BCS is one of the largest trading platforms and is one of the “big three” private brokers in Russia. This platform accounts for about 20% of trading volume on the Moscow Exchange.

The BCS broker has one of the most favorable conditions for “large clients”; the average account size is one of the highest among all brokers in the Russian Federation. One of the most unique services is the opening of a single account for the Russian Federation, the USA and the EU.

In this article we will make a detailed review of the BCS broker - tariffs, conditions for opening an account, trading features, etc. And we will make a general conclusion whether it is worth using the services of this site and who it will suit best.

- What is BCS broker

- How to open an account with BCS broker In the office

- Open a BCS broker account online

What is BCS broker

What is BCS broker

BCS broker

is one of the largest brokers in the Russian Federation, which serves about 108,000 private clients and is the leader in the number of legal entities that use brokerage services - 3,700 companies. According to the rating of the National Rating Agency (NRA), BCS has the most reliable category “AAA”. Provides a choice of a large number of services, from structured products to trust management. Compared to competitors, it has relatively high prices for services and a not very transparent trust management policy (according to customer reviews).

BCS broker is a project of the BCS financial group, which was founded back in 1995 in Novosibirsk. Currently it has more than 120 branches in the largest cities of the Russian Federation.

This is one of the largest brokers in Russia in terms of the number of transactions, which ranks second after the Region broker, fourth in the number of active clients (after brokers of the three largest banks of the Russian Federation (Tinkoff, Sber and VKB), and is also in fourth place in number of open IIS (individual investment accounts).

Exchange trading

BCS broker offers trading on the Moscow Exchange, St. Petersburg Exchange and international platforms on three markets:

- Stock;

- Foreign exchange;

- Urgent.

The BCS broker has two main sites

, which are necessary for working with investments.

☝️

In addition, most investors prefer to use the company’s services from their phone using the BCS World of Investments application.

- BCS Broker is an official website that provides general information about the company.

- BCS Online - functionality for managing an account and viewing reports.

- BKS mobile application

Structural products and notes

A structured product is a ready-made investment strategy with predetermined parameters; its form is an over-the-counter forward contract.

Structured products are an easy way to get started with investing. This option is suitable as a modern alternative to a bank deposit. But if it is still difficult to understand the principle described below, then it is better to focus on mutual funds (chapter above).

The essence of the structural product: the amount of the “contribution” is divided into 2 parts:

- Protective part. It includes highly reliable instruments such as bonds and bank deposits.

- Investment part. It includes high-risk assets such as stocks, derivatives, currencies, and precious metals.

The percentage of these parts is chosen by the investor himself and can regulate the risk of loss.

The minimum amount is 300 thousand rubles . In foreign currency - 8000 dollars .

To purchase a structured product, first open an account.

Then review the products on this page https://broker.ru/sp, a financial consultant will contact you and invite you to a meeting.

Several structural products available at the end of 2022. Latest information here: https://broker.ru/sp

Expert opinion

Dmitry Dunyashev

Blogger, private investor, project manager real-investment.net

Carefully read the terms and conditions of structured products for hidden fees that could reduce your final profitability or lead to an unplanned loss.

If you invest only in a structured product, then your investment is poorly diversified , unlike the same mutual funds.

Discard the product if you do not fully understand how it works and the risks!

The BCS company reports on its website that the range includes about 30 different structured products, differing in the degree of risk and denomination currency. A financial consultant will tell you about each of them in detail.

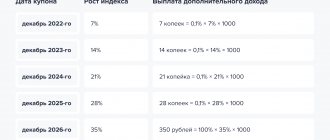

Structured notes are structured products in the form of a marketable security. From a legal point of view, structured notes are recognized as bonds. They, like bonds, provide for the payment of a coupon (interest). This type of security allows it to include different profiles and coupon payment terms.

Since the note is a security, you can buy it on your IIS and receive an additional 13% to your amount.

How do notes differ from structural products? Structured products can be either with full protection of funds, or partial (loss from 2 to 10%) or conditional (loss is not limited). Depending on the type of structured product, the potential profit changes. And in the Notes, there are certain conditions upon the fulfillment of which coupons are paid. They can also be purchased on the market using another broker.

