Hello, fellow Forex traders!

Today we will talk about one of the oldest classical indicators, the relative strength index ( RSI ). This indicator is included in all trading platforms; it is used in thousands of trading systems in any market. Every trader knows this indicator, but nevertheless, not everyone knows how to use it correctly. That is why in this article I will try to lay out all the features of using this wonderful indicator, and will also share an extended version.

Secrets of using the RSI indicator on Forex

History of creation

The indicator was developed by J. Welles Wilder and published in Commodities magazine in June 1978. Later, Wilder wrote the book “New Concepts in Trading Systems,” where he outlined in detail the essence of the relative strength index. After the publication of the book, the RSI oscillator became very popular among traders and helped many users assess market strength.

Wells Wilder is a stock trader, one of the leading specialists in technical analysis and the developer of many trading systems and indicators. An engineer by training, Wilder managed to work both in his specialty and in the real estate market, but he became truly interested in futures trading. Wilder spent many years researching technical analysis, which resulted in several books (“New Concepts in Technical Trading” (1978), “The Adam Theory of the Markets” (1987)) and “The Delta Phenomenon” (1991)).

In the early 80s. Wells founded the Delta Society International. The purpose of the society was to study financial markets. The society's own company, Trend Research Ltd, develops trading software.

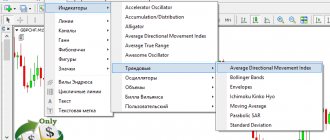

Wilder is the author of such well-known indicators as the Average True Range , Relative Strength Index , Directional Movement Indicator and Parabolic Stop and Reverse .

Today, G. Wells Wilder Jr. is perhaps the most famous living market guru. The retired trader lives in the beautiful South Island of New Zealand. He reflected the experience of his past years in his latest book, “The Wisdom of Ages in Acquiring Wealth.”

He says that if he had known in his youth what is written in this book, he would be much richer than he is now. Its indicators are considered basic for many technical analysis programs and are included in almost all modern trading terminals.

J. Wells Wilder Jr. remains an active trader and consultant on technical trading systems and methods, the author of many articles, and appears on radio and television.

And finally, a couple of interesting quotes from this wonderful trader:

“If you can’t cope with your emotions, quit trading.”

“Some traders are born undisciplined. Life will teach you. It will hurt.”

General description of the indicator

The RSI indicator is an oscillator, which means it fluctuates in a certain zone limited by the maximum and minimum values. The Relative Strength Index is measured on a scale from 0 to 100. It works best when reaching extreme areas. The evaluation criterion is two lines drawn at the level of 30 and 70. It is believed that above 70 there is an overbought zone, and below 30 there is an oversold zone. Therefore, when the Relative Strength Index value reaches and rises above 70, there is a threat of a price decline; movement below 30 is perceived as a warning of an upcoming rise. Some analysts advise taking levels 30 and 70 as boundaries only for sideways trends, and 20 and 80 for pronounced bullish and bearish trends.

Of course, exceeding the levels of 30 and 70 does not mean that you need to immediately start making deals. After all, the market may be in a state of overbought and oversold for a long time, and the oscillator, warning about a trend change in advance, does not explain exactly when this may happen.

When introducing RSI, W. Wilder recommended using its 14-day version. Later, 9 and 25 day RSI also became widespread. Often the period is 5, 7, 9, 14, 21 or 25. Most programs offer one of these numbers as the default value.

The daily RSI will be based on price data covering the last 9 or 14 days. The weekly chart will include the past 9 or 14 weeks. Minute, naturally, 9 and 14 minutes.

The number of unit periods when calculating RSI can be varied, so I recommend experimenting with them to choose the most suitable option. The shorter the RSI calculation period, the more sensitive the indicator is to current price changes.

How to choose the optimal period? The fact is that it will be different for different timeframes of the same currency pair, so it will not be possible to use a successfully selected indicator period on all time scales of the pair you need. As a rule, the smaller the timeframe, the longer the period should be and vice versa. Finding the optimal period for the RSI indicator is not difficult - you need to sequentially go through the periods and look at the overbought and oversold zones. As soon as the main pronounced (reversal, key) highs and lows on the price chart begin to be reflected by the indicator in the overbought and oversold zones, and the rest (at least most of them) are outside these zones, consider that the optimal period has been found.

