The best Forex brokers licensed by the Central Bank of the Russian Federation are presented in our rating.

| Broker | Open an account | Based | Adjustable | Broker type | Min. deposit | Max. credit leverage | Bonus |

| Finam-ForexReviews: 7 | Open account Demo | 1994 | Central Bank, NAFD | NDD, DMA | 0$ | 1:40 | — |

| Alpha ForexReviews: 0 | Open an account Demo | 2016 | Central Bank (Russia) | NDD | 0 | 1:40 |

Until recently, the Forex market was not subject to government regulation. But already in 2015, important norms and laws were introduced. And in order to be a reliable Forex broker, you need to operate in accordance with accepted rules. Advertising related to the activities of forex dealers is also subject to regulation. It must contain a mention that any actions on the stock exchange can lead to loss of finances, since this relates to risky operations. Not all forex brokers comply with the new requirements. For clients, the measures taken by the state are aimed at protecting the population, but for brokers this is not very profitable.

List of the best Russian Forex brokers licensed by the Central Bank of the Russian Federation

I have collected a current list of Forex dealers licensed by the Central Bank of the Russian Federation in 2022, and compiled it into a table. Today, only 4 brokers are accredited in the Russian Federation, so please familiarize yourself with the list:

| Broker name | No. Accreditation of the Central Bank of the Russian Federation |

| PSB-FOREX LLC | № 045-14023-020000 |

| ALFA-FOREX LLC | № 045-14070-020000 |

| VTB Capital Forex LLC | № 045-13993-020000 |

| FINAM Forex LLC | № 045-14070-020000 |

These intermediaries successfully operate in the Russian market and have a positive reputation with the central bank. There are plenty of reasons for this, for example:

- Companies conduct business openly, providing government authorities with reliable information on all transactions;

- Companies provide truthful quotes to clients, and also display transactions on the interbank market;

- Quotes are taken only from trusted sources.

Many companies have lost their licenses due to incompetent work, but I will talk about them a little later. In the meantime, let's talk about what the license from the Central Bank of the Russian Federation provides.

PSB-Forex

Quite a popular broker that works under banks. It has an official license from the Central Bank of Russia, so it is in great demand among traders. But, there are a number of nuances that users criticize. Among the features of the project it is worth highlighting:

- Mandatory payment of income tax. Not every speculator agrees to give part of the profit to the state;

- Leverage is only 1 to 45. This is very little to make large transactions. Unfortunately, the legislation does not plan to expand the limits, which fundamentally does not suit professional players;

- Floating spreads. Because of this, professionals lose money on broker commissions.

The company lives solely on its reputation, which is gradually disappearing. Too high commissions and taxes push professionals to move to foreign sites that offer more favorable conditions.

Alfa-Forex

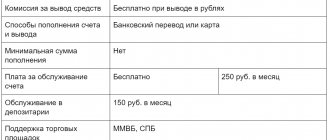

A good broker with government support, thanks to which it received the approval of experienced traders. A special feature of the company is the deposit and withdrawal of deposits without any commissions.

Among the shortcomings, the work of technical support should be highlighted. Issues can be considered for several weeks without a final decision. Of course, such an attitude is unacceptable, but the project administration is not going to resolve this issue.

Many users say that Alfa-Forex does not enter the intermarket, trading within the platform among its own participants. It is impossible to prove this, so you should not believe such rumors.

There are no problems with withdrawal of funds, the broker is licensed, so there is no reason for mistrust as of September 2022. Register, confirm your details and start trading.

VTB Capital Forex

A good broker who has a positive reputation among the professional community. There are no fees for opening an account, unlike Alfa-Forex. Speculators talk about fast technical support and timely resolution of problems, so we recommend trading with this broker.

We do not recommend this broker to beginners due to the high entry threshold. It is recommended to start with at least 50,000 rubles, which is not affordable for everyone.

The list contains only currency pairs, which does not suit many people.

The project has implemented PAMM accounts, which are extremely profitable to use. The team promises high returns on some instruments, and is therefore recommended for trading.

