Greetings fellow traders. My name is Alexander, I trade on the Forex market and leave my notes on the website Tevola.ru. Thank you to everyone who visited my site for the first time, I hope you find my site useful and highlight important information for yourself. As for the rest, you have probably already followed the trend of my recent articles.

Lately I have been delving into the description of technical analysis figures. It’s not that I’m relearning, but I still find more and more new moments that I either didn’t see before or simply ignored due to inexperience.

Description of the wedge pattern in trading

A wedge in trading is a classic breakout figure of technical analysis, in which the price is clamped into a range followed by a breakout of the trend line . It forms both at the bottom and at the top of the market. To identify it, you can use any time interval for trading

The model turned out to be popular with traders because it works equally well on cryptocurrencies, the stock exchange or the Forex currency market.

The wedge, like any reversal trading formation, can:

- Change the global trend for a long time with the emergence of a new one.

- Change the trend locally for a short period of time.

- Make a small correction and continue moving.

The main rule of trading is trading on the breakout of one of the lines against the slope , which form a graphical combination. The figure appears after a pronounced trend and in most cases indicates a reversal of the trend.

In this article we will thoroughly study this strong formation, consider the trading rules, compare it with other technical analysis patterns and the main trading opportunities of the candlestick design.

An example of a wedge on the chart of the EUR/USD pair

At the end of this lesson, let's look at the uptrend that formed on EUR/USD. The wedge breakout resulted in a huge drop of over 3,000 points.

The chart above shows a large technical analysis pattern of a rising wedge that has formed on the daily chart of EUR/USD for 10 months. There are two things I would like to point out when it comes to this particular setup.

1) Time Frame You will remember that I mentioned that the time frames you should use depend on which time frame the price respects the levels better.

The 4-hour chart above shows why we should only trade this pattern on the daily chart. Please note that the market has broken through the resistance level on the intraday chart, but on the daily chart it is only the tail of the candle touching this level.

This proves that in this particular case, the daily chart is the best solution.

2) Repeated testing of the broken level

In nine out of ten cases, the market will retest the broken level.

The chart of the EUR/USD pair shows that immediately after the breakout, the price tested the recent support as a new resistance. This is quite common in a market where there is enormous supply pressure and the bears took control when support was broken.

Of course, in the case of a falling wedge, the situation is similar, only there is enormous demand pressure.

Differences and similarities in technical analysis of wedge and triangle patterns

The wedge resembles a triangle and is even built along inclined lines according to the same rules, but has several differences:

- The model has a wedge slanted lines are directed in one direction (at an angle up or down), they always converge.

Trend lines that form a triangle cannot be directed in one direction at an angle.

- The wedge is predominantly a reversal formation and occurs at market extremes, in contrast to the triangle is mainly .

- In a triangle, the highs and lows do not increase (decrease) at the same time, unlike a wedge . For this technical analysis figure, the highs and lows are formed stepwise above (or below) the previous one, interrupting each other.

The main similarity between the two technical analysis patterns is their similar form with narrowing price ranges . At the same time, the triangle has a variation of the divergent triangle, where the price range expands. In general, both formations are formed in the form of consolidation from a narrow zone from which a sharp exit is expected.

Both figures serve as a guide for further price behavior.

Difference between wedge and triangle shapes

You can read more about the triangle figure in the article Triangles in trading

Technical analysis. Series of articles

Today's topic is the Wedge pattern in Forex. We will look at what it is, how it is formed, what signals it gives the trader and how to act if it is present on the market.

The Wedge is one of the key patterns used in technical analysis and is similar in shape to the Triangle pattern.

The wedge is a technical analysis figure that can indicate both the continuation of a trend and its reversal. It depends on the slope of the trend and the direction of the current trend.

There are two types of this model:

- ascending;

- descending.

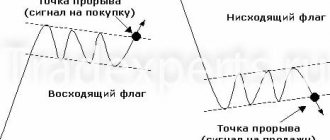

Difference between technical analysis of wedge and flag models

The absence of a flagpole and the subsequent continuation of the chart movement after a breakout distinguishes the Flag price action pattern from the Wedge.

Wedge and Flag trading patterns

The figure shows that the wedge is a tapering figure, and the flag is a rectangle at an angle downwards. If we compare a pennant and a wedge, the pennant, although a tapering pattern, indicates a continuation of the movement.

You can read more about the Flag in the article Flag pattern in trading - bullish and bearish flags in technical analysis

Why does the wedge pattern appear in trading?

