Stop loss and take profit

Both instruments are pending orders. The Forex market operates 24 hours a day, and you cannot constantly sit at the computer and monitor the direction of the trend. This is what such orders are intended for. If you are not at the computer, the system will automatically execute a stop loss or take profit order at the moment the price reaches the value you set.

Another thing is that values are not taken out of thin air. You must clearly understand how much you are willing to lose if prices suddenly fall and how much you want to earn if they rise.

Briefly about trailing stops

Trailing stop should be placed in a separate category (I told you everything interesting about it here). It allows you to automatically move the stop loss at a certain distance from the price, for example, 100 points. Similar situation:

- • the trader buys USDJPY again at 110.00, and the quotes went in his favor to 111.00; • he wants to maintain profits and limit risk, but believes that the price will continue to rise for a long time; • to maximize the potential of his transaction, the trader sets a trailing stop at a distance of 50 points;

Now, when the price rises, the stop loss automatically follows it by the above amount. It is important to remember that this tool works if you have a terminal open and your computer is turned on.

What is stop loss and take profit?

So, in simple words, stop loss is translated from English as “stop loss,” i.e. do not lose more than a certain amount. Take profit literally means “to take profit,” that is, to fix a profit, or to earn so much without risking much.

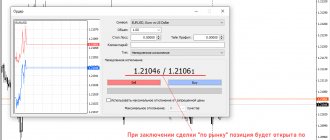

Let's assume that for the EUR/USD pair we set a stop loss at 1.1820 and a take profit at 1.1860. The entry price is 1.1845.

If events develop unfavorably for us, then when we are not at the computer, the broker will automatically close the position when the price falls to 1.1820 and when it rises to 1.1860. In the first case, you are guaranteed not to lose more than 0 rubles. ($0.00 or 0 UAH) from each dollar in the transaction amount, in the second - you will earn 0 rub. ($0.00 or 0 UAH) from every dollar, but no more.

With a stop loss order, everything is more or less clear: the natural desire is to limit losses. But what is take profit for? It would seem, why not allow the price to reach its maximum during an upward trend, or at least wait a little longer if the price has confidently turned in the direction we need?

The fact is that for some Forex pairs prices change many times during the day. By setting a take profit at a certain level, the trader will receive a guaranteed profit if the price, having reached this point, rolls back again.

Let's take the data from our example. Let's say the price reached 1.1860 and then fell to 1.1855. In this case, guaranteed income will be provided, because you have set take profit.

You can transfer both orders, i.e. shift according to the direction of the trend.

Types of orders

All exchange orders are divided into 2 large groups:

- market - executed instantly;

- deferred - trigger when the price reaches a set level.

Market orders include the following orders to a broker:

- Buy — purchase of the selected asset on the market;

- Sell - selling an asset on the market.

The order is executed at the best price available in the order book.

Several types of pending orders are used in trading:

- limit order - purchase or sale of an instrument when the price reaches a set level;

- stop order - an order that is placed to limit losses or fix profits.

Types of stop orders:

- market stop order - when the set price is reached, a Buy or Sell market order is automatically sent to the exchange;

- limit order (take profit and stop limit on the exchange) - when the set price is reached, a limit order to buy or sell is sent to the market;

- Trailing Take Profit - trailing stop for taking profit.

Stoploss orders can be used not only to close an existing position, but also to enter a trade.

What are the similarities and differences

Both instruments perform the function of risk insurance and are created to control profits and losses at a time when you cannot control the situation yourself. In addition, the possibility of losing connection with the server cannot be ruled out.

You already know the main difference: stop loss is an order that will fix your loss, and take profit is a profit.

But there is one significant difference. The point is that it is much easier to assess a potential loss than a profit. With a loss, everything is more or less clear: let’s say, having lost 7,500 rubles. ($100 or 2,900 UAH), I won’t suffer much. Well, just think, I’ll reduce the amount of the next transaction by 7,500 rubles. ($100 or 2,900 UAH), and that’s all.

Useful materials on the topic

Subscribe to my newsletter. Many more articles will be published soon on trading terms, trading strategies, general concepts of financial literacy, and investments. Subscribing will allow me to send you links to new publications directly to your email.

Check out my selection of trading courses. I start it with free materials that I have personally studied. They are all very in-depth, high-quality, systematic. When you have studied everything free, you can move on to paid courses. Although, I do not advise you to do this, everything good is on the Internet in the public domain.

