You can often hear about direct investment on the Internet and on TV. What is this term? In this article you will learn what direct investment is in simple words. With examples. Plus, we’ll find out where it’s profitable to invest directly today and where it’s definitely not worth investing.

From this article you will learn:

- What is direct investment

- Types of direct investment

- Direct and portfolio investments

- Misclassification of private equity

- Advantages and disadvantages of direct investment

- Instead of conclusions

What is direct investment

Direct investment is the purchase of shares in a company and participation in its management.

A direct investor is a person who receives income from such investments. Article navigation

- What is direct investment and who is a direct investor?

- Structure and types of investments, direct investments and their significance

- Investment structure

- Direct investments in shares, business, construction and other examples

- What determines the volume of investment in direct proportion?

- Real direct investment

- Sources of financing, market development and direct results of investments

- How to become an investor

Investments are usually divided into two general groups: direct and portfolio. The latter involve investing capital in securities in order to ultimately receive a certain income. One of the nuances is that the investor will not be able to control the enterprise and is often interested in receiving income as soon as possible. Now let's figure out what direct investment is.

The concept implies a contribution provided that the investor receives a share in the company of 10%. This is an investment in the authorized capital of an enterprise for the purpose of participating in its management. An investment is direct only if the investor plays a role in the management of a particular enterprise.

Another condition is that the company’s shares cannot be listed on the stock exchange. This method of earning money necessarily involves a test or at least a preliminary study of the niche. After all, such investments are sometimes quite risky. For example, direct investment may involve providing a loan to a local company that is just growing.

So, we have figured out what is meant by direct investment, now we will consider who a direct investor is and the main types of such investments.

Enterprise Ireland

You must understand that communicating with an investor or speaking is not about passing an exam or even about finding money. You are proposing a partnership. And as a partner you must be confident and honest

Then the process of searching for the investor himself began. Of course, the first thing that comes to mind when it comes to the IT sector is Silicon Valley and the USA as a whole. But you need to understand that the USA is one of the leading countries in the gaming industry, and this is very competitive. To increase the chances of success of the project, the search for an investor was narrowed to European countries.

The search ended when Alina saw a post on a friend’s Facebook page about an announcement of a competition for venture investments in the state organization Enterprise Ireland. This organization holds such a competition several times a year for people from all over the world and to participate you just need to fill out a form that looks like an excerpt from a business plan. The competition is held in English, so it is better to prepare a little.

After all applications have been collected, the first selection of participants takes place. Try to fill out the application as clearly and clearly as possible: what the game is about, what team it is, what the key features are, etc. The competition, although less than in the USA, is still great. A well-executed application increases your chances of passing the first selection. The second stage is a video interview. The questions are known, so you can prepare in advance.

When this stage was passed, two months of waiting began. We have frozen development for this period. And after two months, we received the result that we passed and need to fly in person to the next stage. The organization paid for the flight and hotel for one participant and the team decided that Alina would fly. In total, about 15 teams participated, 4 of them were from Russia and 3 of these teams received a grant.

I was a little unsure, because almost all the participants came in teams, and I was alone

Before going to perform, all participants were taken to a preparation room. At first Alina was nervous, but then she calmed down and during her speech she realized that she was talking about something that interested her. The letter of happiness arrived after 2-3 months.

What is direct investment and who is a direct investor?

Direct investing is the purchase of shares in a company and participation in its management. A direct investor is a person who receives income from such investments. The peculiarity of such investments is their long-term nature, as well as the ability to influence the development of the enterprise.

Companies that receive direct investment meet a number of criteria:

- They have growth potential. Otherwise, there will be no prospect of investing in their development.

- They belong to an innovative and promising industry. It’s good when the product or service is original, since there are no analogues on the market yet and there will be little competition.

- They have a business plan with a detailed description of all actions and goals.

An investor can invest in a company only if all parties to the transaction agree on its development. Everyone should be interested in increasing the value of the enterprise, otherwise it will turn out that one works, the second simply receives passive income.

Alina's story

Before joining the course, Alina worked in an outsourcing IT studio, where she and several colleagues decided to start developing the first game. They put together a small studio, which now employs 3-4 people constantly and sometimes uses outsourcing. The team thought about the concept for several months, until at a certain point the idea of a puzzle battler appeared. Examples of such games: Best Fiends, Empires & Puzzles . Then the search for the main feature began and thus we came to a solution in the form of Tetris. The prototype was assembled in two weeks, and then the search for an investor began.

Structure and types of investments, direct investments and their significance

Depending on certain factors, types of investments differ according to the conditions of occurrence and duration. You can find out more about autonomous investments here.

According to the conditions of occurrence:

- Outgoing - the investor invests in foreign enterprises. Countries in which outward investment exceeds inward investment are called donors. For example, this is the USA, Canada, China.

