Hello, dear readers!

45 years ago, trader and investor Richard Dennis made a bet with his friend William Eckhardt. Is it possible to train an ordinary person on the street to trade profitably on the stock exchange if you follow certain rules?

The experiment lasted 5 years. During this time, Dennis's students turned $23 million into $175. This was the legendary strategy of the turtles, showing how important a chosen clear set of rules is in stock trading. Therefore, in this article we will consider trading strategies in the stock market.

The Importance of Trading Strategy

The chosen investment strategy determines the risks that the investor is willing to take and the investment time horizon.

If you rely on investing large sums in order to preserve capital and carefully increase it within a little more than a bank deposit, this is a direct path to a long-term investment strategy in the stock market.

If you are willing to take risks, if you want to quickly increase your capital, this is the path of a trading speculator.

Dividend

This investment strategy involves choosing stocks with the highest dividend payouts. Dividend yield is calculated by dividing dividends by the cost of 1 share. This approach guarantees predictability and stability of financial income. At the same time, reinvesting dividends allows you to increase the value of your portfolio and make compound interest work for you.

When choosing dividend stocks, it is important to consider the following aspects:

- features of the dividend policy, in particular, what percentage of the company’s profit is allocated to paying dividends;

- stability of payments over the last 5 years;

- size of dividends and frequency of payments;

- rate of increase in payments;

- current financial indicators of the issuer's activities.

Topic: Investment portfolio for beginners

Disadvantages of the dividend method:

- payment of dividends is not guaranteed (at any time the company may decide to freeze payments);

- too high dividend payments may indicate irrational business practices and lead to limited growth;

- in pursuit of cosmic dividends, there is a high probability of acquiring illiquid assets, which will be very difficult to sell in the future.

To reduce your risks, it is more advisable to diversify your portfolio by selecting at least 10-15 dividend stocks from different industries (not only Russian, but also foreign).

Note: Dividend gap – what is it?

Check out the current list of dividend stocks in Russia.

What distinguishes a speculator from an investor

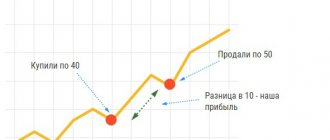

Speculation refers to trading with repeated purchase and sale of assets while holding a position from several seconds to several weeks - an attempt to make money on price fluctuations over short periods of time. Trading speculation is possible both on a rise in value (long position) and a fall (short position).

An investor buys an asset on the stock market in order to profit from growth and receive dividends.

The terms of investment strategies range from a year to decades.

Classification of speculators

- Scalping. Work within the spread of the order book, quickly buy/sell, up to hundreds of transactions per trading session.

- Intraday. Intraday trading, open positions are not carried over to the next trading day. On average from 1 to 5 transactions per session.

- Swing. A strategy for following short-term stock market trends. Trend is your friend. Work from 1 day.

Investor classification

- Short-term investment - up to 1 year.

- Medium term - from one year to 3 years.

- Long-term - over 3 years.

Warning about Forex and binary options

Binary options are bets on price movements. The name contains an algorithm - all or nothing, winning or completely losing the money you bet. BO in the Russian market is not a strategy, but a roulette that has nothing to do with the stock market. A breeding ground for trade fraud. In some countries they are prohibited, in others they are under the control of regulatory authorities.

Forex is an international interbank currency exchange market. Holes in the legislation of our country allow the existence of companies speculating on this topic.

When signing an agreement with a Forex dealer, you must understand that you bear great risks as a non-professional market participant; you will not apply any strategies here.

Bonds

Bond portfolios built on working with bonds of the largest Russian companies have a target return of 9–10%. The instrument is suitable for capital owners whose goal is to protect personal savings from external and inflation risks. Reliability comes from investing in fixed income securities.

I would like to note that rapidly developing domestic enterprises in the current economic situation are often more stable than banks from the top 50. At the same time, the target yield of bond portfolios is significantly higher than the efficiency of domestic deposits. As noted earlier, these strategies can bring 9–10% per annum. The investment horizon of portfolios built on working with bonds of Russian companies is from 1 year.

Types of trading strategies

Below we will look at some types of trading strategies in the stock market.

Asset Allocation

Investment strategy with different classes of instruments. There is no single trading scheme that strictly stipulates - this is 5%, that is 7.5% and not an ounce more. Forming an investment portfolio in this strategy is similar to the approach of an artist - a lot depends on inspiration and goals.

The main thing is risk diversification. The ideal situation is when portfolio assets do not correlate with each other, the correlation is negative. Moreover, the movement of one does not automatically affect the price of the other. But in reality this is impossible: the correlation is taken into account and, if possible, minimized.

Old fact: gold is an indicator of fear. When the market falls, the precious metal often goes against the stock market. Stocks are falling, gold is rising. Simple trading strategy.

There is no strict list of assets for forming a portfolio in the stock market. This:

- stock market instruments - shares, bonds;

- mutual funds, ETFs;

- commodity assets;

- REITs and sometimes real estate;

- cash, currency;

- derivatives on underlying assets - from the stock market to dairy products.