Overall, VTB Capital Forex is reliable and suitable for most traders. If you are ready to start with a fairly large deposit - welcome!

FINAM-Forex

A company with a controversial reputation. Some talk about her reliability, while others accuse her of fraud. The company has a huge number of branches throughout the country, thanks to which it deserves the trust of customers.

“Managers convince you to invest funds for high income, but in reality show from 10 to 40% losses per year. Such work can be assessed extremely negatively, so I do not recommend contacting them,” says a professional trader.

The company consistently pays rewards to users, but you should not contact the managers. It's best to trade on your own.

The service implements PAMM accounts, but reviews about them are also negative. We recommend using the services of a broker only if you have friends who are already trading on this site. Otherwise, use the brokers described above.

Basic Concepts

FOREX brokers are intermediary companies that allow players to make transactions. They carry out trading operations on behalf of the client and on his behalf, bring transactions to the foreign exchange market, and earn commissions.

FOREX dealers are intermediary companies that also enable traders to make transactions, but conduct trading at their own expense and on their own behalf. They make money on the spread - the difference between buying and selling the asset being traded (let's say currency). They pay the client from their own funds.

Dealers (also called kitchens) work mainly with retail traders. They offer a low minimum deposit (the amount to start trading) and high leverage, while brokers work with large financial institutions.

The difficulty lies in the fact that both of them can perform the functions of each other, so further I will not focus on the difference in their work, I will simply immediately clarify the specifics of the services provided by each of them.

What does a license from the Central Bank of the Russian Federation provide?

First of all, the license allows you to carry out advertising activities, i.e. advertise your own company throughout the country. In addition, the broker has the opportunity to enter into formal agreements with speculators, which means the client receives protection and control from government agencies. A license increases confidence in the broker, increasing interest from traders.

Advantages and disadvantages of licensed Forex dealers

The main advantages of reliable dealers include:

- Business transparency;

- Possibility of resolving any issue through the court;

- Control by the Central Bank of the Russian Federation.

But, there are also disadvantages due to which some speculators do not want to deal with official Forex brokers. The disadvantages include:

- Tax obligations. When withdrawing funds, the trader is required to pay tax on profits, if any;

- Leverage limit. In Russia, by law, leverage of more than 1 to 50 is not allowed. This situation is not to the liking of most participants.

The situation regarding licensing is ambiguous, because those who received the right to trade officially acquired additional costs and obligations to clients. At the same time, deprivation of the license made it possible to provide more extensive leverage, as well as pleasant bonuses to new market participants.

How are clients of Russian Forex dealers protected?

Licensed dealers have authorized capital and all the necessary documents for the smooth operation of the company. To eliminate the issue of the deposit immediately, a compensation fund was created. It involves returning funds to the client in full if for any reason the Central Bank revoked the license and the Forex dealer does not have the funds to pay.

If the interests of a trader are violated, then he has the right to solve the problem at the legislative level.

Summary

The rating of Forex brokers in 2022 cannot be lengthy. In general, everything good is always significantly limited. And despite the fact that there are dozens more companies on the organized financial market of the Russian Federation that provide access to FOREX services, according to the compilers of this rating, we should limit ourselves to the six listed above.

But it should be remembered that this was a rating of the reliability of brokers, however, this does not mean at all that when working with one of these companies, you will not be able to incur losses. Here, almost everything depends on the quality of the trading strategy you form, and the broker only provides access to an organized infrastructure and ensures that you are paid out your earnings.

Igor Titov

Economist, financial analyst, trader, investor. Personal interests – finance, trading, cryptocurrencies and investing.

Requirements for brokers and changes for clients

In 2022, the Central Bank imposes the following requirements on brokers:

- It is mandatory to have your own website;

- Availability of accreditation;

- The number of currency pairs should not exceed 26 names;

- Mandatory reporting to the tax service;

- Leverage does not exceed 1 to 50.

Such requirements are quite feasible, but only 4 companies comply with them. As for clients, the changes are not significant for them:

- The minimum deposit has been increased;

- Mandatory verification.

When passing verification, the user is required to provide a passport and also draw up an official contract.

