What does long and short positions mean?

The concepts long (long) and short (short) literally mean “long” and “short”. These are some of the key terms in stock trading. For dummies, the explanation of the essence of long and short operations is as follows:

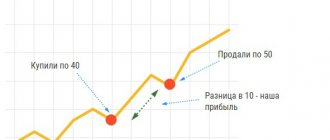

- Long: purchasing an asset for its further sale at a higher price.

- Short: making a profit by reducing the price of an asset. That is, if shares are predicted to fall, then a person borrows them from a broker, sells them on the stock exchange and expects them to fall immediately. After this, it buys back the securities that have fallen in price and returns them back to the broker. The difference between the cost of sale and purchase is profit.

Buy or sell?

Even those who have never had trading experience know the principle “bought low, sold high.” For many years, this instruction was the main goal of all exchange participants. Buy, open “long”, or go “long” - there are many definitions. They characterize one type of operation on the stock exchange - the purchase of an asset. The opposite operation to acquisition is selling, going “short”, opening a “short”. Just a few decades ago, it was impossible to “short” without first buying the asset. Now both operations can be opened independently of each other, where similar options will be shown below. But in general, the result is fixed after using a tandem of opposite operations. And the order remains open until a reverse existing order of the same amount of asset is created.

The classification into long and short owes its appearance to the stock market. Then the purchase was made for a long period, and shorts were used for a short time as a way to fix profits. The scheme was as follows:

- purchasing an asset with an eye to price growth

- expectation of favorable developments

- profit taking

After some time, buying opportunities became scarce and brokers began offering their clients margin lending in the form of short orders. In such situations, it is allowed to sell highly liquid securities without having them on your balance sheet. Most often we are talking about “blue chips” - the most traded shares. Such instruments can be implemented at any time, so the risk of losing funds is minimal for the brokerage house. And clients can enter on any trend. The advent of short trading has opened the door to a variety of risk diversification strategies. We are talking about hedging, when an open market transaction is insured against developments not in favor of the trader by opening an opposite order for another instrument. Or by entering in the opposite direction.

The practice of “boxing” is also known, when two identical positions are simultaneously opened for the same asset with an identical volume. The strategy allows you to open during the uncertainty of the stock market crowd, wait for consensus to be accepted, which is then expressed in price movement. When the trend has decided on the movement vector, the transaction opened against it is liquidated with minimal loss. The second order from the “box” continues to develop, bringing profit.

Currently, the duration of transactions does not correlate in any way with their direction. Long and short in trading can have equally long holding periods.

Short: what does it mean in trading?

Simply put, shorting in trading terminology means making money on a falling price.

Why is the position called short? The explanation is obvious: you can open it (i.e. short it) only for a short time, determined by the agreement with the broker.

Short traders who trade on the stock exchange take shares of a certain company from a broker against cash collateral, so that they can then quickly sell them on the stock market. As soon as the desired shares fall in price, the trader purchases them in the same quantity. Securities borrowed from the broker are returned to him. And the profit received as a result of their sale and purchase remains with the shortist.

The principle of operation of "shortists"

When selling, bears expect prices to fall. As a rule, periods of decline do not take as long a period of time as growth. And this is precisely what attracts traders - the chance to make a quick profit. But in such cases you need to be especially careful. However, bearish plays most often occur against the market. And having reached certain levels, assets begin to grow rapidly, often finding themselves undervalued.

To identify the best periods for starting sales, you can build on both fundamental indicators and technical analysis data. Reversal formations of Japanese candlesticks are of considerable use in such cases. The brightest of them is “head and shoulders”. If a trader chooses the path of a “short trader”, it is necessary to find assets with prerequisites for loss of market value. The main task is to sell high and then buy low.

Regarding bearish positions, you need to remember the following nuances (applies to the stock market):

- they may be forced to close before dividends are paid. Since the broker in margin lending is the owner of the securities, he will want to get them back into his possession so that the dividends that the company pays at the end of the year will be credited to the account.

- Margin trading is not called lending for nothing. To hold such a position, the trader has to pay a commission to the broker.

- The risks are much higher than when purchasing. In this case, the loss has no limit, since the price can fall significantly below the available funds in the account. Such losses must be covered from your own pocket. Therefore, it is important to make sure that the broker limits losses on margin selling positions, preventing them from going into the red.

