Hello, dear readers of the TorguyuSam.ru blog! If you are tired of constantly making the same mistakes when trading the Forex market and losing money, then this article is for you! We will reveal secrets of experienced traders, and we’ll tell you what you need to do in order to trade Forex profitably.

We recommend that you carefully study this article, because the tips described in it will save you a lot of money and nerves, and will help you significantly improve your trading efficiency. Every earning trader on the stock exchange has come a long way through mistakes and losses. For some, this path took a little time, and for others, more than one year of hard work. We have familiar traders who began to regularly make money on Forex after only 5-6 years of almost daily trading. Such cases are not uncommon, but one pattern is visible in them - perseverance, determination, desire for financial independence and a qualitative change in one’s life.

If earlier these guys had financial problems, now they are absolutely wealthy people with earnings of 1 million rubles per month , which, you see, is very impressive!

This kind of profitability is the result of hard work and self-belief. None of them expected the result to come quickly. They sensibly assessed their strengths and capabilities. This fundamentally distinguishes them from most newcomers who come to the stock exchange to get rich quick.

Therefore, the first piece of advice on the path to profitable Forex trading is: don’t expect to get rich quick. Do your work gradually, and success will follow. This does not mean at all that you will learn to earn money only after 5-6 years, of course not!

| Learn to trade. Get personalized trading training . |

We know of traders who started making money after 3 years of trading. There are even those who achieved high profitability after one and a half to two years. It depends on the abilities and desires of the individual trader. We are all different people; some people learn in a year what others cannot understand in 5 years.

When a beginner comes to Forex with the hope of quickly becoming a millionaire, he immediately falls into the trap of his expectations. Thoughts about getting rich quickly make him rush and do rash things. Haste in the market is very expensive! You cannot rush in trading; everything must be done carefully and thoughtfully. So get ready for work right away, and drive away thoughts about a beautiful life that will definitely appear in your head

Your task is to concentrate on the process of studying the market and gaining experience . The money will come on its own, as a result of the right actions on the stock exchange. Let's move on to the next tip.

Go straight to trading

We are convinced that a demo account is needed only to test the capabilities of the terminal, but not to simulate trading. This is due to the fact that trading on a demo account completely dulls the psychological and emotional component of the trader, which is always present and is a very significant component in real trading.

Therefore, open a real account and trade on it. Moreover, you don’t need a lot of money to open an account. For example, at Alpari, you can open an account from $100.

Stop Day Trading

Short-term speculation will not bring profit. All professional traders claim that in their entire lives they have not encountered a single day trading (in other words, intraday). Therefore, do not chase mini movements, take only large ones.

The market drives you crazy if you constantly trade on it without leaving the monitor for 8-12 hours a day (maybe someone can trade around the clock).

You can read more about short-term trading in the article:

- Scalping - basics and principles;

Anything can happen in the market

Take it as an axiom that anything can happen in the market! The market can remain irrational until you run out of money in your account. You must always be prepared that anything bad can happen. A trader constantly deals with probability. There are no 100% situations on the stock exchange. This must be understood very clearly. Don’t look for logical explanations for this, just take it for granted, and then you will save yourself from big losses.

Forex lessons for beginners

Each potential trader can take two paths. The first is to use free Forex lessons for beginners. The second is to purchase a paid course from a popular trainer. Each option has its own advantages and disadvantages. The information you need to take your first successful steps as a currency trader is guaranteed to be freely available.

It makes sense to invest in training after gaining some experience and developing practical skills. By this point, you will have a clear understanding of what course is worth paying for. You will also understand why this needs to be done now, and not in a year.

Books about trading

Literature on stock trading instills stereotyped thinking in a novice trader. In practice, everything happens completely differently. And precisely because a beginner expects a certain development of situations, for example, after the breakdown of some reversal pattern or continuation of a trend, it is difficult for him to refuse a forecast when the situation develops completely differently from what was written in the book. Therefore, approach literature from a critical point of view.

We are not saying that you don’t need to read anything. You will have to read a lot, but always criticize what you read and do not perceive what is written as the only truth. You are risking money, not the author who wrote this book.

How to work with graphical tools - useful tips for beginners

Analyzing the questions that newbies have, we have prepared three recommendations for some elements of the MT4 platform.