As usual, the shorter the period we use, the more sensitive the curve will be and the more signals we will receive. The shorter the period is selected, the closer to the extreme values of the scale are the RSI index indicators corresponding to the “overbought” or “oversold” state of the market. The greater the number of days in the period when calculating the index, the smoother its indicators will be.

You can learn more about the nuances of setting up oscillators here.

How to set up an oscillator?

I would like to note right away that the author of RSI worked on daily charts , so the settings that Wells Wilder used may not be suitable. And the markets have changed , movements have become sharper, volatility has increased.

The key parameter that influences the operation of the indicator is the period . I recommend considering the following:

- Wilder used the value 14 , and many still use it today;

- period values of 25 and 9 are often used on small time frames ;

- you can search for a suitable option among the values 21, 14, 9, 7, 5 . Values below 10 are mainly used on large timeframes. In other terminals the settings profile is the same, there are no additional items.

In addition, in the settings you can set:

- type of price that will be used in calculations;

- line type;

- position of overbought/oversold levels. By default, they are set at 70 and 30 , respectively. For highly volatile pairs , for example, EUR/JPY, GBP/JPY, I recommend to 80 and 20 ;

- you can add arbitrary levels .

Setting up RSI in QUIK, ATAS and other terminals is done in the same way as in MT4. The exception is custom modified versions of the oscillator; the specifics of their settings depend solely on what the author has put into it.

Calculation formula

Since the computer does all the calculations for you, there is no need to memorize the formula. Nevertheless, knowing it will help you better understand the essence of the indicator’s operation, and this is the key to its correct use and interpretation of the signals it provides.

Wilder argues that there are two main problems with constructing a price rate curve (based on price differentials). The first is due to the chaotic movement of the rate curve due to frequent sharp changes between price values during the period under review. A sharp increase or decrease in prices that occurred ten days ago (in the case of a ten-day tempo indicator) today can cause a sharp turn in the curve - even if current prices remain relatively calm. Therefore, in order to reduce such distortions to a minimum, the tempo curve must be smoothed. The second problem relates to the need for constant oscillator band boundaries for benchmarking purposes. The RSI index formula solves both of these problems: it not only flattens the curve, but also provides a constant vertical scale from 0 to 100. It should be noted that the term “relative strength” is used by Wilder to some extent erroneously and is often misleading to those who is familiar with this concept from stock market analysis. “Relative strength” is traditionally understood as a curve of the relationship between two different objects. As for the Wilder Relative Strength Index, it does not measure the “relative strength” of various objects, and therefore the meaning that the author gives to this term is not entirely accurate. However, the RSI index solves the problem of chaotic movement of the oscillator curve and allows you to set constant upper and lower limits of fluctuations.

RSI is calculated using positive (U) and negative (D) price changes. A day is called “up” if the closing price today is higher than yesterday.

A day is called “down” if the closing price today is lower than yesterday.

If the closing prices today and yesterday are equal, then U and D are equal to 0. After the values of U and D are smoothed by an exponential moving average with a period of N, the “relative strength” (RS) is first calculated:

Based on RS, RSI itself is calculated:

It's easy to verify that:

Many sources indicate not an exponential moving average (EMA), but a simple one (SMA).

When calculating RS, it is necessary to take into account the situation when the denominator turns out to be zero. This is possible when using a simple moving average (SMA), when over the entire averaging period the price only went up and, accordingly, all values D = 0. In this case, it is necessary to take RSI=100.

Of course, any price can be used to calculate the indicator. For the MT4 terminal, this is the closing price, opening price, highs or lows, average, typical and weighted price. It is also possible to build RSI using data from another indicator.

Standard Methods for Using the Relative Strength Index

Typical methods for using the RSI indicator in a binary options strategy cannot be written down. The percentage of work done is not enough to earn money, but it is advisable to know these techniques for use as part of other strategies:

- crossing the boundaries of oversold and overbought zones. When the chart leaves these areas, often not a full-fledged reversal begins, but a weak correction or flat;

- crossing level 50, it is believed that after this the graph in most cases reaches the border of the next zone;

- divergence and convergence – the signal is powerful, but it is not always processed immediately, and it is formed relatively rarely. It is also not suitable for the role of an independent trading system.

