Hello, dear readers of the KtoNaNovenkogo.ru blog. Often our contemporaries would like to have a stable income (what is this?), but not work forty or even more hours a week.

The rentier profession allows this. However, one can only assume that this is the name of a profession with very big reservations.

A rentier is a capitalist who lives off passive legal income.

Who are rentiers?

The word "rentier" comes from the French word "rent". These are the people who receive capital income (that is, rent). The rentier lives off unearned but legal income, which is not constant and can change depending on how effectively he manages his capital. The rentier's income does not depend on regular activities and can even be generated without his direct participation.

It may seem that a rentier is the same as an investor, but this is not entirely true. As a rule, the rentier is not directly involved in capital management. He either buys those assets that already generate passive income, or trusts other people to manage his funds.

It’s just a matter of time: what should a freelancer do when work isn’t published?

For a stable relationship and other reasons not to show your wealth to a guy

Eco-friendly, profitable: clothes made from recycled materials as a business - advantages and disadvantages

Largest representatives

Forbes magazine annually compiles lists of the largest investors around the world and in individual countries. Interesting: statistics say that 60% of all businessmen and entrepreneurs are also rentiers. Because they receive income not only from their own business, but also from investments in other people's assets. It is profitable to be the owner of a large block of shares and receive income from it.

For example, Alexey Marshalov owns Severstal; he receives approximately one billion dollars a year in dividends from his own company.

So, according to Bloomberg, Jeff Bezos became the richest rentier. Its annual income is $105 billion.

Main activities of rentiers

There are several types of activities that bring stable income to rentiers. Namely:

- Bank deposits. They are characterized by high reliability but low profitability. This option, rather, preserves rather than increases capital. Except when we are talking about huge amounts.

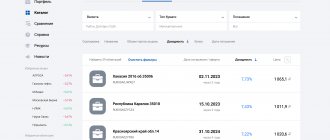

- Bonds. These financial instruments typically generate returns of 2-3% (adjusted for inflation). This option is also characterized by very modest income.

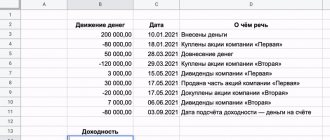

- Stock. Shares have annual returns of 5-6% (adjusted for inflation). As a rule, it is this type of financial instrument that rentiers focus on.

- Precious metals. Gold is always in price. This asset is more protected from inflation than others. However, its income is low - about 2% (increases slightly during crisis periods).

- Real estate. By renting out your property, you can earn about 5-6% of the total investment. If you cannot afford to buy a full-fledged object, then you can purchase its share in the form of shares of a mutual fund (mutual investment fund).

- Copyright. This is one of the few options that does not require material investments. True, not everyone manages to make money from their intellectual property. And the income from it is quite modest.

Investor assets

An asset is an object that accumulates value that can be claimed by the owner when selling or using the asset. In other words, by investing in a certain instrument, the owner pursues the goal of making a profit from the sale or operation of the asset.

Stock

A security that, when purchased, gives an investor the right to a stake in a business. Issue is carried out only by legal entities.

Bonds

A debt security with a par value and a specified expiration date. Within the agreed period, the owner has the right to claim its nominal value from the debtor.

Commodity assets

These are any assets that are sold and bought for investment purposes:

- precious metals;

- oil;

- agricultural products (cereals, cotton), etc.

Investment fund

Issues its own shares and invests in securities of other issuers. That is, an owner who trades his own assets and buys others.

Hedge fund

The activities of hedge funds are aimed at minimizing risks for a given return or increasing profitability for a given degree of risk.

ETF

ETF funds do not trade individual securities, but packages or portfolios of shares formed on the basis of an index. As a result, an investor purchasing a share of an ETF buys shares of several companies.

Real estate

The option of renting out real estate only seems fabulous. In fact, the landlord, in addition to paying taxes, must spend money on major and current repairs. In addition, the initial cost of housing will be repaid for several years. With an average profitability of one property of 5%, it makes sense to engage in this activity only if there are several houses and apartments.

Bank deposit

The average income on bank deposits is 10-12%. If you constantly reinvest the interest, you can significantly increase the amount and get a good monthly profit. But there are two significant points:

- Most domestic banks practice deposits for a period of only 1-3 years. In addition, the rate may change during this time.

- Choosing a bank is fraught with risks. And in case of bankruptcy of a financial institution, the state guarantees the return of the deposit only up to 700,000 rubles.

Are rentiers doing nothing?

From the outside it may seem that the rentier is doing nothing at all. To some extent this is true. If a person was able to invest money wisely and entrust its management to qualified, responsible people, then, indeed, he has no choice but to reap the benefits. However, you can’t just let things take their course. The rentier has to constantly keep his finger on the pulse, control financial flows, and look for ways to increase profits.

