Which stocks are blue chips?

Editorial

Promdevelop editorial team

The stock exchange is where systematic analysis, assessing short-term and long-term trends and monitoring changes is combined with intuition and risk, especially when it comes to stocks (as opposed to safer bonds and exchange-traded funds).

- American Blue Chip Market 2019

There are exceptions in this field that guarantee stable returns, and these are the blue chips .

What are blue chips

This name actually came to the exchange from a casino. There, chips replace currency, and blue ones are the most valuable.

This expression was first used by Oliver Gingold, who worked for the DowJones agency back in the 1920s.

Blue chips are stocks of tier 1 companies. In other words, these are organizations with large capitalization, clean and accessible accounting, and order in financial matters.

Stocks are an instrument that involves higher risks compared to stock indices or bonds. But blue chips are the least dangerous.

They can be assessed by:

- Stability, since these chips paint the overall picture on the market. In order for them to collapse 2-3 times, it is necessary for the same process to occur in the economic field.

- Liquidity. Trading volume for blue chips is always huge. There is both great demand and supply for them. If an investor purchases such shares, he can be sure that he will sell them quite easily.

Where and how to buy risk-free assets?

To purchase shares of the most reliable companies, you should follow the standard instructions. The general purchase scheme is as follows:

- Opening a brokerage account. The main thing here is to choose a reliable partner with a good reputation and an attractive tariff plan.

- Downloading a web terminal (most often brokers provide access to trading through the QUIK platform) or a mobile application (for example, Tinkoff Investments, My Broker from BCS or VTB Investments). The most convenient way is to download the application to your phone and carry out transactions for buying and selling blue chips online at any convenient time. The application is also convenient for evaluating forecasts. Through it you can also buy other types of securities, for example, futures.

- Complete a transaction in real time. To do this, simply find the desired security by ticker and click “buy” or “sell”.

Who are these promotions suitable for?

They are suitable for all types of strategies. Passive investors invest money in a blue chip and do not return it for a year, five or ten years.

Occasionally they take profits and adjust the portfolio. Incomes are growing, albeit slowly, but steadily.

Speculators sell chips because they rise or fall, i.e. liquidity. In the process of trading on the stock exchange, they try to get the maximum and fastest profit from changes in the price of an asset in one direction or another.

Working with the MICEX index

A trader’s work is not limited only to company shares. You can also make money by changing, for example, the price of MICEX shares.

The work options are as follows:

- Manually copy index basket , forming an investment portfolio from the securities of the corresponding companies. This is inconvenient and expensive in terms of broker commissions, and you will also have to rebalance the portfolio yourself.

- Invest in mutual fund from BCS. The broker has a whole set of mutual investment funds, there is a separate mutual fund for the Russian market, it is called “ Russian shares"and has been operating since 2004.

- Invest money in ETF shares. A good option is FinEx Russian RTS Equity UCITS ETF with a yield in foreign currency above 4%. It copies the RTS index, but it is practically the same as the MICEX. The RTS Index differs only in that it takes into account the value of company shares in dollars.

- Trade CFDs. This is the simplest option for working with the Moscow Exchange index for ordinary speculators who prefer active trading. Regular Forex brokers provide access to contracts for difference. You won’t be able to buy the MICEX index; a CFD is a bet on what the price will be in the future.

- Futures and options on the Moscow Exchange index are also suitable for active trading . You can work with them through the same BCS and QUIK terminal.

Open an account with BCS

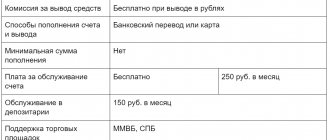

| Company | BKS | Tinkoff investments |

| Minimum deposit | from 50,000 rub. | Unlimited , you can even buy 1 share, they recommend starting from RUB 30,000. |

| Transaction fee | At the “Investor” tariff – 0.1% of the transaction amount, at the “Trader” tariff it is reduced to 0.015% | 0.3% for the “Investor” tariff |

| Additional charges | If the account has less than 30,000 rubles - 300 rubles/month. for access to QUIK and 200 rub./month. for access to the mobile version of QUIK, | — |

| Account maintenance cost | 0 RUR/month on the “Investor” tariff, on other tariffs, funds are debited only if there was activity on the account this month | Free for the "Investor" tariff |

| Leverage | Calculated for each share, within the range of 1 to 2 – 1 to 5 | Calculated for different instruments, the calculation is linked to the risk rate |

| Margin call | Calculated based on the risk for each security | Depends on the asset |

| Trading terminals | My broker, QUIK, WebQUIK, mobile QUIK, MetaTrader5 | The purchase of shares is implemented like an online store, professional software is not used |

| Available markets for trading | Foreign exchange, stock, commodity markets, there is access to foreign exchanges | American and Russian stock markets |

| License | TSB RF | TSB RF |

| Open an account | Open an account |

List and characteristics of blue chips

Although blue chips are the shares of the largest and most reliable companies, there is still no specific criterion by which they can be identified.

