It is quite natural that after the depreciation of Bitcoin and other cryptocurrencies by more than 90%, mining at the end of 2022 became an unprofitable activity. Evidence of this is the drop in hashrate due to the shutdown of tens of thousands of video cards and ASIC miners, the decline in farm prices and the dismal financial performance of Nvidia in the corresponding segment.

Many crypto enthusiasts ask the same question: “what equipment to buy for cryptocurrency mining at the end of 2022?” Despite the global nature of the question, the answer is quite simple: ASIC miners. Why not video cards? - You ask. This is because even the top NVIDIA GTX 1080 Ti now mines $13 per month, and this is a payback of more than 7 years. Therefore, there is no point in looking towards the GPU at all.

In this article, we will present a list of the most cost-effective ASIC miners for different cryptocurrencies, list their characteristics and weigh the output hashrate/power consumption.

What is ASIC

ASIC is an abbreviation that in English stands for application-specific integrated circuit. Literally this means an integrated circuit designed to solve specific problems. Strictly speaking, each ASIC performs only one task - mining cryptocurrency based on a specific algorithm, for example, Bitcoin, Litecoin, Dash.

ASICs appeared as blockchains developed, when the complexity of networks grew and more and more video cards were required to service them. Miners incurred high costs for electricity, and mining could hardly be called profitable. In the spring of 2013, the first ASICs released by ASICminer were presented. The first generation miners used Blade Block Erupter boards with a hashrate of 10 GHz/s and a power consumption of 100 W. Interestingly, the 130 nm process technology, which is outdated in consumer electronics, was used to create it.

Why were miners interested in outlandish devices? They were several times faster than video cards in performance. The first ASICs instantly took a dominant position in the network and were guaranteed to receive rewards, ahead of the pools of video cards. In addition, the box, which hummed like a jet plane, consumed no more energy than a refrigerator or washing machine. However, it should be taken into account that ASICs worked around the clock. Payback within 12-18 months, space saving and easy setup were also important components.

The disadvantages of the devices are their high noise level, the inability to use them for other calculations (including the extraction of other cryptocurrencies), difficult repairs and high cost.

Current ASIC miners for Bitcoin mining in 2022

Information about the material Published: 03/10/2021, 06:02

New interest in cryptocurrencies in 2022 again raised Bitcoin prices to new heights, which in turn affected the income from mining this cryptocurrency. Bitcoin miners again began to buy long-outdated ASIC miners Antminer S9 from 2016, because... even they began to bring relatively good profits compared to the fact that a few months ago they did not even cover the cost of electricity. And this is not to mention the more modern models of SHA-256 ASICs, which are several times more powerful and energy efficient than the S9. Next, we will look at all currently relevant ASIC miners for Bitcoin mining in 2022, which you can purchase. Next, we will compare the hashrate, power consumption and income of SHA-256 ASIC miners, so that you can better navigate the models and manufacturers of various ASICs.

To make the information more clear, we will group all Bitcoin ASIC models by company and year of production in tabular form:

| Firm | Model | Year | Hashrate TH/s | Watt | W/TH | Income per day USD* | Electricity fee USD (0.05USD/kW)** |

