Types and parameters of the moving average

There are four most popular moving averages:

- Simple moving average - SMA or simply MA.

- Exponential moving average - EMA.

- Smoothed moving average - SMMA.

- Linear weighted moving average - LWMA.

It should be noted that the exponential moving average and linear weighted moving average give more weight to recent values. Because of this, these types of MAs react faster to recent price changes.

When using the moving average indicator in Metatrader, you can choose several options:

- Period is the time period for the calculation. For example, period 10 on a daily chart means 10 days.

- The offset is a time delay to be applied to the indicator. For example, a period of 5 on the hourly chart means the moving average has shifted to the right by 5 hours.

- The MA method is the calculation method applied to the MA or the type of MA you want to see on your chart.

- Apply to is the price you want to apply the moving average formula to. For example, calculate a moving average based on the closing price.

Rules for entering a sell trade using the Mega Trend strategy!

The conditions for opening a sell transaction using the Mega Trend strategy are as follows:

- Both curves of the Median indicator should be located below the Mega Trend lines.

- The blue Mega Trend line should turn red.

- The MACD column should be below the zero mark.

- The price should decrease and rise again, but not above the Mega Trend line. At the same time, MACD columns are growing.

- A pending Sell Stop order is placed at the last minimum extremum.

- If the yellow and green Median curves rise and are above the Mega Trend, or the MACD columns are above the zero mark, you should not open a sell trade.

- Stop Loss is set above the last maximum extremum.

Exit from the market is made after crossing the yellow MA Mega Trend line in the upward direction.

Mean reversion and moving average

Mean reversion is a theory that is often used in financial markets. It represents the tendency of the market to continually return to its average price. We can use this pattern to find the optimal entry point.

In the illustration above we have two elements: the average price value and the return to this value. Although this concept is easy to understand, it can change the way you look at the market. This is where the moving average comes in handy.

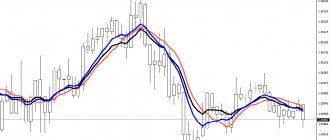

We can use 10 and 20 EMA:

The area between the 10 and 20 EMA acts as a zone that indicates price reversion to the mean. This zone represents the average price of the market. Notice how the market finds support and resistance in this area as part of the trend. This is where the 10 and 20 exponential moving averages help us find market entry points.

Overbought and oversold

One of the most common pitfalls among traders is entering the market on impulse price movements, in other words buying or selling at overbought or oversold levels. Such entries should be avoided.

In the chart above, I highlighted the overbought and oversold areas, from which the price returns to its average value. If the price deviates too far from the moving averages, it is always better to wait for the price to retrace to the average before entering into purchases or sales.

On the daily chart, the price made two long downward movements from the 10 and 20 EMA. In these areas, it is best to stay out of the market. Instead, we expect the price to return to the moving averages and only from them we are already looking for an entry point to sell.

How to understand that the price is in the overbought or oversold area? This depends on several factors:

- Trading instrument.

- Timeframe.

- Current market conditions.

Trading instruments can be currencies, stocks, commodities. Each instrument moves to its own music, that is, it has its own characteristics and nature of price movement.

On each timeframe, the price may behave differently. I have found that 10 and 20 exponential moving averages work best on four-hour and daily charts. In my experience, these two timeframes are the most reliable for identifying trading opportunities.

Current market conditions allow us to understand how the market might react to the average.

It should be noted that studying and applying the average is only suitable for a trending market. So if the market is trading in a range or is too volatile, it is best not to use mean reversion.

Let's see how moving averages can help us find market entry points on a four-hour chart:

In the following example, the price formed a mean reversion pin bar. We also see a trend line that acts as support:

We should avoid buying or selling when the market has moved too far from moving averages. An exception to the rule may be a fast market. What does this mean? This is a market that is experiencing extreme buying or selling and is therefore unlikely to return to its average price anytime soon.

The market made two sharp movements during which there was no reversion to the mean. In fact, the second rally was 1600 points. The price rarely covers such a distance without pullbacks, but sometimes this happens.

Moving average and trend trading

The moving average signals a possible trend change and also helps determine the strength of the current trend. However, there are trends in which the moving average will be completely unnecessary. Eg:

The market is in a strong downward trend and this is obvious without any indicators.

