From this article you will learn:

- Who is a trader?

- What does the trader trade?

- Trading Process

- How much does a trader earn?

- Trader classification

- The difference between a trader and an investor

- How to become a trader?

- Legislation regarding trading and legal status in Russia

- Advantages and disadvantages of being a trader

- The most famous traders in history

- Conclusion

Who is a trader?

A trader is a person who engages in purchase and sale transactions, making money on the difference in price.

A trader in simple words is an ordinary trader. In most cases, we are talking, of course, about exchange trading, that is, transactions on the financial market. This is a difficult profession, which, according to many, is not suitable for everyone; it requires a certain mindset and character. However, among traders there are a variety of personalities, in some cases directly opposite in their approach to business - for example, George Soros and Warren Buffett. But they are both billionaires who started from the bottom.

- Everyone knows who investors are . In the eyes of the average person, an investor is a moneybag who moves a lot of money, the owner of newspapers, houses, and ships. But in reality, an investor is just an ordinary person investing money in order to make a profit. For example, simply buying government bonds with a very modest income. It's not about the scale, but about the process itself.

- There are also speculators who make money from various surges in prices on the market ; most often they are associated with worsening falls on trading floors. That is, they seem to drive prices down due to the fact that they open speculative sales, often even without fundamental grounds. An example is the fall in oil.

So a trader is something between an investor and a speculator . If prices rise, he buys. And if they fall, he sells and speculates. That is, the main goal of a trader is to follow the market, buying cheaper and selling higher. Due to historical circumstances, this type of income is considered by many residents of the country as some kind of “abnormal, incorrect.” But life does not stand still, an increasing number of people are interested in trading, the number of clients of brokers is constantly growing and is now about 10 million.

Basic rules of trading

Before making money from trading, you should remember the main rules:

- This is work and the attitude towards it should be similar. Trading on stock exchanges is not entertainment; you need to devote time from 6 hours a day, and even get up at night to carry out weekend transactions.

- Determine the deposit amount that you won’t mind. This is a high-risk activity, in which even experienced traders lose money.

- Get rid of emotions, work with a “cold” head. You need to trade soberly, thinking carefully about every transaction, even the simplest one.

- All actions must be recorded using programs or the classic method - keeping a journal and adding entries to it as new transactions, positions, and profits appear. This will help conduct analysis, statistics, show the dynamics and correctness of the choice of tactics.

- Choosing a niche is an important point when you need to work with IT developments, stock markets, precious metals, cryptocurrencies, etc. You need to choose one area, understand it and trade only there.

- Diversification of investments - distribution of funds in one niche in different directions. If we are talking about cryptocurrencies, then invest in Bitcoin and other popular coins, and also use some for new tokens that can give large and quick profits or losses. The approach saves part of the investment if force majeure circumstances arise.

- Refuse credits and loans for trade. Some people like to trade with leverage, but it is better to invest only your own funds and not be indebted to anyone.

- Constantly learn, gain new knowledge, read trader forums, chats and focus on the experience of the best.

- Choose only reliable brokers to avoid falling for scammers.

Many people believe that the movement of the chart needs to be predicted; in fact, there are always 2-3 outcomes; it is important to adapt to the market, and not set conditions for it. You should also remember that by violating the rules of deposit management, you can leave your entire capital on the market in just 1 transaction. Risks must be controlled in any transaction.

What does the trader trade?

You can trade anything, literally. From grain to weather futures. Typically, the list of tools is divided into several large categories, which contain a whole list of tools of the same type. The main ones are the following:

- Stock market . These are stocks familiar to everyone, which even people far from trading know about. A stock trader can buy shares of Gazprom or Sberbank, Apple or BMW. And when the global financial crisis begins, sell them.

- Debt market . Various bonds can be bought and then resold at a higher price due to the fact that the policy of the central bank and the general market conditions change. Not the most popular type of trading.