Strategies based on RSI for binary options necessarily include filters, these can be candlestick patterns, graphical constructions, and other indicators. As an option, there are modified versions of the standard oscillator, into which additional tools are already “built in”. Below we will look at examples of both types of strategies.

Overbought and oversold levels

RSI index values are plotted on a vertical scale from 0 to 100. When the indicator is above 70 or below 30, the index registers overbought or oversold conditions, respectively. Two horizontal lines are plotted on the oscillator chart, corresponding to the values of 70 and 30. These lines are often used to receive buy and sell signals. As already mentioned, an oscillator value below 30 indicates that the market is oversold.

Let's say a trader believes that the price decline is about to reach its limit, and is waiting for an opportunity to open a long position. He sees the oscillator curve falling below 30, entering the oversold area, and hopes that there will be some divergence or a double bottom in the oscillator dynamics in this area. When the curve crosses the boundary again - this time rising - many traders view this as confirmation that the oscillator's trend has turned upward. Conversely, re-crossing the 70 line when the curve falls from the overbought area is often regarded as a signal to take a short position. Of course, exceeding the levels of 30 and 70 does not mean that you need to immediately start making deals. After all, the market may be in a state of overbought and oversold for a long time, and the oscillator, warning about a trend change in advance, does not explain exactly when this may happen. You should always keep a close eye on the intersection of the 70 line and the 30 line. During a strong uptrend, it is not unusual for the RSI oscillator to rise above 70 and stay there for quite some time. This is usually a signal of a strong upward trend. In such cases, it is probably best to ignore the oscillator for a while while it remains above 70. A cross below 70, especially if it occurs after a long time, often gives a good signal of a change in trend. Many traders consider a cross below the 70 line to be a sell signal and a cross above the 30 line to be a buy signal.

It is not necessary to use exactly 70 and 30 as levels. Experiment with the levels. For a bullish market, 40 and 80 are better, and for a bearish market, 20 and 60. To reduce the total number of signals and increase their quality, you can use levels 20 and 80. I recommend using the 5 percent rule: draw a line so that the RSI remains 5 percent behind it total time over the last three months, for example, if you trade on daily charts. Adjust the reference line as necessary.

In a very calm market with low volatility, you may notice that the RSI line fluctuates between 70 and 30. You may want to try to increase the amplitude of the RSI swing by shortening the time period. Try to find a lower period, such as 7 or 5. The opposite case involves a situation where the RSI line is too volatile. Frequent transitions above 70 and below 30 become less significant, making it difficult to determine between real signals and market noise. In this case, it is necessary to reduce the amplitude of the RSI line by increasing the period, for example to 21. This will eliminate many minor movements and help identify those that are valuable.

A buy signal is when the RSI leaves the oversold zone, a sell signal when the RSI leaves the overbought zone. Such signals are taken only in the direction of the main trend. Signals against the trend are ignored! It is better to combine these signals with signals from other indicators or with technical analysis. A signal to exit a position is when the overbought or oversold zones are reached. For example, when the RSI reaches the overbought zone, we close buy positions or pull our stops closer.

Most often, the RSI indicator is used by scalpers in their work during periods when there is a narrow flat on the market. Pay attention to the picture with examples of entry points for the RSI indicator: the euro/dollar rate entered the overbought zone - 70, crossed it from top to bottom and we enter to sell, and as soon as the price entered the oversold zone - 30, we enter to buy. This tactic is very effective in a flat, when positional traders are waiting for clarity in the Forex market, then scalpers using the RSI indicator simply stuff their pockets with money with such precise short transactions.

Trend identification

In Technical Analysis for Professional Trading, Constance Brown suggests that oscillators do not move between 0 and 100. In an uptrending stock market, the RSI moves between 40 and 90, with a support zone of 50 to 40.

When the stock market moves down, the RSI fluctuates between 10 and 60, and the support zone is between 60 and 50. In other words, depending on the direction of the trend, you can shift the overbought or oversold levels to receive signals during a trend correction. Examples are presented in the graphs.

Levels 40/80 and 20/60

As I said above, in an uptrend it is advisable to use levels 40 and 80. In this case, we only make purchases when the indicator level drops to level 40.

In a downward trend, it is advisable to use levels 20 and 60. In this case, we only consider sell transactions when the indicator level rises to level 60.

