What does long and short positions mean?

The concepts long (long) and short (short) literally mean “long” and “short”. These are some of the key terms in stock trading. For dummies, the explanation of the essence of long and short operations is as follows:

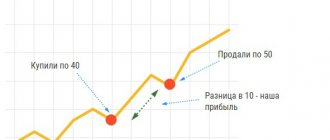

- Long: purchasing an asset for its further sale at a higher price.

- Short: making a profit by reducing the price of an asset. That is, if shares are predicted to fall, then a person borrows them from a broker, sells them on the stock exchange and expects them to fall immediately. After this, it buys back the securities that have fallen in price and returns them back to the broker. The difference between the cost of sale and purchase is profit.

Defensive strategy

Those investors who do not want to immediately close open positions usually use a defensive strategy.

It involves initial investments in larger companies with a stable position, a serious history and good income. Typically, stocks of such giants suffer less during periods of market declines. The list of such “defensive” stocks often includes securities of companies that serve the everyday needs of people - for example, operators of supermarket chains (people need to eat even during the most protracted crises). As a rule, such companies have a good financial cushion, and their goods and services remain in demand. Accordingly, the likelihood of successfully overcoming difficult periods in the economy is higher for them.

One defensive strategy that works is buying defensive put options. These are contracts that give the holder the right, but not the obligation, to sell a stock at a predetermined price on a specified date in the future. For example, if an investor owns 100 shares of the SPY S&P 500 ETF for $250 each, and buys a put option with a strike price of $210 for six months, then on the expiration date he will have the right to sell his holdings at a price of $210 - and the seller of the option will must pay this exact price. The holder of the option can activate it if the price of the asset falls, limiting his losses.

Short: what does it mean in trading?

Simply put, shorting in trading terminology means making money on a falling price.

Why is the position called short? The explanation is obvious: you can open it (i.e. short it) only for a short time, determined by the agreement with the broker.

Short traders who trade on the stock exchange take shares of a certain company from a broker against cash collateral, so that they can then quickly sell them on the stock market. As soon as the desired shares fall in price, the trader purchases them in the same quantity. Securities borrowed from the broker are returned to him. And the profit received as a result of their sale and purchase remains with the shortist.

What is a market squeeze?

A market squeeze can refer to either a short squeeze or a long squeeze. A short squeeze affects sellers who are effectively “pushed out” of the market in light of rapidly rising prices. They will try to get out of their short positions as quickly as possible to cut their losses.

A long squeeze is when buyers are forced out of the market due to suddenly falling prices. Again, they will try to close their positions quickly to prevent large losses.

What are short and long in Forex?

Forex is an international currency market in which sales and purchases of valuable resources (currencies, precious metals, securities, etc.) are constantly made. The concepts of short and long in the Forex market are no different from stock exchange terminology.

A short trade in Forex is opened when a currency pair is sold. For example, if a person shorts the GBP/USD pair (British sterling and US dollar). A long trade in Forex is opened when a person buys an asset and closes as soon as he sells it at an increased cost.

Should private investors be short?

Whether to use shorts or not depends primarily on the investor. This is not an absolute evil, but a complex and risky tool that requires constant analysis and attention.

Everything is determined by the investment strategy, access to information and knowledge of financial markets. Thus, a private investor can insure risks on the derivatives or over-the-counter market, as well as speculate with a small part of the portfolio. But it will be difficult to understand a CDS contract several hundred pages long and with complex calculations at its core Y. Wen, J. Kinsella. Credit Default Swap—Pricing Theory, Real Data Analysis and Classroom Applications Using Bloomberg Terminal.

Short trading is more suitable for traders. They work in financial markets, spend hours studying data, and can handle complex tools.

If we are talking about the over-the-counter market, then in principle there are no non-professionals on it, because serious capital and special legal statuses such as “qualified investor” or “professional participant in the securities market” are needed.

Risks of shorting and longing

In fact, going short is much riskier than going long. However, both strategies are associated with certain risks.

The main risk when going short is running into a big loss. If the possible profit received is limited, then the loss is not. Plus, shares taken from the broker are taken at a percentage. This means that for every day that a trader shorts, a set percentage is deducted from him. And if the loss becomes critical, the short will be forcibly closed. The best scenario is to open and close a short on the same day. In this case, you will not have to pay daily interest to the broker.

And the risks of long are as follows:

- bankruptcy of the company whose shares were purchased;

- indefinite waiting time. It can drag on for a very long period.