If you are too lazy to watch the courses, you can watch this video right now. This is the first lesson of the basic course on trading in the foreign exchange market. It was held offline and broadcast on the Internet. The same ordinary people like you were sitting in the hall, so everything was explained in understandable and accessible language.

Today I don’t think it’s actually possible to make money from trading. If this were real, the richest people would be traders, not Musk, Bezos, Gates, Buffett and others. And the stock exchange would not have existed a long time ago - someone alone would have pumped all the money out of it.

I believe a better use of your money and time is to learn passive investing. And investments in general. If you agree with me, I can recommend you the course “Personal Finance and Investments,” which I studied personally. On it, professional investor Sergey Spirin explains the basics of profitable investment of money, introduces listeners to the main types of investment instruments, and provides excellent literature for further development.

The course is paid, currently costs 7,210 rubles. The course materials will remain with you forever, and you can return to them and review them at any time.

In addition to the course, pay attention to materials from the City of Investors. This is an educational resource on investments, both I and Vasily Blinov, who created this site, study it. Here, for example, three books, they are small, are quite suitable for a first acquaintance with investing. Books are free, download and read.

- How to become financially independent in 1 year.

- 5 ways to effectively invest 1000+ rubles.

- 6 steps to financial security.

Why set stop loss and take profit?

You can place both orders for one position or for opposite currency pairs. It is easy to understand that here the stop loss and take profit balance each other.

For example, the entry price of stock No. 1 is 3,750 rubles. ($50 or 1,450 UAH). We set a stop at RUB 3,375. ($45 or 1,305 UAH), and take profit – 4,500 rubles. ($60 or 1,740 UAH). We bought share No. 2 for 2,625 rubles. ($35 or 1,015 UAH), we set only a stop loss for it - 1,875 rubles. ($25 or 725 UAH). Let's assume that securities are purchased in equal quantities.

If stock No. 1 rises, then we will earn 750 rubles. ($10 or 290 UAH) from each paper. This profit will cover possible losses on stock No. 2.

But here we did not go into detail: why we decided to set exactly these values. Next, we’ll talk about how you can set stop loss and take profit.

Afterword

This is such a fun conversation we had today. By the way, at one time I also realized how important it is to speak foreign languages. And I started, of course, with English. By the way, if you are interested in useful literature for self-development, I have a good selection. Subscribe to my news and read!

PS And my advice to you: when you search on the Internet for everything related to the stock exchange, trading and investment, avoid links to “profit detector”! There was no such device and there is no such device, but catching the virus is as easy as shelling pears. This is what they often do: they disguise viral links with popular words and phrases from search queries.

How to set stop loss and take profit

Opposite strategies are used for buying and selling.

At the time of buying

When buying an asset, everything is simple: the take profit must be greater than the stop loss and located above the purchase price. Stop loss is below the purchase price.

When buying currencies or stocks, we expect their growth. As a rule, such transactions are made at a time when the asset is inexpensive and there is a strong upward trend in the trend. Therefore, no questions should arise here.

When selling

When selling, the situation is the opposite. It would seem strange why this is so: I open a deal at 7,500 rubles. ($100 or 2,900 UAH) and must set take profit at the level of 6,750 rubles. ($90 or 2,610 UAH), and stop loss – 8,250 RUR. ($110 or 3,190 UAH)? Doesn't it work one way? After all, it is more profitable to sell the asset at a higher price.

The fact is that when selling, a trader or investor assumes that the asset will become cheaper. It’s just that few people get rid of profitable positions. Therefore, if I sell for 6,750 rubles. ($90 or 2,610 UAH) share, which I once bought for 6,000 rubles. ($80 or 2,320 UAH), I will thereby record a small profit. And if the price turns around and rises, then I face a loss from the fact that I am getting rid of a potentially profitable position. Unless, of course, I'm going to leave the market completely. Therefore, if quotes increase, the transaction should be closed to avoid a decrease in the value of the portfolio or the deposit amount.

How to set stop loss and take profit - methods

The calculation of stop loss and take profit values depends on the trading strategy you choose. Let's start with the most aggressive strategy.

- 1:3 ratio method. This method implies that out of 10 transactions, only 3 will bring profit. But this profit will cover the losses on the remaining 7. This option is suitable for high-risk strategies and experienced players.

For example, I set take profit for one position at a value significantly above the entry point, knowing that the asset will grow. Three transactions will be closed at stop loss with a minimum loss, which will be less than the profit on the first transaction.

- Method 1:2. Here the gap is narrowing, there will be fewer losing trades, but the profit will also decrease.