What does denial of a license mean?

Refusal to license a Forex broker implies the impossibility of attracting funds from investors, as well as advertising the company and official relations with traders. In fact, the company cannot operate in this segment in the country. Deprived dealers have the right to restore their rating by correcting violations and reapplying.

List of brokers whose license was revoked by the Central Bank of the Russian Federation

In 2022, the Central Bank of the Russian Federation took away licenses for non-compliance from the following companies:

- Alpari;

- BCS Forex;

- 24FX;

- Profit Broker;

- DilFin.

Many of these companies were unable to meet their financial obligations to clients, resulting in litigation. On the Internet you can find reviews from former clients who are trying to get their money back.

Why did the Central Bank revoke the licenses of Forex dealers?

Most companies opened fictitious companies in Russia, declaring them representative offices. In fact, there turned out to be a complete discrepancy in the documents provided, as a result of which government authorities took away the licenses.

The traders' accounts were not actually placed in Russian accounts, which is why almost everyone lost their funds.

What will happen to brokers whose licenses have been revoked by the Central Bank?

Brokers who were deprived of the opportunity to provide services on the territory of the Russian Federation, in the majority, refused to restore the necessary documents. The reason was offshore accounts, funds from which, apparently, would not be returned to clients.

Today, only 2 companies have submitted documents and are awaiting a decision on a refund - BCS Forex and Rodeler.

What awaits Russian traders?

The speculators faced a deplorable situation. Those who kept funds offshore will go unpunished, since they have nothing to do with the legislation of the Russian Federation. Only a limited number of people who were clients of BCS Forex and Rodeler will be lucky. As soon as the companies recover, all deposits and payments will resume without any problems. Now criminal cases have been opened against some companies that have ceased operations and investigations are underway, but whether anything will be found is a big question.

What will happen to the Russian foreign exchange market?

In Russia, there is a possibility of a complete ban on the Forex market. The Central Bank wants to leave only interbank trading, without extension to international relations. Such events can serve as a transition for Russian citizens to trade with foreign brokers, because interest in the foreign market is much higher. During 2019-2021, it will become clear whether Forex dealers will remain open or all companies will lose their licenses.

Forex brokers are caught in a tight relationship with the government, and the rules are becoming more complex every year. More and more speculators are choosing unregulated companies to save money on taxes, but the risk of working with them is much higher. In the near future, the situation may lead to the complete closure of official companies, which will not contribute to the development of the financial market as a whole. Don't forget to bookmark the site and share news on social networks. See you again!

What to Look for When Choosing a Broker?

The developers have also released the next version of the MetaTrader 5 terminal, which brokers provide along with MT4, or offer for work in test mode. Today, the best Forex brokers provide a choice of fixed or floating spreads. Fixed spreads should always have the same value, the spread for the main trading pair EUR/USD should not be higher than 2 points. If there are floating spreads, they should not have prohibitive values at times of high volatility in the market.

To make the right choice, you need an independent rating of Forex brokers, which allows you to identify the best brokerage companies. The top five best Forex brokers (TOP 5) were formed by RoboForex, Forex4you, EXNESS, InstaForex and Alfa-Forex. This list is once again topped by RoboForex. Ahead of its competitors in all respects, RoboForex maintains its position as a leader in the Forex market thanks to its constantly growing trading turnover.

Sources

- Handbook of occupational safety specialist No. 3 2015: monograph. ; MCFR - M., 2015. - 895 p.

- Labor Code of the Russian Federation with comments. Text with changes and additions as of June 25, 2012 / Team of authors. - Moscow: Mir, 2012. - 642 p.

- Collection of Law and Economics in the Modern World. Issue V / Collection of articles. - M.: AUTHOR, 2016. - 296 p.

- Khabrieva, T. Ya. Migration law of Russia. Theory and practice: monograph. / T.Ya. Khabrieva. - M.: Jurisprudence, 2008. - 206 p.

- White, Jana Strategic Real Estate Portfolio Planning / Jana White. - M.: Publishing solutions, 1977. - 913 p.