Who is a trader and what does he do? Which service is designed to maintain trader statistics? How to choose a trader on the stock exchange and what are the prices for their services?

The rate of the popular cryptocurrency Etherium has halved . From 2015 to 2022, it practically did not change and remained low, and from January 2022 it went up sharply - from $10 to $400 . Now I rolled it back.

If you and I had bought $2,000 worth of cryptocurrency at the beginning of January 2022 and sold it on June 13 at $402 , we would have earned $78,400 or 4,704,000 rubles .

Of course, now it is easy to calculate this unearned money. At the “hard right edge,” as traders say, the unknown awaits us and making trading decisions is not at all easy. The hard right edge is the part of the chart where the price is constantly fluctuating, “choosing” where to go.

Good day, dear readers of the HeatherBober business magazine! Alexey Morozov is in touch, an expert on trading in financial markets. We continue to talk about trading.

I gave the example above to illustrate how to make money from trading. The topic of today's article is the trader. Let’s consider who he is, how he earns money, and whether it is realistic for an “ordinary” person to become a trader.

Advantages and disadvantages of trading: what you need to know before you start working

Pros:

- Unlimited income that depends only on your skills and a pinch of luck.

- You can work from anywhere in the world because you will not be tied to the office.

- The profession of a trader requires constant self-improvement and learning new things (trends, company histories, economic terminology, features of a particular exchange).

- Excitement and a feeling of adrenaline - trading is not boring paperwork, everything is like in the movies.

Minuses:

- This job will require increased concentration and stress tolerance from you. There will really be a lot of stress and few beginners will be able to withstand it.

- Risks - you are not just selling a service, but trading, trying to make a profit. No one can guarantee a successful outcome of a transaction because the market can behave completely unpredictably. The situation with the recent collapse of Wall Street at the hands of enthusiasts from Reddit is proof of this.

Career

Students studying trading most often find employment in large international groups after graduation. The level of responsibility there is undoubtedly higher. But the salary is also maximum. The number of vacancies there is limited. Therefore, only the most promising are accepted there.

According to reviews, applicants for trader positions can also work in smaller banks or brokerage companies. There are many more of them. Therefore, it is easier to get a job there. The volume of portfolios there is smaller. But the career opportunities and salary levels are very attractive.

The speed of climbing the career ladder directly depends on the results of your work. With the proper dedication and ambition, it is quite possible to change from a medium-sized company to a large one in 3-4 years.

What skills should you develop to become a trader?

Analytic skills

The main skill that every trader needs. You must be able to quickly and accurately analyze data on the Internet.

In addition, there is a lot of mathematics in stock trading, which is presented in the form of charts, indicators and technical analysis patterns. So, in addition to the ability to study materials, you need a knowledge base on the market in which you work.

Concentration

A trader needs to constantly improve this skill because the more you want to earn, the more you will study, wait for signals and study information (this requires a lot of patience). Train your concentration with games such as chess and sports.

Cool mind

Competitors will try to get you emotional using fake news so that you make a mistake and lose your money. Therefore, we recommend that you learn to control your emotions and not feel either grief when losing money, or joy when earning it.

Record keeping

The main key to success in trading is record keeping. A specialist should carefully record the results of his transactions and strategy settings in order to subsequently analyze them to identify the most successful one.

Be realistic about profits

Don't think that you can constantly extract large sums and that every strategy you make will be a winner. For many traders, only 50-60% of transactions are successful. Before you do anything, it is important to make sure that the risk on each trade is limited to a certain percentage of the account, and that the entry and exit methods are clearly stated.

Ability to stick to a plan

You created the strategy you work by, don’t change it. There is no need to chase profit here and now, study its weak points and improve, and do not take risky steps that, due to emotions, may seem right to you.

And most importantly, no one should venture into the realm of trading without fundamental knowledge of the market.

Who provides training for novice traders - review of the TOP 3 training companies

Below is a description of three brokers. All of them have been tested by a huge number of traders and have been working on the exchange for a long time.

Two companies are licensed by the Central Bank of the Russian Federation.

1) Alpari

At Alpari you will find the best free training. It is held in the format of webinars - the presenters answer questions from participants live. Ninety percent of all courses are free .

There are “conditional fee” classes - you need to top up your account with a certain amount. Usually the replenishment amount is $100 , less often – $1000 . If you looked at the rate and still decided not to trade with Alpari, calmly withdraw your money, you will only lose commissions.