- Derivatives market . You can buy oil futures for delivery in March next year, wait for prices to rise due to some event, and resell the contract. It is clear that the trader is not interested in the oil itself at all, he only needs to make money on the difference in cost.

- Commodity market. It is traded through futures contracts. A trader buys a contract for the supply of coffee beans, then a drought or some other disaster occurs - the price rises rapidly, as in the end the harvest will not meet expectations and demand will dominate. The price of the contract will increase, it can be sold at a profit.

- Currency market . The largest in terms of turnover. Currency has been speculated on since the gold standard was abolished. The number of participants is so large that the total daily trading turnover is approaching the $10 trillion mark. The speculative behavior of participants is very pronounced, any news causes price movements, it constantly fluctuates. It is on these fluctuations that a currency trader, or forex trader, makes money.

- Options . Another type of instrument that traders pay attention to. In addition to classic options contracts, there are also binary options that have gained popularity. This is a separate type of instrument, which involves only a price change in one direction for some time, but the size of this change does not matter.

- Metals. Both precious and ordinary. From being an investment instrument, gold has become almost exclusively speculative. The price constantly moves up and down, often for no reason at all. In order to understand the scale of trading activity, it is enough to familiarize yourself with the figures on the market for this metal - more than 96% of all transactions are an endless chain of resales of the same supply contracts.

- Cryptocurrency . Crypto trading is a relatively new area of trading, but it offers great opportunities. Since instruments in this category are prone to strong movements in both directions, a cryptocurrency trader can constantly earn money, the main thing is to manage risks correctly.

How much can you really earn from trading?

Over these three years, of course, I lost more than I earned; later I will tell you about my mistakes, but I also made some money. Several times, knowledge of the rules of the game on the stock exchange, and specifically on binary options, did not let me go hungry. Yes, there were such difficult moments when there were only 500 rubles on the card and there was complete uncertainty ahead...

I then lived with a guy who psychologically tormented me very much, but there was no money for travel to go to Moscow for work, to at least start earning money, rent a house and live a normal life. I asked my mother for 500 rubles, she sent it to my card, and I... credited it to the binary options platform and began to pray and... trade... I traded two thousand, which was enough for the train and accommodation for a whole week.

I didn’t know then that all these sites have the same operating principle: after replenishing your account, they give you a little money, and then they take everything away. I looked for reviews on the Internet and people who managed to make money and withdraw their accounts were blocked for unknown reasons and did not give back the money. And there are a great many such reviews!

It is not profitable for binary sites to let you earn money, all this is just a deception algorithm, just like in a casino...

How much does a trader earn?

This is perhaps the most frequently asked question after a person finds out who a trader is.

The difference between this profession and all others is that a trader’s earnings are not limited in any way . It is customary to calculate it as a percentage, which gives rise to several opportunities to evaluate the results. You can have a small capital, but at the same time triple it every month. Or you can have a huge account, but trade slowly and get a modest profit. So everything is quite conditional. We will look at the most typical options, which fit 99% of all traders:

- Negative yield . This is almost inevitable for all beginners. There is not a single successful trader who would not lose a deposit at the beginning of his journey. And not even one deposit. This is usually associated with psychology and loss aversion, passion. A gambling person cannot become a professional trader.

- Profitability within 2-4% per month . Calm trading without unnecessary risks, this is exactly how most experienced traders work, who have moved away from the idea of getting rich quickly and simply work for their own pleasure. The lack of nerves completely compensates for the not very high profit margin. We remember that if the deposit is $100,000, then the income will be significant in monetary terms.

- Profitability of 10-15% . These are either traders who are prone to relatively small risks, or those who focus on certain indicators; for some reason, it is 10% that attracts the attention of many and they strive to approach exactly this mark.

- 50-500%. Yes, there are such unique ones. True, with such trading there can be no question of money management rules at all. Usually these are real lucky people or such professionals that they catch all the movements on a variety of instruments. You need to spend dozens of years working on charts to achieve such mastery.