Now let's take a look at a chart where moving averages can help determine the strength of a trend as well as potential changes:

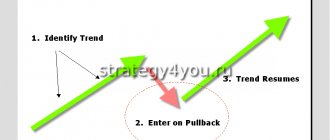

As we know, a downtrend consists of a series of decreasing highs and lows. But sometimes the market makes a higher high in a downtrend. Does this mean the trend is over?

A higher high in a downtrend will not always mean the trend is over. This could be a difficult pullback before the trend resumes its intended path.

You're probably thinking, "How can I identify a trend more objectively?" You can use a moving average to help you with this. For example, if the price is above the 200 EMA, it means the market is in a long-term uptrend.

If the price is above the 20 EMA, it means the market is in a short-term uptrend.

You can gauge the strength of a trend by looking at the steepness of the moving averages. The steeper they are, the stronger the trend. If the moving average becomes horizontal, then there is no trend at all.

There are many variations of moving averages that a trader can use, but my favorites are the 10 EMA and 20 EMA. When used correctly, these two moving averages can make trend trading much easier.

We only look for buying opportunities when the 10 EMA is above the 20 EMA. Since the 10 EMA follows price action more closely than the 20 EMA, it signals that the market is in an uptrend. On the other hand, when the 10 EMA is below the 20 EMA, we look for selling opportunities as the market is in a downtrend.

If you want to make more money, you need to find a strong trending market. This will allow you to gain greater profit potential. To do this, use the 20 and 50 EMA and compare their slope. The stronger it is, the more volatile the market will be.

Let's compare the two graphs.

It is clear that on the first chart the profit potential will be much greater than on the second and therefore the first chart is preferable for trading.

Remember that moving averages are a trend indicator, so they should only be used in trending markets and forgotten during periods of consolidation.

In which markets does it work and is it worth using?

The moving average crossover strategy has been around for a very long time. During this time, it has been tested and tried by thousands of traders. Nevertheless, for some reason, beginners do not want to use it, and more experienced ones, on the contrary, talk about it as the most reliable trading system.

The moving average intersection trading strategy works and brings profit. However, due to the small number of signals, beginners do not tend to use it. They need more signals and higher profit potential. They are not satisfied with 10-15% per annum.

This method works better on the stock market, since this type of asset is prone to growth over the long term, and therefore more often shows trend movements. The strategy is worse in the Forex market, where there is a lot of noise and false movements.

Is it worth using this system? Most likely, yes, since it allows you to receive almost all trend movements, and during periods of crisis it allows you to stay out of the market.

Dynamic support and resistance levels

In a trending market, moving averages can act as dynamic support and resistance levels. The market can be compared to a rubber band. If it stretches too much, there is always a pullback. That is, the market constantly returns to the moving average.

Therefore, if you want to find a good entry point in a trending market, always wait for the price to return to the moving average.

Before we go any further, I want to say that dynamic support and resistance levels are not as strong or revealing as horizontal levels.

Dynamic support and resistance can be found where the moving average intersects with the current price:

Notice how the 10 and 20 period exponential moving averages act as support and resistance for price.

Let's look at the 10 and 20 EMAs, which act as dynamic resistance during a downtrend:

Notice how once the 10 EMA crossed the 20 EMA, the moving average began to act as dynamic resistance.

For trading, dynamic levels can only be used in combination with other structural factors and price action patterns:

Here we see a pin bar at a horizontal level and a price that bounces off a dynamic level. All this happens within the framework of an upward trend. This creates an ideal trading setup.

Here is a list of the five most common moving averages that traders can use:

- 10.

- 20.

- 50.

- 100.

- 200.

Since the above periods are used more often than others, the market tends to respect them more than others. This is also why support and resistance levels work in the market: if enough traders use the same level to buy or sell, there will likely be some market reaction to it.

We can use dynamic support and resistance levels to set a stop loss. When the market is trending, price tends to bounce off dynamic levels. They represent a kind of barrier that prevents price movement. Thus, placing a stop loss behind the dynamic level formed by the moving average makes logical sense.