The list can be expanded indefinitely. The approach to portfolio formation is flexible. The general point of a trading strategy is the distribution of risks and expected returns.

Dividend strategy

Based on dividend payments by companies. We are interested in those who pay dividends regularly. The size and terms of payments are determined by shareholders. This happens once a year, less often - six months or three months.

Technology for receiving dividends:

- Shareholder cut-off date. It is known in advance and follows the reporting period. Payments for 2022: cut-off for Gazprom shares - 07/19/2019, Rosneft - 07/02. Dates are at the discretion of the companies themselves. At the cut-off time, shares must be in the account to receive dividends. It is not necessary to hold shares for the entire previous year; you can buy a few days before the cutoff and sell immediately after it.

- After the cut-off, no later than two months, shareholders gather and approve the amount of payments.

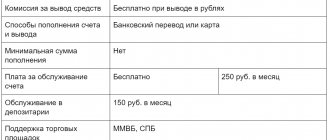

Table of dividend payments for 2022 in the oil and gas and banking sectors. Companies are traded on the MICEX.

The average size is from 1 to 9%.

The usual practice of dividend stocks on the market is that before the cutoff the value increases, and after it the value falls. If you bought just before the cutoff on growth and then sold, the size of the dividends may not cover these jumps. This is always an additional risk in the stock market.

How to choose securities with the best dividends

Issuers are required to post information about “material facts.” This includes decisions of the board of directors.

55 days before the meeting at which the cut-off date is determined, they decide on the payment or absence of dividends and preliminary amounts. This gives you time to analyze and buy in advance. In addition, two to three weeks pass from the meeting to decide the date until the cutoff. This is an additional period for thinking about whether it is worth participating in the dividend race of the stock market.

Expert opinion

Vladimir Silchenko

Private investor, entrepreneur and blog author

Ask a Question

In addition to the approach of buying exclusively for dividends, there remains a “buy and hold” strategy with an investment horizon of one year.

Cost strategy

A strategy built on undervalued market assets. The trading investment horizon is a year or more. The investor determines the criteria for valuation below the market himself - based on experience, insight or fundamental indicators. The latest trading approach is based on fundamental analysis ratios.

Some of them:

- EPS is the ratio of net profit to the number of shares, that is, how much you can earn on one share. A key parameter for building a strategy.

- P/B is the ratio of share price to inventory. Inventories are the balance of materials after debts are paid off. When the parameter is less than 1, the company is undervalued, from 1 to 2 is a fair assessment, >2 is overvalued.

- EV/EBITDA - gives a quick assessment of overvaluation or, conversely, compared to competitors. Shows over what time period the company’s profit not spent on depreciation and payment of interest and taxes will recoup the cost of its acquisition.

Growth strategy

Based on the assumption of an increase in the value of securities on the stock market. The starting point for making a decision may be:

- fundamentals;

- inside information - information available to a limited circle of people that can change the value of assets;

- there is a long-term upward trend.

The decision to purchase can be made based on fundamental ratios showing the revaluation of trading assets on the market.

Trading

Trading - active trading of assets intraday or over a medium-term horizon - up to several weeks.

Varieties:

- Scalping. Frequent intraday transactions. The instrument is the stock order book.

Algorithm: buy/sell in a spread. I bought it and immediately put it up for sale. The number of transactions reaches hundreds per trading day on the stock exchange. For scalping, automated trading is often used, when orders are placed by a robot based on a hard-wired algorithm. Watch the video to see how this happens in stock trading. - Intraday. Intraday trading. The standard working time frame is from 5 to 15 minutes. An open position cannot be carried over to another trading day.

- Swing strategy. Trading on price changes in the short term. The trader does not consider fundamental indicators; the trend movement is used for entry. Getting into a trend on time, closing a trade on time and reversing into the opposite position is the essence of a swing. Trading from one day, working frame - 15 minutes/1 hour/4 hours.

The chart shows a theoretical version of entries and closings with a reversal, hourly candles.

Macro-economic trading

Macroeconomic traders mainly focus on long-term fundamental data that determines a country's economy. These traders can hold positions for months and even years. Many of them have only a few positions open throughout the year. These traders choose their positions carefully because their number is very limited.

Some of the most important economic data that macroeconomic traders study include a country's GDP data, current inflation and employment situation, interest rates and trade balance data.

It is from this primary data set of macroeconomic indicators that a trader can begin to build a forecast, his expectations from a particular country and its exchange rate in relation to other countries.

Successful macro traders can spot new trends in the current business cycle and prepare to enter the market before many others realize the impending changes. These traders tend to be well aware of the overall market sentiment and look for early shifts in market sentiment and psychology.

Although macroeconomic traders rely primarily on fundamental analysis techniques, they also often use technical analysis to plan their trades and find optimal market entry and exit points.

An important analytical method used by many macroeconomic traders is the use of intermarket analysis. They regularly study the cause-and-effect relationships between different asset classes.

