Hello, dear friends! In trading, one of the components of success is correct risk management. What's the point of being able to identify good entry points if you then lose all your profits in 1-2 trades? In risk management, Forex lot calculation plays an important role. You must understand based on what considerations the transaction volume is selected and how it is done. Let's look at this in more detail today.

In addition to Forex, we will also touch on the stock market. On it, the volume of the position depends on the specific site and the company’s securities. Those who are going to start working with stocks need to take this into account.

Lot on Forex

This term refers to position volume . We agreed to assume that 1 lot is equal to 100 thousand units of the base currency in the pair (the base is the currency that comes first in the designation of the currency pair). Examples:

- 1 lot of EURUSD is equal to €100,000 or $113,630 (the euro/dollar exchange rate at the time of preparation of the material was 1.1363).

- 1 lot of GBPUSD is already equal to £100,000 , taking into account the current rate of $1 = 1.3203 in dollars, the lot will be $132,030.

- for USDJPY everything is simpler - a lot is equal to $100,000 .

- According to the cross , for example, AUDNZD 1 lot means 100,000 Australian dollars, taking into account the AUD to American exchange rate, this amount is $70,757.

Fractional units

In addition to the standard volume of 100 thousand currency units, fractional values are also used:

- Mini . As for how much currency a mini lot is equal to on Forex, compared to a standard or classic one, it is reduced by 10 times and is equal to 10,000 units of the base currency.

- Micro - unit of volume in this case is reduced to 1000 .

In order to lower the entry threshold, brokers allow trading with leverage , that is, borrowed funds are used that the company temporarily issues to the trader. An article on how to use leverage will soon appear on the site, I recommend that you read it.

Brokers open so-called cent accounts so that traders can practice trading with real money without large investments. For clarity, I will give the characteristics of a sell transaction with a volume of 1 lot for a regular, mini and micro account for the EURUSD pair. As you can see, all indicators are simply reduced by 10 and 100 times, respectively. On the one hand, we get a smaller load on the deposit, on the other hand, the profit also decreases.

| Characteristic | Classic score | Mini account | Micro account |

| Contract size (amount of currency in a lot), $ | 113 650 | 11 365 | 1136,5 |

| Deposit, $ | 11 365 | 1136,5 | 113,65 |

| Point price, $ | 10 | 1 | 0,1 |

| Swap, $ | +1,95 | +0,195 | +0,0195 |

Units

Kilogram

In the SI system, mass is expressed in kilograms. The kilogram is determined based on the exact numerical value of Planck's constant h

, equal to 6.62607015×10⁻³⁴, expressed in J s, which is equal to kg m² s⁻¹, with the second and meter being determined by the exact values of

c

and Δ

ν

Cs. The mass of one liter of water can be approximately considered equal to one kilogram. The derivatives of kilogram, gram (1/1000 of a kilogram) and ton (1000 kilograms) are not SI units, but are widely used.

Electron-volt

Electronvolt is a unit for measuring energy. It is usually used in the theory of relativity, and energy is calculated using the formula E

=

mc²

, where

E

is energy,

m

is mass, and

c

is the speed of light.

According to the principle of equivalence of mass and energy, an electronvolt is also a unit of mass in the system of natural units, where c

is equal to one, which means mass equals energy. Electrovolts are mainly used in nuclear and atomic physics.

Atomic mass unit

Atomic mass unit ( a.u.m.

) is intended for masses of molecules, atoms, and other particles. One a. e.m. is equal to 1/12 the mass of a carbon nuclide atom, ¹²C. This is approximately 1.66 × 10 ⁻²⁷ kilograms.

Slug

Slugs are used primarily in the British Imperial system in Great Britain and some other countries. One slug is equal to the mass of a body that moves with an acceleration of one foot per second per second when a force of one pound-force is applied to it. This is approximately 14.59 kilograms.

The mass of the Sun is 1.9884×1030 kg

Solar mass

Solar mass is a measure of mass used in astronomy to measure stars, planets and galaxies. One solar mass is equal to the mass of the Sun, that is, 2 × 10³⁰ kilograms. The mass of the Earth is approximately 333,000 times less.

