Hi all! There is a lot of talk about the fact that a successful Forex trader must earn at least 100500% profit per month. Otherwise he is a loser.

The other day, in our VKontakte group, a survey was conducted on how much % of profit per month MINIMUM a trader should earn in order to be considered successful. The results (more about them below) turned out to be very interesting. I propose to consider the issue of the size of the planned monthly profit, come down to earth and clear the path to the treasured millions.

How and how much you can earn on Forex

Trading in the foreign exchange market is a risky activity, and if you have no experience, then it is better to undergo training and training on a virtual account.

You can study for free by gaining knowledge on the Internet.

A demo account will help you test your chosen trading strategies without risk, since it works with virtual money.

The amount you decide to invest may be lost at first.

You should not start trading with your last savings. When getting started, you need to select currencies and determine the following points:

- moment of opening a position (entry point);

- condition for closing a position (exit point);

- acceptable loss per trade;

- trading period (timeframe);

- duration of holding open positions.

All this is called “Trading Strategy”

How much can you earn on Forex with 100 dollars?

The earnings of a trader with a small deposit depend on the trading strategy.

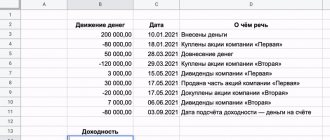

Let's look at an example of a calculation.

Select the dollar-ruble pair (USDRUB)

A sell position with a lot of 0.01 was opened at an exchange rate of 65.0976 rubles. for $1, and closed at the local minimum of 64.2237.

Income per $100: (65.0976-64.2237)/64.2237= $13.60 which is equal to 13.60% increase in deposit.

In the above example, a technical analysis forecast was used, which predicted a drop in quotes after reaching the level of 65 rubles. for $1.

If the ruble had not strengthened immediately, then the period of holding the open position would have allowed us to wait for the desired exchange rate.

Sometimes the price can travel this distance in 1 day, and sometimes in 2 months

You can calculate the profitability of other trades using the trader's calculator:

Go to trader's calculator

How much do you earn on the foreign exchange market per month?

In Forex, income is measured not in money, but as a percentage of capital growth to the deposit.

Strategies with an income of 10 to 5% per month and a stable increase in the deposit over a 2-year horizon will allow you to increase your initial capital by 2762.5%.

You can calculate the possible result yourself using a compound interest calculator.

Using an aggressive approach - accelerating the deposit - can increase the result several times more!

Trader tips

Here is my list of things you need to do to become a successful Forex trader:

- Study yourself. Determine your risk tolerance. Assess temperament. Understand real needs and goals.

- Plan your goals. Always stick to your plan.

- Choose your broker carefully. Monitor the market for better deals.

- Start real trading with small amounts. The rule is this: the deposit should grow not due to replenishment, but due to winnings.

- Focus on a few currency pairs. It is better to try 2-3 currency pairs, studying them to perfection, than to rush to all the tempting offers.

- Do not rely on robots and miracle indicators in the market. The rule is simple - if you can’t understand how it works, it’s better to pass by.

- Don't go against the market. It doesn't matter how much money we have in our stash. If you confidently go against the market, you can easily lose a million.

And, of course, don’t give up. The risk is inevitable, and so are the plums. It all depends on whether we can draw the necessary conclusions from this.

Illusions about Forex

There are several myths about electronic trading in the foreign exchange market that need to be debunked.

Statement 1: Making money on Forex is quick and easy

Profit from financial transactions is ensured by careful study of the market.

Working with fundamental and technical analysis and constantly improving your trading strategy is the path to positive results.

According to statistics from brokerage companies, less than 10% of traders complete trading positively over a 1-year horizon.

Statement 2: Success on a demo account guarantees income in real trading

Training with virtual money allows you to study the rules of the terminal and track the behavior of the chosen strategy.

Such training does not provide skills in real trading.

Fear for your money forces a novice trader to make wrong decisions.

Therefore, psychology in trading is 90% of success.

Statement 3: Only brokers win in Forex

This misconception is common among failed traders.

The loss of capital or income of a trader depends on patience, analysis and skill.

Statement 4: To participate in the auction you need to have a lot of money

On most sites, the minimum deposit is $10, which is affordable for beginners.

Margin trading allows you to enter the market with $10.

It is enough to cover 1% of the contract value. The brokerage office will add the rest.

conclusions

Despite the enormous opportunities to make money on Forex, in the long run, most still lose more than they earn, due to human psychology. Since the not entirely useful qualities inherent in people, such as passion, greed, excessive self-confidence and other similar ones, sooner or later do “their job”, that is, a trader, earning for some time, and especially having earned a lot, sooner or later succumbs to these qualities , ceases to pay sufficient attention to limiting and controlling risks, which leads to significant losses - these are unprofessional traders and it would be more appropriate to use the term “gamblers” here. These are the majority, but the minority earns money - these are professional traders who perceive Forex from the point of view of calculation, thinking with a cool head. Each novice trader chooses which one to be in the future, everything is in his hands.