You can count on a small percentage per month, but it definitely significantly exceeds everything that conservative investment methods offer. But it also takes time. Since there are no ideal and very profitable options, everyone must decide for themselves how to act. Trading provides unlimited earning opportunities.

Why can't you make money from trading?

The main reason is simple - they simply didn’t try to make money. Many deposit money and begin to immerse themselves in charts, quotes and other data in the hope of quickly getting rich. After a couple of days or a week, the euphoria wears off, and zero or a few dollars remain of the initial amount. This is the path of any novice trader, since you cannot make several hundreds or thousands from 10 dollars in 2-3 days. You need to understand that the larger the portfolio, the more opportunities, but also risks.

Important!

In trading, endurance is important, and “losing a deposit” is a mandatory step for any beginner; even successful traders lose hundreds of thousands of dollars.

Trading is a delicate activity. Of the 5,000 people who are interested in this kind of work and income, only a few actually start trying, for several reasons:

- No money to start.

- This is a fraud.

- I can’t count, read graphs or analyze.

- There are no guarantees that it is possible to make money.

As a result, only 100 people try, and 1-2 people succeed. Successful traders must always control their emotions and be in complete control of themselves. Composure is the basis for success, which beginners lack.

Trader classification

You can trade in different ways. Despite the same trading environment for everyone, each trader is individual, each has his own approach. It is only possible to conditionally identify some common features based on the main differences in trade. Depending on each of them, the following types of traders can be distinguished:

1. Long-term and short-term trading . Some people prefer to catch price fluctuations within an hour, while others hold their trades for months. Conventionally, in order of increasing duration of transactions, it will be like this:

- a scalper is an intraday trader who trades on second and minute timeframes;

- short-term trader;

- medium-term trader;

- long term trader.

I also recommend reading:

Murray levels - description of the instrument and examples of use in trading

In his research, Thomas Henning Murray relied on the work of William Gann, an equally famous trader. As a result of creative processing [...]

2. Depending on the type of instruments traded:

- stock trader;

- currency trader;

- commodity trader;

- cryptocurrency trader.

3. Goals are also different . Some are engaged in accelerating the deposit, usually intraday traders, while others are inclined to take the most careful approach. That is, it turns out:

- intraday trader;

- aggressive trader;

- moderate trader;

- conservative trader;

- institutional trader (very rich and who simply wants to preserve capital, cover inflationary losses, the profit is not very large).

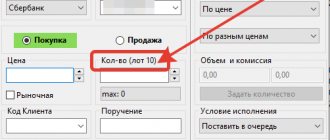

Choosing a broker

When choosing a broker, I pay attention to the following points:

- Costs and commissions. It is important to know exactly the costs of placing orders and withdrawing funds. These are costs that may make ongoing cooperation with a broker not as profitable as initially expected.

- Trading instruments. For successful online trading, you cannot do without a convenient modern working platform and analysis tools. The more advanced functionality a broker provides, the easier it is for us to predict price movements and open profitable trades when trading.

- Reliability and safety. The broker must not only regularly pay what he earns, but also jealously guard our personal data and protect the account from theft.

For the rest, you can rely on “live” ratings of real users, which can be collected on thematic resources.

Rating of the best and reliable brokers for beginner traders

In fact, there are many criteria by which you can evaluate brokers; each time the rating will be different. Therefore, I propose to determine the top ten by selecting brokers based on the size of their client base. If a lot of people trade with them and the number of clients increases, it means they know how to attract a newcomer and know how to keep him.

Therefore, my 2022 rating includes:

- Sberbank;

- Tinkoff Bank;

- VTB;

- BKS;

- Finam;

- FC Otkritie Group;

- Alfa Bank;

- Alfa Capital;

- Promsyazbank;

- Bank GPB.

If you have your own experience of trading in the Russian Federation with domestic brokers, please share it in the comments.

Trading Basics

First, let's find out what stock trading is in general.

