In most materials devoted to cryptocurrencies, the expression “ fiat money ” appears. In general terms, everyone knows the meaning of these words, but for fruitful work with finances, it is better to understand the issue in more detail.

Fiat money (from the Latin fiat) is otherwise called fiduciary. These are classic means of payment, familiar to ordinary people. The fiat category includes all national currencies: rubles, dollars, euros, pounds sterling. They are issued in the form of paper or plastic banknotes, metal coins, and are also presented in non-cash form.

Fiat money is issued by the state; independent issuance is illegal. The state determines what people must pay in national currency (taxes, goods within the country). Previously, fiduciary means of payment were backed by gold, that is, behind each banknote there was a certain amount of precious metal from the state’s gold reserves. Today there is no such thing, fiat is not backed by anything, it is kept by the government and the trust of the people.

Fiat money concept

In simple and understandable words, fiat is money that is familiar to us, which we carry in a wallet or on a plastic card, or keep in bank accounts. This form of money is issued by the state for its residents and, by law, is the official means of payment on its territory. Each country has its own banknotes. For example, in Russia it is rubles, in Great Britain it is pounds, etc. And such a currency as the euro is even recognized as official in two dozen countries.

Fiat currency is also called fiduciary currency. Since it is not tied to any asset (such as gold), its use is based on trust only. The fiduciary issue of banknotes is handled by the government. That is, we, using the issued currency, trust the state that it has value.

For a snack

There is some narrative that soon people will stop trusting fiat too. There seemed to be such cases. During any revolutions, and especially during a change in the social system, one money turned into another. The country created its own currency. But one way or another, this still leads to fiat money, which exists as a means of payment.

Most likely, they will not stop trusting Fiat. And given the criticism of cryptocurrency, no one will make a full transition to its use for a long time. Therefore, it will not yet completely replace fiat and will be associated with it.

Well, they can still refuse paperwork, leaving only cashless payments. This will create much more control and eliminate the need to produce money. But, in essence, it will still be the same Fiat. Although this may be the first step towards switching to crypto.

Food for thought at the end of the article: how soon will crypto replace fiat, and is this possible? Write your guesses.

See you later!

History of fiat currency

For the first time, Plato, the philosopher of Ancient Greece, spoke about the creation of fiat. He formulated the very idea of fiat money. According to Plato, people should not keep gold or silver in their homes. Therefore, he proposed to make and issue coins, the material for which would be some less valuable raw material. Payment with such coins will be allowed only within the borders of one state.

Plato's idea was not implemented in Ancient Greece, but in the Roman Empire it was taken seriously during the reign of Diocletian. Due to the highest level of inflation and the prosperity of counterfeiting, the emperor decided that it was necessary to begin issuing special coins. They must have complex, distinctive features that would be difficult for fraudsters to counterfeit. Gold coins are called solidi. The Roman Empire set the same prices everywhere.

In addition to the Roman Empire, a single fiat currency also spread in China. This happened in the eighth century BC, when the country was ruled by the Tang Dynasty.

Until the nineteenth century, the very concept of “fiat money” did not exist. It appeared in the USA.

Let's dive into history

If we consider the history of the emergence of the financial system, it may seem that it appeared almost at the same time when people felt the need to get what they wanted peacefully. If this had not happened, we would have killed each other long ago in an attempt to get as much as possible at the expense of others.

At first, people exchanged not money, but goods and things. But then the need arose to use something more effective, and money appeared. At first it was something valuable, like gold, precious stones or something like that. But this was unprofitable: there are not enough jewels to ensure the full functionality of the financial units in question. Thus, money ceased to be a commodity and received the status of fiat money, the value of which is determined by the state.

Let's look at the path that fiat money went through before receiving its official status.

- The possibility of using fiat funds was first mentioned by Plato (an ancient Greek thinker). He said it was unsustainable to use gold as an everyday unit of payment. It is much more effective to create your own currency, the use of which is limited to a certain territory, in other words, to the state.