What are short and long in Forex?

Forex is an international currency market in which sales and purchases of valuable resources (currencies, precious metals, securities, etc.) are constantly made. The concepts of short and long in the Forex market are no different from stock exchange terminology.

A short trade in Forex is opened when a currency pair is sold. For example, if a person shorts the GBP/USD pair (British sterling and US dollar). A long trade in Forex is opened when a person buys an asset and closes as soon as he sells it at an increased cost.

Risks of shorting and longing

In fact, going short is much riskier than going long. However, both strategies are associated with certain risks.

The main risk when going short is running into a big loss. If the possible profit received is limited, then the loss is not. Plus, shares taken from the broker are taken at a percentage. This means that for every day that a trader shorts, a set percentage is deducted from him. And if the loss becomes critical, the short will be forcibly closed. The best scenario is to open and close a short on the same day. In this case, you will not have to pay daily interest to the broker.

And the risks of long are as follows:

- bankruptcy of the company whose shares were purchased;

- indefinite waiting time. It can drag on for a very long period.

However, the advantage of going long over shorting is that a person's loss is limited to the amount of money invested. And if they are lost, there will be no debt to the broker.

Features of the bear game

3.1. Collateral requirement

Securities are issued against money on the balance sheet. The broker carefully ensures that this money is enough to buy back the entire issued volume. For example, if your own balance is 100 thousand rubles, and the minus on a short position has reached 70 thousand rubles, then the broker can forcefully close part of the position in order to reduce its risks.

Forced sale is a last resort. Most likely, the broker will first send a warning to your mobile phone/mail that the margin limit of 30% has been reached. For now, this will just be a notification that a little more and positions may begin to be liquidated automatically. After exceeding a certain set level, a “margin call” will occur. This situation means that the client’s own money is only enough to repay the borrowed amount.

It is better to never bring the situation to a “margin call”. Indeed, in this case the losses are almost 100%. Therefore, when trading downwards, you should not take large leverage. Many beginners lose their money by averaging out losing positions. When a stock goes up against them, they continue to add to their short position.

- Averaging strategy;

- Martingale strategy in trading;

- How investors lose money on the stock market;

3.2. Short commissions

When trading on a decline intraday, the broker does not charge commissions for the use of borrowed securities. This makes short sellers even more active speculators. They will always be happy to close their trades during the day (intraday) so as not to bear the overnight risk and fees for transferring the position (swap).

The broker charges a commission for transferring short positions to the next day. This is an important difference from long positions, when a trader can smoothly turn into a long-term investor by sitting out a bad deal until better times. When shorting, you either need to “make money” or close the position. Keeping a trade open for several days is quite risky and unprofitable.

The fee for transferring a position is about 14% per annum of the debt amount. This is equivalent to a daily write-off of about 0.03835%. A relatively small amount if you hold the deal for a couple of days.

Transferring a position always carries great risks, since morning gaps can be very strong. For example, if unexpected news happened overnight.

Please note that at the end of the MICEX trading session (at 18:39) the market very often jumps up. This is closed by short-sellers who held out until the last.

Is there a tax on profits on short positions? Yes, as on any profit received on securities, there are taxes.

If you open a short position on futures, you can do without leverage. The main thing is that there is enough guaranteed collateral in the brokerage account.

3.3. Dividend gap when shorting

If you short shares that close the register that day, you will be charged a dividend fee for rolling that position overnight. This is due to the fact that you will be the official holder of the securities. The short seller will profit from the dividend gap. Therefore, the broker compensates for this loss with a large commission.

Therefore, you should not transfer a position on shares that close the register on this day. It is better to close the position and open it the next day (after the gap down).

3.4. Losses are unlimited

Short positions allow you not only to “drain” your deposit, but even to go negative (remaining owed money). The fact is that when a trader plays bullish, his losses are limited; securities cannot fall below 0. But they can grow by any number, even by 150% and 1000%. If a margin call does not happen or there is a sharp gap, then in theory it is even possible to lose more money than you have.

It is very important to set a stop loss and not take on a lot of borrowed funds. Still, securities tend to grow.

3.5. Not all securities are available for shorting

The full list can be viewed on the broker's website. Access to short-traded securities is monitored by the Federal Service for Financial Markets. It allows or does not allow play for certain types of assets.

