Greetings! The technical analysis reversal pattern Head and Shoulders often serves as a starting point in getting acquainted with trading. And not without reason! Despite its simplicity, Head and Shoulders has been making money even for novice traders for decades. Let's look at this pattern with examples, see how to use it in practice + I'll add a couple of important nuances that are unknown to a wide range of traders.

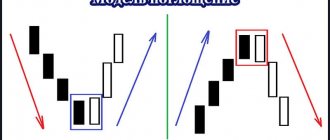

Head and shoulders is a reversal pattern in technical analysis, signaling an imminent change in the current trend. The figure consists of 3 consecutive vertices lying on the same straight line (neck line), with the middle vertex being larger than the others.

The same inverted pattern often occurs in the market, when 3 lows are formed successively, lying on the neckline. This is an inverted Head and Shoulders , a mirror signal that has not lost its strength.

What does a head and shoulders reversal pattern mean?

The head and shoulders reversal pattern (from the English Head And Shoulders, HIP) is a classic pattern of graphical technical analysis that accurately signals a reversal in a trend or trend . This formation of technical analysis has become widespread in trading, thanks to its good development, as well as an excellent risk-to-reward ratio .

For any Forex trader, head and shoulders is an important signal that indicates a high probability of a reversal in the direction of movement. The trading figure became popular in the stock exchange and later found widespread use in the Forex, futures and options markets.

In this article we will provide a detailed overview of the technical analysis of the figure. Let's find out how it emerges, and also allows us to anticipate the future new movement. At the same time, we will consider a sell scenario (classical model) and a buy variation (inverted modification).

A head and shoulders occurs when there is not enough fuel to further renew itself at the cost of its extremes (highs in a bullish trend and lows in a bearish trend).

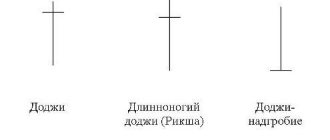

Reversal pattern of graphical analysis on the “double top” market

The work of the “double top” figure is the mirror image of the “double bottom”, but in a short position. Features of working short have some negative nuances:

1 The price may not fall for long; with any positive news about the company, the mood of the players will change dramatically. Therefore, we need compelling reasons for a prolonged fall in prices.

2 Brokers do not allow shorting all securities.

3 There are additional commissions for borrowing shares from a broker.

4 Profit in a short position is limited, unlike a long position in the long term.

5 If you are short on the dividend payment date, the broker will deduct dividends from your account.

Therefore, long-term short positions must be carried out carefully, carefully calculating the benefits of the transaction.

An example of the “double top” graphic figure is shown in the picture.

A market reversal can be seen based on other signs, graphic patterns, which in my opinion work much more effectively, which I will discuss in other articles.

Write questions in the comments, share the article on your social networks. To avoid losing the site, add it to bookmarks. To communicate, add to the telegram chat, address on the contacts page

Reversal pattern structure

The head and shoulders figure in technical analysis always consists of three visual components :

- Left shoulder.

- Head (middle top)

- Right shoulder.

They represent the basis and also cannot do without each other. The absence of any fragment indicates that the figure is not permissible to trade.

The neckline (base of the pattern) is support level for an uptrend, which, when broken, turns into resistance . For the reverse model, this is a resistance zone, which after breaking through becomes support.

The search for a reversal point always goes only in the direction of the breakout of the pattern structure.

Description of the head and shoulders pattern

Let's consider the rules of technical analysis of the formation of the head and shoulders formation during a bullish movement of the stock exchange:

- We see a steady growing trend .

- After the left peak occurs (point A), we see that the price makes a rollback (point B). Which indicates the end of the formation of the left shoulder .

- After which peak A is interrupted and a new maximum appears . It is higher than the previous top ( the highest high is head C ). Then there is a return to the minimum zone (point D).

- After which the price goes up again and peak E appears , which does not break the previous mark C. This only means that a GiP figure is being formed.

- After we see a breakout of the previous lows (points B and D), we can conclude that the formation of the reversal pattern is complete .

- Based on the lows, we build a support level, which is called the neck line .

- The price quote for both legs can be at the same level or at a different one.

Constructing an inverted head and shoulders pattern

Rules for constructing an inverted pattern in a bearish market in technical analysis :

- We see a steady downward trend .