How can you earn more in trending markets? The only way to take the entire trend movement is to not have any profit-taking targets. If you set a take profit, then you are limiting the potential of your trade.

Therefore, in strong trending markets, it is better not to set a take profit, but use only a stop loss, placing it behind the dynamic support and resistance line. This can be done in trending markets over long periods of time.

The period of your moving average will determine the strength of the trend you want to profit from. Short term MAs (eg 5 EMA) will allow you to ride short term trends. While a long-term MA (for example, 200 EMA) will allow you to take maximum profit from long-term trends.

Moving Average: Trading Strategy

We will use a moving average to determine the best entry points on the charts.

- If the price is above the 200 EMA, it means the market is in an upward trend.

- Wait for two tests of dynamic support formed by the intersection of the 20 and 50 period EMAs.

- Enter the trade on the third or subsequent test.

- Place a stop loss of 2 ATR from your entry point.

- Exit the trade when the price closes above the 50 EMA.

Advisor based on two moving averages

When trading on low time frames, the trader has to constantly be at the computer so as not to miss a profitable signal. This is not always convenient, especially if trading is not the main source of income. Therefore, it is advisable to use special advisors.

The trading robot "Sovetnic MA" is based on moving average lines. He independently places orders after crossing the moving averages on the chart. The advisor is based on a simple trading strategy and brings good profits. During preliminary setup, you can manually set the desired Stop-Loss and Take-Profit values, as well as specify the lot sizes for transactions.

50 day moving average: trading strategy

As we already know, there is no best moving average. However, in a normal trend, the 50 day moving average is one of the best indicators.

How to use the 50 day moving average to find trading opportunities?

Most traders are familiar with the strategy of entering the market at support and resistance levels. This strategy works successfully when the market is in a range or weak trend.

But what if the market is in a similar trend?

As you can see, the market does not test the support level for a long time, and you may remain out of the market for a long time, looking for the right trading opportunity. What to do? This is where the 50 day moving average comes into play.

Let's look at the same chart again, but this time with a 50-day moving average overlaid on it:

Do you see the difference? Once price retests the 50 day moving average, you can use price action patterns to find an entry point into the market.

How to sit out long-term trends using the 50 MA?

When it comes to trend trading, many traders take profits at the slightest pullback. At the same time, they tighten their trailing stop too much!

It's like chasing a girl. If you get too close to her, she will run away. But if you give her freedom, you will have a better chance of winning her.

Therefore, you must learn to let the price breathe. One approach for this is to use the 50-day moving average to move your stop loss.

This means that you should hold your position as long as the price remains above the 50 day moving average. And exit the market only when it closes below it (and vice versa for a short position).

How to use the 50 day moving average for reversal trading?

When you are trading a trend reversal, the timing of your entry is critical. If you enter the market too early, you risk being stopped out. If you are late, you miss the opportunity to catch a big price move.

How can you accurately find the time to enter the market not too early or too late? You can use the 50-day moving average, which can act as a trend filter.

If you want to go short against an uptrend, wait for the price to close below the 50-day moving average (and vice versa for a long position).

But what if the price does not close below the 50-day moving average, can I go short? No! You must stay out of the market. Let the 50-day moving average act as a trend filter and tell you when it is safest to go short.

To increase the profitability of your trades, make sure the price is based on the higher time frame market structure. For example, if you are looking to short, check that the price is at a resistance level on a higher time frame.

How to enter the market on time?

Do you enter your trades too late, only to realize later that you bought at the highs? At the same time, your stop loss is knocked out on the first pullback? The market continues to grow, but without you? Why is this happening? The reason is that you may be entering the market too far from a significant area. Therefore, learn to look for entry points near a significant area.

For example, in a healthy trend, the significant area is near the 50 day moving average.

But here you should not open trades:

In a strong trend, the significant area is near the 20 day moving average.

50 day moving average and finding the best entry points

There are two techniques you can use:

- Reversal price action patterns.

- Breakout of the trend line.

We know that the moving average acts as a significant area in a healthy trend. What to do when price retests the 50-day moving average? Here we can look for price action reversal patterns such as pin bar, engulfing pattern.

When price pulls back to the 50-day moving average, you can draw a mini trend line to help you find your entry point.

