olegas Apr 30, 2015 / 140 Views

A lot is a unit of measurement for a contract concluded on an exchange or the Forex currency market. The lot size on the stock exchange is expressed in units of the asset being traded and is determined by the regulatory documents of the exchange.

The term lot, like many other modern exchange terms, has its origins in English. Translated into Russian, the word lot means a set of something (in this case, a set of units in which a specific asset is measured).

The size of one standard lot on the Forex currency market is equal to one hundred thousand units of the base currency (more on this below). Due to the widespread use of Internet trading, many Forex brokers have introduced the concept of microlots. The cost of a micro lot is significantly less than the cost of a standard Forex lot, which makes Forex trading more accessible to the general public.

In addition, the accessibility of trading is greatly facilitated by the leverage provided by Forex brokers (for many it reaches 1:1000). For example, with a leverage size of 1:1000, to purchase one standard lot, a trader only needs to have an amount of only $100 in his account.

What is a lot on the stock exchange and a typical mistake of a novice trader

Friends, I have come across the fact that not everyone uses basic knowledge in their trading.

Everyone immediately comes to the market to get money. It turns out that not all beginners know what a lot is on the stock exchange. I don’t remember if I had such a mistake when I just started trading stocks. But I remember that after trading for a long time on some shares, and then switching, for example, to VTB, I forgot that the number of shares in a lot here is completely different than, for example, in Sberbank. It’s good that when placing orders in the window, the number of lots is still shown. Another thing is that you can simply be inattentive.)

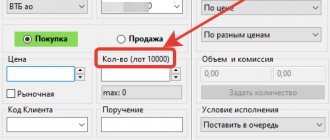

When placing a simple order, the number of lots is indicated (using the example of Sberbank)

And beginners in trading very often make a mistake in their very first transactions. This is especially dangerous when the account is small! They believe that they are selling or buying shares individually. But in fact, they sell or buy in lots. But these same lots include a certain number of shares.

The more lots you buy, the more you buy in the quantitative equivalent of the asset.

Examples according to 44-FZ

Not all lots can be allocated when purchasing 44-FZ: according to the law on protection of competition, allocation is carried out only for similar, technological and functionally related goods, works and services. Most government procurement is carried out on a single item basis.

Errors are also common when forming multi-lot tenders. It is not recommended to combine in one purchase:

- supply of goods, performance of work and provision of services;

- construction, research and design orders;

- licensed and unlicensed activities;

- purchasing food products and the process of organizing meals in children's and medical institutions;

- various types of construction work during renovation or construction.

Separation of goods, works and services in one tender is an option available only for competitive procedures.

There are no regulations or instructions on how to add money to a lot for small purchases to allocate product groups: this cannot be done. There is only one subject of the contract with a single supplier. Customers make small volume purchases separately for each purchased order item.

Why combine assets into lots?

We have already partially answered this question in the first section, but let’s look at a specific example. Let's take VTB shares for analysis. Here on the screen of placing a simple order they tell us that one VTB lot is 10,000 shares.

When placing a simple order, the number of lots is indicated (using VTB as an example)

But let’s imagine that one lot = 1, and the share itself, according to quotes on the Moscow Exchange, costs 0.047770 rubles. This is approximately 4.8 kopecks. We wanted to buy a certain number of VTB shares for 1,000,000 rubles.

1,000,000/0.047770=20,933,640 shares

Can you imagine how inconvenient this is, neither for us, nor for the broker, nor for anyone!! And if you buy or sell in lots, then the figure will be without these crazy zeros.

20,933,640/1000=20,934 lots

The difference is significant: 20 million or 20 thousand. Do you feel it?

Association rules

By what standards is the formation of lots carried out according to the law on the contract system:

- Customers are prohibited from including in product groups items that are technically and functionally not related to products that are the subject of government procurement (Part 3 of Article 17 135-FZ of July 26, 2006).

- The same is stated in the Code of Administrative Offenses: inclusion in one lot of goods, works and services that are not technologically and functionally related to each other threatens the customer with a fine in the amount of 1% of the NMCC, but within the range of 5,000 to 30,000 rubles (h 4 Article 7.30 Code of Administrative Offenses of the Russian Federation).

- It is impossible to combine into one group goods to which national treatment is applied under Art. 14 44-FZ (clause 3 of Order of the Ministry of Finance No. 126n dated June 4, 2018).

It should be remembered that a multi-lot auction in electronic form 44-FZ is no longer held. Product groups are not formed when carrying out a request for quotation, request for proposals, electronic procedures and closed electronic bidding.

Where can you see how much of an asset is included in a lot?

Option 1: In the asset passport on the Moscow Exchange

On the Moscow Exchange website, we go to the passport of the asset we need. In this article we look at lots using the example of blue chips. Therefore, you can find them on the main page of the Moscow Exchange website in the right widget.

In the right widget of the Moscow Exchange we look for the stock we need

And we open the passport, where we can easily find the dimensions of a standard lot of paper.