| Bitmain | Antminer S7 | 2015 | 4.73 | 1293 | 273 | 1.62 | 1.55 (90%) |

| Antminer S9 | 2016 | 14 | 1375 | 98 | 4.89 | 1.64 (34%) | |

| Antminer R4 | 2017 | 8.7 | 845 | 97 | 2.97 | 1.01 (34%) | |

| Antminer T9 | 2017 | 11.5 | 1450 | 126 | 3.93 | 1.74 (44%) | |

| Antminer T9+ | 2018 | 10.5 | 1432 | 136 | 3.59 | 1.72 (48%) | |

| Antminer V9 | 2018 | 4 | 1027 | 256 | 1.37 | 1.23 (90%) | |

| Antminer S9j | 2018 | 14.5 | 1350 | 93 | 5.03 | 1.62 (32%) | |

| Antminer S9i | 2018 | 13 | 1280 | 98 | 4.44 | 1.54 (35%) | |

| Antminer S9 Hydro | 2018 | 18 | 1728 | 96 | 6.15 | 2.07 (34%) | |

| Antminer S9 SE | 2019 | 16 | 1280 | 80 | 5.59 | 1.54 (27%) | |

| Antminer S9k | 2019 | 13.5 | 1310 | 97 | 4.61 | 1.57 (34%) | |

| Antminer S9 DUAL | Custom | 20.4 | 1560 | 76 | 7.13 | 1.87 (26%) | |

| Antminer S11 | 2018 | 20.5 | 1530 | 75 | 7.15 | 1.84 (26%) | |

| Antminer S15 | 2018 | 28 | 1600 | 57 | 9.78 | 1.92 (20%) | |

| Antminer T15 | 2018 | 23 | 1540 | 67 | 8.04 | 1.85 (23%) | |

| Antminer S17 | 2019 | 53 | 2385 | 45 | 18.52 | 2.86 (15%) | |

| Antminer S17 PRO | 2019 | 53 | 2094 | 39 | 18.52 | 2.51 (14%) | |

| Antminer S17e | 2019 | 64 | 2880 | 45 | 22.36 | 3.46 (15%) | |

| Antminer S17+ | 2019 | 73 | 2920 | 40 | 25.51 | 3.50 (14%) | |

| Antminer T17 | 2019 | 40 | 2200 | 55 | 13.98 | 2.64 (19%) | |

| Antminer T17e | 2019 | 53 | 2915 | 55 | 18.52 | 3.50 (19%) | |

| Antminer T17+ | 2019 | 64 | 3200 | 50 | 22.36 | 3.84 (17%) | |

| Antminer S19 | 2020 | 95 | 3250 | 34 | 33.19 | 3.90 (12%) | |

| Antminer S19 Pro | 2020 | 110 | 3250 | 29 | 38.43 | 3.90 (10%) | |

| Antminer T19 | 2020 | 84 | 3150 | 37 | 29.35 | 3.78 (13%) | |

| Antminer S19j | 2021 | 90 | 3250 | 36 | 30.74 | 3.90 (13%) | |

| Antminer S19j PRO | 2021 | 100 | 3050 | 30 | 34.16 | 3.66 (11%) | |

| Canaan | Avalon Miner 741 | 2017 | 7.3 | 1150 | 157 | 2.55 | 1.38 (55%) |

| Avalon Miner 821 | 2018 | 11.5 | 1200 | 104 | 4.02 | 1.44 (36%) | |

| Avalon Miner 841 | 2018 | 13.6 | 1290 | 95 | 4.75 | 1.55 (33%) | |

| Avalon Miner 921 | 2018 | 20 | 1700 | 85 | 6.99 | 2.04 (29%) | |

| Avalon Miner A10 | 2019 | 31 | 1736 | 56 | 10.83 | 2.08 (19%) | |

| Avalon Miner 1066 | 2019 | 50 | 3250 | 65 | 17.47 | 3.90 (22%) | |

| Avalon Miner 1026 | 2020 | 30 | 2070 | 69 | 10.48 | 2.48 (24%) | |

| Avalon Miner 1047 | 2020 | 37 | 2380 | 64 | 12.93 | 2.86 (22%) | |

| AvalonMiner 1066Pro | 2020 | 55 | 3300 | 60 | 19.22 | 3.96 (21%) | |

| Avalon Miner 1146 | 2020 | 56 | 3192 | 57 | 19.57 | 3.83 (20%) | |

| AvalonMiner 1146Pro | 2020 | 63 | 3276 | 52 | 22.01 | 3.93 (18%) | |

| Avalon Miner 1166 | 2020 | 68 | 3196 | 47 | 23.76 | 3.84 (16%) | |

| Avalon Miner 1246 | 2021 | 90 | 3420 | 38 | 31.45 | 4.10 (13%) | |

| Innosilicon | 2018 | 43 | 2100 | 49 | 15.02 | 2.52 (17%) | |

| T3+ | 2019 | 57 | 3300 | 58 | 19.92 | 3.96 (20%) | |

| T3+ PRO | 2020 | 67 | 3300 | 49 | 23.41 | 3.96 (17%) | |

| MicroBT | Whatminer M3 | 2018 | 12 | 2000 | 166 | 4.19 | 2.40 (57%) |

| Whatsminer M3X | 2018 | 12.5 | 2050 | 164 | 4.37 | 2.46 (56%) | |

| Whatminer M10 | 2018 | 33 | 2145 | 65 | 11.53 | 2.57 (22%) | |

| Whatsminer M10S | 2018 | 55 | 3500 | 64 | 19.22 | 4.20 (22%) | |

| Whatsminer M20S | 2019 | 70 | 3360 | 48 | 24.46 | 4.03 (16%) | |

| Whatsminer M21 | 2019 | 30 | 1800 | 60 | 10.48 | 2.16 (21%) | |

| Whatsminer M21S | 2019 | 56 | 3360 | 60 | 19.57 | 4.03 (21%) | |

| Whatminer M32 | 2020 | 68 | 3312 | 49 | 23.76 | 3.97 (17%) | |

| Whatsminer M31S | 2020 | 74 | 3312 | 45 | 25.86 | 3.97 (15%) | |

| Whatsminer M31S+ | 2020 | 80 | 3360 | 42 | 27.95 | 4.03 (14%) | |

| Whatsminer M30S | 2020 | 88 | 3345 | 38 | 30.75 | 4.01 (13%) | |

| Whatsminer M30S+ | 2020 | 100 | 3400 | 34 | 34.94 | 4.08 (12%) | |

| Whatsminer M30S++ | 2020 | 112 | 3472 | 31 | 39.13 | 4.17 (11%) |

*Bitcoin mining income was calculated as of March 10, 2021 (BTC: 53,700 USD)