Carat

Carats measure the weight of precious stones and metals in jewelry. One carat is equal to 200 milligrams. The name and the size itself are associated with the seeds of the carob tree (in English: carob, pronounced “carob”). One carat used to be equal to the weight of the seed of this tree, and buyers carried their seeds with them to check whether they were being deceived by sellers of precious metals and stones. The weight of a gold coin in Ancient Rome was equal to 24 carob seeds, and therefore carats began to be used to indicate the amount of gold in the alloy. 24 karat is pure gold, 12 karat is half gold alloy, and so on.

Soft metric weight labeling on food products in Canada

Grand

The grain was used as a measure of weight in many countries before the Renaissance. It was based on the weight of grains, mainly barley, and other popular crops at the time. One grain is equal to about 65 milligrams. This is a little more than a quarter of a carat. Until carats became widespread, grains were used in jewelry. This measure of weight is still used to this day to measure the mass of gunpowder, bullets, arrows, and gold foil in dentistry.

Other units of mass

In countries where the metric system is not adopted, the British Imperial system is used. For example, in the UK, USA and Canada, pounds, stones and ounces are widely used. One pound is equal to 453.6 grams. Stones are used mainly only to measure human body weight. One stone is approximately 6.35 kilograms or exactly 14 pounds. Ounces are primarily used in cooking recipes, especially for foods in small portions. One ounce is 1/16 of a pound, or approximately 28.35 grams. In Canada, which formally adopted the metric system in the 1970s, many products are sold in rounded imperial units, such as one pound or 14 fluid ounces, but are labeled with weight or volume in metric units. In English, such a system is called “soft metric ”

), in contrast to the “hard metric” system (English

hard metric

), in which the rounded weight in metric units is indicated on the packaging. This image shows "soft metric" food packaging with weight in metric units only and volume in both metric and imperial units.

Bibliography

Author of the article: Kateryna Yuri

Method for selecting a safe lot

I constantly advise beginners to first prioritize not profit, but the reliability of trading . This means that at the start, and then too, you need to reduce the risk to a minimum, preferably within 1-2% of the deposit per transaction.

In the example, we will look at how to calculate a safe lot for the same transaction for deposits of $200 and $1000 . The entry point is shown below - buy at a retest of support after a reversal pattern.

Initial data

- SL – 52 points , USDJPY at the time of calculations is 111.85 . Classic account type .

- Deposits – $200 and $1000 .

- The acceptable risk for the transaction is 2% of the deposit .

- It is necessary to perform a lot calculation on Forex - to determine the maximum volume under which money management will not be violated for these conditions.

Procedure

- We determine acceptable losses in the deposit currency. For our example, the SL in cash is 0.02 x 200 = $4 and 0.02 x $1000 = $20 .

- One point under such conditions should cost no more than 4/52 = $0.077 and $0.385 for deposits of $200 and $1000, respectively.

- From the formula for calculating the price of an item, we derive the dependence for determining the maximum allowable volume.

Point Value = Lot x Pips / Exchange rate to dollar

From it we get:

Lot = Point Value x Exchange rate to dollar / Pips

In our example , for a deposit of $200, the maximum allowable volume for a transaction will be:

Lot = 0.077 x 111.85 / 0.01 = $861.245 or 0.0086 lot .

For a deposit of $1000, using the same formula, the volume will be:

Lot = 0.385 x 111.85 / 0.01 = $4306.22 or 0.043 ≈ 0.04 lot .

A problem arises - the broker set the minimum volume at 0.01, and for a deposit of $200 it should be 0.0086. So you will have to either reduce the stop, or miss the signal, or top up your account. As an option, a small violation of the MM , but this is where the loss of the deposit begins. Small deviations from the rules eventually turn into complete disregard for them . I recommend reading my educational program about margin calls to understand the dangers of violating money management.

I deliberately showed the most detailed calculation possible . After a little practice, you can estimate the transaction volume almost in your head. But you need to understand the theory. The video below shows a couple more examples with calculations.

How to make calculations easier?

For the convenience of traders, brokers post online calculators on their websites. I will briefly go through the functionality of each of them.