Determining a trend change at the 20/60 and 40/80 levels

When using the 20/60 and 40/80 levels everything comes out pretty smoothly, but how do you know when to use which levels? It's pretty easy. So, during a downward trend, the RSI indicator constantly drops to the level of 20 and never reaches the level of 80. During an upward trend, it hangs around 80 and does not want to go to 20. Therefore, when a situation occurs, as in the picture above, we can talk about a change in trend from a downward one to the ascending one in our case. During a downward trend, the indicator dropped to the level of 20 several times, never reaching the level of 80. But one day, the RSI still broke through the level of 80 - from now on you need to be careful, a change in trend is expected. The next decline in the indicator, which did not reach level 20, confirms the change in trend.

Positive and negative reversion

The signals, which were developed by Andrew Cardwell, are the opposite of divergence. If RSI divergence tells us about a possible trend reversal, then reversion tells us about its continuation . This way we can easily interpret pullbacks and corrections.

A positive reversal should be sought in an up market, when the chart shows rising lows (pullbacks) and the RSI oscillator shows falling lows.

The opposite can be said about a negative reversal, which occurs in a down market and looks like this:

Level 50

While the RSI oscillator's main focus is on the oversold and overbought lines, the 50 line is also important. You may notice that in strong trends the price often finds resistance at this level.

If you are looking for confirmation of an uptrend, then make sure that the RSI is above 50. If you think that the market is in a downtrend, then make sure that the RSI is below 50. Let's say you have found an uptrend, but you doubt its strength. To avoid false signals, wait for the moment when the RSI crosses above 50, thereby confirming the assumption. Now we can say quite confidently that a trend has formed; crossing the RSI level above 50 is a good confirmation. You may notice, for example, that during an uptrend correction the RSI line will often find support at the 50 line before moving back up again. During a downtrend, RSI line bounces will often stop near the 50 line.

Use the 50 signal line to confirm the trend. If the RSI is above the 50 line, the trend is upward and it is recommended to enter only into purchases; if below, we consider only sales.

When does RSI divergence not work?

Like any other trading methodology, divergence does not work 100% of the time.

Most often, divergence fails in strongly trending markets. If you take too many divergence trades when the trend is strong, you will lose a lot of money. So make sure you have a solid money management plan.

Your profit percentage and loss percentage will also be determined by your exit strategy, your trading discipline, and your ability to objectively analyze your results.

The most common reasons for the failure of any trading system are:

- Not enough testing

- Give up too early

- Not logging your trades properly

- Trading strategy has no advantage

- Unrealistic expectations

- Ignorance of expected statistics

- Lack of good trading opportunities

These are problems primarily related to your trading psychology and trading process. Therefore, if you have a trading strategy that has a statistical advantage and you are on a losing streak, you need to take a hard look at your trading process and psychology.

Don't change your trading system just because you have a losing streak. This may not be a problem with your strategy. Try to look at all aspects of your trading objectively.

We have studied how RSI divergence works. Remember that while divergence may look good on a few well-chosen examples, you need to have a complete, well-tested trading strategy in place to have long-term success with RSI divergence.

This starts with creating a trading plan and backtesting it. Then, if your strategy passes these tests, you can move on to testing on a demo account and, if it works, to live trading. Take the time to go through this process step by step.

Failed Swing

When index indicators are in oversold or overbought zones, a special pattern can form on the oscillator chart, which Wilder calls a “failure swing.” A “failed swing” in the position of the top is that during an upward trend, the next peak of the indicator curve never reaches the level of the previous peak, after which the curve falls below the level of the previous decline. A "bottom swing" occurs when a falling indicator (below 30) fails to fall below the previous decline and then rises above the previous peak.

However, despite the reliability of the pattern, it should not be used blindly and without confirmation by other tools. At a minimum, you need to filter trades by trend direction.

Laguerre RSI – Trader's Favorite

The Laguerre indicator is used as a basis, but the filter is based on RSI. As a result, we have an interesting hybrid.

The scale of this indicator varies from 0 to 1, almost the same as in the standard RSI. One of the differences is that the line reaches extreme values faster and can literally stick to them - I draw straight segments at levels 1.0 and 0.0. The pair 0.75/0.25 or 0.9/0.15 is used as oversold/overbought levels - depending on the volatility of the pair.

As for signals, the places where the line enters the oversold/overbought zones are marked with colored circles, so only a blind person can miss the signal.