- After this statement, some countries actually tried to make this idea a reality, but this did not always work. One of the first relatively successful experiments was the attempt of the Roman emperor Diocletian. He ordered the use in the country only of the solidus, which was printed in Rome, and created a coin - the denarius. This decision was due to the fact that, due to a strong increase in inflation, counterfeiters became more active in the country. The solid became the only unit of account for goods. The execution of the order was monitored, and if someone did not comply with it, he was executed. Of course, execution is an excessive measure of control, but the emperor managed to ensure that all merchants complied with the terms of the law. Many people didn't like this because Roman coins had no real weight. This is how the so-called “trust money” appeared. When the situation improved a little, the law was repealed and everyone switched to the usual precious coins.

- The next attempt to introduce money based on trust took place in China, and here it finally worked as it should, albeit not for long. In the 8th century, during the Tang Dynasty, China issued full-fledged fiat money - “flying money”. This measure, as in the case of the Roman experience, was applied in order to prevent inflation. But the experiment did not last long, and again - due to the distrust of traders who preferred to deal exclusively with gold rather than backed by money.

- China did not give up, and by the tenth century the state issued fully government-backed coinage. And now she was in demand, since the authorities managed to provide her with the trust of citizens.

- Fiats: France - lire, banknotes, francs. The emergence of paper money in the country was facilitated by the death of Louis XIV and 3 billion lire of national debt. Louis XV increased this amount by creating a paper currency that was backed by gold (in theory). But in fact, the money was not backed by anything, which quickly became clear when people wanted to get gold, which was not available.

- During the New Age, fiduciary money arose in England. They were created by the Bank of England and used as a bill of exchange, which was issued to users who deposited a certain amount of gold coins into the bank. According to the terms, the bills were equivalent to the amount in the bank account. But when capitalist relations no longer suited England's gold reserves, more money supply was required than was available. The Bank of England found a way out of the situation by starting to issue banknotes without an equivalent amount of gold to back them up. Thanks to the Robert Peel Act in 1844, limits were established on the uncovered issue of the state's gold reserves. This is how the gold standard of monetary circulation emerged.

- Such money was used in the United States during the colonial era before independence was declared. True, this is not so simple. R. Michener said that in those days so-called bills of credit were used. Only they cannot be called full-fledged fiat money, although they had all the signs of the latter. In particular, they lacked intrinsic value. But not only “pieces of paper” can be called fiat money, but also billon coins, which were not mentioned.

- Stamp From Germany, issued during the First World War. Changes in the exchange rate of this money against the dollar were as follows: 1919 - 12 marks, 1921 - 263 marks, January 1923 - 17 thousand marks, August 1923 - 4.6 million marks, October 1923 - 25.2 billion marks , December 1923 - 4.2 trillion marks.

However, when the First World War began, almost every country already had its own secured money. It was military actions that caused the emergence of fiat money. Too much spending on meeting the needs of the army forced states to reconsider their financial preferences and develop money that could cover the costs of conducting military operations.

But this phenomenon was too chaotic and uncontrollable. To normalize the situation, the Betton Woods Agreement was adopted. According to the terms of this document, one dollar will be equal to 1/35 of a troy ounce. And all other fiat money will be equated to the dollar. This worked for quite a long time - until February 13, 1973. The dollar exchange rate rose above 1/42.2 troy ounce, and the agreement had to be broken due to its ineffectiveness.

To read: Daily Bitcoin exchange rate analysis

Types of fiat money

An example of fiat money is cash bills that we are used to carrying with us, or electronic funds on a plastic card. Fiat can be paper and credit. In the first case, these are cash securities with different denominations. Credit cards are issued by banks and secured by their own assets. An example of credit fiat is a bill of exchange, a bank certificate.

Fiat money can also be classified by functionality. In this case, they are divided into:

- paper cash;

- electronic means. They are used through electronic banking;

- deposit funds. They exist only in intangible form - in the form of money lying in a bank account.

Fiat and non-fiat money

Electronic money, depending on the degree of government regulation, is divided into fiat and non-fiat. Fiat electronic money, as we have already discussed earlier, is funds that are expressed in the form of state currency. And non-fiat funds no longer belong to the state payment system. They are not issued by the government, but by independent payment associations. The state does not guarantee the reliability of non-fiat money. As an example, we can cite the well-known systems “Qiwi” and “Webmoney”.

Fiat money and cryptocurrency: what is the difference

Cryptocurrency is a relatively new form of money. This digital currency appeared a little over ten years ago. Both cryptocurrency and traditional fiat have a number of differences and similarities. What they are is further in the article.