In isolated cases, for example, to view the second part of the basic course, you need to pay the broker. Not to replenish the account, but to part with your hard-earned money.

In my opinion, nothing prevents you from doing without spending. The materials in the second part of the basic course are devoted mainly to indicators - there is plenty of information on the Internet.

2) Phoenix

At Phoenix, training is paid. Structured, in-depth, but paid. Whether you need it or not - decide for yourself.

It is important to understand a simple thing: no one wants you to be rich. Pay a lot of money to trading specialists - they will give you knowledge, but they won’t teach you how to make money. To make money on the stock exchange, you must constantly trade on your own - I have spoken about this several times throughout the article.

People often pay large sums for training, and when they enter the market, they drain their deposits and curse brokers and their “teachers.” It's your own fault. There is no free money anywhere, except in pyramids.

3) TeleTrade

Another brokerage company licensed by the Central Bank of the Russian Federation. Basic free training is available in webinar format. However, this company is still unable to compete with Alpari. Broker TeleTrade offers traders to sign up for courses, and Alpari runs them every day, with different authors.

There is also paid training, which is more in-depth. Trading conditions in the company are favorable, the company is popular among professional and novice speculators.

How to become a trader - step-by-step guide

- Step 1: first you need to understand who a trader is and what he does.

- Step 2 : Analyze the markets and venues you would like to trade and then start learning different trading strategies.

- Step 3: practice using a demo account, it will allow you to roughly understand how the market works and what kind of income you should expect.

- Step 4: Understand the role psychology plays in trading.

- Step 5: open a real account and start trading.

- Step 6: Develop and improve your own strategy.

Story

The first stock exchange in Russia was created by Peter I. It appeared in St. Petersburg in 1703. As of 1923, there were as many as 70 of them. Until 1930, there was brisk trade there. Then this type of activity was completely curtailed and prohibited.

The exchange market began to revive already in the modern era - since 1991. But it was still out of reach for small investors. Also, an over-the-counter market intended for private individuals has not yet been formed.

The beginning date of the history of the well-known Forex market in Russia can be considered 1994. Then the first office opened in Moscow. Then others began to enter the market - not only Russian, but also international. But the broad masses of private investors still did not have access to it.

The rapid development of exchange trading occurred in the 2000s. This was facilitated by the advancement and reduction in cost of the Internet, as well as the emergence of platforms that were quite accessible for use.

It was during this period that the trader profession gained popularity, which continues to this day. Over the past 5 years, the development of training programs has appeared that almost completely solve the question of how to learn to be a trader and start working.

Resources for traders: websites, platforms, online communities

I studied in detail the public pages and sites that I listed below. You can trust all of them, there are no options or other bullshit that bloggers advertise.

Websites (in English)

- Securities and Exchange Commission is an information site where you can read the rules of trading and how the state regulates it.

- StockChart is an educational site about investing and trading.

- Investopedia is the Wikipedia of the trading world, with information on every aspect of the trade.

- Big Charts is a site with information about financial charts.

- Trading Day - news for traders and investors is published here.

The most reliable trading platforms

- Tinkoff Investments is the most popular platform in Russia, you can open an account here in just 5 minutes, and technical support will help you figure out all the nuances.

- BCS is an investment company that has been operating in the financial market for 25 years.

- Fidelity Investments is one of the largest asset management companies in the world, founded in 1946 and working with investors/traders from 100+ countries.

- TD Ameritrade is the best broker for beginners with the ability to trade using a smartphone.

- Charles Schwab - this company has $6 trillion in client assets, the platform provides users with a wide selection of trading tools.

Communities

- Vladimir Gortsev’s blog is the largest public blog about trading in VK. There is a lot of useful information for beginners and pros.

- Invest Future is a media for private investors, where they talk about money in an accessible way.

- Capital is the author's channel about investments.

- Signals Atlanta - interesting reviews for investors and traders are published here.

- Investiary is a stock exchange diary from Grigory Bogdanov.

- FIRE/Financial Independence Movement - this public page will help you become truly financially free.

Where to study

Those wishing to work as a trader should take care of obtaining a higher education in economics, finance or mathematics. True, one diploma will not be enough. A special license will also be required. It is issued by the Federal Service for Financial Markets.