** The percentage indicates how much you need to pay for electricity from income at an electricity price of 0.05USD per kilowatt.

The table shows the most popular companies and models that can be found on sale. But besides them, there are lesser-known companies that also produce ASIC miners for Bitcoin mining: BitFury, Cheetah, ASICMiner, HummerMiner, Alladin, STRONGU, Ebang, Pantech, Holic, GMO.

The cost and payback of mining equipment were not given because It is now impossible to find ASIC miners on sale, much less at the manufacturer’s recommended price, and prices can vary greatly depending on the seller. It is also not possible to buy SHA-256 ASICs directly from the manufacturer, because... all companies sold their products a year in advance based on pre-orders in large quantities. Therefore, you can now buy ASICs only from resellers or individuals, and this only applies to older models from 2016-2018. Almost all new ASICs go to large Bitcoin mining companies whose supply orders can be up to 100,000 units or more.

It can also be noted that in current realities, even the 2015 Antminer S7 model can generate profit. Although all these models of ASIC miners have long been thrown into the dustbin of history.

It is quite difficult to predict how long the story of super-profits in mining Bitcoin and other cryptocurrencies will last, so the decision to purchase ASIC miners in 2022 at current inflated prices should be approached with caution, especially for older models released before 2022.

List of all ASIC miners

- Mining equipment

What mining algorithms exist

After choosing the cryptocurrency you like best, you need to pay attention to the algorithm for its extraction. Depending on this, an ASIC will be purchased. Today there are three most popular algorithms:

- SHA-256. This is the most famous and widespread algorithm; the first ASICs were created for it. Bitcoin, Bitcoin Cash, Syscoin, Crown, Neoscoin, etc. are based on it.

- X11. This algorithm was proposed during the development of the Dash cryptocurrency. It applies 11 hashing functions for proof of work. It also runs Pura, BitSend, Onix, Centurion, PinkCoin, etc.

- Scrypt. Secure password-based key generation function. To crack it, you need a large amount of memory with random access. This algorithm is used by such blockchains as Litecoin, BitConnect, Dogecoin, BitDeal, etc.

The choice of algorithm is important for PoW (proof-of-work) protocols. Most blockchains are currently built on them. This literally means “proof of work.” They imply the active participation of users in performing calculations and receiving rewards in proportion to the contribution.

The head of Blockstream connected Halong Mining with the head of Satoshi Labs

So far there is not much information about this on the Internet, with the exception of yesterday’s outbursts on social media, articles and posts on forums. Immediately after the announcement, many users suggested that this project is still at the concept stage, since Dragonmint looks like a Photoshopped S9. Unfortunately, the mining community often encounters various “fakes” of some companies that publish photographs of other people’s equipment. However, on the same day, Blockstream CEO Adam Wat published confirming messages about the creation of a new miner on his Twitter page.

He wrote that the CEO of the very first Bitcoin pool Slush, Jan Capek, posted a video on YouTube demonstrating the working process of Dragonmint. Satoshi Labs IT architect Marek Palatinus and Trezor CTO Pavol Rusnak are also allegedly present.

However, Palatinus did not appreciate his connection with Halong Mining. In a reply tweet, he wrote that neither he, nor Chapek, nor Rusnak have anything to do with Halong Mining. He also asked Adam Wat to delete his post, and Rusnak himself asked to remove the relevant tags from the tweet.

“Please remove me from your tweet, I was not present at this filming,” Rusnak said indignantly.

Adam later apologized for the posts on Twitter, explaining that Jan Capek was simply demonstrating the work of his division, while Halong Mining is a separate company and has no connection to Slush or Trezor.

“Sorry for the confusion...” he wrote.