This is not pure investing. It is primarily a process of buying and selling to make money on price differences. Investors typically hold assets for years or even decades. They are interested in the business in which they invest.

Trading, on the other hand, involves the frequent buying and selling of securities or their derivatives. Investors also trade for their own, and traders often use leverage (borrowed money) to make money in rising and falling markets. Simply put, the trader’s task is to buy low and sell high, and to do this in a short time.

Trading system

Trading systems can be divided into two types:

- mechanical trade;

- discretionary trading.

Everything else is their clone or a combination of both types of trading.

Mechanical market trading is based on mathematical rules. A trade is opened only when the desired pattern is formed on the candlestick chart and the readings of several technical or fundamental indicators coincide. Thanks to this, mechanical trading is easier to automate using various robot advisors.

Discretionary trading is a combination of trading performance and experience. The market is tied not only to mathematics, but also to psychology. Therefore, the market can often go against the rules. In this case, discretionary trading systems have an advantage over mechanical ones because an experienced trader understands the psychology of the participants and knows what to expect from the price (in theory).

Capital Management

Money management is what allows us to escape the temptation to lose the weight of our deposit on the first transactions, as well as turn trading into a balanced and conscious activity and optimize our trading results. If we do not know how to manage capital, we will not be successful in trading the financial markets.

Proper risk management is the correct size of the position, the ability to place and move stop losses, and timely reaction to market changes in order to maintain the desired risk-return ratio.

Simply put, money management allows you to trade with confidence and without unnecessary stress.

Psychology of Trading

Trading psychology refers to emotions and how they bring about success or failure in stock trading. Trading psychology refers to the various aspects of a person's character and behavior that influence his trading actions. It stands alongside attributes such as knowledge, experience and skills.

Discipline and risk are two of the most important aspects of trading psychology. Fear and greed are two of the most natural emotions associated with trading psychology. Another strong pairing is hope and regret.

Trading is saturated with emotions. Greed encourages you to make overly risky decisions. Fear, on the contrary, drives away from risk and “sucks out” profit. Therefore, the one who manages to rid himself of the influence of greed and fear, kills false hopes and does not regret what he missed will become successful.

The difference between a trader and an investor

The main goal of a trader is to take a profit. Often the catalyst for such an event is something in the news.

You can buy Apple shares right now (this is what an investor would do), you can wait and see what the quarterly report will be and make a decision based on this, and also get acquainted with the dividend policy and payment plans. An investor will simply buy a reliable security and wait for a profit.

The trader is not inclined to such waste of an important resource (time); during this time he will study 10, 20 or 50 other securities in order to jump from one to another.

The same goes for speculation. If everything is bad, the world economy is falling, then the trader will not sit on the sidelines and wait it out. He will buy protective assets, which will begin to rise in price quite quickly as the crisis develops. And he will make money from it. Or it will begin to open short positions on all falling instruments.

Being on trend is the main thing for a trader . He doesn’t care what’s happening in the world, only income and the opportunity to receive this income are important. And the reasons are secondary. The logic is simple - why wait out corrections in securities or currencies, if you can also make money on them? But everyone determines the scale of such movements for themselves.

Trading: what do you eat it with? And do they eat?

The word "trading" comes from the English word trade - trade. In simple terms, trading is trading on financial markets (or exchanges). Thus, exchange trading may well become a synonym for our concept.

Who can trade

Just 30–50 years ago, only large institutional traders could trade in financial markets. That is, those who operated capital in millions of dollars and worked on behalf of various institutions, banks, foundations and similar organizations.

Now, any person who is ready to allocate trading capital and time for training and directly for the activity itself can engage in trading.

IMPORTANT!

The profession of a trader does not imply giving up your main profession!

You can trade in financial markets in parallel with your main type of employment in order to increase the family budget and create an additional source of income.

The popularity of trading is directly proportional to the decline in confidence in banks and other financial institutions, which during the crisis demonstrated their dependence on the country’s economy. Trading is independent in this matter.

How to become a trader?