Those who see themselves on the stock exchange are recommended to first study at one of the best Russian universities in the financial and economic direction of training specialists. Since there are quite a lot of them, here are a few examples:

- Moscow State University named after. M. Lomonosov.

- National Research University Higher School of Economics in Moscow.

- St. Petersburg State University of Economics and Finance.

- Financial Academy under the Government of the Russian Federation.

- Ural State University of Economics.

Before entering the stock exchange, a novice trader needs to learn how to trade. This is a must. Today in Russia, trading courses are provided by brokerage agencies. Among the most famous are:

- "Teletrade".

- "Phoenix".

- "Alpari".

Free trading training: the best materials

If you have a small budget and are not confident in your talents, then I recommend starting with free courses to get the necessary knowledge base.

- An introductory course on trading from scratch from SDG Trade is a free video course on trading on stock exchanges, which consists of 7 lessons and will help you learn: what is day trading, what amount should you start trading with, what types of charts exist (+ their analysis), formations for the sale and purchase of shares.

- The Trader's Path is an 18-minute story from a practicing trader. The author shared his personal experience and told how he began his journey.

- 13 trading lessons is a playlist with short but very informative videos about trading.

- Courses from BCS - this site publishes many free courses that will help a beginner at the start.

- “How to invest” is a free course from T-Z for beginners that will teach you how to invest wisely.

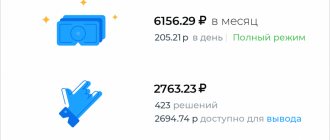

How much does he earn

A trader's earnings cannot be measured in any monetary unit. The level of his income is directly dependent on the total amount of capital used for trading.

For example, a trader with $100,000 in capital can earn 100 times more than someone with only $1,000. That is why a trader’s income is calculated as a percentage of the capital he manages.

The average monthly salary of a self-employed trader is approximately 5% to 10% of the amount in the trading account. The level of risk in this case is small and is considered quite acceptable. If a trader manages other people's money, he can count on 20-50% of the profit.

TOP 5 best trading courses for those who want guaranteed results

All the courses below contain only relevant information and are highly likely to give you a powerful push towards success in trading.

#5. Training in trading and investing in the stock market from Russ-Invest

For beginners, “Course 01: Practice of trading stocks, futures and options” for 12,000 rubles is perfect.

The training takes place in groups and lasts 15 hours. During this time, you will learn how to carry out transactions with minimal risks, master operations on the derivatives market and develop your own strategies.

More about the course

#4. Webinar on the basics of stock exchange business from BCS World of Investments

For just 5,000 rubles you will get access to 10 trading classes taught by speaker Igor Yudin. 4 lessons out of 10 will be practical, and the training will last 2 weeks.

More about the course

#3. London Forex Open Strategy Training from Udemy

In this course you will learn an intraday Forex strategy, which is based on the principles of a surge in volatility in the morning during the London session. This strategy costs $80 and is suitable for those who already have basic knowledge of trading and are familiar with the Forex market.

More about the course

#2. Course on creating trading strategies from Shevelev Trade

This program was created by Alexander Shevelev, who has been trading professionally on the Russian stock exchange for 9 years.

Together with his partner, he created a comprehensive training system that has no analogues in the world.

The course consists of 3 modules, and during the training you will work with your own team of 12 people, you will solve complex issues with a curator (an experienced trader), and you will also get access to the treasury and the central group of the course. The cost of this course is 30,000 rubles.

More about the course

#1. Training in profitable trading in 60 days from ShilinTrade

This course focuses primarily on practical learning. Therefore, there will be a minimum of theory here (as the author stated, “no mess or ambiguity”).

In practice, you will acquire useful habits for a trader, practice strategies and learn to correctly and without nerves expect signals to enter and exit a trade.

During the training, you will be accompanied by a mentor who will test your knowledge of the theoretical part + you will be able to conduct 2 sessions with him via Skype, which will answer all your questions. The cost of this course is 16,700 rubles.

More about the course

Range of duties

As already mentioned, a trader purchases and sells currency, securities (bonds, vouchers, shares), futures, options and other assets, making a profit from each such transaction. This is the main responsibility.

In the decision-making process, a representative of this profession can be guided by anything. For example, tossing a coin or peering into blots of coffee grounds. Despite the fact that such options have a right to exist, their use in practice is not recommended.