- After the left low appears (point A), we see an upward price wave (peak B). The formation of the first part of the pattern is completed .

- Next, there is an interruption and the appearance of a new depression ( the lowest low is head C ), which is lower than the left previous low. Return to the maximum area (peak D),

- After which a downward wave appears and makes a right low (low E). He doesn't break his head (point C)

- Next it breaks through the previous marks B and D , which indicates the end of the formation of a reversal formation .

- At the highs we build resistance, which is the basis of the candlestick structure .

Inverted head and shoulders

Why “Gaps” appear on charts and how to use them in trading

Gap (English: gap) is a price gap on a price chart. Most often it appears due to non-trading time between sessions, when new information arrives, but the markets are closed and participants cannot promptly include it in quotes. The opening price of the next session differs significantly from the closing price of the previous day and a gap forms on the chart.

There is an opinion in the trading community that the price gap should be closed, that is, the price after some time should return to the prices before the gap.

It is worth making some adjustments to this statement for accuracy and reformulating it as follows: statistically, the probability of closing a gap is higher than the probability of not closing it. This is due to the fact that more than 60% of the time financial instruments are traded sideways, and sooner or later the price will return to any previously demonstrated price level.

This applies even to gaps near historical highs and lows. But in this case, closing the gap may take more than one year, which is unlikely to suit traders counting on quick profits. The absence of a time limit is one of the main points due to which a bet on closing a gap in its pure form cannot be used as an independent basis for a trading strategy.

Example: The dividend gap on preferred shares of Surgutneftegaz has not been closed for more than 2 years

Another negative point is that before closing the gap, the price may go quite deep in the opposite direction before returning to previous prices. Even if the gap is located approximately in the middle of the current price range.

Thus, in order to effectively trade gaps, it is necessary to obtain additional confirming signals in addition to the direct presence of the price gap on the chart. To do this, first of all, it is worth understanding why this gap was formed.

Dividend gaps

Based on the results of the high dividend season of 2022, we conducted a study that, among other things, showed: in conditions of geopolitical instability, the general market situation plays a key role in closing dividend gaps. No matter how promising a stock is, if the entire market is under pressure, you shouldn’t count on the deep gap closing soon.

The expected inverse pattern between gap size and closing frequency was also obtained. In general, this effect can be extended to any gaps: the smaller the price gap, the greater the likelihood of it closing in a short time.

Example: The dividend gap for NLMK of about 3% was closed in just 4 trading days. On the first day after the cutoff, the exporter's shares came under pressure due to the strong strengthening of the ruble, but subsequently quickly recovered. The security was supported by a positive general market background (the Moscow Exchange index was growing steadily), expectations about the US-China trade deal, NLMK's established reputation as a divisiter, as well as globally low price levels, which can be seen on the daily chart, were positive for the market.

The above example with NLMK shares is typical for strong dividend chips with low dividend amounts. A small gap can be closed in just a few days, and sometimes in the same session. However, larger dividend gaps are often closed only after a few weeks.

It is also worth noting that until the gap is closed, its borders often become strong technical levels on the chart. Near these values, you can take a closer look at reversal or breakout formations.

In this case, the gap border should not necessarily be considered the immediate closing and opening prices. These could be the nearest local highs/lows, trading boundaries, or the nearest round numbers. This is typical for both dividend gaps and other price gaps.

Example: The price level before the dividend cutoff acted as a turning point on the VTB chart. The overhang of sellers in this zone did not allow quotes to rise higher.

Example: After the news about the repurchase of Megafon shares, quotes opened with a gap above the market and grew against the background of the strengthening of the US dollar, to which the repurchase price was tied. After buying out most of the free-float, quotes dropped to 500 rubles. — a round number near the prices before the gap.

Other types of gaps

In general, gaps are formed in the following situations (in addition to the dividend cutoff):

— the appearance of significant news on an instrument during non-trading hours;

— changes in the general market background;

— change in the dynamics of “guides” for a financial instrument.

By “guide” we mean financial instruments that can affect the value of the asset being traded. For example, this could be the price of oil for oil companies. Raw materials and currencies are traded almost around the clock, so while trading participants on the Moscow Exchange are resting, prices for these instruments may change and lead to a revaluation of shares from the very opening of trading.