Becoming a trader seems simple at first glance. But the deeper a person dives into this matter, the more complicated it turns out to be. At first, when looking at the chart, everyone can say - here you should have bought, and here you should have sold, everything is simple. But this is only simple on a ready-made chart. But in reality, you can never say exactly where the price will go within an hour, a day, a month. One can only guess. So everything is quite complicated.

For those who have decided to become a trader, we can offer this simple action plan that you can follow:

- Since a person already knows who a trader is and has a desire to become one, one can start by searching for information about which broker to choose.

- Read as many materials as possible on trading - news, analytics, study methods and strategies, indicators, and so on.

- Try working on a demo account first, however, it does not always fully reflect the market environment.

- Start with a small amount on a real account.

- Continuing to improve your skills is an endless process. However, the results themselves will encourage the stock trader to continue to improve.

Legislation regarding trading and legal status in Russia

From a tax point of view, a trader is no different from any other person who receives income. You must pay ordinary income taxes on all profits. The declaration for the previous year is submitted at the beginning of the next year, it indicates the amount of profit received. There are several nuances:

- No one knows for certain whether offshore brokers (Forex Club, InstaForex, etc.) share information about clients with the tax authorities of the Russian Federation. That is, only a few actually pay taxes. But this applies to Forex brokers.

- Stock brokers withhold taxes themselves . No worries for the trader. It is possible to take advantage of benefits under a special IIS program.

- Serious foreign brokers provide information about clients . That is, you need to pay so that problems do not arise at some point.

- There are complex schemes for registering an offshore company, but an ordinary person with $10,000 has no need for this.

To summarize, we can say that trading is an absolutely legal, unrestricted activity from which you may or may not pay taxes under certain circumstances . True, we do not recommend avoiding it if the amounts are large, because there is still a problem with the withdrawal of funds, and questions may arise from the bank or electronic wallet. 13% is not that much, you can pay for peace of mind.

Secrets of successful trading

It is believed that trading is an activity and hobby for experienced investors with large starting capital, knowledge and skills. Trading on the Internet gives even beginners the opportunity to gain experience and knowledge, increase capital, the main thing is not to take unjustified risks. Those who study will have success.

It is recommended to complete the program, a trading course, watch seminars from the best traders and start trading using a demo account. It is better to start on currency exchanges, where the market is calm and easier to predict. However, you can’t expect quick profits from this type of trading, but you can become more expert in this environment.

Important! It is better to trade consistently with a 10% profit than to take excess profits and losses. A trader's success is measured by stable income.

Advantages and disadvantages of being a trader

Trading, like any other profession, has both advantages and disadvantages. Some of them may seem far-fetched, but this is only until you try it yourself. So, let's start with the pros :

- Earnings are unlimited . You can take profits, or you can reinvest, in which case the deposit will grow exponentially. And the more we earn every month, the faster this growth will be.

- Independence from the environment . A trader has no boss. If you get sick, you don’t trade or pay minimal attention. In addition, it is quite possible to do this while lying on the couch with a laptop in your hands or, at worst, from your phone.

- This is the most money-related profession . That is, work is sometimes done literally with the money itself. This usually captivates people; they see the results of their actions right before their eyes.

- Quick access to capital . Money can be withdrawn within a short period of time - from instant withdrawal to 3 days in the case of a bank transfer.

- A large number of educational materials . There is no need to study for 6 years and then work for someone. Everything has been studied for a long time and presented in hundreds of different books, articles, seminars and videos. You can take courses with some broker, but this is a rather dubious matter; to be honest, it’s better to do it yourself.

Now let's look at the disadvantages . They may be significant for some.

- Trading often has a serious impact on your emotional state . There are days when it seems that no matter what you do, everything will lead to a loss. And it happens that absolutely everything turns out extremely well. In general, mood swings are guaranteed, especially in short-term trading.

- A trader is a profession inextricably linked with risks . It is important to be able to manage capital correctly and not chase excessive profits.