Thank you for attention! Sincerely, Nikolay Markelov, author

Category:

Basic Upgrade

Factors influencing earnings

Before you start speculating on Forex, you need to decide on the following settings:

- Target return, for example, 100% per annum

- Deposit amount

- Trading strategy or advisor

Earnings depend on several questions that a novice trader has.

Deposit amount

The measure of a down payment is the confidence that if it is lost there will be no financial problems.

To learn with real money, you can deposit $100, understand trading strategies and conduct analysis.

It is better to evaluate the results on a horizon of 3 - 6 months.

If you have managed to avoid sudden losses over a long period, you can increase your deposit. In this case, it is better not to change the strategy.

Let the profitability be 9% per month. If you plan to withdraw $300 monthly, then the deposit must be at least $3500.

Trading strategy or robot

Working on the foreign exchange market involves routine operations.

To save traders from the same type of actions, assistant programs have been developed, also known as Forex experts/robots/advisors/ATS.

Their work algorithms are based on manual strategies that are translated into program code.

An automatic robot opens and closes transactions based on the settings specified by the trader based on the capabilities of a particular robot.

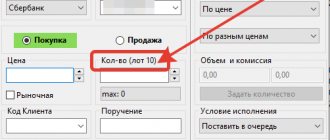

Typically, a trader needs to define for a robot:

- currency pairs,

- install lot,

- risk percentage,

- maximum number of open orders.

The parameters depend on the specific robot - read the instructions carefully.

The use of robots provides certain advantages:

- trading 24 hours 5 days a week;

- transactions based on a clear algorithm, rather than a subjective assessment;

- lack of emotional stress.

Flaws:

- inability to flexibly change strategy;

- When market behavior changes, the robot will not adjust itself.

From the author

Roman Zif

Ask a question to the author

A robot is a tool and it needs someone to control it.

Profitability of the strategy

You can choose a strategy or robot by studying the trading results of the author or other traders.

First of all, you need to study factors such as:

- Monthly profitability

- The maximum drawdown should be half the profitability

- Trading period is at least 3, and preferably 6 months

You need to understand that results in the past are not a guarantee that they will be the same in the future, but at least it is a good guide.

Willingness to take risks

Trading on the foreign exchange market makes money, but also involves the possibility of losing money.

To avoid troubles, you should use risk management recommendations:

- when using risky strategies, withdraw profits as often as possible;

- do not use borrowed funds for deposits;

- distribute the deposit into several accounts with different brokers;

- use different risk strategies and the more aggressive the strategy, the less deposit to allocate for it.

Psychology in trading

Responsibility for invested funds causes nervousness in the behavior of the trader.

To prevent emotional stress from affecting trading results, you need to know what qualities should be controlled.

Gambling, turning into mania, weakens vigilance and pushes one to make ill-considered transactions.

Greed to win is a feeling inherent in all people.

You should control yourself and work strictly on money management without exceeding the risk inherent in the strategy.

Fear and uncertainty arise among traders after a series of failures. It is important to remember that the market is changing. Patient analysis and calm calculation will help turn the situation around.

If panic occurs on the stock exchange, it is better to stop participating in trading.

Larry Williams, who increased his capital by 11,000% in a year, said: “If you want good money, know how to wait.”

You need to make more trades

Most casinos operate 24 hours a day, 365 days a year. Because the more hours they work, the more money they earn. The same applies to trading. The frequency of your trades matters. The more you trade, the more money you can statistically make.

Imagine this: You have a trading strategy that is profitable 70% of the time with a risk to reward ratio of 1 to 3. But if it has 2 signals per year, then how much money can you make with this strategy? Not much, right? You may even end this year with a loss, as there is a 9% chance of making two losing trades in a row.

The frequency of your trades is important, but it is not enough to determine how much you can earn. There are several other factors that play an important role.

How to make money on Forex without trading

In the foreign exchange market, you can earn income without participating in trading. There are a number of tools for this.

Investments in PAMM

If you have available funds, you can invest them in PAMM accounts.

The operations are carried out by a manager - a trader, and the investor receives passive income. Part of the profit is paid as remuneration.

The risk will decrease if you choose several PAMM accounts with different returns and degrees of risk.

Copying trades

To use the service, you need to open a deposit with a broker and select traders to subscribe to their signals.

Actions taken by speculators are automatically copied to the trading account.

There are two types of payment for the work of a signal provider - paid with a share of profits or a fixed commission.

Partnership programs

Attracting clients to brokerage companies will allow you to earn money without investing money in trading itself, if you have a circle of acquaintances or profile subscribers on social networks who are interested in trading on the stock exchange.

Each attracted trader brings a reward from the broker.

Many people think this is easy money and does not require investment, but in fact it is a constant huge work and large financial costs with unclear returns.

Lot size

You've already heard the expression: the greater the risk, the greater the profit. Is it true? Yes and no.

Let's say your trading strategy has a positive return and earns you 20R in a year. Your trading account size is $100,000. How much can you earn? This depends on the amount of risk in each trade.