Successful traders, who have a conservative background, approach their work extremely seriously and carefully. They perform a detailed analysis of charts and closely monitor the flow of statistical information from the markets. These people quickly respond to any change, always keeping their finger on the pulse.

So, a professional trader is obliged to:

- work with special software;

- keep records of transactions on the stock exchange;

- prepare messages of both analytical and informational nature;

- open and close positions on the stock exchange;

- manage the client's portfolio;

- restructure debt obligations;

- perform re-registration of various securities in registers;

- work with private investors.

Theoretical knowledge

Many beginners initially develop an erroneous perception of trading. They see it as a kind of gambling game, where they just have to guess whether the exchange rate will go up or down.

Remember that the guessing game can be fatal. Using such a childishly naive approach, some novice traders very quickly lost all their financial resources.

A professional trader not only saves, but also increases the money invested. To avoid annoying losses, you need to approach the trading process with all seriousness and first study:

- The theory of trade. Focus on the rules and operating principles of the exchange. Learn to plan.

- Basics of analysis. It is impossible to trade successfully without constantly analyzing the situation on the economic market. Quotes change very often. Many factors can influence this process. Traders mainly make their forecasts based on world news.

- Statistics. You need to get into the habit of writing down all your transactions. This will help you see the big picture and give it an adequate assessment. Statistical data allows you to determine profit and loss, as well as see errors in time and make appropriate adjustments.

- Strategies. Guessing where the course will go is almost impossible, and, to be honest, stupid. Every self-respecting trader has his own strategy - developed by him personally or borrowed.

Character traits and personal qualities

The work of a trader is associated with enormous responsibility - for personal funds, the capital of a private investor or the employer’s investment. One wrong step and you can lose a very large amount. Therefore, the applicant for this position must have good psychological preparation.

This type of work is suitable only for those who know how to maintain a sober mind in any situation. If you can't handle your emotions, this position is not for you. All that is needed here is pragmatism and cold calculation.

A trader must have a penchant for mathematics. The job also requires analytical skills, the ability to make and understand calculations.

In addition, this profession provides for constant development, raising the level, and self-improvement. The stock exchange does not stand still. New methods and technologies appear regularly. A trader should learn about them as early as possible in order to successfully apply them in his work.

Who regulates the activities of brokers in the Russian Federation

Brokerage activities on the securities market in Russia are regulated by three main laws:

- Federal Law of April 22, 1996 N 39-FZ (as amended on July 31, 2020) “On the Securities Market”;

- Federal Law of December 26, 1995 N 208-FZ (as amended on July 31, 2020) “On Joint Stock Companies”;

- Federal Law “On Investment Funds” dated November 29, 2001 N 156-FZ (latest edition).

A complete list of acts and documents regulating brokerage activities can be found on the Bank of Russia website:

https://old.cbr.ru/finmarket/common_inf/legals_brokers/

In addition to the Bank of Russia, the activities of brokerage companies are regulated by SROs (self-regulatory organizations). The unified register of SROs can be found on the Bank of Russia website:

https://old.cbr.ru/finmarket/supervision/sv_sro/

Raider seizure of an apartment: how to protect yourself from it?

The so-called household raiders seize ownership of apartments and their own houses. What schemes do scammers use to steal other people's property?

Let's consider them further:

- Illegal court decisions. The seller of the apartment leaves the country, and a third party challenges the deal in court.

- Deception of lonely people. The raiders fraudulently obtain the required signatures from an elderly person who has no relatives. After some time, a new owner appears at the apartment or house.

- Appropriation of a home left unattended. If the apartment is often left unattended (for example, the owner goes on business trips for a long time), then after falsifying the documents, a new owner will appear at the home.

Precautionary measures:

- Sign a notarized agreement with your tenants. You should not rely only on verbal agreements.

- If you travel frequently on business, set the apartment to an alarm system, and store the documents on ownership in another place, otherwise they may be stolen and a number of manipulations with the home may be carried out.

Civil marriage also often leads to home seizure. There is a well-known scheme in which an apartment is sold by the wife, and after some time the husband appears in the home demanding the return of a certain amount of money for the expensive repairs he had previously done in the apartment.

In case of refusal, the raider takes the new owners to court.

Professional responsibility

Since 2022, the Bank of Russia has adopted a law regulating the activities of investment advisers. Market participants providing advice on financial markets are required to be included in the unified register of investment advisers. The list of necessary documents and requirements for obtaining the status of an investment adviser can be found on the Bank of Russia website: https://cbr.ru/explan/invest/

Investment advisors provide services based on an agreement with a client. In case of improper provision of services, as a result of which the client suffered losses, the investment adviser is liable with the property belonging to him.

