The dangerous Martingale money management method came to the world-famous Foreign Exchange thanks to the light hand of gambling enthusiasts. Some traders, especially beginners, perceive the method as a trading strategy and consider martingale on Forex to be the only way to achieve 100% profit. Experienced pros are cautious about the tactics of gamblers, since not only profit awaits the trader at the end of the journey, but also a very likely loss of the deposit.

- What is Martingale?

- What is the essence of the Martingale system?

- How is Martingale used in Forex?

- Advantages and disadvantages of the Martingale principle in Forex

- How do Martingale trading strategies work?

- What does a trader need to know when using the Forex Martingale strategy?

- Is there a safe Martingale on Forex?

- What is needed for a safe Martingale?

- Preparing for a Safe Martin

- Practical example of a secure Martingale

- Mathematical basis for safe Martingale

- Possible problems when using safe "Martin"

- Recommendations for using safe Martingale

- And again about money management

What is the essence of the Martingale system?

For those who are not in the know, let us explain the principle of the classical Martingale system. Initially, the method was focused on playing roulette. For example, $1 was bet on red. If black was dropped, the bet was doubled, that is, $2 was already bet on red. With the next loss, the bet was doubled again and was already 4 dollars per red. And so on until the winning color is drawn.

Roughly speaking, the Martingale method is a geometric progression adapted for roulette.

How to include zeroing of the working bank in the mathematical model?

Since one of the features of the Martingale system is the periodic reset of the working bank, it would be advisable to initially plan for this development of events in order to come out with a profit in the long run. How to do it?

Not difficult. If more than a one-time increase in the bank takes place before the calculated drain of the bank, such a model can already be considered winning. This means that if the starting bank increases by 1 or more times (for example, twice), after which it is scheduled to be reset to zero, then such a scheme will still bring profit to the player.

The simplest example:

Starting bank $100.

With the help of Martingale, we triple the bank every cycle and work on half (to be on the safe side) of the budget. This will give:

- 1st cycle: win $150, lose $50. In the bank - $100 + $50 = $150 (take half for the next cycle, i.e. $75)

- 2nd cycle: win $225, lose $75. In the bank - $75 + $150 = $225

- and so on.

How is Martingale used in Forex?

With the development of exchange trading, the Martingale method began to be used in the Forex currency market. The general principle of its use is very similar to playing roulette, only buy and sell orders are used instead of “red” and “black”.

It looks like this:

At some level, a sell position of 1 lot is opened. If, contrary to expectations, the price continues to rise, the losing position is not closed, but another sale is opened with double the volume. This sequence continues until the price reverses and allows the trader to close trades with a profit or, at a minimum, without a loss.

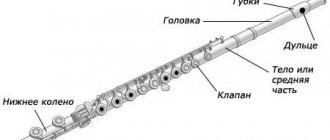

Rice. 1. Classic Martingale method on Forex.

In general, this approach to the Martingale method creates the impression that it is not necessary to close unprofitable trades, and there is almost a 100% probability of “getting away with it”, avoiding losses, and even making some profit on top. However, there are several very significant “buts” in using this strategy.

- Firstly, an increase in open transactions and an increase in their volumes leads to a load on the deposit and, as a result, to Margin Call, when there are not enough funds to open new orders, at best. In the worst case, the result of such trades will be Stop Out, when the Forex broker begins to forcefully close open transactions.

- Secondly, to use Martingale you need fine calculation and skill in analyzing technical charts, indicators, etc. Positions are opened in all sorts of places. Each order is opened at a potential reversal point, which is not so easy to determine. And if you fall into a strong trend, you can easily be left without a deposit. It’s sad, but this is exactly where novice traders try this method.

It is worth noting that most trading systems based on the Martingale method, if used incorrectly, lead to almost 100% loss of funds. This also applies to advisors such as ILAN. The other side of the coin is that with a competent approach and appropriate skills, such systems and robots can make quite a good profit.

Anti-martingale - a strategy for quickly increasing profitability

There is another interesting approach called Anti-Martingale. It implies the opposite situation: doubling bets if you win, and if you lose, we return the bet to the original one.

For example, if you are lucky enough to win 5 times in a row, your winnings will be x32 of the initial bet. Not bad, right? Is it possible to win 5 times in a row? More than.

Anti-martingale has its place in trading. It is especially useful in trend movements, which do not happen as often as we would like, but still happen regularly in all markets. If you trade with the trend and gradually increase your position, you can significantly “accelerate” your deposit to a large amount in one trend. This approach is also called pyramiding.