This commission allows you to restrain panic sales by prohibiting the shorting of any securities during crises.

In the United States, there is a special commission for this, the SEC (Securities and Exchange Commission). It has been around since 1934. It contains the important 10a-1 rule, which prohibits shorting a stock if the last sale price was higher than the second to last price. Simply put, it is necessary for someone to buy at least once for the green light to go short.

This rule allows you to avoid avalanche-like collapses on the stock exchange. If you give complete freedom to speculators, they will be able to collapse any asset. Limit orders to buy are usually close to prices (at a level of up to 3-5%), then the book of orders is very empty.

A rapid drop of 5% leads to a situation where everyone wants to sell, but no one has yet placed limit orders to buy. The “longers” will have their stops triggered and will sell at the market price, while the shortists will also sell at the market price. And who will buy? Thus, even weak sales will pull anything to the bottom.

3.6. Example of a short on Forex

Anyone who is familiar with Forex trading begins to understand the principle of bearish trading much easier. The Forex broker always provides us with leverage. Even if we open a long position (buy) with our own money, we still have a margin.

Trading short in Forex is the same as trading long. The Forex broker allows you to open positions with leverage. To sell, just click Sell or place a Sell Limit (limit order) or Sell Stop (breakout order) order.

At the same time, in Forex, a commission in the form of a swap is taken for transferring a position. The main disadvantage of this market is that a swap is also taken for long positions.

3.7. Large risks of short positions

Trading down carries serious risks. Especially when it comes to volatile securities or cryptocurrencies.

This opportunity can be called the lot of professionals. Plus, profits that seem larger are sometimes not so big. As a famous trader remarked: “Who earned more: the trader who shorted Bitcoin at $19,500 and closed the position at $3,300, or the one who bought at $4,000 and sold at $9,000?” Answer: the second one earned more. The profit of the first is 83%, and the second is 125%. In this case, the first one took all the movement (from the very peak to the very bottom). The second one took only part of the movement, but the income was greater.

When playing short, a trader has unlimited losses. If you sell conditionally at 100, then you can lose everything at a price of 200. If the price is 300, then the losses will already exceed two balances. When trading long, we cannot go into the negative (if we do not take leverage).

What does it mean to short shares on the stock exchange, in trading?

To short, to short, to open short, Short - all these slang expressions mean playing for a fall. That is, shorting on the stock market means selling borrowed securities that will fall in value in the near future in order to buy them back. You need to short falling stocks to generate income, which is the difference between the initial sale and subsequent purchase of the asset. The assets that the trader shorts are borrowed from the broker (at interest), so as soon as the purchase of the fallen shares is completed, they are returned back to the broker. And the profit remains with the person.

However, you need to understand that shorting is not just selling and buying. We must rationally assess opportunities, constantly monitor the state of the economy, exchange rates, etc. And most importantly, we must be able to predict. After all, no forecast gives one hundred percent guarantee that the value of assets will fall.

Why is shorts so dangerous?

Shorting the market is very dangerous. Because your maximum profit is limited, and your maximum loss is not limited at all.

When you sell shares to someone for 1,000 rubles, you cannot earn more than that thousand from them. Even if the price drops right down to zero (although this does not happen), you will earn a maximum of one thousand.

What if the share price rises? It can grow tens and hundreds of times. A thousand times. Against the backdrop of some scientific discoveries, statements by politicians, or the discovery of a new oil field, the share price may increase significantly.

And you will go into the red. A huge minus.

Go long: what does it mean?

Translated “long” is “long”. As discussed above, with a long position, the bet is made on an increase in the value of the purchased shares. Simply put, the essence of long is to buy low and sell high.

Going long is an operation to open a long position, that is, a transaction to buy shares. A kind of bullshit game.

What are the advantages of going long? Firstly, there are no time restrictions and interest obligations. A person does not have to pay a broker for borrowed assets and various commissions. Secondly, there is no profit limit. If with a short position the profit is only the difference between two amounts, then if you open a long position correctly, the profit can amount to very, very big money.

What are the advantages of trading short?

The history of financial market charts shows that quotes fall 70% faster than they rise. In other words: it takes 2 times less time for a stock to fall than it does to recover. History knows many examples when prices fell by 10-20% per day, but it does not know the same rising days.