What to look for when buying an ASIC

When purchasing an ASIC, you should first of all pay attention to its power (hashrate). In relation to ASICs, it is expressed in Th/s, Gh/s or Mh/s. The higher this indicator, the faster the calculations take place, which means the chance of completing the block and receiving a reward increases. ASICs can be overclocked by increasing the hashrate. However, this increases power consumption and, with a standard cooling system, unstable operation of the equipment is possible.

By the way, about electricity consumption. This is the second important characteristic to pay attention to. It is especially important to consider network power when installing a large number of devices (over 10).

A more complex characteristic is energy efficiency. Vendors usually indicate it as the ratio of energy consumed to hashrate (J/Gh). Thus, the lower the coefficient, the more energy efficient the device and its efficiency is higher. Currently, most ASICs are energy-efficient devices.

Another element that constantly attracts attention is the price of the equipment. It is included in the investment model and the payback is calculated. In other words, you must take into account that when mining, the equipment costs must first be recouped and only then will the income come, minus the current costs of repairs, maintenance and electricity.

It is unlikely that anyone will willingly want to be in the same room with an ASIC, but sometimes miners pay attention to the noise level produced by the device. This parameter is not indicated by all manufacturers, but usually it varies from 75 to 90 dB.

Finally, in conclusion, it is worth paying attention to the size and weight. This will be needed when installing the truss and calculating the load on the floor.

Content

- The best ASICs of 2022 on SHA-256

- Scrypt ASICs for mining 2022

- Rating of the best ASIC miners for X11

- ASIC miners 2022 for other algorithms

- How to choose the best ASIC miner

When choosing the best ASICs for mining, it is important to focus on the following criteria - equipment speed (hashrate), manufacturer and payback. Other parameters are no less important for the miner - the noise level of the device, power (kW) and the algorithm on which the device operates. The most popular ASIC miners work on SHA-256, Blake (2b), Scrypt and X11, which allows you to mine dozens of different cryptocurrencies. Let's highlight the most interesting models of 2022, consider their main characteristics and consider the payback.

Types of ASICs

According to their purpose, ASICs are conventionally divided into three types. These include:

- Compact miners, or flash drive miners (USB ASIC Miner). They are designed for “pocket” cryptocurrency mining at home. Their main feature is easy connection to a PC via USB port and small dimensions. True, their characteristics are appropriate, “childish”. This device is perfect as a gift and is used to introduce the topic of mining. Examples include flash drive miners GekkoScience 2PAC BM1384, Bitcoin Miner USB Block Erupter, Bitmain Antrouter R1-LTC, FutureBit MoonLander 2, etc. Such devices cost $80-100

- ASIC for home mining. This includes devices with average characteristics and parameters. They typically consume approximately 600-800 watts. At the same time, the body and other parts are made of lower quality materials than for professional devices. The hashrate of this type of equipment also shows average performance. The mid-range ASICs include Antminer L3++, Innosilicon A4+LTCMaster, Baikal-X and others.

- Professional ASICs. This is the most common type of ASIC. As a rule, they are equipped with built-in power supplies with a capacity of more than a kilowatt and first-class cooling systems. The performance and energy efficiency of such devices is maximum. However, along the way, the payback period should be taken into account. In addition to the cost of the device itself, to calculate the payback, you need to take into account power consumption. For example, with a power of 1 kW, the monthly consumption of one device will be 720 kW (1x24x30). With an electricity cost of 0.06 cents per month, you would have to pay about $43 (or $520 per year). And this is only when one device is running.

ASIC miners for mining other cryptocurrencies

If you prefer to mine a confidential cryptocurrency like Zcash, then the choice is limited: it is Bitmain Antminer Z9 or Innosilicon A9 ZMaster . They both produce an unrealistic 50 ksol/s with a power consumption of only 620 W. With them you can mine $213 per month and break even in just 15 months. We do not recommend considering other ASICs for Zcash.

For the DASH cryptocurrency, there are ASIC miners on the market such as Spondoolies SPx36 and Bitmain Antminer D5 . Hersheit and the consumption of the first is 540 Gh/s at 4400 W, and the second - 119 Gh/s at 1566 W. Both devices are good, so it’s worth considering solely based on financial possibilities. Spondoolies SPx36 mines $1035 per month and pays for itself in just 9 months, and Antminer D5 mines $202 per month and pays for itself in 7 months.