Sometimes gaps can appear intraday on low-liquid instruments. However, these gaps are not of trading interest and there is no point in dwelling on them in detail. They only say that the instrument is low-liquid and is of little use for short-term trading. Such instruments are also called “thin”.

There are different ways to trade gaps at the opening of a session. These methods can be divided into entry tactics before and after the gap.

Gap bet in the evening session

After the main session closes on the Moscow Exchange, trading continues for several hours in the evening session of the derivatives market. If circumstances are such that for any of the shares there is reason to expect a gap from the opening the next day due to the appearance of corporate news, then you can place a bet by buying the corresponding futures and rolling this position over night. If events develop successfully, the position can be closed with a profit in the very first minutes of trading.

However, in case of failure, losses will also be incurred quite quickly. This strategy does not imply a specific stop loss and risks can only be controlled by reducing or increasing the position size. It is also worth considering that many futures have low liquidity.

Example: In the evening session of 10/31/17, prices for nickel, one of the main products of the MMC Norilsk Nickel company, soared by more than 6.5% and reached a new two-year high. Futures also grew, but reacted with a delay, which made it possible to gain a speculative position. In the morning, Norilsk Nickel shares opened with a gap of 1.5% and, against the backdrop of a positive technical picture, formed another wave as part of a long upward trend, providing opportunities for making money both intraday and over the horizon of several days.

Gap closing bets

The idea is that, according to the trader, the morning gap is excessive and the speculative capital that provoked it will very quickly queue up for exit and contribute to the partial or complete closure of positions.

In other words, the trader is betting that the market’s reaction to the news in the form of a gap is excessive and the gap will be quickly closed.

In this case, the intraday chart becomes useful, as well as the order book and the transaction tape. Quite often, a good indicator of market sentiment is the high/low level of the first 15-minute candle after the down/up gap. If this mark is broken, then with a greater probability we can expect a movement in the direction of closing the gap.

Example. Caused by general market weakness, the downward gap of 2.6% in Novatek shares was closed during the day under the influence of purchases by investors who positively assessed the company's prospects and used the drawdown to build up long positions.

A good signal will be active transactions in the direction of closing the gap, co-directed movement of market indices and large orders in the order book in support of the movement.

It is worth noting that in the case of gaps associated with changes in the general market background, strong movements after them are more rare than the rule. More often than not, securities that do not have an independent idea develop a sideways trend within the day and any “breakout” signals turn out to be false.

Bets on continuation of movement after a gap

Another strategy option is the idea that the gap at the opening, on the contrary, is too small and does not take into account the seriousness of the news that has appeared. In this case, the trade is opened in the direction of the gap. Classes of transactions based on a similar pattern are also called “Gap and Go”.

A good confirmatory technical signal would be a breakout of the high/low of the first 15-minute candle after the up/down gap. The remaining confirming factors are the same as in the previous case: indices, guides, active purchases/sales in the direction of the transaction, large orders in the order book.

Example: After news about an increase in the free-float of MMK shares in September 2022, which increased the likelihood of the securities being included in the MSCI Russia index, quotes opened with a gap and reversed the corrective decline of the previous days. A new wave of growth made it possible to earn money both within a day and over the horizon of several days. The target could be the level of historical highs of about 43.5 rubles, after a rebound from which it would be possible to take profit.

Closing the gap or continuing the movement?

The gap itself only means that there may be increased volatility in the stock and wide movements are possible that allow you to make money. The likelihood of a particular direction of movement depends more on the context. Here are examples of different situations and how one might act in similar cases:

After the news that the US Treasury Department was ready to lift sanctions against RUSAL, stock quotes opened with a gap of +25% and formed a long “tail” upward. The market considered this reaction excessive, given that the lifting of sanctions was not yet guaranteed and might not take place. During the day, quotes gradually pressed down to the minimum of the first 15-minute candle at around 30 rubles. The next day, the support was broken and then the quotes dropped step by step until the close of trading.

An option for opening a transaction could be entering a short position for a breakout of 30 rubles. with a stop loss for a local maximum, which could gradually be moved down as the price decreased.