It is possible to receive coupons for some notes quarterly.

The minimum investment amount is 80,000 rubles or 1,000 euros .

To purchase sheet music, first open an account.

How to open an account with BCS broker

Opening an account with a BCS broker

How to open an account with a BCS broker:

- Submit an application on the website to open an account in the office or open an account on the BCS Broker website online.

- Wait for the employee to call or prepare your passport, email and phone number to register online.

- Visit the office or complete the online registration process by following the instructions.

Below you will find some details on how to properly open an account with the BCS broker. Whatever method of opening an account you choose, it all starts with the “Open account” button on the BCS Broker website.

How to open a BCS account

In the office

As mentioned above, BCS offers two options for opening an account. In order to do this in the office, you need to select the appropriate option:

Open an account at the BCS office

You will see a message that an employee will call and set up a meeting time. Therefore, it is advisable to have your phone with you.

When you click, a standard form opens in which you need to provide personal information so that the company can contact you:

Filling out personal data to open a BCS account in the office

That's all, you need to wait for the call and visit the office at the appointed time, taking the necessary documents with you.

Open a BCS broker account online

A faster way is to open a BCS brokerage account online; according to the creators, this takes no more than five minutes. It is more convenient to do this using the “World of Investments” mobile application, which was previously called “My Broker”.

Download the World of Investments app for Android and iPhone

passport with you

. If you already have an account, then you need to click the “I am a client” button and enter the data. We will look at how to open a new brokerage account, for which we click “Open account”:

Registering a new BCS brokerage account

After opening a new window, enter your phone number and tick the consent to the processing of personal data. If you are interested in opening not a simple brokerage account, but an IIS (individual investment account), you need to move the corresponding slider.

Filling out personal data when registering a BCS brokerage account

After this, you need to enter the code received in SMS:

Filling out personal data when registering a BCS brokerage account

For the next stage, passport data will be required. The application offers two options:

- Upload a scan of your passport;

- Fill in the data manually.

We choose a more convenient option. You also need to indicate the source of funds that will be used for trading:

Filling out personal data when registering a BCS brokerage account

If you choose to fill in the data manually, you will need to fill in your personal data exactly as in your passport:

Filling out personal data when registering a BCS brokerage account

The user is offered different options for the source of funds to choose from; several can be selected at once:

Filling out personal data when registering a BCS brokerage account

After filling in all the data and sending it, the application will inform you about the processing of the data, which takes about two minutes:

Filling out personal data when registering a BCS brokerage account

At the next stage, you must indicate your TIN (taxpayer number). If you don’t know it, following the instructions, you can find it on the Federal Tax Service website:

Filling out personal data when registering a BCS brokerage account

Next, the application will send the information to the server and offer to check and confirm the entered data, which must be done very carefully.

Filling out personal data when registering a BCS brokerage account

In the next window, the application will notify you that the necessary documents have been created to get started:

Creating a BCS brokerage account in the mobile application

Next, you need to read the documents and “sign” them with the code from the SMS:

Signing documents when opening a BCS brokerage account

After completing all the steps described above, the service will congratulate you on the successful completion of registration and notify you that it will send personal data to the specified phone number:

Completing registration in the BCS broker application

After about five minutes, the opening of the brokerage account will be confirmed and you will need to use the received login and password to log in:

Login to BCS brokerage account

☝️

Note! The password is temporary and must be changed within one month in your personal account.

The service immediately prompts you to change your password and ask a security question.

☝️

Also keep in mind that you will not be able to immediately start trading on the same day on which the brokerage account was registered, since it will only be opened the next day.

After confirming the opening, which will be sent to the specified email, you need to log in again and make basic application settings. From now on, you can fully use the services of the BCS broker!

Services from the BCS Management Company

Trust management

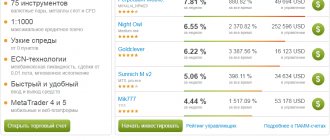

Management specialists offer several trust management strategies. The most interesting for investors are:

- “Capital preservation” is a moderately conservative strategy aimed at preserving your funds and receiving coupon income.