- The 1:1 method is characterized by low risk and low profit.

- The 2:1 method implies that take profit will happen more often than stop loss. However, one stop can “eat up” the profit on two profitable trades.

Functions

The role of stop loss in limiting risk is clear - the order prevents the loss on the transaction from increasing. The function of take profit to reduce risk is not so obvious.

A well-known commandment of the market says: do not rush to leave a position, let the profits accumulate.

However, this thesis applies mainly to stocks and indices that are expected to exhibit continued long-term growth with moderate corrections.

It is assumed that the investor purchases an undervalued asset and waits for the price to rise. In this case, the expectation horizon is from 3-5 years, the time frame for entry is weeks/months.

Instruments on the crypto market are characterized by high volatility. Many coins are traded mainly in a range - between strong levels. The impulse is followed by a counter-impulse, which will take the profit back and easily knock out the trade with a stop (it’s good if it’s at breakeven).

The figure shows the pattern of a trade that would have been aborted due to a sharp lower test, although the intended target of a 50% retracement was subsequently achieved.

Bitcoin post-trend corrections have repeatedly reached 80+%. Therefore, when trading with crypto assets, take profit not only fixes profit, but also saves the trader from losing it, since it limits the risk of making an ineffective transaction.

Stop loss and take profit sizes

Regardless of the parameter you take as a basis (entry price, support/resistance level or moving average), take profit should always be greater than stop loss. And preferably - at least 2 times.

There are several ways to place orders. Let's consider two:

- Trend continuation flag. Stop loss is set slightly below the local minimum or slightly above the maximum, and take profit is set similarly to the movement that developed before the formation of the “flag”.

That is, we know the minimum value, everything is simple. How to understand where to set take profit: we look at the chart before opening a trade and analyze the height of the step (candle). It is not necessary to take the maximum step; it is enough to use the average value.

- Trend line. Here everything is a little more complicated, since you will have to collect forecast data and analytics for the previous period. If you opened a buy position at the moment when the price reached a minimum, it is logical to expect further growth. We set the stop loss just below the buy line, and determine the take profit value based on the averaged data. For example, according to the data obtained, for the period of time we need, quotes should more than double. Then we multiply the stop loss value by 3, and use the resulting value as take profit.

Let's start simple

Profit (English profit) translated into Russian means “profit”, “benefit”. But the same word does not always have the same meaning in every context.

For example, the word "profit" in a colloquial sense means "what has arrived" after subtracting costs from receipts. In accounting, everything is more complicated. In the same way, the word “profit,” depending on what it refers to, can take on different connotations.

In poker

For example, in poker it is possible to play both with an entrance fee, called buy-in, and to play without a fee or freeroll. The entry fee goes towards the formation of the prize fund and other expenses necessary for holding the tournament. In this case, the profit is equal to the difference between the prize and the buy-in.

If the tournament is held as a freeroll (for example, at the expense of a sponsor), then the profit will be equal to the prize itself. Profit in betting on events has approximately the same meaning.

In bets

Let's say we decide to bet on 3 football matches at once. By the way, such a complex bet is called an express bet. Also an English word! So, a bet on each individual event has its own winning coefficient. Let in our case these be 2.0, 3.0 and 1.2.

If we bet that all three events will happen, i.e. If the teams we need win, then the overall winning coefficient is obtained by multiplying 2.0×3.0×1.2=7.2. We bet 1000 rubles and won 7200. So the difference between 7200 and 1000 will be our profit.

How to calculate stop loss and take profit

Let me remind you the formula for calculating stop loss:

\[ S_{top}=Ц_{(pok.)} – \frac{R*Ц_{(pok.)}}{V}, where \]

\( C(pok.) \) – purchase price;

\( R \) – transaction risk (percentage value);

\( V \) – contract volume.

Well, we will calculate take profit based on the ratios discussed above. For example:

\( Take=Ts(pok.)+(Ts(pos.)-Stop)*2 \)

And let’s substitute the values into the formulas:

- purchase price – 1,650 rubles. ($22 or 638 UAH);

- contract volume – RUB 3,750,000. ($50,000 or 1,450,000 UAH);

- risk – 2% (50,000*2%=75,000 rub. (1,000 $ or 29,000 UAH));

- ratio – 1:3

\[ S_{top}=22-\frac{1000*22}{50000}=21.56 $ \]

\( Take \)=22+(22-21.56)*2=1,716 rub. ($22.88 or 664 UAH).

