Bulls and bears on the stock exchange - this definition is associated with the battle of sellers and buyers in trading. In any market, traders and investors are faced with these concepts. This is the Forex financial market, cryptocurrency and stock exchange.

The story of the confrontation between bulls and bears began in 1712 with the stories of John Arbuthnot. In the work “The History of John Bull,” one of the chapters describes the battle of characters in animal costumes on the floor of the London Stock Exchange. The fight is so loved by traders that the concepts of trading are used in our time.

Speculators often purchase figurines of these animals with the hope of making stable money.

In the article we will analyze what they mean, how the concepts and types of animals on the stock exchange differ.

Who are the bulls on the stock market?

Bulls on the stock exchange are investors and traders who open transactions to increase the price of any asset - a security, currency, derivative, etc.

Such a player does not work with short trades. A speculator enters long positions, hoping to make money on a significant increase in value. The main goal of stock bulls is to find the moment when the quote reaches the bottom and is ready for a long upward movement. Buying an asset at this point provides players with a significant profit.

Who is a bull trader

The bull (English Bull) on the farm attacks the enemy from the bottom up with sharp horns, throwing him as high as possible. This feature was noticed by brokers and transferred to the financial world. A bullish trader tries to increase the price.

He is a buyer of a financial asset (stocks, bonds, futures, options).

Therefore, an upward trend is called a bullish trend.

Bullish trend

The bull market could last for several years. Stocks will make new highs every time.

Who are bears?

Bears are traders who short the market - open short positions and make money on a fall in the value of an asset. For this reason, the global downward movement is called a bearish trend.

It is believed that bears are less patient than bulls. They don't like to hold a deal for long. What makes it strong is that to open a short position you need to borrow assets. And if the position is open for a long time, then the bears have to pay a significant commission.

All about bears

Market players who prefer to make money in a bear market sell assets after first analyzing the situation and predicting a fall. Professional traders evaluate the political situation of the state to which the asset is related, as well as publicly available economic indicators, in order to search for factors that could potentially cause a collapse in the value of the instrument.

Bears sell financial assets that do not actually belong to them. Such exchange transactions can be called by several terms:

- short selling;

- short position;

- shorts;

- bearish game.

Bulls and bears on the stock exchange - what's the difference?

These categories of players are key figures in trading or investing on the stock exchange. The same investor periodically becomes a bull or a bear.

Bulls

They buy undervalued assets with clear growth potential . Such high volume positions create a bullish movement. When buying a stock or currency that is moving in an uptrend, players try to sell assets closer to the reversal point of the chart. This is how you get maximum profit.

The Bears

These stock market characters wait for the moment when the market is overbought - when the price rises too much and too quickly. After such growth, the value of the asset will inevitably begin to go down. Favorable times for bearish trades are times of bad news, economic turmoil and crises. During such periods, assets quickly lose value.

Bears buy stocks on margin (on debt) at the time of peak value . They immediately sell the purchased instrument at the market price. When the stock price reaches its minimum value, traders close the trade. That is, they buy back shares from the stock exchange, pay off the debt they took on, and keep a cash profit (the difference in price between selling and buying).

Sometimes the repayment time for such a loan is limited to one trading day. There are times when a short trade is held for months or even years. An example of a long bearish period is the fall in oil prices in 2015-2016.

Moose is a bidder's best friend

Yes, yes, there is also a moose in our zoo - traders’ slang is generally an interesting and funny thing. Moose is a stop loss that is set by a trader when entering a trade. This is the acceptable level beyond which the price should not go. That is, if it comes in, the broker closes your position. When the price goes against you and the broker closes your trade with a loss at the level of the stop loss you specified, you can say that you “caught a moose.”

It’s interesting that beginners are terrified of getting a stop loss and are very worried about every elk they catch. Professional traders think completely differently. They treat feet very calmly, do not see anything terrible in it and consider them simply an inevitable evil, which is impossible to do without. Moreover, several received stops will be more than covered by one successful transaction.

The history of the emergence of terms and the war between them

The first term is associated with the image of a bull charging, lifting its opponent on its horns . Bear traders were called bears by analogy with a bearish attack. The animal attacks the victim, hits it with its paw from top to bottom and presses it to the ground.

These visual images reflect the strategy of players who are buying assets, or vice versa - pushing the price towards the bottom.

The confrontation between bulls and bears comes down to the following:

- Bulls seek to raise asset prices in order to sell at the highest possible point. Buyers are trying to create a stir and convince smaller market participants to join the upward movement.