Levels and trend lines

Classic graphical analysis works quite well on the RSI indicator chart.

In the figure above, a regular horizontal level is plotted on the RSI indicator chart. In this case, the support points of the indicator coincide with the support points of the trend line on the price chart. Notice how the RSI told us about the breakout of the trend line 4 bars before this event. Example of trend lines:

Absolutely classic behavior of the indicator when breaking out trend lines - a lot of touches, then a breakout and almost always a mandatory retest of the broken trend line provides an excellent opportunity to enter a trade at the best price. The best signals are taken in overbought and oversold zones. In this case, you need to act in exactly the same way as when analyzing price charts - the more touches, the higher the time frame, the longer the model in time, the more reliable the signal.

Results

I propose to consider this review complete. We figured out how to set up the RSI indicator, looked at the subtleties of its use and the algorithm of operation. This is enough to not only use the oscillator signals, but also understand the logic of its operation. This is very important, I advise you not to use any indicator at all until you understand exactly what information it displays.

Don't forget to subscribe to my blog and share posts on your social media pages. See you again!

If you find an error in the text, please select a piece of text and press Ctrl+Enter. Thanks for helping my blog get better!

Graphic shapes

In addition to levels and trend lines on the RSI chart, technical analysis figures, such as head and shoulders, triangles, wedges, rectangles and others, are also often analyzed. With their help, you can predict the dynamics of the Index movement, as well as the time when exactly the price trend should change.

RSI often forms graphical patterns that may not appear on the price chart. However, such figures can be quite good signals for entering a position, often ahead of most other methods.

A word about binary options

I think that I will not open America for anyone if I say that today binaries are a very popular direction in trading. But this is not surprising, given the fact that brokers in the binary industry are pursuing an aggressive and massive marketing policy. Of course, it can be noted that advertising of binaries is everywhere. You will find it on the Internet on leftist sites that are not dedicated to this topic; even many bloggers actively advertise binary topics.

Read the topic: Brokers are scammers

But, of course, it is worth noting that the excitement in this area is no longer the same as it was, for example, in 2008, when a huge number of losers poured into this area and only had time, as they say, to bring cartridges. Since those times, the reputation of binaries, let’s say, has become pretty bad. For example, a large number of successful traders do not perceive binaries as a separate direction at all; for them it is all a kind of manifestation of a casino and nothing else.

To the point:

- Anti-Martingale strategy on binary options

- Binary options ladder strategy

- Tumbler Strategy

- Binary options is a casino

No, of course, you can make money within binaries, it’s hard to argue with that. But you must understand that there will be no easy way; I would say that making money here is much more difficult than on Forex. You may think, how can this be, because advertising says that you need to press two buttons and get rich. Well, now I’ll try to prove to you that in the field of binaries, not everything is as simple as it seems.

Well, for starters, about advertising. Tell me, do you always believe everything that they tell you? If this is so, then your affairs are very bad, since you are dooming yourself to constantly remain a sucker. Any information should be viewed critically and with distrust. They want to deceive us everywhere, and this is a fact that we just have to accept.

Divergences

Another tool for predicting prices using the Relative Strength Index is to study the discrepancy that has arisen between the direction of movement of the Index chart and the price trend. Divergence refers to two cases: 1. RSI is growing, but the price is falling or staying at the same level. 2. RSI falls, but the price rises or does not move. The divergence in this case is a strong reversal indicator. And although it does not occur at every turn, it is often encountered at particularly serious turning points.

The divergence between the RSI curve and the price movement curve with index values above 70 or below 30 is a serious signal that is dangerous to ignore. Wilder himself calls the divergence “the most significant indicator for the relative strength index.” In such a case, the index curve shows either a double bottom or two rising bottoms. In this example, the oscillator signal very accurately indicated the beginning of a price correction and the need to take profit in a bearish market.

The RSI indicator shows quite well the discrepancies (divergences) between the price readings on the chart and the values of the oscillator itself.

As stated above, divergences occur when price makes a new high (low) but it is not confirmed by a new high (low) on the RSI chart. In this case, prices usually correct in the direction of the RSI movement. More detailed information about divergences and their types can be found on the blog pages.

Stochastic RSI

What happens if one super-popular indicator - stochastic - is combined with another? You get Stochastic RSI, two shampoos in one bottle.

