Lately, Elon Musk has shown particular interest in cryptocurrencies. First, the head of Tesla and SpaceX published several positive tweets about Bitcoin, which led to an increase in its rate by $5,000, and then in the same way accelerated the price of another cryptocurrency - Dogecoin. by more than 300%. Now it’s clear why Musk was so interested in crypto - Tesla announced that it bought bitcoins for 1.5 billion (!) dollars. This is an official purchase from a company account registered with the US Securities and Exchange Commission. In addition, Tesla also stated that it plans to accept Bitcoin as payment for car purchases. But why does she need all this?

Elon Musk has been writing about cryptocurrencies for a reason over the last month

It would be one thing if this were a purchase by Musk himself, which he would have made from his own funds. But the head of Tesla does not have such a free amount. Despite being one of the richest people in the world, the majority of Elon Musk's wealth comes from Tesla shares. And the entrepreneur prefers to once again take out a loan from the bank (which he is happy to provide) than to sell shares when he needs a large sum of money. It turns out that Musk was able to convince the Tesla board of directors to make such a large purchase from the company’s funds.

Monday

Ethereum futures trading has started on the CME Chicago Mercantile Exchange.

Price data for contract trading is provided by crypto exchanges Bitstamp, Coinbase, Gemini, itBit and Kraken. After the launch of futures, the price of the altcoin began to gradually rise.

Dogecoin price doubles after Musk's new tweets

On Sunday, the head of Tesla and SpaceX published several more posts about the comic digital currency. It temporarily entered the top 10 cryptocurrencies by capitalization.

Bitcoin price breaks record after Tesla purchases $1.5 billion worth of cryptocurrency

The company notified the US Securities and Exchange Commission (SEC) that it had invested part of the funds in cryptocurrency. Against this background, its rate updated its historical maximum above $44 thousand.

Can Bitcoin replace the dollar?

And the fact that Tesla will begin to accept cryptocurrency as payment for Model 3, Model S and other cars only confirms the intentions of the company and Musk himself in the future to abandon the American dollar in favor of Bitcoin. There is only one question: is Bitcoin good for these purposes?

In fact, an alternative to fiat money has long been needed, without transfers that take 3 days and situations like “you can’t transfer money from a bank card in one country to a card in another country.” Another issue is that cryptocurrencies are not very suitable as a replacement, at least those with a floating rate. Moreover, no government in the world will allow the current money to be replaced with something anonymous and decentralized, says Pavel Dmitriev , author of Hi-News.ru .

Surely Musk had a clear argument why Tesla should buy Bitcoin, especially for such an amount. The automaker had about $19 billion in free cash at the end of 2020, so that's quite a chunk of it. And the head of Tesla is clearly not a stupid person to “buy on highs,” as traders say. But I bought it. Another toy for Elon that his company simply paid for? Or does he really have a plan, do you think? Let's discuss in the comments and in our Telegram chat.

PS In the meantime, I’ll probably leave my dogecoins, maybe by the end of 2022 I’ll be able to buy myself a Tesla with them.

Tuesday

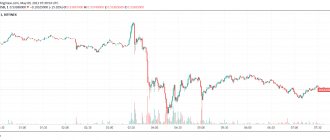

The Bitcoin rate rose above $48 thousand and updated its historical maximum

Over the previous day, the cost of the first cryptocurrency increased by 23%. It began to rise in price sharply after Tesla announced its purchase for $1.5 billion.

The Binance exchange token has risen in price by 2.6 times since the beginning of the year

The price of the BNB coin has reached an all-time high of $97. Its capitalization exceeded $14.6 billion.

Ethereum price exceeded $1.8 thousand for the first time.

Over the past 24 hours, the largest altcoin by capitalization has risen in price by 10%. The day before, trading in cryptocurrency futures started on the Chicago Mercantile Exchange (CME).