- Bears are trying to reduce the price . Big players open short positions at the top of the chart and create a powerful selling impulse. They convince other exchange participants that the instrument will go down. If a large number of small players believe the bears, they will open sell orders and strengthen the bearish trend.

If you study large periods of the stock exchange, you notice both bullish and bearish trends. But on a global scale, the strength of upward trends cumulatively exceeds the opposite downward ones. The reason for this is the natural growth of the economy and technological progress.

There is a pattern that a bull market grows gradually, while a bear market is characterized by sharp falls.

BULLS, BEARS and other representatives of the stock exchange fauna

This publication is intended for beginners in stock trading and covers generally accepted, basic concepts on the stock exchange. If you are a trader who has made at least one trade, you will already be familiar with the terms described here

When exactly the images of Bull and Bear began to be used in stock exchange terminology is not known for certain. One version of their appearance takes us back to the beginning of the 18th century, and is associated with the work of the Scottish physician and satirist, member of the Royal Society, John Arbuthnot. In his work The History of John Bull, dated 1712, the main character John Bull gets into a fight with another character nicknamed Bear outside the London Stock Exchange (although the exchange was officially founded only in 1801, its history dates back to 1570). The nature of their fight corresponded to the names of the heroes and the habits of real animals, which was noticed in North America by organizers of fights between real bulls and Californian grizzly bears. The Bull (English Bull) tried to pry his head up and throw the Bear (English Bear), and he, in turn, tried to knock down and press his opponent down to the ground. This epic battle of the characters in Dr. Arbuthnot's pamphlet served as the prototype for the name of the opposing participants in stock exchange trading - Buyers and Sellers.

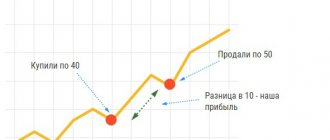

Buyers (Bulls) are confident that the price of the asset they are purchasing will increase, and therefore, by buying now, they can sell it at a higher price and still make money on the difference in price.

Sellers (Bears) believe that the price of the asset they have will decrease and they rush to sell it at a higher price, so that later, when prices fall, they can buy it back cheaper.

Bulls and Bears have become firmly established in stock exchange terminology to denote not only players, but also other concepts associated with the rise and fall of prices in the market. A downward trend is called bearish, and an upward trend is called bullish. Negative news leading to a market recession is bearish, while positive news is bullish. In Germany, opposite the building of the Frankfurt Stock Exchange, there is a monument to the Bull and the Bear, as a symbol of the constant struggle between the two elements of the market - growth and fall. There are monuments to the stock exchange representative of wildlife, the Bull, in both New York and Shanghai.

Buyers and Sellers, by their activity on the exchange, move prices, just as Demand and Supply move the price of a product, depending on the predominance of one of them. This mechanism was described in 1960 by Campbell McConnell and Stanley Brew in their joint work Economics.

In modern conditions, the technique of gambling/speculation on electronic exchange platforms is significantly different from what it was in the good old twentieth century. And with the entry of cryptocurrency assets onto the exchange, entire strategies are being developed to reduce or increase their value. Participants in such market speculation can be not only real traders, but also bot programs.

The technology for sharply increasing prices is called “ Pump ”. This is a deliberate purchase of an asset aimed at short-term appreciation. It requires a fairly large supply of resources and clear coordination in the actions of the major players - participants in the pump. Schematically, the algorithm can be described as follows: at the initial stage, a certain volume of a crypto asset is purchased, then the news background is carefully prepared and rush demand is created. An artificial increase in price, provoked by “purchases,” clearly confirms the value of the asset by the continuing rise in the exchange rate. At the next stage, sell orders are placed at a predetermined price level. By the time ordinary players just enter the market with purchases, pumpers sell them assets at an “inflated” price, which then sharply deflates.

“ Dump ” (eng. Damp - to drown out) is the deliberate sale of assets for the purpose of artificially reducing the exchange rate.

Thus, we came close to meeting other inhabitants of the stock exchange fauna.

Whales are large and experienced players on the stock exchange, capable of moving market prices in the desired direction.

Hamsters are traders who make mistakes when trading, succumbing to panic and excitement in the market.

Wolves are traders with extensive experience who practically never make unprofitable trades.

In order to move prices in the chosen direction, Whales can sell their assets slightly below the market price by opening instant sell orders. This will cause the price to decline faster, creating the impression of a sharp decline. Next, Keith monitors the reaction of traders who may follow Keith’s example and also start selling the asset. The price will accelerate its fall and will soon reach a level acceptable for Keith to purchase the asset. As a result of China's "purchases", the price will return to its previous level.