The main problem here is the personal psychology of the trader. Imagine that you made $10 on your first trade. The next one is $20. After 10 wins in a row, the total winnings will be $1000. Are you willing to take further risks? After all, one failure will immediately deprive the entire previous result. And we started with just $10. This is one of the easiest ways to achieve a large amount from a small starting amount in a short period of time, you just need to get into the trend.

A person has an extremely negative attitude towards any losses - this is our psyche. To have a calm attitude towards major disadvantages on the stock exchange, you will need to have “nerves of steel”, and few people are given this by nature.

If you look at the history of great traders, many of them started with simple luck. They were just very lucky in the beginning. They, not understanding their enormous risk, earned millions of dollars, and then either quickly lost them, or, thanks to the instinct of impending losses, they changed their trading with such risks. After all, one mistake would lead to the complete collapse of the deposit.

I have researched many automated trading systems. He himself invented them and developed the Martingale and Anti-Martingale control methods. The results of my work gave me valuable insights. During certain trading periods you can “make” huge money. But how to determine this period with a guarantee remains an unsolved problem. A trading robot has no instincts and will never be able to show results better than those of an experienced trader.

For myself, I concluded that I would not be able to calmly look at the growing rates under the anti-martingale system. My psyche simply does not allow me to calmly face the fact that I can lose all the income for the previous days in one trade. Therefore, I constantly turned off working robots in the event of a series of big victories, and this did not allow the deposit to accelerate.

Advantages and disadvantages of the Martingale principle in Forex

The advantages of Martingale on Forex include the principle that a trader, even if he often receives a loss, will still remain in the black. At the same time, the use of the Martingale principle sometimes allows you to “pull” a seemingly hopeless position into breakeven, or even into plus.

Along with the opportunity to make a significant profit, the Martingale method has a number of significant disadvantages:

- Firstly, the Maringale principle in Forex, unlike its use in gambling, is a complex mathematical system that is not based on the usual doubling of the subsequent bet, but depends on the volatility of the currency pair, the volume of the initial position and the size of the trader’s deposit.

- secondly, the Martingale strategy assumes the presence of a sufficiently large deposit, which will be able to withstand drawdowns on open positions and will allow opening new positions with an increased volume.

- thirdly, the effectiveness of the Martingale principle directly depends on the trading strategy in which it is applied. If a strategy has low efficiency or is completely unprofitable, then no Martingale system will save it.

- fourthly, the Martingale method has an increased level of risk. If the classic rules of Forex management allow a risk of 3-5% of the deposit, then the risk of Martingale strategies is about 60%.

Combining strategies with Martingale

The pot distribution rule can not be used in conjunction with gaming strategies only in the case of bets on even or odd totals - markets that cannot be predicted. But even on such bets, players take statistical indicators into account, because in 55% of cases matches end with an odd score, which means the chance of winning is higher. In other cases, a combination of bank distribution using the Martingale method and one of the gaming strategies is used:

- Martingale + total betting strategy. In this case, the player will have to identify the matches in which the most productive teams are taking part, and place bets on the TB with odds of 2.0 (1.9-2.5). As a rule, such markets have the form TB 1.5. There is also a strategy for searching for the least productive clubs with a further bet on TM 0.5. When making a bet, the bank is distributed according to the Martingale strategy.

- Martingale + quarter betting strategy. This game tactic is used in basketball, where the player has to find matches in the bookmaker’s line in which it is easy to identify the favorite. In 80% of cases, one of the quarters remains with the outsider, so you can catch a quote of 2.0 or even higher for his victory.

- Martingale + outcome strategy in hockey. In this case, the essence of the game, on the contrary, comes down to matches where it is almost impossible to identify a favorite. The winning percentage of such HCs differs by no more than 5-10 units. One of the periods will still remain behind each of the clubs, and you can take advantage of this, because the odds will be set at approximately the same level. And Martingale will be able to compensate for the costs of lost bets.

These are just the basic strategies; in fact, there are many more of them. The main thing is not to use Martingale on bets with Long-term events (“Winning the Championship”) and in sports disciplines where many athletes or teams take part in the event (horse racing, figure skating, etc.).

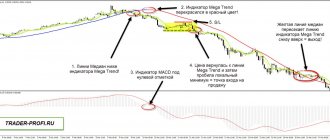

How do Martingale trading strategies work?

1. Select any currency pair.

2. We enter buy or sell positions clearly in the direction of the current trend with a minimum lot. To determine the trend, you can use a chart with a large time frame (for example, D1). After we have determined the price direction (for example, upward), we open a position (in our case, to buy Buy).