Which ASIC to buy in 2022

Currently, each manufacturer has a solid set of ASICs for any kind of computing. Let's look at the most popular of them:

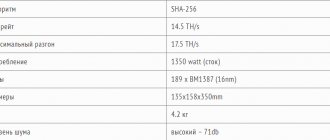

- Bitmain Antminer S9 is the most famous and widespread miner designed for mining bitcoins or other cryptocurrencies using the SHA-256 algorithm. It was released in the summer of 2016 and since then has been “buried” several times, but it continues to enrich miners. Among the most interesting characteristics, we note a hashrate of 13.5 TH/s, power consumption of 1,350 W and two 120 mm fans with a rotation speed of up to 6 thousand rpm. The device has 189 chips on a 16 nm chip. For the future, you can take S9j, which already produces 14.5 terahashes per second (of course, if the manufacturer resumes sales).

- Innosilicon Terminator 2-Turbo. If the manufacturer's information is reliable, then Bitcoin miners have the opportunity to get a device that produces 24TH/s. It uses low power consumption chips from Samsung. Total consumption approaches 1,800 W. They sell for about $1,350 each.

- GMO B3. The Japanese vendor announced the release of one of the most productive miners for the SHA-256 algorithm. It is built on a 7 nm process technology and produces up to 33TH/s. Energy consumption remains at 3,500 W at maximum hashrate. The device's power supply is designed for 4 kW. Among the interesting features, we note the ability of the device to automatically or manually adjust performance. This allows you to increase the hashrate to the maximum when mining profitability is at its peak. You can also reduce it, making the device as energy efficient as possible when it decreases.

- Innosilicon A6 LTCMaster. Designed to support the Scrypt algorithm (Litecoin, Dogecoin, etc.), the ASIC has one of the highest hashrates among analogues (up to 1.23 GH/s), while maintaining power consumption at 1,500 W. Four fans cool the “getter”.

- PinIdea DR-100. This device from a Chinese manufacturer was developed as an alternative to the BitMain Antminer D3. The algorithm produces 17GH/s, consuming about 820W. It was released during the growth phase of Dash and the payback period was 5-6 months. Now the rate of Dash, like many cryptocurrencies, has dropped, but the coin is considered very promising. For its extraction in the long term, the output from Pinldea is best suited.

Of course, we have provided only a few models for reference. Manufacturers offer dozens of ASICs, including their own improved models (marked “+”). Below is a summary table of the most popular devices in terms of performance/power consumption. The main pool of manufacturers looks like this: Bitmain, Baikal, PinIdea, Innosilicon, Ebang Communication, Halong Mining.

Two best ASIC miners for Ethereum mining

Unfortunately, there are currently very few truly profitable ASICs for Ethereum. However, if you urgently need to mine ETH, which has long been a “dead” coin, then you should only take a closer look at the following devices:

- Innosilicon A10 ETHMaster. Choose a model with 485 Mh/s only. It consumes 850 W, modest by today’s standards, and pays for itself in about 3.5 years. Profitability at $129 per month.

- Bitmain Antminer E3. There are various modifications of the E3, but among them it is worth choosing only the 190 Mh/s model. The power consumption of the ASIC miner is 760 W. As for the payback, it is at the level of 2.5 years. Profitability: $32 per month.

How to set up and care for an ASIC miner

Setting up each ASIC is an individual process. It depends on the chosen cryptocurrency and the manufacturer’s instructions. There is a universal set of actions that need to be done to start mining.

connect the power supply. The connectors from the power supply are connected to the connectors until the latch clicks. One of the connectors is connected to the system control panel; connect the network cable to the router; carry out a test run of the system. The indicators should light up and the fans should start running at low speeds; determine the device's IP address. This can be done in a browser or using a utility; after assigning an IP address, you need to go to its web interface and perform a series of actions: register the address of the mining pool, adjust the frequency and power, change the firmware; After saving all the settings, the ASIC reboots and starts working with the new settings.

During the process, pay attention to the following factors:

- make sure that no moisture gets into the ASIC;

- The power of the power supply should be enough for stable operation; when overclocking, take power supplies with a power reserve of 25-40%;

- clean, blow out and replace radiators at least once every few months;

- watch for errors and the appearance of "X's" indicating the beginning of problems with the equipment;

- diagnostics will help identify damage to the power circuit and loss of chips on the board;

- keep an eye on the hashrate level. Its decrease indicates that little power is being supplied to the chip.

The situation in the cryptocurrency market is still far from optimal. The rates of most currencies remain volatile and subject to speculative fluctuations. However, in the long term, ASIC mining remains a stable source of passive income. As the complexity of the network increases, the rewards may decrease, but don't let this scare you, because big risks promise big rewards.

The most important things about the blockchain industry in our telegram channel!