- “Russian shares” is an active strategy based on trading shares of Russian companies and receiving dividends.

Profitability:

The minimum amount for transfer to the trust is 2 million rubles.

The investment period is from 1 to 3 years, depending on the chosen strategy.

If necessary, the client can close the brokerage account early by terminating the contract, change the strategy or withdraw part of the earned funds. The commission amount is determined individually for each strategy.

Thus, owners of available funds from 2 million and above can choose the appropriate type of investment for themselves. Conservative investors can preserve their savings, while more determined ones can make significant profits from changes in the value of assets.

If possible, review historical returns over several years. Do you like them? Compare with other investment options.

Carefully review one-time and annual fees. They can have a significant impact on your investment returns!

If you are interested in remote control strategies, then register an account and a financial consultant will contact you and invite you to a meeting.

Mutual funds

At BKS Management Company you can purchase shares of mutual investment funds (UIFs).

Buying units of Mutual Investment Funds is one of the easiest and safest ways of investing.

You can select a suitable fund and make a preliminary calculation using the online calculator on this page https://bcs.ru/am/pif

The minimum investment amount in different mutual funds ranges from 50,000 to 1 million rubles . Commissions include the remuneration of the management company (1.5 - 3%), as well as the registrar and depository (0.2 - 0.5%). A nice plus is that if you own shares for more than 3 years, there is no need to pay personal income tax when selling.

Listed below are Open-End Mutual Investment Funds for which returns are known. There is no point in considering the rest without knowing the prospects for investment.

| Name of Open Investment Fund | Opening year | Briefcase | Risk | Average annual return | Details in .pdf |

| BKS Basis | 2003 | grew up bonds, foreign bonds, government bonds | moderately conservative | ~26% | |

| BCS Empire | 2011 | shares and bonds of promising global and Russian stocks | rational | ~16% | |

| BCS Perspective | 2000 | shares of mature and growing US companies | moderately aggressive | ~48% | |

| BKS Technologies of the XXII century | 2003 | shares of young and fast-growing US companies | aggressive | ~21% | |

| BKS Precious metals | 2013 | ETFs that invest in precious metals. metals and repeating their dynamics | moderately aggressive | ~12% | |

| BCS Russian shares | 2005 | shares of leading growth companies with growth potential | aggressive | ~36% |

* profitability is indicated without taking into account premiums and discounts (commissions) and is calculated by simply dividing the fund’s operating period by the total profitability for the entire time.

To purchase a mutual fund, you need to first open an account, then a financial officer will contact you. consultant and invite you to a meeting where you can find out the detailed conditions of the mutual fund you are interested in and buy shares.

Mutual Fund "Osnova"

Let's consider this mutual fund as an example. According to the chart below, the average annual return over the fund's 15 years of operation was ~26% . Very good with fairly wide diversification. The minimum wage is 50 thousand rubles.

View the detailed prospectus with manager commentary and fund structure.

When calculating the real return on your investment, take into account all broker commissions!

In general, BKS Management Company offers a fairly large selection of mutual funds. You can buy a share here even with a small amount. This type of investment is characterized by high reliability and minimal risks. The client does not need additional knowledge in the field of trading and investing. Over the past year, many mutual funds from BCS have been included in the rankings of the most profitable according to the website investfunds.ru:

BCS broker's personal account

Trading through the BCS broker

Let's look at how the BCS broker's personal account in the mobile application is structured, since most investors prefer management from a smartphone. The BCS broker has a typical personal account structure, but what stands out is that the assets are clearly divided by type:

- Stock;

- Currency;

- Bonds;

- US shares (traded through the St. Petersburg Stock Exchange);

- Futures;

- Eurobonds;

- Notes (a conditional contract with a change in the value of a basket of assets)

- mutual funds;

- ETF;

- Goods;

- Indexes.