If you risk $1,000, you can earn an average of $20,000 per year. If you risk $3,000, then you can earn an average of $60,000 dollars per year. If you risk $5,000, then you can earn an average of $100,000 dollars per year. This is with the same trading account size and the same strategy.

The only difference is the size of your lot. The more risk you take, the higher your returns.

But if your lot size is too large, there is a possibility of losing all your money completely. This means that taking too much risk lowers your expected return.

What can a beginner expect?

The first steps on the stock exchange will be confident if they are preceded by theoretical and practical preparation.

It is worth spending time studying the strategies and patterns of market behavior in previous periods.

Training on a demo account will help you identify and analyze gross errors.

To start trading, $100 in a cent account is enough. A novice trader should focus on this amount.

Don’t chase super-income, this will lead to loss of your deposit in 100% of cases, 3-10% per month is an excellent result!

After 3-6 months, the deposit can be increased by an amount that you can risk without ruining the family budget.

John Arnold

To say that he started from scratch would be to distort the facts somewhat. In fact, he had a good start, but by Western standards his family was very ordinary. My father worked as a lawyer, my mother also had no interest in stock trading.

John began his career at Enron; before its collapse, this company was a major player in the energy market. He first traded oil, then gas. The trade was so successful that he alone brought the company about $750 million. Of this, he was paid $8 million as a bonus.

With these 8 million, Centaurus Energy was founded, which Arnold headed. In 2007, he became the youngest billionaire in the world. An excellent example of how doing what you love brings not just a stable income, but makes you one of the richest people in the world. There are no exact statistics on how much he earns now, but we can say for sure that Arnold will not miss out on wealth. This is not the right person.

Is it really possible to make money on Forex?

If you consider trading in the foreign exchange market as work, and not gambling, you can get significant income.

40-60% per annum is considered an acceptable achievement among experienced traders.

Stable earnings are based on the analysis of both successful and erroneous decisions. It is necessary to regularly monitor news and learn new strategies to expand your knowledge pool.

Failures in stock trading should be considered temporary. The trend will change, and luck will definitely come.

Share or save:

- Telegram

Bruce Kovner

One of the most stable traders in the world. For several decades, he earned approximately +80% - +90% of his deposit per year. Considering his trade turnover, we were talking about hundreds of millions of dollars.

His example, by the way, shows that you can start trading at any age, not only in your youth. He became interested in stock trading after he was 30 years old . He started with a capital of only a few thousand dollars, that is, at the start he was actually no different from you, he was an ordinary person. No benefits, no inside information, just a sharp mind and a colossal desire to conquer the markets.

Today, his main brainchild, the Caxton fund, is valued at several billion dollars. Since 1983, Bruce has already brought more than $13 billion to his clients. The fund has become a kind of club for the elite; admission of new members to it is closed.

And one deal can bring in millions - Andy Krieger vs New Zealand dollar

Usually, when talking about profit, we consider a long period of time, usually several years. But there are situations when in just one transaction a trader can earn tens or even hundreds of millions of dollars. This is exactly what happened to Andy Krieger.

At that time, he was not working with his own money; he had at his disposal $750 million provided by the company. His world fame came from a deal involving options on the New Zealand dollar.

Thanks to the leverage used of 1:400, the volume of his position was so large that the kiwi dropped by 5% and there were all conditions for the fall to continue. According to unverified information, the reason for closing the short position was a call from a representative of the New Zealand Central Bank to the company where Andy worked.

The deal was closed, but Andy himself brought the company more than $300 million in profit in just 1 deal. This is an outstanding result. By the way, it was this deal that caused Krieger’s change of job. He was dissatisfied that he was given a bonus of only $1.5 million. Now he continues to successfully make money through trading, although he periodically complains that a new generation of speculators is growing up and it is becoming increasingly difficult to keep up with them.

How to make x100 in 1 year - Larry Williams' secret

If you think that it is unrealistic to increase your bill by orders of magnitude in 1 calendar year, then you are very mistaken. In 1987, young Williams set a real record working on the derivatives market.

In just a year, he increased his starting $10,000 to more than a million dollars. During this unique experiment, his account balance went even beyond $2 million, but then a serious drawdown followed as the Dow Jones index fell and the experiment was eventually completed with a balance of just over $1.1 million.

Larry has been in the markets for over 40 years and trading not only provides him with everything he needs for life, but also allows him to constantly increase his capital. He trains other traders, his opinion is valued, Williams managed to become a legend during his lifetime, that is, in addition to financial well-being, he also received worldwide recognition. This is also worth a lot.

It is also necessary to take into account that in the case of Williams, he did not have either rich parents or substantial capital behind him. He started from the bottom and became a millionaire solely by analyzing markets and predicting chart behavior.

There are a lot of such examples; Soros and the collapse of the British pound caused by his actions deserve attention. The main thing you need to take away from these examples is that the amount of earnings is practically unlimited. By working on Forex, you may well become, if not a millionaire, then at least simply solve all your financial problems.