Hundreds of thousands are not the limit. Why Elon Musk is accelerating Bitcoin

MOSCOW, February 9 – PRIME, Valeria Knyaginina. Following Tesla, many technology companies will want to invest in Bitcoin, and other investors will join them. The growth, according to experts, will continue unless regulators interfere: the possibilities for issuance are finite, which means that the No. 1 cryptocurrency will only become more expensive.

Bitcoin rose above $48 thousand

Over the past 24 hours, the price of Bitcoin has increased by more than 20%, according to trading data. On Tuesday morning it was worth $48,000, but fell to $45,000 during the day. The jump in the rate was provoked by the announcement of the American electric vehicle manufacturer Tesla about the purchase of cryptocurrency for $1.5 billion. In addition, the company announced its intention to begin accepting bitcoins as payment for its products.

Tesla reportedly plans to provide greater flexibility to further diversify and increase profits with cash that is not required to maintain operating liquidity. She has chosen to invest in Bitcoin, although as a matter of policy she may invest in alternative reserve assets, gold bullion, exchange traded funds and other instruments.

EXCITEMENT OR TYPICAL SPECULATION

As a rule, such decisions in favor of the most risky assets, including cryptocurrencies, are made in anticipation of an increase in its value. This is adequate risk management for new projects. Bitcoin has risen in price by 300% in 2022 and by 664% from the year’s low of $3,782. That is, if a large company risks 1-2% of its capital, it can earn 300% on its investment.

Essentially, this is speculation - an attempt to increase profits at the expense of a non-core business. However, in the case of Tesla, the bet on Bitcoin is 90% hype and only 10% a calculation for the rise in price of the cryptocurrency, according to experts interviewed by Prime.

“We must understand that the decision to buy Bitcoin came personally from Elon Musk, who had already attracted investor interest in cryptocurrencies and individual stocks several times before on his Twitter. For Musk, this is additional PR,” explains Vladimir Ananyev, senior analyst at the investment consulting company White & Wall.

In addition, $1.5 billion invested in Bitcoin is a small amount for the fourth largest company in the S&P 500 index, the expert notes.

“AVALANCHE” OF CRYPT HUNTERS

Still, it is clear that Tesla's announcement adds confidence to investors. Against this background, the upward movement may continue. Musk's example may be followed by technology companies such as Apple and Amazon, as well as those working in the payment industry - PayPal, MasterCard, Visa. For example, the payment service Square bought Bitcoin back in October, and business analytics software provider MicroStrategy buys it regularly.

Bitcoin continues to rise in price

By the way, after MicroStrategy head Michael Saylor’s speech on February 3 about how corporations can integrate Bitcoin and what benefits they will receive, analysts spotted an impending “avalanche” of companies planning to invest in Bitcoin in 2022.

“However, no corporation will say that it plans to invest in Bitcoin. They only declare when the position is in the black by 50-70%. Everyone understands that if they make their plans public in advance, they simply will not be able to buy Bitcoin at a favorable rate,” explains Alpari IAC analyst Vladislav Antonov.

Investment banks also do not hide their interest in cryptocurrencies. If the Securities Exchange Commission (SEC) approves an exchange-traded fund (ETF) for Bitcoin, it will become an asset. And this will add recognition to it from institutional investors. This situation can be considered the biggest victory for cryptocurrencies as an asset class, the expert notes.

HIGHER AND HIGHER

Now Bitcoin is in a phase of exponential growth and it is difficult to talk about any specific price levels. According to Antonov, the nearest target levels are 59.6 and 66 thousand dollars.

“Due to limited supply, the sky is the limit. There are only guidelines around 350 thousand dollars for one BTC. After halving, 6.25 BTC is mined in 10 minutes (900 BTC per day). This is not enough to satisfy the increased demand for Bitcoin in 2022,” he explains.

Bitcoin is designed in such a way that more than 21 million of it cannot be produced, so the price will tend to rise, Ananyev adds.