3. For an open transaction, be sure to set equidistant stop loss and take profit orders (50 points for each from the market entry).

4. If the price knocks out our take profit, at the same level we open a new position, also for purchase and with similar orders.

5. If the price has hit the stop loss, at the same level we open a new deal in Buy with the same orders, but the lot for the position must be 2 times larger than the previous (already closed) position.

That is, if the first transaction was with a lot of 0.1 and the stop loss was knocked out, then for a new open transaction (in the same direction as the first) the lot should already be 0.2 (this is precisely the main principle of martingale on Forex) . And so on.

In order not to wait for the price to reach take profit or stop loss, you can first place appropriate pending orders at their levels to automatically open new transactions in the desired direction.

The martingale method in the Forex market is not favored by stock speculators , since in order to obtain an insignificant but expected profit, a “weighty” deposit is required. Stock speculators, as a rule, create a kind of average model, similar to the well-known “soap bubble” formula: they operate with large sums and, using the Forex martingale in trading, increase losses in the hope of a proportional increase in profits.

However, despite the high risks of losing a deposit, Forex trading strategies based on the Martingale principle are very popular among traders, as they allow them to make significant profits in a short period of time, up to increasing the deposit several times.

You can learn more about the best Martingale strategies here.

Conclusion

The Martingale strategy is very promising if used skillfully. Before a beginner applies this progressive model of bank management, it is worth testing his skills as a forecaster on a long series of Flat bets. If streaks of more than 3-4 losses in a row do not happen to you, then you can move on to Martingale. This is not a guarantee that such “black streaks” will not happen in the future. But it’s entirely possible to bet this way if you really understand your chosen sport and gaming strategy. If this is not the case, loss will be inevitable, regardless of the chosen financial strategy. It’s just that “Dogon” empties the banks of unlucky forecasters much faster than “Flet”. This must be understood and this scheme must be applied intelligently.

Article

What does a trader need to know when using the Forex Martingale strategy?

In practice, the Forex martingale is an effective tool in the hands of someone who accepts the principles of the strategy. The term, by the way, was first used to refer to a collar that did not allow the horse to throw back its neck, and was also mentioned as a piece of ship equipment to strengthen the jib and bowsprit from the force of the forestays... in general, the principle is to apply increased force to a negative result .

What does a trader need to know to properly use the martingale system in Forex? – making profitable transactions can be increased to 87% (versus 50%) even if the trader works with a minimum deposit (4 financial margins). Taking into account the principle of doubling, it is necessary to calculate your strength, limit yourself to small volumes of transactions and ensure, even before experiments, a large deposit.

Jokingly, experienced pros recommend trying the gambler strategy for those for whom the broker is ready to open an unlimited line of credit. However, the fact remains: martingale Forex is a strategy with an overwhelming level of risk - 62% versus 2% accepted on the exchange. The classic version of the gamblers’ system – entering at random (against the trend) is highly not recommended. If we use the method, then in modified versions adapted for Forex:

- Simple method

Increase the lot value and double trading positions after each loss, but enter the market only according to the trend. The disadvantage of this method is the high level of risk, since trading involves investing significant funds.

- Complex method

Increase in denomination after each subsequent unprofitable transaction within 40% (1.3-1.6 times compared to doubling). This method significantly reduces the range of losses and the likelihood of losing the deposit, but provides less profit. When choosing this method, it is necessary to limit the use of take profit and strictly control stop loss, increasing the level with positive dynamics.

When choosing the Forex martingale method, be sure to make a decision to sell or buy based on either independent research or reliable analytics. Entry “at random” is unacceptable, although it is possible to use a card system as an addition to the strategy in case of unsuccessful entry.

However, it is worth considering that martingale will not be able to correct a bad trading strategy (up to 40% of profitable trades). Another condition for profit when using the method is to start trading with a minimum lot. The profit in this case will be insignificant, regardless of the chosen option (simple, complex), but, thanks to position averaging, the probability of losing the deposit is also minimal.

Game markets for strategy

Not all game markets offered for the match meet the conditions of the strategy. Each sporting discipline has its own markets with equally probable outcomes, as well as a number of common positions. General markets include totals, handicaps and outcome. If a bookmaker offers odds of 2.0 on one of these markets, it means that they conditionally satisfy the conditions of the strategy (2, English). There are also a number of markets that are equally probable by default and do not require any analytical calculations - these are bets on even and odd totals for a match or a particular period, as well as even/odd corners, throw-ins, shots on target, etc.

Even/odd betting is the most representative application of the Martingale strategy.