Markets always fall rapidly. This is explained by the fact that short sellers and those who are closing long positions are participating in the active sale. There are few buyers during the collapse. Therefore, prices can rapidly drop by several percent in a couple of minutes.

A fall often ends with a rebound that resembles the English letter “V”. Short sellers reach a certain level where massive profit-taking begins (closing positions). Since for short sellers to close a position this means placing a “buy” order, the quotes reverse sharply.

Further movement depends on many circumstances. A return to both upper levels and back to new lows is possible.

Pros of short positions:

- The market is falling faster than it is growing;

- Ability to take leverage;

- Availability and low fees for transferring positions;

What does a short position on the stock exchange mean?

A short position in borrowed securities involves selling and then buying assets that are falling in value in order to profit from the difference between these amounts. Short selling shares taken from a broker is justified only if there is confidence that their value is about to fall.

Trading short positions on the stock exchange will become profitable only when the trader shorts thoughtfully: devotes enough time to monitoring and analysis, risk assessment, etc.

Features of short and long trading

Any trading strategies, including short and long positions on the stock exchange, have their own conditions and patterns. To achieve success, you need to act according to a certain pattern. Traders use a trading system that includes analysis of quote movements, entry and exit, and holding an order. In practical trading, it is necessary to take into account all the components of exchange instruments. Ill-considered actions can lead to the collapse of the deposit.

A profitable trading scheme can be compared to a triangle, in which the edges mean:

- Trading strategy.

- Estimated risk of the deposit.

- Trader psychology.

Short trade:

The cost of a certain share is $60. There is information that by evening its price will drop to $50. Let's say there is a friend who will lend you 100 of these shares. The shares are borrowed and immediately sold for $60, the proceeds will be $6,000. The forecast turned out to be correct, and by the evening the shares began to cost $50. One hundred shares are bought again for $5,000 and returned to the friend. The net profit from the financial transaction was $1,000.

A similar mechanism works on the stock exchange, but the broker will not simply provide the asset. Interest must be paid daily for using borrowed shares. Consequently, the trader must calculate the income in such a way that it exceeds the payment for using financial instruments.

How to open a short position?

The technical algorithm that traders use to short looks like this:

- a person borrows an asset from a broker and sells it on the stock market (while its value is high). Placing an order to sell an asset means starting to “short”;

- as soon as the value of an asset falls, a person buys it at a new reduced price. Then returns the loan asset back to the broker. Placing an order to buy an asset is closing a short position;

- The remaining amount as a result is the profit from the transaction.

Risks of short trades

Since massive short transactions to lower quotes can contribute to the destabilization of financial markets, control authorities introduce legislative restrictions. Since 2009, brokers in the Russian Federation have been prohibited from allowing such commercial transactions with shares whose price has decreased by more than 3% of the closing price.

Shorts are not available for any shares on the stock exchange, but only for those on the list of margin securities of the broker (whose services the trader uses) and if he has these shares in the required period of time. Shorting, like other leveraged strategies, has many risks and is not recommended for new stock traders or those using a long-term investment trading strategy.

To make high profits on short trades, the value of the asset must fall rapidly. Only very experienced stock speculators can take advantage of this situation in a timely manner and make good money from it.

To begin with, a beginner needs to work with long trades and work out short trades in demo mode. A stock speculator is not an investor. The purpose of his transactions is not to ensure a sustainable return on funds over a long period of time. The trader’s goal is to make a profit from both the growth and the fall in the value of the financial instrument chosen for speculation.

How to make money by shorting?

There are two effective ways to short profitably:

- Directly short the stock (short sale). Despite the high risk, the standard scheme is used by a large number of investors.

- Waiting for a decrease in the value of liquid shares. This method of shorting is aimed at obtaining indirect profit, that is, not planned in advance.

In what situations is Short not justified?

You need to take reasonable risks, so there is no need to short in the following situations:

- Short to obtain proceeds to purchase desired assets. If a person takes shares from a broker and plans to invest the proceeds from their sale in another asset, there is a high risk that the asset will behave unpredictably. And having lost money, a person will not be able to return the loan shares to his broker.

- Short during dividend payments.

- Short when there is no certainty that the stock price will fall. If you make a mistake, you can not only lose the money invested, but also incur a large debt to the broker.