When you draw a trend line, by default it is drawn as a “ray”, but you can also make a “segment” - right-click on the line, select “Properties”, and uncheck the box in the “Parameters” tab:

In the “General” tab, you select the thickness and color, which can also be important. If you click on the extreme points of a segment, you can change its slope; clicking on the center allows you to move the line.

If you hold Ctrl and start dragging the line to the side, we will get a parallel “copy”:

Two more points. The “crosshair” shows the height from one point to another, and not the length of the line (contrary to the misconception of beginners). So if you move it horizontally, the number of points will not change.

Sometimes a beginner wants to rewind the chart to the side, but it stubbornly comes back. To prevent this from happening, you need to turn off autoscroll - the green arrow on the toolbar:

The red arrow, on the contrary, “pushes” the chart to the side, opening up more space for graphical analysis.

The video will allow you to get acquainted with MetaTrader on a more professional level.

Cases when it is better not to trade

We categorically do not recommend trading in a state of altered consciousness. By altered consciousness we mean intoxication and illness when it is necessary to take medications. When a person is sick, it is very difficult for him to concentrate, he becomes inattentive and makes many mistakes.

By altered consciousness we mean intoxication and illness when it is necessary to take medications. When a person is sick, it is very difficult for him to concentrate, he becomes inattentive and makes many mistakes.

Also, we do not recommend making transactions that may be unattended. An example of such cases would be when a trader makes a transaction and leaves the terminal on business, without the ability to control this transaction.

Trading myths: are there jobs with huge salaries for traders?

The most naive question from novice traders who have watched enough fictional series such as “Billions” (USA, 2016), when one of the managing traders was offended by the annual bonus of $25 million (he wanted $50 million, this does not count income from profitable transactions) and left from the hedge fund, taking away some of the investors. The funniest part of the plot was when he couldn’t find managing traders for his new investment fund. It’s just that no one needed the job of a trader with a salary of $500 thousand - $1 million a year, which is very, very high even by American standards. All seasons of this series are filled with such “blunders” of the director and screenwriter, although the series itself is watched “in one breath” in dozens of countries around the world, showing the life of those who from “zero” managed to become wealthy and independent in our world.

The reality is different.

- you will work only for yourself;

- if you become a successful trader, you will never break into the TOP 5 ratings of most PAMM brokers (except for one or two ratings) and autocopy systems (mql5, myfxbook.com, Zulutrade, etc.)

Can you guess at once why, with such a system, the Masterforex-V Academy created its own rating of auto-copying transactions of Academy traders? Why don’t 95% of brokers need successful MF traders with 300%-600% profit in 4-5 years? And why we work with investors independently.

Place stop orders

Be sure to always place stop orders. Don't listen to anyone who tells you that it is better to trade without stops. There is a popular myth about the fact that big players, or as they also say “dolls,” are hunting for stops. This is all complete nonsense!

People who say this are justifying their lack of understanding of the market and their inability to set stop losses. If the market knocked out a stop, then this means only one thing - the stop was set incorrectly. A correctly placed stop order is never simply knocked out.

Forex Basics

The basis of Forex is the principle of formation of the price of a specific currency. The very concept of “currency price” for a selected pair, for example, euro/dollar, means the number of dollars for which one euro will be sold. For example, a price of 2 means that for one euro they give 2 dollars. In a Forex currency pair (euro/dollar or any other), the first currency is always evaluated. In fact, if the price has dropped to 1.5, for our pair this means that the euro has fallen in price and is now worth one and a half dollars. If the price rises to 2.5, this means that the euro has become more expensive and is now worth two and a half dollars. Remember - when working with currency pairs on Forex, all operations are carried out with the first currency.

Protect your profits

Beginners and loss-making traders have one big problem - overstaying their profits. This is directly related to greed. As a result, a profitable transaction may turn out to be unprofitable. Profit must be taken!

Whenever a position becomes profitable, protect it by setting a stop loss at least at the move point so that the position is at breakeven, and then raise the order as the price moves.

Follow the algorithm:

- entering a deal

- setting the initial stop,

- if the position enters the profit zone, move the stop loss to the break-even point (entry point),

- trading profits and fixing positions in parts when the market goes in your direction.