Prerequisites

Often before a raider takeover occurs, it is preceded by:

- quarrel with partner,

- dissatisfaction from minority shareholders,

- the presence of internal corporate conflicts,

- excessive fight against competitors, bordering on going beyond the law,

- acquisition of the company's accounts payable.

Attention! If, when making a transaction, people are asked to provide certain documents that have nothing to do with it, one may suspect that a base is being prepared for raiding.

All types of businesses are at risk, but most of all this applies to small and medium-sized businesses due to insufficient resources to protect their assets. The most interesting for invaders are:

- real estate,

- expensive equipment,

- large sums of money in bank accounts,

- obtaining property and non-property types of rights.

Raiders' goals

The difference in goals for raiders depends on what means they use to achieve this:

- Psychological pressure on shareholders , owners, their relatives or close people. As a result, the actions of the victims are deprived of justified logic, and due to fear of a raider takeover, they transfer their assets to the invaders free of charge or sell them under unfavorable conditions for themselves.

- Black PR . Its target is usually the company itself or its management in order to turn people against it. Due to this, the value of assets decreases, and the level of external support for owners decreases.

- A decrease in the business reputation of a company due to blocking the supply of goods or loans or a complete termination of financing of existing contracts, which leads to a decrease in the market value of the company. This usually happens with the consent of creditors, as well as suppliers who work with the victim and are loyal to the raiders.

- Involving administrative resources , the police, and the prosecutor's office in carrying out a raider seizure. Such actions are aimed at liquidating an unwanted enterprise or taking it over by competitors.

- Fictitious initiation of criminal cases against organizations, as well as their owners and top managers in order to gain full access to all internal documentation, which is subsequently used to bring the company to bankruptcy or take over it when a raider takeover occurs.

Let's sum it up

There are hundreds of types of earnings on the modern Internet, and their representatives vied with each other to convince us that in their system you can quickly get rich without much effort.

In fact, most of them turn out to be a banal scam, and the only one who makes money from such a pyramid is its owner, and the source of income is gullible applicants.

Trading, in fact, is one of the few really working types of earning money online.

Yes, you can’t expect quick millions here, and gold bars won’t start falling from the sky.

But if you are a beginner and are reading this article now, consider that you have already taken a huge step towards success.

It will be long and filled with annoying mistakes, but as the ancient Romans said: Per aspera ad Astra - “Through thorns to the stars”

Share or save:

- Telegram

Where to contact?

It is necessary to protect yourself from raiding through the courts and law enforcement agencies.

To bring a raider to justice for attempting to illegally seize a business or home, it is necessary to prove the presence of such crimes as:

- fraud (Article 159);

- arbitrariness (Article 330).

- extortion (Article 163).

To initiate an investigation into a raider takeover, you need to file a statement and contact the police and prosecutor's office.

If a criminal case is refused, the victim should initiate legal proceedings or file a complaint with higher authorities.

Only competent defense in court and the presence of evidence of fraud, forgery of documents, and blackmail will help repel a raider attack on an enterprise.

Raiding and raiders

Raiding itself is the illegal appropriation of someone else's private property in the form of a specific asset or an entire company. This is done against the will of the owners.

Due to this, a raider takeover is a procedure in which the takeover of an enterprise occurs through deception or force. After gaining control of assets, attackers sell them or use them at their own discretion.

With the development of technology, the schemes and types of raider seizures change. More and more new types of fraudulent methods of taking over someone else’s business are appearing, which are difficult to recognize and also to incriminate them as an offense. You can determine who the raiders are today as follows:

- companies, as well as groups of people whose activities consist precisely in such seizures of property. These also include those who specialize in raiding real estate, shares and other things,

- persons who use the corruption of specific top managers or government officials to seize the property of other persons and company assets,

- large corporations that want to monopolize a specific industry, thereby resorting to forceful, economic, and legal raider takeovers of smaller firms,

- holdings that own large assets and connections, which are used to illegally seize the property of other organizations,

- counterparties or shareholders who deliberately create negative conditions for other owners in order to acquire assets of interest to them,

- top managers of companies who use their official position to seize the assets of the organization in which they work during a raider takeover.