Having a sufficient amount of an asset in reserve, you can force the price to move in the desired direction, even without making transactions, using bluffing tactics. In a simplified way, it can be represented as follows: pending orders to buy or sell are placed, forming a wall in the exchange book of quotes.

A wall is a large order that can stop the rate from falling or rising.

The order book is a set of nearest orders for counter purchase and sale of an exchange asset. Otherwise called a book order.

Passive orders are established orders at a certain price different from the market price. They remain in the order book unexecuted until the market price reaches them.

Aggressive orders are orders to buy or sell that are executed instantly, at the current price of the asset. Such orders move the market, and the larger the order, the more the market will move.

Ordinary traders, analyzing the book of transactions, believe that the price will not rise or fall due to the wall there, and place their orders to buy or sell in the order book based on this. In reality, when the market price hits the wall, it disappears. The whales simply cancel their large order. Thus, the rate moves in the direction desired by the Whale, and the trader, who did not expect the price to move in this direction, closes trades in a panic with losses, while the Whales sweep away assets at reduced prices, or dump it at the highest price, on the “highs” (eng. . High - height), after which the price returns to its original state.

Loss are traders who close transactions at a loss (English Loss - loss)

These are just some typical representatives of the animal world that are used in unofficial stock exchange terminology.

There are pigs, chickens, sheep and even exotic lemmings here.

Causes of bear and bull markets

Large exchange participants can influence price movements. But a bearish trend (a price decline of more than 20%) is in most cases due to economic problems:

- decrease in income of the population;

- unemployment;

- falling profits of large companies, etc.

A market is called bullish when the growth in asset values is more than 20%. There are several main reasons for this price movement:

- GDP growth;

- reduction in unemployment;

- growth in profits of large enterprises;

- increasing the level of investor confidence.

Regardless of the direction of the market, an individual stock can go into a bullish or bearish move. The reason for this is the rapid development of the issuing company or a strong decrease in investor confidence.

Way to make money for bears

It is not profitable for bears for the price of shares on the stock exchange to increase. That is why they look for securities that, in their opinion, will definitely not increase in price.

Among the criteria that attract the attention of “clubfooted” people are:

- poor company reporting;

- the recent dismissal of the CEO;

- industrial accidents and incidents.

In fact, they are attracted by all factors that could hypothetically have a negative impact on the value of securities.

The earning scheme could be as follows: the bear borrows a thousand shares of the company and immediately begins to get rid of them, selling, for example, one dollar at a time. During the deal, he manages to make a profit of a thousand dollars. Further (if his forecasts turn out to be correct), the securities begin to fall in price on the stock exchange.

During the trading session, he buys back previously sold shares, but not for one dollar, but, say, for fifty cents. Having bought everything, he returns them to the owner, while retaining a profit of $500.

Bulls and bears on Wall Street and other markets

Many major exchanges have statues outside their offices depicting the two main types of players and trends.

The most famous bull figure is located on Wall Street near the New York Stock Market. The hero is depicted filled with rage and ready to attack. The weight of the statue is 32,000 kg.

A bear and a bull stare at each other near the Frankfurt Stock Exchange.

Shanghai also has its own charging bull . The sculpture was created by the same architect who worked on the statue installed in New York.

There is another symbol of upward market movement near the Bombay Stock Exchange.

At the stock exchange in Amsterdam, a monument to an aggressive bull was also erected, ready to raise the enemy to its horns.

Since an upward trend is considered positive, bringing profit to most market participants, bull statues are more common.

1st version

In fact, the origin of these stock exchange terms is more complex and curious.

And, of course, their history is closely connected with the great-grandmother of all exchanges - the English one. Interestingly, the first exchanges arose in the 17th century in London coffee houses, where merchants met to discuss their participation in enterprises. Exchange historian E. Morgan tells the following interesting fact: “And at that time there were dodgers who tried at the first opportunity to deceive their neighbor, and even more so, a stranger. They, hoping for a drop in the price, sold shares that they did not have. They said about these that they sell the skin of an unkilled bear. So they received the wrong name, or the nickname “bear” .

As for bulls , the origin of this concept is interpreted something like this: usually London brokers of that time liked to have fun watching the competitions of bears and bulls, which were held in the center of the City on the Thames. So the bull became a natural opponent of the bear.

Other characters of the exchange

In addition to bulls and bears, there are other models of player behavior on the stock exchange.

These include the following animal names:

- Sharks are wealthy individual investors. Affect the quotes of an individual instrument.

- Whales are large players who own large amounts of assets. By opening positions for huge amounts, whales shift the quotes of the entire market. Whales are often banks, corporations, and investment funds.