In October, rumors appeared in the media that Sberbank could buy up to 30% in Yandex. The news was received negatively by the market and during the American session, Yandex shares fell by more than 17%. Trading on the Moscow Exchange opened with a downward gap of about 10% and formed a descending triangle within the day.

The first opportunity for a speculative short position appeared at the retest of the mirror level of 2100 rubles. The next entry could be made on the breakdown of the descending triangle (at the low of the first 15-minute candle about 2000 rubles) at the opening of the premarket in the USA, where the ADR sales continued with renewed vigor. Part of the profit from the impulse could be recorded closer to the close of the day, part on the next day after the breakdown of the local maximum on lower timeframes.

Subsequently, the rumors were refuted and there was a technical opportunity for purchases with the potential to close the gap, however, the discount in the shares remained and the gap was not closed for a long time.

If your trading style involves relatively short-term speculative trades based more on technical analysis and psychological drivers than on fundamentals, then using a stop loss is essential for profitable trading. Gap trading is no exception. For more information on how to use stop loss, read the special material: Stop orders. How to set them and are they suitable for all investors?

Open an account

BCS Broker

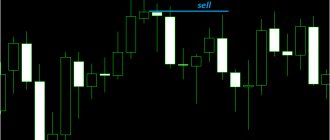

Trading entry point

four ways to enter the market when the stock exchange turns :

- On a breakout when the candle closes . It is important here that the candle closes under the base of the figure in the classic version.

- On breaking through the bottom of the figure through a stop order (buy stop or sell stop). The main problem with this tactic of opening a position is the occurrence of a false breakout of the neckline, after which the price may go in the wrong direction.

The first two types of trading are quite aggressive ways of opening positions.

- After the breakout on the return to the neck line . We mark the location of the penetration and wait for the price in this area. The most preferable option for opening an order at a selected time period. You can enter using the market or with a pending order when returning to the breakout zone.

- Search for a reversal point on a lower timeframe in the breakout area. You can take away all the movement at little risk.

Various trading techniques

Features of the head and shoulders reversal pattern

On a Forex chart in its pure form, you will rarely see an ideal reversal design , for the following reasons:

- Uneven shoulder width. This arises from different times of formation of the elements of the figure.

Example of different shoulder widths of the reverse technical analysis figure - The neckline may be slightly interrupted by the tails of Japanese candlesticks. At the same time, we cut off the spiers of the candles and build a line along the bodies of the candles. An example of such a construction is shown in the figure:

Interrupting the base of the GiP with the tails of Japanese candles - Not equal shoulder height. The left shoulder relative to the right can be higher, lower or at the same level.

Different shoulder heights

Stop loss setting technique

Setting a stop loss for the GiP model can be done in three options:

- Beyond the extremum of the figure's head (the size of the stop loss is equal to the length from the peak of the head to the opposite border of the figure).

- Behind the extremum of the right shoulder (the distance is measured from the base of the figure to the right peak).

If the right side is wide and forms pullbacks before the breakout of the neckline, then it is more advisable to place a stop loss behind the last pullback before the breakout.

- Go to a smaller time frame , find the moment of reversal and place a stop loss at the entry point .

Principles of setting a stop loss

The risk in the first case is lower than in the second, but the risk-to-profit ratio of trading in the second option of setting a stop loss is better.

Where to take profit?

The first and more conservative approach is to take profits at the first key support level. The important support areas you have identified could cause a rebound in the market. Therefore, it may be a good idea to use repeat testing in one of these areas.

Because every situation is different, levels of support will vary. However, the only thing you always need to agree on is a favorable risk-reward ratio. Therefore, remember to always do the necessary calculations before entering into a trade.

A second and more aggressive approach is to use measured movement to determine the purpose of the transaction. Using this method, you need to measure the height of the entire figure. Whatever the situation, you will always have a specific target area.

Below is an example from the daily EURCAD chart:

Please note that measurements need to be taken from the “crown” of the head to the neck line. Then you take the same distance and put it away from the neckline breakout point. This turns out to be a potential place for taking profits. While measured targets can be extremely accurate, they are rarely perfect. So think of them as areas rather than specific levels. Also try to find a key support level that crosses or at least approaches the target being measured. This will help you validate your target area and provide you with a greater degree of confidence when trading.

Methodology for setting take profit

Take profit is determined from your Forex trading strategy and the statistics you collected.