It is enough to put all three options on the chart to evaluate the difference. Top down:

- RSI;

- Stochastic RSI;

- Stochastic.

As you can see, Stoch RSI is an indicator that takes the best of RSI and regular stochastic. In fact, I regard this turkey simply as a more convenient, smoothed version of the usual stochastic.

Detailed description of Stochastic .

Actually, it is this version of the stochastic that I use. It works great for the 5-minute timeframe and above. But for a 1-minute period it is sometimes better to use a regular stochastic - it is more “fast”.

And here is the second popular couple.

RSI and moving averages

Most traders use the RSI indicator only in the traditional manner of analyzing overbought and oversold levels. The chart below shows how simply adding a Moving Average to the indicator creates a smoothing effect and shows the trend direction of the RSI indicator.

The moving average (red) shows the direction of movement of the RSI indicator, as well as the location of the index itself relative to the moving average (above or below), which also indicates the current trend. In addition, the moving average can act as a resistance level for the indicator.

If plotting one average on the relative strength index gives such good results, then two averages must be the holy grail.

This, of course, is not entirely true, but still, if you take into account the direction of the trend, you can get good signals at the intersection of two moving averages constructed using RSI data.

Recommendations for use, strengths and weaknesses

Like any other indicator, RSI is just a tool, and it also has misfires when a seemingly perfect signal brings a loss. Below I will give a list of disadvantages of RSI and try to answer the question of how to trade with it correctly:

- does not work well during a trend . The only way to solve the problem is to use it in combination with other tools. For example, work is carried out using the MA in the direction of the trend, and RSI is used to find the end point of the correction;

- gives different readings on different timeframes . On M15 it may indicate the need for purchases, and on H4 we have a clear downward trend. Always give priority to the older time interval , take into account the position of support/resistance levels on the chart;

- there are a lot of false signals - if you take into account all the signals, then this will happen. I recommend taking only signals that are close to ideal and not entering the market based on the readings of the relative strength index alone.

And don’t forget that RSI goes well with other trading strategies , and not just indicator ones. Before you start inventing and testing your trading system, you need to decide on a broker. The table below will help you with this.

| Company | Just2trade | United Traders | BKS | Tinkoff investments |

| Minimum deposit | From $100 | $300 | from 50,000 rub. | Unlimited, you can even buy 1 share, they recommend starting from RUB 30,000. |

| Commission per cycle (buy + sell trade) | 0.006 USD per share (min. 1.5 USD), 0.25 USD for each application. that is, per lap – $3.50 | “Beginner” tariff – $0.02 per share Average $4 per round | At the “Investor” tariff – 0.1% of the transaction amount, at the “Trader” tariff it is reduced to 0.015% | 0.3% for the “Investor” tariff |

| Additional charges | The ROX platform will cost at least $39/month. (for the American market), for an additional $34.50 they connect Canada/TSE, Level II On the over-the-counter market, the additional fee is 0.75% of the transaction volume (minimum $30), in the case of dividends - 3% from the issuer (minimum $3) | On the Day Trader tariff, they charge $60/month for the Aurora platform, free on other plans | If the account has less than 30,000 rubles - 300 rubles/month. for access to QUIK and 200 rub./month. for access to the mobile version of QUIK, | — |

| Account maintenance cost | $5/€5/350 rub. reduced by the amount of the commission paid | — | 0 RUR/ month on the “Investor” tariff. On other tariffs, funds are debited only if there was activity on the account this month | Free for the "Investor" tariff |

| Leverage | for Forex Up to 1 to 500 for stocks up to 1 to 20 (day) to 1 to 5 (night) | 1 to 20 on the Day Trader tariff, this is the maximum leverage (daily) | Calculated for each share, within the range of 1 to 2 – 1 to 5 | Calculated for different instruments, the calculation is linked to the risk rate |

| Margin call | -90% | Standard -30% of the deposit, in technical terms. support can be set -80% | Calculated based on the risk for each security | Depends on the asset |

| Trading terminals | MetaTrader5, ROX | Aurora, Sterling Trader, Fusion, Laser Trader, Volfix.Net, Pair Trader | My broker, QUIK, WebQUIK, mobile QUIK, MetaTrader5 | The purchase of shares is implemented like an online store, professional software is not used |