Safe use

In both cases, storing savings involves risk. It cannot be said that digital or fiat savings are completely safe. There have always been and will be those who want to own other people's money. Today there are so many different ways to steal data that even when storing savings in cryptocurrency, there is a tiny but real chance of hacking.

Convenient use

There is an obvious “plus” in favor of cryptocurrency – it is convenient to pay with it. And it’s much easier to start a digital “piggy bank.” All you need to do is go online, go to the website and carefully fill out the form provided. In total, all these actions will take literally five to ten minutes. But, unfortunately, not all organizations yet accept cryptocurrency payments.

There is more hassle with opening a “real” fiat account. To do this, you need to go to a bank branch, fill out the required documents, pay a certain fee, and then wait for the bank to approve and complete the account opening. And only then can you get a card and start paying with it.

Anonymity

Here again, cryptocurrency “wins.” When conducting digital payment transactions, personal data, although stored in the system, is securely encrypted. Information about completed transactions is not transmitted to law enforcement agencies. Anonymity is ensured thanks to the special Blockchain technology.

And when conducting transactions in the fiat system, anonymity becomes much less. For example, to withdraw cash you will need an ATM. This device will record information about the withdrawn amount, record it on a video camera, etc. And when a person pays with a card in a store, information about the transaction will immediately be sent to the bank.

Price increase

Unlike fiat currency, cryptocurrency does not depend on inflation in the state. Depreciation threatens only fiat money. When the State Bank issues new paper notes, the value of the currency inevitably decreases.

Popularity

Of course, fiat is in greater demand on a state scale. And there are often situations when, in order to pay for a certain category of goods, it is necessary to convert cryptocurrency into fiat form.

It is possible that cryptocurrency will completely replace fiat in the future. But so far there is not enough government support for this. The current legislative framework of most countries does not contain sufficient information about digital coins, so it is not yet possible to approve their use.

Centralization

Only fiat money is subject to centralized control. Its quantity and value are determined only by the state, not by people.

In the case of cryptocurrency, there is no centralized control. No government agencies control its emission. People using the platforms independently mine digital coins and pay with them only where this is permitted. All information about payment transactions is encrypted; neither banks nor law enforcement can verify it. However, due to the fact that there is no centralized control of cryptocurrency, demand for it is extremely unstable.

Security

Here lies one striking similarity between cryptocurrency and fiat. Both currencies are not backed by any real assets.

Cryptocurrency “lives” at the expense of investors, who are ordinary Internet users. The cryptocurrency rate depends only on the current demand for digital coins.

The fiat currency exchange rate depends on the state and economic policy.

Confused word

Go back 10 years and listen to people, surf the Internet. Of course, dictionaries will give the meaning of the word "fiat". But you won’t see this on forums, but on the streets the first association will be with cars. But we live today, and not 10 years ago, so this word is increasingly being mentioned all over the world.

Who should we throw all the stones at? In theory, in Satoshi Nakamoto. After all, it was he who created the first cryptocurrency. And the phrase “fiat money” is most often used today on forums dedicated to cryptocurrency. This is how we are used to dollars, rubles, euros or any other world currencies. That is, the phrase “withdraw to fiat” means exchanging cryptocurrency for real money.

What is the value of money made up of?

The fiat form of money is unsecured. What does it mean? The fact is that fiat does not have any precious metal or gold behind it (i.e. it does not back it). Fiat unbacked assets are an alternative to so-called backed currency.

If previously each banknote could be exchanged for the corresponding amount of gold, then fiat currency rests only on the trust of the residents of the state. That is, if the government claims that this is an official and legal means for payments within the borders of its state territory, then citizens are simply obliged to obey it. In fact, the entire value of fiat is determined by power. The fiat exchange rate depends on the current economic situation in the country. Therefore, any global and even small event can lead to a collapse in value, depreciation. Things like this kill people's trust in this kind of money.

The price of fiat currency depends on what you can spend it on. Cash itself is just paper. What matters is its face value.

Commodity money

Fiat currency began to circulate fully in the world in the middle of the 20th century. Before this, reference goods were used as a means of payment. They served as the basis for the formation of market prices and were called commodity currency.