The profit potential after entering a trade can be as follows :

- Profit potential equal to or greater than possible loss (with a stop loss behind the head extremum). The best ratio can be traded if the stop loss is minimal.

Exit a trade with a risk to reward ratio of 1 to 2 - Profit potential is determined using Fibonacci lines. At the same time, the target levels for all traders are different (for example, 161.8 and 261.8).

- Exiting a trade on a reverse signal technical analysis reversal formations.

- Other methods of fixing income (strong level, breaking the trend line and others).

Exiting a trade at a strong level of technical analysis

As can be seen from the figure, of the three price tops, the lowest maximum is at the left shoulder. There are also trading situations when, with such a basis, the maximum is lower at the right shoulder or they are at an identical quote.

Additional filtering of entry points

from this technical analysis pattern is more likely to occur if at least one of these conditions is present :

- Availability of trade volumes . Usually there is a drop in volumes from the left shoulder to the head and an increase in volumes from the head to the right part of the structure. It is necessary to use volume indicators from the futures market.

- Formation of a head and shoulders pattern at the support/resistance level from a higher timeframe .

- Confirmation of a reversal from technical indicators (the oscillator is in the overbought or oversold zone). This trading factor is the weakest.

Beginners in trading are recommended to use only a visual determination of where to open an order, without additional filters.

Key rules

At this point we are already familiar with the Head and Shoulders figure. We know how to enter the market correctly, where to place a stop loss and how to take profits. However, there are a few key rules that must be followed when trading this pattern.

The pattern should only form after an uptrend

This rule speaks for itself. Take a close look at the chart. There must be empty space on the left.

Shoulders should not be higher than head

You can't lift your shoulders above your head, right? The same applies to this pattern. The head should always protrude above the left and right shoulders. And although there are no exact rules for the minimum distance between them, it should be obvious at first glance.

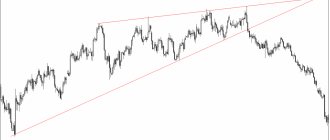

The inclination of the neck line should be horizontal or upward, but not downward

If you find a head and shoulders where the neck line moves from the top left to the bottom right, the figure is considered untrustworthy. Eg:

While you may still see a reversal, the odds are not in your favor.

So you only need to see this pattern:

Notice that the neck line moves from the lower left to the upper right. This indicates the correct structure of this figure.

In my experience, the steeper the neck angle, the more aggressive the subsequent breakout and reversal will be.

The shoulders should be formed within the boundaries of one horizontal area

The graph below illustrates this rule well:

However, the left and right shoulders may extend beyond the horizontal range to some extent.

Which head and shoulders shape is the most reliable?

How reliable is this pattern and when can you enter a trade using it? Not all setups for this formation are suitable for trading. There are two things you need to pay attention to: the structure of the market and the duration of the pattern on the chart.

If the market is in a strong uptrend, it is unlikely that a small figure will change the price course. Instead, the market will likely continue to grow.

A head and shoulders that takes 200 days to form will be more significant than the same figure that takes just 20 days to form. Because if the market breaks the 200-day neckline, a large number of traders will be trapped in an open buy position and their exit from trades will increase pressure on the price, which will fall down. Therefore, if you want to find reliable trading opportunities for this pattern, you must pay attention to the market structure and the duration of its formation on the chart.

Stick to daily and weekly charts

The Head and Shoulders pattern shows the best results on daily and weekly timeframes. Although you can trade this pattern on a 1-hour or 4-hour chart, you risk losses due to the many false patterns.

Classification of the head and shoulders pattern

The following types of this technical analysis figure are distinguished depending on the angle of the base of the reversal structure:

- Sloping ascending neck (descending for reverse version). The current trading formation is characterized by the best risk to return ratio.

Slant ascending neck and working off a short on the mt4 chart - Sloping downward base (ascending for an inverted figure). The short is low and this increases the risk of the position.

Descending neck

As can be seen from the figure, a noticeable delay is very characteristic of this type. In fact , the asset is sold when most of the movement has already passed . - Direct formation base. The angle is practically or completely absent, as in the example of a long EURUSD currency pair.

The Head & Shoulders Dashboard indicator will do all the work for you!