Launch date - starting point: the basics of a dating site startup

Keep small bills in your hands: tips on how to buy the right product at an affordable price

I’m leaving gracefully and with compensation: according to Russians, you should quit your job

And, of course, having enjoyed a comfortable and free life, a person begins to miss work and suffer from laziness. Therefore, many rentiers begin to do something useful and interesting. But, unlike an ordinary employee or entrepreneur, he is free to go on vacation at any time. Or maybe shut down the business altogether in order to rest again or start something new.

Notes[ | ]

- 64% of Europeans support the idea of a basic income / Geektimes [ unauthorized source?

] - VEDOMOSTI No. 1952 dated 09/21/2007

- ↑ 1 2 Stepnov Igor Mikhailovich, Kovalchuk Yulia Aleksandrovna.

Platform capitalism as a source of super-profit formation by digital rentiers

(undefined)

. - ↑ 12

Financial and credit dictionary, 1988, p. 21. - Repinetsky A.I.

Nepmen “New Russians” of the 1920s

(undefined)

.

Can an ordinary person become a rentier?

Purely theoretically, anyone can become a rentier. But in practice, not everything is so simple. There are two essential conditions:

- Learn to earn and save money in order to earn capital that can be invested somewhere. You may need to find a source of additional income, the proceeds of which will be 100% deferred for future purposes.

- Acquire an impressive amount of knowledge in the field of economics and finance. You must understand what investing is, where and how best to invest money, and how market conditions are changing.

Interestingly, if you invest money somewhere and start receiving interest on it, this does not mean that you have become a rentier. You can be called a rentier only when you receive so much that you can give up any other activity and live for your own pleasure.

Separate goals from dreams: how to set career goals for the coming year

Don't Skip the Subway: Five Tips to Avoid Being Late for Work

There are not enough banking services: what restrictions hinder the self-employed in 2022

Accessibility for the average person

Can the average person know what it means to live solely on income from one's own capital?

Of course, many people dream about this, but the reality is that most people spend their active time on work, which takes the lion’s share of energy and emotions. Usually a citizen tries to work harder in order to later accumulate a certain amount and have time to live for his own pleasure. However, special circumstances intervene here: family, children and other serious phenomena.

The meaning of annuity is as follows:

the capital that brings the main profit should not be wasted - there simply should not be a need for this. Income provides a decent life, and the rentier can only increase cash reserves - this is how it is implemented normally.

There are several rules here:

- Be patient and improve your financial knowledge.

Improve your money literacy to the level of a clear understanding of where to invest. Securities, real estate or precious metals - follow the news in the economy and in the world of finance. Learn to determine how to most profitably divide investments - into what areas. - Learn to save and spend money

only after seriously thinking about the process and goals. Analyze your profits, make plans for the development of your capital. - Don't neglect investing in small projects.

The world can be collected by thread. On the contrary, remember that passion for ambitious projects does not guarantee a positive result in the end. - Understand the terminology.

The words “investment coins”, “shares”, “shares”, “stock indices” should not cause confusion.

If a person has a high income, this does not mean that he is a rentier. The latter lives on passive income and does not work in the classical sense.

How much money is needed?

Knowledge is a gain, but even if you become a doctor of economic sciences, you will not be able to do anything without money. So how much does it take to become a rentier? In fact, it all depends on your “appetites”. That is, it depends on how much money you need for a comfortable and comfortable life. For some, 20 thousand a month will be enough, but for others, even 200 thousand will not be enough.

When you have decided on the desired monthly income, you should roughly estimate what interest you can receive in a particular area. You can find projects with even a 50% return. But, as a rule, they are associated with enormous risks. More stable and predictable options can bring 10-12%.

Savings and more: why it’s worth doing business online

“Do everything as for the Lord!”: how to be a leader without being the boss in the office

An old outfit and a visit. How to save on a holiday night

Thus, to receive about 30 thousand rubles per month with a 10% return, you will need at least 3 million rubles. But this amount does not include tax payments, remuneration for those who will manage your capital, and an adjustment for inflation. That is, this amount can be safely multiplied by two or three.

You should also understand that investments do not begin to generate income from the very first day. In addition, there are unprofitable periods. At this time, a person also has to live for something. That is, to become at least a modest rentier, you need to have at least 20 million starting capital.

How to do this?

Before becoming a rentier, you need to decide a few things for yourself: how much money per month you need to provide for all your needs and where you will invest. Once these issues are resolved, you can move directly to the activity itself.

To begin with, choose those projects that will bring you some profit, but the risks will be minimal. Once you understand more about investing, you can move on to the next stage and invest money in other projects and startups.

Only experience will help you understand this issue completely and make a good profit over time.

Can an ordinary person become a rentier?

Can an average person with an average income become a rentier? Financiers joke that for this you need to work until retirement age. And then it will be possible, without doing anything, to receive benefits from the state. And then, a pensioner can be equated to a rentier only if his monthly income is enough to live on.

Young people don't really have many options. If you suddenly receive a large inheritance, this will open up enormous opportunities for you. If you have to live on your earned income, then you need to allocate a monthly share that you can deposit in the bank at interest or invest little by little in securities. Perhaps, after a certain number of years, you will be able to reach a level of passive income that will allow you to no longer work.

Found a violation? Report content