Commodity currency, in turn, arose from the need for a universal equivalent of value (money), when exclusively barter ceased to be a convenient method. At first, popular goods were used as a universal means of payment, for example, glass beads, sea shells, spices, salt, cocoa beans, etc. To this day, in some African countries, camels and other livestock are used as money. In places of military conflicts, cartridges and weapons play the same role.

Over time, precious metals, gold and silver took over the function of money. Silver coins or bars were used for daily household transactions, and gold coins were used for expensive purchases.

The system of bimetallic, gold and silver standards that took shape over thousands of years did not suit everyone. In some countries, the purity of precious metals was reduced by diluting them with cheap impurities. Thus, the coins were of the same denomination, but had a smaller mass. The competitive struggle between metal currencies lasted for centuries. People saved high-grade metal money as savings, and used low-grade money to purchase goods and services.

The economic law of Copernicus-Gresham describes the situation. According to it, a less valuable currency always pushes a better one out of the market. Inadequate money continues to circulate, and good money gradually settles in reserves and savings.

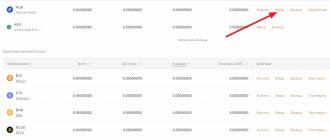

Where can I exchange fiat money for cryptocurrency?

You can make an exchange on a cryptocurrency exchange. It is important to choose a reliable platform that works with the desired currency (ruble, dollar, hryvnia, etc.). How to choose a safe exchange for exchange? First of all, you need a platform with an impressive cash flow. This means that it is popular and therefore trustworthy among people.

Here are some of the best and safest crypto exchanges that support a variety of fiat pairs where you can exchange fiat for crypto:

- Binance. This is a world leader among competitors. The advantages of Binance are low commissions and support for bank transfers in rubles.

- Bittrex. Exchange with a high level of security. Withdrawal of funds is allowed only after complete verification of the account.

- EXMO. An exchange with high turnover, supports withdrawals in a variety of world currencies, including rubles.

- Kraken. The platform has its own mobile application. Kraken offers regular users a nice bonus - the higher the turnover, the lower the commission you have to pay for completed transactions.

- Io. The exchange does not charge a commission for depositing funds via bank transfer.

- Poloniex. The exchange has strong account protection, but there are frequent freezes of user accounts.

- Yobit. It features the largest number of currency pairs, including the ruble. But Yobit's turnover is small. Judging by the reviews, the site unreasonably blocks accounts, and technical support does not in any way resolve user issues.

- Bitfinex. Full verification is also required for withdrawal. The site supports work in Russian.

How to use cryptocurrencies?

Beyond crypto trading and wealth accumulation, there are amazing uses for cryptocurrencies. Every day new channels emerge for their use.

Source: Interactive Crypto

- Investments. Cryptocurrencies have made it much easier to invest in early-stage startups, lowering the barrier to entry for new investors.

- Transfer funds around the world without international bank commissions. New developments are emerging every day, providing access to assets to millions of unbanked people. This has become an important solution for poor and marginalized people around the world.

- Trip planning. The travel industry has seen one of the most active integrations with the cryptocurrency market due to its globally decentralized nature. More and more companies that allow tourists to book flights or accommodations accept cryptocurrencies. You can even plan a trip to space!

- Marketing opportunities. With a large number of new companies emerging, the crypto market has a thriving content creation and marketing industry. Participation in airdrops and bounties gives people the opportunity to benefit from facilitating marketing activities.

- Purchases. Online markets are starting to accept payments in cryptocurrencies, and some blockchain platforms only accept cryptocurrencies in exchange for goods and services.

- Games. Online games that use cryptocurrencies are actively emerging, and some even allow players to withdraw in-game currency into fiat or other assets.

- Buying a home. Real estate is another fast-growing industry that has joined the cryptocurrency market. A number of companies are also developing token-based shared land use and construction options.

Can Bitcoin replace fiat money?

According to experts, fiat is gradually disappearing because it has become obsolete. And cryptocurrency - digital money - arrived to replace it. This is a whole universal system based on blockchain. It is not for nothing that the emergence of digital money received the loud name “financial revolution”. The financial world has since been divided not only into “fiat” and “non-fiat”, but also into cryptocurrency.

The problems due to which fiat depreciates include, for example, the collapse of the gold standard system and the disappointment of state citizens in investing. In addition, many countries literally exist in debt, which is many times larger than their own budget. In fact, such countries are bankrupt, just like their fiat currency. For example, Japan's public debt is 250 percent of its own GDP.