Advantages and disadvantages of stops and profits

Pending orders have both pros and cons. We list the main advantages and disadvantages:

Pros of stop loss and take profit:

- orders perform the function of risk insurance;

- guarantee receipt of a pre-agreed amount;

- control the strategy without the participation of the trader - there is no need to constantly be present at the terminal.

Flaws:

- incorrect use of take profit deprives the trader of part of the potential profit;

- “popular” values of the take profit and stop loss levels often become known to market makers who, having large sums at their disposal, buy up the assets of smaller market players.

Main mistakes when setting stop and profit and how to avoid them

We already know how to set stop loss and take profit. Now we list the most common errors that occur when setting them:

- failure to place stop orders. This is a mistake that entails a large risk, up to the loss of the entire account amount;

- incorrect calculation. The calculation formula involves such an important indicator as the level of risk. If you define it incorrectly, you will get an unreliable result. Recommended risk level (R -2-3% per transaction;

- Stop loss is too small (the value is set close to the entry price). At the slightest fluctuation, the stop will be triggered and the deal will be closed, but you will not have time to make money;

- failure to comply with the ratio of acceptable loss and potential profit, deviation from the strategy or, conversely, following the strategy without taking into account the influence of external factors. Yes, there are certain methods for placing orders, but, you see, the situation may change. It is necessary to react in time and have time to move the stop or profit to a safer point.

Recommendations for beginners:

- Always set a stop loss.

- Do not set the stop loss too small, and the take profit should exceed the stop value several times.

- Use money management calculators, which can be downloaded for free from specialized websites.

Benefits of using TP and SL

The advantages of using stop orders on the stock exchange include the following factors:

- clear control of possible losses and potential profits per transaction;

- eliminating the human factor in trading;

- automatic closing of a transaction if it is impossible to monitor the market online;

- wide possibilities for using TP and SL when designing trading robots;

- compliance with risk management in case of technical malfunctions (trading terminal freezing, stock exchange failures, problems with Internet connection);

- increasing systematic trading;

- possibility of use on the Binary Options market, Forex, exchanges, and non-exchange markets.

But trading using stop orders also has disadvantages:

- Market makers or unscrupulous brokerage firms know where the concentrations of loss-limiting orders are located and specifically “hunt” for them. They can provoke a breakout of important levels in order to knock as many players out of the market as possible and take their money.

- When placing a market stop order, losses may occur due to slippage. The higher the market volatility, the greater the trader's losses will be.

- If you place a limit stop order, there is no guarantee that it will work. This probability increases with a sharp rise or fall in the market.

An example of proper use of stop loss and take profit

Let's look at how stop loss and take profit work using the example of a long position.

Initial data:

- currency pair – USD/JPY;

- purchase price – RUB 7,841. ($104.55 or 3,032 UAH);

- contract volume – 2,250,000 rubles. ($30,000 or 870,000 UAH);

- risk – 1.5%.

Let's calculate stop loss:

\[ SL=104.55-\frac{ (30000*1.5\%)*104.55}{30000}=$102.98 \]

Now let’s set take profit using the 1:3 ratio:

104.55+(104.55-102.98)*3=8,195 rub. ($109.26 or 3,169 UAH).

Let's assume that the price, contrary to our expectations, fell to 103.14. This is a normal situation, and we know that in a short time, most likely, the trend will change direction in the direction we need. Therefore, it makes sense to move the stop loss lower to the distance that the price covered during the decline: 104.55-103.14 = 1.41.

And we get a new stop loss: 102.98-1.41 = 7,618 rubles. ($101.57 or 2,946 UAH).

Of course it's a risk. With a further decline in quotes, our losses will amount to 64,125 rubles. ($855 or 24,795 UAH): (104.55-101.57)*(30000/104.55)=64,132 rub. ($855.09 or 24,798 UAH).

For obvious reasons, it doesn’t make sense to move take profit yet.

So, then the price continued to decline and reached 7,700 rubles. ($102.67 or 2,977 UAH). If we had not moved the stop loss, the trade would have closed with a loss. But we rely on forecasts and know that the situation will soon change. And indeed, the next day the quotes rose to 7,736 rubles. ($103.14 or 2,991 UAH), and then up to 7,822 rubles. ($104.29 or 3,024 UAH). In the following days, the trend continued to move upward, and by the end of the month the price reached 8,195 rubles. ($109.26 or 3,169 UAH).

The trader's profit was:

(30000/104.55)*(109.26-104.55)=RUB 101,363. ($1,351.51 or 39,194 UAH). If we had not moved the stop loss in time, we would not have received this money.