Dividend yield is a measure of the current profitability of owning a stock. It is calculated as the quotient of dividends per share divided by its current value and expressed as a percentage.

For example, a conditional security costs one hundred rubles on the stock exchange. Dividends paid on this share are 10 rubles. Then the dividend yield: 10 rubles divided by 100 rubles and multiplied by 100% equals 10% per annum. This is the dividend yield.

Dividend yield allows you to evaluate how profitable it is to hold certain shares. With its help, you can create optimal investment portfolios for each specific investor based on his goals.

Why calculate profitability

It’s quite easy to buy securities and make some money on them.

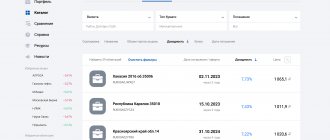

The investor doesn’t even have to go anywhere—brokers have moved to mobile applications, through which you can purchase different assets on different markets. Until an investor knows exactly how much he earns, it is difficult for him to save money or invest it profitably in the future. A person may think that he has excellent results, but a careful calculation will show: they are not so excellent, especially in comparison with other instruments, so you need to think about changing assets. Or vice versa: the real profitability is good, and it is worth continuing in the same spirit.

In order to understand all this, you need to understand the relative return of the portfolio and calculate how much interest the investor receives per annum.

Market price of the bond

The cost of a bond on the secondary market is usually called the market price. It is expressed as a percentage and is easily converted into rubles by multiplying by the nominal value. For example, in the quotes section of the Moscow Exchange, the current price of the corporate bond of OJSC BO-07 (RU000A0JWC82) is 101.3%. The face value of the paper is 1000 ₽, which means its market price is 1013 ₽.

The variable market value depends on the following aspects:

- Supply and demand. The value fluctuates as investor interest in the asset rises and falls.

- Economic growth rate. The value of fixed income bonds increases in a situation where there is a general decline in production and a slowdown in economic growth, and vice versa.

An important factor in the formation of market prices is the reliability of the issuer. For example, from open sources it is known about last year’s losses of the Neftegazholting company. The company's bonds are currently selling at a price of 98.87%. And Sberbank bonds are stable, for example, Sberbank Sb24R now costs 100.15% of the face value or 1,001.5 rubles.

How to calculate annual return on investment

Professionals use complex formulas like the Sharpe ratio or Treynor ratio. This may be useful for a private investor, but to get started, a table in Excel and a few numbers from the broker’s application will be enough.

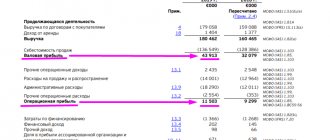

If an investor keeps a table and enters all the money movements, dates, dividend payments and commissions, he can calculate everything conveniently. The basic formula looks like this:

Profit (or loss) on the transaction + dividends − commissions = profitability

Take into account assets

Let's say an investor bought and sold securities for nine months in a row. He knows how much money came and went, remembers the dates of transactions and remembers to sign everything. As a result, he has a simple table:

The investor bought and sold assets, deposited money into the account and withdrew it, so it is correct to first calculate the net return. It’s enough just to substitute the formula NET INDOH (or XIRR, it’s the same thing).

In Excel, colons indicate intervals so as not to enter each cell manually, and semicolons separate values from each other.

It turns out that the investor earned 18.66% per annum. This is not bad, because the S&P 500 index rose over the same time S&P 500 Real Time Price, January 10, 2022 - September 3, 2022 / Yahoo Finance by 19.6%.

Pay commission

Brokers take a percentage of each transaction, although the specific amounts vary - it is best to clarify this in your agreement with a specialist. Often commissions are already “built into” reports, but sometimes they appear as an additional line. In this case, it is better to write them down separately on the plate.

Let's assume that an investor pays 0.3% after each purchase or sale of an asset. If he took into account the indicator in advance, then he will not have to use new formulas, the same pure breath will do. It turns out that you earned less.