Let us analyze the reason for the appearance using the example of the formation of an ascending wedge:

Initially , buyers have complete control over the situation as prices rise. After which we begin to observe that although the quotes are growing, all movements are gradually decreasing . The price is slowing down, although there is a gradual increase in highs and lows. This situation indicates that more and more large players - sellers - are beginning to enter the market. And when the movements become very short, at the current moment the strength of buyers weakens so much that a sharp impulse breakout occurs . After which the chart comes back to our cone-shaped figure and safely goes against the previous movement.

Reasons for pattern formation

The Converging Wedge Forex is considered a reversal figure of technical analysis, but for successful transactions it must be recognized in time. To do this, it is necessary to monitor trading volumes during the formation of a pattern in which the dynamics of volumes resemble the Pennant pattern. The reversal “character” is reflected in any version of the Forex Wedge pattern, it’s just that sometimes it doesn’t have enough “strength” to break the global trend and then a continuation pattern is developed. The main thing when forming a Wedge is the presence of active market manipulations - knocking down stops of small participants and gaining positions by large players.

After small Stop Loss/Take Profit orders accumulate on both sides of the range, they are regularly knocked down by speculators (max/min is updated), but shallowly, so as not to affect large interest, and the price immediately returns to the range of the Wedge Forex model. As orders from large players accumulate, the “depth” of the price drop (amplitude) decreases—the market is preparing for a reversal. Depending on the volume of positions accumulated against the trend, there will be either a change in trend (reversal wedge) or a technical correction (continuation wedge).

Types of figures

A trading figure is classified only by the further direction of its penetration and by its location on the chart .

In the direction of the breakout, the technical analysis formation is:

- Reversal formation (most common).

- Continuation of the movement (a very small part of traders enter on such structures). It is recommended to skip.

In both cases, the variety can be determined by the direction of the price breakout relative to the previous trend.

Depending on the location of the price structure on the chart, there are:

- Rising

- Descending

Rising or bearish wedge

A bearish trading pattern occurs at the top of the market, after a good bullish move.

Let's look at the main features of a rising wedge:

- Maximums and minimums gradually rewrite their maximum values .

- The figure is formed by two converging trend lines sloping upward.

- Before the formation of a contracting figure, there is a stable bullish trend.

- We always see a breakdown downwards.

Rising wedge pattern

In trading, the pattern looks like this:

As we can see from the figure, there was a trend reversal with a breakdown and return to lower support with the emergence of a new trend.

Descending or bullish wedge

A falling, bullish or falling wedge is the inverse of an ascending wedge. It appears during bear markets and at chart lows.

Let's look at the main features of the technical analysis pattern:

- gradually update their minimum values.

- The figure is formed by two converging oblique lines directed at an angle downwards.

- Before the formation of a candlestick combination, there is a stable bearish trend.

- An upward breakdown is observed

Falling Wedge Pattern

On a real chart it looks like this:

Descending wedge on a real chart

There was no retest to the broken former resistance. There was a price increase without return with small kickbacks.

We place take profit

For the wedge model, it is relatively easy to determine significant key levels, since the figure itself is formed in steps.

Rising wedge:

We pay attention to the lows of each swing. These levels are a great starting point for potential profit levels if you trade short.

Falling wedge:

Some key levels may align perfectly with these lows and highs, while others will deviate somewhat.

The classic version of trading the wedge model

Wherever the quotes move after the breakdown of the candlestick pattern, entry is made at a retest to the nearest trend line or extreme .

Trading scheme of the wedge graphic model

When an ascending pattern is formed, it is desirable to identify at least three touches of the trend lines from above (points 1, 3 and 5), as well as from below (points 2, 4 and 6). In this wedge, we see that rollbacks are reduced and the price does not make sharp movements within its boundaries. After the maximum narrowing of the structure (6-7), an impulse exits the boundaries of the figure (7-8).

It is important not to enter the market at section 7-8, but still wait for confirmation and a return to the level from the extremum 6 or the lower slope. In this case, the signal to sell the instrument will be point 9.

If we consider the falling trading model , then everything is exactly the opposite. Here our lines approach at an angle downward , but the main thing is that the entry point is always 9. The breaking of the upper resistance 2-4-6 occurs after the formation of a narrow zone of the structure. And then everything is standard - return to the level of point 6 , which indicates the end of the downward trend and the purchase of the asset is concluded.