- Forex4You – depending on the account type, all indicators are displayed, including swap in both directions.

This Forex lot calculator allows you to track the result of 5 transactions simultaneously . The volume, entry and exit prices are indicated, and as a result, in addition to the swap, spread, and margin, we also get the expected result for each transaction and for the portfolio as a whole.Start trading with Forex4you

- U Exness The functionality is similar to what Forex4You offers, but you can additionally select deposit currency, and the calculations will be shown there.

Open a cent account with Exness

- IN AMarkets The calculators were divided. Separately for margin, volume, point value. In addition to this there is also third party algorithms, but I would recommend using your broker's calculator. It is guaranteed to take into account local peculiarities.

For example, there is an option to select a cent account or deposit currency; this may not be available in custom algorithms.

We have already discussed what a cent account is in Forex. Open an account with Amarkets

]]>Advisors and scripts for lot calculation

A simple script to calculate lot size

From the rules for money management when trading on financial markets, it is known that it is better not to risk more than 1-3% of the deposit amount in one transaction.

Accordingly, the task is set how to calculate the size of a trading lot taking into account the established risk in percentage. If you have already figured out how this is done, you can simplify the process using a special script that calculates the lot size for opening a transaction depending on the percentage of the deposit.

The script is installed in the Meta Trader 4]]>\MQL4\Scripts folder. After that, restart the terminal and find “raschet_lota” in the Scripts section.

Drag the script onto the chart of the currency pair for which you want to calculate the lot size.

The percentage of the deposit you want to risk is set in the MaxRisk variable (the default value is 5, i.e. 5% of the deposit).

Calc indicator for MetaTrader 4

The Calc indicator, or as it can also be called a “Graphical calculator,” performs a very useful job; it calculates the level of stop, profit, as well as the level at which a stop out occurs, if, for example, a trader does not set or forgets to set a stop loss.

Mt4mm - script for calculating the position size of the Forex currency market

A plugin for MT4, which interactively allows you to calculate the lot size for the selected instrument depending on the current balance (or equity) and loss limit, and then place an order with the specified parameters (or several orders simultaneously for one instrument).

How to set the transaction volume in MetaTrader

This parameter is specified in the order settings field:

- Click Trade — New order.

- In field Volume either select it from the drop-down list, or specify it manually. You cannot set a lot below 0.01.

- All that remains is to put stop And take profitand then press Sell or Buy.

If the 1-click trading mode is activated, the volume is indicated in the upper left corner. The corresponding field is located between the Buy and Sell .

When trading, do not forget to take into account the difference between Bid and Ask prices . Read the post about the spread when buying an asset, where this issue is discussed in more detail.

The best brokers with minimal spreads and slippages

Below I will list 2 companies with good trading conditions.

Exness

Cent , Mini , Classic , ECN accounts , the leverage is adjustable in a wide range. In addition to dozens of currency pairs, CFD on crypto and other instruments is available. The commission on ECN accounts is $25 per million traded , the spread on the majors is very narrow, less than a point during peak activity hours.

Open a cent account with Exness

AMarkets

Standard , Fixed , ECN (from $200), Institutional (from $100,000) accounts The spread is slightly higher than that of Exness; for majors it does not fall below 1.3-1.5 points. Trading is carried out in currency pairs, there are CFDs for crypto , metals, indices and other instruments.

Get started with Amarkets

I would also like to note the very fast execution by both companies. There is practically no slippage .

Volumes on the stock exchange

We’ve figured out what a lot is in Forex, now let’s find out what it means when working with stocks. The difference is that its value is not fixed , it depends on:

- Venues . For example, on AMEX , NYSE , CME , NASDAQ , the lot volume is fixed and is 100 shares. On the MICEX after 2011, it may include 1, 100, 1000 securities.

- How many shares are in a lot depends on their value. The cheaper the papers, the more there are in the lot .

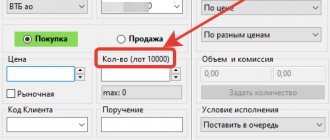

This information is indicated in the paper description. Above is an example for Sberbank , 1 Lot includes 10 shares .