| Available markets for trading | Forex, American, European and other stock markets, cryptocurrency | American and other stock markets, more than 10,000 assets in total, cryptocurrency | Foreign exchange, stock, commodity markets, there is access to foreign exchanges | American and Russian stock markets |

| License | CySEC | Lightweight license from the Central Bank of the Russian Federation | TSB RF | TSB RF |

| Open an account | Open an account | Open an account | Open an account |

How to determine the trend using the RSI indicator

When John D. Rockefeller was asked how Standard Oil's share price would behave, he allegedly replied, “I think it will fluctuate.” Price fluctuations are, of course, the essence of the market, where buyers and sellers collide. Prices can fluctuate within a range that has lower and upper limits, often called support and resistance levels. In other cases, prices may fluctuate within an ascending or descending price channel. When prices break through the range and move towards their final goal - up or down, we can talk about a trend.

Determining the presence or absence of a trend is one of the most important tasks of technical analysis. The classic indicator used in a trending market is the moving average, since price, while moving in a trend, tends to remain on one side or the other of the appropriately chosen moving average throughout most of the trend. The main disadvantage of the moving average is its lag. It cannot reflect current reality, because... is based on historical data.

RSI is based on price changes and is thus an indicator of price speed. With this in mind, when most price movements are on the upside, you can expect the RSI to read 50 or higher, indicating that a moving average with the same period as the RSI has a positive slope. The opposite is true when most price changes are downward and the RSI is below 50.

The 200 period Simple Moving Average (SMA) is shown in red and the RSI (200) in blue. Level 50 is indicated in blue. At point A, the slope changes from downward to upward, while the SMA 200 turns upward, and the RSI 200 rises decisively above 50. Please note that it is difficult to determine the change in the slope of the moving average by eye, but it is easy to notice a drop in the RSI. We have seen that the RSI can detect a change in the slope of a moving average when it moves above or below 50. But this is not the same as defining a trend, since the slope of a moving average price may briefly flatten or even reverse during a major trend.

One way to solve the problem is to use a simple moving average of the RSI index itself as an indicator. Moving averages with periods of 100 and 200 are depicted in green and red to identify the trend. The 100-day average of the RSI 200 is shown in red, with a horizontal line at 50. As stated earlier, a change in trend occurs when the RSI line crosses the 50 level. The same applies to the RSI moving average. The RSI signals occurred a little later than the moving average crossovers (points 2 and 6 vs. 1 and 5). But note that SMA 100/200 prices had sawtooth movements at points 3 and 4. In addition, there were several sawtooth price movements crossing the SMA 200. The 100-day moving average RSI 200 - on the contrary, had no such movements at all during this period .

A more sensitive method is to compare the RSI to its own moving average. The figure above shows the RSI 200 plotted along with its own SMA 200. The RSI 200 crosses its SMA 200 from bottom to top at point 1 and from top to bottom at point 2. Note that the signal at point 1 occurred before the moving average crossover. This method shows us most of the upward phase of the market.

Using RSI to catch a major trend

The next one, which we will consider, is built not only on RSI. In addition to this oscillator, several more indicators are used; for trading we will need:

• actually, the RSI itself with a period of 14. Levels of 60 and 40 will be used instead of the standard 70 and 30;

• Parabolic with settings of 0.03 and 0.03 (step and maximum, respectively);

• SMA70 (simple moving average).

Trading will be carried out on H4 on the EUR/USD, GBP/USD currency pairs. In principle, you can try trading on other instruments, but profitability with standard settings in this case is not guaranteed.

Let's look at the rules of the strategy using the example of purchases:

• the price should be above the moving average, this indicates a growing trend in the market. As in the previous strategy, we are absolutely not interested in the direction of the moving average itself, only the position of the price relative to it;

• Parabolic SAR should jump below the price;

• RSI at this time should already be above the level of 60 or cross it in an upward direction. If the line is below this level, then we wait until it breaks through (the other conditions must not be violated, that is, the price must remain above the moving average, and the Parabolic must not jump above the price);

• if all the listed conditions are met, you can enter the market immediately after the close of the candle on which all the listed conditions are met;

• the author recommends setting a stop at a maximum of 80 pips. You can do less - for example, place a stop loss behind the nearest local extremum, the main thing is that it does not exceed the specified 80 pips. As for the TP, it must be set equal to 500 pips - this is the minimum which you need to count on.