VTB share passport

For the 10 most popular papers, I have prepared a plate with data on the lot:

| paper | lot | denomination currency |

| Gazprom | 10 | rub |

| Lukoil | 1 | rub |

| Norilsk Nickel | 1 | rub |

| Sberbank (priv) | 10 | rub |

| MTS | 10 | rub |

| Rosneft | 10 | rub |

| NLMK | 10 | rub |

| Novatek | 1 | rub |

| Alrosa | 10 | rub |

| SevStal | 1 | rub |

Option 2: In the Quik terminal

In the Quik terminal you will have a current table of your assets. In this table you can add the necessary parameters for working with assets yourself. One of these important parameters is the lot.

In the current table of parameters, select “lot”

Option 3: In buy/sell orders in Quik

The simplest option. In the order book of the instrument we need, in a simple order, or in a stop order, we look at the standard lot.

We look at the lot through the glass of quotes

And we look at how many shares are included in the lot to calculate the position.

We look at the order for the amount of asset in the lot

Examples according to 223-FZ

FAS is very attentive to complaints about multi-lot orders. If the customer prepares an indivisible tender, but the combination of products is unjustified, the contractor and the organization face a fine.

The most common violation is the inclusion of design, research and construction work in one procurement. They will also be fined for combining the supply of components and servicing of office equipment in one contract. If the customer proves that all positions in the agreement are of the same type and functionally interrelated, sanctions will be avoided.

Types of lot

Full lot

A full lot is the number of units of a particular asset in one unit of account. This means that you can buy or sell at least 1 lot in a certain mode of mutual settlements between all trading parties. You can sell more according to your brokerage account, but you can’t sell less.

Less than 1 lot can be bought or sold in a different mode. In the next section we will look in more detail. Trading of shares in full lots on the Moscow Exchange takes place in the T+ mode.

Important! Trading in full lots of shares and depositary receipts for shares occurs from 10:00:00 to 18:39:59 Moscow time. Trading in lots of shares occurs from 10:00:00 to 18:44:59 Moscow time.

Incomplete lot

Trading as a private trader will occur automatically in the Quik terminal. Incomplete lots can be purchased through the special “Incomplete Lots” mode. An ordinary trader does not need this, but this mode can again be found through the parameters of the current parameter table.

We are looking for shares for purchase/sale in incomplete lots in the parameters table

From the list of shares that can be bought or sold in incomplete lots, I will choose VTB shares as an example. Please note that to the right of the name of the shares in parentheses there is an explanation “MB FR: T+: Incomplete lots”.

Having selected the necessary securities for trading from the “Incomplete Lots” mode, click on the “Yes” button to save the changes in the parameters table. And after saving the VTB paper in the parameters table, I display it in two modes:

- Trading in full lots (at the very bottom of the parameters table)

- Trading incomplete lots (a little lower in the parameters table)

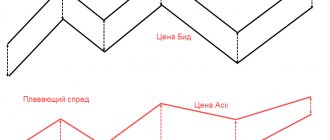

Please note that the spread in the order book for the same VTB shares in the “T+” mode and in the “Incomplete Lots” mode will be different. And trading through the partial lot mode is similar to trading with a less liquid instrument.

Important! Trading in partial lots of shares occurs from 10:00:00 to 18:39:59 Moscow time. Trading in partial lots of investment units occurs from 10:00:00 to 18:44:59 Moscow time.

Currency exchanges

Lots are also relevant for currency trading. The latter operate according to the general rules of classical exchange trading. Currency quotes here depend on its purchasing power. The latter is determined by the economic situation in the issuing state.

The task of the currency exchange is to mobilize free foreign exchange resources, redistribute them between economic sectors, which helps establish their market rate.

Trading is carried out on market pairs: “dollar-pound”, “yen-euro”, “dollar-euro”, etc. During the day, many factors influence their price ratio. The task of a trader (an investor who has received accreditation at a foreign exchange exchange) is to use such a pair as profitably as possible: buy cheaper and sell more expensive.

Commodity exchanges

Based on the name, transactions for the purchase and sale of physical things are carried out on a commodity exchange. Under the lot number there may be agricultural or industrial products, raw materials, consumer goods, energy resources, etc. These items must meet a number of universal characteristics, and also be in wide demand and produced in large volumes.

Here, a lot is the smallest quantity of goods that can be sold or purchased. The price for it cannot be fixed. It constantly fluctuates depending on the balance of supply and demand.

What products are not combined

The procedure for combining different groups of goods, works, and services into one group under 223-FZ is not clearly regulated. The basic rule is that the formation of product groups should not limit competition, i.e., contain several types of work, services, goods, the supply or implementation of which are not technologically interconnected.

The customer prescribes a detailed algorithm for allocating individual orders as part of one competitive procedure in the procurement regulations, as well as specific methods for identifying suppliers, a mechanism for determining the technological relationship between various types of goods, works, services in order to make a decision on the possibility of combining them into one order.