Let's try to highlight the most important characteristics and make a list of such securities in the current year 2022. This process will help determine which securities have the best long-term prospects.

So:

- Steady growth over several decades. Moreover, it is determined not only by speculation, but also by the real state of affairs in the company.

- Huge economic power with an impressive capitalization rate.

- High liquidity due to the large number of transactions that are regularly carried out by shareholders of these companies.

Today, a specific list of blue chips will consist of only a few companies.

This only applies to the Russian market; there are many more large and popular organizations abroad. This will become clear if we recall such corporations as Google, Toyota, General Electric, General Motors, Shell, Coca-Cola, Microsoft.

Among Russian companies, blue chips can be called:

- MMC Norilsk Nickel;

- GAZPROM;

- Surgutneftegaz;

- LUKOIL;

- Plus Gold;

- Sberbank;

- Rosneft;

- RusHydro;

- Rostelecom;

- RAO "UES of Russia".

The list of domestic blue chips is still very small and some companies cannot fully be called such, since the stock market is still too young.

Gazprom and Sberbank deserve this name most of all.

Trading

Blue chips of the Russian stock market 2022 list

sova

| 18-11-2019, 13:10 | Blue chips of the Russian stock market 2020 list.

The latest review of Blue Chips 2022 is already on the website: Blue Chips of Russia 2022 “Blue Chips” - a person who hears this phrase for the first time can have a variety of associations in their head. What chips? Why are they blue? But casino regulars and poker fans, if you ask them about blue chips, will immediately answer that these are the most expensive and therefore desirable chips on the table in any game. It was from there that the concept of “Blue Chips” migrated to the world of investments and the stock market. That is, in the stock market, “Blue chips” are usually called the most popular, reliable and stable shares, akin to poker chips, which are divided by color: white is the cheapest, yellow has an average cost, blue is the most expensive. That is, “Blue chips” are like the “juice” of the stock market. The Moscow Exchange (MICEX) even has an index consisting of the most liquid (popular) companies, akin to the SnP 500 index in the West, consisting of shares of 500 industry giants. The companies that have the greatest weight in our index are: Lukoil (18.86%), Sberbank (17.62%) Gazprom (15.37%).

Let's take a look at the list of top companies on the Russian stock market and take a closer look at the Blue Chips.

For 2022, the list of “Blue Chips” of the Russian stock market includes:

1. Gazprom 2. Sberbank 3. Norilsk Nickel 4. Lukoil 5. MTS 6. Magnit 7. Tatneft 8. Novatek 9. Yandex 10. Rosneft 11. X5 Retail Group 12. VTB Bank 13. Surgutneftegaz 14. Severstal 15. Alrosa

Let's review and quickly go through each of the list.

1. PJSC Gazprom. I think energy is familiar to almost every Russian. The company is engaged in the production, processing and sale (sale) of natural gas. In world gas reserves, the share is 17% and 72% in Russian reserves of this natural resource. 50% of Gazprom shares belong to the state. The general director of the company is Alexey Borisovich Miller.

|

Predicted dividend yield on GAZP shares:

RUB

13.57 The stock price chart for all time looks like this.

Considering the recent increase in dividend payments to 16 rubles per share, this represents a very interesting investment instrument.

2. PJSC Sberbank. The Sberbank company is no less popular in Russia than Gazprom. And it doesn’t need any special introduction. Being a bank, it provides a wide range of banking services. But recently, Sberbank has been trying to develop new non-banking markets: insurance, telecommunications, e-commerce, medicine. As of 2018, it is the most expensive brand in Russia. 50% of the company's shares belong to the Central Bank.

|

Projected dividend yield on SBER shares:

RUB

19.25 The stock price chart for all time looks like this.

Since 2014, it has shown significant positive dynamics in the value of its assets.

3. PJSC Norilsk Nickel. Norilsk Nickel is a Russian mining and metals company. The company ranks first (40%) in the world in terms of palladium production and second in nickel production (12%). Norilsk Nickel has two main production sites in Norilsk, Talnakh, Taimyr Peninsula, Kayerkan and Dudinka. The company's equity capital is $396,000,000, and the number of employees exceeds 83,000 people. In this regard, the company was added to the list of blue chips of the Russian stock market.

The all-time stock price chart looks like this.

Norilsk Nickel plans to launch the Chita copper project soon, with likely revenue growth increasing by 7%.

4. Lukoil. Russian oil producing and refining company. In addition to oil, it also produces and processes gas. For 2014. It ranks second in terms of revenue in Russia after Gazprom. In 1994, the first privatization auctions for the company's shares took place. The company's shares are traded not only on the Moscow Exchange, but also on the London Stock Exchange and the Frankfurt Stock Exchange.

