000% profit.

Investments in rubles would bring greater results. At that time, Ethereum in terms of Russian currency cost 56 rubles. Today the altcoin is trading at 43.4 thousand rubles. Buying a coin in 2015 could increase your investment by 77,500%.