Continuation figures

If the trading figure continues to move, then the price exit goes in the direction of the main trend . The rules for returning to the extreme level (point 5) or the slope for a retest remain the same, after which a long position is opened.

Mirror trading scheme for sale:

I do not recommend trading the model for continued movement due to the low potential of the transaction and the frequency of false entries. Trading statistics will not be on your side in any case.

Setting a stop loss

The rules for setting a stop loss are always the same, namely, it is necessary to set a safety order SL for the last extremum.

It is very important that this peak be within the wedge design.

This considered maximum or minimum can be either intermediate or at the top (bottom of the market)

Setting a stop loss for a wedge pattern

Placement of take profit

Let's look at the main methods for placing take profit:

- On a strong level. It is important to understand that there may be several such levels along the path of an asset’s exchange rate.

- The target zone is equal to the distance of the first wave. The distance from the top (bottom) point of the market in the opposite direction is plotted.

Setting take profit on the first wave - Determining the target of the transaction using Fibonacci levels. More details can be found in the article Fibonacci levels in trading, application, strategies and indicators

- Output on the opposite signal. Such a signal can be any entry point according to your strategy, a Price Action pattern or a signal according to computer analysis.

Trading Strategies

In a trading strategy there can be only two different ways in which you can work:

- Trading using the classic option of entering the market . Conservative approach.

- Look for a pattern within a pattern. That is, you must predict a reversal before a breakout of the level and a large price rise. This strategy is aggressive.

The last option has a significant advantage in its excellent mathematical expectation. You can catch a wave and get a ratio of 1d5 and higher. The main problem is that before the line is broken, you are trading against the main trend and a series of losing positions is possible.

If you trade on High time frames, then you have two options for entering a position:

- According to the market. When making a trade manually, you need to constantly monitor changes in the chart, and not everyone succeeds in this.

- Pending order.

A pending order also provides two entry options:

- Stop order. Placed before the appearance of an impulse across the trend line. But here you need to understand that at the moment of entry, the price may return sharply, forming a candle with a long shadow.

- Limit order . The order is placed at the broken level, when the price has already gone beyond the figure and we are waiting for a return.

Finding a pattern inside a wedge

Let's look at the possibilities of trading a pattern within a pattern. This basically involves three techniques for getting ahead of the breakout itself:

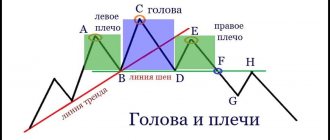

- Head and shoulders . This technical analysis model only confirms a further reversal. For more details, read the article Head and Shoulders – a reversal pattern in the Forex market.

- The presence of a bullish (bearish) engulfing, pin bar and evening (morning) star. On the third touch of the trend line or from the support (resistance) level, this formation is looked for.

- TS False Breakdown . Allows you to enter the market with minimal risks and high profit potential. In this case, the risk-to-reward ratio is 1:3 and higher.

It is in these formations that there is a greater chance of entering successfully with the least risks

We will analyze all of the above types of trading using specific examples below.

How to trade the pattern

Once you have identified an ascending or descending Wedge, you can begin trading. In this case, it is necessary to take into account several features of concluding a transaction.

Breakout trading is the simplest and most effective pattern-based action. It does not require additional indicators and oscillators. The principle is based on the fact that this technical analysis model is most often formed before a trend change. The deal is concluded in the direction opposite to the direction of the figure. So, with a bearish pattern, the asset is bought (and vice versa).

A signal for a trade is a break through the level in the opposite direction. A trader can follow one of two strategies:

- Aggressive trading strategy. The order is opened immediately after breaking through (picture above). In this case, you need to wait until the candle closes behind the level. If a descending Wedge has formed, then the resistance level is broken. The advantage lies in increased profit, the ability to enter the market at the moment a new trend emerges. However, there is also a drawback. It involves a high risk of a false breakout.

- Conservative approach. In this case, the income may be less, but the level of risk will also be reduced. A trade should not be opened immediately after breaking the line. You need to wait until the price forms a new extremum outside the Wedge and tests the line during the rollback (in our case, from top to bottom + the price will rebound). In this case, the side of the Wedge, which was previously a resistance line, became a support line after breaking through.

When opening an order, it is important to set the stop loss correctly. This is often difficult to do, since all Wedge figures differ in size, level of inclination of the sides and other construction features. The main thing to consider is to look for the point at which the strategy will stop working, which means the signals will be incorrect.