Calculate annual interest

But the investor calculated the return on the portfolio only during the time he invested the money. This is less than a year, and it is customary to compare profit volumes as a percentage per annum. We need to add one more formula:

Net return × days per year / days invested = annual return

In our case, the investor traded securities for 236 days. Let's apply the formula:

The annual return on investment is 26.49%. If an investor compares it, for example, with deposits, it turns out that the profitability of his assets is four to five times higher, so it is more profitable to continue placing money in this way. At the same time, the S&P 500 index brought S&P 500 Real Time Price, January 10, 2022 - September 3, 2022 / Yahoo Finance 30.3% per annum for the same period in 2022 - it may be more advisable to invest in funds that are behind it follow.

Factors influencing stock returns

The parameter consists of real payments and market expectations of investors. Therefore, the size of dividends is affected by:

- Net profit amount.

- The policy of the enterprise that determines the amount of payments (they may decide to use the received profit to expand production) and the calculation formula.

Market value is an illusion, credibility and advertising. When an enterprise is a strong average in terms of indicators, a leader in the industry, investors’ expectations of making a profit are understandable.

But there is also advertising when:

- the payment of dividends becomes a discussed media event;

- members of the board are VIPs;

- the company's successes are regularly reported on TV.

The formula is simple: as more people want to buy securities, quotes rise. Sometimes large holders deliberately create the illusion of reliability and get rid of stale goods.

How to calculate the return on investment in the future

No analyst, professional investor or clairvoyant can answer accurately. But you can at least try to estimate this indicator using historical returns.

So, the investor earned 18.66% per annum in 2022. He studied the return on his assets over the previous 5–10 years and realized: on average, such a portfolio yielded 13% per annum.

It is not a fact that everything will happen again in the future. Economic trends change, companies come under strict regulation, and there is always the threat of a crisis.

But the investor has taken everything into account and assumes that profitability will remain at an average level over the next 10 years.

The investor's money remains in the account because he is saving for an apartment for his children. The person reinvests all dividends received back. In this case, the magic of compound interest comes into play:

| Account amount , rubles | Profitability | Annual profit , rubles | |

| 2022 | 90 400 | 13% | 10 400 |

| 2023 | 102 152 | 13% | 11 752 |

| 2024 | 115 431,76 | 13% | 13 279,76 |

| 2025 | 130 437,89 | 13% | 15 006,13 |

| 2026 | 147 394,81 | 13% | 16 956,92 |

| 2027 | 166 556,14 | 13% | 19 161,33 |

| 2028 | 188 208,44 | 13% | 21 652,30 |

| 2029 | 212 675,54 | 13% | 24 467,10 |

| 2030 | 240 323,36 | 13% | 27 647,82 |

| 2031 | 271 565,39 | 13% | 31 242,03 |

If an investor took the profit every year and invested the same amount again, he would earn 104,000 rubles in 10 years. But his actions brought him 191,565 rubles - almost twice as much. This is called compound interest, or interest capitalization.

Accumulated coupon income

The parameter indicates the coupon income that has accumulated to date since the last payment. Since securities can be bought and sold at any time, a bond can have different owners. Each holder receives their coupon income in proportion to the time they hold the asset. This approach allows the bond holder to sell it at any time without waiting for the next coupon payments.

Let's look at an example of how this works. Let’s assume that the par value of the bond at the time of purchase and sale is 10 thousand rubles. With a coupon rate of 6% and interest payments 2 times a year, the monthly income will be 0.5%. If the seller held the bond for 4 months, then he is entitled to a refund of the accrued income in the amount of (0.5%/100) x 4 months x 10,000 ₽ = 200 ₽.

How not to calculate profitability

Net profitability formulas and accounting for commissions allow you to see “honest” numbers. Because the intuitive method of calculation - dividing the current value of the portfolio by investments - will not help. This is only suitable if the investor purchased assets and sold them exactly one year later.

In reality, a person almost certainly buys something new for his portfolio or sells papers. It will be easy to calculate the profitability of each individual investment, but for the entire portfolio, and even taking into account commissions, it is easier to use formulas and a table.