However, the advantage of going long over shorting is that a person's loss is limited to the amount of money invested. And if they are lost, there will be no debt to the broker.

Risks of short trades

Short and long positions on the stock exchange are high-risk. The risk of shorting is associated with several reasons.

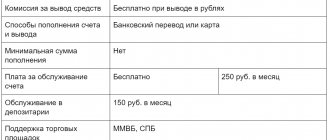

The broker gives shares on loan, which must then be returned with interest. By selling shares, you make a profit - this is credit money. When conducting transactions, you need to carefully read the interest rate.

Short selling is a risk associated with mathematical expectation. It assumes that when you sell shares, your profit is limited and your loss is unlimited.

Dividend cut-off. After dividend payments, stocks fall by the dividend amount. Presumably, the trader can make money on this fall. But there is a nuance. If at the time of the cutoff the trader has a short position in shares borrowed from the broker, he will pay dividends to the original owner of the shares from his account. Therefore, the trader may make money on a fall, but his payments will exceed this earnings.

Some brokers specifically close clients' short positions before the cutoff. It is not recommended to open shorts for traders who are just starting to play on the stock exchange, and for those who make money on long-term contracts. There is always a risk that quotes will go up instead of down, and shorting will cause losses.

What does it mean to short shares on the stock exchange, in trading?

To short, to short, to open short, Short - all these slang expressions mean playing for a fall. That is, shorting on the stock market means selling borrowed securities that will fall in value in the near future in order to buy them back. You need to short falling stocks to generate income, which is the difference between the initial sale and subsequent purchase of the asset. The assets that the trader shorts are borrowed from the broker (at interest), so as soon as the purchase of the fallen shares is completed, they are returned back to the broker. And the profit remains with the person.

However, you need to understand that shorting is not just selling and buying. We must rationally assess opportunities, constantly monitor the state of the economy, exchange rates, etc. And most importantly, we must be able to predict. After all, no forecast gives one hundred percent guarantee that the value of assets will fall.

Advantages and disadvantages

Pros of shorting:

- The opportunity to generate income not only from rising prices, but also from falling prices.

- Hedging (insurance) of risks as a tool of trading strategies.

An example of a game: we buy Gazprom shares on the stock exchange for an investor’s portfolio. A short-term or medium-term price drop is expected, while the securities look attractive in the long term. There is no point in selling. To hedge and earn extra money, we open shorts in futures for Gazprom shares.

At the same time, the underlying asset and futures for it move in parallel with a small difference. Contango (the futures price exceeds the price of the underlying asset) and backwardation (below the asset price). There is confidence that the decline is ending - we buy back short futures positions. We are waiting for the resumption of the upward trend in Gazprom.

There is one disadvantage of the game, but it is significant - the risks in short positions are much higher than in long positions (longs).

When buying shares on an exchange without using leverage, there are two main risks:

- First, the company goes bankrupt, all the money is lost. When using securities from reliable issuers, this is an unlikely event. I can hardly imagine the bankruptcy of Gazprom, Sberbank or Lukoil (the three leading chips on the Moscow Exchange).

- The second is the long-term price drop below the purchase price. The investor has to endure the drawdown. Or close at a loss. But this is entirely the investor's decision. The broker does not have the right to close the client's longs if he has no obligations on borrowed funds. Shares are accounted for by an independent organization - a depository. In any case, the shares will remain with the client. Or the investor can transfer them to his trading account with another broker. Another thing is a bearish game. The trader makes full use of the borrowed money (assets) of his broker. If there is insufficient collateral (the price has gone up), the broker has the right to issue a margin call to the client and forcefully close all positions. You won't be able to sit through it.

Go long: what does it mean?

Translated “long” is “long”. As discussed above, with a long position, the bet is made on an increase in the value of the purchased shares. Simply put, the essence of long is to buy low and sell high.

Going long is an operation to open a long position, that is, a transaction to buy shares. A kind of bullshit game.

What are the advantages of going long? Firstly, there are no time restrictions and interest obligations. A person does not have to pay a broker for borrowed assets and various commissions. Secondly, there is no profit limit. If with a short position the profit is only the difference between two amounts, then if you open a long position correctly, the profit can amount to very, very big money.

Useful materials on the topic

Subscribe to my newsletter. Soon I will have many more new articles on finance, investment, and trading. I think you will find it interesting. Subscribing will allow me to send you the best articles in this section by email. This way you won't miss anything.

If you know nothing at all about investing, I highly recommend this course: “Personal Finance and Investments” from Netology. I personally watched it, although in a more condensed version, now the course has been expanded and made more in-depth.

