Factors influencing cryptocurrency growth in 2022

There are a number of factors influencing the growth of Bitcoin in 2022:

- News in the media. Due to its rapid rise in value since mid-December 2022, Bitcoin is the most talked about cryptocurrency in the world. Statements by large investors, coin holders, and the emergence of laws and regulations regarding the use of BTC instantly make their way into the media. Positive news provokes traders to buy and provides an influx of new users. They buy electronic currency and increase demand for it. The exchange rate is growing from this.

- Lack of competitors. Bitcoin has no competitors in the cryptocurrency market. Not a single coin can show rapid growth in value. This explains the increased interest in BTC, the increasing demand and price of the electronic currency.

- Reduced availability of coins in the public domain. There are 21 million coins in total. Of these, more than 18 million have been mined as of May 2022. The lower the volume of free Bitcoin, the higher its value.

- Falling dollar exchange rate. Due to the elections and the relatively unstable situation in the United States, the national currency began to fluctuate. In such situations, investors look for other ways to store savings. Often the choice falls on Bitcoin.

Interesting! Gold Card World from Sberbank (Salary) in 2022

Attention! A number of factors can negatively affect the Bitcoin price. News about restricting the use of electronic money will lead to the sale of coins and a decrease in the rate.

Breaking the $50,000 resistance level

Technical analysis platform TradingView shows that on Sunday, Bitcoin desperately tried to break through the $50,000 resistance level. But in the end, the asset was unable to hold the position and the attempts ended in rejection.

Source:

TradingView

Industry experts note that nothing surprising happened. The course followed the expected trajectory. At the same time, the market capitalization of the largest cryptocurrency remains below $1 trillion at $921,564,443,336. Twitter user @TechDev_52 refers in his chart to the fact that last year the indicators were similar, and then BTC rushed up.

#BTCWeekly

About as much reason to be bearish here as there was in late 2020 before the first major leg in my opinion.

pic.twitter.com/62AptElE2G — TechDev (@TechDev_52) December 13, 2021

The creator of the famous Bitcoin Stock-to-Flow (S2F) model PlanB also shared an updated forecast. He admitted his prediction fell short last month as Bitcoin (BTC) prices fell below the $60K zone after a recent ATH of $69K. However, PlanB emphasizes that the S2F model is unaffected and is indeed approaching $100k. He remains bullish and notes that BTC has been in an extended consolidation phase for most of the year.

$50K-60K #bitcoin since March, patience is key pic.twitter.com/I3rfFMPEI3

— PlanB (@100trillionUSD) December 12, 2021

At the moment, the US Federal Reserve System (FRS) is creating additional problems for the rate of Bitcoin and other digital assets. It will soon announce the status of its asset purchase program. The Federal Open Market Committee meeting could provide valuable insight into the future of quantitative easing (QE) and the pace of the phase-out of asset purchases. The meeting will be significantly affected by the spread of COVID-19, as well as inflation conditions. Last week's consumer price index showed the highest inflation rate in the United States since 1982, according to official data. Analysts believe this could have a major impact on the cryptocurrency and digital asset market.

Bitcoin Forecast for June, July and August 2022

The table shows the Bitcoin exchange rate forecast for July-August 2021. The cost of 1 coin is displayed in dollars.

| Month | Max-Min price, thousand dollars | Price Start-end, thousand dollars | Deviation, % |

| June | 24,4-47,6 | 39,7-40,2 | 1,26 |

| July | 36,7-42,3 | 40,2-39,5 | -1,74 |

| August | 39,5-49,0 | 39,5-45,8 | 15,95 |

According to experts, the largest increase in the Bitcoin rate over the next 3 months will be in August. In 4 weeks, the price will increase by almost 6 thousand dollars. Within a month, the BTC/USD rate will reach $49 thousand.

Why is the Bitcoin rate rising?

Between December 2022 and May 2022, the value of Bitcoin skyrocketed. The growth of the exchange rate is due to 3 main factors:

- comments by Elon Musk;

- large-scale purchase of a coin by Tesla;

- unstable situation in the United States due to elections, fluctuations in the dollar exchange rate.

Elon Musk is an authoritative figure in the world of business and electronic technology. Users listen to his comments published on the social network Twitter. From December 2022 to May 2021, the entrepreneur often said that cryptocurrency was the future and predicted the growth of Bitcoin. Based on his statements, investors purchased electronic currency.

Interesting! The size of the survivor's pension in 2022 and who is entitled to it

Attention! Tesla, owned by Elon Musk, purchased $1.5 billion worth of Bitcoin.

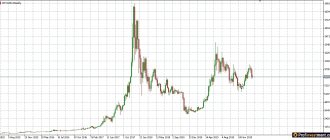

Information about Tesla's purchase of Bitcoin quickly went viral. This provoked high demand for the coin. In the shortest possible time, the value of the cryptocurrency increased by 8%, breaking through the level of $41 thousand. This is clearly visible on the chart.

The unstable situation in the United States after the elections and the change of government led to fluctuations and a depreciation of the American national currency. This had a positive effect on the value of the cryptocurrency. The price of Bitcoin has continued to rise since mid-December, periodically going through periods of correction.

WHATTONEWS

The date May 19, 2022 will go down in the history of the crypto market as “Black Wednesday.” Bitcoin lost $13,000 in a day (over 30%), coming close to the psychologically important $30,000.

Please share this material