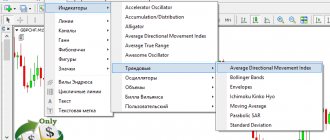

Technical indicators: should a beginner use them?

Technical analysis often uses special indicators that, based on statistical market data, show possible trend reversals, overbought and oversold zones, and other information important for the trader. Among the most popular indicators are Bollinger Bands, Fibonacci Grid, Moving Average, MACD, RSI.

However, Alexander Gerchik believes that you should not rely on indicators: a trader should rely only on his own understanding of the market. This is exactly what he himself has been doing for more than 20 years - and the result is impressive: not a single unprofitable month and millions of dollars in his accounts.

True, there is one indicator that Gerchik is happy to recommend: this is Real Market Volume from Gerchik & Co. This indicator (or rather, a market profile + trading advisor) shows points of accumulation of large capital, at which you can find the best moments for transactions.

Advice!

In addition to the strategy, you also need a trading algorithm, which includes all aspects of trading, including the choice of time frame, signals for entering the market and risk management.

To create such an algorithm, use the “Algorithm Designer” service: fill out the form, and based on your answers you will receive a ready-made step-by-step action plan.

Create your own trading algorithm for free right now

What timeframe to trade on

Try to trade from the younger time period to the older one. This technique allows you to cancel the volume that you include in the transaction. This is especially true for trading on the exchange with a minimum deposit, when you want to increase it.

On a higher timeframe, look for the presence of trend reversal and continuation patterns, and on a younger timeframe, look for an entry point to get the best risk/reward ratio. Using this scheme, a good entry point can be obtained even on a minute timeframe with a close stop, which means little risk. It all depends on the accuracy of the input. Such transactions can be held for quite a long time, and they bring a lot of money, which often determines the performance of trading for the whole year.

News and economic statistics

If you are engaged in active speculation rather than investing, we recommend that you do not make forecasts based on news and economic data. Usually, the market's expectations of any news or statistics are already included in the price. When news comes out, the market's reaction can often be completely different from what you expected. It is better to analyze the chart and make forecasts using technical analysis. Profitable traders do just that.

News, market statistics and other fundamental analysis data may be useful to you when trading over longer investment horizons.

Following the rules of money management

The second important rule: follow the rules of money management or money management in other words. The main idea of these basics is not to use a lot of leverage, and for beginners it is better not to take it at all. Open transactions with lots of adequate size.

- Everything about margin trading;

There is a rule on the market that it is better to always have some amount in fiat, because the market always provides an excellent opportunity to buy more at those moments when we no longer have free money.

I would also like to highlight one more rule from this section: do not increase the size of unprofitable positions. Averaging such transactions can bring profit, but someday there will come a time when the market fails greatly without a rollback, then the trader will find himself in a deep drawdown, from which he may not be able to get out at all in the coming years.

It is better to “add” money to profitable transactions as profits grow.

Read in a separate article:

- A complete list of money management rules;

- Pyramiding strategy;

Don't overload the price chart

Never overload your terminal chart with unnecessary technical analysis tools. You will be constantly confused!

Signals from different indicators will begin to contradict each other, this will bring uncertainty to trading. Just look at this, there are so many indicators hanging here that you can’t even see the price.

Overloaded schedule

Remember, the number of indicators does not increase the accuracy of the forecast, but, on the contrary, interferes with the normal analysis of the price chart. There is no need to overload your schedule. You can get by with just a couple of indicators: some trend indicator and one oscillator. This is more than enough!

Keeping a trade diary

Record all your transactions in a diary. What should such a diary look like? It should contain:

- Transaction dates;

- Purchase amounts;

- Purchase/sale prices;

- Reasons why the transaction was made;

The latter is very important.

After some time, it will be possible to analyze the records, trading results and understand what the mistakes were. It really helps you learn from your mistakes on your own. All professionals use records in their trading.

The diary also disciplines the trader, which is also important.

Make a trading plan before the market opens

Before you start trading, be sure to outline a trading plan and try to stick to it throughout the trading day. Here are our recommendations.

Recommendations for drawing up a trading plan

- Check the economic calendar to see if there are any important news and market statistics for today. You will know when to expect increased volatility in the market. The meaning of the news and data itself is not important, only the timing is important to be ready for increased activity in the market.