Of course, the Head and Shoulders pattern is fairly easy to identify on a chart, but why not take advantage of automation. Namely, a special indicator that searches for this model across all currency pairs and on all timeframes and displays the information in a summary table that contains the following information:

- currency pair

- time interval

- signal (head and shoulders or inverted head and shoulders"

- model formation time

- link to figure chart

As a result, with the help of this indicator, you no longer need to waste time monitoring the appearance of this pattern on the chart. You will only need to study the found figure and make a trading decision.

By clicking the button with the currency pair and time interval, you will see a chart with a graphical model marked on it.

In the indicator settings you can set

- List of instruments (Symbols)

- Enable or disable search for patterns on a specified time interval (Is ... Timeframe Enabled)

- Manage the sorting of found models (Sort By,Sort Type)

- Set the model construction accuracy (Price Proximity Percent)

- Fill Patterns with Color

- Toggle Display Head and Shoulder, Display Reverse Head and Shoulder

- Set the parameters of the ZigZag indicator (Depth, Deviation, Backstep)

- Set up notifications when new signals appear (Popup Alerts)

Questions to the expert

On what time interval can one search for this graphical model?

And on what timeframe do you think the GIP pattern works best? The pattern is formed on any timeframe and works well in trading everywhere. It all depends on whether you use medium-term trading or prefer to trade intraday. For mid-term use, I recommend using M30-H1, for intraday M1-M15

I'm having trouble identifying the pattern - I can't see it on the chart. Tell me, how can I learn to see this pattern before practicing it?

GiP is a graphical model of classical technical analysis, so you need to train your eyes to quickly find it on the chart. The reversal pattern being analyzed is a very strong signal that signals a reversal of a growing or falling trend, so I recommend viewing a large number of charts for a quick search. Unfortunately, there are no other options for beginners in trading.

On which currency pairs is it recommended to look for head and shoulders?

GiP is an ideal pattern because it forms equally well on all instruments. The only graphical construction is one level, after the breakdown of which the direction of the trend changes.

What is the fundamental difference between the GiP pattern and the double top, double bottom in technical analysis?

Although they are market reversal models, they have a number of differences. The structures consist of a different number of price peaks and double tops (bottoms). The head and shoulders contains 3 lows (highs) and the double top (bottom) contains two. The heights of the reversal patterns also vary. If the tops of G&P are formed at different price levels, where there is a high average peak, then on a double top the bottom is at the same level.

Reversal pattern of graphical analysis on the “double bottom” market

Figure structure:

1 Downward movement to a certain level

2 Rebound from the level into a significant correction

3 Continuation of the downward movement with a rebound at the low of the previous movement, thereby forming a second bottom at the rebound level.

We look at the picture for an example:

How the figure works

Typically, the downward movement is slowed down by volume and large purchases by buyers. Therefore, during the second approach of prices to the level, they pick up the remaining supply from sellers, thereby pushing prices up and changing the trend to an upward one. There is no point in looking at a shorter timeframe than the daily one. Only on the daily timeframe can you see the full picture of market sentiment based on transaction volumes.

A clear example on the chart of stopping movement by volume

Double bottom trading strategy

Entry one: volume exit, the candle often meets with a long shadow in the direction of the trend, we buy at the opening of the next candle with a risk for the shadow of the candle.

We take profit as much as we can tolerate in the position.

Entry two: on the repeated approach to the level of the first price rebound, we make a purchase with a risk for the level of the shadow of the first candle, at which there was a price rebound during the first approach.

We maintain the profit as long as we can tolerate it.

Note: This is often positional trading, since transactions can last for several months and if we believe in an upward trend, then they can last for more than a year. Let's look at the fundamental indicators to understand the reason for this movement.

conclusions

Head and shoulders is a classic reversal pattern in technical analysis. Its main disadvantage is that it is difficult to determine the moment where a reversal figure begins to form . This is observed because many conditions must occur on the price chart for an entry point. Only after the formation of the head can we predict that a reversal structure is being drawn, and after the breakdown of the base, the pattern is considered formed. The advantages include the high probability of a trend reversal or the previous trend and the accuracy of the trading signal at the point where the neckline is broken.

The figure of technical analysis is not used in many trading strategies, but in vain, in terms of profitability it is not inferior to many trading trading algorithms.