Structure of the BCS broker's personal account

Assets can be added to favorites by clicking on the star next to the name. All selected products are located in the “My” tab:

Featured Assets

In your personal account you can also find information that will help you create a portfolio. So, there is a tab “News”, “Technical analysis”, “Invest ideas”, where various recommendations are given.

The “Portfolio” tab contains purchased assets. Here you can see the price of products, changes per day, the investor’s current earnings, and the amount of commission paid:

Portfolio at broker BCS

Also in the BCS broker’s personal account there are additional tabs, such as “Help” and “Calendar”.

Your personal account also has basic settings where you can change personal data and link a BCS bank card.

Settings in the personal account of the BCS broker

After the BCS bank card is linked to the account, it will appear in your personal account:

BCS bank card

After this, the “My Accounts” tab will become active:

“My Accounts” tab in the BCS broker

Also watch the video for a full overview of the BCS broker app, including how to use it for trading:

BCS broker review

Bonuses at BCS Forex

The company offers customers as a special offer. This will make it possible to replenish your deposit and withdraw funds without any commissions.

BCS Forex also has a special loyalty program that allows clients to return up to 50% of the spread from each transaction and receive tripcoins for travel. One tripcoin is equal to one ruble. “Tripcoins” can be spent on air travel, hotel and train tickets.

The disadvantage of the program is that it is available exclusively to VIP clients who have made a deposit of at least 20 thousand US dollars. The disadvantages include the fact that if the tripcoins are not used by the client within twelve months from the date of accrual, the company will cancel them.

BCS broker tariffs

BCS broker tariffs

BCS broker offers three tariffs for different tasks. Any of the programs described below allows you to trade on all platforms and markets with which BCS works.

Investor

— most suitable for users who have a monthly turnover of up to 500,000 rubles and make a small (or no) number of transactions. The commission is 0.1% of turnover, and there is no fixed payment.

Trader

— an ideal tariff for active users who use several platforms for trading at the same time. The size of the commission depends on the trading volume - the larger it is, the lower the commission. The rate ranges from 0.015% to 0.05%. The amount of the fixed monthly payment to the broker is 199 rubles, if at least one transaction was completed.

Investor Pro

— suitable for clients whose deposit is at least 900,000 rubles. This tariff is different in that the amount of the commission does not depend on the volume of transactions carried out. The commission for this tariff ranges from 0.015% to 0.3%, plus a fixed payment of 299 rubles per month for transactions.

Trader Pro

— ideal for users who actively trade on specific platforms. Even with a small deposit, you can trade profitably. The commission ranges from 0.015% to 0.045% of the transaction volume. You also need to pay the broker 299 rubles monthly when performing transactions.

☝️

Attention! Some users report hidden fees, so you need to read the terms of the chosen tariff very carefully. You will find more detailed information about BCS broker tariffs on the website.

At the end of each day, the service generates a report, which, among other things, contains information about the commissions paid. Clients also receive a monthly report, which is generated within the first ten days of the next month.

Training and Analytics

FG BKS offers a variety of educational programs in the form of seminars and webinars. Webinars are mostly free and of an educational nature, but the seminars are structured as serious multi-day classes. For example, a complete training course for trading in the stock market is divided into 10 lessons. During them, students receive both basic theoretical information on technical and fundamental analysis, and the opportunity to practice online trading skills in the QUIK terminal. The cost of the course is 10 thousand rubles, which can be called a quite reasonable price, given the large amount of information.

Regular market analytics are published on the specialized website bcs-express.ru. The main economic news, technical analysis of securities of Russian and foreign issuers, as well as investment ideas are presented here. As a rule, the materials presented are prompt and help you quickly navigate the current situation. In terms of the quality of analytics, BCS can easily be considered a leader among Russian brokers.

Topping up a BCS brokerage account

How to top up an account with a BCS broker

How to top up a BCS brokerage account:

- From a bank card.

- Through the fast payment system.

- From an account at BCS Bank.

- Via bank transfer.

These are four ways that allow you to top up your BCS broker account.

You can top up from the card using the “World of Investments” application, and the amount of the commission will be indicated immediately when making the transfer.