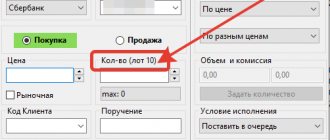

Inter RAO paper is cheaper than Sberbank. Therefore, 1 Lot already includes 1000 shares :

In the stock market, as in Forex, trading in incomplete lots is possible. So the trader can regulate risks here too.

How does equity change depending on lot size?

Equity is the free funds on deposit received after deducting the margin from the total balance. The lot size affects the equity precisely through the margin, which is the key to completing the transaction.

Margin is affected by two factors:

- Lot size,

- And leverage.

By multiplying the deposit by the amount of leverage, we get the amount that we can manage when concluding transactions.

That is, having a thousand dollars on deposit, with a leverage of 1:100, we already receive 100,000.

To enter the market with a mini lot, you will need a deposit of $100. This is the margin.

Accordingly, if the leverage increases to 1:1000, we have 1 million on the conditional deposit, and entering the market with a mini lot, the margin will be only 10 dollars.

It turns out that the larger the lot size on Forex, the higher the margin required to secure the transaction, and therefore the equity decreases.

At the same time, working with the same deposit and lot, but different leverage, the margin level will change. At 1:100 and a lot of 0.1, the margin will be approximately 100 (depending on the real value of the lot on the selected asset) dollars, and at 1:1000 only 10.

Brokers for working on the stock market

It is better to start working on the stock exchange with a trusted broker. I suggest you choose one of the following companies:

- BKS – the best choice for the Russian market. In addition to Russian securities, you can also work with the US market.

I will note a single account from which work is carried out through QUIK; you can trade securities of Russian and more than 800 American issuers (through the St. Petersburg exchange ). The commission is 0.07% for turnover up to $15,000 and decreases with increasing turnover. You can also work on Forex, and the deposit in this case is from $1. Leverage 1:1-1:200 . It is possible to work with ETFs .

Open an account online at BCS - Just2Trade – ideal for the American market. It also supports working with ETF.

Leverage is up to 1:50, and among the features I will highlight the MMA account (single account), through which access to any trading platform in the world is organized. To start trading, just top up your account with $200 .

The minimum lot of shares depends on which platform you connected to. Open an account for the US market on just2trade

Start your acquaintance with the stock market with one of these companies - you won’t go wrong.

Summary

Understanding what a lot is in trading is necessary in order to adequately build your risk management . This will allow you to calculate the volume in each transaction so that money management is observed, and set a stop without violating the strategy.

The situation is the same with the stock market. The only difference is that a lot is calculated in a certain number of shares, and not in units of the base currency. If you have any questions about calculating transaction volumes, I will be happy to answer them in the comments . Don't hesitate to ask anything that seems unclear. Don't forget to subscribe to my blog updates. Materials are published regularly, and a subscription ensures that you do not miss the next publication. With this I say goodbye to you, all the best and see you soon!

If you find an error in the text, please select a piece of text and press Ctrl+Enter. Thanks for helping my blog get better!

Recommendations:

Finally, I would like to add a few useful recommendations that will help you set up your risk management system even more effectively:

- In order not to increase risks, we recommend rounding the calculated lot size down. That is, returning to the last example, we remember that our lot size turned out to be 0.918, which means we round it up to 0.91;

- We also advise you to test your strategy on history and determine the average stop loss value, which will save you from the need to substitute new values every time. Having calculated your average stop loss, all you have to do is substitute the deposit size and the acceptable risk value into the formula, while the stop loss, the minimum cost of one point and the minimum lot will already be known;

- In addition, it is very important to take the spread into account when determining the size of the stop loss. For example, if your stop loss is 30 pips and the spread is 2, then the calculated stop loss value will be 32 pips;

- And finally, do not take risks beyond the limits you personally set as part of your trading strategy. Never, even with one hundred percent confidence in control of the situation. By limiting your intemperance in the short term, you will reap the benefits in the long term!

- Also, if you do not want to calculate risks manually, we recommend that you use a convenient calculator to calculate a trading lot.

Thank you for your attention and see you again, friends!

Best regards, Alexey Vergunov TradeLikeaPro.ru