It is hosted by professional investor Sergey Spirin. He will first explain to you why it is pointless to simply save money, wait for a good pension or make money from speculation, and then he will introduce you to the idea of passive investments. He will tell you in clear language what they are and how they happen.

Then you will get acquainted with the main types of financial instruments, learn how to choose them correctly, and what are the features of their price movements. The course is conducted in video format, after each video you must take a test to better assimilate the material. You can ask the teacher questions even after teaching.

If you don’t have money for the course yet, look at free materials on investing. For example, AkBars Bank, which at the same time is engaged in brokerage activities, has several webinars on investments. More precisely, recordings of these webinars on YouTube. Here is the first entry, you will find the rest yourself:

I also advise you to glance at these three books from the City of Investors. They are free, download them in electronic format and read them.

- How to become financially independent in 1 year.

- 5 ways to effectively invest 1000+ rubles.

- 6 steps to financial security.

Vasily Blinov, who owns this site, regularly takes investment courses in the City of Investors. Among them there are both paid and free. Of the free ones, I recommend these two webinars:

- Investment portfolio for $100 per month - about what investment portfolios are, how to create them from scratch, how to choose a broker, how to rebalance. You will discover the fact that you can start investing with very small amounts. And quite effectively.

- Investments without a million in your pocket are especially important for “ordinary” people. Evgeniy Khodchenkov will teach you how to make investments with 500 or 1,000 rubles, and take the right financial start.

Each webinar lasts approximately 2.5 hours. Do not miss. Moreover, they are both completely free.

The best paid programs are:

- Passive income incubator - here teachers talk about buying stocks. But not to short them or go long with them, but to keep these shares in the portfolio for many, many years and receive good income in the form of dividends.

- Passive income on the machine is a “marathon” that lasts ten days. During this time, you will learn how to choose the right instruments for passive investing, understand the difference between them, and how to properly diversify them.

- Super profitable investments in IPO. You can start investing in an IPO only with large sums. When Vasily Blinov completed this course, he made an investment of 370,000 rubles. You can read about this in his Telegram channel (the link leads directly to the message about the IPO). Even if you don’t have the required amounts right now, you can still take the course to understand how an IPO works and how people make money there. To know what to strive for.

If you still want to try to make money on speculation, here is my selection of trading courses. Take a look there. I used to believe that such earnings were possible, but now I don’t think so. I put free courses first in the selection - study them all first, and then move on to paid ones. You will always have time to throw money away.

What does a short position on the stock exchange mean?

A short position in borrowed securities involves selling and then buying assets that are falling in value in order to profit from the difference between these amounts. Short selling shares taken from a broker is justified only if there is confidence that their value is about to fall.

Trading short positions on the stock exchange will become profitable only when the trader shorts thoughtfully: devotes enough time to monitoring and analysis, risk assessment, etc.

Example of a short squeeze

A notable short squeeze occurred in October 2008, when the share price of Volkswagen (VOWG) doubled from €210 to over €1,000 in two days. This took the markets by surprise and in a short period Volkswagen became the most valuable company in the world.

Porsche announced that it had gained control of 74% of Volkswagen's voting shares, causing its share price to soar as short sellers were forced to pay up to €1,005 per share to cover their positions.

A more recent example of a short squeeze could be the Tesla (TSLA) share price in the early months of 2022. Tesla shares had previously been down sequentially on the Nasdaq, but a slew of positive news - including better-than-expected fourth-quarter results - pushed the price higher to $900 per share.

Sellers were trapped and, as in the case of Volkswagen, a scramble to buy ensued to cover short positions and cover losses. This pushed prices even higher, meaning losses for short sellers increased exponentially.

Below you can see Tesla stock price from January 23, 2022 to May 18, 2022. A short squeeze is circled and indicated when the stock price reverses its downward trajectory, while a rising stock price is indicated by an upward arrow.

There are some specific rules to find a stock that may be experiencing a short squeeze.

Short percentage allows you to define short clicks. It represents the total percentage of any given company's shares that are traded on the market. A short interest greater than 20 is considered high by many traders.

Time to Cover Ratio - This is calculated by taking the total number of short positions in a particular stock and dividing it by that stock's average daily volume. This shows how bullish or bearish traders are on the selected stock. Ideally, you want stocks that have double the coverage ratio.

How to open a short position?