Another convenient way to top up, which is also more profitable than the previous one, since you don’t need to pay a commission, is fast payments through online banking. When used, you will be redirected to your bank's app (if installed) or you can scan the generated QR code.

If you have an account with BCS Bank, then the replenishment will also be without commission. You can carry out this operation in the BCS Bank mobile application.

When replenishing using the details, no commission is charged by BCS, however please note that your bank may charge a commission separately.

☝️

When replenishing your account through the World of Investments, there is a limit on replenishment - no more than 600,000 rubles per transaction (including commission). When replenishing an IIS, there is a limit of no more than 1 million rubles per year.

You can top up your brokerage account with the BCS broker in foreign currency and rubles, with the exception of IIS, to which you can only transfer rubles.

Trading platforms

On the company's website you can select and download several types of trading platforms.

One of the most popular terminals is QUIK . Provides access to stock and derivatives markets, lists of instruments, and current data on the progress of trading online. There is a Web QUIK application for mobile devices; you can download and use it on iOS and Android. The cost of using the terminal is 300 rubles per month, the mobile version is 200 rubles. The payment amount may be reduced by the amount of commission that the client paid to the broker for that month.

Important! If the amount in the account exceeds 30,000 rubles, QUIK is provided free of charge. For the mobile version, this amount is 100,000 rubles. However, this only applies to the first terminal. When downloading again, you will have to pay QUIK in full monthly.

You will have the opportunity to practice using a QUIK demo account - you can open an account in literally 5 minutes online.

Not long ago, BCS launched its own mobile application, My Broker . It supports many of the features of Web Kwik, but in a more simplified way. Suitable primarily for beginners and additionally for those who already use Kwik. In the application you can buy currency at a favorable rate. Free to use !

Expert opinion

Dmitry Dunyashev

Blogger, private investor, project manager real-investment.net

The Quik trading terminal is more professional and has more functionality. My Broker is a simpler application and if you plan to rarely make transactions, then My Broker is suitable for you.

To trade on foreign exchange markets, some are accustomed to using the MetaTrader 5 . The program makes it possible to use technical analysis tools. Orders are placed in 1 click from the chart or through the order book. You can customize the trading interface the way you want. An application has been developed for iOS and Android. The monthly cost will be 200 rubles. However, if the client made transactions, the fee is reduced by the amount of the commission.

If you have not decided which trading platform to use, the BCS broker will help you make your choice. To do this, you will need to answer a few simple questions on the site:

- Do you have experience in stock trading?

- What markets do you want to work in?

- What instruments do you want to trade with?

- What OS is on your computer.

Based on the results of the questionnaire, you will be offered to download one or another terminal.

Click to enlarge

If you are of the old school, you can buy shares (make any transactions) by phone, tracking express stock quotes online here: https://bcs-express.ru/kotirovki-i-grafiki

Withdrawing funds from BCS broker

Withdrawal of funds from BCS

You can withdraw funds from BCS broker to your current account

in several ways:

- Through the World of Investments application.

- Through the BCS Bank application.

- Via Quik terminal.

- By phone.

- At the BCS office.

☝️

These methods are only relevant for a regular brokerage account. When working with IIS, funds can be withdrawn exclusively at the BCS office by writing an application for liquidation of an individual investment account.

There is no commission when withdrawing funds in rubles. If funds are withdrawn in foreign currency, the commission depends on the selected tariff plan.

Customer Reviews

In 2022, you can find quite diverse customer reviews on the network about the work of the broker and the group companies. Among the advantages, clients note an established system of work, ease of depositing and withdrawing money, and the ability to work through the application. Owners of units in mutual funds note the convenience of the site and favorable conditions.

At the same time, some clients are dissatisfied with the quality of service, the discrepancy between analysts' forecasts and the results obtained, the lack of information and the lack of transparency.

Overall, the ratio of positive to negative reviews is comparable to other leading brokers. Some of the negative reviews are caused by the loss of deposits associated with market risks. In addition, high commissions for remote control can significantly reduce the client’s income over several years and he himself may not realize this.