Trading strategy for 50 MA

The idea behind this trading strategy is to profit from one large wave in a healthy trend. Here's how it works:

- Find a healthy trend where price matches the 50 day moving average.

- Wait for price to retest the 50 day moving average.

- Look for an entry trigger (for example, a price action pattern on a breakout of a trend line).

- Enter the market only at the opening of the next candle.

- Set your stop loss below 1 ATR of the previous low.

- If the price moves in your favor, exit at the nearest reversal.

Here are some examples:

Rules for entering a buy transaction using the Mega Trend Forex strategy!

Mega Trend refers to the exact entry Forex strategy .

Entry conditions are simple:

- The yellow and green MA should be above the Median lines.

- The red Mega Trend line should turn blue.

- The MACD column should be above the zero mark.

- The price should rise and fall again, but not below the Mega Trend line. At the same time, the MACD columns are declining.

- At the last maximum extremum, a pending Buy Stop order is placed.

- If the yellow and green Median curves decrease and are below the Mega Trend, or the MACD columns are below the zero mark, you should not open a buy deal.

- Stop Loss is set below the last minimum value.

Exit from the market is performed after crossing the yellow MA lines of the Mega Trend indicator in the top-down direction. You can fix a Take Profit, which is 2 times larger than the Stop Loss order.

200 day moving average: trading strategy

The 200 day moving average (200 MA) is one of the most popular technical indicators.

In news reports and analytical reviews you will often find:

The S&P 500 has fallen below the 200 day moving average - the market is bearish.

Enter into purchases when the price exceeds the 200 day moving average.

Apple shares just closed below the 200 MA - it's time to sell.

However, more often than not, these tips will be completely useless, since they will push you to open positions on emotions and enter the market at the most inopportune time. In today's article we will analyze all the nuances and features of trading using the 200 day moving average.

What is the 200 day moving average?

A moving average is a technical indicator that averages recent price values and appears as a line on a chart.

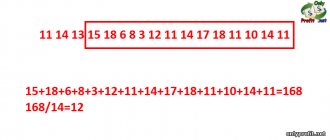

Let's assume that in the last 5 days the Apple stock price was 100, 90, 95, 105 and 100. So the 5 day moving average is:

100 + 90 + 95+ 105 + 100 / 5 = 98

All 5-period MA values can be displayed as a smooth line on the chart. The same is true for the 200 day moving average. The only difference is that you are looking at the last 200 days of data, which shows a longer-term moving average.

There are also different types of moving averages: simple, exponential, weighted. The concept is the same in each of them, but they differ slightly in the calculation methods.

How can you use the 200 day moving average?

The 200 day moving average is a long-term indicator that you can use to identify and trade a long-term trend.

- If the price is above the 200-day moving average, we consider buying.

- If the price is within the 200-day moving average, we look for selling opportunities.

If you trade stocks, you can look at an index to get an overall picture of the direction of the market. For example, if the S&P 500 is above its 200 day moving average, look for opportunities to buy US stocks. This simple technique will increase your chances of making a profit and also reduce possible drawdowns.

What is the best way to enter the market?

Now you're probably thinking, “Now I know how to identify the prevailing trend in the market. But how can you find a suitable entry point?

Here are a few methods you can use:

- Support and resistance levels.

- Rebound from 200 MA.

- Triangle figure.

- Flag figure.

Let's look at each of these methods in more detail.

Support and resistance levels

Support is an area on the chart with potential buying pressure. Resistance is an area on the chart with potential selling pressure.

Thus, if the price is above the 200 day moving average, we look for buying opportunities at the support level. If the price is lower, we look for opportunities to sell at the resistance level.

Rebound from 200 MA

During a trend, the 200 day moving average can act as a significant area from which the price continually bounces. This gives us the opportunity to enter the market.

The setup gains greater strength when the 200 MA line crosses the nearest support or resistance levels.

Triangle

An ascending triangle is a sign of strength and tells us that buyers are willing to buy at higher prices. Thus, in an uptrend, when the price is above the 200MA, you can find an ascending triangle and open a position to break it. Accordingly, in a downward trend we are looking for a descending triangle.

The longer the triangle forms, the stronger its breakdown will be.