The all-time stock price chart looks like this.

In 2022, the company's net profit amounted to RUB 619.2 billion, which is 47.8% more in 2022.

5. MTS. MTS is a telecommunications company providing services in the CIS countries. The services provided by the company include the provision of cellular communications (GSM, UMTS (3G) and LTE), broadband Internet, cable television, satellite television, digital television, wired telephone communication, etc. The company also has a wide network of communication stores of 1,197 stores. MTS also works closely with MTS Bank, which, according to research by Frank RG, ranks 37th in terms of household deposits, 44th in terms of capital and 48th in terms of assets.

The all-time stock price chart looks like this.

For 2022, according to Brand Finance, it is considered the most valuable Russian telecommunications brand. 6. Magnet. The Magnit company is a retailer engaged in the sale of goods through a network of super-markets and hyper-markets with 20,497 points. As of 2022, the company employs more than 300,000 employees, which allows the company to lead the top of the largest private employers in Russia. The company has partnership projects with Russian Post, truck manufacturers MAN, Russian Railways, Samsung, Tatneft. The company's net profit amounted to 1.23 trillion rubles, which is 8.2% more than in 2022. In the first quarter of 2022, the company's net profit decreased to 3.5 billion rubles from 8.4 billion rubles in the fourth quarter of 2022.

The all-time stock price chart looks like this.

According to Brand Finance, Magnit ranks 6th in the TOP 50 most expensive brands in the Russian Federation.

7. Tatneft. The oil company ranks fifth in terms of oil production. The company is engaged in geological prospecting, oil production and refining. As of 2016, the company produced 28.7 million tons of oil. Also in 2016, Tatneft launched the Strategy 2025 program, which envisages doubling the company’s value in dollar terms. Tatneft's net profit according to IFRS in 2022 amounted to 211.812 billion rubles, which is 1.72 times more than in 2017.

The all-time stock price chart looks like this.

The largest ice palace in Kazan (where the Ak Bars hockey club team, sponsored by Tatneft, plays) is called Tatneft Arena.

8. Novatek. The company is engaged in gas production and processing. 19.4% of the company's shares belong to Gazprom. The main volume of gas produced comes from the Khancheyskoye, Yurkhanovskoye and Vostochno-Tarkosalinskoye fields. In 2010, gas reserves amounted to 2.5 trillion cubic meters.

The all-time stock price chart looks like this.

Recently, Novatek announced the signing of an agreement with CNODC to enter the Arctic LNG-2 project with a 10% share.

9. Yandex. Russian IT giant owning an Internet search system. The search engine ranks fourth in terms of traffic among all world search engines and, according to data for 2018, is the 21st most visited world site. The search engine found the greatest popularity in the Russian, Kazakhstan, Belarusian and Turkish markets. In addition to the search engine, over the years of its existence it has acquired a huge number of different services and applications: Yandex.Market, Yandex.Money, Yandex.Maps, etc. The all-time stock price chart looks like this.

invests in promising foreign and Russian IT companies: Blekko, Vizi Labs, Multiship.

10. Rosneft. The company's main activities are oil production and oil refining. The company also produces natural gas. Based on an article in Expert magazine, the company ranked third among Russian companies in terms of revenue for 2017. For 2022, the company's revenue amounted to 8.238 trillion rubles, and net profit was 0.649 trillion rubles. The size of the company's assets in monetary terms is 13.16 trillion rubles.

The all-time stock price chart looks like this.

11. X5 Retail Group. Russian multi-format food company engaged in retail retail. Trade brands owned by Pyaterochka, Perekrestok, Karusel and Perekrestok Express. The share of revenue, based on the results of 2018, was 10.7%. It is one of the fastest growing companies in Russia according to RBC. The company's shares are traded on the MICEX and the London Stock Exchange.

The X5 Retail Group stock price chart for all time looks like this.

Technical analysis on the daily time frame shows the formation of a counter-trend Diamond pattern, which indicates a likely downward reversal of the price trend in 2022.

As of 2022, the company’s revenue amounted to 1.525 trillion rubles.

12. VTB Bank. Russian commercial bank. It is in second place after Sberbank in terms of assets and first in terms of authorized capital. Net profit for 2022 is 178.8 billion rubles.

|

Predicted dividend yield on VTBR shares:

0.0053

rubles

The price chart for VTB shares for all time looks like this.

The price has approached the iconic level and depending on whether there is a breakdown of the level or a rebound from it, the direction of the further price trend will be decided.

13. Surgutneftegaz. The oil and gas production company, founded in 1994, ranks 8th among Russian companies in terms of revenue as of 2022. 70% of the company's shares belong to offshore companies and subsidiaries of Surgutneftegaz itself.

|

Predicted dividend yield on SNGS shares:

0.65

rubles

The price chart for Surgutneftegaz shares for all time looks like this.

Over the past year, the company's shares have shown significant growth.

14. Severstal. The company is engaged in metallurgy and mining. The company produces: Long products, bent profiles and pipes, cold and hot rolled steel. The size of assets for 2022 according to IFRS is 2.072 billion.

The Severstal stock price chart for all time looks like this.

After the formation of the “Double Bottom” pattern on the chart, you can expect a decrease in the price chart.

15. Alrosa. Russian diamond mining company. It has the largest volume of diamond mining in the world and 95% of the production of these precious stones in Russia. The company's net profit for 2022 is 90.4 billion rubles.

|

Projected dividend yield on ALRS shares:

2,085

rubles

. The price chart for Alrosa shares for all time looks like this.

At the end of 2022, the price approached its historical level of 83 rubles, having corrected after a long downward trend. If there is a rebound from the level, the downward trend will likely continue.

This is what the blue chips of the Russian stock market 2020 look like. I hope the list with charts presented above was useful to you. If yes, then you can write a review or in the comments below. If you are seriously thinking about investing in Russian stocks, then you can familiarize yourself with such an instrument as futures. Proper use of futures contracts when investing can significantly reduce risks and increase profits.

You can buy all the blue chips of the Russian stock market at once using RCMX ETF - from Sberbank.

ETF

is a relatively new investment instrument. It is a fund filled with various assets: stocks, bonds, currency, etc. Units of which can be freely purchased on the stock exchange with an individual investment account or brokerage account. You can learn more about this instrument in the article: “ETF - What is it in simple words.”

We recommend How to buy blue chips | How to invest money in blue chips

Well, that’s all, I wish you successful investments in blue chips and a favorable trend!

Advantages and disadvantages

Blue chips have quite a lot of advantages. It is no coincidence that newcomers enter the stock market with just such shares. They are the most reliable.

Since such a company, as a rule, tends to grow, shows good results and holds firm in the market, there are very few risks here.

The growth of blue chips depends on the real state of affairs, and not on the actions of speculators.

The second advantage of these shares is high liquidity. What does it mean? They can be either sold or bought at any time without significant losses in price. This is very important for beginners.

Companies that are considered “blue chips” are very sensitive to their reputation and constantly publish financial statements. This means that they are transparent to investors.

In addition, such organizations value their image and, for the most part, try to ensure payment of dividends.

The disadvantages include:

- slow dynamics. Of course, stocks are rising steadily, but they are doing so extremely slowly;

- low profit. This fact is not surprising, since the greater the risk, the greater the jackpot. Blue chips are reliable, which means that you should not expect high profits. According to a study conducted in America, the average rate of return on investments of this type of stock is 11% per annum.

MOEXBC Index

To know how such shares behave on the stock exchange, it is recommended to regularly monitor the dynamics of the Moscow Exchange blue chip index. The MOEXBC index is regularly updated on the official MICEX website and is convenient for tracking the overall dynamics of the movement of blue chips. This is an indicator of the market for the most liquid shares of domestic companies, which is formed based on the prices of transactions in shares of the top 15 reliable issuers. The indicator is calculated in rubles. Rebalancing is carried out once a quarter.

Requirements for companies that wish to be included in the list

In order to appear on the list of companies with first-tier shares, you must not only have the desire, but also meet certain requirements:

- the organization must exist in the market for a certain period of time and have sufficient experience;

- growth dynamics must be positive throughout the entire period of operation;

- there should not be any delay or refusal in the payment of dividends to the company's shareholders;

- high degree of trust from both Russian and foreign organizations;

- positive credit history;

- good foreign economic relations;

- professional guidance;

- the presence of a franchise structure, subsidiaries and branches;

- competitive services and products on global and Russian markets.

To reach the main echelon, you must comply with all of the above requirements.

List of top stocks (2022)

Below is a current list of 15 shares of top Russian companies for 2022. Who is included in the rating?

| Ticker | Issuer name | Dividend payment |

| FIVE | X5 Retail Group | Yes |

| GAZP | Gazprom | Yes |

| GMKN | Norilsk Nickel | Yes |

| LKOH | Lukoil | Yes |

| Mail.ru Group Limited | No | |

| MGNT | Magnet | Yes |

| MTSS | MTS | Yes |

| NVTK | Novatek | Yes |

| PLZL | Polyus Gold | Yes |

| POLY | Polymetal | Yes |

| ROSN | Rosneft | No |

| SBER | Sberbank | Yes |

| SNGS | Surgutneftegaz | Yes |

| TATN | Tatneft | Yes |

| YNDX | Yandex | No |

Please note that in this list for some securities you can also obtain dividend yield.