- Look at the main timeframes, from high to low, for the presence of reversal and trend continuation patterns and other patterns. You can automatically determine patterns, important price levels and the most likely trend direction using the AutoChartist program.

- Look at oscillator data to see if it shows divergences that could be signs of a reversal.

- Draw the main resistance support lines.

- After analyzing this data, decide on the direction in which you will trade, and stick to the strategy all day.

Having a trading plan will protect you from rash actions. Based on the analysis, you will know in advance what to do during the day: buy or sell. The absence of a plan will bring turmoil and rash actions to trading, which will certainly end in losses.

Forex trading terminal – where to get it and how to install it

The terminal is the trading platform through which you will open transactions on the stock exchange. You need to download it from the website of the broker you have chosen as your eternal companion. As I wrote above, you and I will choose the Alpari company to learn trading from its example.

The registration form is nothing special: enter your first name, last name, phone number, address, and the like.

Information about your place of residence is needed not so that the broker can come to you if you are in debt and remove your furniture, but so that you can contact the company’s office for support and advice.

Usually managers call new clients and ask if they need help, etc. Tell them that you want to learn Forex and for now you plan to trade on demo accounts.

After registration, log into your personal account using your email address and password, which will be sent by email.

In your personal account, find the “Platforms and Applications” tab, click “Download MetaTrader Platform”.

There are three options, let's download the fourth version of MetaTrader for now.

The software is downloaded and installed like any other program. After installation, you need to launch the terminal to start working.

We will make a wide variety of settings for the trading platform as needed, in particular, we will introduce a number of improvements in the next article “Overview of the main functions of the MetaTrader trading terminal.” Now let's just learn how to open accounts and “see” the chart as needed.

At first, you will see the following in the terminal window (without open transactions, of course).

What do you think, green stripes on a black background? Prices? Absolutely right. And in the upper left corner the currency pair to which these prices correspond is shown. Our currency pair is USD/JPY (Dollar/Yen). The price (more precisely, the dynamics of its changes) can be shown by a line, bars or Japanese candles.

In the images above, the chart is represented by bars, the line will look something like this.

Basically, Forex analysts and traders use Japanese candlesticks as the most informative option for displaying price dynamics.

Displaying fluctuations with a line is not informative either for professionals or for beginners. Click on the Japanese candlestick icon and don’t change anything else, since in absolutely all articles we will learn exclusively from candlesticks.

The chart can be narrowed and expanded: the “Terminal” window, as well as everything on the left (“Navigator” and “Market Watch”), can easily be moved to the sides and even removed completely if you click on the border between them and the chart and move it, or to the “cross”.

You are unlikely to need “Navigator” and “Market Watch” in the near future, but you cannot do without “Terminal”, since it reflects open transactions and their profitability/lossability.

If you accidentally closed one of the three windows and broke out in an icy sweat from the horror of an irreparable loss, click “View” and calmly return them to their place.

Let's finally define what candles are. Click on the graph and press “+” on your keyboard to enlarge it and get a better look at the picture. The candle appears to have a body resembling the wax part of a regular candle and two wicks on either side. Sometimes the body of the candle may be missing (there will be just a line), sometimes there are no wicks.

If the body of the candle is the same color as the chart itself, then this candle shows a rise in price, its increase. Subsequently, we will call such candles “bullish”. If the body is shaded, that is, different from the color of the chart, it means that the candle shows a decrease in price, it is “bearish”.

A candle is a price change over a certain time. We have a five-minute chart (shown in the upper left corner), therefore, each candle shows how much the price has risen or fallen in five minutes.

For example, in the screenshot below we see four shaded candles (they are white, but the chart is black, so they are considered shaded relative to the chart), therefore, the price was falling. How long did the fall last if the chart was five minutes? Five minutes multiplied by 4 candles, it turns out twenty minutes.

What are bodies and wicks used for? One border of the body shows where the candle opened, the other - where it closed. For example, at 15:00 the dollar was worth 115.237 Japanese yen, at 15:30 it became worth 114.962. How did we determine this? Draw lines along the upper and lower borders of the candles.

