When the words trader or broker are mentioned, people far from the topic often have associations with men in formal suits, driving expensive cars and with all the corresponding attributes.

This is partly true, but a modern private trader is just a person with a computer or even a smartphone, and it doesn’t matter what he looks like.

In addition, it has long been known that people in formal suits most often work for people in shorts and T-shirts.

From the article you will learn:

- What is trading

- Why is trading needed?

- Skills a trader cannot do without

- Features of Internet trading

- Types of trading

- Famous traders

- Let's sum it up

What is trading

In short, trading is trading on a currency or stock exchange.

Such exchanges are the basis of international economic relations, and not everyone can get directly onto the trading platform. This requires special accreditation, and brokers have it.

It is brokers who carry out all transactions, but they do so on the orders of traders.

Previously, in the pre-Internet era (yes, yes, there was that too), orders were given by telephone.

The trader called his representative and received current stock quotes from him, after which he made a decision to buy or sell an asset.

Today everything has become much simpler, and to access global quotes it is enough to have a personal computer or any other device with Internet access.

Trading is carried out through a special application (trading terminal), which is linked to an account at a brokerage company or dealing center.

The trader replenishes the deposit and starts trading through this terminal, that is, selling or buying assets.

Here one involuntarily recalls the word speculator, and in fact that is what it is, only without the negative connotation that this word received in the post-Soviet space.

Trading is speculation in exchange-traded and over-the-counter assets in order to profit from price fluctuations.

Tips for making money on the stock exchange

- Start by gaining knowledge. The exchange is not a casino with the opportunity to make quick money. This is trading with professional participants who have more information, experience and money. It is impossible to beat them simply by luck. You should read the basics of the stock exchange. On this site you can find a description of many indicators, trading principles, information on risks and portfolio construction. You can watch a lot of videos on youtube on securities and stock trading. It's free.

- To make money on the stock exchange you need to perform fewer trading operations. Typically, the more you trade, the less you earn. Short-term trading and scalping are for professionals.

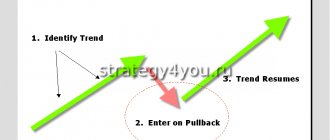

- Combine fundamental and technical analysis. That is, look for undervalued companies with growth potential. Next, based on technical analysis, select entry points. It is not only the choice of the “right” assets that is important, but also the moment of entry and exit. This is even more important than the choice itself.

- Regularly deposit money into the stock exchange to accumulate the amount.

- Limit losses if transactions are speculative and short-term. For this purpose, there is a stop loss (protective order), which will allow you to sell the position if stock quotes move against the trader.

- Be careful with leverage. For most beginners, using borrowed funds most often turns out to be their fatal mistake. Out of ignorance that the market may suddenly go against them, they take a leverage of x10, and then they can add up to x50. The broker provides such opportunities. But as soon as the price moves 1-3 percent against the trader, a margin call occurs.

Why is trading needed?

If we talk about the trader’s personal goals, then this is, of course, making a profit.

He is not guided by any other aspects.

This job is no worse or better than others, only the amount of earnings here directly depends on personal skills and knowledge, and career leaps, as well as failures, occur much more often.

On a global scale, a trader is a person who directly influences the world economy; in this case, I’m talking about traders working for large banks and investment management funds.

The market operates according to the main rule: the greater the demand for a product, the higher its price. The same is true in reverse.

The international market determines not only the value of commodities or shares of large companies, but also currencies.

The more attractive a country’s economy is, the more investment the state will attract into it and the higher the value of its currency.

The main market makers, that is, those who set prices and influence their exchange rates, are the central banks of different countries.

By injecting or withdrawing huge amounts, they can lower or raise the price of a currency.

Ordinary, private traders, of course, do not have such influence, but in the aggregate, their actions also affect the economy.

Skills a trader cannot do without

Government institutes and universities do not train traders as such.

You can get an economic or legal education at a prestigious university and it will certainly play into your hands.

But in fact, most modern traders do not have it, and are generally far from such topics.

Anyone can become a trader.

Do you want to become a trader?

Not really

It is much more difficult to become a “successful trader”, and here you will already need certain knowledge and skills.

Let's start with simple, human factors, without which it will be very difficult to achieve success:

- Perseverance . Get ready for the fact that you will spend long hours behind a computer monitor, especially at the initial stage, when you do not yet have a clear strategy and understanding of the market.

- Self-control . The desire to make money here and now often becomes the main cause of collapse. There is no rush in trading. Every decision must be balanced, and emotions are a direct path to losing your deposit.

- A clear understanding of the goal . Don’t think that if you shell out $200 today, you’ll wake up a millionaire tomorrow. This won’t happen, but you can become poorer by these 200 bucks easily and in just a couple of minutes. A trader always sets goals and goes towards them, and most importantly, they must be real and not illusory.

- Patience . The path to the pinnacle of fame is long and thorny. Yes, there are striking examples of quick gains in trading, but this is rather an exception to the rule. In fact, it can take years to master the market and achieve a stable profit, and you should be prepared for this.

As for special knowledge, these are economics and mathematics.

Only this knowledge does not have to be deep.

In fact, a basic understanding of how the global financial system works is enough.

What influences the price, and what factors can change the balance of power in the market.

By the way, all this knowledge does not have to be absorbed in large quantities at once. They will come with time and experience.

Believe me, once you start trading, you won’t even notice that within six months you will recognize John Powell and Benoit Care by sight.

Which exchange is better to make money on?

In Forex, the main disadvantage is the broker himself. Holding money with him is a risk in itself.

The small list of tools does not allow you to really choose what to make money on. Liquid currency pairs can be counted on one hand. There is a fee called a “swap” for moving a position overnight. Therefore, it is necessary to make short-term transactions.

The cryptocurrency market is suitable for those who already know the basics of trading.

Of course, you can invest here, but the risks of loss are very high. This option is better for those who already have some good savings and use the crypto market as diversification. That is, as an alternative option. It is quite possible that such an investor will be able to earn a lot of interest over time. At the end of 2022, Bitcoin broke through the $20 thousand mark.

The stock exchange is universal.

Here you can either actively trade or simply invest. This option is suitable for everyone.

The main advantage is investor protection. Stock brokers are regulated by law, unlike Forex and crypto exchanges.

In the next step, we will look at step-by-step instructions on how to start trading on the stock exchange.

Features of Internet trading

As I said above, a modern trader is not necessarily a man in a formal suit and tight tie.

In fact, he works at home and in the clothes that are comfortable for him.

Internet trading has given ordinary users, that is, you and me, a whole list of advantages:

- You don't need to be in a noisy office all the time.

- There is no need to adhere to a strict schedule. You work when it suits you.

- There are no bosses and no production standards. If a thousand dollars a month is enough for you, and you have come to the point where you only have to work one day a week, then so be it.

- No salary. You earn as much as you want. For some this is a minus