The principle of income generation

The entity that issued the bonds is called the issuer. When issued, the par value of the bond is determined. The amount may be constant or decrease over time in amortizing bonds.

The issuer sets a fixed interest rate. Coupon payments are regularly transferred to the security holder before the maturity date, for example, once a month, quarterly or annually.

The investor can wait until the day when redemption occurs and receive 100% of the face value. Or try to earn income from the purchase and sale of an asset. Bonds are traded in Russia on the Moscow Exchange.

How to account for taxes on investments

The broker pays taxes for the investor in Russia, so you may not even immediately notice that they have been written off. But it is still useful to know how much you will have to give to the state. It depends on what assets and for what period to acquire.

If a stock, bond or ETF share was purchased more than three years ago, then you can safely sell them and not pay income tax, Article 219.1 of the Tax Code of the Russian Federation, Article 219.1 “Investment tax deductions”. Let's say an investor with plans for an apartment that he wants to buy in 10 years can invest and not worry that mandatory contributions will affect profitability.

But if the assets have to be sold earlier, the tax will still be withheld from them - 13%. Except for those cases when the investor recorded a loss: he sold for less than he bought. If there is profit, then tax must be paid to the Tax Code of the Russian Federation, Article 214.1 “Features of determining the tax base, calculation and payment of income tax on transactions with securities and on transactions with derivative financial instruments,” but only on the difference between purchase and sale.

For example, an investor purchased shares for 80,000 rubles, and the next year sold them for 100,000. For both operations, he gave 0.3% commission to the broker, which is also taken into account in the calculations. You will have to pay this much:

(100,000 − 300 − 80,000 − 240) × 0.13 = 2,529.8 rubles

In addition, there will be payments to the state for dividends and coupons, the same income contribution of 13%. Let's say the dividends amounted to 7,000 rubles - 910 will be withheld from the investor, which will also affect the profitability.

After taxes, an investor would lose 3% of their portfolio's return—quite a lot, and now investing in the S&P 500 with an annual return of 30.3% looks even more reasonable. Although this value will be slightly less - due to fund commissions and taxes.

What returns can you expect from the stock market?

There are no guarantees in the market, but this 10% average has remained surprisingly stable for a long time.

So what kind of returns can investors reasonably expect from the stock market today?

The answer to this question depends largely on what has happened in the recent past.

But here's a simple rule of thumb: the higher the recent return, the lower the future return, and vice versa.

Here are three key takeaways if you want to make money in the stock market.

1. Curb your enthusiasm during good times. Congratulations, you are making money. However, when stocks rise, remember that the future will likely be less good than the past. It seems like investors need to repeat this lesson during every bull market cycle.

Market correction – what it is, read the article at the link.

2. When things go wrong, become more optimistic. A falling market should make you happy: you can buy shares at an attractive price and expect higher returns in the future.

3. You only earn average returns if you buy and hold. If you trade frequently in and out of the market, you can expect to make lower and sometimes negative earnings. Commissions and taxes eat into your profits. Study after study shows that even for professionals it is almost impossible to beat the market.

Things to remember

- If an investor does not consider profitability, then he does not understand whether he invested his money successfully and whether it is worth changing the investment portfolio.

- It is easier to calculate profits, losses on commissions and taxes if you keep a simple diary table in Excel.

- It is best for an investor to determine profitability using the NET INDEX formula - it will take into account irregular movements of money in a brokerage account.

- Sometimes it is more profitable to invest in several funds or indexes than to create your own investment portfolio.

How to assess the attractiveness of a company's shares

The attractiveness of any security depends on the investor's goal. They choose the company that is the best in the industry in terms of liquidity and growth rates. The profitability indicators of issued securities are calculated and compared using known formulas.

Personally, I take into account the hype, scandals associated with the industry and business owners. I look at daily stock exchange quotes for a month, the trend for six months and several years. For my investment portfolio, I buy the most reliable ones that are steadily growing in price. The rest are an object for speculation on the stock exchange.