- Sometimes you have to get up in the middle of the night to watch the market reaction to news releases . This is all due to 24/7 trading.

- There are fraudulent brokers . Getting to the bottom of the truth is not always easy, especially for a person who is far from this matter and has just entered the market.

Factors influencing profitability

In any market there are only 3 factors on which profitability depends:

- Risk Accepted

. A conservative approach to trading reduces not only risk, but also income - the main disadvantage.

- Selected strategy

. Results depend on the frequency of transactions, as well as the average income from each transaction. Strategy is a set of methods and actions used to enter and exit a transaction.

- Start-up capital

. It is better to work with 5% of the deposit. As a result, the larger the starting capital, the higher the profit. Having entered the market with 200 dollars, you do not need to expect that within a month they will multiply, turning into thousands. This can only happen in cryptocurrency markets, but the probability of this is 1-2%.

In reality, you do not need to have any economic or financial education to start trading. A few correct books on technical analysis, as well as training with a mentor, and the results will not keep you waiting. This is not the preserve of rich people; leverage and stop loss will allow you to enter into transactions with small amounts, limiting possible risks.

The most famous traders in history

During trading on the stock exchange, there were cases of stunning successes and even more high-profile failures. People became billionaires, but later some of them lost their fortune. Also interesting are some “records”, both in terms of the amount of earnings per day and in percentage terms. Here are the five most famous:

- Warren Buffett . One of the most successful investors who invested in shares of promising companies and held them for many years. Starting out by personally managing his relatives' funds, Buffett rose to the top of the Forbes list over the course of several decades. At the moment, his fortune amounts to tens of billions of dollars.

- George Soros . Probably absolutely everyone has heard about him. He also went all the way from the very bottom, at the moment he has practically retired and only manages the money of his family. The most interesting fact in his biography can be considered his earnings from the fall of the pound against the German mark - according to unconfirmed information, he earned $1 billion in a day.

- Jesse Lauriston Livermore . A simple guy became one of the most famous traders of the 20th century. He became famous for manipulating the opinions of trading participants, convincing them of one direction of the trend, and then closing positions due to increased market activity. He made and lost his fortune many times, and eventually committed suicide.

- Larry Williams . He holds the record for annual income when trading on the derivatives market - 11,000%. That is, he was able to increase the starting capital 110 times. Since then he has been engaged in training, analytics, and conducting various seminars. The record has still not been broken.

- Richard Dennis . He was nicknamed “the king of futures.” From the very beginning of trading, he was lucky, and therefore he gained great authority in the financial world. It is believed that his view of the market was so important that futures contracts could change in price based on rumors of interest from Dennis alone. He does not occupy a leading position in the list of rich people, but has been successfully trading for decades, having switched to algorithmic trading.

Pros and cons of making money from trading

Given the possibility of receiving unlimited income, all the disadvantages of trading will be covered. The strengths of such income

, if we consider working on the stock exchange as a profession:

- Any income, no limit on the amount, there is no upper limit.

- You can work from anywhere in the world.

- Minimum entry threshold; you can start with tiny amounts.

- Free chart, only linked to trading sessions.

- There are no age restrictions, but reaching the age of majority is required to open a brokerage account.

Among the disadvantages are:

- No social package and fixed salary.

- Instability, because markets change, after which strategies stop working.

- High psychological stress.

- To meet the needs of life, you need a large initial capital.

- There is no live team.

The main doubts about this type of earnings are caused by a lack of understanding of the mechanisms of how markets work. The result is fear and uncertainty. In fact, the process is simple from a technical point of view and only 50% of success depends on knowledge. The other half is managing emotions.

Trading on the stock exchange is an opportunity to quickly and radically change your life, but the path is complicated and has nothing in common with the one that is advertised. It is impossible to make a fortune with 100-500 dollars a month and live comfortably. It's constant work, hard work and studying strategies, conducting endless analysis. The types of assets can be any: currencies, shares, cryptocurrency, futures.