Martingale in football

In football matches, odds of 2 can include bets on the outcome, handicap, total or OZ (both will score), but in this case, Martingale can only be used in conjunction with some kind of analytical gaming strategy. The bettor needs to soberly assess the probability of a particular bet passing, regardless of the offered odds. There are various strategies for betting on total, overall performance and outcome that will help increase your chances of winning and reduce the number of bets in a series on the way to achieving profit.

It is also worth considering that the real probability of a conditional bet on “Even or Odd” will be higher than the passability of bets on the total (or other analytical markets).

Martingale in basketball

In basketball matches, it is allowed to use Martingale on classic markets, as well as on even and odd totals, shots or other statistical indicators. Particular attention in basketball is paid to such a market as “Total Quarters”. If several quarters were extremely productive, the bookmaker will set inflated quotes for the last quarter, since the TB market will obviously be overloaded. In such cases, odds of 2.0 will be set for the total, which is quite easy to break through.

Martingale in tennis

Tennis is not a sports discipline for which Martingale is well used. It is much more difficult to predict the outcome of a tennis match than a football or basketball match, since only two athletes take part in the confrontation (3, English). And here every factor can play a role, from the well-being and motivation of the tennis player to the court surface. Many athletes show exemplary play on grass, but constantly lose on clay.

Is there a safe Martingale on Forex?

As a rule, most traders associate the Martingale method with something dangerous. And for beginners, this is generally one of the most popular “horror stories”. Of course, using the Martingale method in trading carries increased risks. Is there a safe Martingale?

You won't believe it exists! The use of individual elements of Martin can increase trading profitability and even reduce the psychological burden on the trader. How? Very simple!

Let's look at a number of elements of the method that can be used in a trading strategy, increasing its profitability.

Limited "Dogon"

As can be seen from the previous examples, the pain point of the “Catch-up” game is long losing streaks. Indeed, it’s ridiculous for the sake of earning 100 rubles. risk a quarter of the bank, for 25,600 rubles, as in the example. For this reason, a cut or limited Martingale is practiced. They do not raise rates until the loss is complete. For example, they set a limit until step 4. If there is no winning before this move, they roll back to the original amount. If the distance cross-country ability is high, then this allows you to compensate for such micro-failures. If you persist and raise to the limit, you can lose the entire bank on one “black streak”.

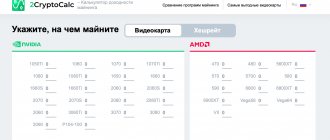

What is needed for a safe Martingale?

First of all, we will need a profitable trading strategy. The Internet offers a huge selection of systems for every taste, so choosing a profitable one from the existing ones will not be difficult. Remember, using the safe “Martin” will give us an increase in income and reduce the psychological stress, however, if the strategy is obviously unprofitable, then it’s unlikely that anything will work out for you.

In addition to a profitable trading strategy, you need a trading account with high leverage. Adequately using the rules of money management, a leverage of 1:100 will be sufficient.

Profitable vehicle + high leverage

Before we start discussing the elements of martingale, it is worth saying that you need an initially profitable strategy. It must be profitable without martingale elements, otherwise nothing will work.

These mini-elements will help us improve its profitability and reduce the moral burden on the trader. But without an initially profitable strategy, this will not be possible.

In addition, we will need a lot of leverage. With adequate money management, 1:100 is, in principle, quite enough. Large leverage will not cause harm in your trading, of course, if it is not abused.

Let's say you have a profitable strategy and high leverage. Then move on to the next point.

Preparing for a Safe Martin

So, the trading strategy has been selected, a trading account with the necessary leverage is available. We continue to prepare our safe Martingale. Let's focus on the following key elements:

- Using stop loss orders in trading

For some reason, most traders believe that trading using the Martingale method occurs without stop losses. Need I say that stop loss is insurance against a large loss and trading without them is stupid and dangerous? Stop-loss orders can and even should be used in the Martingale system.

- Determining a series of losing trades in a trading strategy

Everyone knows that there is no Grail in Forex, and even the most profitable trading strategy suffers from losing trades. Our task is to determine the average series of losing trades. Please note that this is not the maximum value, but rather the average number of consecutive losing trades during the test period.

The test period requires an individual approach. If the trading strategy is intended for trading on the M5 interval, then the test period should be at least 1-2 months. If trading is meant on the daily timeframe, then the testing period is already several years.

To optimize testing of a trading strategy, you can use one of the utilities, of which there are a great many on Forex resources.

Unprofitability of the system

Well, now I’ll prove it to you using a very simple formula.