Bitcoin is the very first digital payment system. It uses its own coin (which received a similar name - Bitcoin) and operates through its own network, equipped with security. Bitcoin allows transactions to be carried out directly from user to user, i.e. without an intermediary such as a bank. Thanks to this, complete anonymity is maintained.

But can Bitcoin completely replace fiat money? It is not yet possible to give an exact answer to such a question. Bitcoin (Bitcoin, BTC) is now only in its early stages of development. And it is unknown how he will cope with the many problems awaiting him ahead. Despite the fact that Bitcoin is allowed to pay in a large number of stores or services, the digital coin cannot yet gain universal recognition. According to major global investors, Bitcoin has a real chance of becoming at least the single currency of the Internet.

As Bitcoin billionaire and co-founder of the Gemini crypto exchange Tyler Winklevoss noted, Bitcoin differs from the money we are used to in that in this case a person trusts mathematics, not central banks.

If we consider the “pros” and “cons” of cryptocurrency as a whole, then the following points can be highlighted as the advantages of digital coins:

- Technically, cryptocurrency cannot be counterfeited.

- Independence from inflation. The emission of many well-known cryptocurrencies has a limit. For example, for Bitcoin it is 21 million coins.

- There is no single centralized server. This means that the system cannot be hacked, and millions of users will not lose their funds. Decentralization is the key basis of cryptocurrency. Copies of the blockchain are stored on a huge number of computers around the planet. It is impossible to make even the slightest changes to the blockchain without the consent of the majority.

- The state and banks cannot subjugate cryptocurrency. Despite repeated attempts, they all failed. The fact that the crypt is not tied anywhere will save its position in any situation. Even if there is a global default.

- All operations carried out are completely transparent. Information about completed payments is stored on the blockchain. Anyone can view them.

- Almost complete anonymity. Transparency of payment transactions does not allow one to “calculate” the owner of a digital wallet. To use crypto, you do not need confidential personal data, including passport data.

Of course, digital money is not without its drawbacks. Among them:

- The dependence of the value of a digital coin on the demand for it. This entails high volatility and an unstable exchange rate. In fact, in the case of crypto, nothing can be predicted or predicted.

- It's easy to lose access to your digital wallet. If you lose your password, secret word and recovery key, then, unfortunately, almost no one can return the money lying there.

- You cannot cancel an erroneous operation and return digital coins back.

Disadvantages and advantages of fiat currency

The advantages of fiat money are:

- Relatively low volatility.

- Great demand and ubiquity. Fiat is accepted literally everywhere.

- If the physical medium (plastic card) is lost, the money will not be lost - it will remain in the bank, as before.

- If you make erroneous transactions on your account, you have the opportunity to get your money back.

If we talk about the disadvantages of fiat money, they include:

- Fiat is subject to inflation. The value of fiat currency is trending downwards.

- The growth of public debt due to the unhindered issue of new money.

- Frequent cases of fakes. Fraudsters have become so advanced in counterfeiting money that even modern security methods are not always effective.

- There is no collateral against any real asset.

- Another problem highlighted is that paper bills wear out over time. Of course, with the gradual transition to electronic banking, people will encounter this less often.

Why did states switch to fiat money?

The main reason why states opted for fiduciary money is very simple - over time, it became increasingly difficult to depend on resources. The size of the gold reserve was limited and it became more difficult to replenish it: the more countries switched to the Gold Standard, the more the reserves became depleted. In addition, precious metal transactions between states created additional costs.

The use of fiat money assumes the following: the amount of money and the level of well-being of the population are determined by a combination of factors determined by the actions of the government. In simple words, fiat currency provides more flexible regulation of value through domestic and foreign policies.

Questions and answers

What is a fiat account?

A fiat account is an account in which currency is held at a bank or other financial institution. Now more than 90 percent of fiat consists of electronic money lying in bank accounts.

What is fiat money?

This is money that is familiar to us, which we carry in a wallet or on a plastic card, and keep in bank accounts. This form of money is issued by the state for its residents and, by law, is the official means of payment on its territory. Each country has its own banknotes. Since fiat is not tied to any asset (such as gold), its use is based only on trust. That is, we, using the money issued, trust the state that it has value.