- Wolves are experienced professionals who know how to work with the market. At the same time, they do not necessarily manage large capitals.

- Loss (English: loss) are traders who constantly suffer losses. Catching a moose means closing a deal at a loss.

- Sheep are cautious stock market participants who are afraid of losing money. They make the decision to sell or buy later than others, and often miss opportunities.

- Hamsters are beginners who do not know how to recognize key trends, but boldly engage in trading. In the image of a hamster, such traders thoughtlessly accumulate assets “by both cheeks” and do not know what to do next.

- Lemmings are newcomers who follow the tactics of famous traders. They rarely make decisions on their own.

- Pigs are greedy traders who hold a position for as long as possible in order to get maximum profit. Some don’t wait for the trend to change.

- Hares are players who make money on minor exchange rate fluctuations. They buy and sell an instrument within one trading session.

It is rare for a market participant to adhere to one model of behavior. As one masters the basic principles of successful investing and studies different strategies, the trader's trading style periodically changes.

Previous article. What is Forex

Next article. Combining work and trading

Exchange Zoo: other inhabitants

Financial market players did not stop at 2 animals and added pigs and chickens to the bull and bear. Let's talk in more detail about each of these representatives.

Bull

This is a trader or investor who always seeks to buy when the market is rising. In a bull market, everything always goes well: the economy grows along with stocks and unemployment decreases. Representatives of this trend quickly choose stocks that will rise in price. But the processes occurring in financial affairs are natural, and after growth there is always a decline, so you need to be smart and exit the bull market at the right time.

Bear

The main goal of bears is to sell; they enter the market when there is a recession. For them, the opposite processes are relevant, that is, a decrease in stock prices, a decrease in GDP and an increase in unemployment. In a bear market, there are virtually no stocks to invest in. But this does not mean that the trader remains a loser; there are a number of special algorithms and techniques that allow you to make money when markets are falling. Interestingly, Wall Street bigwigs are getting rich at a time when bears dominate the financial markets.

Chick

The chicken is associated with the cowardly and indecisive investor who is afraid of losing his profits, and is always very careful before investing his assets. Chickens weigh the risks and the possible amount of losses a hundred times. On the one hand, this approach seems rational, because accuracy helps to keep money in the black, but traders do not recommend working according to this scheme; a financial player must play by bypassing the markets and making a profit from trading.

Pig

These are greedy, risky and emotional investors who invest fabulous sums without even understanding trading issues. They love to take risks and invest money without hesitation. But when playing this way, it is very difficult to deceive the market; an irresponsible approach does not bode well. Professional players, on the other hand, love pigs because they pay all the profits.

How bulls work

Bulls in stock trading are traders who buy securities and expect their value to increase in the future. Their main goal is to buy an asset at a low price and then sell it at a high price. They look for undervalued assets that may grow in the future and acquire them in order to then sell them at a profit. Such operations are called “opening a long position.”

When the value of assets rises, the trade is closed by the bulls and the assets are sold. The difference between the minimum and maximum exchange rate values is the earnings of such traders. Bulls prefer to purchase assets at the peak of falling prices and patiently wait for price growth. Their element is the market at a time of growth; during a market decline, they wait for the price of assets to drop to the level they need to enter the market.

The state of the market is associated with the main players. In a bull market, the economy grows, unemployment decreases, GDP increases, and stock prices rise. It is much easier for bulls to choose assets for investment, since almost all assets are rising in price. We just need to remember that growth cannot continue forever and someday there will be a decline. Bulls should be careful, as the market may become oversaturated and securities will be overvalued. In this case, the market will inevitably fall. It is necessary to be able to exit a bull market in time.

Stock bull or investor who buys

A bull is an animal that, when attacking, always tries to impale its opponent on its horns and then throw it up. Likewise, a trader who is confident that in the future the market will begin to increase, strives to buy existing exchange assets. When a bullish trend dominates on financial markets, there is an increase in all economic indicators (GDP, stocks, etc.) and a decrease in all the negative consequences of the crisis (unemployment, inflation, etc.).

Bullish investors make money by buying assets at a minimum price and waiting for their value to peak. After that, they make a sale and receive income from the resulting difference.

The advantage of bullish earnings tactics is that during a rising market it is easy to choose objects for investment (almost all stocks and their derivatives show positive dynamics). Among the disadvantages, one can note the difficulty of determining the moment when the selected instruments become overvalued and show the opposite direction.

The most famous investor with a bullish approach to the market is Warren Buffett. The American billionaire always relies on budget purchases and inflated sales (or leaves assets unsold at all, further increasing their value).