“However, it is always worth keeping in mind that the volatility of Bitcoin is several times higher than that of the S&P 500 index and an order of magnitude higher than that of currency pairs. A reduction of at least half is absolutely normal for this cryptocurrency,” the analyst recalls.

A total collapse of cryptocurrency is possible if the world's central banks begin to massively ban it and introduce competing means of payment. It is unlikely that regulators will want to accept existing cryptocurrencies as a basis; rather, they will want to invent and impose their own cryptocurrencies, Ananyev concluded.

Wednesday

The cryptocurrency market has surpassed Google in capitalization

The valuation of the digital money industry has exceeded $1.413 trillion, which is higher than the total value of the IT giant's shares.

Elon Musk announced the purchase of Dogecoin for his son

The head of Tesla and SpaceX tweeted that his son could now be a baby hodler.

The head of VTB warned about the possible departure of private investors into Bitcoin

Andrey Kostin believes that this could happen if the choice on the Russian securities market narrows.

"Elon Effect"

Here are the funniest news from this series:

- In June 2016, Musk tweeted: “I would like to clarify that Tesla is working exclusively with Panasonic for Model 3 batteries. News that states otherwise is false.” The tweet sent shares of Samsung's SDI unit, which makes displays, batteries and accumulators, down 8.02%, while Panasonic shares rose 3.68%.

- In January 2022, after Musk’s advice to use the Signal messenger, investors confused it with the small company Signal Advance and raised its shares by 1,100% - from 60 cents to $7.19.

- After Musk answered questions live from users of the audio social network Clubhouse on February 1, 2020, investors wanted to buy shares of the service, but got confused and invested in the Clubhouse Media Group company and raised its shares by 100%.

Complete madness, but you can make money from this madness - Tesla thought and created...

Thursday

Mastercard will start working with cryptocurrency in 2022

The company said that it will support digital money transactions directly through its network.

The oldest US bank will begin working with Bitcoin

Cryptocurrency services will become available to Bank of New York Mellon clients this year.

Bitcoin has reached an all-time high in value

Over the previous day, the price of the first cryptocurrency increased by 4%. It rose amid news that Mastercard and Bank of New York Mellon will begin working with digital assets.

Thoughtful speculation

Firstly, Musk could have made money himself by unofficially buying bitcoins before Tesla bought them (it was clear that the price would immediately jump). Although I’m not sure that he would take the risk - after all, it’s illegal.

Secondly, feed one “bubble” at the expense of another. Support Tesla's price by enlisting the support of the crypto community. And get strong PR, since all the world's media will discuss it.

But these are all bonuses, the main thing is different.

Tesla rightly believed that the announcement of such a large deal would spur prices and inflate the current Bitcoin “bubble” even further.

Most likely, Tesla relied on the “Elon effect”: investors invest in the company after Elon Musk recommends it on Twitter.

Bitcoins in Apple Wallet

Apple Wallet, despite its popularity due to users switching to contactless payments amid the coronavirus pandemic, is not reaching its full potential. If Apple were to add a crypto exchange to its app, the service would easily outshine its competitors' offerings. Apple Wallet comes pre-installed on iPhone, and there are more than 1.5 billion active Apple phones worldwide. In the face of a rival like Apple, there will be little competition from other exchanges such as Coinbase (43 million users). Would you use Apple's cryptocurrency exchange? Tell us in the comments.

Apple could also allow you to add crypto wallets and pay with them in Wallet

The income opportunities are potentially enormous. Analysts note that Square, another financial technology firm offering bitcoin purchases, earned $1.6 billion in cryptocurrency exchange-related revenue in its most recent reported quarter. However, the Square Cash app has about 30 million monthly active users. Imagine how much money Apple could make given the size of its customer base? According to preliminary estimates, up to 80 billion dollars . For one quarter. For comparison, Apple earned $111 billion last quarter, which was its most successful period. Typically, the company's revenue is in the region of 50-80 billion dollars in 3 months.