If a rising Wedge has formed, the stop loss can be set at the level of the last high. When the price reaches this point, the trend is expected to continue with a false breakout. It makes no sense to continue trading according to the chosen strategy. When a pattern is in a downtrend, the stop loss is placed at the level of the last low.

There is another way to determine the point for closing an order - the presence of a pin bar at the place where the level is tested. For example, after the formation of a bullish Wedge, the price broke through the support level and went down. Having made a rollback, it touches the former support level and forms a pin bar with a long shadow. Under these conditions, a stop loss can be placed at the top of the pin bar.

After setting the stop loss, you can proceed to finding a take profit point. This again requires studying the model. If the Wedge is rising, then horizontal lines are drawn from each low. There should be several of them. In the descending model, only the maxima are taken into account and horizontal lines are drawn through them. Take profit can be set at one of these levels.

For more accurate calculations, a trader should plot key levels on the chart. The closer the Wedge extremum indicators are to this level, the greater the chances that the price will change direction here.

Another way to determine the take profit level is to measure the height of the base of the Wedge (its wide base). The same distance is set aside from the breakout point in the direction of the new price movement.

Example of trading using a wedge pattern

According to the classics of technical analysis, you need to enter on a test of the location of the upward breakout , just as the entry was made on the trade:

The stop loss was placed precisely at the extreme, which ensured a large ratio. According to the classics, the stop should be behind the market low in the screenshot.

Let's consider trading when buying a currency pair using the Head and Shoulders model . On the third touch of the lower support line, we observe the formation of a figure with a breakdown of the neck line. The entry would be made aggressively not on the consolidation, but directly on the breakout. This model gave a ratio of stop loss to take profit of 1k4.

As we can see from the transaction, we entered the market earlier by only 10 points and did not improve the potential of the transaction much.

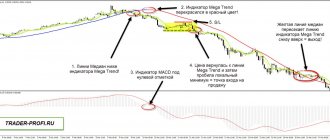

If we consider options for technical analysis absorption models, we can look at the following transaction:

Trading using TS False breakout and wedge candlestick combination

The long position at the bottom of the chart was made on the TS False Break when testing support on a lower timeframe, although later on a higher timeframe we observe a bullish engulfing . The stop loss was initially 10 points, after which it was moved to breakeven. The final ratio of stop loss to take profit was 1 to 20, which led to a good increase in capital. The second purchase of the tool was made according to all the rules of the wedge model, namely on a retest .

Concluding an order on the TS False breakout in a bullish trend. The M15 timeframe used shows that price fluctuations are beginning to narrow, which signals an imminent reversal. Support was built from the previous day's high, after which our complex sell structure was formed the next day. According to the classics, we see a breakout of the lower edge, and if we expected a rebound from it, then this would not have happened.

The screenshot shows the high accuracy of the transaction with a mathematical expectation of 1:10. The take profit location was when the price reached distance h, initially marked in the first wave.

Rectangular expanding patterns

The easiest way to identify expanding patterns is with a flat top or bottom, as shown in Fig. 10-2 and 10-3.

Rice. 10-2. Rectangular Flared Top

This thing is called a rectangular expanding pattern. Since the very concept of wild price throwing implies an extreme degree of emotional involvement, it is difficult to add volumes here. Although at the top of the market the volumes are usually quite significant.

Rice. 10-3. Rectangular flared bottom

These patterns also resemble a head and shoulders except that the “head” in an expanding pattern is the last element. In this case, the bearish signal is activated with a decisive breakdown of the pattern downwards. Volumes can be both large and small, but if activity generally increases, this will add an extra plus to the bearish impulse.

An expanding pattern with a flat top is an accumulation pattern, here it is important that the volumes at the breakout grow, as shown in Fig. 10-4.

Rice. 10-4. Rectangular expanding pattern at the bottom of the market with volumes

From experience, such patterns have a much greater impact on the market than their size might suggest. This is essentially head and shoulders in a situation so bearish (or bullish) that price simply does not have time to form a right shoulder.

The Psychology Behind Expanding Patterns

An expanding flat top pattern usually forms at the end of a strong downtrend. At the very beginning, the bear pressure is very high. Then the price jumps and rolls to the horizontal resistance line. When the bears see that the resistance has held, they pile on more short trades and send the price down again.