- Incoming - foreign investors invest in the company. Often such investments are present in promising countries that can guarantee a stable economy and, accordingly, the safety of money.

By validity period:

- Short-term: from 3 months to 2 years. This usually applies to startups or particularly promising projects that can guarantee a good income in the near future.

- Medium term: from 2 to 5 years. This is the golden mean for investors. In such a time, you can make a good profit from almost any project.

- Long-term: from 5 years. More often, such investments are chosen by large investors who are ready to invest and wait.

The higher the number of incoming investments, the faster the country's economy develops. Investors most often prefer medium- and long-term investments.

Investment structure

Activating investment activity is an important tool for economic development.

The structure of investments is the composition of investments by type and direction of use. There are 3 main types:

- Consumer goods are goods that a person can use for a long time.

- Capital - contributions necessary for construction and reconstruction work.

- Financial - purchase of assets in financial equivalent. For example, shares, bank deposits with interest.

In Russia, the structure of investments and their dynamics over the past 10 years are ambiguous. Most of the investments are in wholesale and retail trade, finance and mining. The metallurgical sector, healthcare, and educational research have become less popular.

So, direct investments include construction work, expansion or launch of new production lines, purchase of assets, products and companies with growth prospects.

Organizational aspects

The conditions for receiving the grant were as follows:

- Team must move to Ireland (optional)

- Open a legal entity in Ireland

- Open an account in an Irish bank

To everyone's surprise, opening a bank account turned out to be more difficult than obtaining a residence permit. The team received a residence permit in one day. Registering a legal entity was also easy. It is enough to hire a lawyer who draws up the transaction, then pays the fee and opens the company.

But the bank account turned out to be a pitfall. It is very difficult for a non-European resident to open an account in a European bank. In total, opening an account for a citizen of the Russian Federation took 8 months. But these torments were fully rewarded and, in addition to money, the team received a good investor.

Direct investments in shares, business, construction and other examples

Direct investments are made in the form of:

- purchase of a block of shares by a foreign investor;

- reinvestment of profits: the income received is used for business development;

- loan within the company.

Let's look at the main examples of such investments.

Investing directly in stocks can yield large returns that far exceed other investments. You can start earning income with small investments, for example, buying one share of a company. In this case, you can choose one of two ways to generate income:

- passive: bought and are waiting for dividends to be paid;

- active: promote price growth to obtain greater profits.

Among the disadvantages are unstable income in the long term, high risks due to the likelihood of bankruptcy of any enterprise, suitable for experienced investors or you will have to pay for the services of a broker.

Direct investment in construction is a more cost-effective way than, for example, purchasing a finished property. Real estate guarantees good prospects, as it has stable demand. The investor is offered a wide selection of investment objects.

Direct financial investment in a business is the most common type of investment. On the one hand, the enterprise receives the necessary funds for development, on the other, the investor participates in the development of the company and receives income for this equal to his share.

What determines the volume of investment in direct proportion?

The volume of investment depends in direct proportion on:

- changes in the share of savings;

- profitability.

In addition, the size of investments depends on the price level, production costs, and the political situation in the state.

Real direct investment

Direct investments are real investments in:

- Real estate or land. You can rent it out or resell it after the price increases.

- Intellectual property rights that can generate income in the short and long term.

- Any business or company that is engaged in providing original products and services.

Such investments do not depreciate in value the way a national currency does. The value of a property can very rarely go up or down. Accordingly, this method of investment is the most stable.

Career management

The private equity industry has become an attractive career opportunity for a wide range of individuals with training in business, finance, consulting and law.

Moreover, as the industry grows, there is a need for more and better trained professionals. This provides attractive career options, however, the future of the private equity industry is still unknown .

However, it seems clear that this financial intermediary will be a promising and important element of the global economic landscape in the coming years.

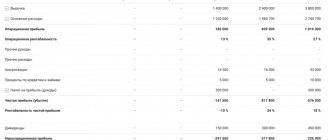

Sources of financing, market development and direct results of investments

Sources of financing for direct investment depend on the company’s operating conditions and the dynamics of its development. It can be:

- own funds or reserves within the enterprise (if it is a legal entity);

- borrowed money;

- raising profits from the issue of securities, share contributions;

- off-budget funds;

- foreign investors.

Sources of investment are closely related to financial and credit relations that arise between other participants in this process. Another equally important source is profit from core activities. The use of foreign deposits contributes to the development of international economic relations.

The emergence of the direct investment market had the greatest impact on the development of free trade, competition and stability in the economy. Under such conditions, investments help countries receive all the benefits of global economic integration.

In addition, not only finances are invested in the company, but also the knowledge, experience, and connections of the investor, because he has a stake in the enterprise and contributes to its development. The direct results of such investments are the development of the country’s economy, increased employment, and reduction of social problems. The development of advanced industries and international trade flows are also being stimulated.