The example shows a good entry into the market - all conditions were met, so purchases followed immediately after Parabolic jumped below the price. It is recommended to start trawling the deal immediately after the price enters a profitable zone. Moreover, the stop loss is transferred with each new candle under the Parabolic.

If the price has already moved 130-150 points in a profitable direction, and the Parabolic still does not allow you to move the stop loss to zero or to the profitable zone, then we move it to zero without paying attention to the location of the Parabolic.

In the example shown, the take profit would not have worked, but the price moved in a profitable direction by more than 200 points, so we would not have received a loss in any case, and due to the trailing stop we would even have been in a slight plus.

The following example is a short position, opened according to mirror rules. The price should be below the moving average, the RSI should fall below the 40 level, and the Parabolic should jump and be above the price. In this case, it is not known exactly how the deal will close, but we can say that we will not lose anything. As of now, we are already in the black, and the deal should break even.

Based on a quick study of the strategy and its behavior in history, I would advise:

• re-open trades in the same direction only after the price has touched the moving average or has been behind it and returned back;

• take into account the slope of the moving average when concluding transactions. The history shows areas where formally all the rules are met, but at the same time the SMA is almost horizontal. In such situations, it is most often impossible to make a profit.

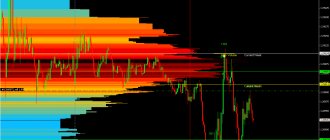

Using channel indicators

Using channel indicators makes the interpretation of RSI signals somewhat easier, since in this case the overbought and oversold levels become dynamic and move along with the relative strength index chart. In addition, the direction of the channel itself indicates to the trader the direction of the trend. For example, you can build Bollinger bands based on RSI values.

Just as the RSI chart itself generally repeats the price chart, often ahead of price reversals, so Bollinger Bands, built based on RSI values, in some cases can generate earlier or more clear signals to open a position. If you are able to use the Bollinger Bands indicator effectively, you may find that using Bollinger Bands based on RSI values will provide you with a number of additional benefits, especially when you consider the other signals generated by the RSI indicator. You can also use Envelopes, or, for example, TMI, as well as any other channel indicator.

Personally, I prefer TMI, the use of which can be seen in the figure above. In addition, some traders use moving averages based on RSI values as the 50 average line.

conclusions

I can note that this indicator is a kind of workhorse, which, although there are not enough stars in the sky, nevertheless performs all the tasks for which it is designed. Essentially, you need to take this tool as a signal indicator, and then add additional filters that will allow you to get away from such a large number of false signals.

Which filters to add is a specific personal matter for each trader, and there are no generally accepted settings that would allow all issues to be resolved with the click of a finger. In general, I can say that this is an ordinary indicator that does not cause enthusiasm, however, it copes with all the tasks assigned to it. Therefore, if you need a good switchman for your system, then this tool will be very useful to you.

RSI on different timeframes

The RSI indicator shows good signals, but its readings still need to be filtered. One such possible filter could be the RSI from an older period. While in the M15 period the RSI signals oversold conditions, in the H4 period the indicator may be in the overbought zone. In this case, entry based on RSI readings on M15 may result in losses.

In the figure above, two RSI indicators with a period of 14 are plotted on the EURUSD H1 chart. The upper one is built according to the H1 period, the lower one - according to H4, all other settings are the same. Red dots show exits of the RSI indicator during the H1 period from the overbought zone, green dots - from the oversold zone. Orange and blue circles are the same, but for the RSI indicator built on the H4 period. Notice how well minor fluctuations are filtered out and only really large movements remain when the readings of both indicators are combined.

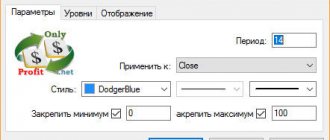

RSI Settings

Setting up the resai is like two fingers on the asphalt. Actually, we can only change the time period, which, by default, is 14 days. And that's a good value, really. I wouldn't change it unless absolutely necessary.

Well, on the Style tab you can easily change the style of the indicator:

- RSI – line of the indicator itself;

- Upper band – color and thickness of the upper line in the shaded area; the value 70 can be changed to 80 ;

- Lower Band – the same for the bottom line; the value 30 can be changed to 20 ;

- Background – instead of the cute purple color, you can use any other color.

And in general, no one bothers you to make an RSI for fans of chernukha, so that they can clearly see when it leaves the colored zone: