It is important for any crypto trader to know how to profit when prices fall by opening a short position in Bitcoin (short Bitcoin).

We often hear about strategies such as HODL and BTD, but in the world of cryptocurrencies, shorting is discussed much less. In this article, we will talk about how to short Bitcoin to profit during a bear market.

Shorting is essentially the practice of betting on the price of a falling asset. Although, this is something more complex than playing for a raise.

Playing for a raise is easy. You just need to buy bitcoins and store them. However, shorting is a completely different process.

How does selling bitcoin work?

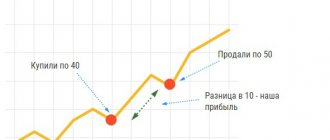

To understand shorting, let's first look at the industry that created this method: stocks. In the stock market, short selling is a popular investment strategy. To execute a short trade, an investor borrows a certain amount of shares that he believes will fall in value. Once the investor receives these shares, he sells them at the current market value. Once the asset price falls, the investor can buy back the shares and return them to the lender.

Can I go short or long on all financial markets?

Yes. Traders open long and short positions in all markets. In fact, this is the very definition of trading, so you cannot do otherwise, regardless of the market.

If you trade derivatives, there are more complex forms of long and short positions. For example, if you trade options, you use several combinations of long and short positions.

Options are contracts that give holders the right (but not the obligation) to buy or sell an underlying asset at a predetermined strike price on or before a specific date. They are quite popular in all financial markets. Typically, traders use call options to go long and put options to go short.

However, they can also mix them. For example, traders can open short positions as well as post positions. If you go short a call option, you are on the bearish outcome of that particular option, which is bullish. Therefore, this means that you are bearish about the price of the underlying asset. Similarly, you can go long on both call and put options.

Bitcoin Shorts

Even though the asset is different, shorting Bitcoin works in much the same way. The crypto trader will borrow Bitcoin before the expected market drop. Once an investor receives their Bitcoin, the asset is sold. After the price of Bitcoin completes its decline, the investor buys back Bitcoin with the original sales funds.

Since the price of Bitcoin is lower than when you borrowed it, you can pay off your loan and keep the difference in your payout and your overall trading activity. Here is a concrete example of a short circuit in action.

Example

Jeremy borrows 5 bitcoins at $12,000 each. He immediately sells these coins for $60,000. Several days pass. On the third day, Jeremy's guess was correct. The price of Bitcoin rose significantly to $10,000.

Jeremy then buys back the bitcoins using the $60,000 he received from the initial sale of his assets. Since the price of bitcoins has fallen by $2,000 apiece, Jeremy receives six bitcoins for his purchase. He then returns the five bitcoins to the lender. The last Bitcoin is his profit.

Jeremy can sell this bitcoin and keep $10,000 or use his proceeds for other investments. If he had not closed the market, he would have shown only losses in his portfolio. Even if he were to exchange his assets for stablecoins, he would only increase the price difference from his original assets and reduce the value.

"Short" and its features

Any financial asset, including cryptocurrency, cannot grow forever. There are definitely moments of downward movements. Such moments should not be missed. You need to short the asset.

Once again, we note that shorting the crypto market is quite difficult. This will be especially difficult for altcoins, since this type of coin has insignificant liquidity. Most often, a narrowing of the market can be observed in such financial instruments. There is a term for this process squeeze . In a squeeze condition, interested investors work to compress the selected cryptocurrency. Inexperienced traders simply lose money at this time.

Let us remind you once again that it is better not to short cryptocurrency for the long term.

However, if you consider yourself an experienced speculator and are aware of all sorts of risks, then you can try shorting Bitcoin on a cryptocurrency exchange. To do this, you will need to take out a loan on a crypto platform.

To read: Where is the best place to store cryptocurrency?

Regarding lending on crypto exchanges: there are separate sites where a line of credit is provided for shorts of Bitcoin and other crypto assets. But for this pleasure a percentage is charged, on average it reaches 0.2%.

By the way, such loans are issued on the crypto platforms Bitfinex and Poloniex . Before using such loans, read the detailed instructions.

How to short Bitcoin?

Selling Bitcoin today is easier than ever. The first step is to find a reliable platform that allows you to trade using leverage. These platforms specialize in short-term, high-risk investment loans.

It is important to note that you will need to pay back any loan you take out plus fees. If you borrow ten bitcoins, you will need to return those coins when it comes time to repay the loan. To ensure that you deliver on your promise, these platforms require users to make a deposit or margin.

Your margin requirements act as collateral or collateral. This holds your position in place to ensure that the shares are paid out at an agreed date in the future. If your short trade starts to go south, your lender can and most likely will call in your margin. Most platforms only need to provide you with a quick notification about this. For these reasons, you need to read all the details of your Bitcoin short agreement.

Ways to shorten Bitcoin

There are many ways to short Bitcoin today. Each of these methods has its own advantages and disadvantages. You must consider the whole situation before deciding which strategy best suits your needs.

Short Selling - Contract for Difference (CFD)

One of the most popular ways to sell Bitcoin is using CFDs. CFDs allow you to sell bitcoins without directly purchasing coins. Instead, you sign a CFD and agree to simply pay the difference between the price of the asset at the time the loan is made and the rate of your contract. CFDs are popular because they are more convenient and cost-effective because there is no need to make additional purchases.

How to sell CFDs

Afex Capital is a leading broker offering cryptocurrency CFD trading services. To get started, you will need to create an account. Luckily, the process is simple. Notably, you must verify your identity and account via email before you can use the platform.

Once you have everything set up, all you need to do is open a trade on the BTC/USD instrument. Then you need to select from the “Sell” options. You will be taken to a screen that allows you to configure all the details of your CFD. Nothing could be simpler. Best of all, Afex Capital offers an advanced interface that is easy to navigate. The form is here, you can stay up to date with all market events.

Results

In this quick guide, you learned how to short on a cryptocurrency exchange. We also showed by example how to conduct technical analysis. We sorted out 3 temporary traffic (D1, H4 and H1).

Don’t be lazy to connect assistants to the analysis of the pair – indicators like the Stochastic Oscillator. They clearly indicate overbought and oversold zones.

If you short cryptocurrencies, consider short-term goals. After all, the market can change the trend. Any, even the most unprofitable position in the market can be limited by the Stop Loss level. Big profits to you!

Exchange sales

There are many exchanges in the market today that offer short circuit services. Most of these platforms allow you to use your selling strategy. A leveraged short is borrowing more Bitcoin from an exchange than you held before selling.

Trading with leverage is one of the riskiest strategies in the market. This requires a solid understanding of market conditions and your investments. Plus, you really need impeccable timing to be successful with this strategy. If the exchange senses that your investment is about to go bad, they will close your trade early, keep your margin, and force you to repay the loan.

Understanding when to cut back

There are times when shorting Bitcoin is more difficult than others. For example, selling Bitcoin against long-term uptrends can be challenging, to say the least. Bitcoin may be slowly rising in value. Conversely, this digital asset can lose thousands of dollars in market value in a matter of minutes. These scenarios provide insight into why it may be difficult for new investors to successfully complete a short sale.

Understanding the Market Mentality

It is also important to consider the mentality of other traders in the market. If you are shorting Bitcoin and suddenly the price starts to rise rapidly, you will need to rush to buy back your holdings. Unfortunately, any other investor making the same decision will be looking to accomplish the same task.

This sudden rush to redeem Bitcoins is driving up the market value dramatically. When this scenario plays out, it is what is called a short squeeze. Short squeezes increase your losses in this position. To avoid this scenario, you must be vigilant in your market assessments.

Diversifying in the crypto market during shorts

The cryptocurrency market does not consist of just one Bitcoin - there are many assets on the market, including Ethereum, Ripple, BTC Cash, USDT and other coins. Therefore, there are many opportunities for diversifying risks in the crypto market during shorts – it’s enough not to put all your eggs in one basket.

In addition, any popular cryptocurrency today can be exchanged for the familiar rubles or dollars - for this you can use exchange services that are very easy to use and allow you to get money onto your card without any problems or difficulties.

Past Bitcoin Sales

The Bitcoin market has nine years of trading data to back this up. A quick look at Bitcoin's past and you can easily see scenarios that triggered major sell-offs. The better you understand these scenarios, the easier it will be to identify the next big sell-off in the market. Here are some of the main reasons why Bitcoin prices have fluctuated in the past.

Regulatory Issues

Since the cryptocurrency market is still in its early stages, there is still a lot of regulatory uncertainty in the industry. In the event that a major country bans or adopts some anti-Bitcoin stance, the market will change accordingly.

Hard forks

Hard forks occur when the community behind a crypto project splits over a specific update. During a hard fork, some miners refuse to switch to the new protocol. This creates two separate blockchains from the moment the fork is promoted. Consequently, hard forks also create a rift in the coin support community.

Bitcoin prices fell as the community split over transaction block size. The dispute eventually led to the creation of Bitcoin Cash. Today, both coins have many fans in the market.

Deferred updates

There is another scenario related to an upgrade that could reduce the price of a digital asset. When important updates occur with significant delays, it can lead to a loss of investor confidence. This loss of faith is reflected in negative price movements.

When developers delayed the SegWit update, Bitcoin faced some significant price disadvantages. SegWit has reduced transaction sizes in an attempt to combat market congestion on the Bitcoin blockchain . At that time, the network congestion was unbearable. Consequently, every delay was met with a negative price movement.

Developers leaving the project

Another major event that could hurt the price of a coin is the departure of a key participant from the platform. Blockchain developers are in high demand. The best programmers are respected throughout the industry. When someone leaves a project, it can symbolize the beginning of the end for the coin. This could also mark a shift in the coin's core functionality in the future. Either way, investors don't like to see these guys leave.

Future Risk Scenarios

There are also future scenarios that could happen that would negatively impact the price of Bitcoin. For example, if Bitcoin's cryptographic hashing algorithm is broken, the coin will become insecure and its market value will plummet. Likewise, major coding hacks can also cause investors to lose faith in this cryptocurrency.

Future rules

Regulatory changes in the market are perhaps the biggest threat to Bitcoin prices. In the past, large countries such as China have put a lot of pressure on the market. In 2022, China banned all exchanges and ICOs in the country. These actions sent Bitcoin's price sharply lower following the news.

Satoshi's back

The anonymous creator of Bitcoin, Satoshi Nakamoto, has remained in the shadows for the past couple of years. In the early days of Bitcoin, Nakamoto mined over a million coins. These coins had been in his wallets since day one. If these coins were to hit the market, the price of Bitcoin would undergo a huge correction to reflect the added supply.

Risks of Selling Bitcoins

Short selling is considered a risky trading strategy because it limits profits even as it increases losses. Short sales are especially risky if the lender calls in the assets before prices have a chance to fall. There are some methods that can be used to simplify the process, however, none of them are complete proof.

Let's look at the same example from before using $12,000 Bitcoin that fell to $10,000. In the first scenario, the short ended as planned, the price of Bitcoin fell, and the investor paid off his debts to the creditor. Now let's see what happens if the price of Bitcoin doesn't fall.

Maximum risk

Let's say the price of Bitcoin, instead of falling, jumped to $13,000. In this situation, the lender will call in their loan. The lender will close your deal and keep your margin. Additionally, you will owe $65,000 worth of Bitcoin instead of the $60,000 worth of Bitcoin you originally borrowed.

You may also be interested in:

- Where to invest 100,000 rubles?

- How to buy shares for an individual and receive dividends

- Ways to earn passive income online