Once again the price rises and hits resistance, however, the distance from the second low is not enough to cover the shorts (i.e., closing short positions by buying back shares from the market, note Binguru). And in fact, if the price is not able to break through resistance, what do the bears do? That's right, they want to pile up even more shorts.

So the price falls below the previous minimum and those who caught up with the movement also want to participate in it. And it’s not surprising, because they have a situation right under their noses where for several weeks or even months bears have been making easy money by working for a bear market. And if the news also adds fire to the stove, hinting at a “sure” price drop, well, then turn out the lights.

As a result, nervous stock owners can't stand it anymore and start selling off those damned shares to anyone who would even agree to buy them. If the bears have completely captured the pattern, the public consensus will only see a future price drop. The market will remain either sellers or the most persistent shareholders who are willing to wait and believe in long-term prospects. As a result, there is no pressure from sellers at all (after all, everyone is a seller) and the reverse process begins - nervous buying occurs to cover shorts.

In other words, they throw gasoline on the fire and soon everything will burst into flames. The activator can be unexpectedly good news, a general reversal of the entire market, or other reasons. It may also be that the news absolutely sucks, but the price does not fall. This will scare short sellers, who will reason that if such news did not push the price down, then nothing will.

One way or another, the specific reason does not matter. The only important thing is that the price will start moving up and this movement will be fast and rapid. It will be fueled by short covering and strong buying of shares at such low prices. All this leads to the price strongly breaking through the horizontal resistance line and thus the pattern ends.

Buyers are in no hurry to enter, because the price has already traveled a significant distance from the previous low. However, longists do not lose hope. Traders who need to cover shorts continue to buy shares. Remember that people who short stocks aren't worried about falling prices. They are very worried about the disaster that awaits them if the price continues to rise.

All short sellers have little time left, so a rise in price from an expanding low looks like a sharp bull market to them. The only option left is to urgently cover the shorts before the price rises even more!

Why is the price rising so rapidly? The reason lies in the completely bearish mood of the market at its very bottom. By that time, traders who had bet on the increase had already left the market. Therefore, the stock is owned either by short sellers or long-term optimists. The former are not going to sell at any price, while the latter naturally have to buy shares to cover shorts.

At the top of the market, the psychology will be exactly the opposite. Here the pattern is formed after a strong market growth, everyone is so optimistic and cheerful, because as the expanding pattern forms, the price takes one maximum after another. Typically, such fun greatly upsets sellers; they place their stops immediately above the resistance, which is the previous high. But after a few attempts, the sellers give up. As a result, there are practically no sellers at the final peak. At the same time, large bearish positions act as support when prices fall. Small positions do not matter at all.

Here you go. Since the pattern formed after a strong growth, new buyers jump into it with each rise to a new high, since they do not see the risks of a fall. However, these new market participants are much less significant than, for example, the people who withstood all the final price fluctuations at the widening bottom.

New kids are lured by positive news and beautiful advertising materials, both in the media and from brokers (all these brokerage recommendations are “buy”, Binguru’s note). The pattern demonstrates strong price jumps and market participants become carefree, and the price attracts greedy and inexperienced buyers who see easy money as one gate.

For people like them, there is a wonderful term LIFO (last in, last out - last in, last out, approx. Binguru). As a result, when the price reaches the final peak, the shares are distributed mainly among poorly informed and greedy, weak owners. To make matters worse, there is virtually no support from short sellers. All this leads to the fact that the price begins to fall rapidly.

Since a flash sale takes everyone by surprise, only a few will be able to get out early. Then the price falls below the support level on the horizontal trend line and attracts sellers. But the covering of shorts, which usually happens at support levels, does not happen, because all the shorts were taken out earlier (the so-called short squeeze, forced and quick liquidation of short positions, note Binguru). As a result, the price falls down without any brakes.

The fall will be quite long and stable, since it will take a lot of time to take out the weak owners who bought shares during the formation of the final peak.

Additional filters for entering the market

The wedge is a self-sufficient confirmation of a reversal, but many traders use:

- Key support and resistance levels for technical analysis. If a pattern is formed exactly in the place where a strong level is determined, then this only increases the likelihood of a new movement in the opposite direction.

- Additional indicators. Signals of divergence and convergence, which we studied in detail in the article Divergence and convergence in Forex trading, trading strategies.

- Futures volumes . Consider a growing wedge. Volumes in it grow on ascending waves and decrease on descending ones. The strength of the pattern is given by the jump in volume at the breakout.