If the candle is bullish, that is, growing, its lower border shows the price that was at the beginning of the formation of the candle, when the next five-minute period began (let's say at 15:00), the upper border shows the closing price of the candle (at 15:04:59). If the candle is bearish, the opposite is true.

The wicks show where the price was during the time interval. The first bearish candle analyzed on the chart opened at a price of 115.237, but its wick can be seen rising above the body, that is, the price did not immediately go down, but fluctuated for some time, rising above the opening level. By the way, traders usually call wicks shadows, which would be more correct.

Didn't get it? Ask in the comments - I will explain in more detail. Or wait for new posts - in the process of constantly working with candles on charts you will be able to “crack nuts”!

What if we want to see price fluctuations not over 5 minutes, but over a minute or a day, a week? There are special icons for this. In general, a time interval is usually called a timeframe, so expand your vocabulary.

The following timeframes are available in Metatrader: 1 minute, 5 minutes, 15 and 30 minutes, one and four hours, one day, one week, one month. You can easily switch between them.

If we look at the minute chart, we will see a more detailed picture.

If you don't really like the color scheme, change it. To do this, right-click on the chart window and select “Properties” from the drop-down list.

The “Black on White” color scheme looks good. In principle, you can paint the candles any color.

In “General”, check the box next to the phrase “Show Ask line” – it won’t hurt to see the spread; it’s especially important for beginners. If you want, leave the net, I usually remove it because it gets in the way.

The result of the work done.

Don’t be afraid of the large spread: on the USD/JPY pair it is tiny, I’m just writing the text on Saturday, the market is closed and the terminal displays this picture.

You are planning to trade multiple currency pairs, right? But does setting up every chart seem like too much of a tedious process? You can make it easier by creating a template. To do this, right-click on our chart (already put in order), click “Template” – “Save template...”

We save our creation to the opened folder. Name the template so as not to confuse it with any other.

Now we open in the terminal the chart that we want to redo, right-click again, select “Template” and the form that we saved (“My Template”).

Everything turns out simply amazing.

So that we can calmly move on and gradually move on to real trading, we need to open an account. First, we will open a demo version where you will learn and hone your skills.

What deposit volume should I trade with?

To determine how much account volume to use in a trade, you need to decide where the position entry point will be and how far the stop loss will be set. Every trader knows and determines his own risks. When a stop can be set at a distance of several points, it would be foolish not to take advantage of this opportunity and not use a significant amount of capital in the transaction. You can even do it all!

In the case when stops need to be placed far from the entry point into a trade, it is better to reduce the volume to enter the position.

“5 candles” strategy

A very simple method that relates to daily Forex strategies. It is based on an interesting pattern - pairs with the pound at different periods of time can sometimes create trend movements consisting of candles that are constantly closed by rising or falling. That is, every day at the end of the American session, the closing level of the day will be further along the trend than on the previous day. Sometimes such series can reach double digits in the number of bars. You can take advantage of this, but you need to be prepared for the fact that anything can happen during the day. That is, endurance is required here; it often happens that everything is talking about a turn to H1 or H4, but by the end of the day we still close further. Now let's see how to apply this.

Trading scheme

First you need to wait four days in one direction. These should be four rising or four falling candles in a row, but with a small tolerance - if the day closes approximately in the same place where it opened with an error of 3-4 points, then we still take such a day into account, since the close can fluctuate greatly due to evening spread extensions. The entry is made at the opening of the fifth candle in the direction where the first four went. The stop should be set beyond the extremum of the fourth candle, which is directed against the trend:

- In a growing market this will be the minimum.

- In a falling market this will be the maximum.

If the range of the candle turns out to be very small (less than 40 points, which is very small for pound pairs), then you can use a fixed value, for example, 60-70 points. As soon as the price closes the new day in positive territory, you can move the stop either to breakeven, or to a similar extreme, only now on the fifth candle. We do the same with a take, that is, in fact, there is no take itself, but there is a profit stop that moves following the price. An exception may be a situation with the formation of a very precise and accurate candlestick pattern of a reversal nature. In other cases, you can hold the position either until the first bar that closes against the trend, or until a profit stop behind the extreme of the previous bar.

I also recommend reading:

Doji Candle in Trading - Review

Typically, candlestick patterns imply some direction of movement. This could be a reversal or, conversely, a prerequisite for continuation of the previous direction. […]