For example, macroeconomic traders want to know:

- How do government bonds move relative to stocks?

- What impact do certain currencies have on crude oil prices?

- What are the prices of basic commodities relative to the US dollar?

- What is the relationship between gold and stocks?

These are just some of the questions that macroeconomic traders try to answer before making their forecast.

How to choose a trading strategy

Useful articles

What is Carry trade: pros and cons of the strategy, who is it suitable for?

We destroy myths about “promoted” forex traders in Russia and the world

Reviews about working as a trader: how beginners are scammed

How much money do you need to invest in stocks to quit and live on dividends?

The choice of trading strategy depends on your preferences or the specific situation that develops in the market. Knowledge of the chosen trading algorithm will allow the trader to open the right position that will bring him profit in the stock market.

High Frequency Trading

High frequency trading is an algorithmic trading method that large organizations use to execute huge numbers of orders in a matter of seconds.

However, this style is not generally classified as a mainstream trading style because it relies on core technology rather than the trader's personal preference or plan to execute trades. High frequency trading is also not widely available to individual traders, meaning they simply cannot keep up with the big companies.

Basic stock trading strategies

Basic stock market approaches are based on trading from support and resistance levels, breaking them, and working in the price channel.

Rebound from price support and resistance levels

When the price cannot break through the support/resistance level. Points for opening a position. The hourly chart shows multiple price rebounds from the support line (blue line).

Breakout of the price level

Buy or sell when resistance or support is broken. The breakout must be confirmed by the daily candle closing above resistance or below support. The daily chart shows the moment of breakdown of the horizontal level of 95.

The breakdown confirms the sharply increased volume of stock trading (lower gray chart).

Shock day

A good day is a speculator's friend. It doesn’t happen every day, it’s a gift to traders. As a rule, it opens on news with a gap, the change during the session is at least 2% from the close of the previous trading day.

An option for a shock day is a price rise/fall in a narrow channel.

An example of such a trading session:

Channel

Price movement in an ascending/descending or horizontal channel with designated boundaries.

The trading strategy is based on the fact that the price moves in the channel and, when approaching the border, opens an opposite position. The price came down to support - open a long position, to resistance - close it or turn into a short position.

The chart shows an ascending channel.

“Blue chips”

The conservative blue chip strategy involves selecting the most liquid stocks with a high level of capitalization. This list includes the largest companies whose names are known all over the world, and whose business reliability has been proven over the years. On the Russian stock market, this list includes Sberbank, Gazprom, NLMK, Lukoil, Tatneft, Yandex, MTS, Norilsk Nickel, Polyus Gold, etc.

pros

- Stable profitability even in times of crisis

- High reliability of the company (the risk of default is minimal)

- High liquidity

- The advantage of this strategy is that it is very easy to implement and is suitable even for beginners.

Minuses

- Limited growth.

Support a startup

According to Oksana Karpenko, Candidate of Economic Sciences, Associate Professor at the Faculty of Economics of RUDN, from the point of view of macroeconomic development, the Strategy involves achieving high rates of economic growth by providing competitive access to Russian economic entities to debt and equity financing, and risk insurance instruments.

“This access will be achieved through the growth of digitalization of the economy, the development of payment infrastructure, the dissemination of new tools and the expansion of the practice of using the digital ruble,” explains the economist, pointing to another important area: the possibility of attracting capital to startups through the use of digital rights and digital financial assets .

“The use of blockchain technologies and attraction of financing through an initial offering of tokens (ICO), expansion of crowdfunding will significantly reduce the cost of raising funds,” adds Karpenko.

According to the founder of the Center for Social Design "Platform" Alexey Firsov, increasing the number of financing options is critical for startups.

In 2022, the company conducted a number of surveys, the majority of participants of which believe that in the development of innovation in the country, one of the key roles should belong to the state - at least in creating infrastructure, early-stage investments and regulation.

“The state is interested in creating a progressive system of innovation, but the national market does not allow innovators to scale their business. Startup leaders say they lack support tools. As a result, Russia is becoming a global reservoir of startups - a supplier of “semi-finished products” for international corporations,” says Firsov.

At the same time, in his opinion, Russia has all the prerequisites for rapid changes - increasing the availability of financing for business, developing entrepreneurship. As an example, the expert cites the “convertible loan” law adopted this summer, which allowed businesses to speed up the receipt of investments as quickly as possible, and allowed investors to postpone lengthy due diligence procedures for the future.

Firsov points to Silicon Valley and popular British law jurisdictions, where founders can rely on a “convertible loan” mechanism that allows them to enter into an agreement with an investor literally on a napkin in a cafe and be sure that the money will arrive as quickly as possible.

“In developed startup ecosystems, the availability of such a mechanism with tens of thousands of active business angels significantly increases the chances of innovators at the pre-seed and seed stages to overcome the “valley of death.” According to experts, every third startup in the world uses it,” explains the founder of the Platform, adding that this kind of innovation can increase the investment attractiveness of startups in Russian jurisdiction.