- Fundamental Analysis . If strong news comes out during the formation of a structure, then this signals the strength of the wedge.

And what is the result?

The Wedge figure must consist of at least 3 “waves” and contain at least 4-5 points to form the boundaries. It is very difficult to predict the moment of breakdown. If you only catch the moment of the breakdown, it often turns out to be “false”, and if you wait for a retest, then you can lose the main impulse. Additional signals from trend instruments are needed, and information about the arrangement of volumes (at least tick volumes!) will be especially useful.

May also be useful:

- oscillators with a large period (at least 10) - they are required to search for divergence situations.

- Fibo levels – will help you determine intermediate key levels

- Elliott indicators, because such patterns often occur in sections 2 and 4 of the classical wave pattern.

Technical analysis considers the Wedge to be a pattern of medium complexity - it is quite difficult to recognize, and all such trading patterns are quite unstable. Binary options are not traded this way. The disadvantage of the model can be considered a large number of “false” breakouts. The main thing is to identify the correct key points and assess what phase the current trend is in. The design of the pattern must be constantly monitored and adjusted as the price moves.

Difficulties and mistakes of trading the wedge pattern

The most common difficulties and mistakes are directly related to the psychology of the trader and violation of the trading rules of the figure:

- Difficulty in defining a graphical analysis model. Not every trader has such a trained eye to find this structure on the chart.

- Entry into the market is not at retest. After a real breakthrough, the trader often enters far from the trend line, after which he sits out the drawdown for a long time. Such actions greatly reduce profits and increase losses.

- Aggressive entry on the long shadow of the candle, without confirmation of its closing above the line. Anticipating an upcoming reversal, traders often enter at the moment when the wedge breaks out. After which we see that the price returns and closes the open order at the table loss.

- Opening a trade after a long period of time to retest the breakout point. This is contrary to the rules of the model and the pattern is already considered invalid. It is not advisable to hold and open such positions.

- Take profit too big. You should not expect too much profit; you should have clear rules for where to place an order.

- This Forex pattern is an ambiguous model because both a reversal and a continuation of the main market movement are possible.

- There is no divergent design. There is no need to try to trade this form.

Where to draw the pattern lines

When drawing such patterns, you often have to remember the drawing lessons that you didn’t like at school. Let's look at the accumulation option as an example.

What we want to draw is the inverse right triangle shown in Fig. 10-5.

Rice. 10-5. Rectangular expanding triangle shaped pattern at market bottom

Since the price moves in ragged waves, we will not be able to beautifully combine all price fluctuations. Let's say you have to skip part of the horizontal resistance zone. If you have not forgotten the psychology that underlies such patterns, then the result will still suit us. However, you must understand that we receive a rather rough, approximate model, and not a black and white signal, which is interpreted unambiguously.

Chart 10-5 shows a widening bottom for Philadelphia Gold stock...

Schedule 10-5. Philadelphia Gold shares, daily TF

and it is also on chart 10-6 for the Silver Share index.

Schedule 10-6. Silver Share Index, daily TF

In the 10-5 chart above, each of the lines is broken once in a while, but the overall pattern is undoubtedly a broadening bottom with a flat top. On the other hand, the price spike (A) on chart 10-6 is no longer so simple.

However, it is enough that the lower line continues to connect the price lows. Moreover, thanks to numerous touches, it also acts as a significant support, imbuing the entire pattern with remarkable power. As a result, when the price does break through the horizontal line, it flies away from the native in a strong, decent movement.

In chart 10-4 above for the dollar index, there are also a couple of points where the price briefly breaks the line. However, the pattern still persisted and was followed by a very strong price movement.

Rectangular expanding patterns in consolidation

These expanding patterns can also become a consolidation pattern, as shown in Fig. 10-6 for an uptrend.

Rice. 10-6. Rectangular Expanding Consolidation Pattern

Chart 10-7 shows a rectangular upper consolidation for the price of copper (CME copper futures, note Binguru).

Schedule 10-7. Copper chart, 2000-2002, weekly TF

As you can see, the price has reached as many as three price targets, so such patterns are no less important than the classic upper and lower ones. And notice the widening bottom at the end of the price decline, the angle of which was quite sharp.

If you look closely at the other examples, you will notice that there is a rough correlation between the angle of the expanding portion and the speed of price movement. In other words, the sharper the angle (i.e., the greater the volatility), the more likely it is that a large drop or rise in price will follow.