The technical algorithm that traders use to short looks like this:

- a person borrows an asset from a broker and sells it on the stock market (while its value is high). Placing an order to sell an asset means starting to “short”;

- as soon as the value of an asset falls, a person buys it at a new reduced price. Then returns the loan asset back to the broker. Placing an order to buy an asset is closing a short position;

- The remaining amount as a result is the profit from the transaction.

Act on emotions

Just give in to the general mood and love the company that everyone is talking about. Or read about the collapse of the oil economy in all the media and run to sell shares of oil-producing corporations. These emotions - hope to earn and fear of losing - influence 1. D. Duxbury, T. Gärling, A. Gamble, V. Klass. How emotions influence behavior in financial markets: a conceptual analysis and emotion-based account of buy-sell preferences / The European Journal of Finance 2. J. Griffith, M. Najand, J. Shen. Emotions in the Stock Market / Journal of Behavioral Science on the actions of investors. Due to emotional behavior, market volatility becomes higher and investments become riskier.

There are many examples of such solutions. Biotech company Theranos has purportedly created a breakthrough blood-testing technology that would revolutionize labs around the world.

Investors liked it so much that major funds valued the loss-making firm with no real sales at $10 billion. True, it later turned out that there were actually no developments.

A scandal began, the owners of Theranos liquidated the company and ended up in court for fraud, and the invested money disappeared.

A less dramatic example is cryptocurrencies. Looks like T. Aste. Cryptocurrency market structure: connecting emotions and economics / Digital Finance, they - and even Bitcoin - are strongly influenced by investor sentiment. In a month and a half, the largest cryptocurrency first collapsed by 40% after critical tweets from Elon Musk, the founder of Tesla. And then it grew again by 10% after his own posts on the social network.

What to do to avoid losing money

- Getting over yourself, especially during times of crisis and upswing in the stock market, is the most emotional time when it is easy to make a mistake with the purchase or sale of assets.

- Wait until volatility returns to normal. The investor will not receive Does Market Timing Work? / Charles Schwab ultra-high profits, but you won’t have to take any risks.

How to make money by shorting?

There are two effective ways to short profitably:

- Directly short the stock (short sale). Despite the high risk, the standard scheme is used by a large number of investors.

- Waiting for a decrease in the value of liquid shares. This method of shorting is aimed at obtaining indirect profit, that is, not planned in advance.

In what situations is Short not justified?

You need to take reasonable risks, so there is no need to short in the following situations:

- Short to obtain proceeds to purchase desired assets. If a person takes shares from a broker and plans to invest the proceeds from their sale in another asset, there is a high risk that the asset will behave unpredictably. And having lost money, a person will not be able to return the loan shares to his broker.

- Short during dividend payments.

- Short when there is no certainty that the stock price will fall. If you make a mistake, you can not only lose the money invested, but also incur a large debt to the broker.

Invest in unknown assets

Any investment is a risky undertaking by definition, because we do not know what will happen to the economy and business in the future.

This means we can lose money. But this risk can really be reduced if you understand a little. First, you need to understand how the asset you are going to invest in generally works. If these are stocks, then figure out why they are needed, why they grow or fall, and how growth stocks differ from dividend stocks. It’s the same with bonds: you need to understand why they exist and how to make money on them.

It is important to understand the market and business even more deeply. You need to spend time and understand the company: what it does, how it earns now and how it can earn in the future, what are the financial forecasts and what analysts say about changes in the price of its shares. There are many more factors that influence companies: from politics and taxes to news and the characteristics of specific industries.

For example, shares of major automakers like Toyota or Ford fell due to shortages Surviving the silicon storm: Why the automotive industry is the hardest hit and how automakers—and other chip buyers—can prepare for future semiconductor shortages / KPMG semiconductors—specialty materials, which conduct current.

Toyota stock price, $TM, August 15, 2022 - May 15, 2021. Red dots indicate news about semiconductor shortages. Source: Yahoo Finance

Modern cars have a lot of electronics, and without, for example, germanium or zinc, they cannot be assembled. This means that the fewer semiconductors on the market, the fewer cars and the lower the profits of their manufacturers.

But if the investor understood the situation, he could earn twice:

- Buy temporarily cheaper shares of automakers: companies will one day restore production, and demand for new cars will be high.

- Buy shares of semiconductor manufacturers that have not yet risen in price: these companies are already earning a lot now, because the materials are needed for cars, computers, and medical equipment.

What to do to avoid losing money

- Study how financial assets work: stocks, bonds or ETFs. Invest only when you understand the mechanisms.

- Understand how the companies you are interested in, the sectors of the economy and the countries in which you want to invest, work.